Deck 24: Professional Money Management, alternative Assets, and Industry Ethics

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/108

العب

ملء الشاشة (f)

Deck 24: Professional Money Management, alternative Assets, and Industry Ethics

1

The total market value of all assets of a mutual fund divided by the number of shares of the fund is known as the net asset value.

True

2

A closed-end investment company is normally referred to as a mutual fund.

False

3

Open-end investment companies continue to sell and repurchase shares after their initial public offering.

True

4

An open-end investment company differs from a closed-end investment company by the way they operate after the initial public offering.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

5

The market price of shares of a closed-end fund is typically determined by supply and demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

6

Income distributions and capital gains distributions are the only source of returns for mutual funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

7

A no-load fund imposes a substantial sales charge and sells shares at their NAV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

8

The primary purpose of government regulations and voluntary standards in the professional asset management industry is to ensure that managers deal with all investors fairly and equitably and that information about investment performance is accurately reported.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

9

Management and advisory firms can advise clients on how to structure their own portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

10

High Portfolio turnover lowers mutual fund costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

11

The total market value of all assets of a mutual fund divided by the number of shares of the fund is known as the net asset value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

12

All investment firms charge annual management fees to compensate the professional manager of the fund.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

13

In an investment company,the invested funds belong to many individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

14

A portfolio is generally managed by the board of directors of an investment company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

15

The returns received by the average individual investor on funds managed by investment companies will probably be superior to the average results for a specific U.S.or international market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

16

The market price of shares of a closed-end fund is typically determined by supply and demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

17

Diversifying a portfolio to eliminate unsystematic risk is one of the major benefits of investing in mutual funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

18

Hedge funds have no limitations on when and how often capital can be contributed or removed from the partnership.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

19

Hedge funds are far less liquid than mutual fund shares.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

20

An investor should be cautious when selecting a fund based solely on the manager's past performance,since past performance may not be repeated in the future.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

21

An open-end investment company functions like any other public firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is an approach to asset management?

A) Management and advisory firms

B) Investment companies

C) Strategic management

D) Choices a and b only

E) All of the above

A) Management and advisory firms

B) Investment companies

C) Strategic management

D) Choices a and b only

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

23

When securities are held in an investment company the appropriate way to value a client's investment is by net asset value (NAV).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

24

The main difference between a closed-end fund and an open-end fund is

A) The way each is traded after the initial public offering.

B) There is no significant difference.

C) The minimum initial investment.

D) The type of allowable investments.

E) The way in which each is regulated by the SEC.

A) The way each is traded after the initial public offering.

B) There is no significant difference.

C) The minimum initial investment.

D) The type of allowable investments.

E) The way in which each is regulated by the SEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

25

Market index funds attempt to match the composition and performance of a specified market indicator series.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

26

All investment companies charge an annual

A) 12b-1 fee.

B) Marketing and distribution.

C) Management fee.

D) Maintenance fee.

E) Market adjustment.

A) 12b-1 fee.

B) Marketing and distribution.

C) Management fee.

D) Maintenance fee.

E) Market adjustment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

27

Open-end and closed-end investment companies are similar in that both companies will repurchase shares on demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

28

Net asset value (NAV)is determined by

A) The total market value of all its assets multiplied by the number of fund shares outstanding.

B) The total market value of all its assets divided by the number of fund shares outstanding.

C) The total market value of all its assets divided by the number of shareholders.

D) Supply and demand for the investment company stock in the secondary market.

E) Supply and demand for the investment company stock in the primary market.

A) The total market value of all its assets multiplied by the number of fund shares outstanding.

B) The total market value of all its assets divided by the number of fund shares outstanding.

C) The total market value of all its assets divided by the number of shareholders.

D) Supply and demand for the investment company stock in the secondary market.

E) Supply and demand for the investment company stock in the primary market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

29

Closed-end investment companies never sell at discounts to their NAV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

30

A 12b-1 plan allows funds to

A) Charge a redemption fee.

B) Deduct 7 to 8 percent commission at the initial offering.

C) Deduct .75 percent of the average net assets per year.

D) Charge a contingent deferred sales load.

E) Switch from closed-end to open-end.

A) Charge a redemption fee.

B) Deduct 7 to 8 percent commission at the initial offering.

C) Deduct .75 percent of the average net assets per year.

D) Charge a contingent deferred sales load.

E) Switch from closed-end to open-end.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

31

The offering price of a load fund equals the NAV of the fund

A) Less an initial requirement.

B) Plus a sales charge.

C) Plus a sales charge and an administrative fee.

D) Less a negotiated discount.

E) At its stated value.

A) Less an initial requirement.

B) Plus a sales charge.

C) Plus a sales charge and an administrative fee.

D) Less a negotiated discount.

E) At its stated value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

32

A common hedge fund strategy known as long-short equity is a type of arbitrage strategy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

33

The closed-end fund index is

A) Value weighted and based on market values.

B) Value weighted and based on NAVs.

C) Price weighted and based on market values.

D) Price weighted and based on NAVs.

E) Equally weighted and based on market values.

A) Value weighted and based on market values.

B) Value weighted and based on NAVs.

C) Price weighted and based on market values.

D) Price weighted and based on NAVs.

E) Equally weighted and based on market values.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

34

The market price of a closed-end investment company has generally been

A) 5 to 20 percent below the NAV.

B) 25 to 35 percent below the NAV.

C) Equal to the NAV (within a 2 percent range).

D) 5 to 20 percent above the NAV.

E) 25 to 35 percent above the NAV.

A) 5 to 20 percent below the NAV.

B) 25 to 35 percent below the NAV.

C) Equal to the NAV (within a 2 percent range).

D) 5 to 20 percent above the NAV.

E) 25 to 35 percent above the NAV.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

35

Fund of funds give investors access to hedge fund managers that might otherwise be unavailable to them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

36

When the offer price and the NAV of a mutual fund are equal it is an indication that

A) The fund's assets are in equilibrium.

B) The fund is trading at par.

C) It is strictly a coincidence.

D) The fund has no initial fee.

E) The fund is backloaded.

A) The fund's assets are in equilibrium.

B) The fund is trading at par.

C) It is strictly a coincidence.

D) The fund has no initial fee.

E) The fund is backloaded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

37

Open-end mutual funds that charge a sales fee when the fund is initially offered to the investor are known as

A) 12b-1.

B) Americus trusts.

C) Unit investment trusts.

D) Load funds.

E) Contingency funds.

A) 12b-1.

B) Americus trusts.

C) Unit investment trusts.

D) Load funds.

E) Contingency funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

38

An open-end investment company is commonly referred to as a(n)

A) Balanced fund.

B) Mutual fund.

C) Money market fund.

D) Accessible fund.

E) Unit trust.

A) Balanced fund.

B) Mutual fund.

C) Money market fund.

D) Accessible fund.

E) Unit trust.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

39

The offering price for a share of a load fund equals the net asset value of the share.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

40

Convertible arbitrage hedge funds profit from disparities in the relationship between prices for convertible bonds and fixed-income bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

41

An investment management company is

A) A corporation that handles the administrative functions for a fund.

B) A corporation that has its major assets in a portfolio of securities.

C) A corporation that invests in financial services firms.

D) a and b.

E) a and c.

A) A corporation that handles the administrative functions for a fund.

B) A corporation that has its major assets in a portfolio of securities.

C) A corporation that invests in financial services firms.

D) a and b.

E) a and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Securities Exchange Act of 1934

A) Contains various anti-fraud provisions and record keeping and reporting requirements for fund advisors.

B) Regulates broker-dealers.

C) Requires federal registration of all public offerings of securities.

D) Regulates the structure and operations of mutual funds.

E) Contains a code of ethics and standards of professional conduct.

A) Contains various anti-fraud provisions and record keeping and reporting requirements for fund advisors.

B) Regulates broker-dealers.

C) Requires federal registration of all public offerings of securities.

D) Regulates the structure and operations of mutual funds.

E) Contains a code of ethics and standards of professional conduct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

43

Funds that normally contain a combination of common stock and fixed income securities are known as

A) Section 401(k) plans.

B) Balanced funds.

C) Contractual plans.

D) Income funds.

E) Flexible funds.

A) Section 401(k) plans.

B) Balanced funds.

C) Contractual plans.

D) Income funds.

E) Flexible funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

44

The following are examples of mutual fund companies

A) Common stock funds.

B) Bond funds.

C) Hedge funds.

D) a and b

E) a, b and c

A) Common stock funds.

B) Bond funds.

C) Hedge funds.

D) a and b

E) a, b and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

45

A mutual fund typically performs all of the following functions,except

A) Provides alternative risk-return options.

B) Eliminates unsystematic risk.

C) Provides diversification.

D) Derives a risk-adjusted performance that is consistently superior to risk-adjusted net return of the aggregate market.

E) Administers the account, keeps records and provides timely information.

A) Provides alternative risk-return options.

B) Eliminates unsystematic risk.

C) Provides diversification.

D) Derives a risk-adjusted performance that is consistently superior to risk-adjusted net return of the aggregate market.

E) Administers the account, keeps records and provides timely information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

46

The Investment Company Act of 1940

A) Contains various anti-fraud provisions and record keeping and reporting requirements for fund advisors.

B) Regulates broker-dealers.

C) Requires federal registration of all public offerings of securities.

D) Regulates the structure and operations of mutual funds.

E) Contains a code of ethics and standards of professional conduct.

A) Contains various anti-fraud provisions and record keeping and reporting requirements for fund advisors.

B) Regulates broker-dealers.

C) Requires federal registration of all public offerings of securities.

D) Regulates the structure and operations of mutual funds.

E) Contains a code of ethics and standards of professional conduct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

47

A major question in modern finance regarding closed-end investment companies is

A) Why do these funds sell at discounts?

B) Why do the discounts differ between funds?

C) What are the returns available to investors from funds that sell at a large discount?

D) Choices a and b only

E) All of the above

A) Why do these funds sell at discounts?

B) Why do the discounts differ between funds?

C) What are the returns available to investors from funds that sell at a large discount?

D) Choices a and b only

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

48

In the case of open-end investment companies,shares of the company

A) Trade on the secondary market.

B) Can be bought from or sold to the investment company at the NAV.

C) Are determined by supply and demand.

D) a and c.

E) b and c.

A) Trade on the secondary market.

B) Can be bought from or sold to the investment company at the NAV.

C) Are determined by supply and demand.

D) a and c.

E) b and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

49

A portfolio manager should be able to perform all of the following functions,except

A) Determine risk-return preferences.

B) Eliminate systematic risk.

C) Maintain diversification ensuring a stabilized risk class.

D) Attempt to derive a risk-adjusted performance that is superior to the market.

E) Administer the account, keep records and provide timely information.

A) Determine risk-return preferences.

B) Eliminate systematic risk.

C) Maintain diversification ensuring a stabilized risk class.

D) Attempt to derive a risk-adjusted performance that is superior to the market.

E) Administer the account, keep records and provide timely information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

50

Funds that attempt to provide current income,safety of principal and liquidity are known as

A) Balanced funds.

B) Flexible funds.

C) Income funds.

D) Money market funds.

E) Index funds.

A) Balanced funds.

B) Flexible funds.

C) Income funds.

D) Money market funds.

E) Index funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

51

An example of an international fund would be one that consisted of investments in securities from

A) The U.S., Germany, and Japan.

B) Germany, Italy, and the U.K.

C) The U.S., Korea, and Argentina.

D) All of the above.

E) None of the above.

A) The U.S., Germany, and Japan.

B) Germany, Italy, and the U.K.

C) The U.S., Korea, and Argentina.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

52

In the case of closed-end investment companies,shares of the company

A) Trade on the secondary market.

B) Can be bought from or sold to the investment company at the NAV.

C) Are determined by supply and demand.

D) a and c.

E) b and c.

A) Trade on the secondary market.

B) Can be bought from or sold to the investment company at the NAV.

C) Are determined by supply and demand.

D) a and c.

E) b and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

53

In the case of private management firms

A) Investors deal with a fund company and do not have separate accounts tailored to their specific needs.

B) Investors deal with a fund company and have separate accounts tailored to their specific needs.

C) Investors deal with an asset manager and do not have separate accounts tailored to their specific needs.

D) Investors deal with an asset manager have separate accounts tailored to their specific needs.

E) None of the above.

A) Investors deal with a fund company and do not have separate accounts tailored to their specific needs.

B) Investors deal with a fund company and have separate accounts tailored to their specific needs.

C) Investors deal with an asset manager and do not have separate accounts tailored to their specific needs.

D) Investors deal with an asset manager have separate accounts tailored to their specific needs.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

54

In the case of investment companies

A) Investors deal with a fund company and do not have separate accounts tailored to their specific needs.

B) Investors deal with a fund company and have separate accounts tailored to their specific needs.

C) Investors deal with an asset manager and do not have separate accounts tailored to their specific needs.

D) Investors deal with an asset manager have separate accounts tailored to their specific needs.

E) None of the above.

A) Investors deal with a fund company and do not have separate accounts tailored to their specific needs.

B) Investors deal with a fund company and have separate accounts tailored to their specific needs.

C) Investors deal with an asset manager and do not have separate accounts tailored to their specific needs.

D) Investors deal with an asset manager have separate accounts tailored to their specific needs.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

55

The gross return of closed-end investments companies has typically been

A) 10-20 percent less than their NAV.

B) 10-15 percent less than their NAV.

C) Less than the net return.

D) About the same as the net return.

E) None of the above

A) 10-20 percent less than their NAV.

B) 10-15 percent less than their NAV.

C) Less than the net return.

D) About the same as the net return.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

56

Mutual fund performance studies have shown that most funds

A) Have risks and returns that are inconsistent with their stated objectives.

B) Have risks and returns that are consistent with their stated objectives.

C) Do not have stated objectives.

D) Have experienced risk-adjusted returns above the market.

E) Have changed their objectives over time.

A) Have risks and returns that are inconsistent with their stated objectives.

B) Have risks and returns that are consistent with their stated objectives.

C) Do not have stated objectives.

D) Have experienced risk-adjusted returns above the market.

E) Have changed their objectives over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

57

The text offers a number of suggestions for investing in mutual funds.Which of the following is not such a suggestion?

A) Choose only those mutual funds which are consistent with your objectives and constraints.

B) Invest in no-load funds whenever possible.

C) Avoid investing in index funds.

D) Use a dollar cost average strategy.

E) None of the above (that is, all are valid suggestions for investing in mutual funds)

A) Choose only those mutual funds which are consistent with your objectives and constraints.

B) Invest in no-load funds whenever possible.

C) Avoid investing in index funds.

D) Use a dollar cost average strategy.

E) None of the above (that is, all are valid suggestions for investing in mutual funds)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

58

A money market fund would be likely to invest in a portfolio containing all of the following except

A) Commercial paper.

B) Banker's acceptances.

C) U.S. Treasury bills.

D) Bank certificates of deposit.

E) U.S. Treasury notes.

A) Commercial paper.

B) Banker's acceptances.

C) U.S. Treasury bills.

D) Bank certificates of deposit.

E) U.S. Treasury notes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

59

An investment company is

A) A corporation that handles the administrative functions for a fund.

B) A corporation that has its major assets in a portfolio of securities.

C) A corporation that invests in financial services firms.

D) a and b. .

E) a and c

A) A corporation that handles the administrative functions for a fund.

B) A corporation that has its major assets in a portfolio of securities.

C) A corporation that invests in financial services firms.

D) a and b. .

E) a and c

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Securities Act of 1933

A) Contains various anti-fraud provisions and record keeping and reporting requirements for fund advisors.

B) Regulates broker-dealers.

C) Requires federal registration of all public offerings of securities.

D) Regulates the structure and operations of mutual funds.

E) Contains a code of ethics and standards of professional conduct.

A) Contains various anti-fraud provisions and record keeping and reporting requirements for fund advisors.

B) Regulates broker-dealers.

C) Requires federal registration of all public offerings of securities.

D) Regulates the structure and operations of mutual funds.

E) Contains a code of ethics and standards of professional conduct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

61

Funds that adjust the asset allocation weights in the portfolio to match the needs of an investor who is nearing retirement are known as

A) Balanced funds

B) Flexible portfolio funds

C) Lifetime funds

D) Money market funds

E) Target date funds

A) Balanced funds

B) Flexible portfolio funds

C) Lifetime funds

D) Money market funds

E) Target date funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

62

The 12b-1 plan permits funds to deduct as much as ____ percent of average net asset per year to cover distribution costs,brokers' commissions,and general marketing expenses.

A) 0.25

B) 0.50

C) 0.75

D) 1.00

E) 1.50

A) 0.25

B) 0.50

C) 0.75

D) 1.00

E) 1.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

63

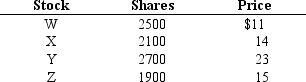

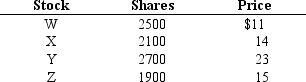

Exhibit 24.1

Use the Information Below for the Following Problem(S)

Suppose ABC Mutual fund owned only 4 stocks as follows:

Refer to Exhibit 24.1.The fund originated by selling $100,000 of stock at $10.00 per share.What is its current NAV?

A) $1.47

B) $14.75

C) $16.03

D) $27.62

E) $234.12

Use the Information Below for the Following Problem(S)

Suppose ABC Mutual fund owned only 4 stocks as follows:

Refer to Exhibit 24.1.The fund originated by selling $100,000 of stock at $10.00 per share.What is its current NAV?

A) $1.47

B) $14.75

C) $16.03

D) $27.62

E) $234.12

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

64

An investment vehicle that acts like a mutual fund of hedge funds,and allows investors access to managers that might otherwise be unavailable is known as

A) Managed futures funds

B) Long-short equity funds

C) Fund of funds

D) Private equity funds

E) Leveraged Buyouts (LBOs)

A) Managed futures funds

B) Long-short equity funds

C) Fund of funds

D) Private equity funds

E) Leveraged Buyouts (LBOs)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

65

Soft dollars are generated when

A) A manager commits to paying a higher than normal brokerage fee in exchange for additional bundled services.

B) A manager commits to paying a higher than normal brokerage fee in exchange for secretarial services.

C) A manager commits to paying a higher than normal brokerage fee in exchange for office equipment.

D) All of the above.

E) None of the above.

A) A manager commits to paying a higher than normal brokerage fee in exchange for additional bundled services.

B) A manager commits to paying a higher than normal brokerage fee in exchange for secretarial services.

C) A manager commits to paying a higher than normal brokerage fee in exchange for office equipment.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is a characteristic of hedge funds?

A) They are generally less restricted in how and where they can make investments.

B) They are more liquid than mutual fund shares.

C) They have no limitations on when and how often investment capital can be contributed or removed.

D) All of the above.

E) None of the above.

A) They are generally less restricted in how and where they can make investments.

B) They are more liquid than mutual fund shares.

C) They have no limitations on when and how often investment capital can be contributed or removed.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following are guiding principles for ethical behavior in the asset management industry as put forward by the CFA Center for Financial Market Integrity?

A) The interests of investment professional come first.

B) The preferred method for promoting fair and efficient markets is to set up a central oversight board.

C) Financial markets in various countries should develop high-quality standards for reporting financial information that reflect local customs.

D) Financial statements should be reported from the perspective of firm shareholders.

E) All of the above.

A) The interests of investment professional come first.

B) The preferred method for promoting fair and efficient markets is to set up a central oversight board.

C) Financial markets in various countries should develop high-quality standards for reporting financial information that reflect local customs.

D) Financial statements should be reported from the perspective of firm shareholders.

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

68

In a convertible arbitrage strategy hedge fund managers attempt to

A) Generate profits by taking advantage of convertible bond pricing disparities caused by changing market events.

B) Generate profits by taking advantage of disparities in the relationship between prices for convertible bonds and the underlying common stock.

C) Generate profits by taking advantage of disparities in the relationship between prices for convertible bonds and the underlying common stock option.

D) All of the above.

E) None of the above.

A) Generate profits by taking advantage of convertible bond pricing disparities caused by changing market events.

B) Generate profits by taking advantage of disparities in the relationship between prices for convertible bonds and the underlying common stock.

C) Generate profits by taking advantage of disparities in the relationship between prices for convertible bonds and the underlying common stock option.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

69

Ethical conflicts may arise as a result of

A) Incentive compensation schemes.

B) Soft dollar arrangements.

C) Marketing investment management services.

D) All of the above.

E) None of the above.

A) Incentive compensation schemes.

B) Soft dollar arrangements.

C) Marketing investment management services.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is not an example of an alternative asset class?

A) Hedge funds

B) Private equity

C) Real estate

D) Commodities

E) All of the above are examples of alternative asset classes.

A) Hedge funds

B) Private equity

C) Real estate

D) Commodities

E) All of the above are examples of alternative asset classes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

71

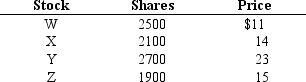

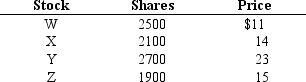

Exhibit 24.1

Use the Information Below for the Following Problem(S)

Suppose ABC Mutual fund owned only 4 stocks as follows:

Refer to Exhibit 24.1.What is the offering price for the fund if the NAV is $25.25 and the load is 6 percent?

A) $26.19

B) $23.74

C) $25.25

D) $26.77

E) $24.13

Use the Information Below for the Following Problem(S)

Suppose ABC Mutual fund owned only 4 stocks as follows:

Refer to Exhibit 24.1.What is the offering price for the fund if the NAV is $25.25 and the load is 6 percent?

A) $26.19

B) $23.74

C) $25.25

D) $26.77

E) $24.13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

72

Hedge funds that are organized as a limited partnership

A) Are less restricted in how they make investments than general partnership hedge funds

B) Typically have larger abnormal returns than general partnership hedge funds

C) Are usually less correlated with traditional asset class investments than general partnership hedge funds

D) Have less liquid investments than mutual funds

E) None of the above

A) Are less restricted in how they make investments than general partnership hedge funds

B) Typically have larger abnormal returns than general partnership hedge funds

C) Are usually less correlated with traditional asset class investments than general partnership hedge funds

D) Have less liquid investments than mutual funds

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following are functions that a portfolio manager should perform for clients?

A) Determine investment objectives and constraints, diversify the portfolio, eliminate tax payments.

B) Determine investment objectives, diversify the portfolio, maintain ethical standards and eliminate tax payments.

C) Determine investment objectives and constraints, diversify the portfolio, and maintain ethical standards.

D) Determine constraints, diversify the portfolio, eliminate tax payments.

E) Determine investment objectives and constraints, diversify the portfolio, eliminate tax payments, and achieve risk adjusted return superior to the relevant benchmark.

A) Determine investment objectives and constraints, diversify the portfolio, eliminate tax payments.

B) Determine investment objectives, diversify the portfolio, maintain ethical standards and eliminate tax payments.

C) Determine investment objectives and constraints, diversify the portfolio, and maintain ethical standards.

D) Determine constraints, diversify the portfolio, eliminate tax payments.

E) Determine investment objectives and constraints, diversify the portfolio, eliminate tax payments, and achieve risk adjusted return superior to the relevant benchmark.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

74

What type of funds are typically no-load funds that impose no penalty for early withdrawal and generally allow holders to write checks against their account?

A) Mutual funds

B) Open-end funds

C) Closed-end funds

D) Money market funds

E) Balanced funds

A) Mutual funds

B) Open-end funds

C) Closed-end funds

D) Money market funds

E) Balanced funds

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

75

When alternative assets of investors are pooled together into a single pool of assets

A) The collection of assets is formed as a limited partnership.

B) One or more general partners are responsible for running the organization.

C) The limited partners are only liable to the extent of their investments.

D) Both a and c

E) All of the above.

A) The collection of assets is formed as a limited partnership.

B) One or more general partners are responsible for running the organization.

C) The limited partners are only liable to the extent of their investments.

D) Both a and c

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

76

Investment companies or mutual funds that continue to sell and repurchase shares after their initial public offerings are referred to as

A) Closed-end

B) Open-end

C) No-load

D) Load

E) None of the above

A) Closed-end

B) Open-end

C) No-load

D) Load

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following statements regarding the closed-end investment company's net asset value (NAV)is false?

A) NAV is computed throughout the day based on prevailing market prices for the portfolio of securities

B) The market price of the shares is determined by how they trade on the exchange

C) NAV and market price of a closed-end fund are almost never the same

D) No new investment dollars are available for the investment company unless it makes another public sale of securities

E) All of the above are true

A) NAV is computed throughout the day based on prevailing market prices for the portfolio of securities

B) The market price of the shares is determined by how they trade on the exchange

C) NAV and market price of a closed-end fund are almost never the same

D) No new investment dollars are available for the investment company unless it makes another public sale of securities

E) All of the above are true

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

78

Investing in emerging markets can be viewed as a global application of

A) Fixed-income arbitrage.

B) Convertible arbitrage.

C) Merger arbitrage.

D) Distressed opportunistic strategies.

E) Equity market neutral.

A) Fixed-income arbitrage.

B) Convertible arbitrage.

C) Merger arbitrage.

D) Distressed opportunistic strategies.

E) Equity market neutral.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

79

The Investment Advisors Act of 1940

A) Contains various anti-fraud provisions and record keeping and reporting requirements for fund advisors.

B) Regulates broker-dealers.

C) Requires federal registration of all public offerings of securities.

D) Regulates the structure and operations of mutual funds.

E) Contains a code of ethics and standards of professional conduct.

A) Contains various anti-fraud provisions and record keeping and reporting requirements for fund advisors.

B) Regulates broker-dealers.

C) Requires federal registration of all public offerings of securities.

D) Regulates the structure and operations of mutual funds.

E) Contains a code of ethics and standards of professional conduct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck

80

In a long short-short hedge fund strategy

A) Managers take long positions in undervalued stocks and short positions in overvalued stocks.

B) Managers take short positions in undervalued stocks and long positions in overvalued stocks.

C) Managers take offsetting risk positions on the long and short side.

D) All of the above.

E) None of the above.

A) Managers take long positions in undervalued stocks and short positions in overvalued stocks.

B) Managers take short positions in undervalued stocks and long positions in overvalued stocks.

C) Managers take offsetting risk positions on the long and short side.

D) All of the above.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 108 في هذه المجموعة.

فتح الحزمة

k this deck