Deck 25: Evaluation of Portfolio Performance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

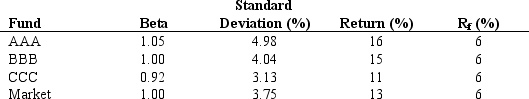

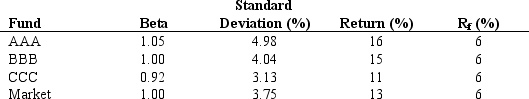

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/100

العب

ملء الشاشة (f)

Deck 25: Evaluation of Portfolio Performance

1

Sharpe's performance assumes that all portfolios are completely diversified.

True

2

Funds with low levels of diversification tend to "beat the market."

False

3

Duration is considered a good measure of risk for a bond portfolio because it indicates the relative volatility of the bond or portfolio due to interest rate changes and also the rating of the bonds.

False

4

An appropriate composite risk measure that indicates the relative price volatility for a bond compared to interest rate changes is the bond's yield to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

5

The portfolio performance measure that can be most affected by a benchmark error is the Sharpe measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

6

A peer group comparison collects the returns produced by a representative universe of investors over a specific period of time and displays them in a simple boxplot format.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

7

Attribution analysis separates a portfolio manager's performance into an allocation effect and selection effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

8

Investors want their portfolio managers to completely diversify their portfolio,that is,eliminate all systematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

9

The Sharpe and Treynor measures complement each other and thus both should be used to measure portfolio performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

10

The Sharpe measure examines the risk premium per unit of systematic risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Jensen measure requires that each period's rates of return and risk-free rate be measured,rather than using the long-term averages as in the Treynor and Sharpe measures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

12

A negative Treynor measure (negative T)for a portfolio always indicates that the portfolio would plot below the SML.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

13

A test of bond performance over time indicated that bond portfolio managers are more consistent over time than equity managers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

14

Treynor's performance measure implicitly assumes a completely diversified portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Sharpe and Treynor measures always give different rankings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

16

Overall performance is the total return above the risk free rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

17

The policy effect is a difference in bond portfolio performance from that of a benchmark index due to a difference in duration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

18

The typical proxy for the market portfolio is the S&P 500 Index because it is diversified and price weighted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

19

In evaluating bond performance,the Lehman Brothers Index is an appropriate risk measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

20

The ranking differences between the Sharpe,Treynor and Jensen performance measures occur because of the differences in diversification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

21

Under the performance attribution analysis method,the ____ measures the manager's ability to form specific market segment portfolios that generate superior returns relative to the way in which the comparable market segment is defined in the benchmark portfolio weighted by the manager's actual market segment investment proportions.

A) Selection effect

B) Allocation effect

C) Distribution effect

D) Diversification effect

E) Attribution effect

A) Selection effect

B) Allocation effect

C) Distribution effect

D) Diversification effect

E) Attribution effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

22

The most common manner of evaluating portfolio managers is a peer group comparison.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Sharpe measure of portfolio performance divides the portfolio's risk premium by the portfolio's beta.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

24

Treynor developed the first composite measure of portfolio performance by introducing the capital market line,which defines the relationship between the return of a portfolio over time and the return for the market portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

25

Treynor showed that rational,risk averse investors always prefer portfolio possibility lines that have

A) Zero slopes.

B) Slightly negative slopes.

C) Highly negative slopes.

D) Slightly positive slopes.

E) Highly positive slopes.

A) Zero slopes.

B) Slightly negative slopes.

C) Highly negative slopes.

D) Slightly positive slopes.

E) Highly positive slopes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

26

The information ratio permits only relative assessments of performance for different portfolios in a style class.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

27

Portfolio managers who anticipate an increase in interest rates should

A) Act to keep the duration constant.

B) Decrease the portfolio duration.

C) Increase the portfolio duration.

D) Assume higher risk in the market.

E) Invest in junk bonds.

A) Act to keep the duration constant.

B) Decrease the portfolio duration.

C) Increase the portfolio duration.

D) Assume higher risk in the market.

E) Invest in junk bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

28

When applying the Jensen's alpha measure the alpha level and significance can vary greatly depending on the specification of the return-generating model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

29

The measure of performance which divides the portfolio's risk premium by the portfolio's beta is the

A) Sharpe measure.

B) Jensen measure.

C) Fama measure.

D) Alternative components model (MCV).

E) Treynor measure.

A) Sharpe measure.

B) Jensen measure.

C) Fama measure.

D) Alternative components model (MCV).

E) Treynor measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

30

Under the performance attribution analysis method,the ____ measures the manager's decision to over- or underweight a particular market segment in terms of that segment's return performance relative to the overall return to the benchmark.

A) Selection effect

B) Allocation effect

C) Distribution effect

D) Diversification effect

E) Attribution effect

A) Selection effect

B) Allocation effect

C) Distribution effect

D) Diversification effect

E) Attribution effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

31

Which measure of portfolio performance allows analysts to determine the statistical significance of abnormal returns?

A) Sharpe measure

B) Jensen measure

C) Fama measure

D) Alternative components model (MCV)

E) Treynor measure

A) Sharpe measure

B) Jensen measure

C) Fama measure

D) Alternative components model (MCV)

E) Treynor measure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

32

Selectivity measures how well a portfolio performed relative to a

A) Market portfolio (S&P 400).

B) Portfolio of the same securities in the previous period.

C) Naively selected portfolio of equal risk.

D) Naively selected portfolio of equal return.

E) World market portfolio.

A) Market portfolio (S&P 400).

B) Portfolio of the same securities in the previous period.

C) Naively selected portfolio of equal risk.

D) Naively selected portfolio of equal return.

E) World market portfolio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

33

Two desirable attributes of a portfolio manager's performance are the ability to derive above-average returns for a given risk class and the ability to time the market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

34

If the return increases as more global investments with low correlation are added to the market portfolio,the efficient frontier moves

A) Up and right.

B) Up and left.

C) Down and right.

D) Down and left.

E) Up only.

A) Up and right.

B) Up and left.

C) Down and right.

D) Down and left.

E) Up only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

35

A portfolio performance measurement technique that decomposes the return of a manager's holdings to a predetermined benchmark's returns and separates the difference into an allocation and selection is called

A) Immunization analysis.

B) Performance attribution analysis.

C) Tactical rankings.

D) Convexity utilization.

E) Duration matching attrition.

A) Immunization analysis.

B) Performance attribution analysis.

C) Tactical rankings.

D) Convexity utilization.

E) Duration matching attrition.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

36

The market rewards investors for bearing total risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

37

Sharpe's performance measure divides the portfolio's risk premium by the

A) Standard deviation of the rate of return.

B) Variance of the rate of return.

C) Slope of the fund's characteristic line.

D) Beta.

E) Risk free rate.

A) Standard deviation of the rate of return.

B) Variance of the rate of return.

C) Slope of the fund's characteristic line.

D) Beta.

E) Risk free rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

38

The major requirements of a portfolio manager include the following,except

A) Follow the client's policy statement.

B) Completely diversify the portfolio to eliminate all unsystematic risk.

C) The ability to derive above-average risk adjusted returns.

D) Completely diversify the portfolio to eliminate all systematic risk.

E) None of the above (that is, all are requirements of a portfolio manager)

A) Follow the client's policy statement.

B) Completely diversify the portfolio to eliminate all unsystematic risk.

C) The ability to derive above-average risk adjusted returns.

D) Completely diversify the portfolio to eliminate all systematic risk.

E) None of the above (that is, all are requirements of a portfolio manager)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

39

Wagner and Tito suggested that a bond portfolio return differing from the return from the Lehman Brothers Index can be divided into four components.Which of the following is not included?

A) Policy effect

B) Rate anticipation effect

C) Sector/Quality effect

D) Analysis effect

E) Trading effect

A) Policy effect

B) Rate anticipation effect

C) Sector/Quality effect

D) Analysis effect

E) Trading effect

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

40

A portfolio manager should be evaluated many times and in a variety of market environments before a final judgment is reached regarding his/her strengths and weaknesses.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

41

A portfolio's gross selectivity is made up of

A) Manager's risk.

B) Net selectivity.

C) Diversification.

D) a and b.

E) b and c.

A) Manager's risk.

B) Net selectivity.

C) Diversification.

D) a and b.

E) b and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements concerning performance measures is false?

A) The Sharpe measure examines both unsystematic and systematic risk.

B) The Treynor measure examines systematic risk.

C) The Jensen measure examines systematic risk.

D) All three measures examine both unsystematic and systematic risk.

E) None of the above (that is, all statements are true)

A) The Sharpe measure examines both unsystematic and systematic risk.

B) The Treynor measure examines systematic risk.

C) The Jensen measure examines systematic risk.

D) All three measures examine both unsystematic and systematic risk.

E) None of the above (that is, all statements are true)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

43

Bailey,Richards,and Tierney maintain that any useful benchmark should have the following characteristics:

A) Measurable.

B) Investable.

C) Value-weighted.

D) a and b.

E) a, b and c.

A) Measurable.

B) Investable.

C) Value-weighted.

D) a and b.

E) a, b and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

44

A disadvantage of the Treynor and Sharpe measures is that

A) They produce absolute performance rankings.

B) The beta and standard deviation are static.

C) They are both difficult to compute.

D) They produce relative performance rankings.

E) They give very different measurements for well-diversified portfolios.

A) They produce absolute performance rankings.

B) The beta and standard deviation are static.

C) They are both difficult to compute.

D) They produce relative performance rankings.

E) They give very different measurements for well-diversified portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

45

A manager's superior returns could have occurred due to:

A) an insightful asset allocation strategy, over weighting an asset class that earned high returns.

B) investing in undervalued sectors.

C) selecting individual securities that earned above average returns.

D) Choices a and c

E) All of the above

A) an insightful asset allocation strategy, over weighting an asset class that earned high returns.

B) investing in undervalued sectors.

C) selecting individual securities that earned above average returns.

D) Choices a and c

E) All of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

46

In the Characteristic Selectivity (CS)performance measure,

A) Portfolio performance is measured by assessing the quality of services provided by money managers by looking at adjustments made to the content of their portfolios.

B) Portfolio performance is measured by examining both unsystematic and systematic risk.

C) Portfolio performance is measured by comparing the returns of each stock in the portfolio to the return of a benchmark portfolio. With the same aggregate investment characteristics as the security in question.

D) Portfolio performance is measured on the basis of return per unit of risk.

E) Portfolio performance is measured on the basis of historic average differential return per unit of historic variability of differential return.

A) Portfolio performance is measured by assessing the quality of services provided by money managers by looking at adjustments made to the content of their portfolios.

B) Portfolio performance is measured by examining both unsystematic and systematic risk.

C) Portfolio performance is measured by comparing the returns of each stock in the portfolio to the return of a benchmark portfolio. With the same aggregate investment characteristics as the security in question.

D) Portfolio performance is measured on the basis of return per unit of risk.

E) Portfolio performance is measured on the basis of historic average differential return per unit of historic variability of differential return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

47

In the evaluation of bond portfolio performance,the analysis effect refers to

A) The difference in portfolio duration and index duration.

B) The extra return attributable to acquiring bonds that are temporarily mispriced relative to risk.

C) Short-run changes in the portfolio during a specific period.

D) The differential return from changing duration of the portfolio during a specific period.

E) None of the above

A) The difference in portfolio duration and index duration.

B) The extra return attributable to acquiring bonds that are temporarily mispriced relative to risk.

C) Short-run changes in the portfolio during a specific period.

D) The differential return from changing duration of the portfolio during a specific period.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

48

Information ratio portfolio performance measures

A) Adjust portfolio risk to match benchmark risk.

B) Compare portfolio returns to expected returns under CAPM.

C) Evaluate portfolio performance on the basis of return per unit of risk.

D) Indicate historic average differential return per unit of historic variability of differential return.

E) None of the above.

A) Adjust portfolio risk to match benchmark risk.

B) Compare portfolio returns to expected returns under CAPM.

C) Evaluate portfolio performance on the basis of return per unit of risk.

D) Indicate historic average differential return per unit of historic variability of differential return.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

49

In the evaluation of bond portfolio performance,the policy effect refers to

A) The difference in portfolio duration and index duration.

B) The extra return attributable to acquiring bonds that are temporarily mispriced relative to risk.

C) Short-run changes in the portfolio during a specific period.

D) The differential return from changing duration of the portfolio during a specific period.

E) None of the above.

A) The difference in portfolio duration and index duration.

B) The extra return attributable to acquiring bonds that are temporarily mispriced relative to risk.

C) Short-run changes in the portfolio during a specific period.

D) The differential return from changing duration of the portfolio during a specific period.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

50

Excess return portfolio performance measures

A) Adjust portfolio risk to match benchmark risk.

B) Compare portfolio returns to expected returns under CAPM.

C) Evaluate portfolio performance on the basis of return per unit of risk.

D) Indicate historic average differential return per unit of historic variability of differential return.

E) None of the above.

A) Adjust portfolio risk to match benchmark risk.

B) Compare portfolio returns to expected returns under CAPM.

C) Evaluate portfolio performance on the basis of return per unit of risk.

D) Indicate historic average differential return per unit of historic variability of differential return.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements about returns-based analysis or effective mix analysis is true?

A) This analysis compares the historical return pattern of the portfolio in question with the historical returns of various well-specified indexes.

B) This analysis uses sophisticated quadratic programming techniques to indicate what styles or style combinations were most similar to the portfolio's actual historical returns.

C) This analysis is based on the belief that the portfolio's current make-up will be a good predictor for the next period's returns.

D) Choices a and b

E) All of the above statements describe returns-based analysis or effective mix analysis

A) This analysis compares the historical return pattern of the portfolio in question with the historical returns of various well-specified indexes.

B) This analysis uses sophisticated quadratic programming techniques to indicate what styles or style combinations were most similar to the portfolio's actual historical returns.

C) This analysis is based on the belief that the portfolio's current make-up will be a good predictor for the next period's returns.

D) Choices a and b

E) All of the above statements describe returns-based analysis or effective mix analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

52

The cost of active management is the coefficient sER and it is sometimes referred to as

A) Market timing.

B) Reward for risk.

C) Excess reward.

D) Excess risk.

E) Tracking error.

A) Market timing.

B) Reward for risk.

C) Excess reward.

D) Excess risk.

E) Tracking error.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

53

In the Grinblatt-Titman (GT)performance measure,

A) Portfolio performance is measured by assessing the quality of services provided by money managers by looking at adjustments made to the content of their portfolios.

B) Portfolio performance is measured by examining both unsystematic and systematic risk.

C) Portfolio performance is measured by comparing the returns of each stock in the portfolio to the return of a benchmark portfolio. With the same aggregate investment characteristics as the security in question.

D) Portfolio performance is measured on the basis of return per unit of risk.

E) Portfolio performance is measured on the basis of historic average differential return per unit of historic variability of differential return.

A) Portfolio performance is measured by assessing the quality of services provided by money managers by looking at adjustments made to the content of their portfolios.

B) Portfolio performance is measured by examining both unsystematic and systematic risk.

C) Portfolio performance is measured by comparing the returns of each stock in the portfolio to the return of a benchmark portfolio. With the same aggregate investment characteristics as the security in question.

D) Portfolio performance is measured on the basis of return per unit of risk.

E) Portfolio performance is measured on the basis of historic average differential return per unit of historic variability of differential return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

54

In the evaluation of bond portfolio performance,the interest rate anticipation effect refers to

A) The difference in portfolio duration and index duration.

B) The extra return attributable to acquiring bonds that are temporarily mispriced relative to risk.

C) Short-run changes in the portfolio during a specific period.

D) The differential return from changing duration of the portfolio during a specific period.

E) None of the above

A) The difference in portfolio duration and index duration.

B) The extra return attributable to acquiring bonds that are temporarily mispriced relative to risk.

C) Short-run changes in the portfolio during a specific period.

D) The differential return from changing duration of the portfolio during a specific period.

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

55

For a poorly diversified portfolio the appropriate measure of portfolio performance would be

A) The Treynor measure because it evaluates portfolio performance on the basis of return and diversification.

B) The Sharpe measure because it evaluates portfolio performance on the basis of return and diversification.

C) The Treynor measure because it uses standard deviation as the risk measure.

D) The Sharpe measure because it uses beta as the risk measure.

E) None of the above.

A) The Treynor measure because it evaluates portfolio performance on the basis of return and diversification.

B) The Sharpe measure because it evaluates portfolio performance on the basis of return and diversification.

C) The Treynor measure because it uses standard deviation as the risk measure.

D) The Sharpe measure because it uses beta as the risk measure.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

56

A more recent adjustment to the Sharpe measurement for portfolio evaluation is

A) To divide the portfolio risk premium by total risk rather than the portfolio's beta.

B) To divide the portfolio risk premium by standard deviation rather than the portfolio's beta.

C) To divide the portfolio risk premium by the excess portfolio return rather than total risk.

D) To divide the excess portfolio return by the portfolio's standard deviation.

E) To divide the excess portfolio return by the portfolio's beta.

A) To divide the portfolio risk premium by total risk rather than the portfolio's beta.

B) To divide the portfolio risk premium by standard deviation rather than the portfolio's beta.

C) To divide the portfolio risk premium by the excess portfolio return rather than total risk.

D) To divide the excess portfolio return by the portfolio's standard deviation.

E) To divide the excess portfolio return by the portfolio's beta.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

57

Components of overall portfolio performance include

A) Selectivity.

B) Manager's risk.

C) Security risk.

D) a and b.

E) a, b and c.

A) Selectivity.

B) Manager's risk.

C) Security risk.

D) a and b.

E) a, b and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

58

Relative return portfolio performance measures

A) Adjust portfolio risk to match benchmark risk.

B) Compare portfolio returns to expected returns under CAPM.

C) Evaluate portfolio performance on the basis of return per unit of risk.

D) Indicate historic average differential return per unit of historic variability of differential return.

E) None of the above.

A) Adjust portfolio risk to match benchmark risk.

B) Compare portfolio returns to expected returns under CAPM.

C) Evaluate portfolio performance on the basis of return per unit of risk.

D) Indicate historic average differential return per unit of historic variability of differential return.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

59

The Sortino measure differs from the Sharpe ratio in that

A) It measures the portfolio's average return in excess of a user-selected minimum acceptable return threshold.

B) It measures the downside risk in a portfolio.

C) Higher values of the Sortino measure are not desirable, while higher values in the Sharpe ratio are desirable.

D) Both a and b

E) All of the above.

A) It measures the portfolio's average return in excess of a user-selected minimum acceptable return threshold.

B) It measures the downside risk in a portfolio.

C) Higher values of the Sortino measure are not desirable, while higher values in the Sharpe ratio are desirable.

D) Both a and b

E) All of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which portfolio measurement uses the mean excess return in the numerator divided by the amount of residual risk that the investor incurred in pursuit of those excess returns?

A) Jensen measure.

B) Fama measure.

C) Sharpe measure.

D) Treynor ratio.

E) Information ratio.

A) Jensen measure.

B) Fama measure.

C) Sharpe measure.

D) Treynor ratio.

E) Information ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

61

Exhibit 25.2

Use the Information Below for the Following Problem(S)

The portfolios identified below are being considered for investment. Assume that during the period under consideration Rf = .04.

-Refer to Exhibit 25.2.Using the Sharpe Measure,which portfolio performed best?

A) W

B) X

C) Y

D) Z

E) Two portfolios are tied

Use the Information Below for the Following Problem(S)

The portfolios identified below are being considered for investment. Assume that during the period under consideration Rf = .04.

-Refer to Exhibit 25.2.Using the Sharpe Measure,which portfolio performed best?

A) W

B) X

C) Y

D) Z

E) Two portfolios are tied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

62

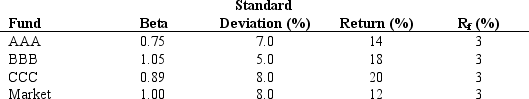

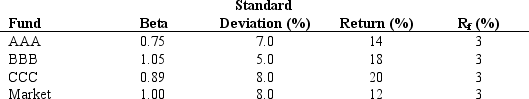

Exhibit 25.1

Use the Information Below for the Following Problem(S)

The portfolios identified below are being considered for investment. During the period under consideration Rf = .03.

-Refer to Exhibit 25.1.Using the Sharpe Measure,which portfolio performed best?

A) A

B) B

C) C

D) D

E) Two portfolios are tied

Use the Information Below for the Following Problem(S)

The portfolios identified below are being considered for investment. During the period under consideration Rf = .03.

-Refer to Exhibit 25.1.Using the Sharpe Measure,which portfolio performed best?

A) A

B) B

C) C

D) D

E) Two portfolios are tied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

63

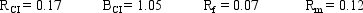

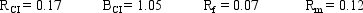

Exhibit 25.6

Use the Information Below for the Following Problem(S)

Given the following information evaluate the performance of Cloud Incorporated (CI).

Refer to Exhibit 25.6.Calculate CI's selectivity.

A) 0.1225

B) 0.1000

C) 0.0525

D) 0.0475

E) 0.0325

Use the Information Below for the Following Problem(S)

Given the following information evaluate the performance of Cloud Incorporated (CI).

Refer to Exhibit 25.6.Calculate CI's selectivity.

A) 0.1225

B) 0.1000

C) 0.0525

D) 0.0475

E) 0.0325

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

64

Exhibit 25.2

Use the Information Below for the Following Problem(S)

The portfolios identified below are being considered for investment. Assume that during the period under consideration Rf = .04.

-Refer to Exhibit 25.2.According to the Treynor Measure,which portfolio performed best?

A) W

B) X

C) Y

D) Z

E) Two portfolios are tied

Use the Information Below for the Following Problem(S)

The portfolios identified below are being considered for investment. Assume that during the period under consideration Rf = .04.

-Refer to Exhibit 25.2.According to the Treynor Measure,which portfolio performed best?

A) W

B) X

C) Y

D) Z

E) Two portfolios are tied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following performance measures is the most rigorous risk-adjustment process separating systematic and unsystematic risk?

A) Treynor ratio

B) Sharpe ratio

C) Jensen's Alpha

D) Information ratio

E) None of the above

A) Treynor ratio

B) Sharpe ratio

C) Jensen's Alpha

D) Information ratio

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

66

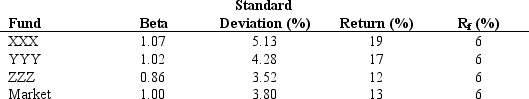

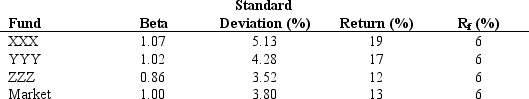

Exhibit 25.5

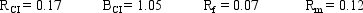

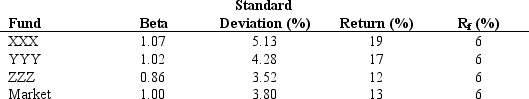

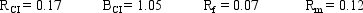

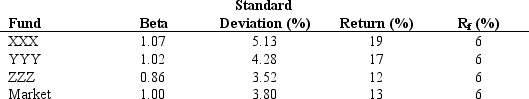

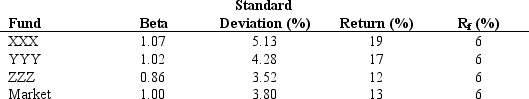

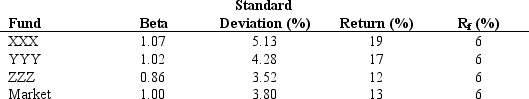

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.5.Compute the Jensen Measure for the YYY fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.5.Compute the Jensen Measure for the YYY fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

67

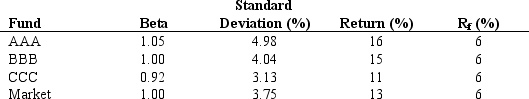

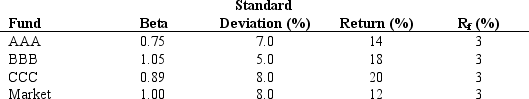

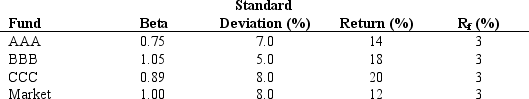

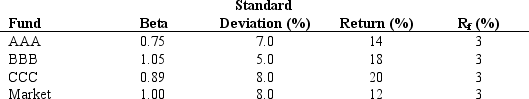

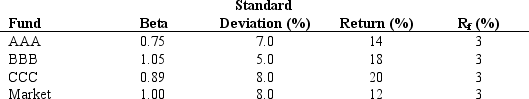

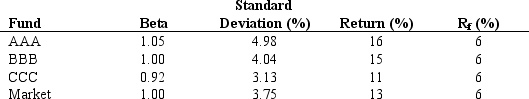

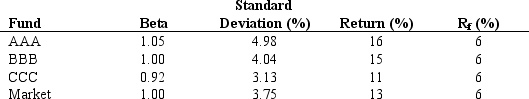

Exhibit 25.3

Use the Information Below for the Following Problem(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 25.3.Compute the Treynor Measure for the CCC fund.

A) 14.7

B) 15.3

C) 19.1

D) 17.0

E) 12.7

Use the Information Below for the Following Problem(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 25.3.Compute the Treynor Measure for the CCC fund.

A) 14.7

B) 15.3

C) 19.1

D) 17.0

E) 12.7

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

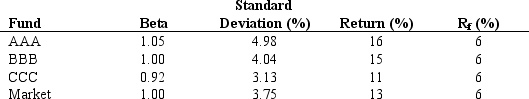

68

Exhibit 25.4

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.4.Compute the Treynor Measure for the CCC fund.

A) 5.43

B) 2.74

C) 2.19

D) 2.00

E) 1.65

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.4.Compute the Treynor Measure for the CCC fund.

A) 5.43

B) 2.74

C) 2.19

D) 2.00

E) 1.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

69

Exhibit 25.5

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.5.Compute the Sharpe Measure for the XXX fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.5.Compute the Sharpe Measure for the XXX fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

70

Exhibit 25.1

Use the Information Below for the Following Problem(S)

The portfolios identified below are being considered for investment. During the period under consideration Rf = .03.

-Refer to Exhibit 25.1.According to the Treynor Measure,which portfolio performed best?

A) A

B) B

C) C

D) D

E) Two portfolios are tied

Use the Information Below for the Following Problem(S)

The portfolios identified below are being considered for investment. During the period under consideration Rf = .03.

-Refer to Exhibit 25.1.According to the Treynor Measure,which portfolio performed best?

A) A

B) B

C) C

D) D

E) Two portfolios are tied

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

71

Exhibit 25.6

Use the Information Below for the Following Problem(S)

Given the following information evaluate the performance of Cloud Incorporated (CI).

Refer to Exhibit 25.6.Calculate CI's overall performance.

A) 0.1225

B) 0.1000

C) 0.0525

D) 0.0475

E) 0.0325

Use the Information Below for the Following Problem(S)

Given the following information evaluate the performance of Cloud Incorporated (CI).

Refer to Exhibit 25.6.Calculate CI's overall performance.

A) 0.1225

B) 0.1000

C) 0.0525

D) 0.0475

E) 0.0325

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

72

Exhibit 25.6

Use the Information Below for the Following Problem(S)

Given the following information evaluate the performance of Cloud Incorporated (CI).

Refer to Exhibit 25.6.Calculate CI's risk.

A) 0.1225

B) 0.1000

C) 0.0525

D) 0.0475

E) 0.0325

Use the Information Below for the Following Problem(S)

Given the following information evaluate the performance of Cloud Incorporated (CI).

Refer to Exhibit 25.6.Calculate CI's risk.

A) 0.1225

B) 0.1000

C) 0.0525

D) 0.0475

E) 0.0325

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

73

Exhibit 25.5

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.5.Compute the Treynor Measure for the ZZZ fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.5.Compute the Treynor Measure for the ZZZ fund.

A) 6.98

B) 2.35

C) 2.53

D) 3.86

E) 1.72

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

74

Exhibit 25.3

Use the Information Below for the Following Problem(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 25.3.Compute the Sharpe Measure for the AAA fund.

A) 4.49

B) 2.74

C) 1.57

D) 1.70

E) 1.27

Use the Information Below for the Following Problem(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 25.3.Compute the Sharpe Measure for the AAA fund.

A) 4.49

B) 2.74

C) 1.57

D) 1.70

E) 1.27

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

75

Exhibit 25.3

Use the Information Below for the Following Problem(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 25.3.Compute the Jensen Measure for the BBB fund.

A) 4.49

B) 2.74

C) 4.25

D) 5.55

E) 8.99

Use the Information Below for the Following Problem(S)

Consider the data presented below on three mutual funds and the market.

Refer to Exhibit 25.3.Compute the Jensen Measure for the BBB fund.

A) 4.49

B) 2.74

C) 4.25

D) 5.55

E) 8.99

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

76

Exhibit 25.5

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

What is the Sharpe measure for the S&P 500 over the last ten years if the standard deviation was 8% and the return was 14%?

A) 1.55

B) 1.69

C) 1.75

D) 1.99

E) 2.09

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

What is the Sharpe measure for the S&P 500 over the last ten years if the standard deviation was 8% and the return was 14%?

A) 1.55

B) 1.69

C) 1.75

D) 1.99

E) 2.09

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

77

Exhibit 25.4

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.4.Compute the Sharpe Measure for the AAA fund.

A) 2.01

B) 2.74

C) 2.91

D) 5.43

E) 1.72

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.4.Compute the Sharpe Measure for the AAA fund.

A) 2.01

B) 2.74

C) 2.91

D) 5.43

E) 1.72

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

78

Suppose the expected return for the market portfolio and risk-free rate are 13% and 3% respectively.Stocks A,B,and C have Treynor measures of 0.24,0.16,and 0.11,respectively.Based on this information an investor should

A) Buy stocks A, B, and C

B) Buy stocks A and B and sell stock C

C) Buy stock A and sell stocks B and C

D) Sell stocks A, B, and C

E) Hold stocks A, B, and C

A) Buy stocks A, B, and C

B) Buy stocks A and B and sell stock C

C) Buy stock A and sell stocks B and C

D) Sell stocks A, B, and C

E) Hold stocks A, B, and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

79

Exhibit 25.4

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.4.Compute the Jensen Measure for the BBB fund.

A) 2.10

B) 2.74

C) 5.43

D) 2.00

E) 1.65

Use the Information Below for the Following Problem(S)

The data presented below has been collected at this point in time.

Refer to Exhibit 25.4.Compute the Jensen Measure for the BBB fund.

A) 2.10

B) 2.74

C) 5.43

D) 2.00

E) 1.65

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck

80

Portfolio managers are often evaluated using a boxplot of returns for a universe of investors over a specific period of time which is known as a(n)

A) Return adjusted comparison

B) Efficient frontier comparison

C) Time plot comparison

D) Peer group comparison

E) None of the above

A) Return adjusted comparison

B) Efficient frontier comparison

C) Time plot comparison

D) Peer group comparison

E) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 100 في هذه المجموعة.

فتح الحزمة

k this deck