Deck 14: Public Goods and the Role of the Government

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/70

العب

ملء الشاشة (f)

Deck 14: Public Goods and the Role of the Government

1

Conservatives

A) argue that the government can do a great deal to overcome the limitations of the price system.

B) view massive government intervention as necessary to ensure economic and political freedom.

C) support the notion that government bureaucracies respond rapidly to new situations.

D) are skeptical about the government's ability to solve social and economic problems.

E) point out that the price system is a form of unfair coercion.

A) argue that the government can do a great deal to overcome the limitations of the price system.

B) view massive government intervention as necessary to ensure economic and political freedom.

C) support the notion that government bureaucracies respond rapidly to new situations.

D) are skeptical about the government's ability to solve social and economic problems.

E) point out that the price system is a form of unfair coercion.

D

2

Excluded from the generally recognized limitations of the price system is its inability to

A) create an equitable distribution of income.

B) provide sufficient amounts of public goods.

C) allocate resources.

D) minimize external diseconomies.

E) produce adequate amounts of necessities consumed primarily by the poor.

A) create an equitable distribution of income.

B) provide sufficient amounts of public goods.

C) allocate resources.

D) minimize external diseconomies.

E) produce adequate amounts of necessities consumed primarily by the poor.

C

3

According to conservatives,large elaborate government bureaucracies

A) constitute an appropriate alternative to an outmoded market system.

B) are efficient and effective promoters of the general welfare.

C) are slow to respond to changes in economic conditions and difficult to control because of political considerations.

D) quickly assimilate the information necessary to provide appropriate remedies to most social problems.

E) rarely interfere or limit the economic freedom of individuals and businesses.

A) constitute an appropriate alternative to an outmoded market system.

B) are efficient and effective promoters of the general welfare.

C) are slow to respond to changes in economic conditions and difficult to control because of political considerations.

D) quickly assimilate the information necessary to provide appropriate remedies to most social problems.

E) rarely interfere or limit the economic freedom of individuals and businesses.

C

4

Liberals

A) argue that the role of the government should be minimized and carefully circumscribed.

B) feel that economic and political freedom is undermined by reliance on the government.

C) are skeptical about the government's ability to solve economic and social problems.

D) assert that the government can and should overcome the limitations of the price system by regulating private activity.

E) view the price system as an efficient noncoercive method of allocation.

A) argue that the role of the government should be minimized and carefully circumscribed.

B) feel that economic and political freedom is undermined by reliance on the government.

C) are skeptical about the government's ability to solve economic and social problems.

D) assert that the government can and should overcome the limitations of the price system by regulating private activity.

E) view the price system as an efficient noncoercive method of allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

5

Goods that may be collectively consumed so that one person's enjoyment of them does NOT deprive others of the same enjoyment are ________ goods.

A) public

B) complementary

C) intermediate

D) primary

E) complex

A) public

B) complementary

C) intermediate

D) primary

E) complex

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

6

There appears to be some consensus that the proper economic role of government includes all of the following EXCEPT

A) providing help for those unable to care for themselves.

B) providing some public goods.

C) maintaining competition.

D) discouraging external economies.

E) maintaining a legal and social framework.

A) providing help for those unable to care for themselves.

B) providing some public goods.

C) maintaining competition.

D) discouraging external economies.

E) maintaining a legal and social framework.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

7

Some economists,such as John Kenneth Galbraith,assert that the public sector receives too few resources relative to the private sector.This assertion

A) is one with which most conservative economists, such as Milton Friedman, would agree.

B) is one that can be completely settled by economic theory.

C) is based on Galbraith's idea that government programs tend to be inefficient.

D) reflects a value judgment about an economy's composition of output.

E) is one that can be resolved by maintaining full employment.

A) is one with which most conservative economists, such as Milton Friedman, would agree.

B) is one that can be completely settled by economic theory.

C) is based on Galbraith's idea that government programs tend to be inefficient.

D) reflects a value judgment about an economy's composition of output.

E) is one that can be resolved by maintaining full employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

8

Public goods are generally financed by

A) user charges.

B) voluntary contributions.

C) the price system.

D) a tax system.

E) nothing; a public good is by definition costless.

A) user charges.

B) voluntary contributions.

C) the price system.

D) a tax system.

E) nothing; a public good is by definition costless.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

9

A common argument against prices determined in noncompetitive markets is that such prices

A) do not reflect consumer desires properly.

B) tend to be below competitive market prices, creating surpluses.

C) always work to the advantage of the buyer.

D) eliminate the need for regulation.

E) primarily promote the interest of those lacking market power.

A) do not reflect consumer desires properly.

B) tend to be below competitive market prices, creating surpluses.

C) always work to the advantage of the buyer.

D) eliminate the need for regulation.

E) primarily promote the interest of those lacking market power.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

10

National defense is often cited as a major example of a

A) public good.

B) free resource.

C) basic good.

D) price support.

E) secondary good.

A) public good.

B) free resource.

C) basic good.

D) price support.

E) secondary good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

11

With which of the following statements would John Kenneth Galbraith probably agree?

A) All people should have equal income.

B) Economic and political freedoms are likely to be lost if we rely too heavily on the government to solve economic problems.

C) The nation suffers because too little is spent on government services such as transportation, education, and urban renewal.

D) There is every reason to be skeptical about government's ability to solve our social and economic problems.

E) Government tends to be slow, inefficient, and cumbersome.

A) All people should have equal income.

B) Economic and political freedoms are likely to be lost if we rely too heavily on the government to solve economic problems.

C) The nation suffers because too little is spent on government services such as transportation, education, and urban renewal.

D) There is every reason to be skeptical about government's ability to solve our social and economic problems.

E) Government tends to be slow, inefficient, and cumbersome.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

12

Establishing the "rules of the game" means that the government

A) uses its authority to redistribute income from the rich to the poor.

B) becomes the owner of all of the nonhuman resources in the economy.

C) should be the primary sponsor of athletic contests in the country.

D) establishes market prices by law.

E) provides an appropriate institutional framework to enable the price system to function properly.

A) uses its authority to redistribute income from the rich to the poor.

B) becomes the owner of all of the nonhuman resources in the economy.

C) should be the primary sponsor of athletic contests in the country.

D) establishes market prices by law.

E) provides an appropriate institutional framework to enable the price system to function properly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

13

An individual who smokes in a public place is an example of

A) public choice.

B) the ability-to-pay principle.

C) an external diseconomy.

D) nonselectivity.

E) a transfer payment.

A) public choice.

B) the ability-to-pay principle.

C) an external diseconomy.

D) nonselectivity.

E) a transfer payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

14

The fact that all citizens,whether they pay taxes or not,benefit from expenditures on national defense is an example of a(n)

A) unfair distribution of income.

B) external economy.

C) external diseconomy.

D) public good.

E) transfer payment.

A) unfair distribution of income.

B) external economy.

C) external diseconomy.

D) public good.

E) transfer payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is the best example of a public good?

A) a hamburger

B) an automobile

C) a parade

D) an upholstered chair

E) a model airplane kit

A) a hamburger

B) an automobile

C) a parade

D) an upholstered chair

E) a model airplane kit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

16

Government requirements that food and drug products be pure and properly labeled are an example of

A) economic stabilization policy.

B) income redistribution.

C) establishing the "rules of the game."

D) trust busting.

E) providing public goods.

A) economic stabilization policy.

B) income redistribution.

C) establishing the "rules of the game."

D) trust busting.

E) providing public goods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

17

One notable characteristic of a public good is that

A) its production incurs no economic costs.

B) consumers can easily be denied the benefits of the good.

C) it will automatically be produced by the free market price system.

D) its consumption by one person does not reduce the amount available to others.

E) consumers may readily divide it into individual pieces and distribute it among themselves.

A) its production incurs no economic costs.

B) consumers can easily be denied the benefits of the good.

C) it will automatically be produced by the free market price system.

D) its consumption by one person does not reduce the amount available to others.

E) consumers may readily divide it into individual pieces and distribute it among themselves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

18

When the government establishes programs to aid the poor by taxing the more affluent,it

Engages in

A) income redistribution.

B) economic stabilization.

C) providing a competitive framework.

D) establishing the rules of the game.

E) free market capitalism.

Engages in

A) income redistribution.

B) economic stabilization.

C) providing a competitive framework.

D) establishing the rules of the game.

E) free market capitalism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

19

Income redistribution programs reflect a belief that

A) the poor are entitled to an income that accurately reflects their productivity.

B) economic resources should be owned and managed by the government.

C) tax structures that are regressive benefit the poor.

D) the more affluent should be taxed to allow others to take more from the nation's output than they produce.

E) poverty is necessary for the rich to practice altruism.

A) the poor are entitled to an income that accurately reflects their productivity.

B) economic resources should be owned and managed by the government.

C) tax structures that are regressive benefit the poor.

D) the more affluent should be taxed to allow others to take more from the nation's output than they produce.

E) poverty is necessary for the rich to practice altruism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

20

With which of the following would Milton Friedman probably agree?

A) All people should have equal incomes.

B) Economic and political freedoms are likely to be lost if we rely too heavily on government to solve economic problems.

C) The nation suffers because too little is spent on governmental services such as transportation, education, and urban renewal.

D) The price system involves substantial coercion and must be supervised carefully.

E) Government tends to be more efficient and to respond more quickly than the market.

A) All people should have equal incomes.

B) Economic and political freedoms are likely to be lost if we rely too heavily on government to solve economic problems.

C) The nation suffers because too little is spent on governmental services such as transportation, education, and urban renewal.

D) The price system involves substantial coercion and must be supervised carefully.

E) Government tends to be more efficient and to respond more quickly than the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

21

The marginal tax rate for the federal personal income tax

A) increases as income rises.

B) is 90 percent for income over $10 million per year.

C) is equal to the average tax rate for all income brackets.

D) is constant for all income levels.

E) is structured to increase after-tax income.

A) increases as income rises.

B) is 90 percent for income over $10 million per year.

C) is equal to the average tax rate for all income brackets.

D) is constant for all income levels.

E) is structured to increase after-tax income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

22

The idea that when citizens vote for an elected official they vote for a bundle of inseparable political programs is known as

A) the benefit principle.

B) bureaucratic inefficiency.

C) the equity principle.

D) nonselectivity.

E) patronage.

A) the benefit principle.

B) bureaucratic inefficiency.

C) the equity principle.

D) nonselectivity.

E) patronage.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

23

Policies that benefit special interest groups are often adopted by governments because

A) these groups in the aggregate tend to represent a broad social consensus.

B) such groups are more efficient in the allocation of resources than government bureaucracies; hence, support of their programs raises economic efficiency.

C) doing so equates marginal social benefits with marginal social costs.

D) such groups contribute more to government revenues than they receive in the form of public benefits.

E) the gains of these relatively small groups come at the expense of a large number of people, each of whom loses very little and so is less aware of the loss.

A) these groups in the aggregate tend to represent a broad social consensus.

B) such groups are more efficient in the allocation of resources than government bureaucracies; hence, support of their programs raises economic efficiency.

C) doing so equates marginal social benefits with marginal social costs.

D) such groups contribute more to government revenues than they receive in the form of public benefits.

E) the gains of these relatively small groups come at the expense of a large number of people, each of whom loses very little and so is less aware of the loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

24

If external diseconomies exist in an industry,the

A) market price is too high and should be reduced.

B) industry is producing a public good.

C) socially optimal output level is below the equilibrium output level.

D) industry is perfectly competitive.

E) industry demand curve should be increased and the industry should be subsidized.

A) market price is too high and should be reduced.

B) industry is producing a public good.

C) socially optimal output level is below the equilibrium output level.

D) industry is perfectly competitive.

E) industry demand curve should be increased and the industry should be subsidized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

25

Public choice theorists argue that the provision of public goods tends to be economically inefficient because

A) the private sector will always provide those goods even if the government does not.

B) government officials are generally more stupid, lazy, or corrupt than their private-sector counterparts.

C) it leads the economy to operate outside the production possibilities curve.

D) to stay elected, politicians frequently adopt programs that benefit a great number of people who each gain very little at the expense of a small group of people who each lose very much.

E) all a voter is able to do is vote for a candidate who favors that group of programs closest to those favored by the voter.

A) the private sector will always provide those goods even if the government does not.

B) government officials are generally more stupid, lazy, or corrupt than their private-sector counterparts.

C) it leads the economy to operate outside the production possibilities curve.

D) to stay elected, politicians frequently adopt programs that benefit a great number of people who each gain very little at the expense of a small group of people who each lose very much.

E) all a voter is able to do is vote for a candidate who favors that group of programs closest to those favored by the voter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

26

The Tennessee Valley Authority (TVA)represents a controversial example of the government's role in providing public goods because

A) flood control and navigation dams will be provided by private barge companies.

B) the dams would enable the government to provide hydroelectric power in competition with private utilities.

C) the Tennessee Valley region was so economically depressed that it was unable to raise the tax revenues needed for the project.

D) the benefits that would be generated from these projects would be significantly lower than the costs of construction.

E) there were clear external diseconomies that would result from damming up rivers and increasing barge traffic.

A) flood control and navigation dams will be provided by private barge companies.

B) the dams would enable the government to provide hydroelectric power in competition with private utilities.

C) the Tennessee Valley region was so economically depressed that it was unable to raise the tax revenues needed for the project.

D) the benefits that would be generated from these projects would be significantly lower than the costs of construction.

E) there were clear external diseconomies that would result from damming up rivers and increasing barge traffic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

27

The concept that people should be taxed so as to result in a socially desirable redistribution of income is known as the ________ principle.

A) benefit

B) ethical

C) ability-to-pay

D) confiscatory-tax

E) tax reform

A) benefit

B) ethical

C) ability-to-pay

D) confiscatory-tax

E) tax reform

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the socially optimal level of output for an industry is identical to the equilibrium output,there are

A) external internalities of substance.

B) both external internalities and internal externalities.

C) no external economies or diseconomies.

D) both external economies and diseconomies.

E) internal and external reciprocities.

A) external internalities of substance.

B) both external internalities and internal externalities.

C) no external economies or diseconomies.

D) both external economies and diseconomies.

E) internal and external reciprocities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

29

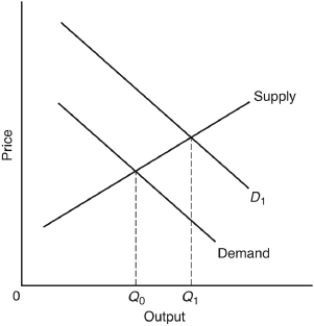

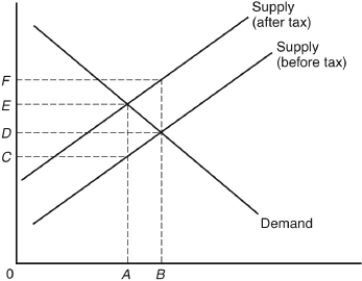

If D₁ is the demand curve reflecting externalities in this industry

A) external diseconomies are present.

B) taxing producers is warranted to reduce output.

C) the optimal output from society's standpoint is 0Q₀.

D) the social benefits from production are greater than those measured by the industry's demand curve.

E) subsidies to producers are too high and should be reduced or eliminated altogether.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

30

One way government could intervene when external diseconomies exist in an industry is to act to

A)shift the industry demand curve to the right.

B) shift the industry supply curve to the left.

C) subsidize the industry to raise its profits.

D) encourage increased production of the industry's product.

E) make the industry's supply curve more nearly reflect the supply curve of a competitive industry.

A)shift the industry demand curve to the right.

B) shift the industry supply curve to the left.

C) subsidize the industry to raise its profits.

D) encourage increased production of the industry's product.

E) make the industry's supply curve more nearly reflect the supply curve of a competitive industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

31

An example of an ability-to-pay principle tax is the

A) gasoline tax.

B) real estate tax.

C) sales tax.

D) license fee for vehicles and drivers.

E) personal income tax.

A) gasoline tax.

B) real estate tax.

C) sales tax.

D) license fee for vehicles and drivers.

E) personal income tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following taxes can be related to the benefit principle?

A) personal income tax

B) estate tax

C) gasoline tax

D) corporate income tax

E) inheritance tax

A) personal income tax

B) estate tax

C) gasoline tax

D) corporate income tax

E) inheritance tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

33

A childless couple has a taxable income of $50,000 per year.They are in the 28 percent marginal tax bracket.Their tax must be

A) less than $14,000.

B) $14,000.

C) more than $14,000.

D) below the average rate but above the marginal rate.

E) it is not possible to determine taxes without more information.

A) less than $14,000.

B) $14,000.

C) more than $14,000.

D) below the average rate but above the marginal rate.

E) it is not possible to determine taxes without more information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

34

If external economies exist in the production of a good,the government could intervene to

A) shift the industry supply curve to the left.

B) tax the industry to reduce production.

C)shift the industry demand curve to the right.

D) tax the user of the industry's product.

E) prohibit production until the external economies are eliminated.

A) shift the industry supply curve to the left.

B) tax the industry to reduce production.

C)shift the industry demand curve to the right.

D) tax the user of the industry's product.

E) prohibit production until the external economies are eliminated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

35

If the socially optimal level of output for an industry is greater than the equilibrium output for that industry,there are

A) external diseconomies.

B) external economies.

C) both external economies and diseconomies simultaneously.

D) external internalities of substance.

E) both external internalities and internal externalities.

A) external diseconomies.

B) external economies.

C) both external economies and diseconomies simultaneously.

D) external internalities of substance.

E) both external internalities and internal externalities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

36

An external economy occurs when

A) library facilities of a university are open to the general public without charge.

B) wealthy individuals are taxed more heavily to support programs to help poor people.

C) a consumer buys a hamburger and a milkshake.

D) someone attends a regular Academy of Music performance of the Philadelphia Orchestra.

E) people smoke in public facilities.

A) library facilities of a university are open to the general public without charge.

B) wealthy individuals are taxed more heavily to support programs to help poor people.

C) a consumer buys a hamburger and a milkshake.

D) someone attends a regular Academy of Music performance of the Philadelphia Orchestra.

E) people smoke in public facilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

37

A significant source of revenue for the federal government is ________ taxes.

A) personal income

B) sales

C) property

D) inheritance

E) import

A) personal income

B) sales

C) property

D) inheritance

E) import

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

38

A basic characteristic of an equitable tax system is that

A) it promotes a perfectly equal distribution of income.

B) only the highest income families pay taxes.

C) people in essentially the same circumstances pay the same taxes.

D) marginal and average tax rates fall as incomes rise.

E) it places the tax burden primarily on businesses, rather than on households.

A) it promotes a perfectly equal distribution of income.

B) only the highest income families pay taxes.

C) people in essentially the same circumstances pay the same taxes.

D) marginal and average tax rates fall as incomes rise.

E) it places the tax burden primarily on businesses, rather than on households.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

39

The concept that those people who receive more from a certain government service should pay more in taxes to support it is known as the ________ principle.

A) benefit

B) ethical

C) ability-to-pay

D) confiscatory tax

E) tax reform

A) benefit

B) ethical

C) ability-to-pay

D) confiscatory tax

E) tax reform

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

40

Two general principles of taxation are the ________ principle and the ________ principle.

A) income; revenue

B) public; private

C) Republican; Democratic

D) demand-side; supply-side

E) ability-to-pay; benefit

A) income; revenue

B) public; private

C) Republican; Democratic

D) demand-side; supply-side

E) ability-to-pay; benefit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the quantity demanded is relatively sensitive to changes in price and the quantity supplied is relatively insensitive to changes in price,the imposition of a sales tax will

A) shift entirely to the buyer.

B) fall more heavily on the buyer.

C) be equally shared by the buyer and seller.

D) fall more heavily on the seller.

E) shift entirely to the seller.

A) shift entirely to the buyer.

B) fall more heavily on the buyer.

C) be equally shared by the buyer and seller.

D) fall more heavily on the seller.

E) shift entirely to the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

42

The major source of revenue for state governments is ________ taxes.

A) personal income

B) sales

C) property

D) inheritance

E) import

A) personal income

B) sales

C) property

D) inheritance

E) import

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

43

A sales or excise tax

A) is often considered to be an incidental tax.

B) has a very high collection cost relative to its yield.

C) is another name for a supply-side tax.

D) imposes a greater relative burden on the rich.

E) in general is paid by both the buyer and the seller.

A) is often considered to be an incidental tax.

B) has a very high collection cost relative to its yield.

C) is another name for a supply-side tax.

D) imposes a greater relative burden on the rich.

E) in general is paid by both the buyer and the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

44

Tax incidence refers to

A) whether the sales tax is collected by sellers or buyers.

B) who bears the ultimate burden of the tax.

C) the principle of taxation used, either benefit or ability-to-pay.

D) the classification of a particular act as tax evasion or tax avoidance.

E) the separation of taxation from expenditure as in revenue sharing.

A) whether the sales tax is collected by sellers or buyers.

B) who bears the ultimate burden of the tax.

C) the principle of taxation used, either benefit or ability-to-pay.

D) the classification of a particular act as tax evasion or tax avoidance.

E) the separation of taxation from expenditure as in revenue sharing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

45

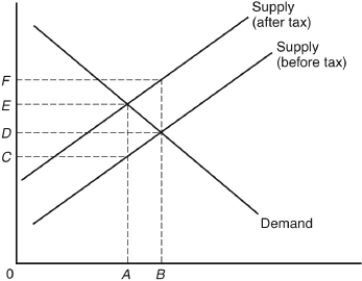

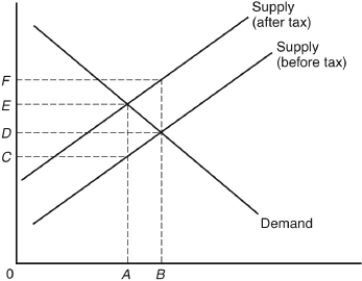

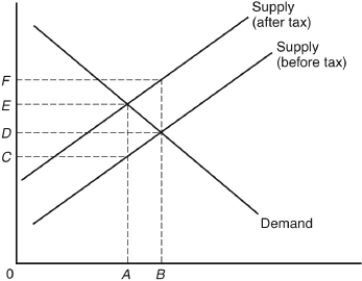

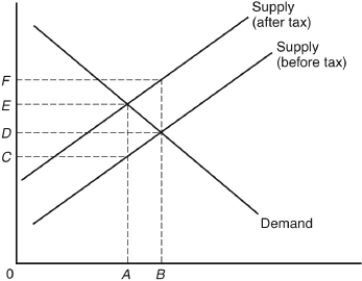

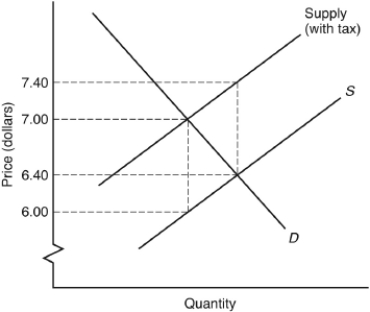

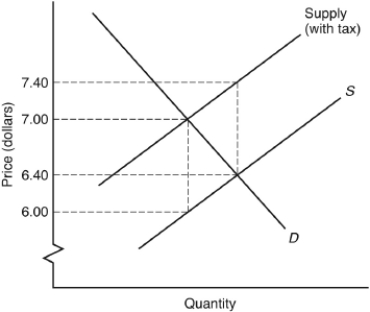

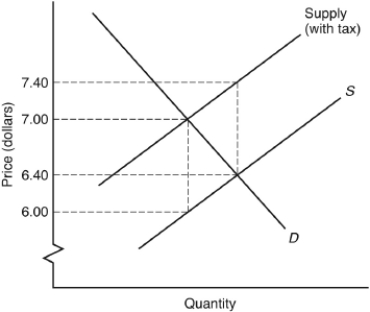

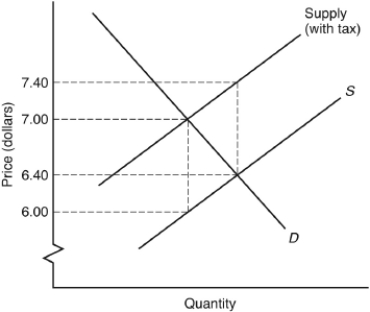

The following questions are based on the following diagram:

The amount of tax shifted forward onto the consumer is best illustrated by

A) AB.

B) DE.

C) CE.

D) DC.

E) CF.

The amount of tax shifted forward onto the consumer is best illustrated by

A) AB.

B) DE.

C) CE.

D) DC.

E) CF.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

46

The major source of revenue for local governments is ________ taxes.

A) personal income

B) sales

C) property

D) inheritance

E) import

A) personal income

B) sales

C) property

D) inheritance

E) import

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

47

If a $100,000 household consumes 50 percent of its income whereas a $10,000 household consumes 90 percent of its income,then a 5 percent sales tax

A) affects both households equally.

B) effectively taxes the income of the low-income household at the rate of 4.5 percent and the income of the high-income household at 2.5 percent.

C) taxes the incomes of both households at the rate of 5 percent.

D) costs the low-income household $500 per year and the high-income household $5,000 per year; therefore, a greater burden is placed on the high-income household.

E) effectively duplicates the impact of a rising marginal tax rate.

A) affects both households equally.

B) effectively taxes the income of the low-income household at the rate of 4.5 percent and the income of the high-income household at 2.5 percent.

C) taxes the incomes of both households at the rate of 5 percent.

D) costs the low-income household $500 per year and the high-income household $5,000 per year; therefore, a greater burden is placed on the high-income household.

E) effectively duplicates the impact of a rising marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

48

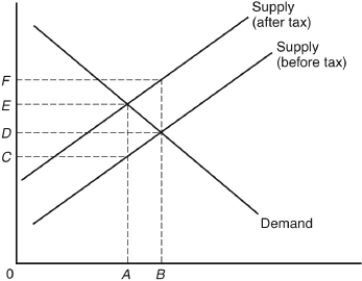

The following questions are based on the following diagram:

Assume an excise tax is imposed on the sale of a good described by the diagram.The excise tax is best illustrated by

A) AB.

B) CD.

C) DF.

D) 0F.

E) 0E.

Assume an excise tax is imposed on the sale of a good described by the diagram.The excise tax is best illustrated by

A) AB.

B) CD.

C) DF.

D) 0F.

E) 0E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

49

If the demand curve is vertical and the supply curve slopes upward,the imposition of a sales tax will

A) shift entirely to the buyer.

B) fall more heavily on the buyer.

C) be equally shared by the buyer and seller.

D) fall more heavily on the seller.

E) shift entirely to the seller.

A) shift entirely to the buyer.

B) fall more heavily on the buyer.

C) be equally shared by the buyer and seller.

D) fall more heavily on the seller.

E) shift entirely to the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

50

If the supply curve is vertical and the demand curve slopes downward,the imposition of a sales tax will

A) shift entirely to the buyer.

B) fall more heavily on the buyer.

C) be equally shared by the buyer and seller.

D) fall more heavily on the seller.

E) shift entirely to the seller.

A) shift entirely to the buyer.

B) fall more heavily on the buyer.

C) be equally shared by the buyer and seller.

D) fall more heavily on the seller.

E) shift entirely to the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

51

Property taxes are

A) quite flexible, with assessments and rates changing frequently.

B) generally taxes with rising marginal rates, taxing the wealthy more heavily.

C) the major source of revenue for the federal government.

D) frequently calculated on assessed values, which are much lower than actual market values.

E) levied only on real estate.

A) quite flexible, with assessments and rates changing frequently.

B) generally taxes with rising marginal rates, taxing the wealthy more heavily.

C) the major source of revenue for the federal government.

D) frequently calculated on assessed values, which are much lower than actual market values.

E) levied only on real estate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

52

If the quantity demanded is relatively insensitive to changes in price and the quantity supplied is relatively sensitive to changes in price,the imposition of a sales tax will

A) shift entirely to the buyer.

B) fall more heavily on the buyer.

C) be equally shared by the buyer and seller.

D) fall more heavily on the seller.

E) shift entirely to the seller.

A) shift entirely to the buyer.

B) fall more heavily on the buyer.

C) be equally shared by the buyer and seller.

D) fall more heavily on the seller.

E) shift entirely to the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

53

The portion of a sales tax increase paid by the consumers of a good is smaller the

A) steeper the demand curve.

B) greater the upward shift of the supply curve.

C) less sensitive the quantity supplied is to changes in price.

D) smaller the downward shift of the supply curve.

E) less sensitive the quantity demanded is to changes in price.

A) steeper the demand curve.

B) greater the upward shift of the supply curve.

C) less sensitive the quantity supplied is to changes in price.

D) smaller the downward shift of the supply curve.

E) less sensitive the quantity demanded is to changes in price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

54

A sales or excise tax

A) shifts the supply curve upward by the amount of the tax.

B) is rarely paid by the consumer if demand is insensitive to price.

C) is another name for a supply-side tax.

D) increases the quantity sold in the market.

E) has a very high collection cost relative to its yield.

A) shifts the supply curve upward by the amount of the tax.

B) is rarely paid by the consumer if demand is insensitive to price.

C) is another name for a supply-side tax.

D) increases the quantity sold in the market.

E) has a very high collection cost relative to its yield.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

55

The primary reason for arguing that the sales tax imposes a greater relative burden on the poor is that

A) the incidence of the sales tax falls entirely on the consumer.

B) sales taxes lower the final prices of the goods taxed.

C) the poor spend a greater percentage of their incomes than do the rich.

D) poor people have more trouble evading sales taxes than the rich.

E) poor people live primarily in rental dwellings, whereas rich people own their own houses.

A) the incidence of the sales tax falls entirely on the consumer.

B) sales taxes lower the final prices of the goods taxed.

C) the poor spend a greater percentage of their incomes than do the rich.

D) poor people have more trouble evading sales taxes than the rich.

E) poor people live primarily in rental dwellings, whereas rich people own their own houses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

56

The incidence of a sales tax falls more heavily on consumers when

A) the government receives the revenue from the tax.

B) the quantity demanded is insensitive to price changes.

C) the quantity supplied is very insensitive to price changes.

D) they give up consuming the taxed good.

E) the equilibrium market price is unaffected by the tax.

A) the government receives the revenue from the tax.

B) the quantity demanded is insensitive to price changes.

C) the quantity supplied is very insensitive to price changes.

D) they give up consuming the taxed good.

E) the equilibrium market price is unaffected by the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following questions are based on the following diagram:

The amount of tax shifted onto the seller is best illustrated by

A) AB.

B) DE.

C) CE.

D) DC.

E) CF.

The amount of tax shifted onto the seller is best illustrated by

A) AB.

B) DE.

C) CE.

D) DC.

E) CF.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following best describes the concept of a marginal tax rate?

A) the amount of income divided by the amount of taxes

B) the tax rate divided by total income

C) the change in taxes divided by the amount of taxes

D) the change in taxes divided by the change in income

E) the amount of before-tax income divided by the amount of after-tax income

A) the amount of income divided by the amount of taxes

B) the tax rate divided by total income

C) the change in taxes divided by the amount of taxes

D) the change in taxes divided by the change in income

E) the amount of before-tax income divided by the amount of after-tax income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

59

A major advantage of a sales tax is that it

A) tends to place a relatively greater burden on high-income individuals who have more money to spend.

B) cannot be shifted.

C) provides a high yield with relatively low collection costs.

D) has little or no effect on the final prices consumers pay.

E) does not affect the overall level of retail sales.

A) tends to place a relatively greater burden on high-income individuals who have more money to spend.

B) cannot be shifted.

C) provides a high yield with relatively low collection costs.

D) has little or no effect on the final prices consumers pay.

E) does not affect the overall level of retail sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

60

The sales tax

A) is the major source of revenue for local government.

B) is never applied to food or medical purchases.

C) is usually at the rate of 1-2 percent.

D) is completely shifted to the consumer.

E) imposes a relatively greater burden on the poor.

A) is the major source of revenue for local government.

B) is never applied to food or medical purchases.

C) is usually at the rate of 1-2 percent.

D) is completely shifted to the consumer.

E) imposes a relatively greater burden on the poor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

61

The passing of Proposition 13 in 1978 tends to illustrate that California voters may have

A) been willing to pay higher taxes to ensure increased levels of public services.

B) been fed up with increasingly higher progressive income tax rates and voted to reduce them.

C) felt the government's role in the fields of labor and welfare should be increased at the state level.

D) believed that the existing levels of local government services were being inefficiently produced and not worth the increasing taxes necessary to finance them.

E) wished to place a greater importance on the property tax as a source of local government funds.

A) been willing to pay higher taxes to ensure increased levels of public services.

B) been fed up with increasingly higher progressive income tax rates and voted to reduce them.

C) felt the government's role in the fields of labor and welfare should be increased at the state level.

D) believed that the existing levels of local government services were being inefficiently produced and not worth the increasing taxes necessary to finance them.

E) wished to place a greater importance on the property tax as a source of local government funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

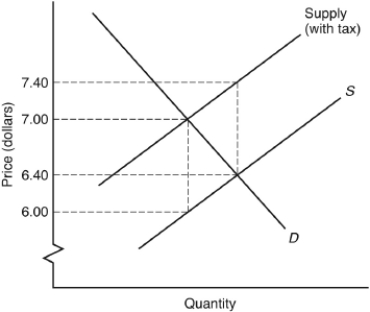

62

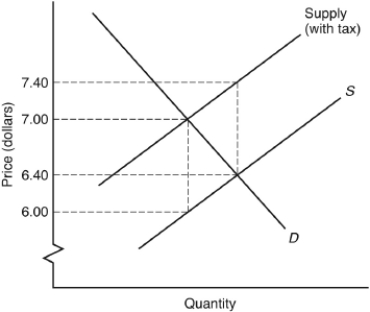

The following questions are based on the following diagram:

The amount of tax per unit is

A) $1.40.

B) $1.

C) $0.60.

D) $0.50.

E) $0.40.

The amount of tax per unit is

A) $1.40.

B) $1.

C) $0.60.

D) $0.50.

E) $0.40.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

63

Government health care programs such as Medicare and Medicaid are justified on the basis of the notion that the government has a responsibility to ensure

A) that markets remain competitive.

B) a fairer or more desirable distribution of income.

C) full employment with stable prices.

D) that fraud is prevented.

E) the elimination of external economies.

A) that markets remain competitive.

B) a fairer or more desirable distribution of income.

C) full employment with stable prices.

D) that fraud is prevented.

E) the elimination of external economies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

64

One group that feared the negative impact of the TVA on the demand for the output of its industry was the

A) electrical equipment manufacturers.

B) homebuilders.

C) farmers.

D) barge operators.

E) coal miners.

A) electrical equipment manufacturers.

B) homebuilders.

C) farmers.

D) barge operators.

E) coal miners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

65

The biggest financial winners from the passage of Proposition 13 in California were

A) renters.

B) homeowners.

C) business and agriculture.

D) tourists.

E) local governments.

A) renters.

B) homeowners.

C) business and agriculture.

D) tourists.

E) local governments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is an accurate statement about tax incidence?

A) Questions about tax incidence are purely problems of normative economics, that is, questions involving, "Who should pay the tax?"

B) The incidence of the personal income tax is not generally agreed on.

C) The property tax is borne entirely by the landlord.

D) The incidence of the sales tax depends on the price sensitivity of the supply and demand curves for the taxed commodity.

E) Economists agree that most, if not all, corporate income taxes are incidental.

A) Questions about tax incidence are purely problems of normative economics, that is, questions involving, "Who should pay the tax?"

B) The incidence of the personal income tax is not generally agreed on.

C) The property tax is borne entirely by the landlord.

D) The incidence of the sales tax depends on the price sensitivity of the supply and demand curves for the taxed commodity.

E) Economists agree that most, if not all, corporate income taxes are incidental.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

67

When companies and newscasters say that any additional excise tax will just be "passed on to the consumer," they are correct only if

A) the quantity demanded is completely insensitive to the price.

B) the amount of the tax is relatively small.

C) producers do not want to absorb any of the tax themselves.

D) the government allows firms to do that.

E) the tax reduces the equilibrium quantity of the good.

A) the quantity demanded is completely insensitive to the price.

B) the amount of the tax is relatively small.

C) producers do not want to absorb any of the tax themselves.

D) the government allows firms to do that.

E) the tax reduces the equilibrium quantity of the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

68

The following questions are based on the following diagram:

Suppose a sales tax on the commodity is imposed where S and D are the market supply and demand curves before the tax was levied.The equilibrium price with the tax is

A) $6.

B) $6.40.

C) $7.

D) $7.40.

E) somewhere between $6.40 and $7.

Suppose a sales tax on the commodity is imposed where S and D are the market supply and demand curves before the tax was levied.The equilibrium price with the tax is

A) $6.

B) $6.40.

C) $7.

D) $7.40.

E) somewhere between $6.40 and $7.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

69

The following questions are based on the following diagram:

The incidence of the tax on the seller is ________ per unit.

A) $1.40

B) $1

C) $0.60

D) $0.50

E) $0.40

The incidence of the tax on the seller is ________ per unit.

A) $1.40

B) $1

C) $0.60

D) $0.50

E) $0.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck

70

For a society operating at full employment,an increase in the amount of publicly provided goods

A) can be achieved without the sacrifice of privately provided goods.

B) means a reduction in the scope of government services.

C) means that the rate of unemployment falls.

D) means that society must reduce its consumption of privately provided goods.

E) means that the production possibilities curve has shifted to the left.

A) can be achieved without the sacrifice of privately provided goods.

B) means a reduction in the scope of government services.

C) means that the rate of unemployment falls.

D) means that society must reduce its consumption of privately provided goods.

E) means that the production possibilities curve has shifted to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 70 في هذه المجموعة.

فتح الحزمة

k this deck