Deck 17: Financial Statement Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/19

العب

ملء الشاشة (f)

Deck 17: Financial Statement Analysis

1

Intercompany comparison refers to comparison with other companies to provide insight into competitive position.

True

2

Vertical analysis expresses all income statement items as a percentage of profit.

False

3

A base year is selected when performing horizontal analysis.

True

4

Current ratio, receivables turnover, and inventory turnover, are measures of solvency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

5

Gross profit margin, asset turnover, and return on equity are profitability ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

6

The payout ratio is a reflection of investor's assessments of a company's future profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

7

The formula for calculating the interest coverage ratio is profit before income tax expense and interest expense divided by interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

8

Earnings per share is reported for both common and preferred shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

9

Sales (in millions) for a three-year period are: Year 1 $4.0, Year 2 $4.6, and Year 3 $5.0. Using Year 1 as the base year, sales in Years 2 and 3 expressed as a percentage of the base year sales are, respectively:

A) 115% and 125%.

B) 115% and 109%.

C) 15% and 25%.

D) 87% and 80%.

A) 115% and 125%.

B) 115% and 109%.

C) 15% and 25%.

D) 87% and 80%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

10

All of the formulas are correct except:

A) Receivables Turnover = Net Credit Sales ÷ Average Gross Receivables.

B) Asset turnover = Net Sales ÷ Average Total Assets.

C) Current Ratio = Current Liabilities ÷ Current Assets.

D) Payout Ratio = Cash Dividends ÷ Profit.

A) Receivables Turnover = Net Credit Sales ÷ Average Gross Receivables.

B) Asset turnover = Net Sales ÷ Average Total Assets.

C) Current Ratio = Current Liabilities ÷ Current Assets.

D) Payout Ratio = Cash Dividends ÷ Profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

11

Net credit sales are $4,000,000 and average gross receivables are $250,000. The collection period is:

A) 16 times.

B) 6.25 percent.

C) 16 days.

D) 22.8 days.

A) 16 times.

B) 6.25 percent.

C) 16 days.

D) 22.8 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

12

The Operating Cycle:

A) Represents the number of days to purchase inventory

B) Measures liquidity of inventory.

C) Measures the number of days receivables are outstanding

D) Increases as the collection period increases.

A) Represents the number of days to purchase inventory

B) Measures liquidity of inventory.

C) Measures the number of days receivables are outstanding

D) Increases as the collection period increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

13

Earnings per share:

A) is calculated by dividing profit by the number of common share issued in the year

B) is a measure of the profit earned on each common share

C) is not presented on the income statement for publicly traded companies

D) is a measure of profit earned on each preferred share

A) is calculated by dividing profit by the number of common share issued in the year

B) is a measure of the profit earned on each common share

C) is not presented on the income statement for publicly traded companies

D) is a measure of profit earned on each preferred share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

14

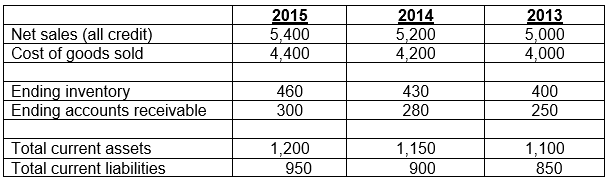

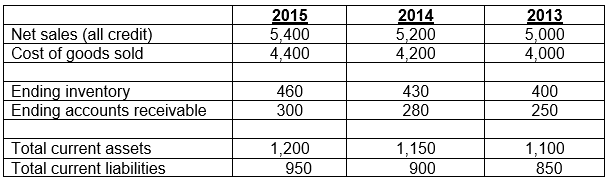

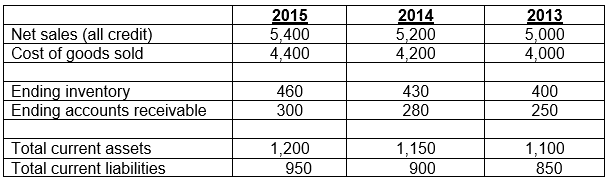

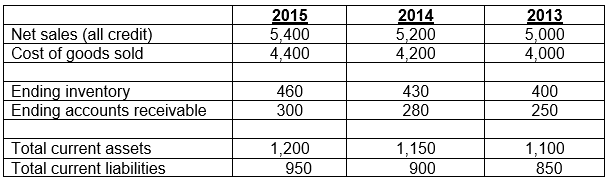

Here is selected information for Phillips Inc. Use this information to answer the questions below.

Round each answer to one decimal place.

-Calculate the gross profit margin for 2014. ______________________

Calculate the gross profit margin for 2015. ______________________

Comment on the change____________________________

Round each answer to one decimal place.

-Calculate the gross profit margin for 2014. ______________________

Calculate the gross profit margin for 2015. ______________________

Comment on the change____________________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

15

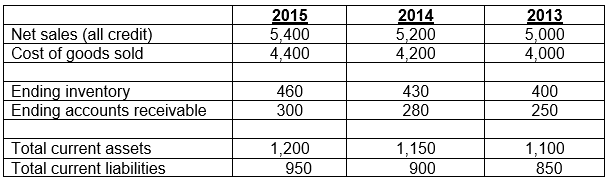

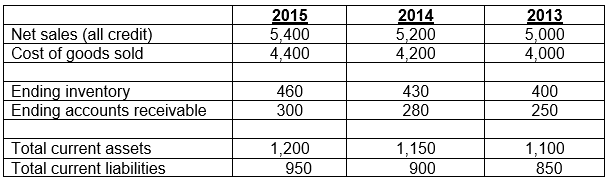

Here is selected information for Phillips Inc. Use this information to answer the questions below.

Round each answer to one decimal place.

-Calculate the inventory turnover for 2014. ______________________

Round each answer to one decimal place.

-Calculate the inventory turnover for 2014. ______________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

16

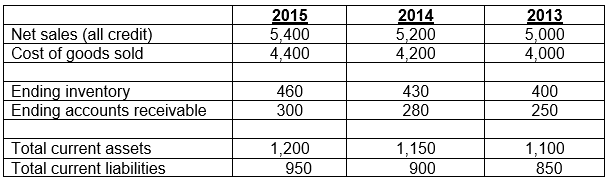

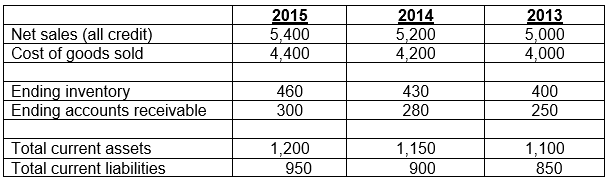

Here is selected information for Phillips Inc. Use this information to answer the questions below.

Round each answer to one decimal place.

-Calculate the collection period for 2015. ______________________

Round each answer to one decimal place.

-Calculate the collection period for 2015. ______________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

17

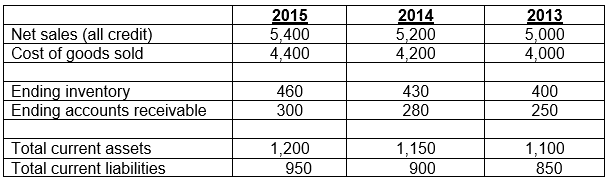

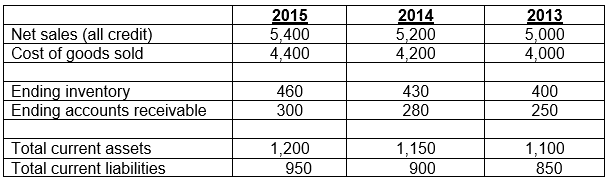

Here is selected information for Phillips Inc. Use this information to answer the questions below.

Round each answer to one decimal place.

-Calculate the working capital for 2015. ______________________

Round each answer to one decimal place.

-Calculate the working capital for 2015. ______________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

18

Here is selected information for Phillips Inc. Use this information to answer the questions below.

Round each answer to one decimal place.

-Calculate the current ratio for 2015. ______________________

Round each answer to one decimal place.

-Calculate the current ratio for 2015. ______________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck

19

List two ratios that are used to evaluate liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 19 في هذه المجموعة.

فتح الحزمة

k this deck