Deck 8: Analysis of Risk and Return

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/118

العب

ملء الشاشة (f)

Deck 8: Analysis of Risk and Return

1

Which of the following is not an example of a source of systematic risk?

A)interest rate changes

B)foreign competition with an industry's products

C)changes in the overall economic outlook

D)changes in the inflation rate

A)interest rate changes

B)foreign competition with an industry's products

C)changes in the overall economic outlook

D)changes in the inflation rate

B

2

Security A's expected return is 10 percent while the expected return of B is 14 percent.The standard deviation of A's returns is 5 percent, and it is 9 percent for B.An investor plans to invest equal amounts in A and B.Which of the following statements is true about this portfolio consisting of stock A and stock B.

A)The risk of the portfolio is equal to 7 percent.

B)The lower the correlation of returns between the two stocks, the higher the portfolio's risk.

C)The risk of the portfolio is primarily dependent on the utility function of the investor.

D)The higher the correlation of returns between the two stocks, the higher the portfolio's risk.

A)The risk of the portfolio is equal to 7 percent.

B)The lower the correlation of returns between the two stocks, the higher the portfolio's risk.

C)The risk of the portfolio is primarily dependent on the utility function of the investor.

D)The higher the correlation of returns between the two stocks, the higher the portfolio's risk.

D

3

Users of the CAPM should be aware of some of the problems in its practical application.These problems include which of the following?

A)estimating expected future market returns

B)determining the most appropriate measure of the risk- free rate

C)determining an asset's future beta

D)all of these are problems in application of the CAPM

A)estimating expected future market returns

B)determining the most appropriate measure of the risk- free rate

C)determining an asset's future beta

D)all of these are problems in application of the CAPM

D

4

The primary difference between the standard deviation and the coefficient of variation as measures of risk is:

A)the coefficient of variation is easier to compute.

B)the standard deviation is a measure of relative risk whereas the coefficient of variation is a measure of absolute risk.

C)the coefficient of variation is a measure of relative risk whereas the standard deviation is a measure of absolute risk.

D)the standard deviation is rarely used in practice whereas the coefficient of variation is widely used.

A)the coefficient of variation is easier to compute.

B)the standard deviation is a measure of relative risk whereas the coefficient of variation is a measure of absolute risk.

C)the coefficient of variation is a measure of relative risk whereas the standard deviation is a measure of absolute risk.

D)the standard deviation is rarely used in practice whereas the coefficient of variation is widely used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

5

The coefficient of variation is a(n) measure of risk.

A)relative

B)absolute

C)systematic

D)unsystematic

A)relative

B)absolute

C)systematic

D)unsystematic

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

6

When comparing two equal-sized investments, the is an appropriate measure of total risk.

A)standard deviation

B)coefficient of variation

C)correlation

D)covariance

A)standard deviation

B)coefficient of variation

C)correlation

D)covariance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

7

Values of the can range from +1.0 to -1.0.

A)coefficient of variation

B)correlation coefficient

C)standard deviation

D)covariance

A)coefficient of variation

B)correlation coefficient

C)standard deviation

D)covariance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

8

The security market line can be thought of as expressing relationships between required rates of return and

A)the time value of money

B)beta

C)total risk

D)portfolio diversification

A)the time value of money

B)beta

C)total risk

D)portfolio diversification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

9

The is the ratio of to the .

A)standard deviation, covariance, expected value

B)covariance, expected value, standard deviation

C)coefficient of variation, standard deviation, expected value

D)coefficient of variation, systematic risk, expected value

A)standard deviation, covariance, expected value

B)covariance, expected value, standard deviation

C)coefficient of variation, standard deviation, expected value

D)coefficient of variation, systematic risk, expected value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

10

A beta value of 0.5 for a security indicates

A)the security has average systematic risk

B)the security has above-average systematic risk

C)the security has no unsystematic risk

D)the security has below-average systematic risk

A)the security has average systematic risk

B)the security has above-average systematic risk

C)the security has no unsystematic risk

D)the security has below-average systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

11

Recalling the meaning and calculation of beta, a security that is completely uncorrelated (ρj,m = 0) with the market portfolio would have a beta of

A)-1

B)0

C)+1

D)-100

A)-1

B)0

C)+1

D)-100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

12

All of the following are primary sources of systematic risk except

A)changes in the amount of foreign competition facing an industry

B)changes in investor expectations about the economy

C)interest rate changes

D)changes in purchasing power

A)changes in the amount of foreign competition facing an industry

B)changes in investor expectations about the economy

C)interest rate changes

D)changes in purchasing power

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

13

The slope of the characteristic line for a specific security is an estimate of for that security.

A)beta

B)systematic risk

C)total risk

D)both beta and systematic risk

A)beta

B)systematic risk

C)total risk

D)both beta and systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

14

Beta is defined as:

A)a measure of volatility of a security's returns relative to the returns of a broad-based market portfolio of securities.

B)the ratio of the variance of market returns to the covariance of returns on a security with the market

C)the inverse of the slope of the security regression line

D)all of these

A)a measure of volatility of a security's returns relative to the returns of a broad-based market portfolio of securities.

B)the ratio of the variance of market returns to the covariance of returns on a security with the market

C)the inverse of the slope of the security regression line

D)all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

15

The security market line

A)is defined as the slope of a line relating an individual security's return to the returns of other securities in that firm's primary industry.

B)provides a picture of the risk-return tradeoff required by diversified investors considering various risky assets.

C)has as its slope the beta of the security

D)is determined by the prevailing level of risk-free interest rates minus a risk premium

A)is defined as the slope of a line relating an individual security's return to the returns of other securities in that firm's primary industry.

B)provides a picture of the risk-return tradeoff required by diversified investors considering various risky assets.

C)has as its slope the beta of the security

D)is determined by the prevailing level of risk-free interest rates minus a risk premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

16

The is a statistical measure of the mean or average value of the possible outcomes.

A)probability distribution

B)standard deviation

C)expected value

D)coefficient of variation

A)probability distribution

B)standard deviation

C)expected value

D)coefficient of variation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

17

The of a portfolio of two or more securities is equal to the weighted average of the of each of the individual securities in the portfolio.

A)standard deviation, standard deviation

B)risk, risk

C)expected return, expected return

D)standard deviation, risk

A)standard deviation, standard deviation

B)risk, risk

C)expected return, expected return

D)standard deviation, risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

18

The the standard deviation, the the investment.

A)smaller, larger the expected return on

B)larger, riskier

C)smaller, riskier

D)larger, smaller the expected return on

A)smaller, larger the expected return on

B)larger, riskier

C)smaller, riskier

D)larger, smaller the expected return on

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

19

The is an absolute measure of risk, and the is a relative measure of risk.

A)systematic risk, unsystematic risk

B)standard deviation, coefficient of variation

C)correlation, covariance

D)security market line, characteristic line

A)systematic risk, unsystematic risk

B)standard deviation, coefficient of variation

C)correlation, covariance

D)security market line, characteristic line

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

20

All other things being equal, what is the major impact that an increase in the expected inflation rate would be expected to have on the security market line?

A)reduce its slope

B)shift it down and to the right

C)shift it up and to the left

D)reduce required returns for investors in any individual asset

A)reduce its slope

B)shift it down and to the right

C)shift it up and to the left

D)reduce required returns for investors in any individual asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following is not an approach for managing risk:

A)hedging

B)gaining control over the operating environment

C)limited use of firm-specific assets

D)ignoring systematic risk

A)hedging

B)gaining control over the operating environment

C)limited use of firm-specific assets

D)ignoring systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

22

The most relevant risk that must be considered for any widely traded individual security is its .

A)unsystematic risk

B)standard deviation

C)covariance risk

D)systematic risk

A)unsystematic risk

B)standard deviation

C)covariance risk

D)systematic risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

23

An increase in uncertainty regarding the future economic outlook has the effect of .

A)increasing the slope of the security market line

B)shifting the security market line upward

C)reducing risk

D)none of the above

A)increasing the slope of the security market line

B)shifting the security market line upward

C)reducing risk

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

24

The risk premium for an individual security is equal to the

A)beta times the market return

B)difference between the required return and the risk free rate

C)weighted average of the individual security betas in a portfolio

D)the security's covariance divided by the variance of the market

A)beta times the market return

B)difference between the required return and the risk free rate

C)weighted average of the individual security betas in a portfolio

D)the security's covariance divided by the variance of the market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

25

Texas Computers (TC) stock has a beta of 1.5 and American Water (AW) stock has a beta of 0.5.Which of the following statements will be true about these securities?

A)The addition of TC would reduce portfolio risk more than the addition of AW.

B)The addition of AW would reduce total portfolio risk more than the addition of TC.

C)The required return for TC is greater than the required return for AW.

D)The required return for AW is greater than the required return of TC.

A)The addition of TC would reduce portfolio risk more than the addition of AW.

B)The addition of AW would reduce total portfolio risk more than the addition of TC.

C)The required return for TC is greater than the required return for AW.

D)The required return for AW is greater than the required return of TC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

26

The security returns from multinational companies tend to have systematic risk than domestic companies.

A)more

B)less options with

C)less

D)more hedging of

A)more

B)less options with

C)less

D)more hedging of

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

27

An increase in the expected future inflation rate has the effect of .

A)increasing the slope of the security market line

B)shifting the security market line upward by the amount of the expected increase in inflation

C)increasing systematic risk

D)none of these

A)increasing the slope of the security market line

B)shifting the security market line upward by the amount of the expected increase in inflation

C)increasing systematic risk

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

28

In the , the expected return on a security is equal to the risk-free rate plus a single risk premium that is equal to the product of the expected rate of return on the market portfolio less the risk-free rate times the sensitivity of the security's returns to the market return.

A)Arbitrage Pricing Theory

B)Capital Asset Pricing Model

C)Dividend Valuation Model

D)Risk Premium on Debt Model

A)Arbitrage Pricing Theory

B)Capital Asset Pricing Model

C)Dividend Valuation Model

D)Risk Premium on Debt Model

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following (if any) is a relative (rather than absolute) measure of risk?

A)standard deviation

B)standard normal probability distribution

C)expected value

D)coefficient of variation

A)standard deviation

B)standard normal probability distribution

C)expected value

D)coefficient of variation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

30

The is a relative measure of variability because it measures the risk per unit of expected return.

A)coefficient of variation

B)correlation coefficient

C)covariance

D)standard deviation

A)coefficient of variation

B)correlation coefficient

C)covariance

D)standard deviation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

31

In order to completely eliminate the risk (i.e., a portfolio standard deviation of zero) in a two-asset portfolio, the correlation coefficient between the securities must be .

A)less than +1.0

B)equal to 0.0

C)less than 0.0

D)equal to -1.0

A)less than +1.0

B)equal to 0.0

C)less than 0.0

D)equal to -1.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

32

Arbitrage pricing theory is a model that relates expected returns on securities to

A)security risk and yield spreads

B)yield spreads and yield curve slope

C)anticipated economic factors

D)multiple risk factors

A)security risk and yield spreads

B)yield spreads and yield curve slope

C)anticipated economic factors

D)multiple risk factors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

33

Investors generally are considered to be risk because they expect to be compensated for assuming risk.

A)inverse

B)seekers

C)averse

D)takers

A)inverse

B)seekers

C)averse

D)takers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

34

All of the following factors have their primary impact on unsystematic risk except

A)availability of raw materials

B)effects of foreign competition

C)changes in inflation

D)strikes

A)availability of raw materials

B)effects of foreign competition

C)changes in inflation

D)strikes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

35

In general, when the correlation coefficient between the returns on two securities is , the risk of a portfolio is

The weighted average of the total risk of the two individual securities.

A)equal to +1.0;equal to

B)less than +1.0;less than

C)a and b

D)none of these

The weighted average of the total risk of the two individual securities.

A)equal to +1.0;equal to

B)less than +1.0;less than

C)a and b

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

36

The risk remaining after extensive diversification is primarily:

A)unsystematic risk

B)systematic risk

C)coefficient of variation risk

D)standard deviation risk

A)unsystematic risk

B)systematic risk

C)coefficient of variation risk

D)standard deviation risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

37

A portfolio is efficient if .

A)for a given standard deviation, there is no other portfolio with a higher expected return

B)for a given expected return, there is no other portfolio with a lower standard deviation

C)its standard deviation is equal to -1.0

D)for a given standard deviation, there is no other portfolio with a higher expected return and if, for a given expected return, there is no other portfolio with a lower standard deviation

A)for a given standard deviation, there is no other portfolio with a higher expected return

B)for a given expected return, there is no other portfolio with a lower standard deviation

C)its standard deviation is equal to -1.0

D)for a given standard deviation, there is no other portfolio with a higher expected return and if, for a given expected return, there is no other portfolio with a lower standard deviation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

38

What will happen to the Security Market Line if: (1) inflation expectations increase, and (2) investors become more risk averse?

A)shift up and have a steeper slope

B)shift down and have the same slope

C)shift down and have a steeper slope

D)shift up but have less slope

A)shift up and have a steeper slope

B)shift down and have the same slope

C)shift down and have a steeper slope

D)shift up but have less slope

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

39

The correlated the returns from two securities are, the will be the portfolio effects of risk reduction.

A)more positively, greater

B)greater, greater

C)less positively, greater

D)lower, lower

A)more positively, greater

B)greater, greater

C)less positively, greater

D)lower, lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

40

The risk-free rate of return can be thought of as consisting of the following two components:

A)a real rate of return, a default premium

B)unanticipated inflation, bond default premium

C)a real rate of return, an inflation premium

D)a zero beta component, an expectation premium

A)a real rate of return, a default premium

B)unanticipated inflation, bond default premium

C)a real rate of return, an inflation premium

D)a zero beta component, an expectation premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

41

The term structure of interest rates is the pattern of interest rate yields for securities that differ only in

A)default risk

B)liquidity premiums

C)the yield to maturity

D)the length of time to maturity

A)default risk

B)liquidity premiums

C)the yield to maturity

D)the length of time to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

42

Investors can obtain high returns in their investments if:

A)they use hedging techniques

B)they assume high risks

C)they invest only international securities

D)they invest in legal Ponzi type securities

A)they use hedging techniques

B)they assume high risks

C)they invest only international securities

D)they invest in legal Ponzi type securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

43

The theory of the yield curve holds that required returns on long-term securities tend to be greater the longer the time to maturity.

A)expectations

B)market segmentation

C)preferred habitat

D)liquidity premium

A)expectations

B)market segmentation

C)preferred habitat

D)liquidity premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

44

The maturity premium reflects a preference by many lenders for

A)shorter maturities

B)reducing yields

C)high yield securities

D)longer maturities

A)shorter maturities

B)reducing yields

C)high yield securities

D)longer maturities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

45

The two elements that make up the risk-free rate of return are

A)the supply of funds and the demand for funds

B)the yield on 90-day Treasury bills plus an inflation premium

C)the real rate of return plus an inflation premium

D)the required return plus a risk premium

A)the supply of funds and the demand for funds

B)the yield on 90-day Treasury bills plus an inflation premium

C)the real rate of return plus an inflation premium

D)the required return plus a risk premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

46

On the capital market line (CML), any risk-return combination beyond the Market Portfolio (m) is obtained by ____.

A)lending money

B)borrowing money

C)reducing risk

D)investing in index funds

A)lending money

B)borrowing money

C)reducing risk

D)investing in index funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

47

The term structure of interest rates is the pattern of interest rate yields for debt securities that are similar in all respects except for differences in

A)tax status

B)liquidity

C)risk of default

D)maturity

A)tax status

B)liquidity

C)risk of default

D)maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

48

The risk-free rate of return is composed of which of the following elements:

A)risk premium and inflation

B)cost of capital and risk premium

C)real rate of return and risk premium

D)real rate of return and inflation

A)risk premium and inflation

B)cost of capital and risk premium

C)real rate of return and risk premium

D)real rate of return and inflation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

49

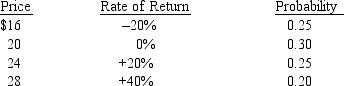

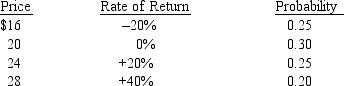

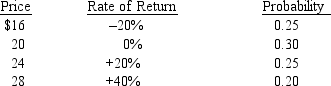

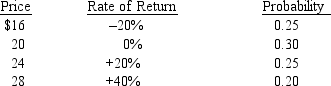

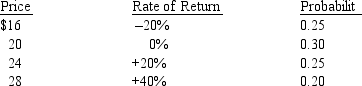

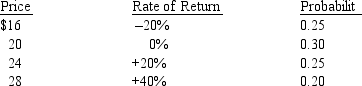

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the coefficient of variation for the rate of return on Phoenix stock.

A)0.0

B)2.68

C)2.61

D)0.275

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the coefficient of variation for the rate of return on Phoenix stock.

A)0.0

B)2.68

C)2.61

D)0.275

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

50

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

A)8%

B)0%

C)10%

D)40%

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the expected rate of return on Phoenix Stock.

A)8%

B)0%

C)10%

D)40%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

51

Phoenix Company common stock is currently selling for $20 per share.Security analysts at Smith Blarney have assigned the following probability distribution to the price of (and rate of return on) Phoenix stock one year from now:

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the standard deviation of possible rates of return on Phoenix stock (to the nearest tenth of a percent).

A)456%

B)20.9%

C)2.2%

D)21.4%

Assuming that Phoenix is not expected to pay any dividends during the coming year, determine the standard deviation of possible rates of return on Phoenix stock (to the nearest tenth of a percent).

A)456%

B)20.9%

C)2.2%

D)21.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

52

The following yields on 20 year bonds prevailed in January for the three securities shown:

Aa-rated corporate bond 9.98%

Baa-rated corporate bond 10.34%

B-rated corporate bond 11.12%

The difference in yields is due primarily to

A)maturity risk premium

B)default risk premium

C)seniority risk premium

D)financial risk premium

Aa-rated corporate bond 9.98%

Baa-rated corporate bond 10.34%

B-rated corporate bond 11.12%

The difference in yields is due primarily to

A)maturity risk premium

B)default risk premium

C)seniority risk premium

D)financial risk premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

53

According to the , long-term interest rates are a function of expected short-term interest rates.

A)Maturity theory

B)Expectations theory

C)Market segmentation theory

D)Preferred habitat theory

A)Maturity theory

B)Expectations theory

C)Market segmentation theory

D)Preferred habitat theory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

54

The term structure of interest rates is related to the .

A)default risk premium

B)seniority risk premium

C)marketability risk premium

D)maturity risk premium

A)default risk premium

B)seniority risk premium

C)marketability risk premium

D)maturity risk premium

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

55

The default risk premium reflects the fact that

A)the premium remains constant over time

B)there is a positive relationship between risk and maturity

C)there is a positive relationship between default risk and required returns

D)the premium varies depending on the time to maturity

A)the premium remains constant over time

B)there is a positive relationship between risk and maturity

C)there is a positive relationship between default risk and required returns

D)the premium varies depending on the time to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

56

The ability of an investor to buy and sell a company's securities quickly and without a significant loss of value is known as the

A)financial risk

B)marketability risk

C)business risk

D)security risk

A)financial risk

B)marketability risk

C)business risk

D)security risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

57

The business risk of a firm refers to the

A)results from using fixed-cost sources of funds

B)variability in the price of a firm's securities

C)variability in the firm's operating earnings over time

D)influence of government regulations on business earnings

A)results from using fixed-cost sources of funds

B)variability in the price of a firm's securities

C)variability in the firm's operating earnings over time

D)influence of government regulations on business earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

58

Business risk is influenced by all the following factors except:

A)variability in interest expenses

B)variability in sales

C)diversity of its product line

D)choice of production technology

A)variability in interest expenses

B)variability in sales

C)diversity of its product line

D)choice of production technology

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

59

refers to the ability of an investor to buy and sell a company's securities quickly and without a significant loss of value.

A)Default risk

B)Business and financial risk

C)Maturity risk

D)Marketability risk

A)Default risk

B)Business and financial risk

C)Maturity risk

D)Marketability risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

60

can be achieved by investing in a set of securities that have different risk-return characteristics.

A)Indexing

B)Capital Asset pricing

C)Diversification

D)Asset allocation

A)Indexing

B)Capital Asset pricing

C)Diversification

D)Asset allocation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

61

The expected rate of return for the coming year on FTC common stock is normally distributed with a mean of 14% and a standard deviation of 7%.Determine the probability of earning more than 21% on FTC common stock.(Note: Table V is required to work this problem.)

A)1.00

B)0.8413

C)0.0013

D)0.1587

A)1.00

B)0.8413

C)0.0013

D)0.1587

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

62

Determine the beta of a portfolio consisting of equal investments in the following common stocks:

A) 1.05

B) 1.00

C) 1.10

D) 0.95

A) 1.05

B) 1.00

C) 1.10

D) 0.95

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

63

The expected rate of return for 3COM is 18 percent, with a standard deviation of 10.98 percent.The expected rate of return for Just the Fax is 26 percent with a standard deviation of 15.86%.Which firm would be considered the riskier from a total risk perspective?

A)3COM

B)Just the Fax

C)Neither, both have the same risk

D)Cannot be determined

A)3COM

B)Just the Fax

C)Neither, both have the same risk

D)Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

64

An investor plans to invest 75 percent of her funds in the common stock of Gamma Industries and 25 percent in Epsilon Company.The expected return on Gamma is 12 percent and the expected return on Epsilon is 16 percent.The standard deviation of returns for Gamma is 8 percent and for Epsilon is 12 percent.The correlation between the returns for Gamma and Epsilon is +0.8.Determine the standard deviation of returns for this investor's portfolio.

A)73.8%

B)6.71%

C)3.00%

D)8.59%

A)73.8%

B)6.71%

C)3.00%

D)8.59%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

65

Over the 10-year period from 1978 through 1987, the compound annual rate of return on U.S.Treasury bills was 9.17 percent.Over the same time period, the average annual inflation rate was 6.39 percent.Therefore,

A)the inflation premium was 2.78 percentage points

B)the real expected rate of return was 9.17 percentage points

C)the realized real rate of return was 2.78 percentage points

D)the required rate of return was 6.39 percentage points

A)the inflation premium was 2.78 percentage points

B)the real expected rate of return was 9.17 percentage points

C)the realized real rate of return was 2.78 percentage points

D)the required rate of return was 6.39 percentage points

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

66

Don has $3,000 invested in AT&T with an expected return of 11.6 percent;$10,000 in IBM with an expected return of 12.8 percent;and $6,000 in GM with an expected return of 12.2 percent.What is Don's expected return on his portfolio?

A)12.42%

B)12.20%

C)11.81%

D)Cannot be determined

A)12.42%

B)12.20%

C)11.81%

D)Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

67

Sally's broker told her that the expected return from her portfolio was 14.2%.If 40% of her securities have an expected return of 10.3 percent and 20% have an expected return of 12.8 percent, what is the expected return of the remaining portion of her portfolio?

A)20.9%

B)18.8%

C)12.5%

D)cannot be determined

A)20.9%

B)18.8%

C)12.5%

D)cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

68

The real rate of interest is expected to be 3 percent and the expected rate of inflation for next year is expected to be 5.5 percent.If the default risk premium is 1.1 percentage points, and the seniority risk premium is 0.4 percentage points, what is the required return on a 1 year U.S.Treasury security?

A)9.6%

B)10.0%

C)8.5%

D)8.9%

A)9.6%

B)10.0%

C)8.5%

D)8.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

69

An investor plans to invest 75 percent of her funds in the common stock of Gamma Industries and 25 percent in Epsilon Company.The expected return on Gamma is 12 percent and the expected return on Epsilon is 16 percent.The standard deviation of returns for Gamma is 8 percent and for Epsilon is 12 percent.The correlation between the returns for Gamma and Epsilon is +0.8.Determine the expected return on the investor's portfolio.

A)14%

B)12%

C)13%

D)9%

A)14%

B)12%

C)13%

D)9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

70

Elephant Company common stock has a beta of 1.2.The risk-free rate is 6 percent and the expected market rate of return is 12 percent.Determine the required rate of return on the security.

A)7.2%

B)14.4%

C)19.2%

D)13.2%

A)7.2%

B)14.4%

C)19.2%

D)13.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

71

A college student owns two securities: Apple and Coca- Cola.Apple has an expected return of 15 percent with a standard deviation of those returns being 11 percent.Coca-Cola has an expected return of 12 percent, and a standard deviation of 7 percent.The correlation of returns between Apple and Coca-Cola is 0.81.If the portfolio consist of $6,000 in Coca-Cola and $4,000 in Apple, what is the expected standard deviation of portfolio returns?

A)8.18%

B)13.20%

C)8.60%

D)9.71%

A)8.18%

B)13.20%

C)8.60%

D)9.71%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

72

The yield to maturity on ACL bonds maturing in 2005 is 8.75 percent.The yield to maturity on a similar maturity U.S.Government Treasury bond in 7.06 percent and the yield on Treasury bills is 6.51 percent.What is the default risk premium on the ACL bond?

A)2.24%

B)1.69%

C)0.55%

D)8.75%

A)2.24%

B)1.69%

C)0.55%

D)8.75%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

73

The expected rate of return for the coming year on FTC common stock is normally distributed with a mean of 14% and a standard deviation of 7%.Determine the probability of earning a negative rate of return (i.e.less than 0%) on FTC common stock.(Note: Table V is required to work this problem.)

A)0.0228

B)2.00

C)0.5000

D)0.9772

A)0.0228

B)2.00

C)0.5000

D)0.9772

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

74

The return expected from a risky investment is 24 percent, and the standard deviation of this return is 17 percent.If returns from this investment are normally distributed, what is the probability that the investment may earn a negative rate of return? (Note: Table V is required to work this problem.)

A)8.33%

B)7.93%

C)6.88%

D)5.44%

A)8.33%

B)7.93%

C)6.88%

D)5.44%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

75

The risk-free rate of return is 5.51 percent, based on an expected inflation premium of 2.54 percent.The expected return on the market is 12.8 percent.What is the required rate of return for Envoy common stock which has a beta of 1.35?

A)6.98%

B)16.24%

C)15.35%

D)12.80%

A)6.98%

B)16.24%

C)15.35%

D)12.80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

76

Dana has a portfolio of 8 securities, each with a market value of $5,000.The current beta of the portfolio is 1.28 and the beta of the riskiest security is 1.75.Dana wishes to reduce her portfolio beta to 1.15 by selling the riskiest security and replacing it with another security with a lower beta.What must be the beta of the replacement security?

A)1.21

B)0.91

C)0.73

D)1.62

A)1.21

B)0.91

C)0.73

D)1.62

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

77

Compute the risk premium for the stock of Omega Tools if the risk-free rate is 6%, the expected market return is 12%, and Omega's stock has a beta of .8.

A)10.8%

B)4.8%

C)48.0%

D)16.8%

A)10.8%

B)4.8%

C)48.0%

D)16.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

78

If the return on U.S.Treasury bills is 7.02%, the risk premium is 2.32%, and the inflation rate is 4.16%, then the real rate of return is:

A)2.86%

B)7.02%

C)4.70%

D)6.48%

A)2.86%

B)7.02%

C)4.70%

D)6.48%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

79

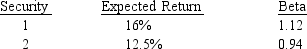

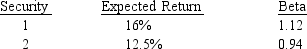

Assume you want to construct a portfolio with a 14 percent return from the following two securities:

What percentage of your portfolio should be invested in Security 1?

A)57%

B)47%

C)43%

D)53%

What percentage of your portfolio should be invested in Security 1?

A)57%

B)47%

C)43%

D)53%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck

80

Twin City Knitting (TCK) pays a current dividend of $2.20 and dividends are expected to grow at a rate of 7 percent annually in the foreseeable future.The beta of TCK is 1.2.If the risk-free rate is 9.2 percent and the market risk premium is 6 percent, at what price would you expect TCK's common stock to sell?

A)$14.35

B)$33.63

C)$23.40

D)$25.04

A)$14.35

B)$33.63

C)$23.40

D)$25.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 118 في هذه المجموعة.

فتح الحزمة

k this deck