Deck 12: Poverty,income Inequality,and Discrimination

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/60

العب

ملء الشاشة (f)

Deck 12: Poverty,income Inequality,and Discrimination

1

The 2011 U.S.per capita income was about

A) $25,000.

B) $33,000.

C) $40,000.

D) $48,000.

E) $55,000.

A) $25,000.

B) $33,000.

C) $40,000.

D) $48,000.

E) $55,000.

D

2

Which of the following would be LEAST likely to contribute to income inequality in the United States?

A) differences in the amount of education and training people receive

B) perfectly competitive, homogeneous resource markets

C) differences in inherited wealth

D) the possession of unique abilities and skills

E) monopoly power

A) differences in the amount of education and training people receive

B) perfectly competitive, homogeneous resource markets

C) differences in inherited wealth

D) the possession of unique abilities and skills

E) monopoly power

B

3

The actual progressivity of a tax is often reduced by

A) giving the revenues from the tax to the poor.

B) raising rates on upper income brackets.

C) shifting the burden of the tax to those paying it.

D) the fact that people with incomes below $10,000 pay no taxes.

E) the use of legal loopholes by taxpayers.

A) giving the revenues from the tax to the poor.

B) raising rates on upper income brackets.

C) shifting the burden of the tax to those paying it.

D) the fact that people with incomes below $10,000 pay no taxes.

E) the use of legal loopholes by taxpayers.

E

4

Social Security and payroll taxes are typically considered to be

A) invisible.

B) indirect.

C) regressive.

D) redundant.

E) equitable.

A) invisible.

B) indirect.

C) regressive.

D) redundant.

E) equitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

5

In 2012,a household with an annual income of $100,000 was in the top ________ percent of U.S.households

A) 50

B) 40

C) 30

D) 20

E) 10

A) 50

B) 40

C) 30

D) 20

E) 10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

6

A tax that takes a greater proportion of one's income as that income rises is called a(n)________ tax.

A) progressive

B) regressive

C) income

D) excise

E) proportional

A) progressive

B) regressive

C) income

D) excise

E) proportional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

7

To say that a tax is progressive means that

A) the receipts from the tax are used for research and development.

B) it is a tax on income.

C) the tax affects the distribution of income.

D) the poor pay a smaller proportion of their incomes for the tax than the rich.

E) the tax rate declines with increasing income levels.

A) the receipts from the tax are used for research and development.

B) it is a tax on income.

C) the tax affects the distribution of income.

D) the poor pay a smaller proportion of their incomes for the tax than the rich.

E) the tax rate declines with increasing income levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

8

After-tax income inequality tends to be reduced under a tax structure that is

A) progressive.

B) productive.

C) propulsive.

D) prohibitive.

E) protective.

A) progressive.

B) productive.

C) propulsive.

D) prohibitive.

E) protective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

9

In 2012,the bottom fifth of U.S.households received incomes below

A) $5,000.

B) $12,000.

C) $18,000.

D) $23,000.

E) $27,000.

A) $5,000.

B) $12,000.

C) $18,000.

D) $23,000.

E) $27,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

10

A tax that takes a smaller proportion of one's income as that income rises is called a(n)________ tax.

A) progressive

B) regressive

C) income

D) excise

E) proportional

A) progressive

B) regressive

C) income

D) excise

E) proportional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

11

A sales tax is generally considered to be regressive because

A) the poor spend a greater percentage of their income on taxable items than the rich.

B) sales tax rates rise as the price of the item rises.

C) only necessities are subject to the sales tax.

D) poor people pay a larger absolute amount of sales tax than the rich.

E) poor people do not benefit from the services provided by sales tax revenues.

A) the poor spend a greater percentage of their income on taxable items than the rich.

B) sales tax rates rise as the price of the item rises.

C) only necessities are subject to the sales tax.

D) poor people pay a larger absolute amount of sales tax than the rich.

E) poor people do not benefit from the services provided by sales tax revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following regions would be most likely to contain those countries with the lowest per capita income?

A) North America

B) western Europe

C) Southeast Asia

D) eastern Europe

E) the Mediterranean

A) North America

B) western Europe

C) Southeast Asia

D) eastern Europe

E) the Mediterranean

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

13

Those who argue against income inequality say that

A) inequality does not help the rich very much and may well reduce society's output.

B) a more equal distribution of income raises the productivity of society because the rich do not want to work and the poor cannot.

C) the poor are important patrons of new and high quality products that benefit the entire society.

D) capital formation would be greater because the poor save more since they spend only on necessities, while the rich squander their incomes on conspicuous consumption of useless goods.

E) income inequality leads to political inequality and reduced opportunity for advanced education and training.

A) inequality does not help the rich very much and may well reduce society's output.

B) a more equal distribution of income raises the productivity of society because the rich do not want to work and the poor cannot.

C) the poor are important patrons of new and high quality products that benefit the entire society.

D) capital formation would be greater because the poor save more since they spend only on necessities, while the rich squander their incomes on conspicuous consumption of useless goods.

E) income inequality leads to political inequality and reduced opportunity for advanced education and training.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following countries had the lowest per capita income in 2012?

A) Russia

B) France

C) Japan

D) Canada

E) Sweden

A) Russia

B) France

C) Japan

D) Canada

E) Sweden

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

15

One reason for rejecting the argument that inequality of income lessens total consumer satisfaction (because an extra dollar given to a poor man provides him with more extra satisfaction than the loss of a dollar taken away from a rich man)is that

A) the rich and the poor have the same capacity to gain enjoyment from income.

B) interpersonal comparisons of satisfaction do not rest on scientific grounds.

C) poor people spend their incomes on consumption, whereas the rich invest theirs in capital.

D) arguments based on considerations of positive economics cannot be used to make ethical judgments.

E) the rich are more deserving than the poor.

A) the rich and the poor have the same capacity to gain enjoyment from income.

B) interpersonal comparisons of satisfaction do not rest on scientific grounds.

C) poor people spend their incomes on consumption, whereas the rich invest theirs in capital.

D) arguments based on considerations of positive economics cannot be used to make ethical judgments.

E) the rich are more deserving than the poor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

16

Sales taxes are typically considered to be

A) regressive.

B) proportional.

C) progressive.

D) indirect.

E) indivisible.

A) regressive.

B) proportional.

C) progressive.

D) indirect.

E) indivisible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

17

A tax structure under which an individual is taxed $1,000 per year regardless of income is

A) unconstitutional.

B) progressive.

C) proportional.

D) regressive.

E) biased against higher-income groups.

A) unconstitutional.

B) progressive.

C) proportional.

D) regressive.

E) biased against higher-income groups.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

18

The argument that total consumer enjoyment from income increases if income is redistributed from the rich to the poor is based in part on the idea that an additional dollar given to a poor person provides him or her with more

A) purchasing power than it provides a rich person.

B) wants than it provides a rich person.

C) employment than it provides a rich person.

D) money than it provides a rich person.

E) extra satisfaction than it provides a rich person.

A) purchasing power than it provides a rich person.

B) wants than it provides a rich person.

C) employment than it provides a rich person.

D) money than it provides a rich person.

E) extra satisfaction than it provides a rich person.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

19

It is difficult to tell whether the corporate income tax is progressive or regressive because

A) the income of stockholders is generally not known.

B) dividends are often paid out to pension funds.

C) the corporation may be able to pass on the tax by charging a higher price.

D) dividends are not taxed.

E) it may be offset by the personal income tax.

A) the income of stockholders is generally not known.

B) dividends are often paid out to pension funds.

C) the corporation may be able to pass on the tax by charging a higher price.

D) dividends are not taxed.

E) it may be offset by the personal income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

20

In 2012,the top 5 percent of U.S.households received incomes in excess of

A) $5 million.

B) $1 million.

C) $500,000.

D) $250,000.

E) $200,000.

A) $5 million.

B) $1 million.

C) $500,000.

D) $250,000.

E) $200,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following best states John Rawls's argument for income equality?

A) A dollar taken from a rich man and given to a poor man provides the poor man with more satisfaction than the rich man loses.

B) Income equality encourages people to take risks and to become more productive.

C) If people were framing a constitution for society without knowing what their class position would be, they would opt for equality.

D) Greater income equality leads to significantly higher rates of capital formation.

E) Political freedom and economic equality can only be achieved with a perfectly equal distribution of income.

A) A dollar taken from a rich man and given to a poor man provides the poor man with more satisfaction than the rich man loses.

B) Income equality encourages people to take risks and to become more productive.

C) If people were framing a constitution for society without knowing what their class position would be, they would opt for equality.

D) Greater income equality leads to significantly higher rates of capital formation.

E) Political freedom and economic equality can only be achieved with a perfectly equal distribution of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

22

Poverty as defined by the Social Security Administration means having an income

A) of less than $12,500.

B) below the nation's per capita income.

C) in the lowest 10 percent of the population.

D) in the lowest 20 percent of the population.

E) of less than three times the cost of a minimal nutritionally sound food plan.

A) of less than $12,500.

B) below the nation's per capita income.

C) in the lowest 10 percent of the population.

D) in the lowest 20 percent of the population.

E) of less than three times the cost of a minimal nutritionally sound food plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

23

Since the end of World War II,the incidence of poverty as measured by the Social Security Administration's criterion has ________ percent of the population.

A) held steady at about 15

B) declined from about 50 to 25

C) increased from about 20 to 24

D) declined from about 30 to 15

E) increased from about 25 to 32

A) held steady at about 15

B) declined from about 50 to 25

C) increased from about 20 to 24

D) declined from about 30 to 15

E) increased from about 25 to 32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

24

According to the Social Security Administration,the cost of a minimal nutritionally sound food plan is multiplied by what number to arrive at an income level used as the criteria for establishing the poverty line?

A) 2

B) 3

C) 4

D) 5

E) 6

A) 2

B) 3

C) 4

D) 5

E) 6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

25

Measures taken to reduce inequality are likely to cause economic efficiency to

A) increase indefinitely at an increasing rate.

B) increase steadily.

C) increase significantly at first and then level off.

D) fall.

E) remain unchanged.

A) increase indefinitely at an increasing rate.

B) increase steadily.

C) increase significantly at first and then level off.

D) fall.

E) remain unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

26

In 2011,a family of four would be above the poverty line with an annual income of at least

A) $5,250.

B) $8,000.

C) $10,000.

D) $15,000.

E) $22,350.

A) $5,250.

B) $8,000.

C) $10,000.

D) $15,000.

E) $22,350.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

27

Those at the lowest end of the income distribution are typically those who

A) have large amounts of inherited wealth.

B) are disabled, single, or lacking in employable skills.

C) hold jobs requiring extensive training.

D) have unique abilities or skills.

E) manage to obtain monopoly power.

A) have large amounts of inherited wealth.

B) are disabled, single, or lacking in employable skills.

C) hold jobs requiring extensive training.

D) have unique abilities or skills.

E) manage to obtain monopoly power.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

28

Social Security benefits are funded by taxes levied on

A) sales.

B) wages.

C) property income.

D) wealth.

E) all forms of income.

A) sales.

B) wages.

C) property income.

D) wealth.

E) all forms of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

29

Some argue that to determine whether a certain degree of income inequality is unfair,one must

A) look at the justice of the process leading to the prevailing distribution.

B) assume that perfect equality is the optimal condition.

C) measure the comparable worth of high- and low-income households.

D) determine whether it is correlated with the marginal utility of money.

E) quantify the utility curve for individuals at similar income levels.

A) look at the justice of the process leading to the prevailing distribution.

B) assume that perfect equality is the optimal condition.

C) measure the comparable worth of high- and low-income households.

D) determine whether it is correlated with the marginal utility of money.

E) quantify the utility curve for individuals at similar income levels.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

30

Economists view the relationship between the degree of equality of income and wealth and economic efficiency as a

A) technicality.

B) tradeoff.

C) tempest in a teapot.

D) truism.

E) travesty of justice.

A) technicality.

B) tradeoff.

C) tempest in a teapot.

D) truism.

E) travesty of justice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

31

The role of the federal government in helping the poor

A) was virtually nonexistent until about 70 years ago.

B) is currently limited to old-age insurance programs.

C) is now exercised through a negative income tax.

D) began on a large scale in the late 1800s.

E) has declined since the Great Depression.

A) was virtually nonexistent until about 70 years ago.

B) is currently limited to old-age insurance programs.

C) is now exercised through a negative income tax.

D) began on a large scale in the late 1800s.

E) has declined since the Great Depression.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

32

Families below the poverty line are most likely to be

A) large (above seven persons), nonwhite, and headed by females.

B) small (two to three persons), nonwhite, and headed by males.

C) single male or female white persons.

D) three- to four-person households located in the suburbs.

E) uniformly distributed over all demographic groups.

A) large (above seven persons), nonwhite, and headed by females.

B) small (two to three persons), nonwhite, and headed by males.

C) single male or female white persons.

D) three- to four-person households located in the suburbs.

E) uniformly distributed over all demographic groups.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

33

Those who argue for income inequality say that

A) reducing inequality will not help the poor very much and may very well reduce society's output.

B) every dollar taken from the rich puts $1.05 into the pockets of the poor.

C) the poor are necessary so that the rich can be altruistic.

D) people framing a constitution for society without knowing what their class position would be would automatically opt for inequality.

E) greater inequality produces lower saving and greater consumption, thereby ensuring high levels of aggregate demand and employment.

A) reducing inequality will not help the poor very much and may very well reduce society's output.

B) every dollar taken from the rich puts $1.05 into the pockets of the poor.

C) the poor are necessary so that the rich can be altruistic.

D) people framing a constitution for society without knowing what their class position would be would automatically opt for inequality.

E) greater inequality produces lower saving and greater consumption, thereby ensuring high levels of aggregate demand and employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Social Security Act,which provides compulsory old-age insurance for both workers and self-employed people,was passed in

A) 1887.

B) 1914.

C) 1929.

D) 1933.

E) 1935.

A) 1887.

B) 1914.

C) 1929.

D) 1933.

E) 1935.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

35

It is argued that measures taken to reduce inequality may decrease economic efficiency because

A) poor people are inherently unproductive.

B) it will lead to opportunities for poor people to gain advanced education and training.

C) it is more efficient to produce the goods and services that rich people buy.

D) it will increase saving at the expense of consumption and thereby lower output.

E) people will have less incentive to produce if their incomes are unrelated to their productivity.

A) poor people are inherently unproductive.

B) it will lead to opportunities for poor people to gain advanced education and training.

C) it is more efficient to produce the goods and services that rich people buy.

D) it will increase saving at the expense of consumption and thereby lower output.

E) people will have less incentive to produce if their incomes are unrelated to their productivity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

36

Defining poverty in terms of a certain percentage of the population with the lowest incomes means that

A) as income rises the number of poor people will remain the same.

B) income distribution will never become more equal.

C) unless income distribution is perfectly equal, poverty will never be eliminated.

D) the number of people who are poor will fall as population rises.

E) the poverty level will automatically decline as per capita income increases.

A) as income rises the number of poor people will remain the same.

B) income distribution will never become more equal.

C) unless income distribution is perfectly equal, poverty will never be eliminated.

D) the number of people who are poor will fall as population rises.

E) the poverty level will automatically decline as per capita income increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

37

By the Social Security Administration's definition,the number of poor people in the United States in 2011 was around ________ million.

A) 2

B) 14

C) 46

D) 58

E) 75

A) 2

B) 14

C) 46

D) 58

E) 75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

38

A major cause of poverty is that

A) income in the United States has been increasing at a slower rate than population.

B) most poor people would rather receive public assistance than work.

C) barriers exist in the form of discrimination and lack of opportunity or access to information about opportunity.

D) each year the proportion of people in poverty steadily increases; thus, poverty becomes a self-perpetuating predominant condition.

E) the definition of poverty makes it impossible ever to eliminate poverty without a completely equal distribution of income.

A) income in the United States has been increasing at a slower rate than population.

B) most poor people would rather receive public assistance than work.

C) barriers exist in the form of discrimination and lack of opportunity or access to information about opportunity.

D) each year the proportion of people in poverty steadily increases; thus, poverty becomes a self-perpetuating predominant condition.

E) the definition of poverty makes it impossible ever to eliminate poverty without a completely equal distribution of income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

39

Social Security taxes are considered to be regressive because they tax

A) wages up to a cap; thus, those with earnings above the cap pay a smaller proportion of their incomes than those who earn less.

B) corporate profits more heavily than other forms of income, since firms pay Social Security payroll taxes.

C) all forms of income, earned and unearned, forcing poor people on welfare to pay taxes on their welfare income.

D) everyone including the unemployed, and most retired people are considered unemployed.

E) workers at higher rates than the rates paid out to those who are retired so that individuals can never get back more than they contributed to the fund.

A) wages up to a cap; thus, those with earnings above the cap pay a smaller proportion of their incomes than those who earn less.

B) corporate profits more heavily than other forms of income, since firms pay Social Security payroll taxes.

C) all forms of income, earned and unearned, forcing poor people on welfare to pay taxes on their welfare income.

D) everyone including the unemployed, and most retired people are considered unemployed.

E) workers at higher rates than the rates paid out to those who are retired so that individuals can never get back more than they contributed to the fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

40

A controversial element of the Social Security program is that

A) participation is mandatory.

B) the Social Security payments are withheld dollar for dollar.

C) to collect any Social Security benefits, workers must retire at 65.

D) it is run strictly like an ordinary insurance system that ties the level of benefits directly to the amount of an individual's contributions.

E) the Social Security tax is progressive.

A) participation is mandatory.

B) the Social Security payments are withheld dollar for dollar.

C) to collect any Social Security benefits, workers must retire at 65.

D) it is run strictly like an ordinary insurance system that ties the level of benefits directly to the amount of an individual's contributions.

E) the Social Security tax is progressive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

41

Economists criticize wage rates set on the basis of comparable worth because they

A) promote efficiency at the expense of equity.

B) ignore the effect of such important job characteristics as accountability, knowledge and skills, mental demands, and working conditions.

C) generate surplus value that accrues to the owner rather than the employed.

D) establish wage rates that do not reflect market demand and supply conditions.

E) relate only to government employees and not all workers.

A) promote efficiency at the expense of equity.

B) ignore the effect of such important job characteristics as accountability, knowledge and skills, mental demands, and working conditions.

C) generate surplus value that accrues to the owner rather than the employed.

D) establish wage rates that do not reflect market demand and supply conditions.

E) relate only to government employees and not all workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

42

In the United States,the compulsory hospitalization insurance plan for people over 65 is known as

A) Supplemental Security.

B) the Family Assistance Plan.

C) Blue Cross.

D) Medicare.

E) the Federal Security Life Insurance Copay (FSLIC) program.

A) Supplemental Security.

B) the Family Assistance Plan.

C) Blue Cross.

D) Medicare.

E) the Federal Security Life Insurance Copay (FSLIC) program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

43

Discrimination in labor markets arises because

A) race or gender characteristics present barriers to mobility and create noncompeting groups.

B) women and minorities are inherently less productive.

C) the supply curve of women and minorities is smaller than the total labor supply curve.

D) women and minorities typically have more education and experience.

E) of various laws such as the Civil Rights Act of 1964.

A) race or gender characteristics present barriers to mobility and create noncompeting groups.

B) women and minorities are inherently less productive.

C) the supply curve of women and minorities is smaller than the total labor supply curve.

D) women and minorities typically have more education and experience.

E) of various laws such as the Civil Rights Act of 1964.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

44

The government program that in 1996 replaced the existing Aid to Families with Dependent Children program is called

A) the Family Assistance Plan.

B) the Equal Pay Act.

C) the Job Corps.

D) the Family Income Continuation Arrangement.

E) Temporary Assistance for Needy Families.

A) the Family Assistance Plan.

B) the Equal Pay Act.

C) the Job Corps.

D) the Family Income Continuation Arrangement.

E) Temporary Assistance for Needy Families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

45

Unlike the negative income tax proposal,which was an income transfer proposal,Social Security is a popular program because it

A) is an insurance system and not an income transfer program.

B) does not require a large bureaucracy to administer.

C) deals with the symptoms rather than the causes of old age.

D) applies to everybody; young workers who pay the taxes to support those currently receiving payments will someday be elderly and expect to receive the transfers themselves.

E) provides training for retired individuals who want to work part-time.

A) is an insurance system and not an income transfer program.

B) does not require a large bureaucracy to administer.

C) deals with the symptoms rather than the causes of old age.

D) applies to everybody; young workers who pay the taxes to support those currently receiving payments will someday be elderly and expect to receive the transfers themselves.

E) provides training for retired individuals who want to work part-time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following government programs provides goods or services rather than cash payments to the poor?

A) Aid to Families with Dependent Children

B) unemployment insurance

C) Social Security

D) Medicaid

E) old-age insurance

A) Aid to Families with Dependent Children

B) unemployment insurance

C) Social Security

D) Medicaid

E) old-age insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

47

One reason why it is difficult to reform an existing welfare system is that

A) the people who provide these services currently are not willing to see their programs eliminated.

B) any reform provides disincentives to both taxpayers and welfare recipients.

C) the system has been fine-tuned to the point where further reforms are not cost effective.

D) most families receiving assistance are lazy and would not benefit from welfare reforms.

E) welfare is a right provided for in the Constitution.

A) the people who provide these services currently are not willing to see their programs eliminated.

B) any reform provides disincentives to both taxpayers and welfare recipients.

C) the system has been fine-tuned to the point where further reforms are not cost effective.

D) most families receiving assistance are lazy and would not benefit from welfare reforms.

E) welfare is a right provided for in the Constitution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following is an INCORRECT statement about the Social Security program?

A) The Social Security tax is levied on wages up to an annual cap or maximum.

B) The Social Security tax is regressive.

C) The Social Security program is like an ordinary insurance program, in that the program's assets are sufficient to finance all the benefits promised.

D) Participation in the program is mandatory.

E) Monthly Social Security benefits depend on the number of years one has worked as well as one's average monthly earnings.

A) The Social Security tax is levied on wages up to an annual cap or maximum.

B) The Social Security tax is regressive.

C) The Social Security program is like an ordinary insurance program, in that the program's assets are sufficient to finance all the benefits promised.

D) Participation in the program is mandatory.

E) Monthly Social Security benefits depend on the number of years one has worked as well as one's average monthly earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

49

The effect of racial discrimination in the labor market is to

A) increase the size of the African American labor force.

B) create two separate labor markets where one would suffice.

C) eliminate other forms of discrimination.

D) raise the productivity of the labor force.

E) raise the average wage of all labor combined.

A) increase the size of the African American labor force.

B) create two separate labor markets where one would suffice.

C) eliminate other forms of discrimination.

D) raise the productivity of the labor force.

E) raise the average wage of all labor combined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

50

An antipoverty program structured along the conceptual lines of the negative income tax proposed by Richard Nixon but NEVER passed by Congress was the

A) Job Corps.

B) Comparable Worth Act.

C) Family Assistance Plan.

D) Equal Pay Act.

E) Federal Workfare Program.

A) Job Corps.

B) Comparable Worth Act.

C) Family Assistance Plan.

D) Equal Pay Act.

E) Federal Workfare Program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

51

Assume a negative income tax that is structured according to the formula T = -$5,000 + 0.5Y,where T = tax liability and Y = earned income.The break-even income,when the family neither receives a tax payment nor pays any income tax,is

A) $5,000.

B) $7,500.

C) $10,000.

D) $12,500.

E) $15,000.

A) $5,000.

B) $7,500.

C) $10,000.

D) $12,500.

E) $15,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

52

An argument against income transfer programs is that they

A) do not work in the short run when help is needed.

B) provide incentives to work hard only for those who pay the taxes.

C) affect only the causes and not the symptoms of poverty.

D) discourage immigration of industrious foreigners.

E) provide economic disincentives to work, both to those who pay the taxes and those who receive the transfers.

A) do not work in the short run when help is needed.

B) provide incentives to work hard only for those who pay the taxes.

C) affect only the causes and not the symptoms of poverty.

D) discourage immigration of industrious foreigners.

E) provide economic disincentives to work, both to those who pay the taxes and those who receive the transfers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

53

Occupational wage rates tied to a point scale that weighs different jobs in terms of criteria such as accountability,knowledge and skills,mental demand,and working conditions reflects the doctrine of

A) comparative advantage.

B) comparable worth.

C) crowding out.

D) consumer surplus.

E) conscious parallelism.

A) comparative advantage.

B) comparable worth.

C) crowding out.

D) consumer surplus.

E) conscious parallelism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

54

The negative income tax is a

A) principle that argues that most income taxes reduce incentives to produce in a market system.

B) system whereby families below a certain break-even level receive a government income tax payment.

C) proposal to allow the automatic setting of income tax rates to negate the effects of a business cycle.

D) form of unequal taxation that disproportionately hurts low-income families.

E) tax on unearned income primarily designed to affect high-income families.

A) principle that argues that most income taxes reduce incentives to produce in a market system.

B) system whereby families below a certain break-even level receive a government income tax payment.

C) proposal to allow the automatic setting of income tax rates to negate the effects of a business cycle.

D) form of unequal taxation that disproportionately hurts low-income families.

E) tax on unearned income primarily designed to affect high-income families.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

55

Reducing or eliminating discrimination in labor markets would tend to

A) lower all workers' wages.

B) raise the prices of final goods and services.

C) decrease the total demand for labor.

D) decrease the demand for minority labor only.

E) raise labor force productivity.

A) lower all workers' wages.

B) raise the prices of final goods and services.

C) decrease the total demand for labor.

D) decrease the demand for minority labor only.

E) raise labor force productivity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

56

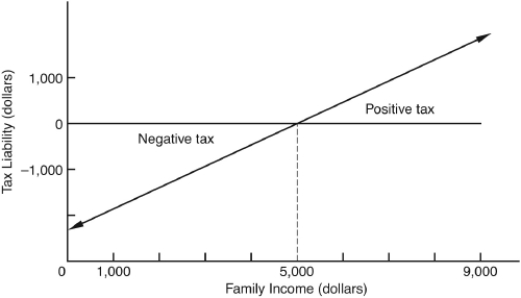

In the diagram

A) the tax rate is regressive over all incomes.

B) the dollar amount of tax liability falls as income rises.

C) all family incomes of less than $5,000 before taxes are raised to $5,000 with the negative tax payment.

D) families with incomes of $3,000 receive a $1,000 payment.

E) the amounts of negative and positive taxes balance out so the government will just break even.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

57

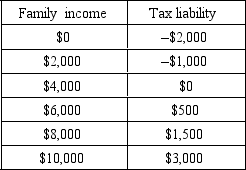

This table shows a payment schedule for a hypothetical negative income tax program.

From the table,it can be seen that

A) families with an income of $2,000 must pay taxes of $1,000.

B) $4,000 is the poverty level of income.

C) families earning $3,000 find their after-tax incomes increased to $3,500.

D) the tax rate on incomes above $4,000 is constant.

E) this tax scheme is a regressive tax.

From the table,it can be seen that

A) families with an income of $2,000 must pay taxes of $1,000.

B) $4,000 is the poverty level of income.

C) families earning $3,000 find their after-tax incomes increased to $3,500.

D) the tax rate on incomes above $4,000 is constant.

E) this tax scheme is a regressive tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

58

In 1996,the government replaced Aid to Families with Dependent Children (once the most important single program of welfare cash payments)with

A) a system of payments in return for work.

B) food stamps.

C) a negative income tax.

D) Medicare.

E) unemployment compensation.

A) a system of payments in return for work.

B) food stamps.

C) a negative income tax.

D) Medicare.

E) unemployment compensation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

59

Suppose a family with an earned income of $2,000 receives an extra $2,000 under a negative income tax scheme.If this family's earned income increased by $100,the tax payment it receives would

A) remain at $2,000.

B) decrease by $100.

C) decrease by more than $100.

D) decrease by less than $100.

E) increase but by less than $100.

A) remain at $2,000.

B) decrease by $100.

C) decrease by more than $100.

D) decrease by less than $100.

E) increase but by less than $100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck

60

Some elements of a negative income tax have been incorporated into the U.S.federal tax code in the form of

A) reduced inheritance and estate taxes.

B) unemployment compensation programs.

C) capital gains taxes.

D) the Earned Income Tax Credit.

E) the Aid to Families with Dependent Children program.

A) reduced inheritance and estate taxes.

B) unemployment compensation programs.

C) capital gains taxes.

D) the Earned Income Tax Credit.

E) the Aid to Families with Dependent Children program.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 60 في هذه المجموعة.

فتح الحزمة

k this deck