Deck 3: Adjusting the Accounts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/20

العب

ملء الشاشة (f)

Deck 3: Adjusting the Accounts

1

Accountants divide the life of a business into specific time periods, such as monthly, quarterly and yearly.

True

2

Revenue is recognized in the period in which it was received rather than when it was earned.

False

3

Payments of expenses that will benefit more than one accounting period are referred to as prepaid expenses

True

4

Cost less accumulated depreciation is a measurement of the current value of an asset such as equipment or a building.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

5

Depreciation is the allocation of the cost of a long-lived asset to expense over its useful life in a rational and systematic manner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

6

The adjusting entry for unearned revenues results in a debit to an asset account and a credit to a revenue account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

7

Accumulated depreciation is an example of a contra asset account and its balance is deducted from the related asset in the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

8

When the accrual basis of accounting is applied, adjusting entries are not necessary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

9

Adjustments for accrued expenses are necessary to record the obligations that exist at the balance sheet date and to recognize the expenses that are applicable to the current accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

10

Accrued revenues are also called accrued liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under IFRS, companies must prepare quarterly financial statements which means they must prepare adjusting entries quarterly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

12

Under ASPE, the term "depreciation" must be used for the cost allocation of all long-lived assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

13

Some retail companies use a 52-week period, instead of exactly one year, for their fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

14

The recording of wages earned but not yet paid is an example of an adjustment that:

A) recognizes an accrued expense.

B) recognizes an unrecorded revenue.

C) apportions revenues between two or more periods.

D) apportions estimated costs between two or more periods.

A) recognizes an accrued expense.

B) recognizes an unrecorded revenue.

C) apportions revenues between two or more periods.

D) apportions estimated costs between two or more periods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

15

A list of the accounts and their balances after all adjustments have been made is known as a(n):

A) trial balance.

B) adjusted trial balance.

C) general ledger.

D) balance sheet.

A) trial balance.

B) adjusted trial balance.

C) general ledger.

D) balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

16

Prior to recording adjusting entries, revenues exceed expenses by $60,000. Adjusting entries for accrued wages of $5,000 and depreciation expense of $5,000 were made. Profit for the year would be:

A) $60,000.

B) $55,000.

C) $50,000.

D) None of the above.

A) $60,000.

B) $55,000.

C) $50,000.

D) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

17

Revenue is not recorded in the accounting period when:

A) there is an increase in assets or a decrease in liabilities.

B) the service has been performed or the goods have been sold and delivered.

C) the revenue can be reliably measured and collection is reasonably certain.

D) there is a decrease in assets or an increase in liabilities.

A) there is an increase in assets or a decrease in liabilities.

B) the service has been performed or the goods have been sold and delivered.

C) the revenue can be reliably measured and collection is reasonably certain.

D) there is a decrease in assets or an increase in liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

18

If an adjusting entry to record accrued revenue was not posted:

A) assets would be understated.

B) revenue would be understated.

C) profit would be understated.

D) All of the above.

A) assets would be understated.

B) revenue would be understated.

C) profit would be understated.

D) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

19

a)Revenue should be recorded in the accounting period when ________________________ ________________________.

If a cost is directly related to earning revenue it should be recorded as an expense in the accounting period when _____________________________________________.

If the there is no direct association between the cost and the revenue but the company will benefit from a cost over several years, the cost should be recognized as expense in the accounting period when _____________.

If the benefit from a cost is fully used in the current period it should be recognized as expense in the accounting period when ________________________.

If a cost is directly related to earning revenue it should be recorded as an expense in the accounting period when _____________________________________________.

If the there is no direct association between the cost and the revenue but the company will benefit from a cost over several years, the cost should be recognized as expense in the accounting period when _____________.

If the benefit from a cost is fully used in the current period it should be recognized as expense in the accounting period when ________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

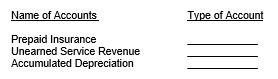

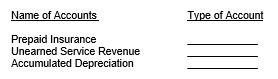

20

What type of accounts (i.e. asset, liability or owner's equity) are the following accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck