Deck 14: Capital Structure Management in Practice

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/85

العب

ملء الشاشة (f)

Deck 14: Capital Structure Management in Practice

1

The degree of financial leverage is defined as the percentage change in

A)EBIT resulting from a given percentage change in sales

B)EPS resulting from a given percentage changes in sales

C)EBIT resulting from a given percentage change in EPS

D)EPS resulting from a given percentage change in EBIT

A)EBIT resulting from a given percentage change in sales

B)EPS resulting from a given percentage changes in sales

C)EBIT resulting from a given percentage change in EPS

D)EPS resulting from a given percentage change in EBIT

D

2

Cash insolvency analysis evaluates the adequacy of a firm's cash position in a

A)bankruptcy proceeding

B)non-normal environment

C)highly competitive environment

D)recessionary environment

A)bankruptcy proceeding

B)non-normal environment

C)highly competitive environment

D)recessionary environment

D

3

When fixed operating costs are incurred by the firm, a change in is magnified into a relatively larger change in earnings before interest and taxes.

A)overhead expenses

B)interest charges

C)labor costs

D)sales revenue

A)overhead expenses

B)interest charges

C)labor costs

D)sales revenue

D

4

In the analysis of financial leverage, all of the following are referred to as fixed charges except:

A)bond interest

B)common stock dividends

C)bank interest

D)preferred stock dividends

A)bond interest

B)common stock dividends

C)bank interest

D)preferred stock dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

5

Rent, insurance, and the salaries of top management are examples of:

A)fixed costs

B)capital costs

C)variable costs

D)fluctuating costs

A)fixed costs

B)capital costs

C)variable costs

D)fluctuating costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

6

An analytical technique called can be used to help determine when debt financing is advantageous and when equity financing is advantageous.

A)DFL-EPS analysis

B)EBIT-EPS analysis

C)DCL-EPS analysis

D)DOL-EBIT analysis

A)DFL-EPS analysis

B)EBIT-EPS analysis

C)DCL-EPS analysis

D)DOL-EBIT analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

7

The degree of combined leverage is defined as the percentage change in earnings per share resulting from a given percentage change in

A)operating costs

B)interest charges

C)common stock dividends

D)sales (or output)

A)operating costs

B)interest charges

C)common stock dividends

D)sales (or output)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

8

Financial leverage causes a firm's to change at a rate greater than the change in .

A)EBIT;EPS

B)EPS;EBIT

C)EBIT;sales

D)sales;EBIT

A)EBIT;EPS

B)EPS;EBIT

C)EBIT;sales

D)sales;EBIT

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

9

The degree of combined leverage is equal to the multiplied by the .

A)degree of operating leverage, variable cost ratio

B)degree of financial leverage, variable cost ratio

C)degree of operating leverage, degree of financial leverage

D)degree of operating leverage, fixed cost ratio

A)degree of operating leverage, variable cost ratio

B)degree of financial leverage, variable cost ratio

C)degree of operating leverage, degree of financial leverage

D)degree of operating leverage, fixed cost ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

10

Raw material and direct labor costs are examples of

A)fixed costs

B)overhead costs

C)variable costs

D)capital costs

A)fixed costs

B)overhead costs

C)variable costs

D)capital costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

11

The percentage change in a firm's EBIT that results in a 1% change in sales or output is known as the

A)degree of combined leverage

B)degree of financial leverage

C)degree of operating leverage

D)degree of business risk

A)degree of combined leverage

B)degree of financial leverage

C)degree of operating leverage

D)degree of business risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

12

A firm that employs relatively large amounts of labor- saving equipment in its operations will have a relatively degree of operating leverage.

A)low

B)constant

C)insignificant

D)high

A)low

B)constant

C)insignificant

D)high

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

13

A firm that employs a relatively large proportion of debt and preferred stock in its capital structure will have a relatively degree of financial leverage.

A)low

B)high

C)insignificant

D)constant

A)low

B)high

C)insignificant

D)constant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

14

A firm which has a 2.5 DOL (degree of operating leverage) would find that an 8% increase in EBIT would result from a increase in sales.

A)3.2%

B)5.4%

C)20.0%

D)2.0%

A)3.2%

B)5.4%

C)20.0%

D)2.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

15

In EBIT-EPS analysis, the indifference point is found at the point where for the two alternative financing plans are equal.

A)EBIT

B)EPS

C)stock prices

D)DOL

A)EBIT

B)EPS

C)stock prices

D)DOL

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

16

To balance the operating and financial risks that are so variable for a multinational company, Nestle allows its foreign operating subsidiaries operational flexibility and follows a financing strategy.

A)decentralized, centralized

B)centralized, centralized

C)centralized, decentralized

D)decentralized, decentralized

A)decentralized, centralized

B)centralized, centralized

C)centralized, decentralized

D)decentralized, decentralized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

17

The degree of combined leverage is equal to the degree of operating leverage the degree of financial leverage.

A)added to

B)divided by

C)multiplied by

D)subtracted from

A)added to

B)divided by

C)multiplied by

D)subtracted from

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

18

The total variability of the firm's EPS associated with a change in sales is an indication of combined leverage and is best measured by

A)DOL

B)DFL

C)DOL + DFL

D)DOL × DFL

A)DOL

B)DFL

C)DOL + DFL

D)DOL × DFL

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

19

When fixed capital costs are incurred by the firm, a change in is magnified into a larger change in earnings per share.

A)earnings before interest and taxes

B)overhead expenses

C)interest charges

D)preferred dividends

A)earnings before interest and taxes

B)overhead expenses

C)interest charges

D)preferred dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

20

A firm is considering the purchase of assets that will increase its fixed operating costs.The firm should decrease the proportion of it employs in its capital structure if it wants to maintain its existing degree of combined leverage.

A)debt

B)warrants

C)common stock

D)common stock and warrants

A)debt

B)warrants

C)common stock

D)common stock and warrants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

21

Kermit's Hardware's (KH) fixed operating costs are $20.8 million and its variable cost ratio is 0.30.The firm has $10 million in bonds outstanding with a coupon interest rate of 9%.KH has 200,000 shares of common stock outstanding.The firm has revenues of $32.2 million and its marginal tax rate is 40%.Compute KH's degree of combined leverage.

A)26.8

B)5.5

C)29.1

D)4.7

A)26.8

B)5.5

C)29.1

D)4.7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

22

The use of increasing amounts of combined leverage the risk of financial distress.

A)decreases

B)increases

C)has no effect on

D)creates diversity in

A)decreases

B)increases

C)has no effect on

D)creates diversity in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

23

Illinois Tool Company's (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales) is 0.70.The firm has $3,000,000 in bonds outstanding at an interest rate of 8 percent.ITC has 30,000 shares of $5 preferred stock and 150,000 shares of common stock outstanding.ITC is in the 50 percent corporate income tax bracket.Forecasted sales for next year are $9 million.What is ITC's degree of financial leverage at an EBIT level of $1,440,000?

A)1.20

A)3.0

B)1.60

B)1.875

A)1.20

A)3.0

B)1.60

B)1.875

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

24

Last year Avator's operating income (EBIT) increased by 22 percent while its dollar sales increased by 15%.What is Avator's degree of operating leverage (DOL)?

A)0.68

B)2.0

C)1.47

D)0.32

A)0.68

B)2.0

C)1.47

D)0.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

25

A firm is said to be if it is unable to meet its current obligations.

A)cash insolvent

B)bankrupt

C)free cash challenged

D)technically insolvent

A)cash insolvent

B)bankrupt

C)free cash challenged

D)technically insolvent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

26

A negative DOL indicates the percentage in operating losses that occurs as the result of a 1% increase in output.

A)increase

B)reduction

C)change

D)none of these

A)increase

B)reduction

C)change

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

27

Weis Products has fixed operating costs of $20 million and a variable cost ratio of 0.55.Weis has 4 million common shares outstanding and a marginal tax rate of 45%.What is Weis's degree of operating leverage at an expected sales level of $150 million?

A)1.00

B)1.74

C)1.42

D)1.32

A)1.00

B)1.74

C)1.42

D)1.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

28

Illinois Tool Company's (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales) is 0.70.The firm has $3,000,000 in bonds outstanding at an interest rate of 8 percent.ITC has 30,000 shares of $5 preferred stock and 150,000 shares of common stock outstanding.ITC is in the 50 percent corporate income tax bracket.Forecasted sales for next year are $9 million.What is ITC's degree of operating leverage at a sales level of $9 million?

A)1.60

A)3.0

B)1.26

B)1.875

A)1.60

A)3.0

B)1.26

B)1.875

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

29

Illinois Tool Company's (ITC) fixed operating costs are $1,260,000 and its variable cost ratio (i.e., variable costs as a fraction of sales) is 0.70.The firm has $3,000,000 in bonds outstanding at an interest rate of 8 percent.ITC has 30,000 shares of $5 preferred stock and 150,000 shares of common stock outstanding.ITC is in the 50 percent corporate income tax bracket.Forecasted sales for next year are $9 million.What is ITC's degree of combined leverage at a sales level of $10 million?

A)2.00

B)1.72

C)2.50

D)1.25

A)2.00

B)1.72

C)2.50

D)1.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

30

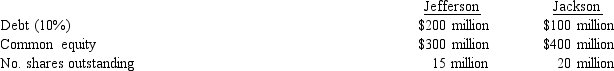

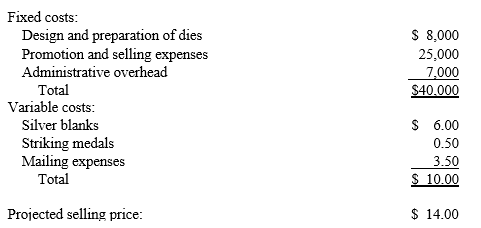

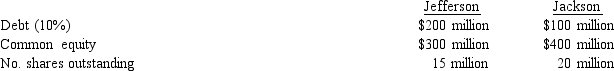

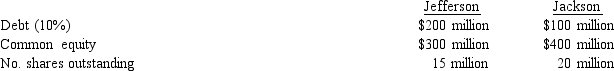

Two companies, Jefferson and Jackson, are virtually identical in all aspects of their operations except that the two companies differ in their capital structures, as shown below:

Both companies have $500 million in total assets and both have a 40% marginal tax rate.What is the EPS for Jefferson at an EBIT level of $50 million?

A)-$1.20

B)$1.20

C)$2.20

D)$3.33

Both companies have $500 million in total assets and both have a 40% marginal tax rate.What is the EPS for Jefferson at an EBIT level of $50 million?

A)-$1.20

B)$1.20

C)$2.20

D)$3.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

31

The Albany Corporation has a present capital structure consisting of common stock ($200 million, 10 million shares) and debt ($150 million, 8%).The company is planning a major expansion and is undecided between two financing plans.

Plan A: Equity financing.Under this plan, an additional 2.5 million shares of common stock will be sold at $15 each.

Plan B: Debt financing.Under this plan, $37.5 million of 10% long-term debt will be sold.

What happens to the EBIT indifference point if the interest rate on the new debt decreases and the common stock price remains constant?

A)the indifference point increases

B)the indifference point decreases

C)the indifference point does not change

D)cannot be determined from the information provided

Plan A: Equity financing.Under this plan, an additional 2.5 million shares of common stock will be sold at $15 each.

Plan B: Debt financing.Under this plan, $37.5 million of 10% long-term debt will be sold.

What happens to the EBIT indifference point if the interest rate on the new debt decreases and the common stock price remains constant?

A)the indifference point increases

B)the indifference point decreases

C)the indifference point does not change

D)cannot be determined from the information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

32

Chemex has a cash and marketable securities balance of $200 million.Management expects free cash flows of $320 million during the coming year.If management is considering a restructuring of its capital structure that would add an additional $350 million of annual fixed financial charges, what is the expected cash balance at the end of the year?

A)-$30 million

B)$170 million

C)$230 million

D)$470 million

A)-$30 million

B)$170 million

C)$230 million

D)$470 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

33

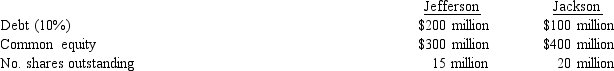

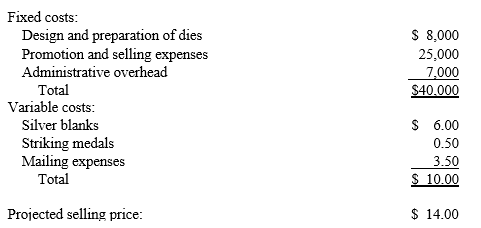

The Lincoln Mint produces various types of one ounce silver commemorative medals for sale to collectors.The cost of producing and selling a given medal is as follows:

Fixed costs:

Projected selling price: $ 14.00

What is the degree of operating leverage at an output level of 15,000 units?

A)0.0

B)1.0

C)3.0

D)cannot be determined from the information provided

Fixed costs:

Projected selling price: $ 14.00

What is the degree of operating leverage at an output level of 15,000 units?

A)0.0

B)1.0

C)3.0

D)cannot be determined from the information provided

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

34

Leigh Fibers expects its operating income over the coming year to equal $2.5 million with a standard deviation of $800,000.Leigh must pay interest charges of $1.2 million next year and preferred dividends of $300,000.Leigh's marginal tax rate is 35%.What is the probability that Leigh will have negative EPS next year if its operating income is expected to be normally distributed? (Problem requires normal distribution table.)

A)14.7%

B)5.2%

C)10.6%

D)15.7%

A)14.7%

B)5.2%

C)10.6%

D)15.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

35

Kermit's Hardware's (KH) fixed operating costs are $20.8 million and its variable cost ratio is 0.30.The firm has $10 million in bonds outstanding with a coupon interest rate of 9%.KH has 200,000 shares of common stock outstanding.The firm has revenues of $32.2 million and its marginal tax rate is 40%.Compute KH's degree of operating leverage.

A)14.81

B)5.19

C)12.95

D)4.54

A)14.81

B)5.19

C)12.95

D)4.54

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

36

Kermit's Hardware's (KH) fixed operating costs are $20.8 million and its variable cost ratio is 0.30.The firm has $10 million in bonds outstanding with a coupon interest rate of 9%.KH has 200,000 shares of common stock outstanding.The firm has revenues of $32.2 million and its marginal tax rate is 40%.Compute KH's degree of financial leverage.

A)1.22

B)2.07

C)1.09

D)1.04

A)1.22

B)2.07

C)1.09

D)1.04

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

37

Kenzel has an EPS of $4.20 and sales are $9 million.If the firm has a degree of operating leverage of 4.0 and a degree of financial leverage of 5.2, forecast EPS if the firm expects a 4% sales decline.

A)$0.71

B)$3.49

C)$4.03

D)$3.33

A)$0.71

B)$3.49

C)$4.03

D)$3.33

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

38

A DFL (degree of financial leverage) of 3.0 indicates that a 27% increase in EPS is the result of a increase in EBIT.

A)81%

B)3%

C)9%

D)6%

A)81%

B)3%

C)9%

D)6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

39

The Albany Corporation has a present capital structure consisting of common stock ($200 million, 10 million shares) and debt ($150 million, 8%).The company is planning a major expansion and is undecided between two financing plans.

Plan A: Equity financing.Under this plan, an additional 2.5 million shares of common stock will be sold at $15 each.

Plan B: Debt financing.Under this plan, $37.5 million of 10% long-term debt will be sold.

What is the EBIT-EPS indifference point? Assume a 40 percent marginal tax rate.

A)$33.9 million

B)$30.75 million

C)$37.0 million

D)$12.9 million

Plan A: Equity financing.Under this plan, an additional 2.5 million shares of common stock will be sold at $15 each.

Plan B: Debt financing.Under this plan, $37.5 million of 10% long-term debt will be sold.

What is the EBIT-EPS indifference point? Assume a 40 percent marginal tax rate.

A)$33.9 million

B)$30.75 million

C)$37.0 million

D)$12.9 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose that ITC's degree of combined leverage (DCL) is 3.00 at a sales volume of $9 million.Determine ITC's percentage change in earnings per share (EPS) if forecasted sales increase by 20 percent to $10,800,000.

A)60%

B)50%

C)32%

D)30%

A)60%

B)50%

C)32%

D)30%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

41

Onyx expects to have an EBIT of $240,000 with a standard deviation of $110,000.The distribution of operating income is approximately normal.If Onyx has interest expenses of $50,000, what is the probability that it will have an operating income that is below $0?

A)4.27%

B)1.46%

C)0.02%

D)2.4%

A)4.27%

B)1.46%

C)0.02%

D)2.4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

42

Onex expects to have an EBIT of $240,000 with a standard deviation of $90,000.The distribution of operating income is approximately normal.What is the probability that Onex will have an EBIT that is below $0?

A)0.47%

B)2.67%

C)0.38%

D)2.25%

A)0.47%

B)2.67%

C)0.38%

D)2.25%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

43

If a firm sees its EPS increase 27% on a 12% increase in sales, what is the firm's DOL.During the same period the firm saw its EBIT increase only 8%.

A)1.50

B)3.38

C)1.34

D)0.67

A)1.50

B)3.38

C)1.34

D)0.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

44

Last year Alpine Growers experienced a 34% increase in earnings per share on 11% increase in sales.If management knows that Alpine's DOL is 1.5, what is its DFL?

A) 3.09

B) 2.06

C) 3.55

D) 1.67

A) 3.09

B) 2.06

C) 3.55

D) 1.67

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

45

Archive Storage earned $3.20 a share on sales of $13.6 million.Archive has determined that its degree of operating leverage is 1.87 and its degree of financial leverage is 2.91.If sales are expected to increase 15%, what will be the EPS forecast?

A) $2.61

B) $4.60

C) $5.81

D) $3.68

A) $2.61

B) $4.60

C) $5.81

D) $3.68

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

46

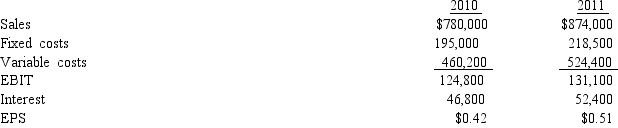

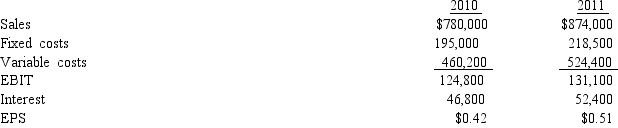

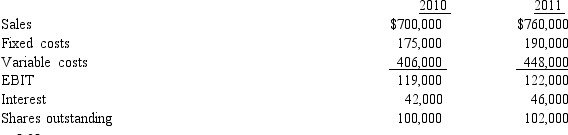

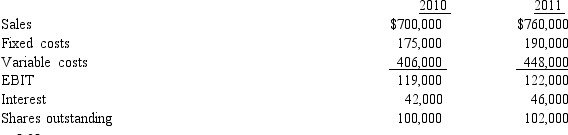

Given the following financial data for Cosmos, compute the firm's degree of combined leverage.

A) $0.42

B) 8.37

C) -2.15

D) 1.78

A) $0.42

B) 8.37

C) -2.15

D) 1.78

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

47

Higgins currently has 2 million shares of common stock outstanding that are selling for $32 per share.Higgins also has a $20 million mortgage bond outstanding that has an 11 percent coupon rate.Higgins is considering two alternatives to financing a major expansion.Plan A is to sell $10 million of additional long-term debt with a 12.5 percent coupon.Plan B is to sell 200,000 shares of common stock at $30 per share and $4 million in long-term debt with an 11.25 percent coupon.What is the EBIT indifference level between these two alternatives? Assume the marginal tax rate is 40 percent.

A)$1,374,000

B)$11,450,000

C)$4,554,000

D)$2,650,000

A)$1,374,000

B)$11,450,000

C)$4,554,000

D)$2,650,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

48

Borkstran has sales of $7.8 million, a variable cost ratio of 0.6, EBIT of $1.1 million, and a degree of combined leverage of 3.4.What is Borkstran's degree of financial leverage?

A)1.20

B)0.73

C)2.29

D)0.84

A)1.20

B)0.73

C)2.29

D)0.84

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

49

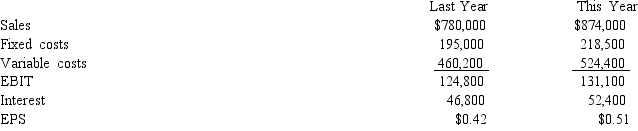

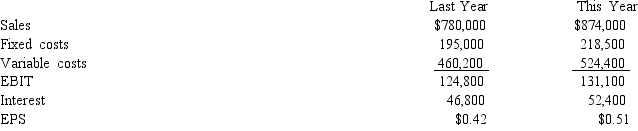

Given the following financial data for Cosmos, compute the firm's degree of financial leverage.

A) 23.81

B) 4.24

C) 0.42

D) 2.18

A) 23.81

B) 4.24

C) 0.42

D) 2.18

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

50

TCA Cable has fixed operating cost of $2.6 million, and its variable cost ratio is 0.30.TCA has $4.0 in bonds outstanding with a coupon interest rate of 12%.TCA has 1.0 million common shares and 1,000,000 shares of $1.75 preferred stock outstanding.Total revenues for TCA Cable are $14.2 million.If TCA has a marginal tax rate of 40%, what is its degree of combined leverage?

A)2.1

B)1.0

C)1.9

D)2.5

A)2.1

B)1.0

C)1.9

D)2.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

51

Centex, a producer of telephone systems for small businesses, has current sales of$43 million and variable operating costs of$27.95 million.Centex expects to increase sales in the coming year by 15% while keeping fixed operating costs constant at $9.1 million.What is the DOL for Centex?

A)3.3

A)7.2

B)1.0

B)2.5

A)3.3

A)7.2

B)1.0

B)2.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

52

Knight Moves is considering two alternative financing plans.The firm is expected to operate at the $75 million EBlT level.Under Plan D (debt financing) EPS is expected to be $2.25, and under Plan E (equity financing) EPS is expected to be $1.82.If the market is expected to assign a PIE ratio of 12 to the debt plan and 15 to the equity plan, which plan should Knight pursue?

A)debt

B)equity

C)indifferent between the two alternatives

D)neither is satisfactory

A)debt

B)equity

C)indifferent between the two alternatives

D)neither is satisfactory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

53

ASG expects next year's operating income (EBIT) to equal $22 million, with a standard deviation of $16 million.The coefficient of variation of operating income is equal to 0.73.Interest expenses will be $9 million next year and debt retirement will require a principal payment of $2.5 million.ASG's marginal tax rate is 40%.If EBIT is normally distributed, what is the probability that ASG will have a negative EPS next year?

A)20.9%

B)25.5%

C)23.3%

D)25.8%

A)20.9%

B)25.5%

C)23.3%

D)25.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

54

The Ames Company has an expected EBIT of $16 million with a standard deviation of $8 million.The indifference point between a debt financing alternative and a common stock financing alternative was computed to be $12 million.Determine the probability that the equity financing alternative will be superior to the debt financing alternative (i.e., have a higher EPS).(Problem requires normal distribution table.)

A)50.0%

B)30.85%

C)69.15%

D)cannot be computed

A)50.0%

B)30.85%

C)69.15%

D)cannot be computed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

55

Two companies, Jefferson and Jackson, are virtually identical in all aspects of their operations except that the two companies differ in their capital structures, as shown below:

Both companies have $500 million in total assets and both have a 40% marginal tax rate.What is the EPS for Jackson at an EBIT level of $50 million?

A)$1.50

B)$1.20

C)$2.00

D)$2.50

Both companies have $500 million in total assets and both have a 40% marginal tax rate.What is the EPS for Jackson at an EBIT level of $50 million?

A)$1.50

B)$1.20

C)$2.00

D)$2.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

56

Dagger Company has a current capital structure consisting of$60 million in long-term debt with an interest rate of 9% and $60 million in common equity (12 million shares).The firm is considering an expansion plan costing $23 million.The expansion plan can be financed with additional long-term debt at a 12% interest rate or the sale of new common stock at $8 per share.The firm's marginal tax rate is 40%.Determine the indifference level of EBIT for the two financing plans.

A)-$30.24 million

B)$18.36 million

C)$30.24 million

D)$19.68 million

A)-$30.24 million

B)$18.36 million

C)$30.24 million

D)$19.68 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

57

Given the following financial data for Boston Technology, compute the firm's degree of combined leverage.Assume a marginal tax rate of 40%.

A)0.29

B)-0.38

C)-0.15

D)0.38

A)0.29

B)-0.38

C)-0.15

D)0.38

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

58

Sulzar's capital structure consists only of common stock (20 million shares), but the firm is planning a major expansion which will require $100 million of new capital.Sulzar has a choice of obtaining the needed capital through the sale of 5 million shares of common stock at $20 per share or the sale of $100 million of first mortgage bonds that would have a coupon rate of 9%.If Sulzar has a marginal tax rate of 40%, calculate the EBIT-EPS indifference point.

A)$45 million

B)$36 million

C)$5 million

D)$9 million

A)$45 million

B)$36 million

C)$5 million

D)$9 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

59

Midwest Can Company is considering opening a new plant in St.Louis that is expected to produce an average EBIT of $3 million per year.To finance this new plant, Midwest is considering two financing plans.The first plan is to sell 600,000 shares of common stock at $15 each.The second plan is to sell 200,000 shares of common stock at $15 each and $6 million of 13 percent long-term debt.If Midwest has a marginal tax rate of 40 percent, what is the EBIT-EPS indifference point for this plant?

A)$702,000

B)$234,000

C)$2,234,000

D)$1,170,000

A)$702,000

B)$234,000

C)$2,234,000

D)$1,170,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

60

Alace is an all equity firm with 10 million shares outstanding that is evaluating two alternative financing plans.With the first plan, Alace will sell 1 million shares of common stock at $15 each.Under the second plan, the firm would sell $15 million of 12 percent long-term debt.If Alace has a marginal tax rate of 35 percent, what is the EBlT-EPS indifference point?

A)$12.9 million

B)$19.8 million

C)$11.7 million

D)$18.0 million

A)$12.9 million

B)$19.8 million

C)$11.7 million

D)$18.0 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

61

Magnificent Manes Hair Salons is forecasting a 17% increase in sales.What would be its degree of operating leverage if it anticipates that its EBIT will go from $150,000 to $175,000 during the same time frame?

A)1.76

B)2.5

C).98

D)1.11

A)1.76

B)2.5

C).98

D)1.11

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

62

In using Nestle Corporation as a model, when a subsidiary is first formed, about one-half of the financing needed to acquired fixed assets comes from:

A)debt

B)federal funds

C)tax breaks

D)equity from the parent company

A)debt

B)federal funds

C)tax breaks

D)equity from the parent company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

63

Dippity Doodle Noodle Makers has a capital structure that consists of2.0 million shares outstanding and $2.0 million of debt at 8% interest.The company is planning a major plant expansion must decide between the following two financing plans.Option 1 is to increase debt by $1.0 million at 9% interest and sell 10,000 new shares of stock at $50 per share.Option 2 is to sell 30,000 new shares of stock at $50 per share.What would be the indifference point and considering that EBIT is expected to be $10,000,000 which option would be best

A)Indifference of $10,750,000.Use stock option.

B)Indifference of $1,600,000.Use stock option.

C)Indifference of $16,270,000.Use the debt option.

D)Indifference of $9,250,000.Use the debt option.

A)Indifference of $10,750,000.Use stock option.

B)Indifference of $1,600,000.Use stock option.

C)Indifference of $16,270,000.Use the debt option.

D)Indifference of $9,250,000.Use the debt option.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

64

Twin City Printing is considering two financial alternatives for financing a major expansion program.Under either alternative EBIT is expected to be $15.6 million.Currently the firm's capital structure consists of 4 million shares of common stock and $35 million in 11% long-term bonds.Under the debt financing alternative $10 million in 12% long term bonds will be sold and under the equity financing alternative the firm would sell 500,000 shares of common stock.The PIE under the debt alternative would be 15 and the PIE under the equity alternative would be 16.The firm's marginal tax rate is 40%.Which alternative would produce the higher stock price?

A)debt-stock price of $23.70

B)debt-stock price of $32.29

C)equity-stock price of $25.12

D)equity-stock price of $33.28

A)debt-stock price of $23.70

B)debt-stock price of $32.29

C)equity-stock price of $25.12

D)equity-stock price of $33.28

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

65

Crown Data (CD) has a current capital structure that consists of$120 million in common equity (15 million shares) and $80 million in long-term debt with an average interest rate of 11 percent.CD is considering an expansion project that will cost $22 million.The project will be financed either by issuing long-term debt at a cost of 12.5 percent, or the sale of new common stock at $35 per share.The firm's marginal tax rate is 40%.What is the EBIT indifference point between the two financing options?

A)$71.5 million

B)$77.2 million

C)$68.3 million

D)$1.0 million

A)$71.5 million

B)$77.2 million

C)$68.3 million

D)$1.0 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

66

Sitco has a total of $12 million in cash and marketable securities.Free cash flows during the coming year are expected to be $47 million with a standard deviation of$31 million.Assume that Sitco's free cash flows are approximately normally distributed.What is the probability that Sitco will run out of cash during the coming year?

A) 29.98%

B) 34.83%

C) 97.13%

D) 2.87%

A) 29.98%

B) 34.83%

C) 97.13%

D) 2.87%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

67

What type of security is used to purchase a target company in a leveraged buy-out?

A)common stock

A)debt

B)dividends

B)retained earnings

A)common stock

A)debt

B)dividends

B)retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

68

What is the degree of operating leverage for Flippin' Out Company, a maker of scuba flippers, if the firm sells its finished product for $50 per unit with variable costs per unit of $15? The company has fixed operating costs of $2,000,000 and sells 200,000 units (the answer is rounded).

A)2.0

B)3.7

C)6.5

D)1.4

A)2.0

B)3.7

C)6.5

D)1.4

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

69

A change in EBIT is magnified into a larger change in EPS.This means that financial leverage is using as its fulcrum.

A)short-term costs

B)fixed costs

C)variable costs

D)retained earnings

A)short-term costs

B)fixed costs

C)variable costs

D)retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

70

What would be the degree of financial leverage for Under A Cloud Skydiving School if the company will have earnings before interest and taxes of $750,000 which would be a 15% increase? The firm had EPS of $1.25 but, with the increased earnings, anticipates paying $1.37.

A).80

A)1.08

B)2.01

C)1.25

A).80

A)1.08

B)2.01

C)1.25

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

71

In evaluating degree of operating leverage, it is best that the firm's DOL is:

A)higher than 1

B)higher than 2

C)lower than 1

D)equal to 1

A)higher than 1

B)higher than 2

C)lower than 1

D)equal to 1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

72

What would be the degree of financial leverage for Foggy Futures Weather Forecasters if the company has earnings before interest and taxes of$750,000, has a 4.5% loan on $1,000,000 and is in the 38% tax bracket? The firm does not have any preferred stock outstanding.

A)1.22

B)1.78

C)1.06

D)97

A)1.22

B)1.78

C)1.06

D)97

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

73

River Rafts has determined that its expected EBIT for the coming year is $8.3 million.The EBIT is approximately normally distributed with a standard deviation of $5.1 million.If River Rafts has $1.9 million in annual interest payments, what is the probability that the firm will have negative earnings?

A)4.65%

B)10.47%

C)5.16%

D)35.20%

A)4.65%

B)10.47%

C)5.16%

D)35.20%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

74

Ipsy Dipsy Preschools, Inc.has a capital structure that consists of 60% common equity (2.0 million shares), 30% long-term debt ($10 million with 12% coupon), and 10% preferred stock ($50 par value with $4.75 dividend).The company is planning a major plant expansion and is undecided between the following two financing plans:

1) Equity financing: Sale of 400,000 shares of common at $10 each.

2) Debt financing: Sale of$4 million of 12.5 percent long-term bonds.

Calculate the EBIT-EPS indifference point.Assume the marginal tax rate is 40%.

A)$4.253 million

B)$3.051 million

C)$3.654 million

D)$4.728 million

1) Equity financing: Sale of 400,000 shares of common at $10 each.

2) Debt financing: Sale of$4 million of 12.5 percent long-term bonds.

Calculate the EBIT-EPS indifference point.Assume the marginal tax rate is 40%.

A)$4.253 million

B)$3.051 million

C)$3.654 million

D)$4.728 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

75

What are the effects of leverage on shareholder wealth and the cost of capital?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

76

There are three categories of costs: fixed costs, variable costs and semi-variable costs.Which of the following is a semi-variable cost?

A)depreciation

B)labor costs

C)raw materials

D)management salaries

A)depreciation

B)labor costs

C)raw materials

D)management salaries

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

77

In considering EBIT-EPS analysis, which of the following statements is/are correct?

A)Both statements a and b are correct.

A)If the expected earnings are above the indifference point, the debt option is preferred.

B) If the expected earnings are below the indifference point, the equity option is preferred.

B)Neither statement a nor b is correct.

A)Both statements a and b are correct.

A)If the expected earnings are above the indifference point, the debt option is preferred.

B) If the expected earnings are below the indifference point, the equity option is preferred.

B)Neither statement a nor b is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

78

Some companies use debt or preferred stock financing instead of common stock financing.The purpose is:

A)to retain control

B)to facilitate record-keeping

C)to maintain privacy

D)to prevent audit problems

A)to retain control

B)to facilitate record-keeping

C)to maintain privacy

D)to prevent audit problems

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

79

In evaluating a firm's degree of financial leverage, financial risk is with an increase in DFL.

A)increased

B)decreased

C)not impacted

D)reflective of excess inventory

A)increased

B)decreased

C)not impacted

D)reflective of excess inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck

80

Fanny Nanny Weight Monitors, Inc.is considering two financial alternatives for financing a major expansion program.Under either alternative, EBIT is expected to be $12.5million.Currently the firm's capital structure consists of 2 million shares of common stock and $15 million in 6% long-term bonds.Under the debt financing alternative $8 million in 4% long-term bonds will be sold and under the equity financing alternative the firm would sell 150,000 shares of common stock.The P/E under the debt alternative would be 21 and the P/E under the equity alternative would be 22.The firm's marginal tax rate is 40%.Which alternative would produce the higher stock price?

A)debt-stock price of $57.36

B)debt-stock price of $70.98

C)equity-stock price of $71.28

D)equity-stock price of $85.32

A)debt-stock price of $57.36

B)debt-stock price of $70.98

C)equity-stock price of $71.28

D)equity-stock price of $85.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 85 في هذه المجموعة.

فتح الحزمة

k this deck