Deck 23: Productivity,growth,and Technology Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/58

العب

ملء الشاشة (f)

Deck 23: Productivity,growth,and Technology Policy

1

New methods of producing existing products and new designs that make it possible to create new products are best regarded as examples of

A) innovation.

B) investment.

C) technological change.

D) supply-side economics.

E) asymmetric information.

A) innovation.

B) investment.

C) technological change.

D) supply-side economics.

E) asymmetric information.

C

2

Productivity is measured by the

A) rate of growth of output per hour of labor.

B) rate of growth in the money supply.

C) rate of unemployment.

D) rate of accelerated depreciation.

E) Phillips curve.

A) rate of growth of output per hour of labor.

B) rate of growth in the money supply.

C) rate of unemployment.

D) rate of accelerated depreciation.

E) Phillips curve.

A

3

The rate of real per capita GDP growth in the United States

A) has consistently exceeded that of every other major nation except Japan.

B) steadily increased by 4 percent during each decade from 1870 to 1970.

C) has not been affected by changes in labor force productivity.

D) has averaged about 2 percent per year over the last century.

E) has averaged in excess of 5 percent per year in the decades since World War II.

A) has consistently exceeded that of every other major nation except Japan.

B) steadily increased by 4 percent during each decade from 1870 to 1970.

C) has not been affected by changes in labor force productivity.

D) has averaged about 2 percent per year over the last century.

E) has averaged in excess of 5 percent per year in the decades since World War II.

D

4

In 1840,the country with the highest per capita output was

A) the United States.

B) Canada.

C) Germany.

D) Japan.

E) England.

A) the United States.

B) Canada.

C) Germany.

D) Japan.

E) England.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

5

In recent decades research and development activities in the United States have been

A) funded primarily by universities and nonprofit institutions.

B) carried out by independent inventors inside commercial research laboratories.

C) noticeably declining in importance as a source of economic growth.

D) generally directed toward making incremental improvements rather than major advances.

E) directed primarily toward achieving civilian rather than military or political objectives.

A) funded primarily by universities and nonprofit institutions.

B) carried out by independent inventors inside commercial research laboratories.

C) noticeably declining in importance as a source of economic growth.

D) generally directed toward making incremental improvements rather than major advances.

E) directed primarily toward achieving civilian rather than military or political objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

6

Economic growth is generally measured by the rate of increase in

A) population.

B) the price level.

C) output per hour of labor.

D) technological change.

E) per capita output.

A) population.

B) the price level.

C) output per hour of labor.

D) technological change.

E) per capita output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

7

Generally,in the field of technology,the United States has been

A) a world leader for much of its history.

B) a step behind most European nations, even in recent years.

C) ahead of Europe but far behind Japan.

D) a leader in science but not in manufacturing.

E) a user rather than a creator of new technologies.

A) a world leader for much of its history.

B) a step behind most European nations, even in recent years.

C) ahead of Europe but far behind Japan.

D) a leader in science but not in manufacturing.

E) a user rather than a creator of new technologies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

8

A major contribution to economic growth comes from

A) increases in the labor-output ratio.

B) a growing proportion of youths and unskilled people in the labor force.

C) runaway inflation.

D) expansions in the level of government regulation.

E) expenditures on research and development.

A) increases in the labor-output ratio.

B) a growing proportion of youths and unskilled people in the labor force.

C) runaway inflation.

D) expansions in the level of government regulation.

E) expenditures on research and development.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

9

The federal government is the source of over ________ of all research and development (R&D)funds.

A) one-third

B) one-half

C) two-thirds

D) three-quarters

E) four-fifths

A) one-third

B) one-half

C) two-thirds

D) three-quarters

E) four-fifths

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

10

New methods of producing existing products and new designs that make it possible to create new products are forms of

A) depreciation.

B) natural endowments.

C) compensation.

D) technological change.

E) price stability.

A) depreciation.

B) natural endowments.

C) compensation.

D) technological change.

E) price stability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

11

In the late 1990s and early 2000s,in the United States

A) negative increases in productivity were experienced.

B) productivity growth improved, returning to levels closer to those of the 1960s.

C) increases in productivity averaged zero.

D) productivity achieved the lowest values in history.

E) the measurement of productivity was discontinued because of the ambiguity surrounding its interpretation.

A) negative increases in productivity were experienced.

B) productivity growth improved, returning to levels closer to those of the 1960s.

C) increases in productivity averaged zero.

D) productivity achieved the lowest values in history.

E) the measurement of productivity was discontinued because of the ambiguity surrounding its interpretation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

12

High rates of economic growth are clearly related to high rates of

A) unemployment.

B) consumption.

C) inflation.

D) technological change.

E) taxes on profits.

A) unemployment.

B) consumption.

C) inflation.

D) technological change.

E) taxes on profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

13

Most R&D funds provided by the federal government are spent on

A) national security and education.

B) space technology and defense.

C) education and medicine.

D) education and space technology.

E) subsidies to start up high-tech small businesses.

A) national security and education.

B) space technology and defense.

C) education and medicine.

D) education and space technology.

E) subsidies to start up high-tech small businesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

14

The average annual growth rate of labor productivity

A) has remained relatively constant at about 3 percent.

B) fell to an average rate of about 1.5 percent during the period 1977 to 1995 and has averaged 3.2 percent since then.

C) steadily rose to about 4.5 percent in the late 1990s and early 2000s.

D) fell steadily to its postwar low in 1984 but has risen rapidly since then.

E) reached a peak in 1995 but has fallen steadily since then.

A) has remained relatively constant at about 3 percent.

B) fell to an average rate of about 1.5 percent during the period 1977 to 1995 and has averaged 3.2 percent since then.

C) steadily rose to about 4.5 percent in the late 1990s and early 2000s.

D) fell steadily to its postwar low in 1984 but has risen rapidly since then.

E) reached a peak in 1995 but has fallen steadily since then.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

15

The source of the largest share of research and development funds in the United States is

A) the federal government.

B) universities and colleges.

C) industry.

D) nonprofit foundations.

E) the stock market.

A) the federal government.

B) universities and colleges.

C) industry.

D) nonprofit foundations.

E) the stock market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

16

As compared to earlier years,the rate of growth of labor productivity in the United States from the 1970s through the mid-1990s

A) increased dramatically.

B) increased slightly.

C) slowed considerably.

D) increased in the 1970s and declined in the late 1980s.

E) remained constant.

A) increased dramatically.

B) increased slightly.

C) slowed considerably.

D) increased in the 1970s and declined in the late 1980s.

E) remained constant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

17

In 2009 the federal government was the source of ________ percent of all R&D funds.

A) less than 10

B) between 10 and 20

C) between 20 and 30

D) between 30 and 40

E) over 40

A) less than 10

B) between 10 and 20

C) between 20 and 30

D) between 30 and 40

E) over 40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

18

It is sometimes hard to separate the impact of technology from that of investment because

A) you can directly measure investment, but there is no way to quantify new technology.

B) neither has been a major factor in economic growth for about 10 years now.

C) technology has grown at a such a variable rate that its impact cannot be effectively measured.

D) new technology is useful only when it is embodied in the physical capital financed through investment.

E) neither activity is reflected in the prices we pay for goods and services.

A) you can directly measure investment, but there is no way to quantify new technology.

B) neither has been a major factor in economic growth for about 10 years now.

C) technology has grown at a such a variable rate that its impact cannot be effectively measured.

D) new technology is useful only when it is embodied in the physical capital financed through investment.

E) neither activity is reflected in the prices we pay for goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

19

In their study on the resurgence of growth in the late 1990s,Oliner and Sichel identified the following three sources of growth that were more than twice as important in the late 1990s as in the 1970s:

A) money supply, labor hours, and output.

B) information technology capital, labor quality, and greater efficiency.

C) population growth, research and development, and other capital.

D) foreign imports, the federal budget deficit, and technological change.

E) new products, tax-rate reductions, and labor hours.

A) money supply, labor hours, and output.

B) information technology capital, labor quality, and greater efficiency.

C) population growth, research and development, and other capital.

D) foreign imports, the federal budget deficit, and technological change.

E) new products, tax-rate reductions, and labor hours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

20

By 2009 U.S.expenditures on research and development

A) averaged about 10 percent of the GDP.

B) fell well below the levels of the 1960s.

C) were over 11 times what they were in 1953.

D) consistently led those of other developed nations in all fields.

E) have been directed primarily to making major advances in civilian technology.

A) averaged about 10 percent of the GDP.

B) fell well below the levels of the 1960s.

C) were over 11 times what they were in 1953.

D) consistently led those of other developed nations in all fields.

E) have been directed primarily to making major advances in civilian technology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is cited as a reason for the productivity swings in the United States?

A) a value system that promotes a materialistic philosophy

B) changes in the rate of growth of the capital-labor ratio

C) a shift in national output away from services toward goods

D) the depletion of our natural resources

E) swings in the balance of trade

A) a value system that promotes a materialistic philosophy

B) changes in the rate of growth of the capital-labor ratio

C) a shift in national output away from services toward goods

D) the depletion of our natural resources

E) swings in the balance of trade

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

22

Incremental research and development tax credits

A) allow firms to reduce the after-tax cost of their research and development activities.

B) fund federal government insurance on a portion of research and development costs.

C) generate revenues to subsidize government laboratories for research and development.

D) are designed to reduce the amount of government regulatory restraints that limit innovation.

E) fund a government prize for important industrial innovations.

A) allow firms to reduce the after-tax cost of their research and development activities.

B) fund federal government insurance on a portion of research and development costs.

C) generate revenues to subsidize government laboratories for research and development.

D) are designed to reduce the amount of government regulatory restraints that limit innovation.

E) fund a government prize for important industrial innovations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

23

High rates of inflation discourage research and development by

A) making long-run forecasting more hazardous, increasing the risk on longer-term programs.

B) raising the price of bonds sold to finance new investment.

C) forcing the government to lower taxes to fight inflation.

D) reducing the amount of discretionary money households and businesses have to spend on research and development.

E) encouraging investors to seek opportunities in areas where the return is high but the outcome is less predictable than in basic research.

A) making long-run forecasting more hazardous, increasing the risk on longer-term programs.

B) raising the price of bonds sold to finance new investment.

C) forcing the government to lower taxes to fight inflation.

D) reducing the amount of discretionary money households and businesses have to spend on research and development.

E) encouraging investors to seek opportunities in areas where the return is high but the outcome is less predictable than in basic research.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

24

Increased government regulation is said to have contributed to the slowdown in U.S.productivity because such regulation

A) led to the substitution of research and development for goods and services available to consumers.

B) reduced the labor force by requiring limited resources to be used for compliance.

C) generated both litigation and uncertainty, discouraging business investment.

D) reduced the quality of the work environment, lowering worker morale.

E) lowered the cost of production, making many goods unprofitable.

A) led to the substitution of research and development for goods and services available to consumers.

B) reduced the labor force by requiring limited resources to be used for compliance.

C) generated both litigation and uncertainty, discouraging business investment.

D) reduced the quality of the work environment, lowering worker morale.

E) lowered the cost of production, making many goods unprofitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

25

An important disadvantage of incremental tax credits to encourage industrial research and development is that they

A) are difficult to administer, requiring more government control and intervention.

B) disproportionately penalize those firms that do little research and development.

C) apply only to defense-related research and development.

D) reward firms for doing research and development they would have done anyway.

E) raise the after-tax cost of applied research and development, discouraging new technology.

A) are difficult to administer, requiring more government control and intervention.

B) disproportionately penalize those firms that do little research and development.

C) apply only to defense-related research and development.

D) reward firms for doing research and development they would have done anyway.

E) raise the after-tax cost of applied research and development, discouraging new technology.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

26

Among the reasons cited for the productivity slowdown in our society is the

A) increased rate of incorporating new technology in capital equipment.

B) change in the composition of both the labor force and national output.

C) increased rate of growth of the capital-labor ratio.

D) devotion of too great a share of our resources to research and development.

E) increase of resource mobility and competitiveness in our market economy.

A) increased rate of incorporating new technology in capital equipment.

B) change in the composition of both the labor force and national output.

C) increased rate of growth of the capital-labor ratio.

D) devotion of too great a share of our resources to research and development.

E) increase of resource mobility and competitiveness in our market economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

27

A major U.S.tax bill that contained a provision for an incremental tax credit for research and development was passed in

A) 1981.

B) 1979.

C) 1974.

D) 1967.

E) 1963.

A) 1981.

B) 1979.

C) 1974.

D) 1967.

E) 1963.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

28

In a 1999 study,Professor Robert Gordon showed that the gains in productivity during the 1990s

A) were nonexistent when adjusted for changes in the unemployment rate.

B) occurred primarily in the traditional manufacturing sector.

C) were due entirely to gains in the high-tech sector.

D) were in line with the earlier results of a Federal Reserve Bank study.

E) matched the performance of the economy during the 1970s and 1980s.

A) were nonexistent when adjusted for changes in the unemployment rate.

B) occurred primarily in the traditional manufacturing sector.

C) were due entirely to gains in the high-tech sector.

D) were in line with the earlier results of a Federal Reserve Bank study.

E) matched the performance of the economy during the 1970s and 1980s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

29

Excluded from the four key trends that account for the high Asian growth rates in the 1980s and early 1990s are

A) rising female labor force participation rates.

B) rapid rises in educational attainment.

C) rapid increases in the rate of innovation and a growth in Asian consumer demand.

D) high and rising investment rates.

E) shifts of workers from agriculture to manufacturing.

A) rising female labor force participation rates.

B) rapid rises in educational attainment.

C) rapid increases in the rate of innovation and a growth in Asian consumer demand.

D) high and rising investment rates.

E) shifts of workers from agriculture to manufacturing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

30

Most available evidence suggests that the U.S.technological lead over other countries is

A) widening.

B) narrowing.

C) the same as it has been since 1900.

D) negative (below other countries).

E) nonexistent; Japan and West Germany have caught up with it.

A) widening.

B) narrowing.

C) the same as it has been since 1900.

D) negative (below other countries).

E) nonexistent; Japan and West Germany have caught up with it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

31

A slowdown in the United States' rate of increase in productivity is of concern to policy makers because it

A) reduces our dependency on imports.

B) may contribute to a higher rate of inflation.

C) shifts the Phillips curve downward to the left.

D) forces interest rates too low.

E) makes foreign producers less competitive.

A) reduces our dependency on imports.

B) may contribute to a higher rate of inflation.

C) shifts the Phillips curve downward to the left.

D) forces interest rates too low.

E) makes foreign producers less competitive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following would be conducive to developing and commercializing a new technology?

A) keeping personal tax rates low to encourage consumption

B) using monetary policy to keep interest rates high

C) policies to encourage investment in plant and equipment

D) eliminating tax provisions that allow firms to depreciate their plant and equipment

E) providing more funds for low-income families

A) keeping personal tax rates low to encourage consumption

B) using monetary policy to keep interest rates high

C) policies to encourage investment in plant and equipment

D) eliminating tax provisions that allow firms to depreciate their plant and equipment

E) providing more funds for low-income families

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

33

Economists are concerned about a slowdown in productivity because of the risk of higher inflation rates and a(n)

A) loss of our ability to diversify in manufacturing.

B) increased dependence on imported raw materials.

C) decline in service industries that depend on microelectronics technology.

D) potential decline in technological change that could affect our future rate of growth.

E) fear that it will lead to an influx of unskilled workers replacing domestic workers.

A) loss of our ability to diversify in manufacturing.

B) increased dependence on imported raw materials.

C) decline in service industries that depend on microelectronics technology.

D) potential decline in technological change that could affect our future rate of growth.

E) fear that it will lead to an influx of unskilled workers replacing domestic workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following government policies discourages technological innovation?

A) research and development tax credits

B) expansion of relevant work in government laboratories

C) grants and contracts from government agencies to support civilian technology

D) measures to reduce after-tax costs of plant and equipment

E) encouragement of higher rates of inflation to promote rising profits

A) research and development tax credits

B) expansion of relevant work in government laboratories

C) grants and contracts from government agencies to support civilian technology

D) measures to reduce after-tax costs of plant and equipment

E) encouragement of higher rates of inflation to promote rising profits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

35

The commercial introduction of new products and processes for the first time is called

A) research and development.

B) capitalization.

C) patent pending.

D) innovation.

E) derived demand.

A) research and development.

B) capitalization.

C) patent pending.

D) innovation.

E) derived demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

36

The deep recessions experienced in many fast-growing East Asian economies in 1997-98

A) were unexpected by virtually all economists who had been studying the "Asian miracle."

B) produced a significant shortage in overall global capacity.

C) led to a continuing and deepening condition of economic stagnation over the entire region.

D) demonstrated that it is extremely unlikely that sustained economic growth can be accomplished in developing countries.

E) were a direct result of the Asian financial crisis.

A) were unexpected by virtually all economists who had been studying the "Asian miracle."

B) produced a significant shortage in overall global capacity.

C) led to a continuing and deepening condition of economic stagnation over the entire region.

D) demonstrated that it is extremely unlikely that sustained economic growth can be accomplished in developing countries.

E) were a direct result of the Asian financial crisis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

37

The basic argument for government grants and contracts in support of civilian technology is that they

A) make it easier to predict the social costs and benefits of a proposed project.

B) are both direct and selective.

C) provide better investment qualities than market incentives.

D) enable the government to earn money on the patents it acquires as a result of these grants.

E) decrease the market rate of interest on investment funds since banks need to be responsible for funding high-risk R&D activities.

A) make it easier to predict the social costs and benefits of a proposed project.

B) are both direct and selective.

C) provide better investment qualities than market incentives.

D) enable the government to earn money on the patents it acquires as a result of these grants.

E) decrease the market rate of interest on investment funds since banks need to be responsible for funding high-risk R&D activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

38

A more rapid rate of growth of productivity can be achieved if

A) the rate of investment in equipment increases.

B) a country's population growth rate rises rapidly, increasing demand.

C) high rates of inflation are maintained.

D) government involvement is eliminated.

E) private saving is discouraged.

A) the rate of investment in equipment increases.

B) a country's population growth rate rises rapidly, increasing demand.

C) high rates of inflation are maintained.

D) government involvement is eliminated.

E) private saving is discouraged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

39

Excluded from a list of reasons often cited as responsible for the slowdown in U.S.productivity during the 1970s is the

A) increase in the proportion of youths and women in the labor force.

B) reduction in the rate of growth of the capital-labor ratio.

C) presence of increased amounts of government regulation.

D) reduction in the proportion of GDP devoted to research and development.

E) price stability and stable interest rates over that period, which reduced profit opportunities.

A) increase in the proportion of youths and women in the labor force.

B) reduction in the rate of growth of the capital-labor ratio.

C) presence of increased amounts of government regulation.

D) reduction in the proportion of GDP devoted to research and development.

E) price stability and stable interest rates over that period, which reduced profit opportunities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

40

Technological change

A) inevitably creates persistent technological unemployment.

B) is reflected in improvements in labor output per hour.

C) increases the intended spending function faster than the growth in output.

D) has no impact on long-run aggregate supply without specific government intervention to increase it.

E) causes the profitability of existing investment to fall, reducing the intended spending function.

A) inevitably creates persistent technological unemployment.

B) is reflected in improvements in labor output per hour.

C) increases the intended spending function faster than the growth in output.

D) has no impact on long-run aggregate supply without specific government intervention to increase it.

E) causes the profitability of existing investment to fall, reducing the intended spending function.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

41

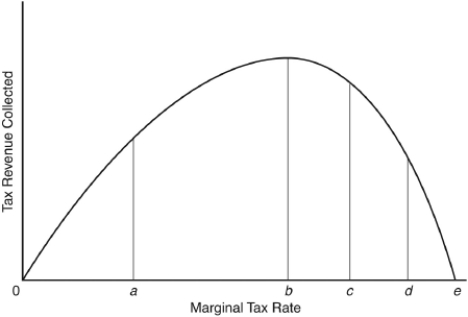

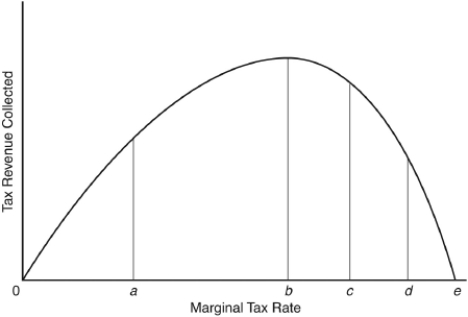

Tax revenues rise when the rate is

A) reduced from 0c to 0b.

B) raised from 0d to 0e.

C) reduced from 0a to 0.

D) raised from 0b to 0e.

E) reduced from 0b to 0a.

A) reduced from 0c to 0b.

B) raised from 0d to 0e.

C) reduced from 0a to 0.

D) raised from 0b to 0e.

E) reduced from 0b to 0a.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

42

Supply-side government policies emphasize measures to

A) increase total real output while reducing the price level.

B) shift aggregate demand to the classical range of the supply curve.

C) shift the aggregate supply curve to the left.

D) increase taxes to finance increased government expenditures on public works projects such as highways and mass transit.

E) supplement increased government spending with increased consumer spending on goods and services.

A) increase total real output while reducing the price level.

B) shift aggregate demand to the classical range of the supply curve.

C) shift the aggregate supply curve to the left.

D) increase taxes to finance increased government expenditures on public works projects such as highways and mass transit.

E) supplement increased government spending with increased consumer spending on goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

43

Critics of supply-side economic theory argue that the tax cut of 1981

A) shifted the aggregate supply curve to the left.

B) shifted the aggregate demand curve to the left.

C) caused the price level to rise with no change in real GDP.

D) led mainly to dramatic increases in the money supply.

E) did not increase the percent of total income devoted to saving.

A) shifted the aggregate supply curve to the left.

B) shifted the aggregate demand curve to the left.

C) caused the price level to rise with no change in real GDP.

D) led mainly to dramatic increases in the money supply.

E) did not increase the percent of total income devoted to saving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

44

Supply-siders typically advocate

A) tax increases to balance the federal budget.

B) tax reductions for households and tax increases for businesses to stimulate national output.

C) a steeply progressive personal income tax structure.

D) tax reductions to increase both the labor force participation and investment.

E) tax reductions for low-income workers, to stimulate consumption.

A) tax increases to balance the federal budget.

B) tax reductions for households and tax increases for businesses to stimulate national output.

C) a steeply progressive personal income tax structure.

D) tax reductions to increase both the labor force participation and investment.

E) tax reductions for low-income workers, to stimulate consumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

45

The following questions are based on the following Laffer curve:

According to this curve,tax revenue is maximized when the tax rate is

A) 0a.

B) 0b.

C) 0c.

D) 0e.

E) 0d.

According to this curve,tax revenue is maximized when the tax rate is

A) 0a.

B) 0b.

C) 0c.

D) 0e.

E) 0d.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

46

To produce a rightward shift in the aggregate supply curve,supply-siders argue for

A) a large surplus of unemployed workers to hold down wage rates.

B) large government deficits to hold down aggregate demand.

C) higher taxes on personal and corporate incomes.

D) financial incentives to encourage additional saving.

E) a money supply that is absolutely fixed over time.

A) a large surplus of unemployed workers to hold down wage rates.

B) large government deficits to hold down aggregate demand.

C) higher taxes on personal and corporate incomes.

D) financial incentives to encourage additional saving.

E) a money supply that is absolutely fixed over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

47

Inflationary pressures may be lessened with measures designed to

A)shift the aggregate demand curve to the right.

B) shift the aggregate supply curve to the right.

C) shift the Phillips curve to the right.

D) couple a leftward shift in the aggregate supply curve with a rightward shift in the aggregate demand curve.

E) make the aggregate supply curve vertical at a lower level of real output.

A)shift the aggregate demand curve to the right.

B) shift the aggregate supply curve to the right.

C) shift the Phillips curve to the right.

D) couple a leftward shift in the aggregate supply curve with a rightward shift in the aggregate demand curve.

E) make the aggregate supply curve vertical at a lower level of real output.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

48

According to supply-side economists,noninflationary policies to expand real GDP involve

A) decreasing the rate of growth of the money supply to lower interest rates.

B) reducing the tax burden.

C) increasing welfare and other government income support programs.

D) policies to make the aggregate supply curve vertical.

E) the use of wage and price controls.

A) decreasing the rate of growth of the money supply to lower interest rates.

B) reducing the tax burden.

C) increasing welfare and other government income support programs.

D) policies to make the aggregate supply curve vertical.

E) the use of wage and price controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following would be the most effective public policy for encouraging research and development?

A) subsidizing industries that are at a competitive disadvantage

B) maintaining price stability and encouraging saving and investment

C) increasing interest rates to make investment more profitable

D) reducing resource mobility to ensure an adequate labor supply

E) increasing the scope and extent of industrial regulation

A) subsidizing industries that are at a competitive disadvantage

B) maintaining price stability and encouraging saving and investment

C) increasing interest rates to make investment more profitable

D) reducing resource mobility to ensure an adequate labor supply

E) increasing the scope and extent of industrial regulation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

50

Supply-side measures pushed through Congress by the Reagan administration include

A) proposals to decrease the money supply.

B) changes limiting the protection afforded by our patent laws.

C) a 25 percent cut in the personal income tax and accelerated depreciation of plant and equipment.

D) "comparable worth" laws to ensure equal pay.

E) laws limiting the rate of interest that may be charged on loans for investment purposes.

A) proposals to decrease the money supply.

B) changes limiting the protection afforded by our patent laws.

C) a 25 percent cut in the personal income tax and accelerated depreciation of plant and equipment.

D) "comparable worth" laws to ensure equal pay.

E) laws limiting the rate of interest that may be charged on loans for investment purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

51

Advocates of supply-side tax reductions,such as a reduction in the capital gains tax,argue that these taxes currently have marginal tax rates that are

A) 0.

B) to the left of 0a.

C) between 0a and 0b.

D) to the right of 0b.

E) greater than 0e.

A) 0.

B) to the left of 0a.

C) between 0a and 0b.

D) to the right of 0b.

E) greater than 0e.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

52

The best example of the influences of supply-side economists on economic policy is seen in the

A) Federal Reserve Act of 1913.

B) Employment Act of 1946.

C) tax increase of 1968.

D) wage and price controls of 1971.

E) tax cut of 1981.

A) Federal Reserve Act of 1913.

B) Employment Act of 1946.

C) tax increase of 1968.

D) wage and price controls of 1971.

E) tax cut of 1981.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

53

In the video,Nariman Behravesh argued that the supply-side impact of the Reagan tax cuts was

A) very large, leading to increased government tax revenues.

B) about equal in magnitude to the demand-side impact of those cuts.

C) enough to ensure that the size of the federal budget deficit would decrease.

D) small at first but likely to grow as time went on.

E) virtually nonexistent, although they did boost investment and lead to higher productivity.

A) very large, leading to increased government tax revenues.

B) about equal in magnitude to the demand-side impact of those cuts.

C) enough to ensure that the size of the federal budget deficit would decrease.

D) small at first but likely to grow as time went on.

E) virtually nonexistent, although they did boost investment and lead to higher productivity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

54

The argument that the primary impact of the 1981 tax cut was on aggregate demand is based on the fact that

A) output did not rise sufficiently to offset the effect of the tax cuts on the size of the federal deficit.

B) unemployment rose significantly after the tax cut, necessitating increased federal welfare.

C) after the tax cut, the velocity of circulation of the money supply rose at a rapid rate.

D) the inflationary pressures in the economy after the tax cut were greater than the pre-tax cut rate of inflation.

E) the United States ran a balance of payments surplus for the first time in the post-Vietnam War era two years after the tax cut.

A) output did not rise sufficiently to offset the effect of the tax cuts on the size of the federal deficit.

B) unemployment rose significantly after the tax cut, necessitating increased federal welfare.

C) after the tax cut, the velocity of circulation of the money supply rose at a rapid rate.

D) the inflationary pressures in the economy after the tax cut were greater than the pre-tax cut rate of inflation.

E) the United States ran a balance of payments surplus for the first time in the post-Vietnam War era two years after the tax cut.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

55

The Laffer curve

A) shows the relationship between sales taxes and income taxes in the United States.

B) indicates that tax revenues are greatest when marginal tax rates are greatest.

C) relates the size of the government debt to the level of national output.

D) shows an inverse relationship between tax revenues and government spending.

E) has been used to demonstrate that a decline in the marginal tax rate may cause a rise in total tax revenue.

A) shows the relationship between sales taxes and income taxes in the United States.

B) indicates that tax revenues are greatest when marginal tax rates are greatest.

C) relates the size of the government debt to the level of national output.

D) shows an inverse relationship between tax revenues and government spending.

E) has been used to demonstrate that a decline in the marginal tax rate may cause a rise in total tax revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

56

In the Stagflation video,economist Laffer argued that

A) a penny saved is a penny earned.

B) people do not work to pay taxes.

C) demand creates its own supply.

D) output per worker is a poor measure of productivity.

E) expected rates of return on R&D are positively correlated with the rate of inflation.

A) a penny saved is a penny earned.

B) people do not work to pay taxes.

C) demand creates its own supply.

D) output per worker is a poor measure of productivity.

E) expected rates of return on R&D are positively correlated with the rate of inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

57

The relationship between the amount of income tax revenue collected and the marginal tax rate is called the

A) total revenue curve.

B) aggregate supply curve.

C) capital gains curve.

D) balanced budget multiplier.

E) Laffer curve.

A) total revenue curve.

B) aggregate supply curve.

C) capital gains curve.

D) balanced budget multiplier.

E) Laffer curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck

58

In the video,Edwin Mansfield notes that one reason why R&D spending by firms has declined as a percent of national output is that

A) very little is left to invent, since research was so great in the first half of the twentieth century.

B) most research goes to enhance military spending, which is no longer as important as it once was.

C) a firm cannot appropriate all the benefits it creates from R&D, because they spill over to outsiders, so it tends to underinvest in this area.

D) R&D rarely results in marketable products, so increasingly it is being performed in government research facilities.

E) stagflation has made R&D unprofitable for the smaller firms that carry out the largest share of this activity.

A) very little is left to invent, since research was so great in the first half of the twentieth century.

B) most research goes to enhance military spending, which is no longer as important as it once was.

C) a firm cannot appropriate all the benefits it creates from R&D, because they spill over to outsiders, so it tends to underinvest in this area.

D) R&D rarely results in marketable products, so increasingly it is being performed in government research facilities.

E) stagflation has made R&D unprofitable for the smaller firms that carry out the largest share of this activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 58 في هذه المجموعة.

فتح الحزمة

k this deck