Deck 10: Forecasting Financial Statements

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/63

العب

ملء الشاشة (f)

Deck 10: Forecasting Financial Statements

1

Projecting sales price changes depends on factors specific to the firm and its industry that might affect demand and price elasticity.Which of the following companies would most likely not be able to increase prices in the near future?

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to maintain its current production processes.

D) A firm operating in an industry that is transitioning from the introduction phase to the high growth phase of its life cycle.

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to maintain its current production processes.

D) A firm operating in an industry that is transitioning from the introduction phase to the high growth phase of its life cycle.

B

2

To ensure that the financial statements articulate,it is important that the change in the cash balance on the balance sheet each year agrees with

A) the cash collections from sales in the projected income statement.

B) the cash provided by or used by operations on the projected statement of cash flows.

C) the net change in cash on the projected statement of cash flows.

D) the net change in working capital from period to period.

A) the cash collections from sales in the projected income statement.

B) the cash provided by or used by operations on the projected statement of cash flows.

C) the net change in cash on the projected statement of cash flows.

D) the net change in working capital from period to period.

C

3

Financial statement forecasts rely on additivity within financial statements and articulation across financial statements.Given this information forecasts of future growth in inventory will most likely affect growth in

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

B

4

Using common-size balance sheet percentages to project individual assets,liabilities,or shareholders' equity has all of the following shortcomings except:

A) Individual assets, liabilities, and shareholders' equity are not independent

Of each other.

B) If a company experiences changing proportions for investments in securities among its assets, other asset categories may show decreasing percentages in some years even though their dollar amounts are increasing.

C) Individual assets, liabilities, and shareholders' equity are independent

Of each other.

D) The common-size percentages do not permit the analyst to easily change

The assumptions about the future behavior of an individual asset or liability.

A) Individual assets, liabilities, and shareholders' equity are not independent

Of each other.

B) If a company experiences changing proportions for investments in securities among its assets, other asset categories may show decreasing percentages in some years even though their dollar amounts are increasing.

C) Individual assets, liabilities, and shareholders' equity are independent

Of each other.

D) The common-size percentages do not permit the analyst to easily change

The assumptions about the future behavior of an individual asset or liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

5

Nichols and Wahlen's 2004 study showed that superior forecasting provides the potential to earn superior security returns.Nichols and Wahlen's findings indicate

A) that an investor could earn excess returns if the investor could predict accurately the sign of the change in earnings one year ahead.

B) that an investor could earn excess returns if the investor could predict accurately the magnitude of the change in earnings one year ahead.

C) that an investor could earn excess returns if the investor could predict accurately the sign of the change in cash flows from operations one year ahead.

D) that an investor could earn excess returns if the investor could predict accurately the sign of the change in working capital one year ahead.

A) that an investor could earn excess returns if the investor could predict accurately the sign of the change in earnings one year ahead.

B) that an investor could earn excess returns if the investor could predict accurately the magnitude of the change in earnings one year ahead.

C) that an investor could earn excess returns if the investor could predict accurately the sign of the change in cash flows from operations one year ahead.

D) that an investor could earn excess returns if the investor could predict accurately the sign of the change in working capital one year ahead.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

6

Card Sharks, Inc.

Card Sharks, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2011 amounted to $352,412 and the company expects growth in 2012 of 30% and in 2013 of 35%.

Given the information provided about Card Sharks,what is the company's 2012 projected year-end cash balance?

A) $966

B) $50,820

C) $15,623

D) $38,524

Card Sharks, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2011 amounted to $352,412 and the company expects growth in 2012 of 30% and in 2013 of 35%.

Given the information provided about Card Sharks,what is the company's 2012 projected year-end cash balance?

A) $966

B) $50,820

C) $15,623

D) $38,524

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

7

Projecting sales price changes depends on factors specific to the firm and its industry that might affect demand and price elasticity.Which of the following types of companies would most likely be able to increase prices?

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to experience technological improvements in its production process.

D) A firm operating in an industry that is transitioning from the high growth to the maturity phase of its life cycle.

A) A firm in a capital intensive industry that is expected to operate near capacity for the near future.

B) A firm in a capital intensive industry in which excess capacity exists.

C) A firm operating in an industry that is expected to experience technological improvements in its production process.

D) A firm operating in an industry that is transitioning from the high growth to the maturity phase of its life cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

8

All of the following are the fundamental bases for future payoffs to equity shareholders and share value except:

A) earnings

B) cash flows

C) dividends

D) depreciation

A) earnings

B) cash flows

C) dividends

D) depreciation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following statements does not apply to preventing "garbage in,garbage out" when implementing a forecasting game plan?

A) The quality of the financial statement forecasts will depend on the quality of the

Forecast assumptions.

B) The quantities forecasted within financial statement forecasts will depend on the quantity of the forecast assumptions.

C) Analysts should justify and evaluate the most important assumptions that reflect the critical risk and success factors of the firm's strategy.

D) Analysts can impose reality checks on the assumptions by analyzing the forecasted financial statements using ratios, common-size, and rate-of-change financial statements.

A) The quality of the financial statement forecasts will depend on the quality of the

Forecast assumptions.

B) The quantities forecasted within financial statement forecasts will depend on the quantity of the forecast assumptions.

C) Analysts should justify and evaluate the most important assumptions that reflect the critical risk and success factors of the firm's strategy.

D) Analysts can impose reality checks on the assumptions by analyzing the forecasted financial statements using ratios, common-size, and rate-of-change financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

10

All of the following are true regarding the key principles of forecasting except:

A) Financial statement forecasts need not be comprehensive.

B) Forecasts should not manifest wishful thinking.

C) Financial statement forecasts must be internally consistent.

D) Financial statement forecasts must rely on assumptions that have external validity.

A) Financial statement forecasts need not be comprehensive.

B) Forecasts should not manifest wishful thinking.

C) Financial statement forecasts must be internally consistent.

D) Financial statement forecasts must rely on assumptions that have external validity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

11

Card Sharks, Inc.

Card Sharks, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2011 amounted to $352,412 and the company expects growth in 2012 of 30% and in 2013 of 35%.

Given the information provided about Card Sharks,what is the company's 2013 projected annual sales?

A) $656,191

B) $493,377

C) $618,482

D) $542,333

Card Sharks, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2011 amounted to $352,412 and the company expects growth in 2012 of 30% and in 2013 of 35%.

Given the information provided about Card Sharks,what is the company's 2013 projected annual sales?

A) $656,191

B) $493,377

C) $618,482

D) $542,333

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

12

The objective of forecasting is to develop

A) stand-alone financial statements for future analysis.

B) a set of realistic expectations for future value-relevant payoffs.

C) a balance sheet and income statement that articulate.

D) financial statements for comparison to industry averages.

A) stand-alone financial statements for future analysis.

B) a set of realistic expectations for future value-relevant payoffs.

C) a balance sheet and income statement that articulate.

D) financial statements for comparison to industry averages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

13

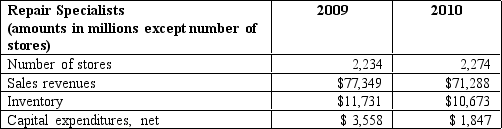

Sparky's

Sparky's sells auto parts. Provided below is selected financial information from the company's 2012 annual report:

-Using Sparky's financial information what is the company's inventory turnover ratio for 2012?

A) 0.69

B) 1.00

C) 3.35

D) 4.03

Sparky's sells auto parts. Provided below is selected financial information from the company's 2012 annual report:

-Using Sparky's financial information what is the company's inventory turnover ratio for 2012?

A) 0.69

B) 1.00

C) 3.35

D) 4.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

14

When projecting operating expenses it is important to determine the mix of fixed and variable costs,one clue suggesting the presence of fixed costs is

A) the percentage change in cost of goods sold in prior years is significantly greater than the percentage change in sales.

B) the percentage change in cost of goods sold in prior years is significantly less than the percentage change in sales.

C) low capital intensity in the production process.

D) the percentage change in sales in prior years is significantly greater than the percentage change in receivables.

A) the percentage change in cost of goods sold in prior years is significantly greater than the percentage change in sales.

B) the percentage change in cost of goods sold in prior years is significantly less than the percentage change in sales.

C) low capital intensity in the production process.

D) the percentage change in sales in prior years is significantly greater than the percentage change in receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

15

Sparky's

Sparky's sells auto parts. Provided below is selected financial information from the company's 2012 annual report:

-Sparky's forecasts that sales will grow by 25% in 2013 and that its cost of goods sold to sales ratio will be the same in 2013 as it was in 2012.If these assumptions prove correct and Sparky's inventory turnover ratio for 2013 is 4.5 what will be the level of inventory at the end of 2013?

A) $31,353

B) $26,475

C) $40,000

D) $42,314

Sparky's sells auto parts. Provided below is selected financial information from the company's 2012 annual report:

-Sparky's forecasts that sales will grow by 25% in 2013 and that its cost of goods sold to sales ratio will be the same in 2013 as it was in 2012.If these assumptions prove correct and Sparky's inventory turnover ratio for 2013 is 4.5 what will be the level of inventory at the end of 2013?

A) $31,353

B) $26,475

C) $40,000

D) $42,314

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

16

An analyst using the inventory turnover ratio to calculate future levels of inventory may face the problem that

A) the method reduces the potential understatement inherent in average balances.

B) the method can introduce artificial volatility in ending balances.

C) the method results in understating inventory each year.

D) the method results in overstating inventory each year.

A) the method reduces the potential understatement inherent in average balances.

B) the method can introduce artificial volatility in ending balances.

C) the method results in understating inventory each year.

D) the method results in overstating inventory each year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a company has very low operating leverage (i.e.a low proportion of fixed costs in the cost structure)and no changes are expected in operations

A) percentage change income statement percentages can serve as the basis for projecting operating expenses.

B) using common-size income statement percentages will overstate future projected operating expenses.

C) using common-size income statement percentages will understate future projected operating expenses.

D) using common-size income statement percentages can serve as a reasonable basis for projecting future operating expenses.

A) percentage change income statement percentages can serve as the basis for projecting operating expenses.

B) using common-size income statement percentages will overstate future projected operating expenses.

C) using common-size income statement percentages will understate future projected operating expenses.

D) using common-size income statement percentages can serve as a reasonable basis for projecting future operating expenses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

18

Financial statement forecasts rely on additivity within financial statements and articulation across financial statements.Given this information sales growth forecasts will most likely affect growth in

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

A) accounts receivables.

B) accounts payable.

C) depreciation.

D) salary payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a firm competes in a capital-intensive industry with excess capacity,all of the following are true except:

A) price increases will be less likely.

B) price increases will be more likely.

C) companies in competitive industries face high exit barriers.

D) companies in competitive industries may experience future price decreases.

A) price increases will be less likely.

B) price increases will be more likely.

C) companies in competitive industries face high exit barriers.

D) companies in competitive industries may experience future price decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

20

Card Sharks, Inc.

Card Sharks, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2011 amounted to $352,412 and the company expects growth in 2012 of 30% and in 2013 of 35%.

Given the information provided about Card Sharks,what is the company's 2013 projected cash balance?

A) $53,934

B) $49,524

C) $21,873

D) $50,820

Card Sharks, Inc. sells baseball cards and other memorabilia. The company tries to maintain a cash balance equivalent to approximately 30 days of sales. Sales in 2011 amounted to $352,412 and the company expects growth in 2012 of 30% and in 2013 of 35%.

Given the information provided about Card Sharks,what is the company's 2013 projected cash balance?

A) $53,934

B) $49,524

C) $21,873

D) $50,820

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

21

As a firm progresses through the introduction life-cycle stage,what type of flexible account will it be more likely to use to balance the balance sheet?

A) dividends.

B) growth related assets.

C) issued equity.

D) stock buy-backs.

A) dividends.

B) growth related assets.

C) issued equity.

D) stock buy-backs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

22

Financial statement forecasts should rely on _________________________ across financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

23

Realistic expectations are ____________________ and ____________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

24

The formula for forecasting inventory is ____________ /365 X .

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

25

All of the following statements are true regarding ratios and forecasts except:

A) Ratios cannot confirm whether forecast assumptions will turn out to be correct.

B) Ratios can tell whether future sales growth was accurately captured.

C) Ratios cannot tell whether assumptions about future cash flows are realistic.

D) Ratios can tell whether growth rates for sales are consistent with past sales growth performance.

A) Ratios cannot confirm whether forecast assumptions will turn out to be correct.

B) Ratios can tell whether future sales growth was accurately captured.

C) Ratios cannot tell whether assumptions about future cash flows are realistic.

D) Ratios can tell whether growth rates for sales are consistent with past sales growth performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

26

It may be difficult to forecast sales for firms with _________________________ patterns because their historical growth rates reflect wide variations in both direction and amount from year to year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

27

As a firm progresses through the growth life-cycle stage,what type of flexible account will it be more likely to use to balance the balance sheet?

A) issued debt.

B) paying down of debt.

C) dividends

D) stock buy-backs.

A) issued debt.

B) paying down of debt.

C) dividends

D) stock buy-backs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

28

Projected financial statements can be used to assess the sensitivity of all of the following except:

A) a firm's liquidity

B) a firm's leverage to changes in assumptions

C) conditions under which the firm's debt covenants may become binding

D) unusual patterns for projected total assets.

A) a firm's liquidity

B) a firm's leverage to changes in assumptions

C) conditions under which the firm's debt covenants may become binding

D) unusual patterns for projected total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

29

Financial statement forecasts are important analysis tools because forecasts of ______________________________ play a central role in valuation and many other financial decision contexts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

30

A firm in a mature industry with little expected change in its market share might anticipate volume increases equal to the growth rate in the _________________________ within its geographic markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

31

Financial ratio,percentage,and trend comparisons can be distorted by all of the following except:

A) aggressive revenue recognition practices.

B) the timing of asset purchases.

C) accounting for similar economic fundamentals in similar fashion.

D) the presence of nonrecurring items among the firms being analyzed.

A) aggressive revenue recognition practices.

B) the timing of asset purchases.

C) accounting for similar economic fundamentals in similar fashion.

D) the presence of nonrecurring items among the firms being analyzed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

32

All of the following are true regarding projected financial statements except:

A) The statement of cash flows is the most critical forecast since it reflects profitability rather than viability.

B) Preparing projected financial statements must incorporate a company's past performance records.

C) Preparing projected financial statements must incorporate a company's current performance records.

D) The income statement demonstrates immediate capability to service debt for banks or real potential for growth in returns for venture capital.

A) The statement of cash flows is the most critical forecast since it reflects profitability rather than viability.

B) Preparing projected financial statements must incorporate a company's past performance records.

C) Preparing projected financial statements must incorporate a company's current performance records.

D) The income statement demonstrates immediate capability to service debt for banks or real potential for growth in returns for venture capital.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

33

In developing forecasts of expenses the analyst must take into consideration that expenses can be broken down into ________________________ or ______________________ components.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

34

Financial statement forecasts should rely on ____________________ within financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

35

Firms which have differentiated ___________________________________ for its products may have a greater potential to increase prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

36

To develop forecasts of individual assets,the analyst must first link historical growth rates for individual assets to historical growth rates in ____________________ and other activity-based drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

37

A company that has a cost structure in which its costs grow at a lesser rate than its sale enjoys ___________________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

38

Common-size financial statements recast each statement item as

A) a percentage of the "bottom line."

B) a percentage using industry averages for the "base number."

C) a percentage using a base year number for each line item.

D) a percentage of some "base number" on the financial statement in question.

A) a percentage of the "bottom line."

B) a percentage using industry averages for the "base number."

C) a percentage using a base year number for each line item.

D) a percentage of some "base number" on the financial statement in question.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

39

As a firm progresses through the decline life-cycle stage,what type of flexible account will it be more likely to use to balance the balance sheet?

A) issued debt.

B) growth related assets.

C) issued equity.

D) stock buy-backs.

A) issued debt.

B) growth related assets.

C) issued equity.

D) stock buy-backs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

40

For some types of assets,such as plant,property and equipment,asset growth typically ____________________ future sales growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

41

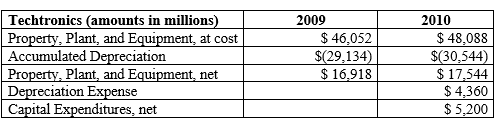

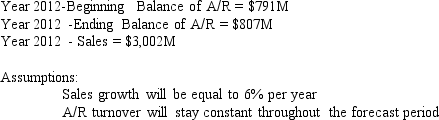

Techtronics is a leader in manufacturing computer chips,which is very capital-intensive.Because the production processes in computer chip manufacturing require sophisticated and rapidly changing technology,production and manufacturing assets in the chip industry tend to have relatively short useful lives.

The following summary information relates to Techtronics' property,plant,and

equipment for 2009 and 2010:

Required

Assume that Techtronics depreciates all property,plant,and equipment using the straight-line

depreciation method and zero salvage value.Assume that Intel spends $6,000 on new

depreciable assets in Year 1 and does not sell or retire any property,plant,and equipment

during Year1. a.Compute the average useful life that Techtronics used for depreciation in 2010.

b.Project total depreciation expense for Year 1 using the following steps: (i)project

depreciation expense for Year 1 on existing property,plant,and equipment at the

end of 2010;(ii)project depreciation expense on capital expenditures in Year 1

assuming that Intel takes a full year of depreciation in the first year of service;and

(iii)sum the results of (i)and (ii)to obtain total depreciation expense for Year 1.

c.Project the Year 1 ending balance in property,plant,and equipment,both at cost

and net of accumulated depreciation.

The following summary information relates to Techtronics' property,plant,and

equipment for 2009 and 2010:

Required

Assume that Techtronics depreciates all property,plant,and equipment using the straight-line

depreciation method and zero salvage value.Assume that Intel spends $6,000 on new

depreciable assets in Year 1 and does not sell or retire any property,plant,and equipment

during Year1. a.Compute the average useful life that Techtronics used for depreciation in 2010.

b.Project total depreciation expense for Year 1 using the following steps: (i)project

depreciation expense for Year 1 on existing property,plant,and equipment at the

end of 2010;(ii)project depreciation expense on capital expenditures in Year 1

assuming that Intel takes a full year of depreciation in the first year of service;and

(iii)sum the results of (i)and (ii)to obtain total depreciation expense for Year 1.

c.Project the Year 1 ending balance in property,plant,and equipment,both at cost

and net of accumulated depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a firm operates at less then full capacity then price _______________________ are not likely

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

43

When projecting ____________________,the analyst should consider economy-wide factors such as the expected rate of general price inflation in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

44

Based on the following statement from the text," to develop forecasts of individual operating assets and liabilities,you must first determine the underlying operating activities that drive them".Explain what those underlying activities are?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

45

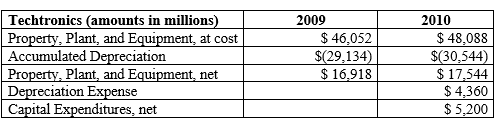

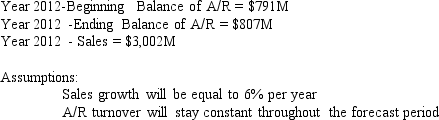

The following information about Douglas Corp.'s Accounts Receivable and Sales are presented below:

Required: a.Using this information,forecast Douglas Corp.'s the growth in Accounts Receivable for years 2013-2017.

b.What problem does a constant A/R turnover assumption cause?

c.Provide a solution to the problem caused by a constant A/R turnover assumption.

Required: a.Using this information,forecast Douglas Corp.'s the growth in Accounts Receivable for years 2013-2017.

b.What problem does a constant A/R turnover assumption cause?

c.Provide a solution to the problem caused by a constant A/R turnover assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

46

Analysts must develop realistic expectations for the outcomes of future business activities.

To develop these expectations,analysts build a set of _____________________________.

To develop these expectations,analysts build a set of _____________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

47

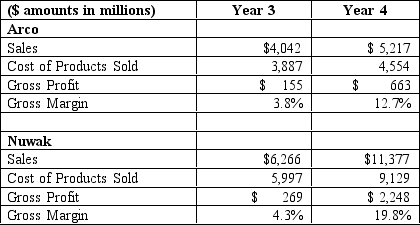

Arco is an integrated manufacturer in capital-intensive industry.Nuwak manufactures more commodity-level products in the same industry at the lower end of the market and uses less capital-intensive processes.The following data describe sales and cost of products sold for both firms for Years 3 and 4.

Industry analysts anticipate the following annual changes in sales for the next five years:

Year +1,5 percent increase;Year +2,10 percent increase;Year +3,20 percent increase;Year +4,10 percent decrease;Year +5,20 percent decrease.

Required: a.The analyst can sometimes estimate the variable cost as a percentage of sales for a

particular cost (for example,cost of products sold)by dividing the amount of the

change in the cost item between two years by the amount of the change in sales for

those two years.The analyst can then multiply the variable-cost percentage times

sales to estimate the total variable cost.Subtracting the variable cost from the total

cost yields an estimate of the fixed cost for that particular cost item.Follow this procedure

to estimate the manufacturing cost structure (variable cost as a percentage of

sales,total variable costs,and total fixed costs)for cost of products sold for both Arco and Nuwak in Year 4.

b.Discuss the structure of manufacturing cost (that is,fixed versus variable)for each

firm in light of the manufacturing process and type of product produced.

c.Using the analysts' forecasts of sales changes,compute the projected sales,cost of

products sold,gross profit,and gross margin (gross profit as a percentage of sales)

of each firm for Year +1 through Year +5.

d.Why do the levels and variability of the gross margin percentages differ for these two

firms for Year +1 through Year +5?

Industry analysts anticipate the following annual changes in sales for the next five years:

Year +1,5 percent increase;Year +2,10 percent increase;Year +3,20 percent increase;Year +4,10 percent decrease;Year +5,20 percent decrease.

Required: a.The analyst can sometimes estimate the variable cost as a percentage of sales for a

particular cost (for example,cost of products sold)by dividing the amount of the

change in the cost item between two years by the amount of the change in sales for

those two years.The analyst can then multiply the variable-cost percentage times

sales to estimate the total variable cost.Subtracting the variable cost from the total

cost yields an estimate of the fixed cost for that particular cost item.Follow this procedure

to estimate the manufacturing cost structure (variable cost as a percentage of

sales,total variable costs,and total fixed costs)for cost of products sold for both Arco and Nuwak in Year 4.

b.Discuss the structure of manufacturing cost (that is,fixed versus variable)for each

firm in light of the manufacturing process and type of product produced.

c.Using the analysts' forecasts of sales changes,compute the projected sales,cost of

products sold,gross profit,and gross margin (gross profit as a percentage of sales)

of each firm for Year +1 through Year +5.

d.Why do the levels and variability of the gross margin percentages differ for these two

firms for Year +1 through Year +5?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

48

For some types of assets,such as accounts receivable,asset growth typically ____________________ future sales growth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

49

The first step in the forecasting game plan is to project sales and other other operating activities.Sales numbers are determined by both a volume component and price component.Projecting prices depends on factors specific to the firm and its industry that might affect demand and price elasticity.For the following types of firms discuss whether it would be likely that the firm would be able to raise future prices:

a.A firm in a capital-intensive industry that is expected to operate near capacity for the near future.

b.A firm in an industry that is expected to experience numerous technological improvements.

c.A firm with products which are transitioning from the growth to maturity phase of the product life cycle.

d.A firm that has established a well known brand name and image.

a.A firm in a capital-intensive industry that is expected to operate near capacity for the near future.

b.A firm in an industry that is expected to experience numerous technological improvements.

c.A firm with products which are transitioning from the growth to maturity phase of the product life cycle.

d.A firm that has established a well known brand name and image.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

50

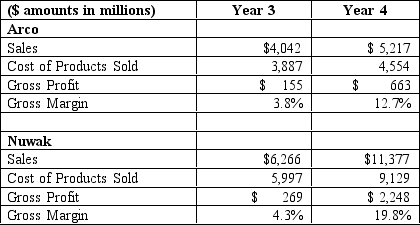

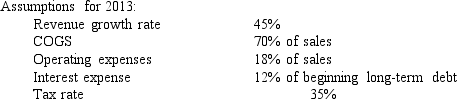

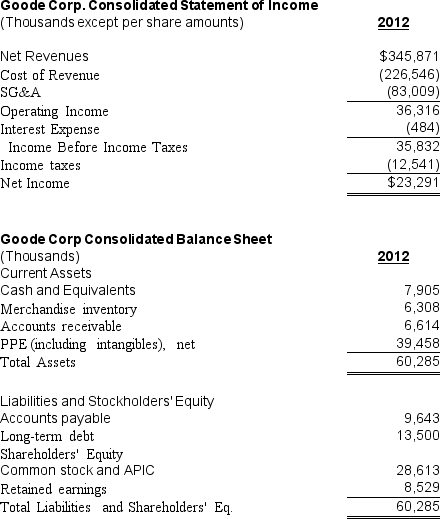

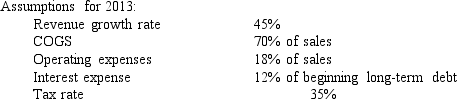

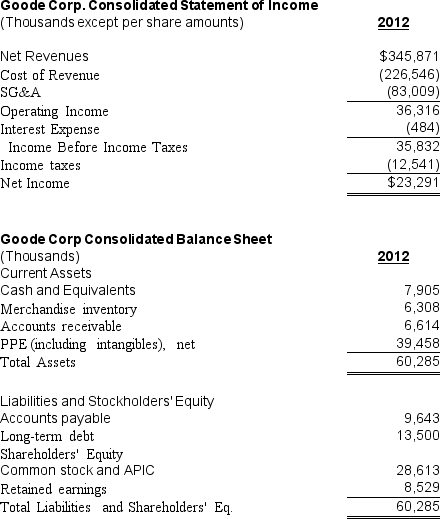

The following balance sheet and income statement pertain to Goode Corp.,using the following assumptions complete a forecasted 2013 income statement:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

51

Office Mart,Inc.sells numerous office supply products through a national distribution center.The company has focused on maintaining a cash balance equivalent to approximately 14 days of sales.Sales in 2010 amounted to $125,980,673 and the company expects growth in 2011 of 11% and in 2012 of 15%.Given this information determine Office Mart,Inc.'s projected year-end cash balance for 2011 and 2012.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

52

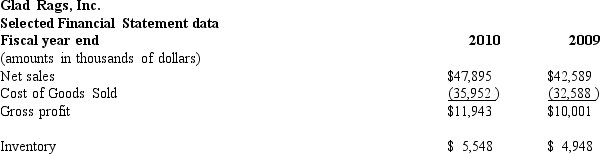

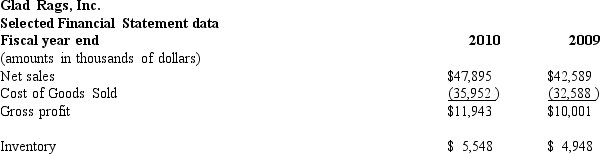

Glad Rags,Inc.sells women's clothes.Provided below is selected financial statement information:

Required: a.Compute the inventory turnover ratio for 2010.

b.Clothes,Inc.projects that sales will grow at a compound rate of 7% per year for years 2011-2013 and that the cost of goods sold to sales percentage will equal that realized in 2010.Compute the projected implied level of inventory at the end of 2011 to 2013.

Required: a.Compute the inventory turnover ratio for 2010.

b.Clothes,Inc.projects that sales will grow at a compound rate of 7% per year for years 2011-2013 and that the cost of goods sold to sales percentage will equal that realized in 2010.Compute the projected implied level of inventory at the end of 2011 to 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

53

As an analyst it is important when projecting sales to make estimates about future changes in sales volume.Compare how you might make estimates about future sales value for a company in a mature industry and one in a rapidly growing industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

54

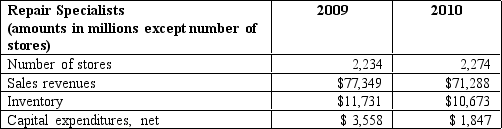

Repair Specialists is a leading retailer of home improvement products.It operates large warehouse-style stores.Despite declining sales and difficult economic conditions in 2009 and 2010,Repair Specialists continued to invest in new stores.The following table provides summary data for Repair Specialists.

Required:

a.Use the preceding data for Repair Specialists to compute average revenues per store,

capital spending per new store,and ending inventory per store in 2010.

b.Assume that Repair Specialists will add 100 new stores by the end of Year1.Use

the data from 2010 to project Year 1 sales revenues,capital spending,and ending

inventory.Assume that each new store will be open for business for an average of

one-half year in Year1.For simplicity,assume that in Year 1,Repair Specialists' sales

revenues will grow,but only because it will open new stores.

Required:

a.Use the preceding data for Repair Specialists to compute average revenues per store,

capital spending per new store,and ending inventory per store in 2010.

b.Assume that Repair Specialists will add 100 new stores by the end of Year1.Use

the data from 2010 to project Year 1 sales revenues,capital spending,and ending

inventory.Assume that each new store will be open for business for an average of

one-half year in Year1.For simplicity,assume that in Year 1,Repair Specialists' sales

revenues will grow,but only because it will open new stores.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

55

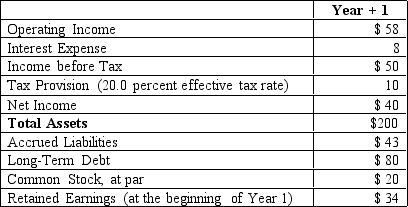

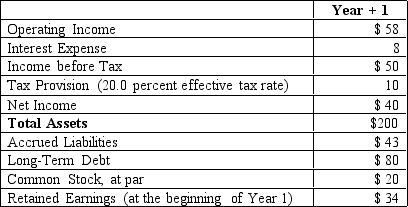

Simmons Company

These data represent a summary of your first-iteration forecast amounts for Year1.Simmons uses dividends as a flexible financial account.

A.See the information for Simmons Company.

Compute the amount of dividends you can assume that Simmons will pay in order to balance your projected balance sheet.Present the projected balance sheet.

B.See the information for Simmons Company.

Now assume that Simmons pays common shareholders a dividend of $25 in Year +1.Also assume that Simmons uses long-term debt as a flexible financial account,increasing borrowing when it needs capital and paying down debt when it generates excess capital.For simplicity,assume that Simmons pays 10.0 percent interest expense on the ending balance in long-term debt for the year and that interest expense is tax deductible at Simmons' average tax rate of 20.0 percent.

Present the projected income statement and balance sheet for Year +1.(Hint: Because of the circularity between interest expense,net income,and debt,several iterations may be needed to balance the projected balance sheet and to have the projected balance sheet articulate with net income.You may find it helpful to program a spreadsheet to work the iterative computations.)

These data represent a summary of your first-iteration forecast amounts for Year1.Simmons uses dividends as a flexible financial account.

A.See the information for Simmons Company.

Compute the amount of dividends you can assume that Simmons will pay in order to balance your projected balance sheet.Present the projected balance sheet.

B.See the information for Simmons Company.

Now assume that Simmons pays common shareholders a dividend of $25 in Year +1.Also assume that Simmons uses long-term debt as a flexible financial account,increasing borrowing when it needs capital and paying down debt when it generates excess capital.For simplicity,assume that Simmons pays 10.0 percent interest expense on the ending balance in long-term debt for the year and that interest expense is tax deductible at Simmons' average tax rate of 20.0 percent.

Present the projected income statement and balance sheet for Year +1.(Hint: Because of the circularity between interest expense,net income,and debt,several iterations may be needed to balance the projected balance sheet and to have the projected balance sheet articulate with net income.You may find it helpful to program a spreadsheet to work the iterative computations.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

56

The authors set forth a seven-step forecasting game plan for preparing pro forma financial statements.Discuss the seven steps necessary to prepare the three principal financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

57

One problem caused by using turnover ratios to calculate asset balances is that it can lead to volatility in projected ending balances.What might an analyst do to reduce the "sawtooth" pattern caused by using turnover ratios?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

58

Required:

a.An analyst can sometimes estimate the variable cost as a percentage of sales for a particular cost by dividing the amount of the change in the cost item between two years by the amount of the change in sales for those two years.The analyst can then multiply the variable cost percentage times sales to determine the total variable cost.Subtracting the variable cost yields the fixed cost for that particular item.Follow this procedure to determine the cost structure for costs of goods sold for Bargains,Inc.

b.Bargains,Inc.projects sales to grow at the following percentages in future years: 2011,10percent;2012,12 percent;2013,16 percent.Using this information project sales,cost of goods sold and gross profit for Bargains,Inc.for 2011 to 2013.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

59

In comparison of 2010 to 2009 performance,Watson Company's inventory turnover decreased substantially,although sales and inventory amounts were essentially unchanged.

Required:

During a corporate meeting you heard the following managers postulate why the decreased inventory turnover ratio happened.Which statement best explains the decreased inventory turnover ratio and why? a.The marketing manager said: The decreased inventory turnover ratio is due to an increase in the cost of goods sold.

b.The operations manager said: The decreased inventory turnover ratio is due to increased gross profit percentage.

c.The credit manager said: The decreased inventory turnover ratio is due to a decrease in the accounts receivable turnover.

d.The shipping manager said: The decreased inventory turnover ratio is due toinventory being shipped FOB destination point which keeps those items in inventory until they reach the purchasers warehouse.

Required:

During a corporate meeting you heard the following managers postulate why the decreased inventory turnover ratio happened.Which statement best explains the decreased inventory turnover ratio and why? a.The marketing manager said: The decreased inventory turnover ratio is due to an increase in the cost of goods sold.

b.The operations manager said: The decreased inventory turnover ratio is due to increased gross profit percentage.

c.The credit manager said: The decreased inventory turnover ratio is due to a decrease in the accounts receivable turnover.

d.The shipping manager said: The decreased inventory turnover ratio is due toinventory being shipped FOB destination point which keeps those items in inventory until they reach the purchasers warehouse.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

60

A firm in transition from the high growth to the mature phase of its life cycle,or a firm with significant technological improvements in its production processes,might expect increases in ______________________________ but decreases in sales prices per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

61

Benson sells books through retail stores and on the Web.For a retailer like Benson,inventory is a critical element of the business and it is necessary to carry a wide array of titles.In 2010,sales totaled $5,122 million and cost of sales and occupancy totaled $3,541 million.Inventories constitute the largest asset on Benson's balance sheet,totaling $1,203 million at the end of 2010 and $1,358 million at the end of 2009.

Required:

a.Compute the inventory turnover ratio for Benson for 2010.

b.Over the last two years,the number of Benson retail stores has remained fairly steady and sales have grown at a compounded annual rate of 11.6 percent.Assume that the number of stores will remain constant and that sales will continue to grow at an annual rate of 11.6 percent each year between Year +1 and Year +5.Also assume that the future cost of goods sold to sales percentage will equal that realized in 2010 (which is very similar to the cost of goods sold percentage over the past three years).Project the amount of inventory at the end of Year +1 through Year +5 using the inventory turnover ratio computed in Part a.Also compute the percentage change in inventories between each of the year-ends between 2010 and Year +5.Does the pattern of growth in your projections of Benson inventory seem reasonable to you considering the assumptions of smooth growth in sales and steady cost of goods sold percentages? Explain.

c.The changes in inventories in Part b display the sawtooth pattern depicted in Exhibit 10.5 of the text.Smooth the changes in the inventory forecasts between 2010 and Year +5 using the compound annual growth rate in inventories between the end of 2010 and the end of Year +5 implied by the projections in Part b.Does this pattern of growth seem more reasonable? Explain.

d.Now suppose that instead of following the smoothing approach in Part c,you used the rate of growth in inventory during 2010 to project future inventory balances at the end of Year +1 through Year +5.Use these projections to compute the implied inventory turnover rates.Does this pattern of growth and efficiency in inventory for Benson seem reasonable? Explain.

Required:

a.Compute the inventory turnover ratio for Benson for 2010.

b.Over the last two years,the number of Benson retail stores has remained fairly steady and sales have grown at a compounded annual rate of 11.6 percent.Assume that the number of stores will remain constant and that sales will continue to grow at an annual rate of 11.6 percent each year between Year +1 and Year +5.Also assume that the future cost of goods sold to sales percentage will equal that realized in 2010 (which is very similar to the cost of goods sold percentage over the past three years).Project the amount of inventory at the end of Year +1 through Year +5 using the inventory turnover ratio computed in Part a.Also compute the percentage change in inventories between each of the year-ends between 2010 and Year +5.Does the pattern of growth in your projections of Benson inventory seem reasonable to you considering the assumptions of smooth growth in sales and steady cost of goods sold percentages? Explain.

c.The changes in inventories in Part b display the sawtooth pattern depicted in Exhibit 10.5 of the text.Smooth the changes in the inventory forecasts between 2010 and Year +5 using the compound annual growth rate in inventories between the end of 2010 and the end of Year +5 implied by the projections in Part b.Does this pattern of growth seem more reasonable? Explain.

d.Now suppose that instead of following the smoothing approach in Part c,you used the rate of growth in inventory during 2010 to project future inventory balances at the end of Year +1 through Year +5.Use these projections to compute the implied inventory turnover rates.Does this pattern of growth and efficiency in inventory for Benson seem reasonable? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

62

Hart designs,manufactures,and markets toys in domestic and international markets.Sales during 2010 totaled $4,022 million.Accounts receivable totaled $655 million at the beginning of 2010 and $612 million at the end of 2010.

Required: a.Use the average balance to compute the accounts receivable turnover ratio for Hart for 2010.

b.Hart generated a compound annual sales growth rate of 13.0 percent over the past two years.Assume that Hart's sales will continue to grow at that rate each year for Year +1 through Year +5 and that the accounts receivable turnover ratio each year will equal the ratio computed in requirement a.for 2010.Project the amount of accounts receivable at year-end through Year +5 based on the accounts receivable turnover computed in requirement a.Also compute the percentage change in accounts receivable between each of the year-ends through Year +5.

c.Does the pattern of growth in your projections of Hart's accounts receivable seem

reasonable considering the assumptions of smooth growth in sales and steady turnover? Explain.

d.The changes in accounts receivable computed in requirement b.display the sawtooth pattern depicted in Exhibit 10.5 in the text.Smooth the changes in accounts receivable by computing the year-end accounts receivable balances for Year 1 through Year 5 using the compound annual growth rate in accounts receivable between the end of 2010 and the end of Year +1 from requirement b.

e.Smooth the changes in accounts receivable using the compound annual growth rate in accounts receivable between the end of 2010 and the end of Year +4 from requirement b.Apply this growth rate to compute accounts receivable at the end of Year +1 through Year +5.Why do the amounts for ending accounts receivable using the growth rate from requirement d.differ from those using the growth rate from this requirement?

f.Compute the accounts receivable turnover for 2010 by dividing sales by the balance in accounts receivable at the end of 2010 (instead of using average accounts receivable as in requirement a).Use this accounts receivable turnover ratio to compute the projected balance in accounts receivable at the end of Year +1 through Year +5.Also compute the percentage change in accounts receivable between the year-ends for Year +1 through Year +5.

Required: a.Use the average balance to compute the accounts receivable turnover ratio for Hart for 2010.

b.Hart generated a compound annual sales growth rate of 13.0 percent over the past two years.Assume that Hart's sales will continue to grow at that rate each year for Year +1 through Year +5 and that the accounts receivable turnover ratio each year will equal the ratio computed in requirement a.for 2010.Project the amount of accounts receivable at year-end through Year +5 based on the accounts receivable turnover computed in requirement a.Also compute the percentage change in accounts receivable between each of the year-ends through Year +5.

c.Does the pattern of growth in your projections of Hart's accounts receivable seem

reasonable considering the assumptions of smooth growth in sales and steady turnover? Explain.

d.The changes in accounts receivable computed in requirement b.display the sawtooth pattern depicted in Exhibit 10.5 in the text.Smooth the changes in accounts receivable by computing the year-end accounts receivable balances for Year 1 through Year 5 using the compound annual growth rate in accounts receivable between the end of 2010 and the end of Year +1 from requirement b.

e.Smooth the changes in accounts receivable using the compound annual growth rate in accounts receivable between the end of 2010 and the end of Year +4 from requirement b.Apply this growth rate to compute accounts receivable at the end of Year +1 through Year +5.Why do the amounts for ending accounts receivable using the growth rate from requirement d.differ from those using the growth rate from this requirement?

f.Compute the accounts receivable turnover for 2010 by dividing sales by the balance in accounts receivable at the end of 2010 (instead of using average accounts receivable as in requirement a).Use this accounts receivable turnover ratio to compute the projected balance in accounts receivable at the end of Year +1 through Year +5.Also compute the percentage change in accounts receivable between the year-ends for Year +1 through Year +5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck

63

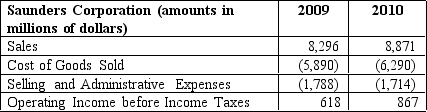

Saunders Corporation manufactures consumer electronics products.Selected income statement data for 2009 and 2010 follow (amounts in millions of dollars):

Required: a.The analyst can sometimes estimate the variable cost as a percentage of sales for a particular cost (for example,cost of goods sold)by dividing the amount of the change in the cost item between two years by the amount of the change in sales for those two years.The analyst can then multiply total sales by the variable-cost percentage to determine the total variable cost.Subtracting the variable cost from the total cost yields the fixed cost component for that particular cost item.Follow this procedure to determine the cost structure (fixed cost plus variable cost as a percentage of sales)for cost of goods sold for Saunders.

b.Repeat requirement a.for selling and administrative expenses.

c.Saunders Corporation discloses that it expects sales to grow at the following percentages

in future years: Year 1,12 percent;Year 2,10 percent;Year 3,8 percent;Year 4,6 percent.Project sales,cost of goods sold,selling and administrative expenses,and operating income before income taxes for Saunders for Year 1 to Year 4 using the cost structure amounts derived in requirements a.and b.

d.Compute the ratio of operating income before income taxes to sales for Year 1 through Year 4.

e.Interpret the changes in the ratio computed in requirement d.in light of the expected changes in sales.

Required: a.The analyst can sometimes estimate the variable cost as a percentage of sales for a particular cost (for example,cost of goods sold)by dividing the amount of the change in the cost item between two years by the amount of the change in sales for those two years.The analyst can then multiply total sales by the variable-cost percentage to determine the total variable cost.Subtracting the variable cost from the total cost yields the fixed cost component for that particular cost item.Follow this procedure to determine the cost structure (fixed cost plus variable cost as a percentage of sales)for cost of goods sold for Saunders.

b.Repeat requirement a.for selling and administrative expenses.

c.Saunders Corporation discloses that it expects sales to grow at the following percentages

in future years: Year 1,12 percent;Year 2,10 percent;Year 3,8 percent;Year 4,6 percent.Project sales,cost of goods sold,selling and administrative expenses,and operating income before income taxes for Saunders for Year 1 to Year 4 using the cost structure amounts derived in requirements a.and b.

d.Compute the ratio of operating income before income taxes to sales for Year 1 through Year 4.

e.Interpret the changes in the ratio computed in requirement d.in light of the expected changes in sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 63 في هذه المجموعة.

فتح الحزمة

k this deck