Deck 13: Capital Structure Concepts

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/75

العب

ملء الشاشة (f)

Deck 13: Capital Structure Concepts

1

The Modigliani-Miller theory that the value of the firm is independent of its capital structure is based on a(n) ?process.

A)reinvestment

B)capital asset pricing model

C)arbitraging

D)compound interest

A)reinvestment

B)capital asset pricing model

C)arbitraging

D)compound interest

C

2

Financial leverage benefits shareholders when the

A)return on assets is greater than the cost of debt

B)return on equity is greater than the cost of debt

C)return on investments is less than the weighted cost of capital

D)return on equity is less than the cost of debt

A)return on assets is greater than the cost of debt

B)return on equity is greater than the cost of debt

C)return on investments is less than the weighted cost of capital

D)return on equity is less than the cost of debt

A

3

In analyzing the value of the firm as a function of capital structure, the present value of the tax shield benefit is offset by the present value of the expected , resulting in an interior optimal capital structure.

A)financial distress costs

B)agency costs

C)holding costs

D)financial distress costs and agency costs

A)financial distress costs

B)agency costs

C)holding costs

D)financial distress costs and agency costs

D

4

One of the primary assumptions of capital structure analysis is that the level and variability of is not expected to change as changes in capital structure are contemplated.

A)net income

B)earnings before taxes

C)operating income

D)debt

A)net income

B)earnings before taxes

C)operating income

D)debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

5

Generally the a firm's business risk, the the amount of financial leverage that will be used in the optimal capital structure.

A)greater, greater

B)smaller, less

C)greater, less

D)smaller, greater

A)greater, greater

B)smaller, less

C)greater, less

D)smaller, greater

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

6

Perfect capital markets imply the following:

A)there are no transactions costs for buying and selling securities

B)relevant information is unavailable for individuals

C)all investors can borrow and lend at the same rate

D)a single investor can influence security prices

A)there are no transactions costs for buying and selling securities

B)relevant information is unavailable for individuals

C)all investors can borrow and lend at the same rate

D)a single investor can influence security prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

7

Operating leverage involves the use of

A)equity and debt in equal proportions

B)market power

C)debt

D)assets having fixed costs

A)equity and debt in equal proportions

B)market power

C)debt

D)assets having fixed costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

8

Holding all other things equal, as the relative amount of debt in the capital structure of the firm increases, the cost of equity capital will

A)increase

B)decrease

C)remain unchanged;there is no relationship between the two

D)initially rise rapidly, then increase slowly beyond some point

A)increase

B)decrease

C)remain unchanged;there is no relationship between the two

D)initially rise rapidly, then increase slowly beyond some point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statements is (are) true concerning the relationship between the firm's cost of equity and its capital structure (as measured by the debt ratio)?

A)The exact relationship between the cost of equity and the debt ratio is difficult to determine.

B)The range of debt ratios where the cost of equity begins to increase rapidly varies by firm and industry depending on the firm's age.

C)The relationship is a saucer-shaped curve.

D)The relationship is determined by the static tradeoff theory.

A)The exact relationship between the cost of equity and the debt ratio is difficult to determine.

B)The range of debt ratios where the cost of equity begins to increase rapidly varies by firm and industry depending on the firm's age.

C)The relationship is a saucer-shaped curve.

D)The relationship is determined by the static tradeoff theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is true regarding the relationship between the firm's cost of debt and its capital structure (as measured by the debt ratio)?

A)The range of debt ratios where the cost of debt begins to increase rapidly varies by firm and industry, depending on the level of business risk.

B)The precise relationship between the cost of debt and the debt ratio is simple to determine.

C)The relationship is a saucer-shaped curve.

D)The relationship is determined by the static tradeoff theory.

A)The range of debt ratios where the cost of debt begins to increase rapidly varies by firm and industry, depending on the level of business risk.

B)The precise relationship between the cost of debt and the debt ratio is simple to determine.

C)The relationship is a saucer-shaped curve.

D)The relationship is determined by the static tradeoff theory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

11

With an optimal capital structure

A)overall capital costs are minimized

B)the net present value of new projects is minimized

C)financial leverage is minimized

D)the weighted cost of capital is maximized

A)overall capital costs are minimized

B)the net present value of new projects is minimized

C)financial leverage is minimized

D)the weighted cost of capital is maximized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

12

The amount of permanent short-term debt, long-term debt, preferred stock, and common stock used to finance a firm defines the firm's

A)financial structure

B)capital structure

C)target capital structure

D)optimal financial structure

A)financial structure

B)capital structure

C)target capital structure

D)optimal financial structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

13

Two prominent finance researchers (Modigliani and Miller) showed that

A)the firm's optimal capital structure consists of approximately equal proportions of debt and equity

B)the value of the firm is independent of its capital structure in perfect capital markets with no income taxes

C)the firm's cost of capital is minimized when its capital structure consists of approximately equal proportions of debt and equity

D)the firm's cost of capital is maximized when its capital structure consists of approximately equal proportions of debt and equity

A)the firm's optimal capital structure consists of approximately equal proportions of debt and equity

B)the value of the firm is independent of its capital structure in perfect capital markets with no income taxes

C)the firm's cost of capital is minimized when its capital structure consists of approximately equal proportions of debt and equity

D)the firm's cost of capital is maximized when its capital structure consists of approximately equal proportions of debt and equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

14

As more debt is added to the capital structure of a firm, the cost of debt capital

A)initially rises slowly, then falls beyond some point

B)increases at a steady rate throughout the entire range

C)beyond some point, becomes greater than the cost of equity

D)initially rises slowly, then increases rapidly beyond some point

A)initially rises slowly, then falls beyond some point

B)increases at a steady rate throughout the entire range

C)beyond some point, becomes greater than the cost of equity

D)initially rises slowly, then increases rapidly beyond some point

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

15

The mix of debt, preferred stock, and common equity that minimizes the weighted cost of capital to the firm is known as the

A)optimal corporate structure

B)target financial structure

C)optimal capital structure

D)optimal degree of combined leverage

A)optimal corporate structure

B)target financial structure

C)optimal capital structure

D)optimal degree of combined leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

16

The objective of capital structure management is to find the capital mix that leads to

A)maximization of earnings per share

B)shareholder wealth maximization

C)maximization of net income

D)maximization of the current period's dividends

A)maximization of earnings per share

B)shareholder wealth maximization

C)maximization of net income

D)maximization of the current period's dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

17

The optimal capital structure is determined by several factors including all of the following except:

A)corporate capital gains

B)business risk

C)potential bankruptcy risk

D)agency costs

A)corporate capital gains

B)business risk

C)potential bankruptcy risk

D)agency costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

18

All of the following factors influence a firm's business risk except:

A)degree of operating leverage

B)variability of interest rates

C)variability of operating costs

D)variability of selling prices

A)degree of operating leverage

B)variability of interest rates

C)variability of operating costs

D)variability of selling prices

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

19

The use of fixed-cost financing sources is referred to as the use of

A)operating leverage

B)a leveraged buyout

C)financial leverage

D)combined leverage

A)operating leverage

B)a leveraged buyout

C)financial leverage

D)combined leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

20

The use of fixed cost sources of funds, such as debt and preferred stock affect a firm's .

A)financial risk

B)degree of operating leverage

C)market power

D)business risk

A)financial risk

B)degree of operating leverage

C)market power

D)business risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

21

In determining the capital structure for an international firm, the managerial objective is to

A)minimize exchange rate risk

B)minimize the risk of expropriation

C)minimize the overall cost of capital

D)minimize available local low-cost financing

A)minimize exchange rate risk

B)minimize the risk of expropriation

C)minimize the overall cost of capital

D)minimize available local low-cost financing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

22

Studies of capital structure changes have found that actions that increase leverage have generally been associated with stock returns and actions that decrease leverage are associated with stock returns.

A)negative, positive

B)negative, no change in

C)positive, negative

D)no change in, negative

A)negative, positive

B)negative, no change in

C)positive, negative

D)no change in, negative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

23

The optimal capital structure of a firm is a function of the .

A)business risk of the firm

B)tax structure

C)business risk of the firm and the tax structure

D)the variability of sales volumes

A)business risk of the firm

B)tax structure

C)business risk of the firm and the tax structure

D)the variability of sales volumes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

24

As the proportion of debt in the capital structure increases, investors require a return and the value of existing debt will .

A)higher, increase

B)higher, decrease

C)lower, increase

D)lower, decrease

A)higher, increase

B)higher, decrease

C)lower, increase

D)lower, decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

25

A survey of Fortune 500 firms indicate that they prefer internal financing (retained earnings) to external financing.This preference is known as .

A)financial slack

B)the pecking order theory

C)capital structure theory

D)asymmetric capital

A)financial slack

B)the pecking order theory

C)capital structure theory

D)asymmetric capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

26

According to the "pecking order theory," firms prefer to issue securities first and then issue securities as a last resort.

A)equity, debt

B)debt, convertible debt

C)debt, equity

D)equity, convertible debt

A)equity, debt

B)debt, convertible debt

C)debt, equity

D)equity, convertible debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

27

The managerial implications of capital structure theory include all of the following except:

A)capital structure changes transmit important information to investors

B)changes in capital structure result in changes in the market value of the firm's equity

C)optimal capital structure is influenced heavily by the business risk facing the firm

D)tax shield benefits from equity lead to increased firm value

A)capital structure changes transmit important information to investors

B)changes in capital structure result in changes in the market value of the firm's equity

C)optimal capital structure is influenced heavily by the business risk facing the firm

D)tax shield benefits from equity lead to increased firm value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

28

refers to the argument that officers and managers have access to information about the expected future earnings of the firm that is not available to outside investors.

A)Insider trading

B)Asymmetric information

C)Signaling effect

D)Pecking order theory

A)Insider trading

B)Asymmetric information

C)Signaling effect

D)Pecking order theory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

29

Modigliani and Miller show that the value of a firm is capital structure given perfect capital markets and no corporate income taxes.

A)maximized by having no debt in the

B)independent of

C)maximized by having an optimal

D)dependent on the

A)maximized by having no debt in the

B)independent of

C)maximized by having an optimal

D)dependent on the

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

30

represents the permanent sources of the firm's financing.

A)Financial structure

B)Capital structure

C)Equity structure

D)Cost structure

A)Financial structure

B)Capital structure

C)Equity structure

D)Cost structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

31

The market value of a levered firm can be represented by the following equation:

Market value of levered firm = Market value of unlevered firm Present value of tax shield Present value of financial distress costs Present value of agency costs

A)minus;plus;plus

B)plus;plus;plus

C)plus;minus;minus

D)minus, plus, minus

Market value of levered firm = Market value of unlevered firm Present value of tax shield Present value of financial distress costs Present value of agency costs

A)minus;plus;plus

B)plus;plus;plus

C)plus;minus;minus

D)minus, plus, minus

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

32

The management of Graphicopy is trying to determine how much debt they should have in their capital structure.If they sell $500,000 in perpetual bonds with a 9 percent coupon, what would be the present value of the tax shield? Assume the marginal tax rate is 35%.

A)$15,750

B)$29,250

C)$175,000

D)$45,000

A)$15,750

B)$29,250

C)$175,000

D)$45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

33

The optimal capital structure is a function of .

A)corporate income taxes

B)financial distress costs

C)agency costs

D)corporate income taxes, financial distress costs, and agency costs

A)corporate income taxes

B)financial distress costs

C)agency costs

D)corporate income taxes, financial distress costs, and agency costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

34

Agency costs

A)increase as the debt/total assets ratio decreases

B)affect the present value of the tax shield

C)decrease as financial distress increases

D)reduce the market value of the levered firm

A)increase as the debt/total assets ratio decreases

B)affect the present value of the tax shield

C)decrease as financial distress increases

D)reduce the market value of the levered firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

35

The less a firm's business risk, the the amount of that will be used in the optimal capital structure, holding constant all other relevant factors.

A)less;financial leverage

B)more;financial leverage

C)less;equity capital

D)more;debt capital

A)less;financial leverage

B)more;financial leverage

C)less;equity capital

D)more;debt capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

36

A firm with highly liquid assets plus unused debt capacity is said to have .

A)arbitrage structural capacity

B)the optimal capital structure

C)financial slack

D)optimal financial structure

A)arbitrage structural capacity

B)the optimal capital structure

C)financial slack

D)optimal financial structure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

37

Investors' required returns and the cost of equity capital as the relative amount of debt used to finance the firm .

A)increase, increases

B)increase, decreases

C)remain constant, increases

D)remain constant, decreases

A)increase, increases

B)increase, decreases

C)remain constant, increases

D)remain constant, decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

38

Protection for debt holders takes the form of protective covenants in the bond indenture.These covenants place restrictions on which of the following activities?

A)the sale of assets

B)payment of dividends

C)the issuance of additional debt

D)all of these are typical protective covenants

A)the sale of assets

B)payment of dividends

C)the issuance of additional debt

D)all of these are typical protective covenants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

39

Due to both financial distress and agency costs, a firm should have a capital structure that

A)contains all debt

B)contains all equity

C)contains both debt and equity

D)contains only long-term debt

A)contains all debt

B)contains all equity

C)contains both debt and equity

D)contains only long-term debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

40

The increased variability in earnings per share due to the firm's use of debt is a definition of .

A)combined leverage

B)agency risk

C)financial risk

D)operating risk

A)combined leverage

B)agency risk

C)financial risk

D)operating risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

41

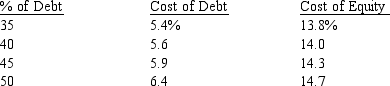

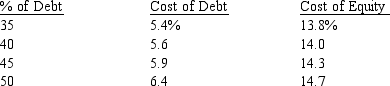

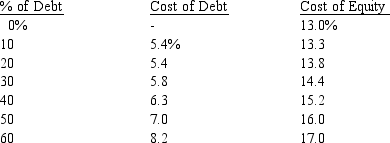

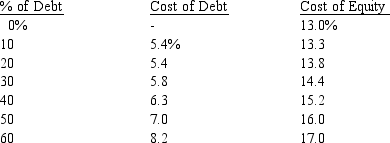

Biotec has estimated the costs of debt and equity capital for various proportions of debt in its capital structure:

If Biotec pays a current dividend of $1.00 and expects dividends to grow at a constant rate of 7%, what is Biotec's stock price if it obtains its optimal capital structure?

A)$14.66

B)$30.40

C)$30.14

D)$29.40

If Biotec pays a current dividend of $1.00 and expects dividends to grow at a constant rate of 7%, what is Biotec's stock price if it obtains its optimal capital structure?

A)$14.66

B)$30.40

C)$30.14

D)$29.40

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

42

Calculate the market value of a firm with total assets of $105 million and $50 million of 10% perpetual debt in the capital structure.The firm's cost of equity is 14% on the $55 million in equity in the capital structure.The perpetual EBIT is expected to be $9 million and the marginal tax rate is 40%.

A)$88.6 million

B)$67.1 million

C)$114.3 million

D)$78.6 million

A)$88.6 million

B)$67.1 million

C)$114.3 million

D)$78.6 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

43

Arbitrage transactions are:

A)risky

B)illegal

C)speculative

D)risk-free

A)risky

B)illegal

C)speculative

D)risk-free

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

44

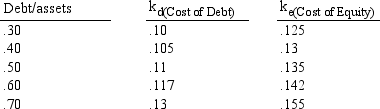

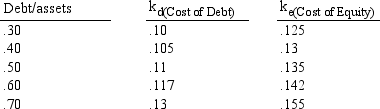

Feldspar Inc.is considering the capital structure for a new division.Management has been given the following cost information:

Based on this information, what capital structure (debt/asset ratio) should management accept? Assume the marginal tax rate is 40%.

A)40% has lowest cost of capital

B)50% has lowest cost of capital

C)60% has lowest cost of capital

D)70% has lowest cost of capital

Based on this information, what capital structure (debt/asset ratio) should management accept? Assume the marginal tax rate is 40%.

A)40% has lowest cost of capital

B)50% has lowest cost of capital

C)60% has lowest cost of capital

D)70% has lowest cost of capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

45

What is the annual tax shield to a firm that has a capital structure consisting of $100 million of debt and $180 million of equity, if the average interest rate on debt is 9%, the return on equity is 13%, and the marginal tax rate is 40%?

A)$9.0 million

B)$5.4 million

C)$9.36 million

D)$3.6 million

A)$9.0 million

B)$5.4 million

C)$9.36 million

D)$3.6 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

46

The capital structure decision attempts to minimize which maximizes the value of the firm.

A)leverage costs

B)the cost of capital

C)labor costs

D)compensation packages

A)leverage costs

B)the cost of capital

C)labor costs

D)compensation packages

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

47

What is the market value of Barings, a firm with total assets of $100 million and $30 million in perpetual debt in its capital structure? Barings' cost of equity is 15% and its cost of debt is 10%.Expected perpetual net operating income (EBIT) will be $17 million and the marginal tax rate is 40%.

A)$86.0 million

B)$104.0 million

C)$98.0 million

D)$92.7 million

A)$86.0 million

B)$104.0 million

C)$98.0 million

D)$92.7 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

48

Calculate the market value of Lotle Group, a firm with total assets of $80 million and $30 million of perpetual debt in its capital structure.The firm's cost of equity is 14% and the cost of debt is 9%.Lotle expects annual, perpetual net operating income (EBIT) of $9 million and a marginal tax rate of 40%.

A)$30 million

B)$61.3 million

C)$57 million

D)$64.3 million

A)$30 million

B)$61.3 million

C)$57 million

D)$64.3 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

49

Triad Labs has total assets of $120 million and $40 million of debt in its capital structure.Its current cost of equity is 13% and its cost of debt is 8.5%.Triad is considering increasing its debt to $70 million and purchasing its own stock with proceeds from the sale of $30 million in debt with a cost of 9.5%, reducing equity to $50 million.The cost of equity will increase to 14.5%.Net operating income (EBIT) will remain at $12 million.If Triad has a marginal tax rate of 40%, should the firm increase its debt? Assume that both debt and EBIT are perpetual.

A)No, the value of the firm decreases $15.9 million

B)No, the value of the firm decreases $30.0 million

C)Yes, the value of the firm increases $14.1 million

D)Yes, the value of the firm increases $30.0 million

A)No, the value of the firm decreases $15.9 million

B)No, the value of the firm decreases $30.0 million

C)Yes, the value of the firm increases $14.1 million

D)Yes, the value of the firm increases $30.0 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

50

Seduak has estimated the costs of debt and equity capital for various proportions of debt in its capital structure:

Based on these estimates, determine Seduak's optimal capital structure.

A)30% debt

B)40% debt

C)50% debt

D)60% debt

Based on these estimates, determine Seduak's optimal capital structure.

A)30% debt

B)40% debt

C)50% debt

D)60% debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

51

RoTek has a capital structure of $300,000 in equity and $300,000 in perpetual debt.The firm's cost of equity is 14 percent and its cost of debt is 9 percent.If the firm has an expected, perpetual net operating income of $120,000 and a marginal tax rate of 40 percent, what is the market value of RoTek? Assume all net income is paid out as dividends.

A)$698,571

B)$814,286

C)$818,571

D)$55,800

A)$698,571

B)$814,286

C)$818,571

D)$55,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

52

The greater the variability of costs, the greater the business risk of the firm.This is reflected in the:

A)selling price

B)cost of inputs used to produce a firm's output

C)sales volume

D)existence of market power

A)selling price

B)cost of inputs used to produce a firm's output

C)sales volume

D)existence of market power

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

53

Calculate the market value of a firm with total assets of $60 million and a net worth of $35 million.The firm's cost of equity is 15% and the cost of perpetual debt is 8%.The firm has a perpetual net operating income (EBIT) of $4.5 million and a marginal tax rate of 35%.

A)$41.67 million

B)$30.00 million

C)$35.83 million

D)$30.83 million

A)$41.67 million

B)$30.00 million

C)$35.83 million

D)$30.83 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

54

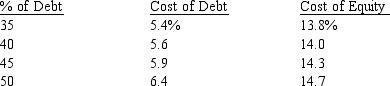

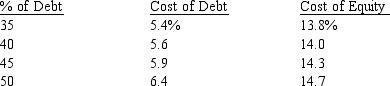

Biotec has estimated the costs of debt and equity capital for various proportions of debt in its capital structure:

Based on these estimates, determine Biotec's optimal capital structure.

A)35% debt

B)40% debt

C)45% debt

D)50% debt

Based on these estimates, determine Biotec's optimal capital structure.

A)35% debt

B)40% debt

C)45% debt

D)50% debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

55

The airline industry is extremely price competitive, as well as having huge fixed costs and very low variable costs.

This is an example of:

A)low asset performance

B)high profitability

C)high operating leverage

D)low fixed threshold

This is an example of:

A)low asset performance

B)high profitability

C)high operating leverage

D)low fixed threshold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

56

What is the present value of the tax shield to a firm that has a capital structure consisting of $100 million of perpetual debt and $180 million of equity, if the average interest rate on debt is 9%, the return on equity is 13%, and the marginal tax rate is 40%?

A)$72 million

B)$40 million

C)$60 million

D)$3.6 million

A)$72 million

B)$40 million

C)$60 million

D)$3.6 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

57

The process of simultaneously buying and selling the same or equivalent securities in different markets to take advantage of price differences and make a profit is called:

A)option pricing

B)diversification

C)arbitrage

D)margining

A)option pricing

B)diversification

C)arbitrage

D)margining

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

58

What is the present value of the tax shield to a firm that has total assets of $80 million and a net worth of $55 million, if the average interest rate on perpetual debt is 8.5%, the average return on equity is 14%, and the marginal tax rate is 35%?

A)$8.75 million

B)$12.25 million

C)$0.85 million

D)$0.744 million

A)$8.75 million

B)$12.25 million

C)$0.85 million

D)$0.744 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

59

What is the annual tax shield to a firm that has total assets of $80 million and a net worth of $55 million, if the average interest rate on debt is 8.5%, the average return on equity is 14%, and the marginal tax rate is 35%?

A)$2.125 million

B)$1.87 million

C)$0.85 million

D)$0.744 million

A)$2.125 million

B)$1.87 million

C)$0.85 million

D)$0.744 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

60

Technico has determined that its optimal capital structure is 40% debt, at which point its weighted cost of capital, ka, is 13.7%.Due to financial problems, the firm has decided to raise the proportion of debt to 50%, which will increase its weighted cost of capital to 14.4%.What is the effect on the stock price of Technico? The current dividend is $1.60 and the long-term growth rate of dividends is expected to be 8.5%.

A)Decrease $3.65

B)Decrease $3.96

C)Increase $3.65

D)Increase $3.96

A)Decrease $3.65

B)Decrease $3.96

C)Increase $3.65

D)Increase $3.96

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

61

In considering a firm's capital structure, the firm should increase its which will maximize its value.

A)stock outstanding

B)earnings

C)cash flow from investing

D)debt

A)stock outstanding

B)earnings

C)cash flow from investing

D)debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

62

How do signaling effects impact the firm's capital structure decision?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

63

What is the pecking order theory with regard to managerial preferences for financing alternatives?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

64

A firm accepts the risk of fixed-cost financing is to:

A)increase stock sales.

B)decrease overhead costs.

C)increase possible returns to stockholders.

D)develop synergy.

A)increase stock sales.

B)decrease overhead costs.

C)increase possible returns to stockholders.

D)develop synergy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

65

The tax deductibility of the interest payments on corporate debt is known as:

A)the tax structure

B)the tax shield

C)the optimal capital structure

D)Section 402a of the IRS tax code.

A)the tax structure

B)the tax shield

C)the optimal capital structure

D)Section 402a of the IRS tax code.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

66

There are many benefits to a leveraged buy-out.However, the benefits from LBOs come with significant costs.

Explain the down-side of LBOs.

Explain the down-side of LBOs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

67

What is optimal capital structure?

A)It is the mix of debt, preferred stock and common equity that maximizes profits.

B)It is the mix of debt, preferred stock and common equity that minimizes risk.

C)It is the mix of debt, preferred stock and common equity that minimizes the weighted cost of the firm's employed capital.

D)It is the mix of common and preferred stock that maximizes dividends to the stockholders.

A)It is the mix of debt, preferred stock and common equity that maximizes profits.

B)It is the mix of debt, preferred stock and common equity that minimizes risk.

C)It is the mix of debt, preferred stock and common equity that minimizes the weighted cost of the firm's employed capital.

D)It is the mix of common and preferred stock that maximizes dividends to the stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

68

List the factors that determine the specific capital structure for a multinational firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

69

When a corporation must get external financing, the first place to look for funds is with debt.There are various reasons for this preference.List the reasons why debt is generally issued first.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

70

With financial leverage, a change in EBIT results in a change in:

A)fixed costs

B)EPS

C)financial risk

D)EBT

A)fixed costs

B)EPS

C)financial risk

D)EBT

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

71

The amount of debt in a firm's optimal capital structure is often referred to as the firm's:

A)debt capacity

B)lending ability

C)line of credit

D)loan limit

A)debt capacity

B)lending ability

C)line of credit

D)loan limit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

72

There are many factors that influence a firm's business risk.List them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

73

In considering the arbitrage process in perfect capital markets with no income taxes, the market value of a firm is ____.

A)dependent on its capital structure.

B)independent of its capital structure.

C)reliant on stock equity prices.

D)reliant on management expertise.

A)dependent on its capital structure.

B)independent of its capital structure.

C)reliant on stock equity prices.

D)reliant on management expertise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

74

Explain how industry effects need to be considered in the capital structure decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck

75

The tax deductibility of interest payments provides the firm with a:

A)market advantage

B)learning curve

C)tax shield

D)safeguard against auditing

A)market advantage

B)learning curve

C)tax shield

D)safeguard against auditing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 75 في هذه المجموعة.

فتح الحزمة

k this deck