Deck 15: The monetary and financial system

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/124

العب

ملء الشاشة (f)

Deck 15: The monetary and financial system

1

The currency of Australia is:

A)backed dollar for dollar by gold.

B)backed by a gold cover of 50 per cent.

C)not backed by any precious metal.

D)backed by the government's silver reserves.

E)backed by the government's gold and silver reserves.

A)backed dollar for dollar by gold.

B)backed by a gold cover of 50 per cent.

C)not backed by any precious metal.

D)backed by the government's silver reserves.

E)backed by the government's gold and silver reserves.

C

2

Which of the following could not serve as commodity money?

A)Gold.

B)Cattle.

C)Sugar.

D)Paper money that is not backed up by valuable commodity.

A)Gold.

B)Cattle.

C)Sugar.

D)Paper money that is not backed up by valuable commodity.

D

3

Comparing how many dollars it takes to run your car each year to annual earnings on a job instead of recording costs in terms of litres of petrol and oil represents the use of money as:

A)a means of payment.

B)a unit of account.

C)a store of purchasing power.

D)a form of plastic money.

A)a means of payment.

B)a unit of account.

C)a store of purchasing power.

D)a form of plastic money.

B

4

The key property of money is that it is:

A)always desired.

B)fluent.

C)liquid.

D)expensive.

E)not needed.

A)always desired.

B)fluent.

C)liquid.

D)expensive.

E)not needed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

5

Barter is:

A)the indirect exchange of a service for money.

B)the direct exchange of a dollar for an orange.

C)the direct exchange of an apple for an orange.

D)the direct exchange of coins for a pizza.

A)the indirect exchange of a service for money.

B)the direct exchange of a dollar for an orange.

C)the direct exchange of an apple for an orange.

D)the direct exchange of coins for a pizza.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

6

Fiat money is paper money:

A)backed dollar for dollar by gold.

B)backed dollar for dollar by silver.

C)produced by an Italian car manufacturer.

D)which is not backed by or convertible into any good.

E)which is backed by and convertible into a specific good.

A)backed dollar for dollar by gold.

B)backed dollar for dollar by silver.

C)produced by an Italian car manufacturer.

D)which is not backed by or convertible into any good.

E)which is backed by and convertible into a specific good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is false?

A)Round stones with holes in the centre can serve as money.

B)Money eases the process of exchanging goods and services in a modern economy.

C)Money serves as a measure of value only when it is backed by gold or silver.

D)Money is used as a measure of the relative value of goods and services in an economy.

A)Round stones with holes in the centre can serve as money.

B)Money eases the process of exchanging goods and services in a modern economy.

C)Money serves as a measure of value only when it is backed by gold or silver.

D)Money is used as a measure of the relative value of goods and services in an economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is the best description of fiat money?

A)Coins made of gold and silver.

B)Paper money that can be redeemed for gold or silver.

C)Legal tender that has no intrinsic value.

D)Cheque accounts and debit cards.

A)Coins made of gold and silver.

B)Paper money that can be redeemed for gold or silver.

C)Legal tender that has no intrinsic value.

D)Cheque accounts and debit cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

9

Comparison of the price of a cup of coffee and the price of a glass of juice represents the use of money as:

A)a medium of exchange.

B)a unit of account.

C)a store of value.

D)a leverage of your income.

A)a medium of exchange.

B)a unit of account.

C)a store of value.

D)a leverage of your income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

10

Money is a mechanism for transforming income earned in the present into:

A)past experience.

B)a sacred treasure.

C)future purchases.

D)a unit of selling capacity.

A)past experience.

B)a sacred treasure.

C)future purchases.

D)a unit of selling capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following items does not provide a store of value?

A)Currency.

B)Bonds.

C)Credit cards.

D)Gold.

A)Currency.

B)Bonds.

C)Credit cards.

D)Gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which one is not a primary function of money?

A)Medium of exchange.

B)Unit of exchange.

C)Unit of account.

D)Store value.

A)Medium of exchange.

B)Unit of exchange.

C)Unit of account.

D)Store value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

13

The primary functions of money are:

A)velocity, liquidity and transactions.

B)speculative demand, measure of value and precautionary demand.

C)a medium of exchange, a measure of value and a store of value.

D)a store of value, heterogeneity and a medium of exchange.

E)currency value, fiat value and accepted value.

A)velocity, liquidity and transactions.

B)speculative demand, measure of value and precautionary demand.

C)a medium of exchange, a measure of value and a store of value.

D)a store of value, heterogeneity and a medium of exchange.

E)currency value, fiat value and accepted value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

14

Precious metals and cigarettes are the example of:

A)gold-exempt money.

B)non-backed money.

C)paper money.

D)commodity money.

A)gold-exempt money.

B)non-backed money.

C)paper money.

D)commodity money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

15

If every person is willing to accept money rather than goods and services for payment,money serves as a:

A)medium of exchange.

B)unit of account.

C)store of value.

D)coincident exchange.

A)medium of exchange.

B)unit of account.

C)store of value.

D)coincident exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

16

The statement that Computech's profits totalled $500 million last year represents the use of money as a:

A)medium of exchange.

B)store of value.

C)unit of account.

D)means of coincidence.

A)medium of exchange.

B)store of value.

C)unit of account.

D)means of coincidence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

17

The characteristics that money should have include:

A)portability, durability and flexibility.

B)durability, flexibility and stability.

C)durability, portability and homogeneity.

D)scarcity, portability and divisibility.

A)portability, durability and flexibility.

B)durability, flexibility and stability.

C)durability, portability and homogeneity.

D)scarcity, portability and divisibility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

18

Money can:

A)remove a problem of increasing wants.

B)create a problem of coincidence of wants.

C)remove the problem of coincidence of wants.

D)create a problem of reducing wants.

A)remove a problem of increasing wants.

B)create a problem of coincidence of wants.

C)remove the problem of coincidence of wants.

D)create a problem of reducing wants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

19

Credit cards are:

A)M1 money.

B)M2 money.

C)M3 money.

D)near money.

E)not money.

A)M1 money.

B)M2 money.

C)M3 money.

D)near money.

E)not money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

20

One hundred dollars on deposit in a cheque account represents the use of money as a:

A)medium of exchange.

B)store of value.

C)unit of account.

D)coincident exchange.

E)treasure.

A)medium of exchange.

B)store of value.

C)unit of account.

D)coincident exchange.

E)treasure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

21

The M1 money supply is defined to be the sum of currency,traveller's cheques and:

A)cheque account deposits.

B)Treasury bonds.

C)savings accounts.

D)long-time deposits.

A)cheque account deposits.

B)Treasury bonds.

C)savings accounts.

D)long-time deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

22

Three important motives for people to hold money and forego earning interest payments are:

A)the opportunity cost motive, precautionary motive and speculative motive.

B)the transaction motive, precautionary motive and speculative motive.

C)the transaction motive, safety motive and speculative motive.

D)the transaction motive, precautionary motive and special motive.

E)the future motive, precautionary motive and speculative motive.

A)the opportunity cost motive, precautionary motive and speculative motive.

B)the transaction motive, precautionary motive and speculative motive.

C)the transaction motive, safety motive and speculative motive.

D)the transaction motive, precautionary motive and special motive.

E)the future motive, precautionary motive and speculative motive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

23

When interest rates rise,the quantity demanded of money held for the:

A)speculative demand rises.

B)precautionary demand rises.

C)transactions demand falls.

D)precautionary demand falls.

E)speculative demand falls.

A)speculative demand rises.

B)precautionary demand rises.

C)transactions demand falls.

D)precautionary demand falls.

E)speculative demand falls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

24

The speculative demand for money shows the relationship between money demand and:

A)income levels.

B)interest rates.

C)price levels.

D)investment rates.

E)consumption patterns.

A)income levels.

B)interest rates.

C)price levels.

D)investment rates.

E)consumption patterns.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

25

Fiat money is:

A)commodity money issued by the central bank that does not have intrinsic value.

B)paper money issued by the central bank that does have intrinsic value.

C)paper money issued by the central bank.

D)paper money issued by the central bank that does not have intrinsic value.

A)commodity money issued by the central bank that does not have intrinsic value.

B)paper money issued by the central bank that does have intrinsic value.

C)paper money issued by the central bank.

D)paper money issued by the central bank that does not have intrinsic value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

26

One reason that people hold money is to pay for unexpected car repairs and other unpredictable expenses.This motive for holding money is called:

A)transactions demand.

B)precautionary demand.

C)speculative demand.

D)non-cyclical demand.

A)transactions demand.

B)precautionary demand.

C)speculative demand.

D)non-cyclical demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

27

Fiat money:

A)is accepted because of the market value of the material.

B)has intrinsic worth.

C)does not have intrinsic worth.

D)is accepted by law.

A)is accepted because of the market value of the material.

B)has intrinsic worth.

C)does not have intrinsic worth.

D)is accepted by law.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

28

Keynes called the money that people hold in order to buy bonds,stocks or other non-money financial assets the:

A)transactions demand for spending money.

B)precautionary demand for holding money.

C)speculative demand for holding money.

D)unit of account demand for holding money.

A)transactions demand for spending money.

B)precautionary demand for holding money.

C)speculative demand for holding money.

D)unit of account demand for holding money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

29

The precautionary demand for money is the demand for money:

A)for normal transactions purposes.

B)for normal investment purposes.

C)for special stock purchases.

D)to protect against inflation.

E)to cover unexpected events.

A)for normal transactions purposes.

B)for normal investment purposes.

C)for special stock purchases.

D)to protect against inflation.

E)to cover unexpected events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

30

As the interest rate decreases,the quantity of money people will hold:

A)decreases.

B)increases.

C)stays the same.

D)rises and then falls.

E)falls and then rises.

A)decreases.

B)increases.

C)stays the same.

D)rises and then falls.

E)falls and then rises.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

31

Other things being equal,an increase in the rate of interest causes a/an:

A)upward movement along the demand for money curve.

B)downward movement along the demand for money curve.

C)rightward shift of the demand for money curve.

D)leftward shift of the demand for money curve.

A)upward movement along the demand for money curve.

B)downward movement along the demand for money curve.

C)rightward shift of the demand for money curve.

D)leftward shift of the demand for money curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which type of demand for money causes the demand for money curve to slope downward?

A)Speculative demand.

B)Precautionary demand.

C)Transactions demand.

D)Foreign-exchange demand.

A)Speculative demand.

B)Precautionary demand.

C)Transactions demand.

D)Foreign-exchange demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

33

The quantity of money demanded to satisfy transactions needs:

A)is intended for unexpected expenditures.

B)increases with the level of real GDP.

C)decreases with the level of real GDP.

D)is unrelated to either national income or the interest rate.

E)varies inversely with the liquidity demand for money.

A)is intended for unexpected expenditures.

B)increases with the level of real GDP.

C)decreases with the level of real GDP.

D)is unrelated to either national income or the interest rate.

E)varies inversely with the liquidity demand for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

34

Other things being equal,the quantity of money that people wish to hold can be expected to:

A)increase as the interest rate increases.

B)increase as the interest rate decreases.

C)decrease as real GDP increases.

D)decrease as the fixed interest deposits decrease .

A)increase as the interest rate increases.

B)increase as the interest rate decreases.

C)decrease as real GDP increases.

D)decrease as the fixed interest deposits decrease .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is not counted as part of M1?

A)Silver coins.

B)Reserve Bank notes or 'paper money'.

C)Passbook savings deposits.

D)Cheque account deposits.

E)Traveller's cheques.

A)Silver coins.

B)Reserve Bank notes or 'paper money'.

C)Passbook savings deposits.

D)Cheque account deposits.

E)Traveller's cheques.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

36

The precautionary demand for money:

A)varies inversely with the income level.

B)varies inversely with the price level.

C)is used as an insurance agent against unexpected needs.

D)states that nominal income must exceed real income.

A)varies inversely with the income level.

B)varies inversely with the price level.

C)is used as an insurance agent against unexpected needs.

D)states that nominal income must exceed real income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

37

The M1 definition of the money supply includes currency plus:

A)cheque account deposits and savings accounts.

B)cheque account deposits and credit cards.

C)cheque account deposits and debit cards.

D)cheque account deposits and traveller's cheques.

E)traveller's cheques and credit cards.

A)cheque account deposits and savings accounts.

B)cheque account deposits and credit cards.

C)cheque account deposits and debit cards.

D)cheque account deposits and traveller's cheques.

E)traveller's cheques and credit cards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

38

Keynes called the money that people hold to make routine day-to-day purchases the:

A)transactions demand for holding money.

B)precautionary demand for spending money.

C)speculative demand for holding money.

D)store of value demand for holding money.

A)transactions demand for holding money.

B)precautionary demand for spending money.

C)speculative demand for holding money.

D)store of value demand for holding money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following statements is true?

A)The speculative demand for money at possible interest rates gives the demand for money curve its upward slope.

B)There is a direct relationship between the quantity of money demanded and the interest rate.

C)According to the quantity theory of money, any change in the money supply will have no effect on the price level.

D)People hold money to pay unpredictable expenses or against 'rainy days'.

A)The speculative demand for money at possible interest rates gives the demand for money curve its upward slope.

B)There is a direct relationship between the quantity of money demanded and the interest rate.

C)According to the quantity theory of money, any change in the money supply will have no effect on the price level.

D)People hold money to pay unpredictable expenses or against 'rainy days'.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

40

People learn to hold a specific quantity of money for their groceries,theatre tickets,petrol,clothes,film and other items they habitually purchase.This behaviour is representative of the:

A)precautionary demand.

B)speculative demand.

C)transactions demand.

D)volatility demand.

E)habitual demand.

A)precautionary demand.

B)speculative demand.

C)transactions demand.

D)volatility demand.

E)habitual demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

41

People react to an excess supply of money by:

A)selling bonds, thus driving up the interest rate.

B)selling bonds, thus driving down the interest rate.

C)buying bonds, thus driving up the interest rate.

D)buying bonds, thus driving down the interest rate.

A)selling bonds, thus driving up the interest rate.

B)selling bonds, thus driving down the interest rate.

C)buying bonds, thus driving up the interest rate.

D)buying bonds, thus driving down the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

42

If people attempt to sell bonds because of excess money demand,then the interest rate will:

A)rise.

B)fall.

C)remain unchanged

D)react unpredictably.

A)rise.

B)fall.

C)remain unchanged

D)react unpredictably.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

43

Assume the RBA decreases the money supply and the demand for money curve is fixed.In response,people will:

A)sell bonds, thus driving up the interest rate.

B)buy bonds, thus driving down the interest rate.

C)buy bonds, thus driving up the interest rate.

D)sell bonds, thus driving down the interest rate.

A)sell bonds, thus driving up the interest rate.

B)buy bonds, thus driving down the interest rate.

C)buy bonds, thus driving up the interest rate.

D)sell bonds, thus driving down the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

44

If there is excess money supply in the economy,which of the following is most likely to occur?

A)People will buy bonds, raising bond prices and decreasing interest rates.

B)People will buy bonds, raising bond prices and increasing interest rates.

C)People will sell bonds, raising bond prices and decreasing interest rates.

D)People will sell bonds, decreasing bond prices and decreasing the interest rate.

E)People will sell bonds, decreasing bond prices and increasing the interest rate.

A)People will buy bonds, raising bond prices and decreasing interest rates.

B)People will buy bonds, raising bond prices and increasing interest rates.

C)People will sell bonds, raising bond prices and decreasing interest rates.

D)People will sell bonds, decreasing bond prices and decreasing the interest rate.

E)People will sell bonds, decreasing bond prices and increasing the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

45

The relationship between bond prices and the interest rate is:

A)an undefined relationship.

B)a steady relationship.

C)a direct relationship.

D)an inverse relationship.

A)an undefined relationship.

B)a steady relationship.

C)a direct relationship.

D)an inverse relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

46

The money supply known as M3:

A)includes large-denomination time deposits.

B)excludes interest-earning cheque accounts in savings and loans.

C)does not include money-market mutual accounts.

D)includes savings accounts and small-denomination time deposits.

E)includes large-denomination repurchase agreements.

A)includes large-denomination time deposits.

B)excludes interest-earning cheque accounts in savings and loans.

C)does not include money-market mutual accounts.

D)includes savings accounts and small-denomination time deposits.

E)includes large-denomination repurchase agreements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

47

When the interest rate falls:

A)the opportunity cost of holding money rises.

B)people shift out of holding interest-yielding bonds into holding money.

C)the quantity of money people will hold decreases.

D)investment spending decreases.

E)real GDP will decrease.

A)the opportunity cost of holding money rises.

B)people shift out of holding interest-yielding bonds into holding money.

C)the quantity of money people will hold decreases.

D)investment spending decreases.

E)real GDP will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

48

Currency is:

A)the less liquid of all financial assets.

B)the sum of M1 and M3.

C)the sum of M3 and the non-deposit borrowings from the private sector by AFIs.

D)the sum of coins and paper money.

A)the less liquid of all financial assets.

B)the sum of M1 and M3.

C)the sum of M3 and the non-deposit borrowings from the private sector by AFIs.

D)the sum of coins and paper money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

49

Assume a fixed demand for money curve and the RBA increases the money supply.The result is a temporary:

A)excess quantity of money demanded.

B)excess quantity of money supplied.

C)new equilibrium interest rate.

D)decrease in the demand for loans.

A)excess quantity of money demanded.

B)excess quantity of money supplied.

C)new equilibrium interest rate.

D)decrease in the demand for loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

50

In Keynes' view,an excess quantity of money demanded causes people to:

A)sell bonds pushing the interest rate up.

B)buy bonds pushing the interest rate down.

C)buy bonds pushing the interest rate up.

D)increase speculative balances.

A)sell bonds pushing the interest rate up.

B)buy bonds pushing the interest rate down.

C)buy bonds pushing the interest rate up.

D)increase speculative balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

51

Expansionary monetary policy is:

A)reducing interest rates by increasing money supply.

B)increasing interest rates by increasing money supply.

C)reducing interest rates by decreasing money supply.

D)increasing interest rates by decreasing money supply.

A)reducing interest rates by increasing money supply.

B)increasing interest rates by increasing money supply.

C)reducing interest rates by decreasing money supply.

D)increasing interest rates by decreasing money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

52

Assume a fixed demand for money curve and the RBA decreases the money supply.In response,people will:

A)sell bonds, thus driving up the interest rate.

B)sell bonds, thus driving down the interest rate.

C)buy bonds, thus driving up the interest rate.

D)buy bonds, thus driving down the interest rate.

A)sell bonds, thus driving up the interest rate.

B)sell bonds, thus driving down the interest rate.

C)buy bonds, thus driving up the interest rate.

D)buy bonds, thus driving down the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

53

Suppose you transfer $1000 from your cheque account to your savings account.How does this action affect the M1 and M3 money supplies?

A)M1 and M3 are both unchanged.

B)M1 falls by $1000 and M3 rises by $1000.

C)M1 is unchanged and M3 rises by $1000.

D)M1 falls by $1000 and M3 is unchanged.

E)It depends on MPS.

A)M1 and M3 are both unchanged.

B)M1 falls by $1000 and M3 rises by $1000.

C)M1 is unchanged and M3 rises by $1000.

D)M1 falls by $1000 and M3 is unchanged.

E)It depends on MPS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume a fixed demand for money curve and the RBA increases the money supply.In response,people will:

A)sell bonds, thus driving up the interest rate.

B)sell bonds, thus driving down the interest rate.

C)buy bonds, thus driving up the interest rate.

D)buy bonds, thus driving down the interest rate.

A)sell bonds, thus driving up the interest rate.

B)sell bonds, thus driving down the interest rate.

C)buy bonds, thus driving up the interest rate.

D)buy bonds, thus driving down the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

55

If people are selling bonds,it causes the interest rate to:

A)rise and MD > MS.

B)fall and MS > MD.

C)fall and MD = MS.

D)The demand for money has fallen.

A)rise and MD > MS.

B)fall and MS > MD.

C)fall and MD = MS.

D)The demand for money has fallen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

56

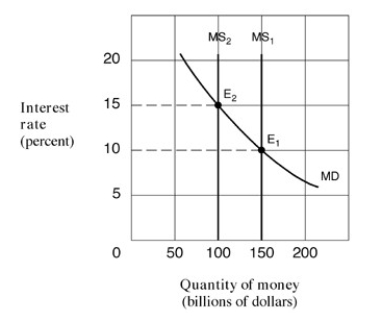

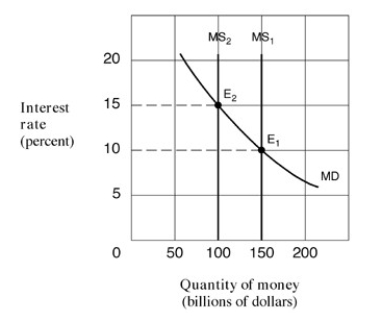

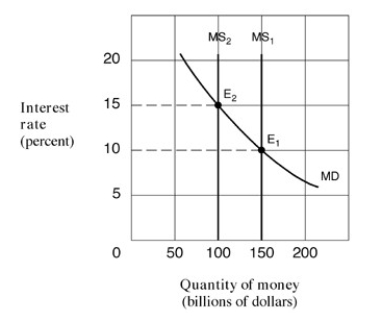

Exhibit 15-1 Money market demand and supply curves

Starting from an equilibrium at E₁ in Exhibit 15-1,a leftward shift of the money supply curve from MS₁ to MS₂ would cause an excess:

A)demand for money, leading people to sell bonds.

B)demand for money, leading people to buy bonds.

C)supply of money, leading people to sell bonds.

D)supply of money, leading people to buy bonds.

Starting from an equilibrium at E₁ in Exhibit 15-1,a leftward shift of the money supply curve from MS₁ to MS₂ would cause an excess:

A)demand for money, leading people to sell bonds.

B)demand for money, leading people to buy bonds.

C)supply of money, leading people to sell bonds.

D)supply of money, leading people to buy bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

57

Monetary Base is:

A)the most popular of all financial assets.

B)the least liquid of all financial assets.

C)the most liquid of all financial assets.

D)difficult to sustain.

A)the most popular of all financial assets.

B)the least liquid of all financial assets.

C)the most liquid of all financial assets.

D)difficult to sustain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

58

The expansionary and contractionary policies are the:

A)monetary policies.

B)current policies.

C)fiscal policies.

D)relevant policies.

A)monetary policies.

B)current policies.

C)fiscal policies.

D)relevant policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following falls when bond prices rise?

A)Stock prices.

B)Interest rates.

C)Money demand.

D)Money supply.

A)Stock prices.

B)Interest rates.

C)Money demand.

D)Money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

60

Assume the demand for money curve is stationary and the RBA increases the money supply.The result is that people:

A)increase the supply of bonds, thus driving up the interest rate.

B)increase the supply of bonds, thus driving down the interest rate.

C)increase the demand for bonds, thus driving up the interest rate.

D)increase the demand for bonds, thus driving down the interest rate.

A)increase the supply of bonds, thus driving up the interest rate.

B)increase the supply of bonds, thus driving down the interest rate.

C)increase the demand for bonds, thus driving up the interest rate.

D)increase the demand for bonds, thus driving down the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

61

Assume that Paris First National Bank is a thriving bank with deposits of $20 million.If the minimum liquidity requirement is 20 per cent and the bank is fully loaned out,the bank will keep what amount of required reserves?

A)$2 million.

B)$4 million.

C)$10 million.

D)$16 million.

E)$20 million.

A)$2 million.

B)$4 million.

C)$10 million.

D)$16 million.

E)$20 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

62

The lower interest rates:

A)stimulate investment and consumer durable demand and this increases aggregate demand.

B)discourage investment and consumer durable demand and this increases aggregate demand.

C)stimulate investment and consumer durable demand and this decreases aggregate demand.

D)discourage investment and consumer durable demand and this decreases aggregate demand.

A)stimulate investment and consumer durable demand and this increases aggregate demand.

B)discourage investment and consumer durable demand and this increases aggregate demand.

C)stimulate investment and consumer durable demand and this decreases aggregate demand.

D)discourage investment and consumer durable demand and this decreases aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

63

The monetary policy transmission mechanism explains changes in:

A)monetary policy, money supply, interest rate, investment, aggregate demand, prices, real GDP and employment.

B)monetary policy, money demand, interest rate, investment, aggregate supply, prices, real GDP and employment.

C)monetary policy, money supply, interest rate, research and development, aggregate demand, prices, real GDP and employment.

D)monetary policy, money supply, interest rate, investment, aggregate demand, prices, nominal GDP and employment.

A)monetary policy, money supply, interest rate, investment, aggregate demand, prices, real GDP and employment.

B)monetary policy, money demand, interest rate, investment, aggregate supply, prices, real GDP and employment.

C)monetary policy, money supply, interest rate, research and development, aggregate demand, prices, real GDP and employment.

D)monetary policy, money supply, interest rate, investment, aggregate demand, prices, nominal GDP and employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

64

The minimum liquidity requirement is the:

A)actual amount of reserves that banks must hold.

B)excess amount of reserves that a bank must hold.

C)minimum amount of reserves the RBA requires a bank to hold.

D)total amount of reserves that banks hold at all times.

E)maximum amount of reserves that banks can hold to remain liquid.

A)actual amount of reserves that banks must hold.

B)excess amount of reserves that a bank must hold.

C)minimum amount of reserves the RBA requires a bank to hold.

D)total amount of reserves that banks hold at all times.

E)maximum amount of reserves that banks can hold to remain liquid.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

65

The expansionary monetary policy can be seen as an:

A)outward shift in the aggregate demand curve.

B)inward shift in the aggregate supply curve.

C)outward shift in the aggregate supply curve.

D)inward shift in the aggregate demand curve.

A)outward shift in the aggregate demand curve.

B)inward shift in the aggregate supply curve.

C)outward shift in the aggregate supply curve.

D)inward shift in the aggregate demand curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

66

If the economy is inflationary,the RBA would most likely:

A)encourage banks to provide loans by lowering the cash rate.

B)encourage banks to provide loans by raising the cash rate.

C)restrict bank lending by lowering the cash rate.

D)restrict bank lending by raising the cash rate.

A)encourage banks to provide loans by lowering the cash rate.

B)encourage banks to provide loans by raising the cash rate.

C)restrict bank lending by lowering the cash rate.

D)restrict bank lending by raising the cash rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

67

If there is a recession,the RBA would most likely:

A)encourage banks to provide loans by lowering the cash rate.

B)encourage banks to provide loans by raising the cash rate.

C)restrict bank lending by lowering the cash rate.

D)restrict bank lending by raising the cash rate.

A)encourage banks to provide loans by lowering the cash rate.

B)encourage banks to provide loans by raising the cash rate.

C)restrict bank lending by lowering the cash rate.

D)restrict bank lending by raising the cash rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

68

Keynesian economists argue that monetary policy works through its effects on:

A)budget deficits and trade deficits.

B)price and wage flexibility.

C)interest rates and investment.

D)the spending and money multipliers.

E)unemployment and budget deficits.

A)budget deficits and trade deficits.

B)price and wage flexibility.

C)interest rates and investment.

D)the spending and money multipliers.

E)unemployment and budget deficits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

69

According to Keynesians,an increase in the money supply will:

A)decrease the interest rate and increase investment, aggregate demand, prices, real GDP and employment.

B)decrease the interest rate and decrease investment, aggregate demand, prices, real GDP and employment.

C)increase the interest rate and decrease investment, aggregate demand, prices, real GDP and employment.

D)only increases prices.

E)decrease investment but increase aggregate demand, prices, nominal GDP and employment.

A)decrease the interest rate and increase investment, aggregate demand, prices, real GDP and employment.

B)decrease the interest rate and decrease investment, aggregate demand, prices, real GDP and employment.

C)increase the interest rate and decrease investment, aggregate demand, prices, real GDP and employment.

D)only increases prices.

E)decrease investment but increase aggregate demand, prices, nominal GDP and employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

70

A decrease in the money supply:

A)lowers the interest rate, causing a decrease in investment and a decrease in GDP.

B)lowers the interest rate, causing a decrease in investment and an increase in GDP.

C)raises the interest rate, causing an increase in investment and a decrease in GDP.

D)raises the interest rate, causing an increase in investment and an increase in GDP.

E)raises the interest rate, causing a decrease in investment and a decrease in GDP.

A)lowers the interest rate, causing a decrease in investment and a decrease in GDP.

B)lowers the interest rate, causing a decrease in investment and an increase in GDP.

C)raises the interest rate, causing an increase in investment and a decrease in GDP.

D)raises the interest rate, causing an increase in investment and an increase in GDP.

E)raises the interest rate, causing a decrease in investment and a decrease in GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

71

Using the aggregate supply and demand model,assume the economy is operating along the intermediate portion of the aggregate supply curve.An increase in the money supply will increase the price level and:

A)lower both the interest rate and real GDP.

B)raise both the interest rate and nominal GDP.

C)lower the interest rate and raise GDP.

D)raise the interest rate and lower real GDP.

A)lower both the interest rate and real GDP.

B)raise both the interest rate and nominal GDP.

C)lower the interest rate and raise GDP.

D)raise the interest rate and lower real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

72

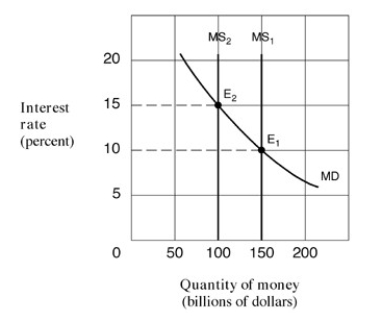

Exhibit 15-1 Money market demand and supply curves

As shown in Exhibit 15-1,assume the money supply curve shifts leftward from MS₁ to MS₂ and the economy is operating along the intermediate segment of the aggregate supply curve.The result will be a:

A)higher investment, lower real GDP and lower price level.

B)lower investment, lower real GDP and lower price level.

C)higher investment, higher real GDP and higher price level.

D)higher interest rate and no effect on real GDP or the price level.

As shown in Exhibit 15-1,assume the money supply curve shifts leftward from MS₁ to MS₂ and the economy is operating along the intermediate segment of the aggregate supply curve.The result will be a:

A)higher investment, lower real GDP and lower price level.

B)lower investment, lower real GDP and lower price level.

C)higher investment, higher real GDP and higher price level.

D)higher interest rate and no effect on real GDP or the price level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

73

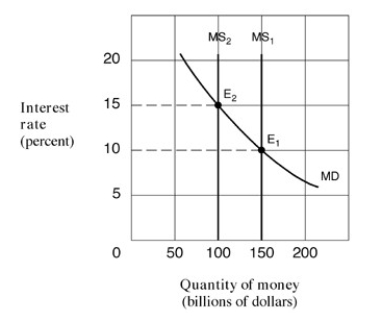

Exhibit 15-1 Money market demand and supply curves

Beginning from an equilibrium at E₁ in Exhibit 15-1,a decrease in the money supply from $150 billion to $100 billion causes people to:

A)sell bonds and drive the price of bonds down.

B)sell bonds and drive the price of bonds up.

C)buy bonds and drive the price of bonds down.

D)buy bonds and drive the price of bonds up.

Beginning from an equilibrium at E₁ in Exhibit 15-1,a decrease in the money supply from $150 billion to $100 billion causes people to:

A)sell bonds and drive the price of bonds down.

B)sell bonds and drive the price of bonds up.

C)buy bonds and drive the price of bonds down.

D)buy bonds and drive the price of bonds up.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

74

The Reserve Bank of Australia:

A)is America's central bank.

B)is Australia's central bank.

C)is Australia's only bank.

D)is Australia's best bank.

A)is America's central bank.

B)is Australia's central bank.

C)is Australia's only bank.

D)is Australia's best bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

75

A decrease in the money supply:

A)raises the interest rate, causing an increase in investment and an increase in GDP.

B)lowers the interest rate, causing an increase in investment and an increase in GDP.

C)raises the interest rate, causing a decrease in investment and a decrease in GDP.

D)lowers the interest rate, causing a decrease in investment and an increase in GDP.

E)lowers the interest rate, causing a decrease in investment and a decrease in GDP.

A)raises the interest rate, causing an increase in investment and an increase in GDP.

B)lowers the interest rate, causing an increase in investment and an increase in GDP.

C)raises the interest rate, causing a decrease in investment and a decrease in GDP.

D)lowers the interest rate, causing a decrease in investment and an increase in GDP.

E)lowers the interest rate, causing a decrease in investment and a decrease in GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

76

According to Keynesians,an increase in the money supply will:

A)decrease the interest rate and increase investment and aggregate demand, prices, real GDP and employment.

B)decrease the interest rate and decrease investment and aggregate demand, prices, real GDP and employment.

C)increase the interest rate and decrease investment and aggregate demand, prices, real GDP and employment.

D)only increases prices.

A)decrease the interest rate and increase investment and aggregate demand, prices, real GDP and employment.

B)decrease the interest rate and decrease investment and aggregate demand, prices, real GDP and employment.

C)increase the interest rate and decrease investment and aggregate demand, prices, real GDP and employment.

D)only increases prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

77

According to Keynesian economists,which of the following is not a consequence of increasing the money supply?

A)A lower interest rate.

B)Greater investment.

C)Lower real GDP.

D)Higher real GDP.

E)Lower nominal GDP.

A)A lower interest rate.

B)Greater investment.

C)Lower real GDP.

D)Higher real GDP.

E)Lower nominal GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

78

The monetary policy transmission mechanism describes:

A)how a regulatory policy change might be transmitted into the economy affecting market structure.

B)how an export policy change might be transmitted into the economy affecting spending multipliers.

C)how a monetary policy change might be transmitted into the economy affecting prices, output and employment.

D)how a competition policy change might be transmitted into the economy affecting prices, output and employment.

A)how a regulatory policy change might be transmitted into the economy affecting market structure.

B)how an export policy change might be transmitted into the economy affecting spending multipliers.

C)how a monetary policy change might be transmitted into the economy affecting prices, output and employment.

D)how a competition policy change might be transmitted into the economy affecting prices, output and employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

79

If the economy is inflationary,the RBA would most likely:

A)encourage banks to provide loans by buying government securities.

B)encourage banks to provide loans by raising the cash rate.

C)encourage banks to provide loans by selling government securities.

D)restrict bank lending by selling government securities.

E)restrict bank lending by lowering the cash rate.

A)encourage banks to provide loans by buying government securities.

B)encourage banks to provide loans by raising the cash rate.

C)encourage banks to provide loans by selling government securities.

D)restrict bank lending by selling government securities.

E)restrict bank lending by lowering the cash rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck

80

The effect of expansionary monetary policy on aggregate demand is as follows:

A)the decrease in money supply causes the interest rates to drop and investment and production to increase.

B)the increase in money supply causes the interest rates to grow and investment and production to increase.

C)the increase in money supply causes the interest rates to drop and investment and production to increase.

D)the increase in money supply causes the interest rates to drop and investment and production to decrease.

A)the decrease in money supply causes the interest rates to drop and investment and production to increase.

B)the increase in money supply causes the interest rates to grow and investment and production to increase.

C)the increase in money supply causes the interest rates to drop and investment and production to increase.

D)the increase in money supply causes the interest rates to drop and investment and production to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 124 في هذه المجموعة.

فتح الحزمة

k this deck