Deck 16: Working Capital Management

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 16: Working Capital Management

1

The length of the operating cycle for a firm is equal to the length of the

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements I and II are correct.

D)Neither statements I nor II is correct.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements I and II are correct.

D)Neither statements I nor II is correct.

C

2

Which of the following factors does not directly affect the firm's level of investment in working capital?

A)the firm's inventory and credit policies

B)the age of the firm's plant and equipment

C)the firm's sales level

D)the length of the firm's operating cycle

A)the firm's inventory and credit policies

B)the age of the firm's plant and equipment

C)the firm's sales level

D)the length of the firm's operating cycle

B

3

The rate of return on fixed assets is normally assumed to be the rate of return on current assets (especially cash and marketable securities).

A)less than

B)greater than

C)equal to

D)none of these answers is correct.

A)less than

B)greater than

C)equal to

D)none of these answers is correct.

B

4

The relationship between the maturity of debt and its associated cost (interest rate) is referred to as

A)term structure of interest rates

B)risk-return tradeoff function

C)seniority structure of interest rates

D)Both statements I and II are correct.

A)term structure of interest rates

B)risk-return tradeoff function

C)seniority structure of interest rates

D)Both statements I and II are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

The relationship between the maturity of debt and its associated cost (interest rate) is referred to as:

A)term structure of interest rates

B)investment opportunity curve

C)risk-return tradeoff function

D)both the term structure of interest rates and the investment opportunity curve.

A)term structure of interest rates

B)investment opportunity curve

C)risk-return tradeoff function

D)both the term structure of interest rates and the investment opportunity curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

With the matching approach to meeting the financing needs of the firm, fixed and permanent current assets are financed with

A)long-term debt only

B)equity funds only

C)both long-term debt and equity funds

D)neither long-term debt nor equity funds

A)long-term debt only

B)equity funds only

C)both long-term debt and equity funds

D)neither long-term debt nor equity funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

Of the accounts listed, the account(s) that is (are) NOT part of a firm's working capital is:

A)plant and equipment

B)marketable securities

C)cash

D)accounts receivable

A)plant and equipment

B)marketable securities

C)cash

D)accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following factors affect the firm's level of investment in working capital?

A)the length of the firm's operating cycle

B)the firm's sales level

C)the firm's inventory and credit policies

D)all of these

A)the length of the firm's operating cycle

B)the firm's sales level

C)the firm's inventory and credit policies

D)all of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

The shows the time interval over which additional non-spontaneous sources of working capital financing must be obtained to carry out the firm's activities.

A)inventory conversion period

B)cash conversion cycle

C)payables deferral period

D)receivables conversion period

A)inventory conversion period

B)cash conversion cycle

C)payables deferral period

D)receivables conversion period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

Historically, the yield curve has generally been , which indicates that long-term interest rates usually have been short-term interest rates.

A)upward sloping, lower than

B)downward sloping, higher than

C)upward sloping, higher than

D)level, about equal to

A)upward sloping, lower than

B)downward sloping, higher than

C)upward sloping, higher than

D)level, about equal to

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

All other things being equal, a policy of financing its assets with a relatively proportion of short-term debt will tend to result in expected after-tax earnings for the firm.

A)large, lower

B)constant, higher

C)constant, lower

D)large, higher

A)large, lower

B)constant, higher

C)constant, lower

D)large, higher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

All other things being equal, a policy of financing its assets with a relatively proportion of short-term debt will tend to the variability (or risk) of the after-tax earnings of the firm.

A)large, decrease

B)small, increase

C)constant, lower

D)large, increase

A)large, decrease

B)small, increase

C)constant, lower

D)large, increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

When the level of working capital is increased, all of the following are expected to occur except

A)expected profitability decreases

B)expected profitability increases

C)risk decreases

D)none of these

A)expected profitability decreases

B)expected profitability increases

C)risk decreases

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

All other things being equal, a policy of holding a relatively proportion of the firm's total assets in the form of current assets will tend to result in a risk of the firm encountering financial difficulties.

A)large, higher

B)small, higher

C)constant, higher

D)constant, lower

A)large, higher

B)small, higher

C)constant, higher

D)constant, lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

Borrowers (e.g., business firms) feel that there is more risk associated with short-term debt (as compared with long- term debt) because of the

A)uncertainty arising from interest rate fluctuations

B)risk of being unable to refund the debt

C)relatively high cost of short-term debt

D)a and b

A)uncertainty arising from interest rate fluctuations

B)risk of being unable to refund the debt

C)relatively high cost of short-term debt

D)a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

The length of the operating cycle is equal to the length of the

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements I and II are correct.

D)Neither statement I nor II is correct.

A)Only statement I is correct.

B)Only statement II is correct.

C)Both statements I and II are correct.

D)Neither statement I nor II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

Under a conservative approach to working capital management, a firm tends to hold a relatively proportion of its total assets in the form of current assets.

A)small

B)constant

C)stable

D)large

A)small

B)constant

C)stable

D)large

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

All other things being equal, a policy of holding a relatively proportion of the firm's total assets in the form of current assets will tend to result in a expected profitability or rate of return on the total assets of the firm.

A)large, higher

B)small, higher

C)constant, higher

D)constant, lower

A)large, higher

B)small, higher

C)constant, higher

D)constant, lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following working capital financing policies subjects the firm to the greatest risk?

A)financing fluctuating current assets with long-term debt

B)financing permanent current assets with long-term debt

C)financing permanent current assets with short-term debt

D)financing fluctuating current assets with short-term debt

A)financing fluctuating current assets with long-term debt

B)financing permanent current assets with long-term debt

C)financing permanent current assets with short-term debt

D)financing fluctuating current assets with short-term debt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

Lenders normally feel that the relative risk associated with short-term debt is the risk associated with long- term debt.

A)lower than

B)equal to

C)higher than

D)none of these

A)lower than

B)equal to

C)higher than

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

The size and nature of a firm's investment in current assets is a function of a number of different factors including all of the following except

A)how efficient the firm manages its fixed assets

B)the length of the operating cycle

C)the sales level

D)credit policies

A)how efficient the firm manages its fixed assets

B)the length of the operating cycle

C)the sales level

D)credit policies

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

A firm's operating cycle is equal to its:

A)Only statement I is correct.

B)Only statement II is correct

C)Both statements I and II are correct.

D)Neither statement I nor II is correct.

A)Only statement I is correct.

B)Only statement II is correct

C)Both statements I and II are correct.

D)Neither statement I nor II is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

Many contain provisions requiring firms to maintain a minimum net working capital provision.

E)loan agreements with commercial banks

F)bond indentures

G)Both statements I and II are correct h.Neither statement I nor II is correct

E)loan agreements with commercial banks

F)bond indentures

G)Both statements I and II are correct h.Neither statement I nor II is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

A firm's net working capital position is a widely used measure of its .

A)leverage

B)profitability

C)risk

D)none of these

A)leverage

B)profitability

C)risk

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

The is the optimal working capital investment and financing policy.

A)aggressive policy

B)moderate policy

C)conservative policy

D)none of these

A)aggressive policy

B)moderate policy

C)conservative policy

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

If a firm shows a profit on the quarterly income statement, then

A)there will be no need for additional financing

B)the firm may need additional financing

C)the firm will increase its cash balance

D)all these may be correct

A)there will be no need for additional financing

B)the firm may need additional financing

C)the firm will increase its cash balance

D)all these may be correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following assets (if any) are not part of a firm's working capital investment?

A)cash

B)accounts receivable

C)inventory

D)none of these

A)cash

B)accounts receivable

C)inventory

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

If a firm uses only short-term debt to finance the fluctuating level of current assets, the firm is said to be using the approach to asset financing.

A)aggressive

B)moderate

C)matching

D)conservative

A)aggressive

B)moderate

C)matching

D)conservative

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

The firm's receivables conversion period (measured in days) is equal to its accounts receivable divided by its .

A)annual credit sales/365

B)annual credit sales

C)annual sales/365

D)none of these

A)annual credit sales/365

B)annual credit sales

C)annual sales/365

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

Computerized financial planning models may be classified as any of the following except:

A)deterministic

B)optimistic

C)probabilistic

D)none of these

A)deterministic

B)optimistic

C)probabilistic

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

The optimal level of working capital investment is the level that is expected to

A)maximize return on total assets

B)maximize earnings per share

C)maximize shareholder wealth

D)minimize interest expenses

A)maximize return on total assets

B)maximize earnings per share

C)maximize shareholder wealth

D)minimize interest expenses

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

Basically the overall working capital policy decision involves a of alternative policies.

A)profit-risk tradeoff

B)financial choice

C)risk decision

D)none of these

A)profit-risk tradeoff

B)financial choice

C)risk decision

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

Net working capital is defined as:

A)total current assets

B)current assets minus current liabilities

C)total assets minus total liabilities

D)current assets plus current liabilities

A)total current assets

B)current assets minus current liabilities

C)total assets minus total liabilities

D)current assets plus current liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

A firm's cash conversion cycle is equal to its operating cycle minus its .

A)inventory conversion period

B)receivables conversion period

C)payables deferral period

D)none of these

A)inventory conversion period

B)receivables conversion period

C)payables deferral period

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

The assets are those that are affected by the seasonal or cyclical nature of company sales.

A)current

B)permanent current

C)fluctuating current

D)none of these

A)current

B)permanent current

C)fluctuating current

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

The aggressive approach to the financing of a firm's current assets uses a proportion of short-term debt and a proportion of long-term debt.

A)low, high

B)relatively high, relatively low

C)high interest, low interest

D)none of these

A)low, high

B)relatively high, relatively low

C)high interest, low interest

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

The operating cycle begins with the and ends with the .

A)purchase of resources, selling of the product on credit

B)payment for purchases, liquidation of receivables

C)purchases of resources, receipt of cash

D)payment for purchases, receipt of cash

A)purchase of resources, selling of the product on credit

B)payment for purchases, liquidation of receivables

C)purchases of resources, receipt of cash

D)payment for purchases, receipt of cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

The size of a firm's investment in current assets is a function of all of the following factors except

A)sales level

B)inventory policies

C)credit policies

D)stockholders equity

A)sales level

B)inventory policies

C)credit policies

D)stockholders equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

An anticipated need for short-term borrowed funds is best shown in

A)an operating budget

B)a capital budget

C)a production budget

D)a cash budget

A)an operating budget

B)a capital budget

C)a production budget

D)a cash budget

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

The firm's inventory conversion period (measured in days) is equal to its average inventory divided by its .

A)cost of sales

B)sales

C)cost of sales/365

D)none of these

A)cost of sales

B)sales

C)cost of sales/365

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

Crystal Oil has $9 million in accounts payable, $1.8 in salaries and taxes payable, and $10.4 in other current liabilities.If Crystal Oil had a cost of sales of $54 million and selling, general, and administrative expense of $18 million, what is the length of its payables deferral period?

A)107.47 days

B)73.02 days

C)54.75 days

D)45.63 days

A)107.47 days

B)73.02 days

C)54.75 days

D)45.63 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

Tefft Industries has an average inventory of $170,000, sells on terms of 2/10, net 30, and its cost of sales is $540,000.What is Tefft's inventory conversion period?

A)85 days

B)115 days

C)105 days

D)cannot be determined from the data given

A)85 days

B)115 days

C)105 days

D)cannot be determined from the data given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

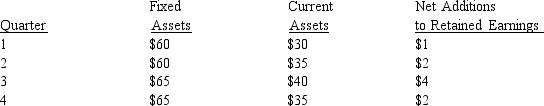

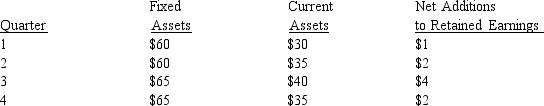

Barnes Company has highly seasonal sales and financing requirements.Barnes has made the following projections of its asset needs and net additions to retained earnings over the next year (in $ million).

Net worth (equity) at the beginning of the year is $50 million.The company does not plan to sell any new equity during the coming year.Assume that Barnes follows a matching approach to finance its assets, i.e., long-term debt and equity are used to finance fixed and permanent current assets and short-term debt is used to finance fluctuating current assets.Determine the amount of long-term and short-term debt respectively outstanding at the end of the third quarter ($ million).

A)$39;$2

B)$48;$0

C)$41;$7

D)none of these/cannot be determined

Net worth (equity) at the beginning of the year is $50 million.The company does not plan to sell any new equity during the coming year.Assume that Barnes follows a matching approach to finance its assets, i.e., long-term debt and equity are used to finance fixed and permanent current assets and short-term debt is used to finance fluctuating current assets.Determine the amount of long-term and short-term debt respectively outstanding at the end of the third quarter ($ million).

A)$39;$2

B)$48;$0

C)$41;$7

D)none of these/cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

Linear Technology had sales (all on credit) of $36 million and a gross profit margin of 30% last year.If Linear Technology's inventory averaged $3.9 million, and its accounts receivable were $5.0 million, what was the length of its operating cycle?

A)90.2 days

B)128.9 days

C)111.9 days

D)107.2 days

A)90.2 days

B)128.9 days

C)111.9 days

D)107.2 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

Commercial paper is:

A)long-term with maturities greater than one year.

B)short-term with maturities under six months.

C)short-term with maturities that do not exceed nine months.

D)long-term with maturities of greater than five years.

A)long-term with maturities greater than one year.

B)short-term with maturities under six months.

C)short-term with maturities that do not exceed nine months.

D)long-term with maturities of greater than five years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

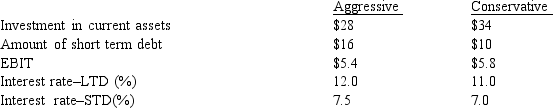

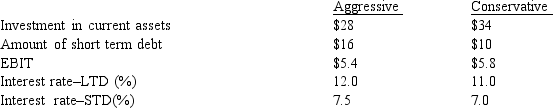

Cisco Systems wishes to analyze the joint impact of its working capital investment and financing policies on shareholder return.The company has $24 million in fixed assets.Cisco wishes to maintain a debt ratio of 40%.The company's tax rate is also 40%.The following information was developed for the two policies under consideration (dollars in millions):

For the aggressive approach, Cisco's ROE is and for the conservative approach the ROE is .

A)4.18%, 3.77%

B)11.62%, 10.48%

C)6.97%, 6.29%

D)none of these are correct

For the aggressive approach, Cisco's ROE is and for the conservative approach the ROE is .

A)4.18%, 3.77%

B)11.62%, 10.48%

C)6.97%, 6.29%

D)none of these are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

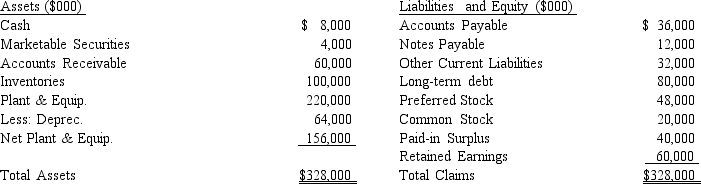

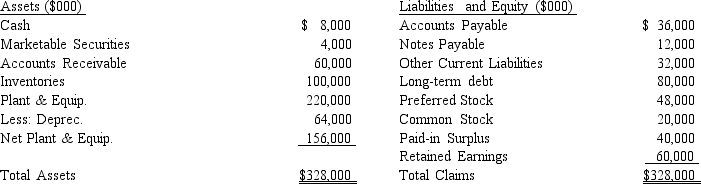

Renfro Industries balance sheet for December 31, 20x3 is as follows:

What is Renfro's net working capital at the end of 20x3?

A)-$8 million

B)$36 million

C)$92 million

D)$172 million

What is Renfro's net working capital at the end of 20x3?

A)-$8 million

B)$36 million

C)$92 million

D)$172 million

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

Cryo-vac expects sales to increase 20% next year from the current level of $5,000,000.The firm has current assets of $1,000,000 and fixed assets of $1,500,000.Cryo-vac has current liabilities of $750,000 of which $300,000 are in notes payable.What additional financing will Cryo-vac need to support the expected sales increase if its profit margin is 8% and the firm expects to pay out $200,000 in dividends? An increase in net fixed assets of $300,000 will be required.

I)$130,000

J)$70,000

K)Surplus of $70,000

L)$270,000

I)$130,000

J)$70,000

K)Surplus of $70,000

L)$270,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

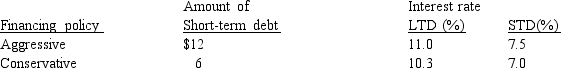

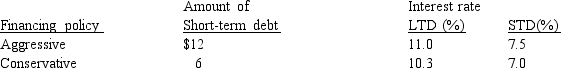

Laserscope Inc.is trying to determine the best combination of short-term and long-term debt to employ in financing its assets.Laserscope will have $16 million in current assets and $20 million in fixed assets next year and expects operating income (EBIT) to be $4.1 million.The company's tax rate is 40% and its debt ratio is 50%.The firm's debt will be financed by one of the following policies:

What is the return on shareholder's equity under each policy?

A)aggressive = 12.70% & conservative = 12.22%

B)aggressive = 8.47% & conservative = 8.14%

C)aggressive = 4.23% & conservative = 4.07%

D)aggressive = 7.67% & conservative = 8.81%

What is the return on shareholder's equity under each policy?

A)aggressive = 12.70% & conservative = 12.22%

B)aggressive = 8.47% & conservative = 8.14%

C)aggressive = 4.23% & conservative = 4.07%

D)aggressive = 7.67% & conservative = 8.81%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

What is the inventory conversion period for O'Brian's if it has sales of $320,000, an average inventory of $5,333, and a cash conversion cycle of 20 days? Assume that the cost of sales is 55 percent of sales.

A)6 days

B)11 days

C)13.5 days

D)15 days

A)6 days

B)11 days

C)13.5 days

D)15 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

Last year Bizmart had credit sales of $32 million and a net profit margin of 8%.If Bizmart had accounts receivable of $4.5 million, what was the length of the receivables conversion period?

A)51.3 days

B)56.3 days

C)54.9 days

D)47.2 days

A)51.3 days

B)56.3 days

C)54.9 days

D)47.2 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

Sherwood Packing had sales of $3.2 million and a gross profit margin of 35% last year.If Sherwood's inventory averaged $0.4 million last year, what was the length of the inventory conversion period?

A)130.4 days

B)70.2 days

C)195.5 days

D)45.6 days

A)130.4 days

B)70.2 days

C)195.5 days

D)45.6 days

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

Laserscope has an inventory conversion period of 45 days, a receivables conversion period of 42 days, and a payables deferral period of 51 days.What is the length of its cash conversion cycle?

A)54 days

B)36 days

C)48 days

D)can determine with more information

A)54 days

B)36 days

C)48 days

D)can determine with more information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

Simmons Industries is considering two alternative working capital investment and financing policies.Policy A requires the firm to keep its current assets at 60% of forecasted sales and to finance 75% of its debt requirements with long-term debt (and 25% with short-term debt).Policy B, on the other hand, requires the firm to keep current assets at 40% of forecasted sales and to finance 50% of its debt requirements with long-term debt (and 50% with short-term debt).Forecasted sales for next year are $20 million.Earnings before interest and taxes are projected to be 20% of sales.The firm's corporate income tax rate is 40%.Its fixed assets total $10 million.The firm desires to maintain its existing capital structure that consists of 50% debt (both long-term and short-term) and 50% equity.Interest rates on short- and long-term debt are 8% and 10% respectively.

Determine the expected rate of return on equity next year for Simmons Industries under each of the working capital policies.

A)26.9%, 30.4%

B)21%, 26.7%

C)8.1%, 9.1%

D)16.1%, 21.3%

Determine the expected rate of return on equity next year for Simmons Industries under each of the working capital policies.

A)26.9%, 30.4%

B)21%, 26.7%

C)8.1%, 9.1%

D)16.1%, 21.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

When pledging accounts receivables, which of the following statements is/are correct?

M)Only statement I is correct

N)Only statement II is correct

O)Both statements I and II are correct

P)Neither statement I nor II is correct

M)Only statement I is correct

N)Only statement II is correct

O)Both statements I and II are correct

P)Neither statement I nor II is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

Great Skot expects to have cash receipts in June of $532,160.Skot's cash disbursements in June are $581,720, including an interest payment on a bond issue of $32,000.If Skot wishes to maintain a cash balance of $40,000, how much will Skot have to borrow if it started the month with a cash balance of $52,000?

A)Surplus of $2,440.Will not have to borrow

B)Surplus of $34,440.Will not have to borrow

C)$5,560

D)$37,560

A)Surplus of $2,440.Will not have to borrow

B)Surplus of $34,440.Will not have to borrow

C)$5,560

D)$37,560

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

If Swatch's inventory conversion period is 45 days, its payables deferral period is 35 days, and its receivables conversion period is 50 days, then its cash conversion cycle must be days.

A)60

B)90

C)30

D)cannot be determined from information given

A)60

B)90

C)30

D)cannot be determined from information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

Gates Industries balance sheet and income statement for the year ending December 31, 1978 are as follows:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

Runners Ink, Inc.had sales last year of $700,000 and 35 percent of its sales are for cash, with the remainder buying on terms of net 30 days.If the receivables conversion period is actually 38 days, what is Runners Ink's accounts receivable?

A)$72,877

B)$25,507

C)$47,370

D)none of these

A)$72,877

B)$25,507

C)$47,370

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

What is the length of the cash conversion cycle for a firm with annual sales (all cash) of $280,000, an inventory conversion period of 35 days, and a payables deferral period of 25 days.

A)0 days

B)25 days

C)10 days

D)none of these

A)0 days

B)25 days

C)10 days

D)none of these

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

What is "stretching accounts payable" and what are the advantages and disadvantages of doing it?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

Sources of debt financing are classified according to their:

A)Maturities

B)Interest paid

C)Par

D)Yield

A)Maturities

B)Interest paid

C)Par

D)Yield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

Explain how a firm uses commercial paper as a short-term financing source and explain the disadvantage of using this form of financing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

Efficient current assets management refers to the firm's ability to economize on which of the following?

U)Only inventory

V)Only marketable securities

W)Both inventory and marketable securities

X)Neither inventory nor marketable securities

U)Only inventory

V)Only marketable securities

W)Both inventory and marketable securities

X)Neither inventory nor marketable securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

When factoring accounts receivables, the factor is the:

A)negotiated accounts receivable account.

B)the percent deduction in payment to the firm.

C)the financial institution that buys the accounts receivable.

D)the method of determining how much money is lent to the firm.

A)negotiated accounts receivable account.

B)the percent deduction in payment to the firm.

C)the financial institution that buys the accounts receivable.

D)the method of determining how much money is lent to the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

Why is working capital so important to a firm's continued profitability?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

A firm's working capital position is important from an internal and external standpoint.Which of the following apply:

A)It measures a firm's risk.

B)Provisions for a minimum working capital position are often included in restrictive covenants.

C)A firm's policy often affects its ability to obtain debt.

D)A working capital position determines its level of common stock sales.

A)It measures a firm's risk.

B)Provisions for a minimum working capital position are often included in restrictive covenants.

C)A firm's policy often affects its ability to obtain debt.

D)A working capital position determines its level of common stock sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

What are the classifications for short-term lenders and how do they differ?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

Firms can meet its financing needs by using a matching approach for financing.What is the matching approach?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

Factoring accounts receivable is done:

A)on a default basis

B)on a consignment basis

C)on an interest only basis

D)on a non-recourse basis

A)on a default basis

B)on a consignment basis

C)on an interest only basis

D)on a non-recourse basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

Name some factors that affect the firm's investment decision to invest in current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

What are accrued expenses and how are they handled as unsecured short-term credit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

Working capital policy involves day-to-day decisions that determine all of the following EXCEPT:

A)firm's level of longterm assets.

B)proportions of short-term and long-term debt used to finance assets.

C)level of each type of current asset.

D)specific sourcers and mix of short-term liabilities the firm should employ.

A)firm's level of longterm assets.

B)proportions of short-term and long-term debt used to finance assets.

C)level of each type of current asset.

D)specific sourcers and mix of short-term liabilities the firm should employ.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

Explain trade credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

What is financial forecasting?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

Negotiated short-term credit sources are all of the following EXCEPT:

A)commerical paper

B)inventory loans

C)trade credit

D)bank credit

A)commerical paper

B)inventory loans

C)trade credit

D)bank credit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

In considering factoring accounts receivable, which of the following statements is/are correct?

Q)Only statement I is correct

R)Only statement II is correct

S)Both statements I and II are correct

T)Neither statement I nor II is correct

Q)Only statement I is correct

R)Only statement II is correct

S)Both statements I and II are correct

T)Neither statement I nor II is correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

A firm's working capital position is important since::

A)it is a measure of risk.

B)it is a measure of efficiency.

C)it is much more in demand due to its scarcity.

D)it reflects the amount of short-term liabilities that the firm must consider.

A)it is a measure of risk.

B)it is a measure of efficiency.

C)it is much more in demand due to its scarcity.

D)it reflects the amount of short-term liabilities that the firm must consider.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

79

In examining the term structure of interest rates, the interest rates of have exceeded short-term rates.

A)Commercial paper

B)Notes payable

C)Corporate bonds

D)Marketable securities

A)Commercial paper

B)Notes payable

C)Corporate bonds

D)Marketable securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

Fluctuating current assets are those assets that are affected by:

A)the consumer's demand for the product

B)the seasonal nature of the company

C)management preferences

D)IRS regulations

A)the consumer's demand for the product

B)the seasonal nature of the company

C)management preferences

D)IRS regulations

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck