Deck 12: Money and Banking

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

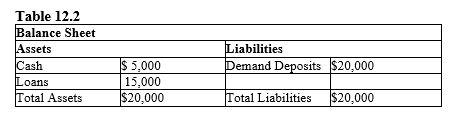

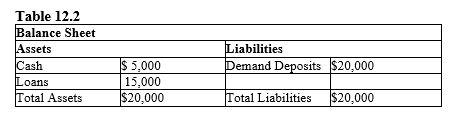

سؤال

سؤال

سؤال

سؤال

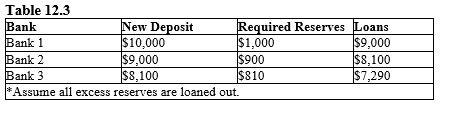

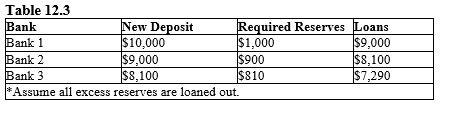

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/125

العب

ملء الشاشة (f)

Deck 12: Money and Banking

1

Using money as a medium of exchange:

A) requires people to match goods wanted with goods available.

B) inhibits economic transactions.

C) reduces the need for barter in the economy.

D) reduces the need for a banking system.

E) reduces the range of feasible exchanges in the economy.

A) requires people to match goods wanted with goods available.

B) inhibits economic transactions.

C) reduces the need for barter in the economy.

D) reduces the need for a banking system.

E) reduces the range of feasible exchanges in the economy.

reduces the need for barter in the economy.

2

In the United States, the different categories of money supply measurement are based on:

A) the elasticity of money.

B) the liquidity of money.

C) the amount of purchasing power.

D) the reserve requirements in the banking system.

E) the velocity of money.

A) the elasticity of money.

B) the liquidity of money.

C) the amount of purchasing power.

D) the reserve requirements in the banking system.

E) the velocity of money.

the liquidity of money.

3

The use of foreign money instead of domestic money when the domestic economy has a high rate of inflation is called _____.

A) currency depreciation

B) currency substitution

C) capital flight

D) currency devaluation

E) currency trade

A) currency depreciation

B) currency substitution

C) capital flight

D) currency devaluation

E) currency trade

currency substitution

4

The concept of double coincidence of wants refers to the fact that:

A) for a financial asset to be exchanged, it needs to be priced correctly.

B) for barter to take place, both parties must accept what the other party has to offer.

C) people can never exactly agree on an equilibrium price.

D) different people value goods differently.

E) for barter to take place, both parties must have equal quantities of the same good.

A) for a financial asset to be exchanged, it needs to be priced correctly.

B) for barter to take place, both parties must accept what the other party has to offer.

C) people can never exactly agree on an equilibrium price.

D) different people value goods differently.

E) for barter to take place, both parties must have equal quantities of the same good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following would be counted as part of M1?

A) Money market deposit accounts

B) Saving deposits

C) Mutual funds

D) Traveler's checks

E) Time deposits

A) Money market deposit accounts

B) Saving deposits

C) Mutual funds

D) Traveler's checks

E) Time deposits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is a transactions account?

A) Currency

B) Travelers' checks

C) A savings account

D) A credit card balance

E) A demand deposit

A) Currency

B) Travelers' checks

C) A savings account

D) A credit card balance

E) A demand deposit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

7

Identify the correct definition of liquidity.

A) The availability of credit in the form of money is known as liquidity.

B) The ability of money to be a store of value is known as liquidity.

C) The difference between real and nominal money values is known as liquidity.

D) The ability of an asset to be easily converted into money is known as liquidity.

E) The ability of an asset to be universally accepted as a means of exchange is known as liquidity.

A) The availability of credit in the form of money is known as liquidity.

B) The ability of money to be a store of value is known as liquidity.

C) The difference between real and nominal money values is known as liquidity.

D) The ability of an asset to be easily converted into money is known as liquidity.

E) The ability of an asset to be universally accepted as a means of exchange is known as liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is a reason why the Japanese yen is considered money?

A) It is backed by gold.

B) Its value over the years has varied significantly.

C) Goods in Japan are priced in terms of the yen, the most liquid asset of the economy.

D) It is backed by silver.

E) It is an asset that lacks liquidity.

A) It is backed by gold.

B) Its value over the years has varied significantly.

C) Goods in Japan are priced in terms of the yen, the most liquid asset of the economy.

D) It is backed by silver.

E) It is an asset that lacks liquidity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

9

Perishable goods such as tomatoes and milk are never used as a form of money, primarily because they cannot function as:

A) a store of purchasing power.

B) a means of payment.

C) a standard of deferred payment.

D) a medium of exchange.

E) a unit of account.

A) a store of purchasing power.

B) a means of payment.

C) a standard of deferred payment.

D) a medium of exchange.

E) a unit of account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

10

The measure of money supply that includes the fewest types of assets:

A) is M4.

B) is M2.

C) is M3.

D) is M1.

E) is M0.

A) is M4.

B) is M2.

C) is M3.

D) is M1.

E) is M0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

11

An asset is said to be illiquid when:

A) it lacks purchasing power.

B) it cannot act as a store of value.

C) it is an illegal tender.

D) it cannot be readily exchanged for goods.

E) it cannot be used to settle debts.

A) it lacks purchasing power.

B) it cannot act as a store of value.

C) it is an illegal tender.

D) it cannot be readily exchanged for goods.

E) it cannot be used to settle debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following assets would be considered least liquid?

A) A silver coin

B) An antique automobile

C) A U.S. savings bond

D) A debit card

E) A certificate of deposit

A) A silver coin

B) An antique automobile

C) A U.S. savings bond

D) A debit card

E) A certificate of deposit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

13

Credit can be described as:

A) money used as a standard of deferred payment.

B) savings made available to borrowers.

C) fiduciary currency.

D) a form of liquid asset.

E) bank loans converted into commodity money.

A) money used as a standard of deferred payment.

B) savings made available to borrowers.

C) fiduciary currency.

D) a form of liquid asset.

E) bank loans converted into commodity money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following properties should a commodity have to be considered as money?

A) It should be scarce and rare.

B) It should be perishable.

C) It should be indivisible.

D) It should be unpredictable in value.

E) It should be homogenous in nature.

A) It should be scarce and rare.

B) It should be perishable.

C) It should be indivisible.

D) It should be unpredictable in value.

E) It should be homogenous in nature.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

15

The use of money as a unit of account:

A) discourages specialization and division of labor.

B) inhibits the exchange of goods and services.

C) makes it difficult to compare the relative values of goods and services.

D) lowers information costs relative to barter.

E) relies on the existence of a double coincidence of wants.

A) discourages specialization and division of labor.

B) inhibits the exchange of goods and services.

C) makes it difficult to compare the relative values of goods and services.

D) lowers information costs relative to barter.

E) relies on the existence of a double coincidence of wants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

16

Money fails to act as a store of value when:

A) it is no longer backed by gold.

B) the inflation rate is very high.

C) the goods produced in an economy are indivisible.

D) the economy goes into a recession.

E) coins are replaced by paper money.

A) it is no longer backed by gold.

B) the inflation rate is very high.

C) the goods produced in an economy are indivisible.

D) the economy goes into a recession.

E) coins are replaced by paper money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

17

If Brazil experienced a period of rapid and unexpected inflation, causing Brazilians to lose confidence in the local currency (real) as a store of value, which of the following would be least likely to occur?

A) The value of the Brazilian real would depreciate on the foreign exchange market.

B) Foreign currency would be used as a substitute for the real.

C) The real would be used as a store of value in other countries

D) Brazilians would save less.

E) The purchasing power of the real would decrease.

A) The value of the Brazilian real would depreciate on the foreign exchange market.

B) Foreign currency would be used as a substitute for the real.

C) The real would be used as a store of value in other countries

D) Brazilians would save less.

E) The purchasing power of the real would decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

18

An asset that can easily be exchanged for goods and services is referred to as:

A) an intangible asset.

B) a productive resource.

C) a liquid asset.

D) a fixed asset.

E) a scarce resource.

A) an intangible asset.

B) a productive resource.

C) a liquid asset.

D) a fixed asset.

E) a scarce resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

19

As a standard of deferred payment, money can be used to:

A) express debt obligations in the form of purchasing power.

B) foster barter activity.

C) facilitate exchanges of goods and services.

D) achieve a common denominator for measuring the value of goods and services.

E) ascertain the liquidity of financial assets.

A) express debt obligations in the form of purchasing power.

B) foster barter activity.

C) facilitate exchanges of goods and services.

D) achieve a common denominator for measuring the value of goods and services.

E) ascertain the liquidity of financial assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

20

A scalper reselling Super Bowl tickets is an example of money being used as:

A) a store of value.

B) a unit of account.

C) an illegal asset.

D) a standard of deferred payment.

E) a medium of exchange.

A) a store of value.

B) a unit of account.

C) an illegal asset.

D) a standard of deferred payment.

E) a medium of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is true of a certificate of deposit?

A) They are accounts at savings and loan associations.

B) The funds in this deposit account are not given out in the form of loans.

C) The funds in this account must be deposited for a specified period of time.

D) The value of the deposit should be more than $100,000.

E) The deposits earn very little or no interest.

A) They are accounts at savings and loan associations.

B) The funds in this deposit account are not given out in the form of loans.

C) The funds in this account must be deposited for a specified period of time.

D) The value of the deposit should be more than $100,000.

E) The deposits earn very little or no interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

22

_____ are accounts at the U.S. commercial banks that combine an interest-bearing savings account with a noninterest bearing checking account.

A) Automatic transfer system accounts

B) Negotiable orders of withdrawal

C) Eurodollar deposits

D) Certificates of deposit

E) Credit union share draft accounts

A) Automatic transfer system accounts

B) Negotiable orders of withdrawal

C) Eurodollar deposits

D) Certificates of deposit

E) Credit union share draft accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

23

The primary international reserve asset in most countries is:

A) silver.

B) gold.

C) the euro.

D) the U.S. dollar.

E) the Japanese yen.

A) silver.

B) gold.

C) the euro.

D) the U.S. dollar.

E) the Japanese yen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

24

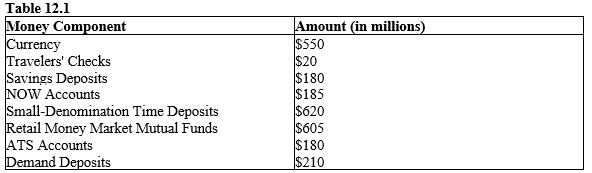

The table given below shows the components of money supply in an economy.?

Refer to Table 12.1 and calculate the value of M1.

A) $550 million

B) $570 million

C) $780 million

D) $1,125 million

E) $1,145 million

Refer to Table 12.1 and calculate the value of M1.

A) $550 million

B) $570 million

C) $780 million

D) $1,125 million

E) $1,145 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is true of international reserve currencies?

A) They are used for international exchange of goods and services.

B) They are used to settle international debt.

C) They are used for international bookkeeping.

D) They are held for government investment abroad.

E) They are created for international stock market trading.

A) They are used for international exchange of goods and services.

B) They are used to settle international debt.

C) They are used for international bookkeeping.

D) They are held for government investment abroad.

E) They are created for international stock market trading.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

26

Commodity money is money that:

A) has no value as a commodity.

B) is not backed by gold or silver and is not a legal tender.

C) may go out of circulation with an increase in its intrinsic value.

D) always has a face value greater than the intrinsic value.

E) is solely used in barter exchanges.

A) has no value as a commodity.

B) is not backed by gold or silver and is not a legal tender.

C) may go out of circulation with an increase in its intrinsic value.

D) always has a face value greater than the intrinsic value.

E) is solely used in barter exchanges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

27

U.S. bank notes have no intrinsic value and yet are widely accepted as a medium of exchange. This is a result of:

A) Gresham's law.

B) the use of money as a store of value.

C) the fiduciary monetary system.

D) the valuation of currency as commodity money.

E) the gold and silver reserves of the Federal government that backs the currency.

A) Gresham's law.

B) the use of money as a store of value.

C) the fiduciary monetary system.

D) the valuation of currency as commodity money.

E) the gold and silver reserves of the Federal government that backs the currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is true of the European Currency Unit?

A) It was used by the European nations as a medium of exchanging goods and services.

B) It was an accounting entry that was transferred between two European nations.

C) It was replaced by the euro in the early 1980s.

D) It was denominated in the British pound.

E) It was a primary international reserve asset of most of the nations across the world.

A) It was used by the European nations as a medium of exchanging goods and services.

B) It was an accounting entry that was transferred between two European nations.

C) It was replaced by the euro in the early 1980s.

D) It was denominated in the British pound.

E) It was a primary international reserve asset of most of the nations across the world.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

29

The thrift institutions:

A) were nonprofit banking institutions.

B) were owned by the Federal Reserve.

C) historically offered only savings accounts, not checking accounts.

D) controlled the U.S. monetary policy prior to the establishment of the Federal Reserve.

E) were monitored by the Federal Deposit Insurance Corporation.

A) were nonprofit banking institutions.

B) were owned by the Federal Reserve.

C) historically offered only savings accounts, not checking accounts.

D) controlled the U.S. monetary policy prior to the establishment of the Federal Reserve.

E) were monitored by the Federal Deposit Insurance Corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

30

The Depository Institutions Deregulation and Monetary Control Act passed by the Congress in 1980 led to:

A) the complete removal of thrift institutions.

B) increased competition among financial institutions.

C) the formation of large number of savings and loan associations.

D) privatization of all financial institutions in the U.S.

E) the complete removal of credit unions.

A) the complete removal of thrift institutions.

B) increased competition among financial institutions.

C) the formation of large number of savings and loan associations.

D) privatization of all financial institutions in the U.S.

E) the complete removal of credit unions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which of the following is not true about a special drawing right (SDR)?

A) The SDR is a composite currency.

B) The value of the SDR is an average of the values of the currencies of major industrial countries.

C) The SDR was created in 1980 by the World Bank.

D) The SDR is an international reserve asset.

E) The SDR is used to settle international debts.

A) The SDR is a composite currency.

B) The value of the SDR is an average of the values of the currencies of major industrial countries.

C) The SDR was created in 1980 by the World Bank.

D) The SDR is an international reserve asset.

E) The SDR is used to settle international debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

32

Calculate the dollar price of a German automobile worth 40,000 euros, if the dollar per euro exchange rate is 1.5.

A) $41,500

B) $26,700

C) $60,000

D) $50,000

E) $38,500

A) $41,500

B) $26,700

C) $60,000

D) $50,000

E) $38,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following can be categorized as a composite currency?

A) Italian lira

B) European Currency Unit

C) Pound

D) Australian dollar

E) Danish Krone

A) Italian lira

B) European Currency Unit

C) Pound

D) Australian dollar

E) Danish Krone

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following is true of other checkable deposits?

A) They are checking account deposits at commercial banks and do not pay any interest.

B) They are accounts at financial institutions that pay interest and give the depositor check-writing privileges.

C) They comprise solely of demand deposits at mutual savings banks.

D) They are not included in the M1 money supply.

E) They are savings deposits that earn interest at savings and loan associations.

A) They are checking account deposits at commercial banks and do not pay any interest.

B) They are accounts at financial institutions that pay interest and give the depositor check-writing privileges.

C) They comprise solely of demand deposits at mutual savings banks.

D) They are not included in the M1 money supply.

E) They are savings deposits that earn interest at savings and loan associations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

35

According to Gresham's Law:

A) money with relatively high intrinsic value will be used for transactions.

B) money with relatively low intrinsic value will be used for transactions.

C) money with relatively high intrinsic value will cause inflation.

D) money with relatively low intrinsic value will cause inflation.

E) inflation increases the intrinsic value of money.

A) money with relatively high intrinsic value will be used for transactions.

B) money with relatively low intrinsic value will be used for transactions.

C) money with relatively high intrinsic value will cause inflation.

D) money with relatively low intrinsic value will cause inflation.

E) inflation increases the intrinsic value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

36

Assume that an American investor decides to buy one-year Swiss bonds that are denominated in Swiss francs and pay 2 percent annual interest. For this purpose, $10,000 is exchanged into Swiss francs at an exchange rate of $1 = 2Fr to buy the bonds. How many dollars will the investor have after one year if the exchange rate is $1 = 1.5Fr?

A) $10,000

B) $10,200

C) $15,300

D) $13,600

E) $7,650

A) $10,000

B) $10,200

C) $15,300

D) $13,600

E) $7,650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

37

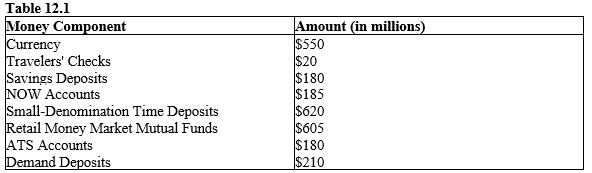

The table given below shows the components of money supply in an economy.?

Refer to Table 12.1 and calculate the value of M2.

A) $1,145

B) $1,325

C) $1,750

D) $2,550

E) $2,815

Refer to Table 12.1 and calculate the value of M2.

A) $1,145

B) $1,325

C) $1,750

D) $2,550

E) $2,815

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

38

Under Gresham's law, the term bad money refers to:

A) money with no face value.

B) illegal tender.

C) devalued money.

D) commodity money.

E) money with low commodity value.

A) money with no face value.

B) illegal tender.

C) devalued money.

D) commodity money.

E) money with low commodity value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

39

The M2 measure of money supply includes all of the following, except:

A) demand deposits.

B) U.S. government securities.

C) savings deposits.

D) money market deposits.

E) certificates of deposit.

A) demand deposits.

B) U.S. government securities.

C) savings deposits.

D) money market deposits.

E) certificates of deposit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

40

A composite currency whose value is the average of the values of the U.S. dollar, the Japanese yen, the euro, and the British pound is known as a:

A) special drawing right.

B) productive resource.

C) standard of value.

D) scarce diligence resource.

E) scarce delivery resource.

A) special drawing right.

B) productive resource.

C) standard of value.

D) scarce diligence resource.

E) scarce delivery resource.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

41

The main source of earning profits for banks is:

A) government securities.

B) saving accounts.

C) reserves.

D) loans.

E) checking account fees.

A) government securities.

B) saving accounts.

C) reserves.

D) loans.

E) checking account fees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following is true of the banks that operate under Islamic law?

A) Islamic banks are not allowed to lend out to private firms.

B) Islamic banks do not function as intermediaries between borrowers and lenders.

C) Islamic Banks are not allowed to offer checking accounts or traveler's checks.

D) Islamic banks are required to offer trade-related services free of cost.

E) Islamic banks do not charge interest on loans or pay interest on deposits.

A) Islamic banks are not allowed to lend out to private firms.

B) Islamic banks do not function as intermediaries between borrowers and lenders.

C) Islamic Banks are not allowed to offer checking accounts or traveler's checks.

D) Islamic banks are required to offer trade-related services free of cost.

E) Islamic banks do not charge interest on loans or pay interest on deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

43

A depository institution's profit is derived from the difference between:

A) the interest rate it receives on loans and the rate it receives on investments in government securities.

B) the interest rate it pays on deposits and the rate it receives on loans.

C) its primary deposit and its derivative deposit.

D) its assets and its liabilities.

E) the interest rate it receives on domestic loans and the rate it receives on Eurodollar loans.

A) the interest rate it receives on loans and the rate it receives on investments in government securities.

B) the interest rate it pays on deposits and the rate it receives on loans.

C) its primary deposit and its derivative deposit.

D) its assets and its liabilities.

E) the interest rate it receives on domestic loans and the rate it receives on Eurodollar loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following facilities give bank customers access to services over a much wider geographic area than any single bank's branches can cover?

A) Traveler's checks

B) Saving account checks

C) ATM networks

D) Demand drafts

E) Certificates of deposit

A) Traveler's checks

B) Saving account checks

C) ATM networks

D) Demand drafts

E) Certificates of deposit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

45

The balance sheet of a depository institution lists:

A) loans to private individuals as assets.

B) excess reserves as liabilities.

C) checkable deposits as liabilities.

D) required reserves as liabilities.

E) loans from the central bank as assets.

A) loans to private individuals as assets.

B) excess reserves as liabilities.

C) checkable deposits as liabilities.

D) required reserves as liabilities.

E) loans from the central bank as assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is true of unit banking?

A) It is the dominant form of banking in the United Sates.

B) It occurs when national banks open interstate branch offices.

C) It implies that every financial institution should maintain its account with the Federal Reserve.

D) It occurs when a bank is not allowed to operate in more than one location.

E) It refers to the monopolization of the banking industry.

A) It is the dominant form of banking in the United Sates.

B) It occurs when national banks open interstate branch offices.

C) It implies that every financial institution should maintain its account with the Federal Reserve.

D) It occurs when a bank is not allowed to operate in more than one location.

E) It refers to the monopolization of the banking industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

47

People in developing countries may want to participate in a rotating savings and credit association (ROSCAS) because:

A) such associations are part of the black market and they offer attractive returns.

B) such associations promise a guaranteed return unlike other banking institutions.

C) such associations allow participating individuals to invest their savings abroad.

D) such associations allow all but the last member to receive funds faster than they could save on their own.

E) most governments encourage it.

A) such associations are part of the black market and they offer attractive returns.

B) such associations promise a guaranteed return unlike other banking institutions.

C) such associations allow participating individuals to invest their savings abroad.

D) such associations allow all but the last member to receive funds faster than they could save on their own.

E) most governments encourage it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

48

In the 1980s, some states in the United States had significantly more bank failures than other states. What industries did the former states depend on heavily?

A) Oil and agriculture

B) Tourism

C) Defense and aeronautics

D) Construction and textiles

E) The computer industry

A) Oil and agriculture

B) Tourism

C) Defense and aeronautics

D) Construction and textiles

E) The computer industry

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is the most popular instrument for financing Islamic investments?

A) Murabaha

B) Mortgage

C) Microfinance

D) Riba

E) Mudaraba

A) Murabaha

B) Mortgage

C) Microfinance

D) Riba

E) Mudaraba

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is true of offshore banking?

A) The offshore banks are mainly concentrated in the European Union and the transactions are generally denominated in euro.

B) The offshore banks operate with costly restrictions and pay higher taxes than the domestic banks.

C) The offshore banks usually charge higher rates of interest on consumption loans than the domestic banks.

D) Offshore banks in the U.S. are able to offer a higher rate on dollar deposits and a lower rate on dollar loans than their domestic competitors.

E) Offshore banking transactions are considerably less risky than domestic transactions as they are closely monitored by the government of the nations in which they operate.

A) The offshore banks are mainly concentrated in the European Union and the transactions are generally denominated in euro.

B) The offshore banks operate with costly restrictions and pay higher taxes than the domestic banks.

C) The offshore banks usually charge higher rates of interest on consumption loans than the domestic banks.

D) Offshore banks in the U.S. are able to offer a higher rate on dollar deposits and a lower rate on dollar loans than their domestic competitors.

E) Offshore banking transactions are considerably less risky than domestic transactions as they are closely monitored by the government of the nations in which they operate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements apply to international banking facilities (IBFs)?

A) IBFs are subject to U.S. interest rate regulations.

B) IBFs are located all over the world.

C) IBFs do not require FDIC deposit insurance premiums.

D) IBFs offer a higher interest rate spread than normal U.S. banks.

E) IBFs allow European residents to participate in the American stock exchanges.

A) IBFs are subject to U.S. interest rate regulations.

B) IBFs are located all over the world.

C) IBFs do not require FDIC deposit insurance premiums.

D) IBFs offer a higher interest rate spread than normal U.S. banks.

E) IBFs allow European residents to participate in the American stock exchanges.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

52

When do we say that a bank is loaned up?

A) When its debtors don't want to repay

B) When it is susceptible to a bank panic

C) When its excess reserves equal zero

D) When it is part of a fractional reserve banking system

E) When its required reserves are equal to its excess reserves

A) When its debtors don't want to repay

B) When it is susceptible to a bank panic

C) When its excess reserves equal zero

D) When it is part of a fractional reserve banking system

E) When its required reserves are equal to its excess reserves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

53

In fractional reserve banking:

A) bank assets are less than bank reserves.

B) only a fraction of total deposits are bank reserves.

C) only a fraction of required reserves are investor assets.

D) bank loans are less than bank reserves.

E) a fraction of bank reserves needs to be backed by gold.

A) bank assets are less than bank reserves.

B) only a fraction of total deposits are bank reserves.

C) only a fraction of required reserves are investor assets.

D) bank loans are less than bank reserves.

E) a fraction of bank reserves needs to be backed by gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following is true of the FDIC?

A) It controls the operations of all commercial banks in the U.S.

B) It exists only in the countries of North America and Europe.

C) It covers depositors against losses up to $500,000 in a bank account.

D) It is a federal agency that insures bank deposits in commercial banks.

E) It is a financial institution that uses cost-plus pricing.

A) It controls the operations of all commercial banks in the U.S.

B) It exists only in the countries of North America and Europe.

C) It covers depositors against losses up to $500,000 in a bank account.

D) It is a federal agency that insures bank deposits in commercial banks.

E) It is a financial institution that uses cost-plus pricing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is true of International Banking Facilities (IBFs) in the U.S.?

A) IBFs were legalized by the Federal Reserve Board in 1970.

B) IBFs are bookkeeping systems set up in existing bank offices of the U.S. to record international banking transactions

C) IBFs are "shell" bank branches of U.S. banks in the Caribbean.

D) Loans extended by the IBFs are subject to reserve requirements and interest rate regulations.

E) IBFs are allowed to extend loans to the residents and businesses of the United States and not to the nonresidents.

A) IBFs were legalized by the Federal Reserve Board in 1970.

B) IBFs are bookkeeping systems set up in existing bank offices of the U.S. to record international banking transactions

C) IBFs are "shell" bank branches of U.S. banks in the Caribbean.

D) Loans extended by the IBFs are subject to reserve requirements and interest rate regulations.

E) IBFs are allowed to extend loans to the residents and businesses of the United States and not to the nonresidents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

56

A Eurodollar loan is a(n):

A) ECU-denominated loan issued by a U.S. bank.

B) dollar-denominated loan payable to a European bank.

C) ECU-denominated loan that is subject to banking regulations in both the United States and Europe.

D) dollar-denominated loan issued outside the U.S. domestic banking system.

E) loan by the European Community to the U.S. government.

A) ECU-denominated loan issued by a U.S. bank.

B) dollar-denominated loan payable to a European bank.

C) ECU-denominated loan that is subject to banking regulations in both the United States and Europe.

D) dollar-denominated loan issued outside the U.S. domestic banking system.

E) loan by the European Community to the U.S. government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

57

Commercial banks act as middlemen between savers and borrowers, therefore they are called _____.

A) lenders of the last resort

B) financial intermediaries

C) banker's banks

D) thrift institutions

E) profitable institutions

A) lenders of the last resort

B) financial intermediaries

C) banker's banks

D) thrift institutions

E) profitable institutions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

58

The Gramm-Leach-Bliley Act (GLBA), passed by the U.S. Congress in the year 1999, allows commercial banks to:

A) operate in all foreign countries.

B) open new branches in Cuba.

C) expand their business into other areas of finance, including insurance and selling securities.

D) raise reserve requirements for other financial institutions.

E) eliminate unit banking.

A) operate in all foreign countries.

B) open new branches in Cuba.

C) expand their business into other areas of finance, including insurance and selling securities.

D) raise reserve requirements for other financial institutions.

E) eliminate unit banking.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

59

The interest rate charged on a Eurodollar loan will be:

A) higher than the interest rate charged on a U.S. loan.

B) lower than the interest rate charged on a U.S. deposit.

C) essentially equal to the interest rate charged on a Eurodollar deposit.

D) lower than the London interbank offer rate.

E) lower than the interest rate charged on a U.S. loan.

A) higher than the interest rate charged on a U.S. loan.

B) lower than the interest rate charged on a U.S. deposit.

C) essentially equal to the interest rate charged on a Eurodollar deposit.

D) lower than the London interbank offer rate.

E) lower than the interest rate charged on a U.S. loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

60

The _____ account for about 60 percent of deposit and loan activity in the Eurocurrency market.

A) ECUs

B) U.S. dollar

C) Euroyen

D) Euros

E) Eurodollars

A) ECUs

B) U.S. dollar

C) Euroyen

D) Euros

E) Eurodollars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

61

Excess reserves are equal to:

A) total reserves plus required reserves.

B) total reserves multiplied by required reserves.

C) total reserves minus loans.

D) total reserves minus required reserves.

E) required reserves minus loans.

A) total reserves plus required reserves.

B) total reserves multiplied by required reserves.

C) total reserves minus loans.

D) total reserves minus required reserves.

E) required reserves minus loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

62

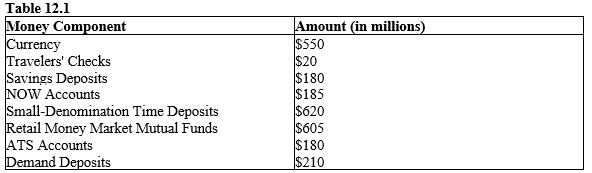

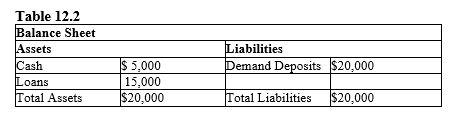

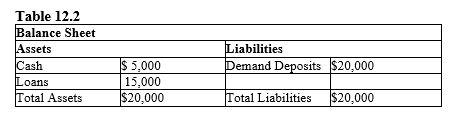

Refer to Table 12.2. If the reserve requirement is 12 percent and the bank receives a new deposit of $10,000, then required reserves will increase by _____.

A) $3,600

B) $2,400

C) $2,600

D) $2,800

E) $1,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

63

Suppose the National Bank has total cash reserves of $2,000 and has $5,000 in total deposits. If its total excess reserves are $1,250, then the reserve requirement is equal to:

A) 25 percent.

B) 15 percent.

C) 10 percent.

D) 5 percent.

E) 20 percent.

A) 25 percent.

B) 15 percent.

C) 10 percent.

D) 5 percent.

E) 20 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

64

Assume that the reserve requirement is 25 percent and that the amount of checkable deposits in Federal Bank is $200. If the bank has loaned out $120, then the bank's excess reserves must equal:

A) $0.

B) $25.

C) $30.

D) $80.

E) $225.

A) $0.

B) $25.

C) $30.

D) $80.

E) $225.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

65

Suppose the reserve requirement is 10 percent and a person deposits $1,500 in a local bank. The local bank can now create a maximum of:

A) $150 in additional money, by lending $150.

B) $15,000 in additional money, by lending $15,000.

C) $1,500 in additional money, by lending $1,500.

D) $1,350 in additional money, by lending $1,350.

E) $135 in additional money, by lending $135.

A) $150 in additional money, by lending $150.

B) $15,000 in additional money, by lending $15,000.

C) $1,500 in additional money, by lending $1,500.

D) $1,350 in additional money, by lending $1,350.

E) $135 in additional money, by lending $135.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

66

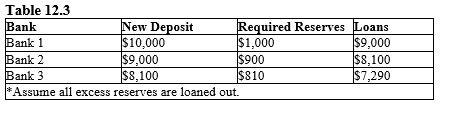

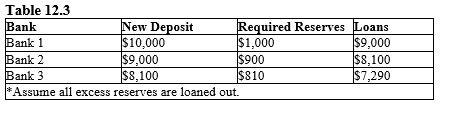

The table given below records the amount of new deposits, the value of required reserves, and total amount loaned out by Banks 1, 2, and 3.?

Refer to Table 12.3. What is the reserve requirement?

A) 11 percent

B) 90 percent

C) 10 percent

D) 9 percent

E) 19 percent

Refer to Table 12.3. What is the reserve requirement?

A) 11 percent

B) 90 percent

C) 10 percent

D) 9 percent

E) 19 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

67

Assume that the reserve requirement is 10 percent. If a bank has total deposits of $80 million, then the required reserves must equal:

A) $80 million.

B) $12 million.

C) $50 million.

D) $8 million.

E) $10 million.

A) $80 million.

B) $12 million.

C) $50 million.

D) $8 million.

E) $10 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

68

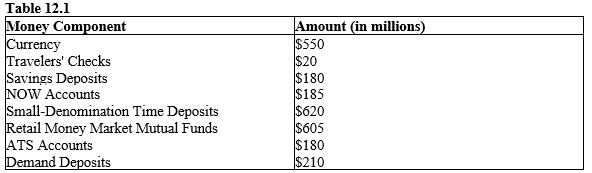

Refer to Table 12.2. If excess reserves equal $2,000, what must the reserve requirement be equal to?

A) 3 percent

B) 10 percent

C) 15 percent

D) 20 percent

E) 25 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

69

The table given below records the amount of new deposits, the value of required reserves, and total amount loaned out by Banks 1, 2, and 3.?

Refer to Table 12.3. What is the total increase in the money supply created in the banking system as a result of the initial deposit of $10,000 in Bank 1?

A) $10,000

B) $27,100

C) $100,000

D) $90,000

E) $20,000

Refer to Table 12.3. What is the total increase in the money supply created in the banking system as a result of the initial deposit of $10,000 in Bank 1?

A) $10,000

B) $27,100

C) $100,000

D) $90,000

E) $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

70

If a bank has deposits worth $800,000, total reserves worth $800,000, and the reserve ratio of 0.20, what is the value of excess reserves?

A) $620,000

B) $1,000,000

C) $1,160,000

D) $640,000

E) $160,000

A) $620,000

B) $1,000,000

C) $1,160,000

D) $640,000

E) $160,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

71

Refer to Table 12.2. With a reserve requirement of 20 percent, the bank has excess reserves of _____.

A) $5,000

B) $3,000

C) $2,000

D) $1,000

E) $2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

72

For a depository institution, reserves are:

A) assets on the balance sheet.

B) loans to individuals and businesses.

C) borrowings from the central bank.

D) liabilities it owes to customers.

E) checkable deposits.

A) assets on the balance sheet.

B) loans to individuals and businesses.

C) borrowings from the central bank.

D) liabilities it owes to customers.

E) checkable deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

73

Assume that the reserve requirement is 10 percent. A $1,000 cash deposit into a savings account will immediately increase the bank's required reserves by _____.

A) $10,000.

B) $500.

C) $100.

D) $1,500.

E) $10.

A) $10,000.

B) $500.

C) $100.

D) $1,500.

E) $10.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

74

The reciprocal of the reserve requirement is called the:

A) spending multiplier.

B) tax multiplier.

C) lending multiplier.

D) deposit expansion multiplier.

E) excess reserve multiplier.

A) spending multiplier.

B) tax multiplier.

C) lending multiplier.

D) deposit expansion multiplier.

E) excess reserve multiplier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

75

If a banking system receives an initial deposit of $150,000 and the reserve requirement is 40 percent, the total deposit in the banking system (including the initial deposit) can be expanded by _____.

A) $375,000

B) $150,000

C) $60,000

D) $250,000

E) $450,000

A) $375,000

B) $150,000

C) $60,000

D) $250,000

E) $450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

76

Refer to Table 12.2. Assume a reserve requirement of 10 percent. The maximum amount of new loans the bank could extend is _____.

A) $500

B) $1,000

C) $2,000

D) $3,000

E) $4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

77

If a bank's required reserves equal $270,000. Suppose the bank holds no excess reserves, and the reserve requirement is equal to 18 percent, what is the value of the bank's total deposits?

A) $900,000

B) $1,500,000

C) $48,000

D) $486,000

E) $150,000

A) $900,000

B) $1,500,000

C) $48,000

D) $486,000

E) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

78

In the United States, the reserve requirement is set by the:

A) Bank of America.

B) federal government.

C) U.S. Treasury.

D) Federal Reserve Board.

E) Department of Commerce.

A) Bank of America.

B) federal government.

C) U.S. Treasury.

D) Federal Reserve Board.

E) Department of Commerce.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

79

What is the immediate effect when Bank A lends $1,000 to a local business?

A) The money supply increases by $1,000.

B) The money supply decreases by $1,000.

C) Bank A's liability increases by $1,000.

D) Bank A's excess reserves increase by $1,000.

E) Bank A's demand deposits decrease by $1,000.

A) The money supply increases by $1,000.

B) The money supply decreases by $1,000.

C) Bank A's liability increases by $1,000.

D) Bank A's excess reserves increase by $1,000.

E) Bank A's demand deposits decrease by $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck

80

Suppose Bank X is holding total cash reserves of $32,000 on deposits of $90,000. If the reserve requirement is 15 percent, then the excess reserves held by this bank is:

A) $27,200.

B) $58,000.

C) $4,800.

D) $13,200.

E) $18,500.

A) $27,200.

B) $58,000.

C) $4,800.

D) $13,200.

E) $18,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 125 في هذه المجموعة.

فتح الحزمة

k this deck