Deck 4: Profitability Analysis

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

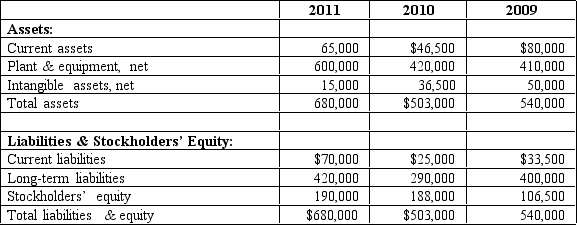

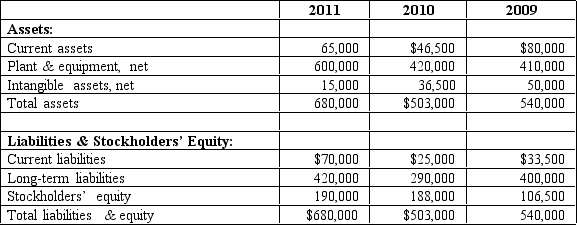

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

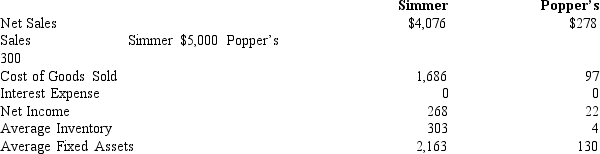

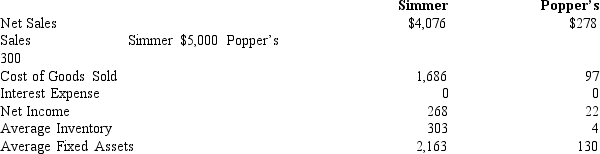

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/97

العب

ملء الشاشة (f)

Deck 4: Profitability Analysis

1

Orca Industries

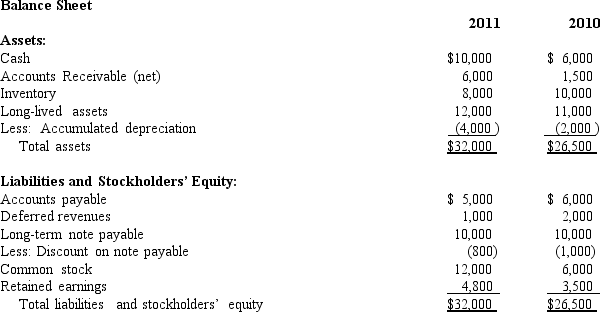

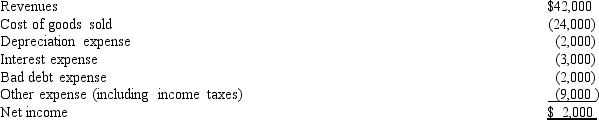

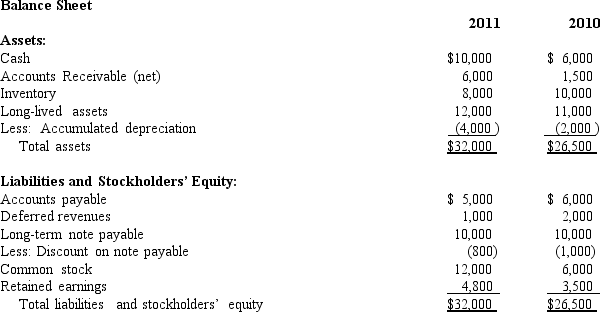

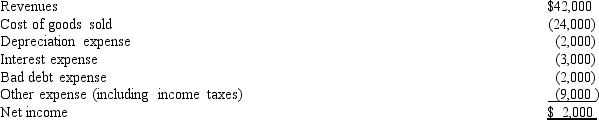

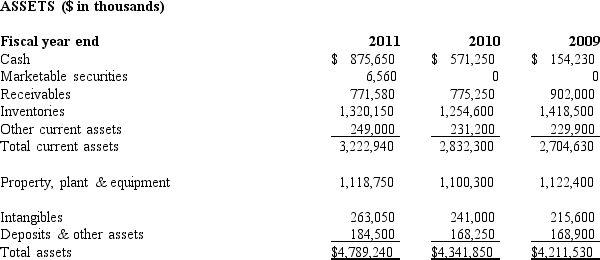

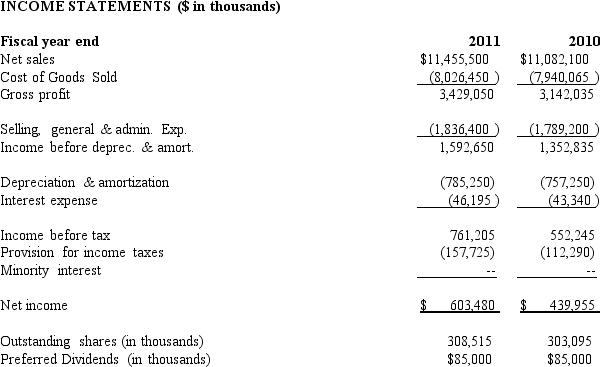

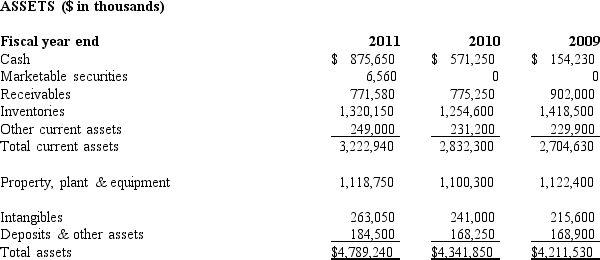

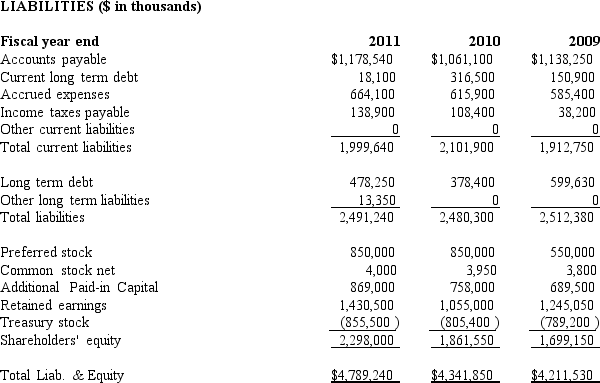

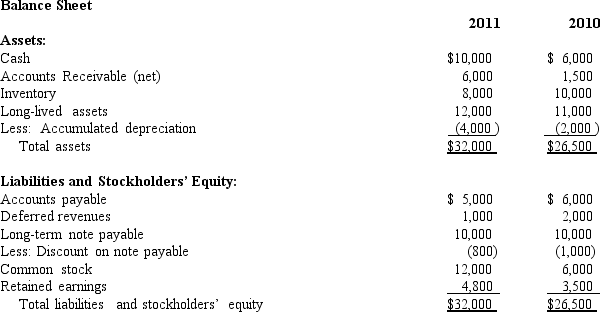

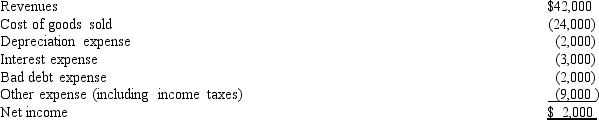

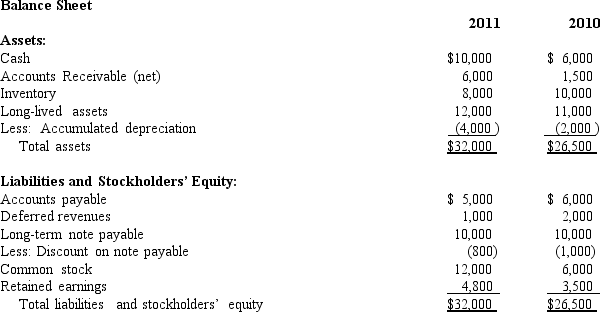

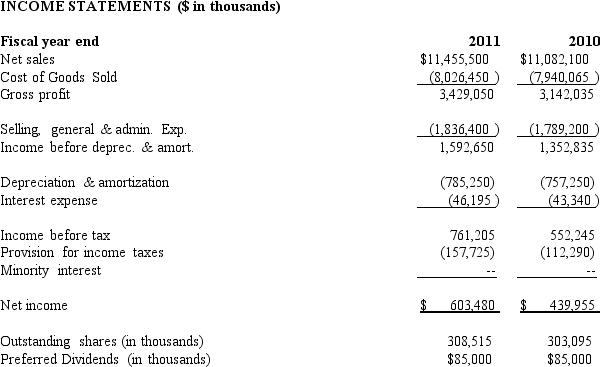

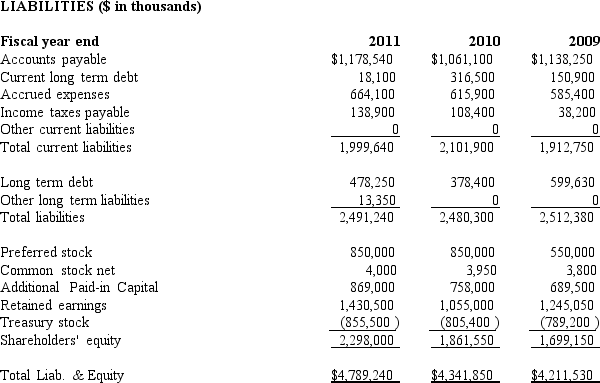

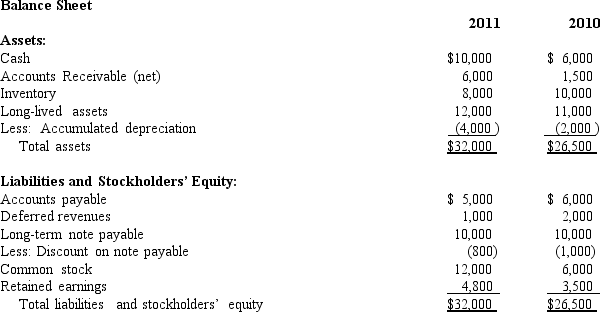

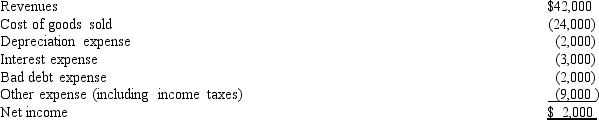

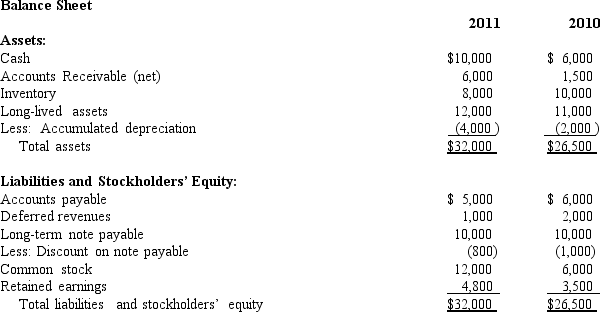

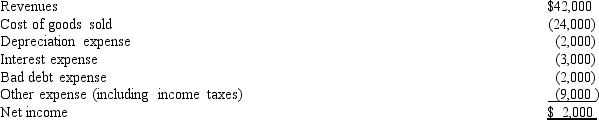

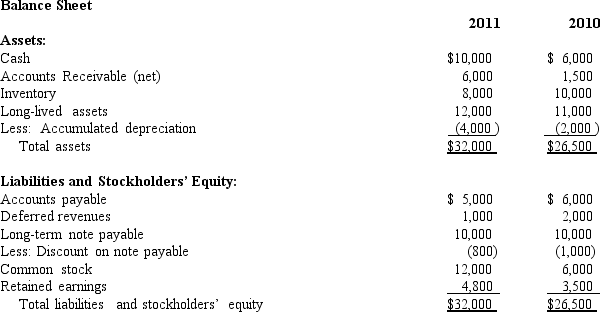

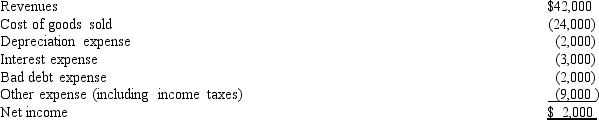

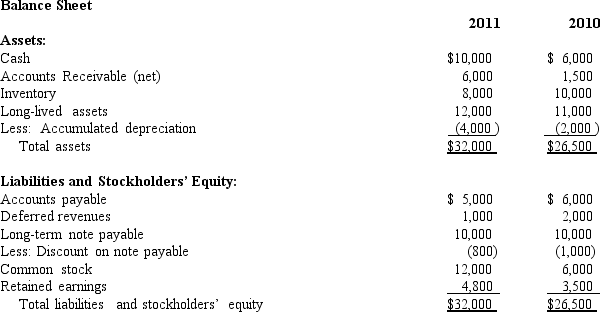

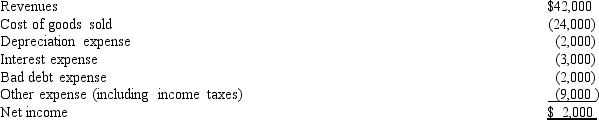

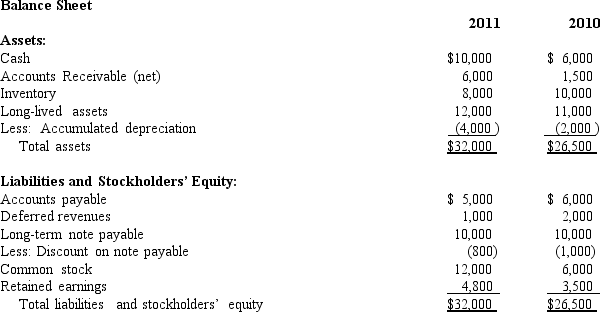

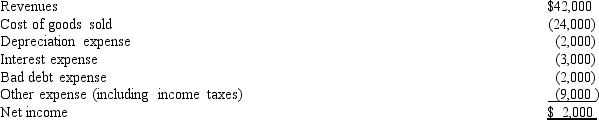

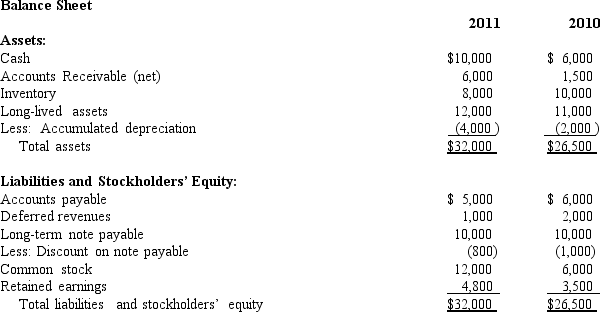

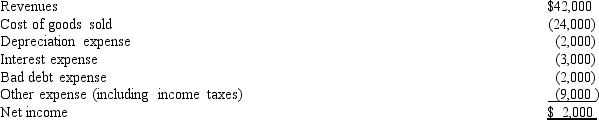

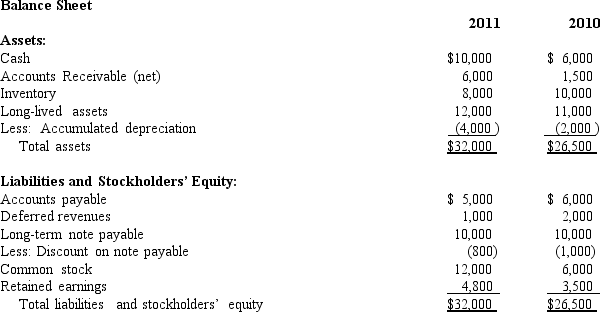

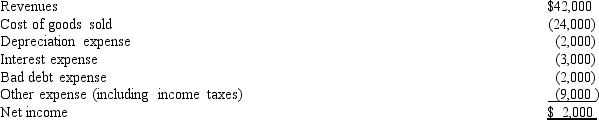

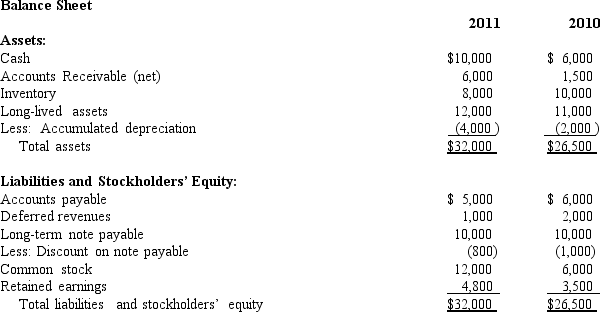

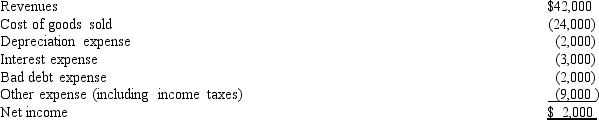

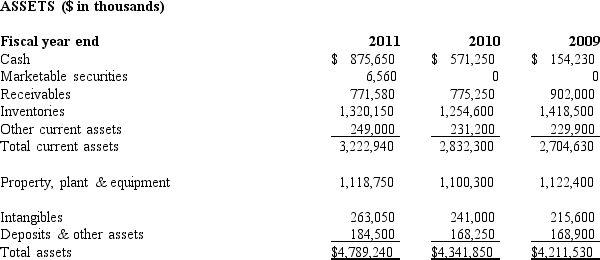

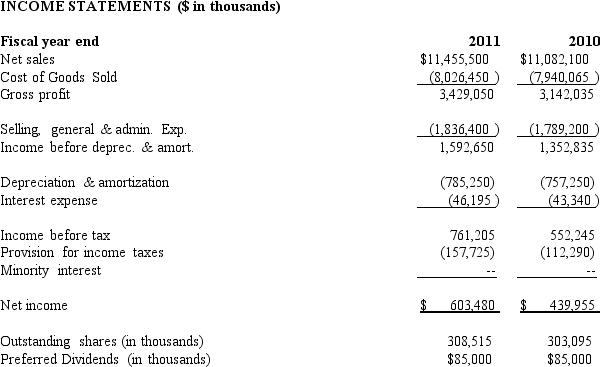

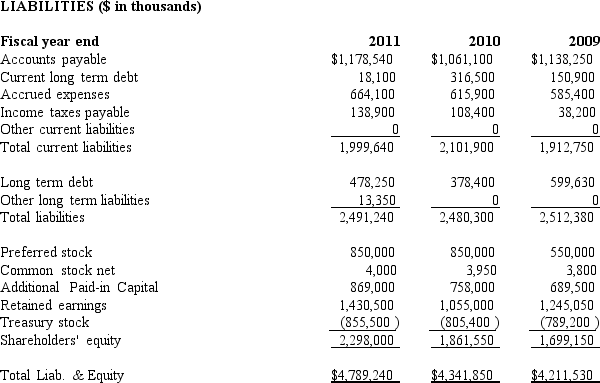

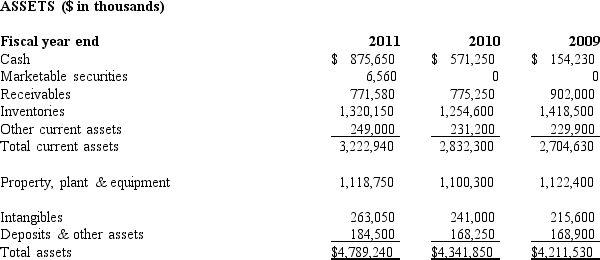

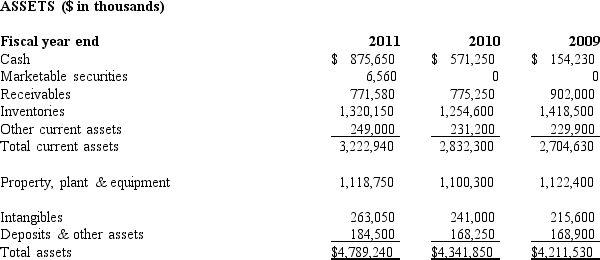

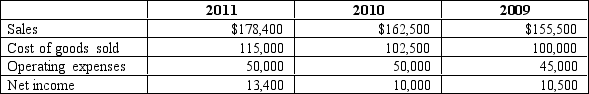

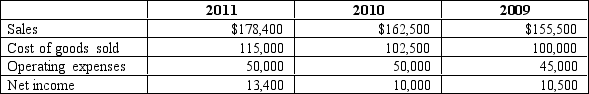

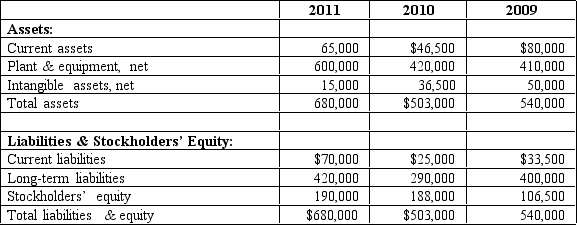

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

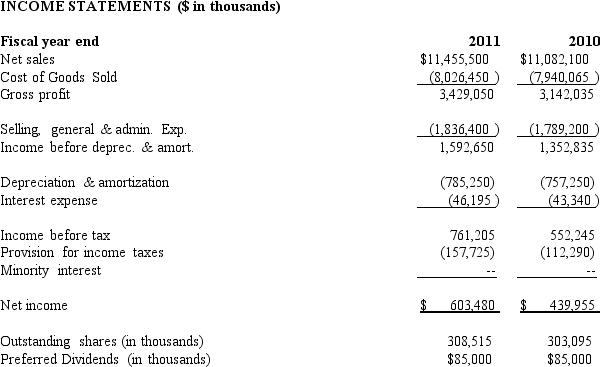

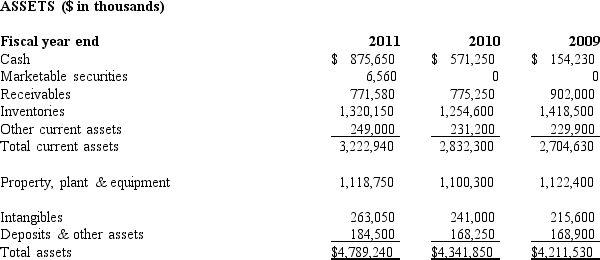

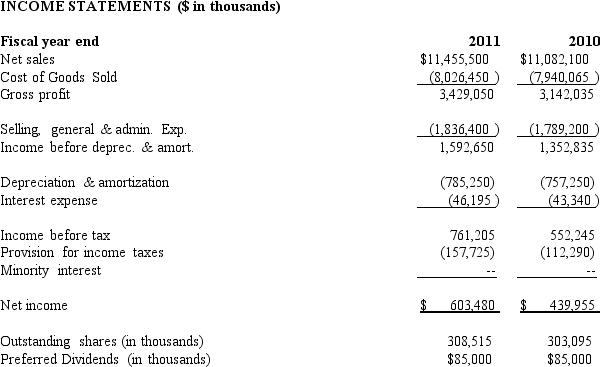

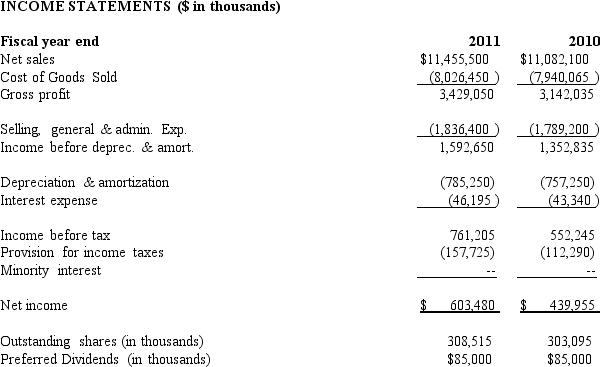

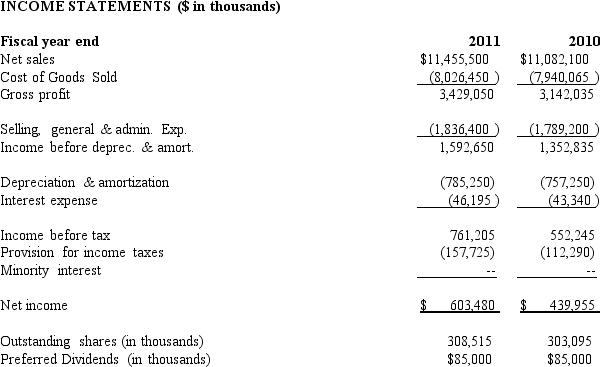

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.The profit margin for computing ROA for Orca Industries is

A) 9.4%

B) 13.5%

C) 4.8%

D) 12.3%

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.The profit margin for computing ROA for Orca Industries is

A) 9.4%

B) 13.5%

C) 4.8%

D) 12.3%

A

[2,000 + (1 - .35)3,000] / 42,000 = 9.4%

[2,000 + (1 - .35)3,000] / 42,000 = 9.4%

2

Net Devices Inc.

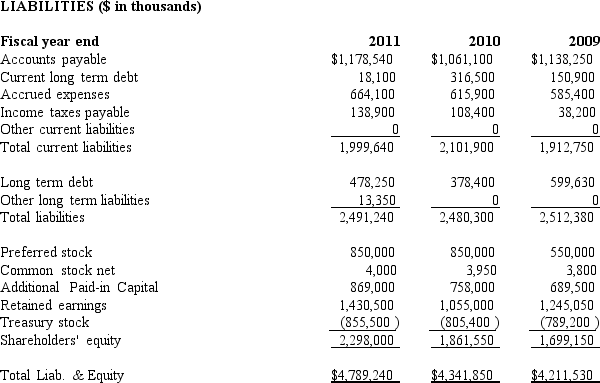

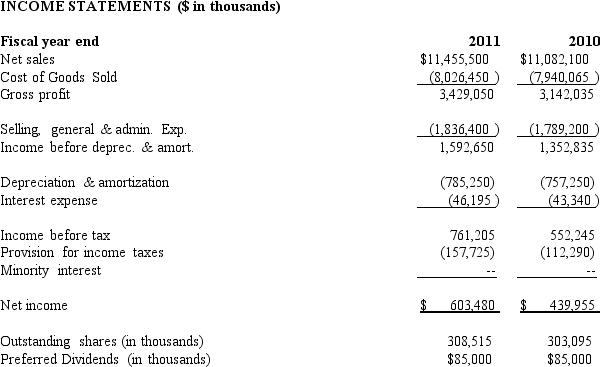

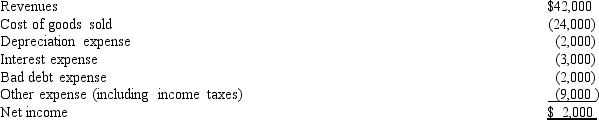

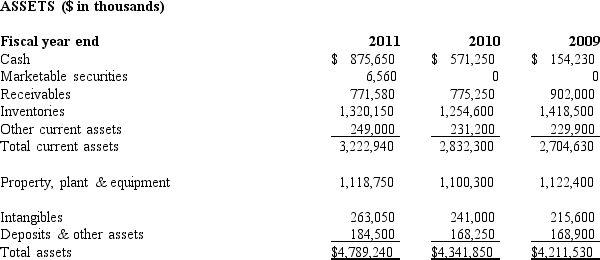

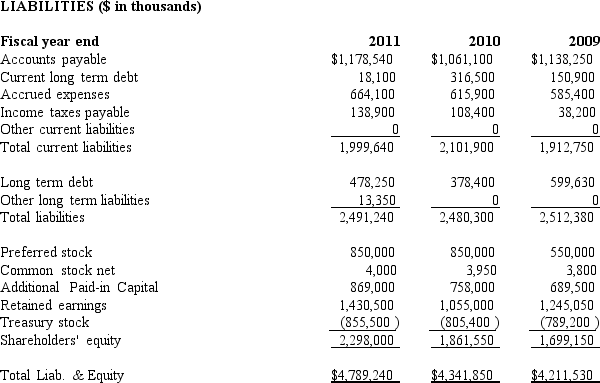

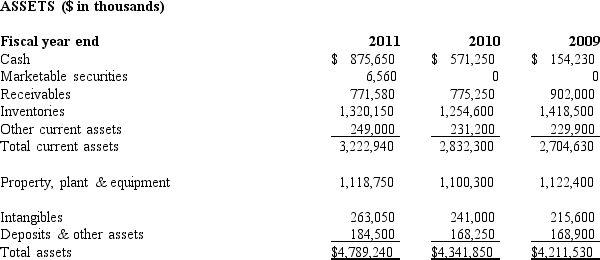

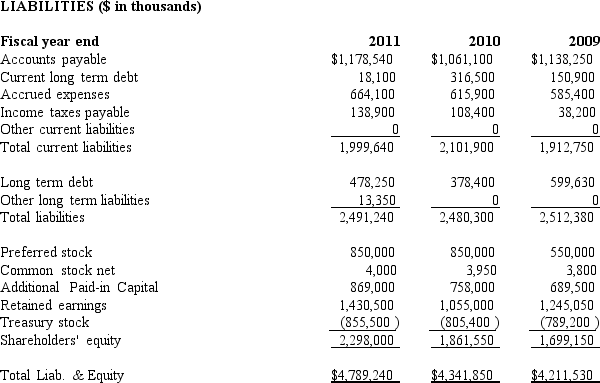

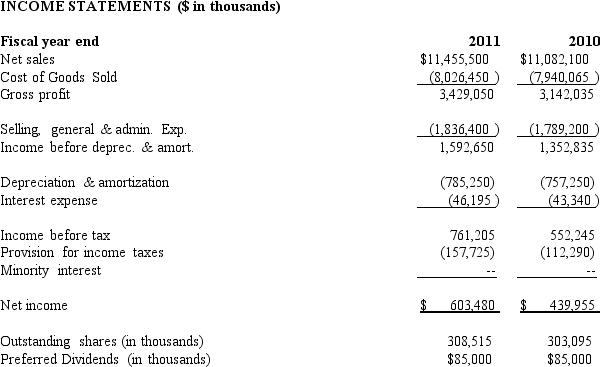

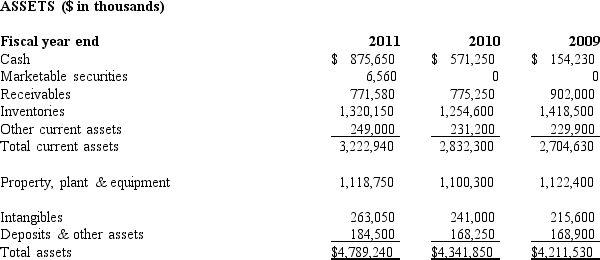

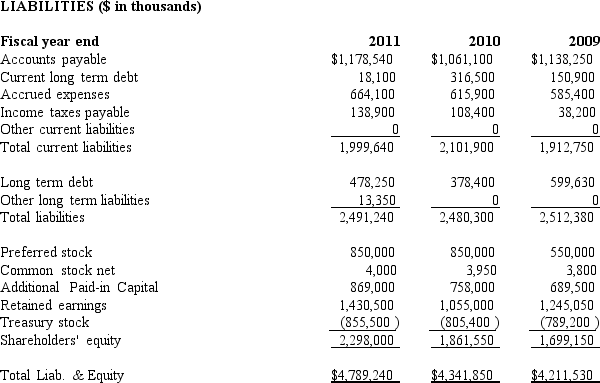

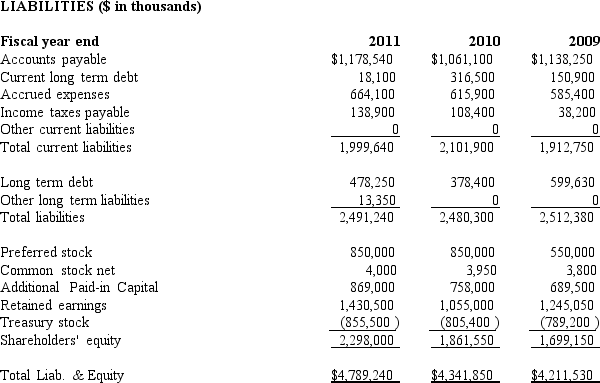

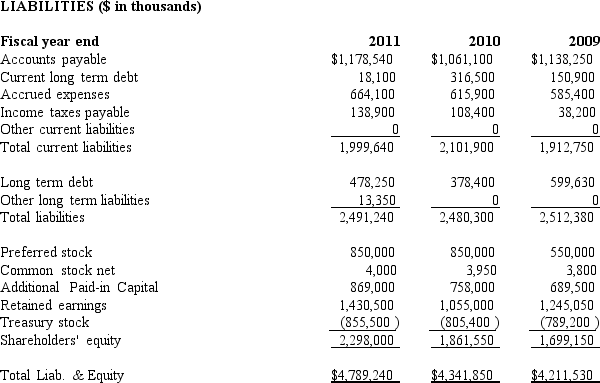

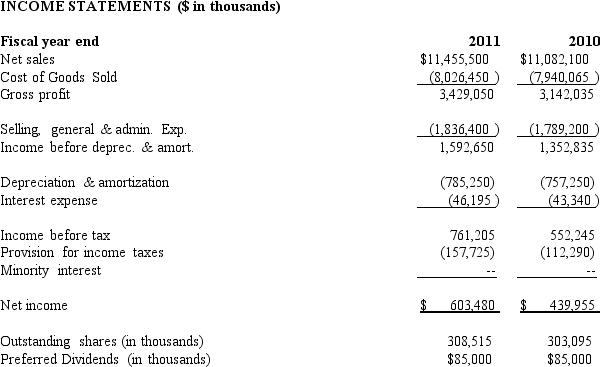

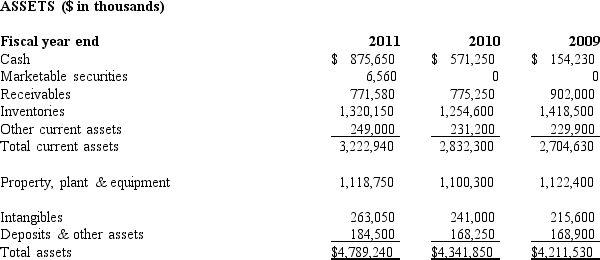

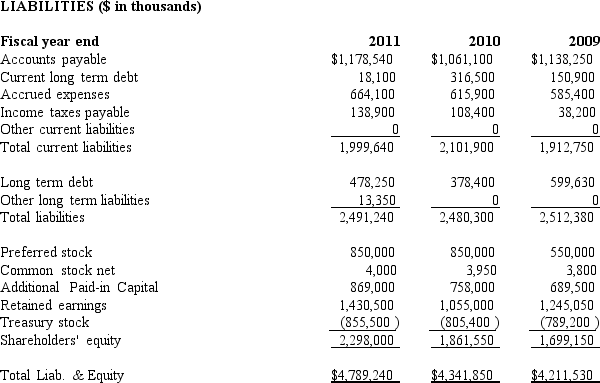

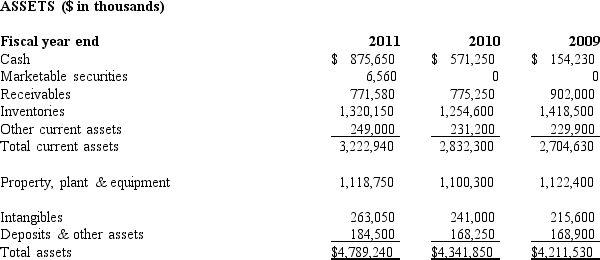

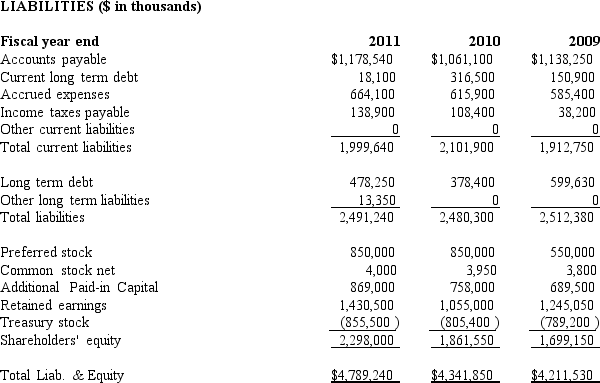

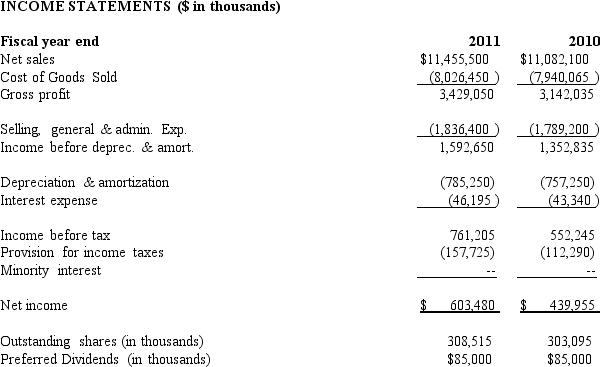

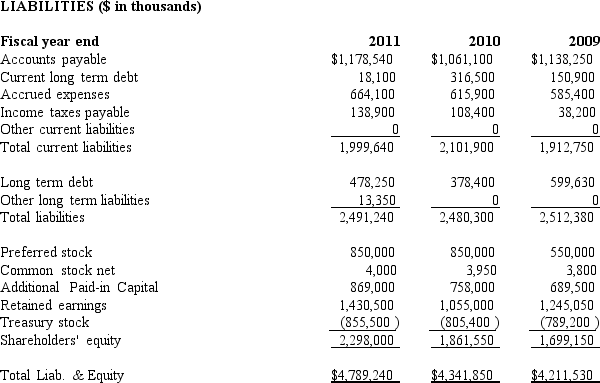

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

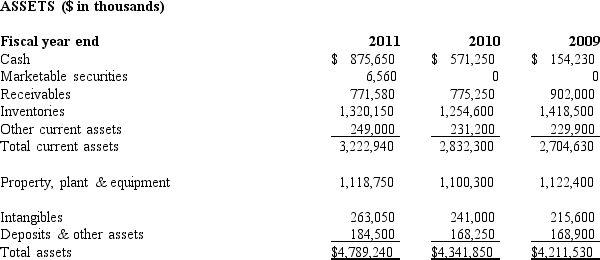

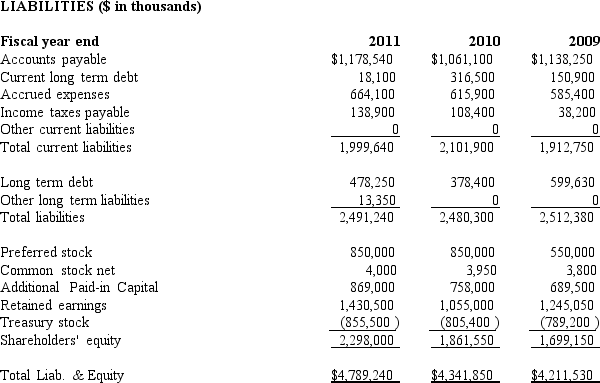

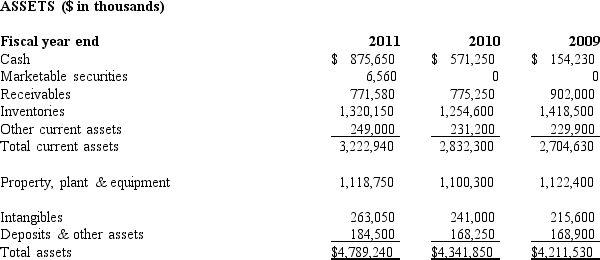

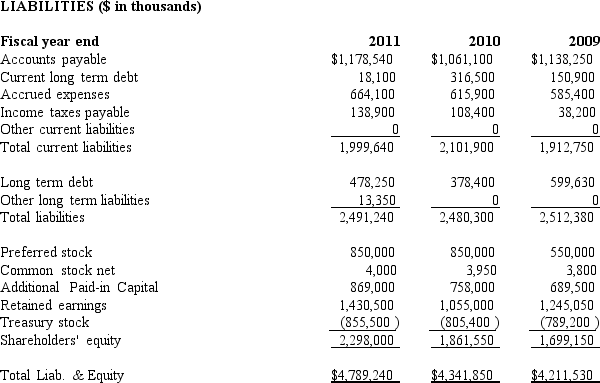

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the accounts receivable turnover ratio for Net Devices for 2011?

A) 24.65

B) 14.85

C) 14.81

D) 10.50

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the accounts receivable turnover ratio for Net Devices for 2011?

A) 24.65

B) 14.85

C) 14.81

D) 10.50

C

11,455,500 / [ (771,580 + 775,250)/ 2 ] = 14.81

11,455,500 / [ (771,580 + 775,250)/ 2 ] = 14.81

3

Orca Industries

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.The return on assets for Orca Industries is

A) 6.8%

B) 13.5%

C) 10%

D) 12.3%

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.The return on assets for Orca Industries is

A) 6.8%

B) 13.5%

C) 10%

D) 12.3%

B

[2,000 + (1 - .35)3,000] / [(32,000 + 26,500)/2] = 13.5%

[2,000 + (1 - .35)3,000] / [(32,000 + 26,500)/2] = 13.5%

4

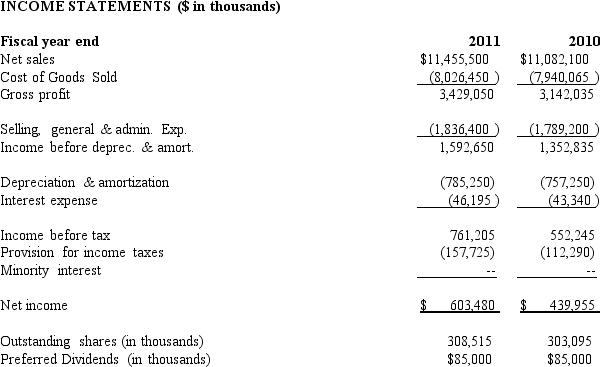

Net Devices Inc.

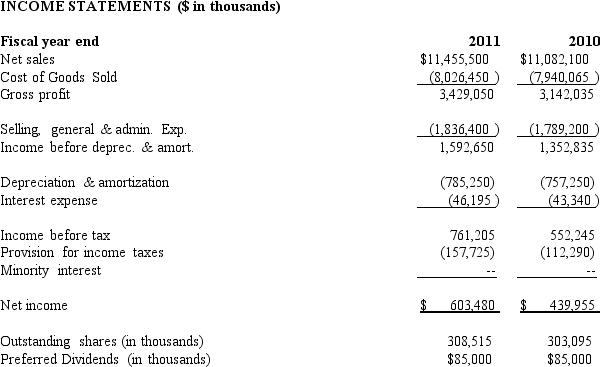

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is Net Devices' return on common shareholders' equity for 2011?

A) 26.54%

B) 30.89%

C) 35.81%

D) 42.16%

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is Net Devices' return on common shareholders' equity for 2011?

A) 26.54%

B) 30.89%

C) 35.81%

D) 42.16%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following might an analyst not want to eliminate from past earnings when using past earnings to forecast future earnings?

A) nonrecurring gains from the sale of assets.

B) unusual asset impairment charges.

C) nonrecurring restructuring charges.

D) revenue from the sale of inventory.

A) nonrecurring gains from the sale of assets.

B) unusual asset impairment charges.

C) nonrecurring restructuring charges.

D) revenue from the sale of inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

6

Firms with high levels of operating leverage experience which of the following in comparison to firms with low levels of operating leverage

A) Higher levels of risk in operations.

B) Lower expected rates of return.

C) Lower variability in returns on assets.

D) Higher sales.

A) Higher levels of risk in operations.

B) Lower expected rates of return.

C) Lower variability in returns on assets.

D) Higher sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

7

Orca Industries

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.Orca's basic earnings per share is

A) .22

B) .13

C) .25

D) .30

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.Orca's basic earnings per share is

A) .22

B) .13

C) .25

D) .30

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

8

Orca Industries

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.Orca's asset turnover is

A) 1.31

B) 1

C) 1.58

D) 1.44

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.Orca's asset turnover is

A) 1.31

B) 1

C) 1.58

D) 1.44

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

9

One important difference between return on assets (ROA)and return on common shareholder's equity (ROCE)is

A) ROA does not differentiate based on how a company finances its assets; ROCE does.

B) ROA does not distinguish between the different types of income items, such as income from continuing operations, discontinued operations, extraordinary items and changes in accounting principles; ROCE does.

C) ROCE does not distinguish between the different types of income items, such as income from continuing operations, discontinued operations, extraordinary items and changes in accounting principles; ROA does.

D) ROCE does not differentiate based on how a company finances its assets; ROA does.

A) ROA does not differentiate based on how a company finances its assets; ROCE does.

B) ROA does not distinguish between the different types of income items, such as income from continuing operations, discontinued operations, extraordinary items and changes in accounting principles; ROCE does.

C) ROCE does not distinguish between the different types of income items, such as income from continuing operations, discontinued operations, extraordinary items and changes in accounting principles; ROA does.

D) ROCE does not differentiate based on how a company finances its assets; ROA does.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which factor does not explain differences or changes in ROA?

A) Operating leverage

B) Cyclicality of sales

C) Product life cycle

D) Financial leverage

A) Operating leverage

B) Cyclicality of sales

C) Product life cycle

D) Financial leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following industries would you expect to have,on average,high asset turnover and low profit margin?

A) Hotels

B) Grocery stores

C) Utilities

D) Oil and Gas extraction

A) Hotels

B) Grocery stores

C) Utilities

D) Oil and Gas extraction

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

12

Net Devices Inc.

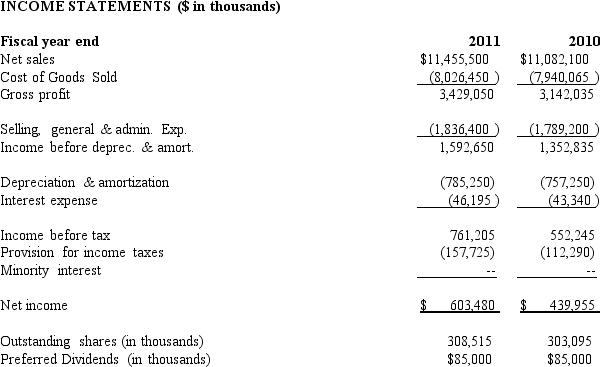

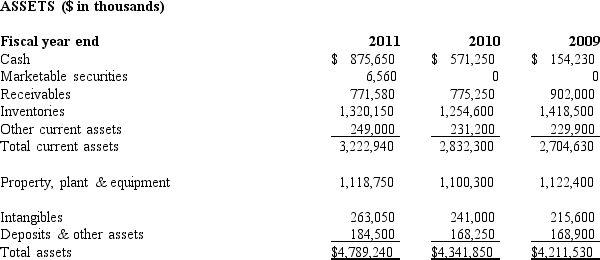

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the rate of return on assets for Net Devices for 2011?

A) 11.64%

B) 14.50%

C) 12.60%

D) 13.88%

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the rate of return on assets for Net Devices for 2011?

A) 11.64%

B) 14.50%

C) 12.60%

D) 13.88%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

13

Net Devices Inc.

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is Net Devices' earnings per share for 2011?

A) $1.00

B) $1.70

C) $1.96

D) $0

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is Net Devices' earnings per share for 2011?

A) $1.00

B) $1.70

C) $1.96

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

14

Orca Industries

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.Orca's accounts receivable turnover is (assume that Orca makes all sales on account)

A) 7.0

B) .53

C) 11.2

D) 10

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.Orca's accounts receivable turnover is (assume that Orca makes all sales on account)

A) 7.0

B) .53

C) 11.2

D) 10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

15

Orca Industries

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.The return on common shareholders' equity for Orca Industries is

A) 15.2%

B) 13.5%

C) 10%

D) 11.9%

Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%.

Income Statement

For the year ended December 31, 2011

Refer to the information for Orca Industries.The return on common shareholders' equity for Orca Industries is

A) 15.2%

B) 13.5%

C) 10%

D) 11.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

16

Return on assets can be disaggregated into three components.Which of the following is not one of the components?

A) Assets Turnover ratio

B) Profit Margin ratio

C) Debt to Equity ratio

D) Capital Structure Leverage ratio

A) Assets Turnover ratio

B) Profit Margin ratio

C) Debt to Equity ratio

D) Capital Structure Leverage ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

17

Net Devices Inc.

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is Net Devices' capital structure leverage ratio for 2011?

A) 3.89

B) 1.68

C) 3.71

D) 10.32

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is Net Devices' capital structure leverage ratio for 2011?

A) 3.89

B) 1.68

C) 3.71

D) 10.32

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

18

Asset turnover represents

A) The ability of the firm to generate income from operations for a particular level of sales.

B) The ability to generate sales from a particular investment in assets.

C) The ability to manage the level of investment in assets for a particular level of assets.

D) The number of days, on average, it takes management to turnover assets.

A) The ability of the firm to generate income from operations for a particular level of sales.

B) The ability to generate sales from a particular investment in assets.

C) The ability to manage the level of investment in assets for a particular level of assets.

D) The number of days, on average, it takes management to turnover assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

19

Net Devices Inc.

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the inventory turnover for Net Devices for 2011?

A) 10.32

B) 8.90

C) 2.51

D) 6.23

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the inventory turnover for Net Devices for 2011?

A) 10.32

B) 8.90

C) 2.51

D) 6.23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

20

Net Devices Inc.

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the profit margin for ROA for Net Devices for 2010?

A) 7.26%

B) 4.22%

C) 5.00%

D) 3.97%

The following balance sheets and income statements are for Net Devices Inc., a manufacturer of small electronic devices, including calculators, personal digital assistants and mp3 players. For purposes of these questions assume that the company has an effective tax rate of 35%.

BALANCE SHEETS

Refer to the information for Net Devices Inc.What is the profit margin for ROA for Net Devices for 2010?

A) 7.26%

B) 4.22%

C) 5.00%

D) 3.97%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

21

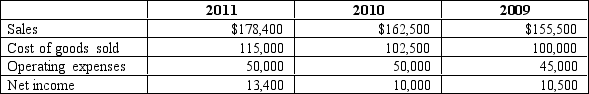

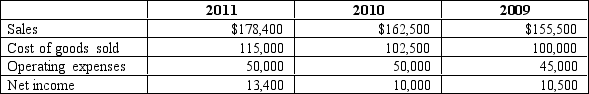

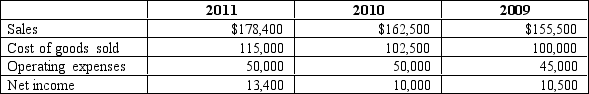

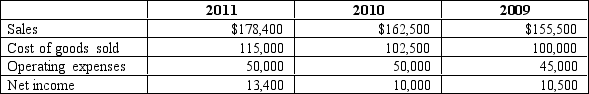

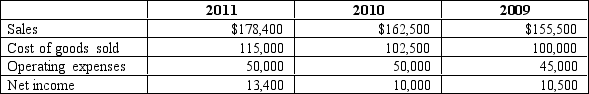

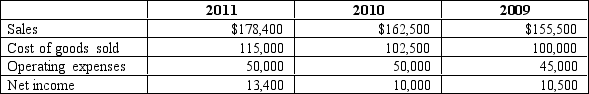

Ramos Company

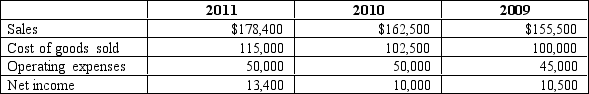

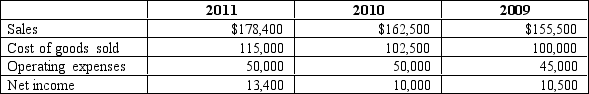

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a common size income statement for 2009,the cost of goods sold are expressed as:

A) 64.3%

B) 40.0%

C) 87 %

D) 103%

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a common size income statement for 2009,the cost of goods sold are expressed as:

A) 64.3%

B) 40.0%

C) 87 %

D) 103%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

22

The statutory tax rate differs from a firm's average tax rate due to which of the following reasons

A) the statutory tax rate is a marginal tax rate.

B) some expenses are included in book income but do not enter into taxable income.

C) the average tax rate is for a period of three years.

D) the statutory tax rate does not effect GAAP measures of revenues and expenses.

A) the statutory tax rate is a marginal tax rate.

B) some expenses are included in book income but do not enter into taxable income.

C) the average tax rate is for a period of three years.

D) the statutory tax rate does not effect GAAP measures of revenues and expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

23

To calculate diluted EPS,the accountant does all of the following except:

A) adds back to net income any compensation expense recognized on the employee stock options

B) adds back any interest expense (net of taxes) on convertible bonds

C) adds back any dividends on convertible preferred stock the firm subtracted in computing net income to common shareholders.

D) enters only the net incremental shares issued (shares issued under options minus assumed shares repurchased) in the computation of diluted EPS.

A) adds back to net income any compensation expense recognized on the employee stock options

B) adds back any interest expense (net of taxes) on convertible bonds

C) adds back any dividends on convertible preferred stock the firm subtracted in computing net income to common shareholders.

D) enters only the net incremental shares issued (shares issued under options minus assumed shares repurchased) in the computation of diluted EPS.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

24

Multiples of EPS to value firms are referred to as.

A) ROA

B) price-earnings ratios

C) ROCE

D) Weighted average number of common shares outstanding

A) ROA

B) price-earnings ratios

C) ROCE

D) Weighted average number of common shares outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

25

Ramos Company

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a percentage change income statement over the period of 2009 to 2011,what is the change in sales?

A) 100%

B) 87.2%

C) 12.8%

D) 14.7%

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a percentage change income statement over the period of 2009 to 2011,what is the change in sales?

A) 100%

B) 87.2%

C) 12.8%

D) 14.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

26

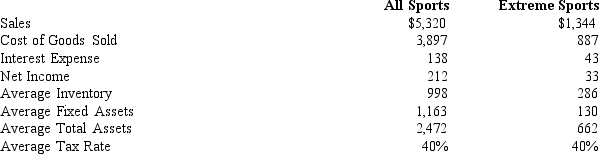

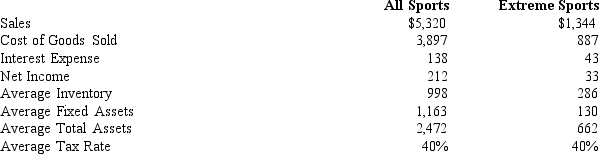

Extreme Sports Company and All Sports Corporation

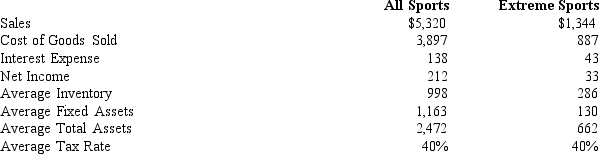

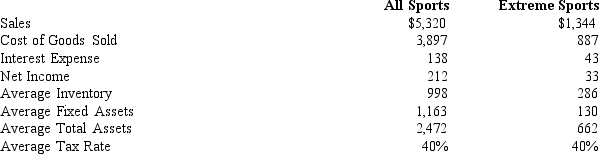

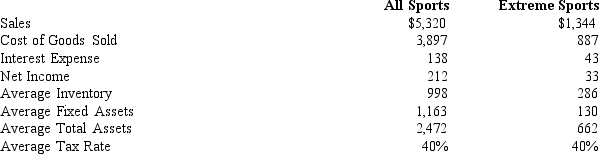

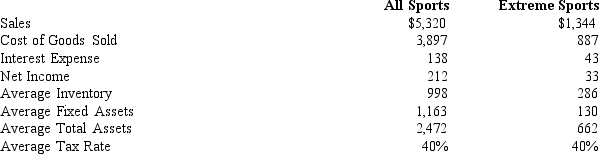

Below is financial information for two sporting goods retailers. Extreme Sports Company operates a retail business and franchising business. At the end 2011, Extreme Sports had 263 Company-owned and 120 franchise-operated retail stores. Extreme's stores are located in suburban, strip mall and regional mall locations, the company operates in 32 states. All Sports Corporation sells sporting goods and related products at over 2,500 Company-operated retail stores.

Selected Data for All Sports and Extreme Sports

(amounts in millions)

Refer to the information for Extreme Sports Company and All Sports Corporation. Calculate All Sports' inventory turnover ratio

A) 5.3

B) 1.2

C) 3.9

D) .256

Below is financial information for two sporting goods retailers. Extreme Sports Company operates a retail business and franchising business. At the end 2011, Extreme Sports had 263 Company-owned and 120 franchise-operated retail stores. Extreme's stores are located in suburban, strip mall and regional mall locations, the company operates in 32 states. All Sports Corporation sells sporting goods and related products at over 2,500 Company-operated retail stores.

Selected Data for All Sports and Extreme Sports

(amounts in millions)

Refer to the information for Extreme Sports Company and All Sports Corporation. Calculate All Sports' inventory turnover ratio

A) 5.3

B) 1.2

C) 3.9

D) .256

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

27

Extreme Sports Company and All Sports Corporation

Below is financial information for two sporting goods retailers. Extreme Sports Company operates a retail business and franchising business. At the end 2011, Extreme Sports had 263 Company-owned and 120 franchise-operated retail stores. Extreme's stores are located in suburban, strip mall and regional mall locations, the company operates in 32 states. All Sports Corporation sells sporting goods and related products at over 2,500 Company-operated retail stores.

Selected Data for All Sports and Extreme Sports

(amounts in millions)

Refer to the information for Extreme Sports Company and All Sports Corporation. Compute the Asset Turnover for All Sports

A) 3.2%

B) 2.15

C) 8.9%

D) 1.1%

Below is financial information for two sporting goods retailers. Extreme Sports Company operates a retail business and franchising business. At the end 2011, Extreme Sports had 263 Company-owned and 120 franchise-operated retail stores. Extreme's stores are located in suburban, strip mall and regional mall locations, the company operates in 32 states. All Sports Corporation sells sporting goods and related products at over 2,500 Company-operated retail stores.

Selected Data for All Sports and Extreme Sports

(amounts in millions)

Refer to the information for Extreme Sports Company and All Sports Corporation. Compute the Asset Turnover for All Sports

A) 3.2%

B) 2.15

C) 8.9%

D) 1.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

28

Hall and Porter argue that firms have two generic alternative strategies for any particular product.These strategies are

A) low risk focus, low risk focus

B) retail customer focus, wholesale customer focus

C) product differentiation, low-cost leadership

D) low operating leverage, high operating leverage

A) low risk focus, low risk focus

B) retail customer focus, wholesale customer focus

C) product differentiation, low-cost leadership

D) low operating leverage, high operating leverage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following would be considered a committed fixed cost ( a cost that is incurred regardless of the level of activity during the period)?

A) depreciation expense

B) bad debt expense

C) advertising expense

D) cost of goods sold

A) depreciation expense

B) bad debt expense

C) advertising expense

D) cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

30

Ramos Company

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a common size income statement for 2011,the operating expenses are expressed as:

A) 30.3%

B) 28.0%

C) 43.8%

D) 100%

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a common size income statement for 2011,the operating expenses are expressed as:

A) 30.3%

B) 28.0%

C) 43.8%

D) 100%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

31

Ramos Company

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a common size income statement for 2011,the cost of goods sold are expressed as:

A) 130%

B) 115%

C) 64.5%

D) 63.1%

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a common size income statement for 2011,the cost of goods sold are expressed as:

A) 130%

B) 115%

C) 64.5%

D) 63.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

32

Extreme Sports Company and All Sports Corporation

Below is financial information for two sporting goods retailers. Extreme Sports Company operates a retail business and franchising business. At the end 2011, Extreme Sports had 263 Company-owned and 120 franchise-operated retail stores. Extreme's stores are located in suburban, strip mall and regional mall locations, the company operates in 32 states. All Sports Corporation sells sporting goods and related products at over 2,500 Company-operated retail stores.

Selected Data for All Sports and Extreme Sports

(amounts in millions)

Refer to the information for Extreme Sports Company and All Sports Corporation. What is the return on assets for All Sports?

A) 11.9%

B) 10.8%

C) 9.2%

D) 8.6%

Below is financial information for two sporting goods retailers. Extreme Sports Company operates a retail business and franchising business. At the end 2011, Extreme Sports had 263 Company-owned and 120 franchise-operated retail stores. Extreme's stores are located in suburban, strip mall and regional mall locations, the company operates in 32 states. All Sports Corporation sells sporting goods and related products at over 2,500 Company-operated retail stores.

Selected Data for All Sports and Extreme Sports

(amounts in millions)

Refer to the information for Extreme Sports Company and All Sports Corporation. What is the return on assets for All Sports?

A) 11.9%

B) 10.8%

C) 9.2%

D) 8.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

33

Critics of EPS as a measure of profitability point out that it does not consider:

A) simple capital structures.

B) the amount of assets or capital required to generate a particular level of earnings.

C) the deduction of preferred stock dividends from net income.

D) Adjustments for dilutive securities and the adjustment to weighted average number of

Shares outstanding for complex capital structures.

A) simple capital structures.

B) the amount of assets or capital required to generate a particular level of earnings.

C) the deduction of preferred stock dividends from net income.

D) Adjustments for dilutive securities and the adjustment to weighted average number of

Shares outstanding for complex capital structures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

34

Sustainable earnings represent

A) the level of earnings expected to persist in the future.

B) the level of earnings and the growth in the levels of earnings expected to persist in the future.

C) the growth rate of future earnings.

D) retained earnings.

A) the level of earnings expected to persist in the future.

B) the level of earnings and the growth in the levels of earnings expected to persist in the future.

C) the growth rate of future earnings.

D) retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following scenarios is consistent with an increasing cost of goods sold to sales percentage and increasing inventory turnover?

A) Firm raises prices to increase its gross margin but inventory sells more slowly.

B) Weak economic conditions lead to reduced demand for a firm's products, necessitating price reductions to move goods.

C) Strong economic conditions lead to increased demand for a firm's products, allowing price increases.

D) Firm shifts its product mix toward lower margin, faster moving products.

A) Firm raises prices to increase its gross margin but inventory sells more slowly.

B) Weak economic conditions lead to reduced demand for a firm's products, necessitating price reductions to move goods.

C) Strong economic conditions lead to increased demand for a firm's products, allowing price increases.

D) Firm shifts its product mix toward lower margin, faster moving products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

36

Adjustments for dilutive securities and the adjustment to weighted average number of shares outstanding presumes that the dilutive securities are converted to common shares

A) as of the beginning of the year.

B) as of the end of the year.

C) as of the middle of the year.

D) as of the point in time where the maximum number of shares are outstanding.

A) as of the beginning of the year.

B) as of the end of the year.

C) as of the middle of the year.

D) as of the point in time where the maximum number of shares are outstanding.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

37

Time-series analysis helps answer all of the following questions except:

A) Is the firm becoming more or less profitable over time?

B) Is the firm becoming more or less risky?

C) How is management of the firm responding to external economic forces?

D) What is the amount of assets or capital required to generate a particular level of earnings?

A) Is the firm becoming more or less profitable over time?

B) Is the firm becoming more or less risky?

C) How is management of the firm responding to external economic forces?

D) What is the amount of assets or capital required to generate a particular level of earnings?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

38

The profit margin for ROA indicates the ability of a firm to generate earnings for a particular level of

A) sales

B) assets

C) working capital

D) shareholders' equity

A) sales

B) assets

C) working capital

D) shareholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is the primary objective in most financial statement analysis?

A) to value a firm's equity securities.

B) to look for unrecorded liabilities.

C) to establish a firm's strategy within the industry.

D) to define markets for the firm.

A) to value a firm's equity securities.

B) to look for unrecorded liabilities.

C) to establish a firm's strategy within the industry.

D) to define markets for the firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is not a way a company can achieve a low-cost position

A) economies of scale

B) production efficiency

C) customer service

D) outsourcing

A) economies of scale

B) production efficiency

C) customer service

D) outsourcing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

41

The computation of the additional shares to be issued on the exercise of stock options assumes that the firm would repurchase common shares on the open market using an

Amount equal to the sum of all the following except:

A) any cash proceeds from such exercise

B) net incremental shares issued

C) any unamortized compensation expense on those options

D) any tax benefits that would be credited to additional paid-in capital

Amount equal to the sum of all the following except:

A) any cash proceeds from such exercise

B) net incremental shares issued

C) any unamortized compensation expense on those options

D) any tax benefits that would be credited to additional paid-in capital

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

42

In order to measure how profitable a firm is in generating a return for its common shareholders,a financial analyst would examine the return on _____________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

43

Ramos Company

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a percentage change income statement over the period of 2009 to 2011,what is the change in net income?

A) 100%

B) 21.6%

C) 72.4%

D) 27.6%

Ramos Company included the following information in its annual report:

Refer to the information for Ramos Company.In a percentage change income statement over the period of 2009 to 2011,what is the change in net income?

A) 100%

B) 21.6%

C) 72.4%

D) 27.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

44

Carl Industries

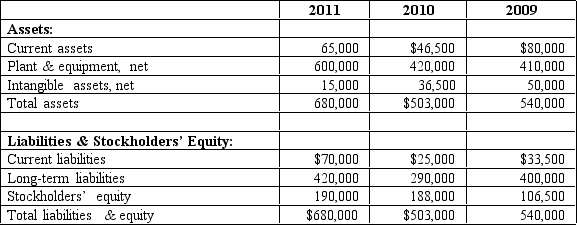

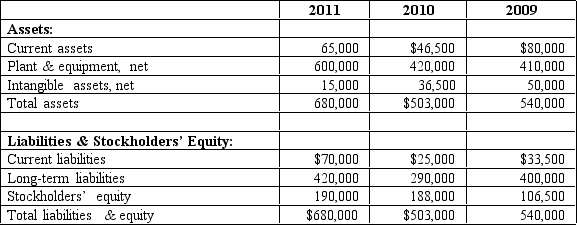

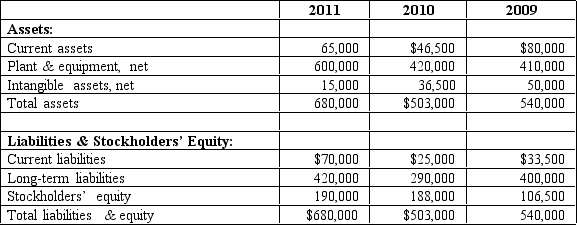

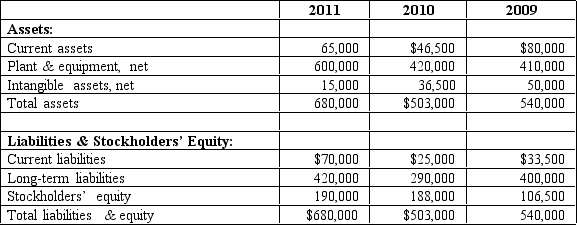

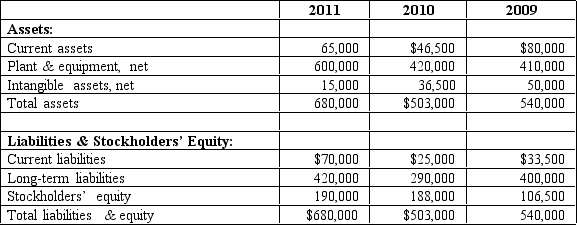

Carl Industries has condensed balance sheets as shown:

Refer to the information for Carl Industries.In a percentage change balance sheet over the period of 2009 to 2011,what is the change in long-term liabilities?

A) 94.7%

B) 15.4%

C) 5.3%

D) 5%

Carl Industries has condensed balance sheets as shown:

Refer to the information for Carl Industries.In a percentage change balance sheet over the period of 2009 to 2011,what is the change in long-term liabilities?

A) 94.7%

B) 15.4%

C) 5.3%

D) 5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

45

Firms with complex capital structures can use which of the following in calculating EPS

A) outstanding convertible bonds.

B) stock options exercised

C) stock warrants issued

D) all of the above

A) outstanding convertible bonds.

B) stock options exercised

C) stock warrants issued

D) all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

46

The three elements of risk that help in understanding differences across firms and changes over time in ROAs are:

A) product life cycles, cyclicality of sales, competitive constraint.

B) operating leverage, cyclicality of sales, product life cycles.

C) cyclicality of sales, competitive constraint, operating leverage.

D) operating leverage, competitive constraint, product life cycles.

A) product life cycles, cyclicality of sales, competitive constraint.

B) operating leverage, cyclicality of sales, product life cycles.

C) cyclicality of sales, competitive constraint, operating leverage.

D) operating leverage, competitive constraint, product life cycles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

47

Carl Industries

Carl Industries has condensed balance sheets as shown:

Refer to the information for Carl Industries.In a common size balance sheet for 2009,total liabilities and equity are expressed as

A) 25.9%

B) 100%

C) 74.1%

D) 103.6%

Carl Industries has condensed balance sheets as shown:

Refer to the information for Carl Industries.In a common size balance sheet for 2009,total liabilities and equity are expressed as

A) 25.9%

B) 100%

C) 74.1%

D) 103.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

48

When the financial analysts multiplies the profit margin for ROA with the assets turnover ratio the result is called______________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following are better indicated by percentage change statements than common-size statements?

A) monetary changes

B) profitability

C) stability

D) growth and decline

A) monetary changes

B) profitability

C) stability

D) growth and decline

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

50

Firms with ____________________ levels of operating leverage experience greater variability in their return on assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

51

Carl Industries

Carl Industries has condensed balance sheets as shown:

Refer to the information for Carl Industries.In a common size balance sheet for 2010,plant and equipment (net)is expressed as

A) 74.5%

B) 93.2%

C) 83.5 %

D) 30.5%

Carl Industries has condensed balance sheets as shown:

Refer to the information for Carl Industries.In a common size balance sheet for 2010,plant and equipment (net)is expressed as

A) 74.5%

B) 93.2%

C) 83.5 %

D) 30.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

52

Another term for earnings power is

A) nonrecurrent revenue.

B) nonrecurrent gains.

C) sustainable earnings.

D) net change in equity.

A) nonrecurrent revenue.

B) nonrecurrent gains.

C) sustainable earnings.

D) net change in equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

53

Carl Industries

Carl Industries has condensed balance sheets as shown:

Refer to the information for Carl Industries.In a percentage change balance sheet over the period of 2009 to 2011,what is the change in current assets?

A) 78.6%

B) (27.3%)

C) (21.4%)

D) (18.75%)

Carl Industries has condensed balance sheets as shown:

Refer to the information for Carl Industries.In a percentage change balance sheet over the period of 2009 to 2011,what is the change in current assets?

A) 78.6%

B) (27.3%)

C) (21.4%)

D) (18.75%)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

54

The ____________________ effect of interest expense on net income equals one minus the marginal tax rate times the interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

55

Return on assets will likely differ across firms and across time.Three elements of risk that will help explain these differences are ________________________________________,cyclicality of sales and stage and length of product life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

56

Return on assets will likely differ across firms and across time.Three elements of risk that will help explain these differences are operating leverage,___________________________________,and stage and length of product life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

57

Return on common equity can be disaggregated into profit margin for ROCE,capital structure leverage and _________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

58

Return on assets can be disaggregated into asset turnover and ____________________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

59

Common-size analysis requires the analyst to be aware that percentages can change because of all of the following except:

A) changes in expenses in the numerator independent of changes in sales

B) changes in sales independent of changes in expenses

C) interaction effects between the numerator and denominator

D) All of these are possible explanations.

A) changes in expenses in the numerator independent of changes in sales

B) changes in sales independent of changes in expenses

C) interaction effects between the numerator and denominator

D) All of these are possible explanations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

60

Firms with high operating leverage have a higher proportion of _________________________ in their cost structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

61

One problem with using EPS as a measure of profitability is that it does not consider the amount of ____________________ or ____________________ required to generate a particular level of earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

62

EPS is an ambiguous measure of profitability because it reflects operating performance in the numerator and ________________________________________ in the denominator.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

63

Inventory turnover is calculated by dividing ________________________________________ by average inventories.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

64

To reduce the risk inherent in ______________________________ a company should strive for a high proportion of variable costs in its cost structure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

65

Return on assets can be a misleading ratio when analyzing technology firms because two important assets,______________________________ and ______________________________ do not appear on their balance sheets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

66

All else being equal,firms with high levels of ________________________________________ incur more risk in their operations and should earn higher rates of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

67

Economic theory suggests that higher levels of ____________________ in any activity should lead to higher levels of ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

68

The ___________________________________ of interest expense on net income equals one minus the marginal tax rate times interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

69

When calculating the return on fixed assets sales is divided by _________________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

70

The rationale for adding back the _______________________________________________________ relates to attaining consistency in the numerator and denominator of ROA.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

71

________________________________________ is the level of earnings and the growth in the levels of earnings expected to persist in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

72

Accounts receivable turnover is calculated by dividing ________________________________________ by average net accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

73

When an analyst uses measures of past profitability to forecast the firm's future profitability the expectation is that those revenues,gains,expenses and losses will ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

74

Operating income is negative in an amount equal to _________________________ when revenues are zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

75

Below is financial information for two restaurant retailers.Popper's Company operates an innovative retail bakery-cafe business and franchising business.At the end 2010,Popper's had 132 company-owned and 346 franchise-operated bakery-cafes.Popper's located most of their unique bakery-cafe concept stores in suburban,strip mall,and regional mall locations.As a first mover in this concept,the company operates in 32 states.Simmer Corporation began operations five years earlier than Popper's and purchases and roasts whole bean coffees and sells them,along with numerous coffee drinks and related products at over 2,900 Company-operated retail stores.

Selected Data for Popper's Company and Simmer Corporation

(amounts in millions)

Required:

a.Compute the Inventory turnover,fixed asset turnover,and accounts receivable turnover.

b.Describe the likely reasons for the difference in the accounts receivable turnover and the inventory turnover

Selected Data for Popper's Company and Simmer Corporation

(amounts in millions)

Required:

a.Compute the Inventory turnover,fixed asset turnover,and accounts receivable turnover.

b.Describe the likely reasons for the difference in the accounts receivable turnover and the inventory turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

76

The ability of a firm to generate income from operations given a particular level of sales is measured by the ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

77

When calculating Basic earnings per share net income is adjusted by____________

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

78

Firms and industries characterized by heavy fixed capacity costs and lengthy periods required to add new capacity operate under a ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

79

The ability of a firm to manage the level of investment in assets for a particular level of sales is measured by the ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck

80

Firms that have either convertible securities or stock options or warrants outstanding have __________________________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 97 في هذه المجموعة.

فتح الحزمة

k this deck