Deck 13: Primary Markets and the Underwriting of Securities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/45

العب

ملء الشاشة (f)

Deck 13: Primary Markets and the Underwriting of Securities

1

Which of the below statements is FALSE?

A) The value of a right can be found by calculating the difference between the price of a share before the rights offering and the price of a share after the rights offering.

B) The difference between the price before the rights offering and after the rights offering expressed as a percentage of the original price is called the concentration effect of the rights issue.

C) Value of a right = Share price rights on - Share price ex rights

D) Value of a right = Price before rights offering - Price after rights offering

A) The value of a right can be found by calculating the difference between the price of a share before the rights offering and the price of a share after the rights offering.

B) The difference between the price before the rights offering and after the rights offering expressed as a percentage of the original price is called the concentration effect of the rights issue.

C) Value of a right = Share price rights on - Share price ex rights

D) Value of a right = Price before rights offering - Price after rights offering

B

2

The ________ involves the distribution to investors of newly issued securities by central governments, its agencies, municipal governments, and corporations

A) OTC market

B) secondary market

C) primary market

D) stock market

A) OTC market

B) secondary market

C) primary market

D) stock market

C

3

In a variant of the auction process, a security is allocated to bidders from the highest bid price (________) to the lower ones (________) until the entire issue is allocated.

A) (highest yield in the case of a bond); (higher yield in the case of a bond)

B) (lowest yield in the case of a bond); (higher yield in the case of a bond)

C) (lowest yield in the case of a bond); (lower yield in the case of a bond)

D) (highest yield in the case of a bond); (lower yield in the case of a bond)

A) (highest yield in the case of a bond); (higher yield in the case of a bond)

B) (lowest yield in the case of a bond); (higher yield in the case of a bond)

C) (lowest yield in the case of a bond); (lower yield in the case of a bond)

D) (highest yield in the case of a bond); (lower yield in the case of a bond)

B

4

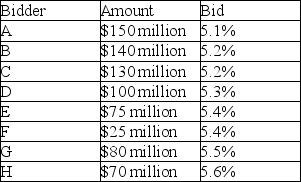

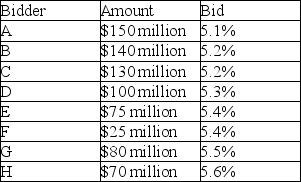

Suppose that an issuer is offering $600 million of a bond issue, and nine bidders submit the following yield bids:

Which of the below statements is FALSE?

A) The first five bidders (A, B, C, D, and E) will be allocated the amount for which they bid because they submitted the lowest-yield bids. In total, they will receive $595 million of the $600 million to be issued.

B) After allocating $420 million to the highest three bidders, then $180 million can be allocated to the next two highest bidders.

C) The lowest bidders will receive an amount proportionate to the amount for which they bid.

D) After allocating $595 million to the highest bidders, then $5 million can be allocated to the next lowest bidders.

Which of the below statements is FALSE?

A) The first five bidders (A, B, C, D, and E) will be allocated the amount for which they bid because they submitted the lowest-yield bids. In total, they will receive $595 million of the $600 million to be issued.

B) After allocating $420 million to the highest three bidders, then $180 million can be allocated to the next two highest bidders.

C) The lowest bidders will receive an amount proportionate to the amount for which they bid.

D) After allocating $595 million to the highest bidders, then $5 million can be allocated to the next lowest bidders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

5

A red herring is ________.

A) a period of waiting for SEC approval.

B) an amended prospectus.

C) a preliminary prospectus.

D) a prospectus printed fully in red ink.

A) a period of waiting for SEC approval.

B) an amended prospectus.

C) a preliminary prospectus.

D) a prospectus printed fully in red ink.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

6

Not all deals are underwritten using the traditional syndicate process. For example, variations in the United States, the Euromarkets, and foreign markets include ________.

A) the auction process and rights offering for the underwriting of bonds.

B) the bought deal of the Eurostock market.

C) a rights offering for underwriting common stock.

D) All of these

A) the auction process and rights offering for the underwriting of bonds.

B) the bought deal of the Eurostock market.

C) a rights offering for underwriting common stock.

D) All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

7

Underwriting activities are regulated by the ________.

A) Initial Public Offerings Market (IPOM).

B) Securities and Exchange Commission (SEC).

C) Investment Banking Industry (IBI).

D) Federal Bureau of Investigation (FBI).

A) Initial Public Offerings Market (IPOM).

B) Securities and Exchange Commission (SEC).

C) Investment Banking Industry (IBI).

D) Federal Bureau of Investigation (FBI).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the below statements is FALSE?

A) A secondary common stock offering is an offering of common stock that had been issued in the past by the corporation.

B) For a secondary offering, the range for the gross spread as a percentage of the amount raised is between 3% and 6%.

C) For traditional bond offerings, the gross spread as a percentage of the principal is around 100 basis points.

D) The typical underwritten transaction involves so much risk of capital loss that a single investment banking firm undertaking it alone would be exposed to the danger of losing a significant portion of its capital.

A) A secondary common stock offering is an offering of common stock that had been issued in the past by the corporation.

B) For a secondary offering, the range for the gross spread as a percentage of the amount raised is between 3% and 6%.

C) For traditional bond offerings, the gross spread as a percentage of the principal is around 100 basis points.

D) The typical underwritten transaction involves so much risk of capital loss that a single investment banking firm undertaking it alone would be exposed to the danger of losing a significant portion of its capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

9

The traditional process in the United States for issuing new securities involves investment bankers performing up to three functions. Which of the below is NOT one of these functions?

A) One function is advising the issuer on the terms and the timing of the offering.

B) One function is selling the securities to the issuer.

C) One function is distributing the issue to the public.

D) One function is buying the securities from the issuer.

A) One function is advising the issuer on the terms and the timing of the offering.

B) One function is selling the securities to the issuer.

C) One function is distributing the issue to the public.

D) One function is buying the securities from the issuer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Securities Act of 1933 ________.

A) does not provide for penalties in the form of fines and/or imprisonment if the information provided is inaccurate or material information is omitted.

B) governs the issuance of securities.

C) provides that investors who purchase the security are entitled to sue the issuer but not the underwriter to recover damages if they incur a loss as a result of the misleading information.

D) provides that financial statements must be included after the registration statement.

A) does not provide for penalties in the form of fines and/or imprisonment if the information provided is inaccurate or material information is omitted.

B) governs the issuance of securities.

C) provides that investors who purchase the security are entitled to sue the issuer but not the underwriter to recover damages if they incur a loss as a result of the misleading information.

D) provides that financial statements must be included after the registration statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

11

When all bidders buy the amount allocated to them, then the auction is referred to ________.

A) as a multiple-price auction or a Dutch auction.

B) as a single-price auction or a German auction.

C) as a single-price auction or a Dutch auction.

D) as a multiple-price auction or a German auction.

A) as a multiple-price auction or a Dutch auction.

B) as a single-price auction or a German auction.

C) as a single-price auction or a Dutch auction.

D) as a multiple-price auction or a German auction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

12

A variation for underwriting securities is the auction process. In this method, ________.

A) the issuer announces the terms of the issue, and interested parties submit bids for part of the issue.

B) the auction form is mandated for certain securities of regulated public utilities but not for municipal debt obligations.

C) the issuer announces the terms of the issue, and interested parties submit bids for the entire issue.

D) mandated for many municipal debt obligations but not for certain securities of regulated public utilities.

A) the issuer announces the terms of the issue, and interested parties submit bids for part of the issue.

B) the auction form is mandated for certain securities of regulated public utilities but not for municipal debt obligations.

C) the issuer announces the terms of the issue, and interested parties submit bids for the entire issue.

D) mandated for many municipal debt obligations but not for certain securities of regulated public utilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

13

The type of information contained in the registration statement includes ________.

A) the nature of the business of the issuer and key provisions or features of the security.

B) the nature of the investment risks associated with the security and the background of management.

C) the nature of the business of the issuer and the background of management.

D) All of these

A) the nature of the business of the issuer and key provisions or features of the security.

B) the nature of the investment risks associated with the security and the background of management.

C) the nature of the business of the issuer and the background of management.

D) All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

14

The registration is actually divided into two parts. Part I is the ________. It is this part that is typically distributed to the public as an offering of the securities. Part II contains ________, which is not distributed to the public as part of the offering but is available from the SEC upon request.

A) registration; additional information

B) prospectus; supplemental information

C) supplemental information; registration

D) beginning information; prospectus

A) registration; additional information

B) prospectus; supplemental information

C) supplemental information; registration

D) beginning information; prospectus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the below statements is TRUE?

A) The filing of a registration statement with the SEC means that the security can be offered to the public.

B) When the SEC declares the registration statement is "effective," it means that an amendment to the registration statement can be filed.

C) The registration statement must be reviewed and approved by the SEC's Division of Corporate Finance before a public offering can be made.

D) The approval of the SEC means that the securities have investment merit or are properly priced or that the information is accurate.

A) The filing of a registration statement with the SEC means that the security can be offered to the public.

B) When the SEC declares the registration statement is "effective," it means that an amendment to the registration statement can be filed.

C) The registration statement must be reviewed and approved by the SEC's Division of Corporate Finance before a public offering can be made.

D) The approval of the SEC means that the securities have investment merit or are properly priced or that the information is accurate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

16

The participants in the marketplace that work with issuers to distribute newly issued securities are called investment bankers. Investment banking is performed by two groups: ________.

A) commercial banks and securities houses.

B) hometown banks and securities houses.

C) commercial banks and bank houses.

D) savings & loans and bank houses.

A) commercial banks and securities houses.

B) hometown banks and securities houses.

C) commercial banks and bank houses.

D) savings & loans and bank houses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

17

A consequence of ________ is that underwriting firms need to expand their capital so that they can commit greater amounts of funds to such deals.

A) accepting auction deals

B) rejecting bought deals

C) accepting bought deals

D) rejecting auction deals

A) accepting auction deals

B) rejecting bought deals

C) accepting bought deals

D) rejecting auction deals

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

18

An ________ is a common stock offering issued by companies that have NOT previously issued common stock to the public.

A) initial private issuance (IPI)

B) seasoned equity offering (SEO)

C) initial public offering (IPO)

D) seasoned offering (SO)

A) initial private issuance (IPI)

B) seasoned equity offering (SEO)

C) initial public offering (IPO)

D) seasoned offering (SO)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

19

An investment banker may merely act as an advisor and/or distributor of the new security. The function of buying the securities from the issuer is called ________.

A) advising.

B) distributing.

C) purchasing.

D) underwriting.

A) advising.

B) distributing.

C) purchasing.

D) underwriting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

20

The mechanics of a bought deal are that ________.

A) the lead manager or a group of managers offers a potential issuer of debt securities a firm bid to purchase an undetermined amount of the securities with an interest (coupon) rate and maturity to be announced later.

B) the issuer is given a month or more to accept or reject the bid.

C) if the bid is rejected, the underwriting firm has bought the deal.

D) the underwriter can sell the securities to other investment banking firms for distribution to their clients and/or distribute the securities to its clients.

A) the lead manager or a group of managers offers a potential issuer of debt securities a firm bid to purchase an undetermined amount of the securities with an interest (coupon) rate and maturity to be announced later.

B) the issuer is given a month or more to accept or reject the bid.

C) if the bid is rejected, the underwriting firm has bought the deal.

D) the underwriter can sell the securities to other investment banking firms for distribution to their clients and/or distribute the securities to its clients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

21

________ are the major investors in private placements.

A) Life insurance companies .

B) Credit Unions.

C) Pension funds.

D) Auto insurance companies.

A) Life insurance companies .

B) Credit Unions.

C) Pension funds.

D) Auto insurance companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

22

The gross spread earned by the underwriter depends on numerous factors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

23

In April 1990, the SEC Rule 144A became effective and ________.

A) eliminated the five-year holding period by permitting large institutions to trade securities acquired in a private placement among themselves by registering these securities with the SEC.

B) eliminated the two-year holding period by disallowing large institutions to trade securities acquired in a private placement among themselves without having to register these securities with the SEC.

C) eliminated the two-year holding period by permitting large institutions to trade securities acquired in a private placement among themselves without having to register these securities with the SEC.

D) added the two-year holding period by permitting small institutions to trade securities acquired in a public placement among themselves without having to register these securities with the SEC.

A) eliminated the five-year holding period by permitting large institutions to trade securities acquired in a private placement among themselves by registering these securities with the SEC.

B) eliminated the two-year holding period by disallowing large institutions to trade securities acquired in a private placement among themselves without having to register these securities with the SEC.

C) eliminated the two-year holding period by permitting large institutions to trade securities acquired in a private placement among themselves without having to register these securities with the SEC.

D) added the two-year holding period by permitting small institutions to trade securities acquired in a public placement among themselves without having to register these securities with the SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

24

In 1982, the SEC adopted Regulation D,which ________.

A) exempts securities sold only within a state.

B) states that if the offering is for $1 million or less, the securities need not be registered

C) sets forth the guidelines that determine if an issue is qualified for exemption from registration.

D) exempts from registration "transactions by an issuer not involving any public offering."

A) exempts securities sold only within a state.

B) states that if the offering is for $1 million or less, the securities need not be registered

C) sets forth the guidelines that determine if an issue is qualified for exemption from registration.

D) exempts from registration "transactions by an issuer not involving any public offering."

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

25

The Securities Act of 1933 does not provide specific guidelines to identify what is a ________.

A) private security.

B) public placement.

C) public offering.

D) private offering.

A) private security.

B) public placement.

C) public offering.

D) private offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

26

Because of the low risks associated with the underwriting of securities, an underwriting syndicate and a selling group are rarely formed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

27

Congress specifies the conditions that must be satisfied to qualify for a private placement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

28

A private placement is the distribution of shares to a limited number of institutional investors rather than through a public offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

29

An offering of a new security cannot be made by means of an auction process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

30

Depending on the type of underwriting agreement, the underwriting function may expose the investment banking firm to the risk of selling the securities to the public at a price greater than the price paid to the issuer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

31

A corporation can offer existing shareholders new shares in a preemptive rights offering, and using a standby underwriting arrangement, the corporation can have an investment banking firm agree to distribute any shares not subscribed to.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the below statements is FALSE?

A) Using an auction allows corporate issuers to place newly issued debt obligations directly with institutional investors rather than follow the indirect path of using an underwriting firm.

B) By dealing with just a few institutional investors, investment bankers argue, issuers cannot be sure of obtaining funds at the lowest cost.

C) A preemptive right grants existing shareholders the right to buy some proportion of the new shares issued at a price below market value.

D) For the shares sold via a preemptive rights offering, the underwriting services of an investment banker are needed.

A) Using an auction allows corporate issuers to place newly issued debt obligations directly with institutional investors rather than follow the indirect path of using an underwriting firm.

B) By dealing with just a few institutional investors, investment bankers argue, issuers cannot be sure of obtaining funds at the lowest cost.

C) A preemptive right grants existing shareholders the right to buy some proportion of the new shares issued at a price below market value.

D) For the shares sold via a preemptive rights offering, the underwriting services of an investment banker are needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

33

In addition to underwriting securities for distribution to the public, securities may be placed with a limited number of institutional investors such as ________.

A) insurance companies.

B) investment companies.

C) pension funds.

D) All of these

A) insurance companies.

B) investment companies.

C) pension funds.

D) All of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

34

In regards to Rule 144a, which of the below statements is FALSE?

A) Rule 144A encouraged non-U.S. corporations to issue securities in the U.S. private placement market by relaxing the requirement to hold the securities for two years.

B) Rule 144A encourages non-U.S. corporations to issue securities in the U.S. private placement market by relaxing the requirement to furnish necessary disclosure set forth by U.S. securities laws.

C) Rule 144A improved liquidity, reducing the cost of raising funds.

D) Rule 144A improved the liquidity of securities acquired by all institutional investors in a private placement.

A) Rule 144A encouraged non-U.S. corporations to issue securities in the U.S. private placement market by relaxing the requirement to hold the securities for two years.

B) Rule 144A encourages non-U.S. corporations to issue securities in the U.S. private placement market by relaxing the requirement to furnish necessary disclosure set forth by U.S. securities laws.

C) Rule 144A improved liquidity, reducing the cost of raising funds.

D) Rule 144A improved the liquidity of securities acquired by all institutional investors in a private placement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

35

Rule 415 is popularly referred to as the closet registration rule because the securities can be viewed as sitting in the "closet," and can be taken out of the closet and sold to the public without obtaining additional SEC approval.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

36

A rights offering ensures that current shareholders may maintain their proportionate equity interest in the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

37

Rule 415 permits certain issuers to file a single registration document indicating that they intend to sell a certain amount of a certain class of securities at one or more times within the next two years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

38

Investment banking firms assist in the private placement of securities by ________.

A) working with the issuer and potential investors on the design and pricing of the security.

B) lining up the investors but not designing or pricing the issue.

C) designing the issue but not lining up the investors or pricing the issue.

D) participating in the transaction on a fixed efforts underwriting arrangement

A) working with the issuer and potential investors on the design and pricing of the security.

B) lining up the investors but not designing or pricing the issue.

C) designing the issue but not lining up the investors or pricing the issue.

D) participating in the transaction on a fixed efforts underwriting arrangement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

39

Investment bankers will typically work with issuers in the design of a security for a private placement and line up the potential investors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

40

The time interval between the initial filing of the registration statement and the time the registration statement becomes effective is referred to as the waiting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

41

In addition to the number of rights and the subscription price, there are two other elements of a rights offering that are important. Name and briefly describe these two elements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Securities Acts allow three exemptions from federal registration. Describe two of these three exemptions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

43

What is the waiting period? What do underwriters do during the waiting period?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

44

Demonstrate how a rights offering works. In your illustration, demonstrate the effect on the economic wealth of shareholders and how the terms affect an issuer's need for an underwriter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck

45

Give a description of the underwriter discount including the factors that determine the factors that influence it. Give an example of the underwriting fee for an IPO including the underwriter discount as a percentage of the proceeds raised.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 45 في هذه المجموعة.

فتح الحزمة

k this deck