Deck 12: Accounting for Partnerships

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/18

العب

ملء الشاشة (f)

Deck 12: Accounting for Partnerships

1

An advantage of partnerships is mutual agency.

False

2

In a limited partnership, one or more partners have limited liability for the debts of the firm.

True

3

In a limited liability partnership, a partner cannot be held liable for the negligence of the people directly supervised by that partner.

False

4

In a partnership where the division of profits and losses is based on salaries, interest, and a stated ratio, if the salary and interest allocation will exceed the profit, the profit is allocated only by the stated ratio instead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

5

A partnership is considered an accounting entity for financial reporting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

6

When the partnership contract does not specify the manner in which profits and losses are to be divided, profits and losses are distributed based on the average capital balances of each partner during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

7

The statement of partners' capital explains the changes in each partner's capital account and in total partnership capital during the year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

8

Admission of a new partner to the partnership does not result in the legal dissolution of the existing partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

9

If a partnership is admitting a new partner to the existing partnership and the existing partners are to receive a bonus, this bonus would be allocated on the basis of their profit and loss ratios before the admission of the new partner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

10

Upon liquidation, once the assets have been sold and the creditors paid, the final cash is distributed equally among partners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which one of the following is not a feature of partnerships?

A) Limited life

B) Limited liability

C) Mutual agency

D) Co-ownership of property

A) Limited life

B) Limited liability

C) Mutual agency

D) Co-ownership of property

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

12

B invests $60,000 for a 25% interest in a partnership that has total capital of $200,000 after admitting B. Which of the following is true?

A) B's capital is $60,000.

B) B's capital is $35,000.

C) B received a bonus of $10,000.

D) The original partners received a total bonus of $10,000.

A) B's capital is $60,000.

B) B's capital is $35,000.

C) B received a bonus of $10,000.

D) The original partners received a total bonus of $10,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

13

Partners A and B receive a salary allowance of $12,000 and $18,000, respectively, and share the remainder equally. If the company earned $20,000 during the period, what is the effect on A's capital?

A) $12,000 increase

B) $7,000 decrease

C) $7,000 increase

D) $10,000 increase

A) $12,000 increase

B) $7,000 decrease

C) $7,000 increase

D) $10,000 increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

14

After selling the assets and paying the creditors, the partnership had $90,000 cash remaining. A, B, and C had capital balances of $20,000, $30,000 and $40,000 respectively. Profit is shared on a ratio of 1:3:5, respectively. The cash to be received by partner C would be:

A) $30,000.

B) $40,000.

C) $45,000.

D) $50,000.

A) $30,000.

B) $40,000.

C) $45,000.

D) $50,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

15

Selling partnership assets and paying the proceeds to creditors and owners refers to:

A) dissolution.

B) unlimited liability.

C) mutual agency.

D) liquidation.

A) dissolution.

B) unlimited liability.

C) mutual agency.

D) liquidation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

16

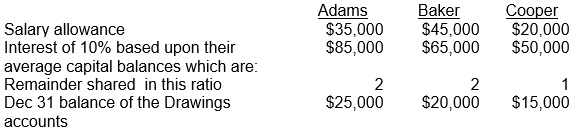

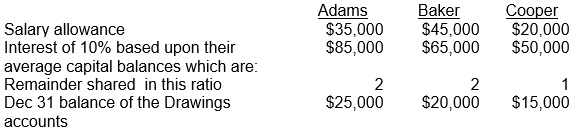

ABC Partnership has a profit of $150,000 for the year ended December 31, 2011. The partnership agreement states that profit and losses are to be distributed using salary allowances, interest allowances, and a ratio for the remainder. Information about the agreement and the balance of the Drawings accounts is contained in the table below.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.

(b) Assume that the revenue and expense accounts have been closed. Prepare the remaining closing entries.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.

(a) Prepare a detailed schedule to show how the profit would be allocated among the three partners.(b) Assume that the revenue and expense accounts have been closed. Prepare the remaining closing entries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

17

On July 1, the Duncan & Evan partnership agreed to admit Foster to the partnership. Foster will receive a 40% share of the business for a cash investment of $200,000. Information regarding the partnership records prior to the admission of Foster is located in the table.

Prepare the journal entry to admit Foster into the partnership. Show calculations.

Prepare the journal entry to admit Foster into the partnership. Show calculations.

Prepare the journal entry to admit Foster into the partnership. Show calculations.

Prepare the journal entry to admit Foster into the partnership. Show calculations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck

18

Define Limited Partnerships and Limited Liability Partnerships, indicating the difference between the two.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 18 في هذه المجموعة.

فتح الحزمة

k this deck