Deck 5: The Global Financial System and Exchange Rates

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/81

العب

ملء الشاشة (f)

Deck 5: The Global Financial System and Exchange Rates

1

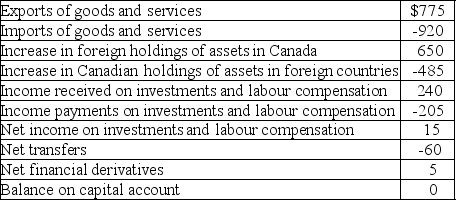

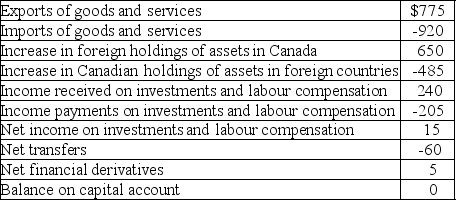

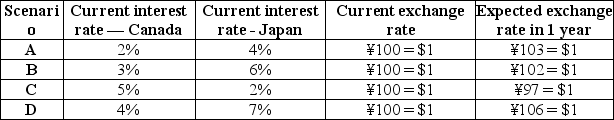

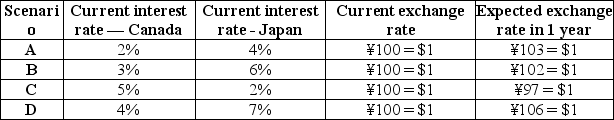

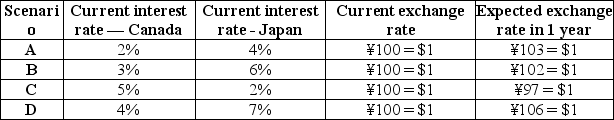

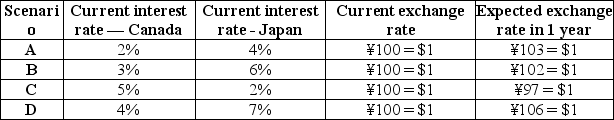

Table 5.1

Refer to Table 5.1.Using the data in the table calculate the following:

a. The balance on the current account

b. The balance on the financial account

c. The statistical discrepancy

d. The balance of payments

Refer to Table 5.1.Using the data in the table calculate the following:

a. The balance on the current account

b. The balance on the financial account

c. The statistical discrepancy

d. The balance of payments

a. The balance on the current account = 775 + (-920)+ 240 + (-205)+ 15 + (-60)= -$155.

b. The balance on the financial account = 650 + (-485)+ 5 = $170.

c. The statistical discrepancy = -155 + 170 = $15.

d. The balance of payments = -155 + 170 - 15 = $0.

b. The balance on the financial account = 650 + (-485)+ 5 = $170.

c. The statistical discrepancy = -155 + 170 = $15.

d. The balance of payments = -155 + 170 - 15 = $0.

2

Suppose the majority of the shares of Royal Bank of Canada stock were sold to an Italian firm.Other things equal,this will

A) increase the balance of the Canadian current account.

B) increase the balance of the Canadian financial account.

C) create a capital outflow in Canada.

D) decrease net portfolio investment in Canada.

A) increase the balance of the Canadian current account.

B) increase the balance of the Canadian financial account.

C) create a capital outflow in Canada.

D) decrease net portfolio investment in Canada.

B

3

Which of the following transactions would be included in Germany's current account?

A) A German citizen purchases a new BMW made in Germany.

B) An American citizen purchases 500 shares of BMW stock.

C) A German citizen purchases 500 shares of eBay stock.

D) An American citizen purchases a new BMW made in Germany.

A) A German citizen purchases a new BMW made in Germany.

B) An American citizen purchases 500 shares of BMW stock.

C) A German citizen purchases 500 shares of eBay stock.

D) An American citizen purchases a new BMW made in Germany.

D

4

The part of the balance of payments that records purchases of assets a country has made abroad and foreign purchases of assets in the country is the

A) capital account.

B) current account.

C) financial account.

D) statistical discrepancy account.

A) capital account.

B) current account.

C) financial account.

D) statistical discrepancy account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

5

A currency's spot exchange rate against every other individual currency is known as a ________ exchange rate,and the exchange rate that shows how a currency is changing relative to a group of other countries' currencies is known as a ________ exchange rate.

A) nominal; real

B) unilateral; bilateral

C) nominal; parity

D) bilateral; multilateral

A) nominal; real

B) unilateral; bilateral

C) nominal; parity

D) bilateral; multilateral

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

6

When net capital outflows are negative,

A) capital inflows are greater than capital outflows.

B) net factor payments must be positive.

C) the current account must be negative.

D) foreign direct investment must be greater than foreign portfolio investment.

A) capital inflows are greater than capital outflows.

B) net factor payments must be positive.

C) the current account must be negative.

D) foreign direct investment must be greater than foreign portfolio investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

7

Why is the balance of payments always zero?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

8

If the dollar appreciates relative to the Swiss franc,

A) Canadian exports to Switzerland become more expensive.

B) Canadian exports to Switzerland become less expensive.

C) Swiss imports to Canada become more expensive.

D) the value of Swiss imports to Canada does not change.

A) Canadian exports to Switzerland become more expensive.

B) Canadian exports to Switzerland become less expensive.

C) Swiss imports to Canada become more expensive.

D) the value of Swiss imports to Canada does not change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

9

If Canadians decrease their purchases of Mexican beer,assuming all else remains constant,this will ________ of Canada.

A) decrease the financial account balance

B) decrease net exports

C) increase the trade deficit

D) decrease the current account balance

A) decrease the financial account balance

B) decrease net exports

C) increase the trade deficit

D) decrease the current account balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

10

The price of one currency in terms of another country's currency is known as the

A) nominal exchange rate.

B) real exchange rate.

C) relative inflation rate.

D) purchasing power parity rate.

A) nominal exchange rate.

B) real exchange rate.

C) relative inflation rate.

D) purchasing power parity rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is an example of foreign direct investment in the United Kingdom?

A) British Airways purchases a small, Toronto-based helicopter transport company.

B) The Bank of England purchases Canadian Treasury securities.

C) Rogers purchases stock in British Telecom.

D) Canada-based BlackBerry purchases a distribution warehouse in London.

A) British Airways purchases a small, Toronto-based helicopter transport company.

B) The Bank of England purchases Canadian Treasury securities.

C) Rogers purchases stock in British Telecom.

D) Canada-based BlackBerry purchases a distribution warehouse in London.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

12

If the current account is in surplus and the capital account is zero,then

A) net exports must be positive.

B) the balance of payments must be in surplus.

C) the financial account must be in deficit.

D) there is a capital inflow.

A) net exports must be positive.

B) the balance of payments must be in surplus.

C) the financial account must be in deficit.

D) there is a capital inflow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

13

The part of the balance of payments that records (generally)minor transactions such as migrant's transfers,copyrights,and trademarks is the

A) capital account.

B) current account.

C) financial account.

D) statistical discrepancy account.

A) capital account.

B) current account.

C) financial account.

D) statistical discrepancy account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

14

The current account includes all of the following accounts except

A) net transfers.

B) net exports.

C) net financial derivatives.

D) net factor payments.

A) net transfers.

B) net exports.

C) net financial derivatives.

D) net factor payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

15

Other things equal,if foreign holdings of Canadian dollars decrease,

A) the balance on the Canadian current account will decrease.

B) the balance on the Canadian financial account will decrease.

C) the balance on the Canadian capital account will decrease.

D) the Canadian balance of payments will decrease.

A) the balance on the Canadian current account will decrease.

B) the balance on the Canadian financial account will decrease.

C) the balance on the Canadian capital account will decrease.

D) the Canadian balance of payments will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

16

If the dollar depreciates relative to the Mexican peso,

A) Canadian exports to Mexico become more expensive.

B) Canadian exports to Mexico become less expensive.

C) Mexican imports to Canada become less expensive.

D) the value of Mexican imports to Canada does not change, but the value of Canadian exports to Mexico increases.

A) Canadian exports to Mexico become more expensive.

B) Canadian exports to Mexico become less expensive.

C) Mexican imports to Canada become less expensive.

D) the value of Mexican imports to Canada does not change, but the value of Canadian exports to Mexico increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

17

The part of the balance of payments that records a country's net exports,net investment income,and net transfers is the

A) capital account.

B) current account.

C) financial account.

D) statistical discrepancy account.

A) capital account.

B) current account.

C) financial account.

D) statistical discrepancy account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

18

When Canada sends money to Japan to help earthquake survivors,in which account is this transaction recorded?

A) the financial account

B) the capital account

C) the foreign services account

D) the current account

A) the financial account

B) the capital account

C) the foreign services account

D) the current account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

19

An increase in capital outflows from Canada will

A) decrease the balance of the Canadian current account.

B) decrease the balance of the Canadian financial account.

C) increase the balance of the capital account of Canada.

D) decrease the balance of the capital account of Canada.

A) decrease the balance of the Canadian current account.

B) decrease the balance of the Canadian financial account.

C) increase the balance of the capital account of Canada.

D) decrease the balance of the capital account of Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

20

An American insurance company hires a call centre in India to handle customer service calls in order to cut costs.Other things equal,this will ________ of the United States.

A) decrease the financial account balance

B) decrease net exports

C) decrease the capital account balance

D) increase the current account balance

A) decrease the financial account balance

B) decrease net exports

C) decrease the capital account balance

D) increase the current account balance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

21

What are the three major types of foreign-exchange systems,and how do they operate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

22

One disadvantage of a fixed exchange rate system compared to a floating or managed float exchange rate system is

A) it is more difficult for central banks to control inflation with a fixed exchange rate system.

B) a fixed exchange rate system does not allow for government intervention.

C) a fixed exchange rate system can worsen inflation if domestic prices of imports rise quickly.

D) a fixed exchange rate system eliminates the possibility of depreciation during a recession.

A) it is more difficult for central banks to control inflation with a fixed exchange rate system.

B) a fixed exchange rate system does not allow for government intervention.

C) a fixed exchange rate system can worsen inflation if domestic prices of imports rise quickly.

D) a fixed exchange rate system eliminates the possibility of depreciation during a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

23

What is the difference between nominal exchange rates and real exchange rates?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

24

One advantage of a fixed exchange rate system compared to a floating or managed float exchange rate system is

A) business planning becomes much easier.

B) there is no need for government intervention.

C) it allows the exchange rate to reflect demand and supply in the market.

D) it eliminates the possibility of depreciation during a recession.

A) business planning becomes much easier.

B) there is no need for government intervention.

C) it allows the exchange rate to reflect demand and supply in the market.

D) it eliminates the possibility of depreciation during a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

25

One disadvantage of a floating exchange rate system compared to a fixed or managed float exchange rate system is

A) it does not allow the exchange rate to reflect demand and supply in the market.

B) it is difficult to maintain.

C) it can make business planning difficult.

D) it eliminates the possibility of depreciation during a recession.

A) it does not allow the exchange rate to reflect demand and supply in the market.

B) it is difficult to maintain.

C) it can make business planning difficult.

D) it eliminates the possibility of depreciation during a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

26

An agreement among countries about how relative currency values should be determined is known as

A) an exchange rate system.

B) an international currency market.

C) a free-trade arrangement.

D) a parity intervention.

A) an exchange rate system.

B) an international currency market.

C) a free-trade arrangement.

D) a parity intervention.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the theory of purchasing power parity is correct,which of the following statements should be true in the long run?

A) The percentage change in the nominal exchange rate equals the foreign inflation rate minus the domestic inflation rate.

B) The percentage change in the real exchange rate equals the foreign inflation rate plus the domestic inflation rate.

C) The percentage change in the nominal exchange rate equals the percentage change in the real exchange rate minus the sum of the foreign inflation rate and the domestic inflation rate.

D) The percentage change in the nominal exchange rate equals zero.

A) The percentage change in the nominal exchange rate equals the foreign inflation rate minus the domestic inflation rate.

B) The percentage change in the real exchange rate equals the foreign inflation rate plus the domestic inflation rate.

C) The percentage change in the nominal exchange rate equals the percentage change in the real exchange rate minus the sum of the foreign inflation rate and the domestic inflation rate.

D) The percentage change in the nominal exchange rate equals zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the nominal exchange rate between the dollar and the Thai baht (baht per dollar)is lower than the relative purchasing power between the two countries,which of the following would be true?

A) Purchasing power parity predicts that the value of the dollar will fall as traders take advantage of profit opportunities.

B) Purchasing power parity predicts that the baht is undervalued as traders take advantage of profit opportunities.

C) There are opportunities for profit by purchasing goods in Canada and selling them in Thailand.

D) There are no opportunities for profit by purchasing goods in one country and selling them in the other.

A) Purchasing power parity predicts that the value of the dollar will fall as traders take advantage of profit opportunities.

B) Purchasing power parity predicts that the baht is undervalued as traders take advantage of profit opportunities.

C) There are opportunities for profit by purchasing goods in Canada and selling them in Thailand.

D) There are no opportunities for profit by purchasing goods in one country and selling them in the other.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

29

The price of domestic goods in terms of foreign goods is referred to as the

A) nominal exchange rate.

B) real exchange rate.

C) relative inflation rate.

D) purchasing power parity rate.

A) nominal exchange rate.

B) real exchange rate.

C) relative inflation rate.

D) purchasing power parity rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

30

If Greece chose to abandon the euro and the Greek government decided to exchange euro bank deposits for drachmas,the affected bank depositors would experience gains if the

A) euro then appreciated.

B) euro then depreciated.

C) drachma then appreciated.

D) drachma then depreciated.

A) euro then appreciated.

B) euro then depreciated.

C) drachma then appreciated.

D) drachma then depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the purchasing power of a dollar is less than the purchasing power of the Mexican peso,purchasing power parity would predict that

A) in the short run, the dollar will appreciate relative to the peso to equalize the purchasing power of the dollar and the peso.

B) in the short run, the dollar will depreciate relative to the peso to equalize the purchasing power of the dollar and the peso.

C) in the long run, the dollar will appreciate relative to the peso to equalize the purchasing power of the dollar and the peso.

D) in the long run, the dollar will depreciate relative to the peso to equalize the purchasing power of the dollar and the peso.

A) in the short run, the dollar will appreciate relative to the peso to equalize the purchasing power of the dollar and the peso.

B) in the short run, the dollar will depreciate relative to the peso to equalize the purchasing power of the dollar and the peso.

C) in the long run, the dollar will appreciate relative to the peso to equalize the purchasing power of the dollar and the peso.

D) in the long run, the dollar will depreciate relative to the peso to equalize the purchasing power of the dollar and the peso.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

32

If the exchange rate changes from $1.52 = £1.00 to $1.65 = £1.00,then relative to each other,

A) both the dollar and the British pound have appreciated.

B) both the dollar and the British pound have depreciated.

C) the dollar has appreciated and the British pound has depreciated.

D) the dollar has depreciated and the British pound has appreciated.

A) both the dollar and the British pound have appreciated.

B) both the dollar and the British pound have depreciated.

C) the dollar has appreciated and the British pound has depreciated.

D) the dollar has depreciated and the British pound has appreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

33

According to the theory of purchasing power parity,in the long run

A) the nominal exchange rate should equal the domestic inflation rate.

B) the domestic inflation rate should equal the foreign inflation rate.

C) the real exchange rate should equal 1.

D) the real exchange rate should equal the domestic inflation rate divided by the foreign inflation rate.

A) the nominal exchange rate should equal the domestic inflation rate.

B) the domestic inflation rate should equal the foreign inflation rate.

C) the real exchange rate should equal 1.

D) the real exchange rate should equal the domestic inflation rate divided by the foreign inflation rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following explains why purchasing power parity may not hold perfectly in the long run?

A) Most countries have free markets with limited government regulation.

B) Consumer preferences for goods and services across countries are very similar.

C) Most countries do not impose trade barriers.

D) Some goods and services produced in any country are not traded internationally.

A) Most countries have free markets with limited government regulation.

B) Consumer preferences for goods and services across countries are very similar.

C) Most countries do not impose trade barriers.

D) Some goods and services produced in any country are not traded internationally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

35

One advantage of a floating exchange rate system compared to a fixed or managed float exchange rate system is

A) it is easier for central banks to control inflation.

B) there is no need for government intervention.

C) it allows greater exchange rate stability.

D) it eliminates the possibility of depreciation during a recession.

A) it is easier for central banks to control inflation.

B) there is no need for government intervention.

C) it allows greater exchange rate stability.

D) it eliminates the possibility of depreciation during a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

36

Suppose a Big Mac costs $4.20 in Canada and 9.55 zlotys in Poland.If the exchange rate is 2.77 zlotys per dollar,purchasing power parity predicts that

A) the dollar is undervalued.

B) the zloty is undervalued.

C) the zloty is overvalued.

D) both the dollar and the zloty are undervalued.

A) the dollar is undervalued.

B) the zloty is undervalued.

C) the zloty is overvalued.

D) both the dollar and the zloty are undervalued.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

37

If Greece chose to abandon the euro and the Greek government decided to exchange euro bank deposits for drachmas,the affected bank depositors would suffer losses if the

A) euro then appreciated.

B) euro then depreciated.

C) drachma then appreciated.

D) drachma then depreciated.

A) euro then appreciated.

B) euro then depreciated.

C) drachma then appreciated.

D) drachma then depreciated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

38

One advantage of a managed float exchange rate system compared to a floating exchange rate system is

A) it allows the exchange rate to reflect demand and supply in the market.

B) there is no need for government intervention.

C) it allows greater exchange rate stability.

D) it eliminates the possibility of depreciation during a recession.

A) it allows the exchange rate to reflect demand and supply in the market.

B) there is no need for government intervention.

C) it allows greater exchange rate stability.

D) it eliminates the possibility of depreciation during a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

39

If the nominal exchange rate between the dollar and the euro is $1 = €0.70,and the price of an 8.4 oz.can of Red Bull is $1.75 in Canada and €1.40 in Germany,the real exchange rate between the dollar and the euro is

A) 1.25 cans of Red Bull in Germany per can of Red Bull in Canada.

B) 0.80 cans of Red Bull in Canada per can of Red Bull in Germany.

C) 0.875 cans of Red Bull in Germany per can of Red Bull in Canada.

D) 0.56 cans of Red Bull in Germany per can of Red Bull in Canada.

A) 1.25 cans of Red Bull in Germany per can of Red Bull in Canada.

B) 0.80 cans of Red Bull in Canada per can of Red Bull in Germany.

C) 0.875 cans of Red Bull in Germany per can of Red Bull in Canada.

D) 0.56 cans of Red Bull in Germany per can of Red Bull in Canada.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

40

Buying a product in one market and reselling it in another market at a higher price is referred to as

A) arbitrage.

B) purchasing power parity.

C) crowding in.

D) barter.

A) arbitrage.

B) purchasing power parity.

C) crowding in.

D) barter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

41

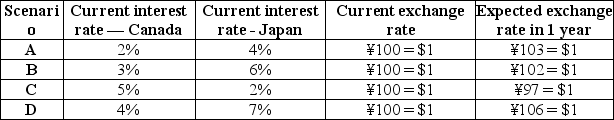

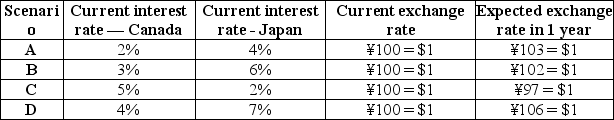

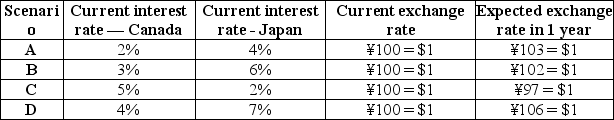

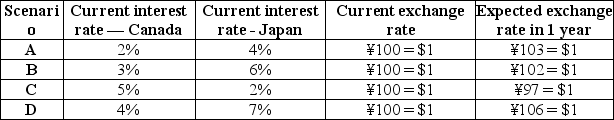

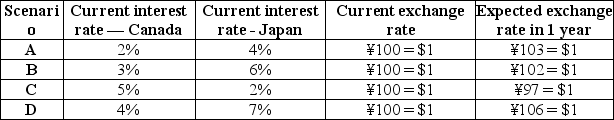

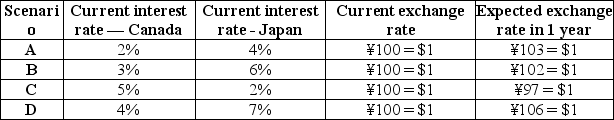

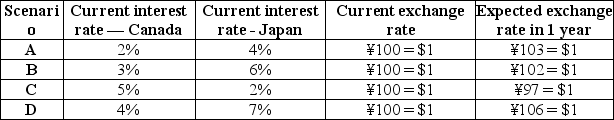

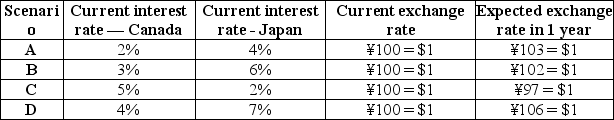

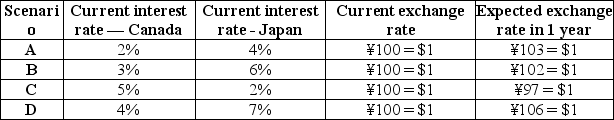

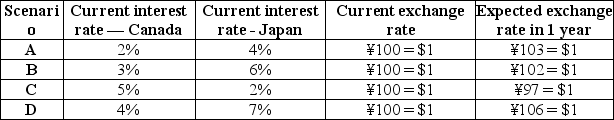

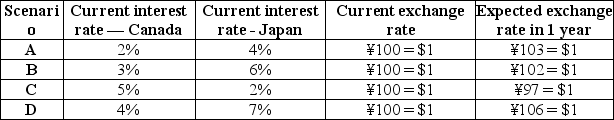

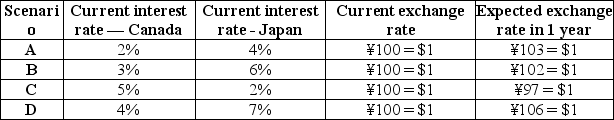

Table 5.2

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.If you choose to invest in Japanese bonds,your investment return from Scenario A will be

A) 1%.

B) 3%.

C) 4%.

D) 7%.

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.If you choose to invest in Japanese bonds,your investment return from Scenario A will be

A) 1%.

B) 3%.

C) 4%.

D) 7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

42

Table 5.2

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.With which scenario will you be best off by investing in Japanese bonds instead of Canadian bonds?

A) A

B) B

C) C

D) D

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.With which scenario will you be best off by investing in Japanese bonds instead of Canadian bonds?

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

43

What real-world complications keep purchasing power parity from being a complete explanation of exchange-rate fluctuations in the long run? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

44

When the Bank of Canada pursues a monetary policy of low interest rates,the exchange rate between the dollar and other currencies will tend to ________,generally making it ________ for foreign firms to sell their goods in Canada.

A) rise; easier

B) rise; more difficult

C) fall; easier

D) fall; more difficult

A) rise; easier

B) rise; more difficult

C) fall; easier

D) fall; more difficult

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

45

What three factors regarding differences in interest rates on similar bonds can prevent the interest parity condition from holding?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

46

Table 5.2

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.If you choose to invest in Japanese bonds,your investment return from Scenario D will be

A) 1%.

B) 3%.

C) 7%.

D) 13%.

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.If you choose to invest in Japanese bonds,your investment return from Scenario D will be

A) 1%.

B) 3%.

C) 7%.

D) 13%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

47

When determining interest rates,the loanable funds model is more useful when we are concerned with the determinants of the ________,and the money market model is more useful when we are concerned with the determinants of the ________.

A) long-term real interest rate; short-term nominal interest rate

B) short-term real interest rate; long-term nominal interest rate

C) short-term real interest rate; short-term nominal interest rate

D) long-term real interest rate; long-term nominal interest rate

A) long-term real interest rate; short-term nominal interest rate

B) short-term real interest rate; long-term nominal interest rate

C) short-term real interest rate; short-term nominal interest rate

D) long-term real interest rate; long-term nominal interest rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

48

The return that a domestic investor receives on a foreign investment is equal to

A) the interest rate on the foreign investment minus the interest rate on a comparable domestic investment.

B) the appreciation rate of the foreign currency minus the appreciation rate of the domestic currency.

C) the interest rate on the foreign investment times the appreciation rate of the foreign currency.

D) the interest rate on the foreign investment minus the rate of appreciation of the domestic currency.

A) the interest rate on the foreign investment minus the interest rate on a comparable domestic investment.

B) the appreciation rate of the foreign currency minus the appreciation rate of the domestic currency.

C) the interest rate on the foreign investment times the appreciation rate of the foreign currency.

D) the interest rate on the foreign investment minus the rate of appreciation of the domestic currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following best represents household saving?

A) T - (G + TR)

B) (Y - TR) + I

C) (Y - C - G - NX)

D) (Y + TR - T) + C

A) T - (G + TR)

B) (Y - TR) + I

C) (Y - C - G - NX)

D) (Y + TR - T) + C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

50

The supply of loanable funds is equal to the supply of saving in the economy.The three sources of saving in an economy include all of the following,except

A) households.

B) businesses.

C) the government.

D) the foreign sector.

A) households.

B) businesses.

C) the government.

D) the foreign sector.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

51

An appreciation of the Mexican peso relative to the dollar would ________ Mexican firms that are exporting goods to Canada and would ________ Mexican firms that have borrowed in Canadian dollars.

A) help; help

B) help; hurt

C) hurt; help

D) hurt; hurt

A) help; help

B) help; hurt

C) hurt; help

D) hurt; hurt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

52

Table 5.2

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.If you choose to invest in Japanese bonds,your investment return from Scenario B will be

A) 3%.

B) 4%.

C) 6%.

D) 8%.

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.If you choose to invest in Japanese bonds,your investment return from Scenario B will be

A) 3%.

B) 4%.

C) 6%.

D) 8%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

53

A depreciation of the Mexican peso relative to the dollar would ________ Mexican firms that are exporting goods to Canada and would ________ Mexican firms that have borrowed in Canadian dollars.

A) help; help

B) help; hurt

C) hurt; help

D) hurt; hurt

A) help; help

B) help; hurt

C) hurt; help

D) hurt; hurt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

54

Suppose that you intend to invest $10 000 in one-year government bonds.You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan,but as a Canadian resident,you want your investment return to be in Canadian dollars.Assume the current interest rate on one-year government bonds is 3% in Canada and 7% in Japan,the current exchange rate is ¥100 = $1,and the expected exchange rate in one year is ¥110 = $1.

a. What is your return on Japanese bonds?

b. Would you have been better off investing in Japanese bonds or Canadian bonds? Explain.

c. For the interest parity condition to hold,what would have to happen to the interest rate on Japanese bonds,assuming all other data remains the same?

a. What is your return on Japanese bonds?

b. Would you have been better off investing in Japanese bonds or Canadian bonds? Explain.

c. For the interest parity condition to hold,what would have to happen to the interest rate on Japanese bonds,assuming all other data remains the same?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

55

Purchasing power parity does a ________ job in explaining movements in nominal exchange rates in the short run and does a ________ job in explaining movements in nominal exchange rates in the long run.

A) reasonable; reasonable

B) reasonable; poor

C) poor; reasonable

D) poor; poor

A) reasonable; reasonable

B) reasonable; poor

C) poor; reasonable

D) poor; poor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

56

Table 5.2

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.In which scenario does the interest parity condition hold?

A) A

B) B

C) C

D) D

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.In which scenario does the interest parity condition hold?

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

57

Table 5.2

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.With which scenario will you be indifferent about investing in either Canadian or Japanese bonds?

A) A

B) B

C) C

D) D

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.With which scenario will you be indifferent about investing in either Canadian or Japanese bonds?

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

58

Table 5.2

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.If you choose to invest in Japanese bonds,your investment return from Scenario C will be

A) -3%.

B) -1%.

C) 2%.

D) 5%.

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.If you choose to invest in Japanese bonds,your investment return from Scenario C will be

A) -3%.

B) -1%.

C) 2%.

D) 5%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

59

Table 5.2

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.With which scenario will you be worst off by investing in Japanese bonds instead of Canadian bonds?

A) A

B) B

C) C

D) D

Suppose that you intend to invest $10 000 in one-year government bonds. You are looking for the highest return on your investment and do not care whether you invest in Canada or Japan, but as a Canadian resident, you want your investment return to be in Canadian dollars. Table 5.2 lists four scenarios, each showing the current interest rate for one-year government bonds in Canada and Japan, the current exchange rate between the dollar and the yen, and the expected exchange rate in one year. Other than the interest rates, you assume the bonds from each country to be identical.

Refer to Table 5.2.With which scenario will you be worst off by investing in Japanese bonds instead of Canadian bonds?

A) A

B) B

C) C

D) D

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following best represents government saving?

A) T - (G + TR)

B) (Y - TR) + I

C) (Y - C - G - NX)

D) (Y + TR - T) + C

A) T - (G + TR)

B) (Y - TR) + I

C) (Y - C - G - NX)

D) (Y + TR - T) + C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

61

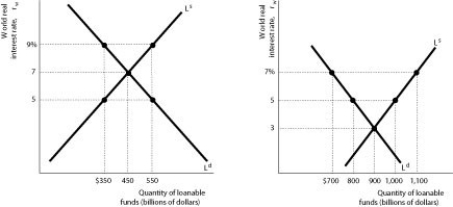

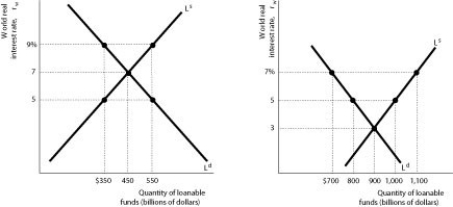

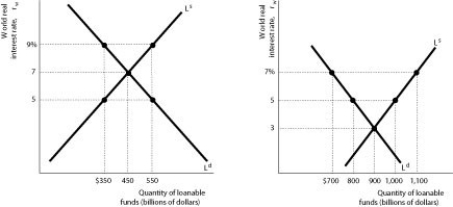

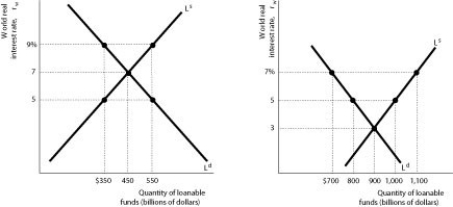

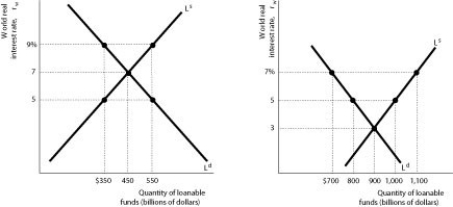

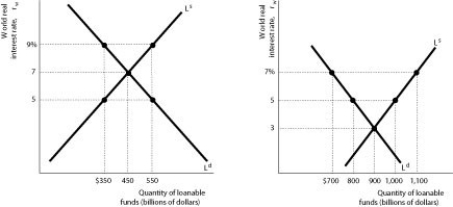

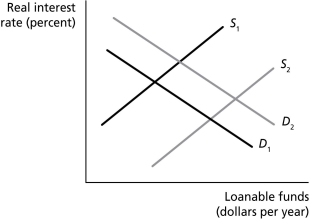

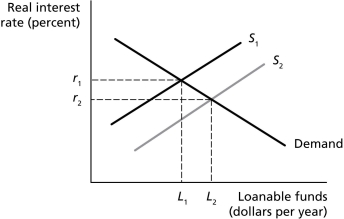

Figure 5.4

Suppose the world consists of two large open economies, Canada and the rest of the world. The figures above represent loanable funds graphs for these two economies.

Refer to Figure 5.4.The international capital market will be in equilibrium when the real interest rate in Canada is ________ and the real interest rate in the rest of the world is ________.

A) 7%; 3%

B) 5%; 7%

C) 9%; 3%

D) 5%; 5%

Suppose the world consists of two large open economies, Canada and the rest of the world. The figures above represent loanable funds graphs for these two economies.

Refer to Figure 5.4.The international capital market will be in equilibrium when the real interest rate in Canada is ________ and the real interest rate in the rest of the world is ________.

A) 7%; 3%

B) 5%; 7%

C) 9%; 3%

D) 5%; 5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

62

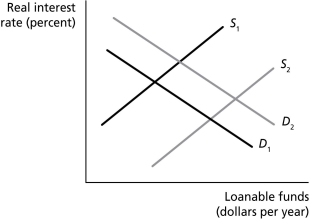

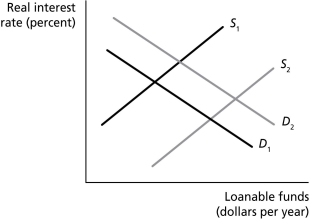

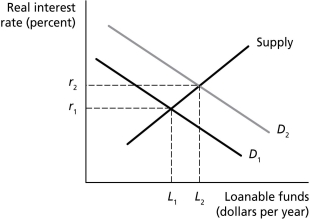

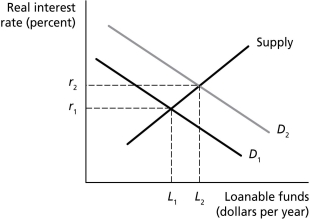

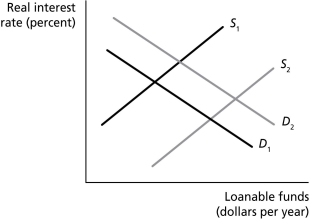

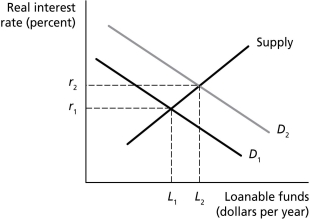

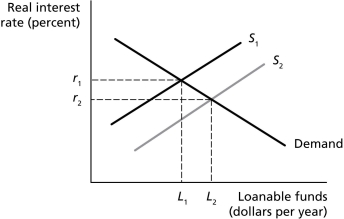

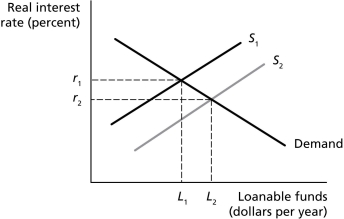

Figure 5.3

Refer to Figure 5.3.All else equal,an increase in the government's budget deficit accompanied by a decrease in corporate taxes would cause which of the following shifts?

A) S₁ to S₂ and D₁ to D₂

B) S₂ to S₁ and D₁ to D₂

C) S₁ to S₂ and D₂ to D₁

D) S₂ to S₁ and D₂ to D₁

Refer to Figure 5.3.All else equal,an increase in the government's budget deficit accompanied by a decrease in corporate taxes would cause which of the following shifts?

A) S₁ to S₂ and D₁ to D₂

B) S₂ to S₁ and D₁ to D₂

C) S₁ to S₂ and D₂ to D₁

D) S₂ to S₁ and D₂ to D₁

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

63

If the world real interest rate were 6% and the domestic real interest rate in Estonia were 4%,borrowers in Estonia would borrow at the rate of ________ and lenders in Estonia would lend at the rate of ________.

A) 6%; 6%

B) 6%; 4%

C) 4%; 6%

D) 4%; 4%

A) 6%; 6%

B) 6%; 4%

C) 4%; 6%

D) 4%; 4%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

64

Figure 5.4

Suppose the world consists of two large open economies, Canada and the rest of the world. The figures above represent loanable funds graphs for these two economies.

Refer to Figure 5.4.At an interest rate of 7%,

A) foreign borrowers want to borrow more from international capital markets than is available.

B) Canadian borrowers want to borrow more from the domestic market than is available.

C) foreign lenders have more to lend in international capital markets than meets demand.

D) Canadian borrowers want to borrow less in international capital markets than is available.

Suppose the world consists of two large open economies, Canada and the rest of the world. The figures above represent loanable funds graphs for these two economies.

Refer to Figure 5.4.At an interest rate of 7%,

A) foreign borrowers want to borrow more from international capital markets than is available.

B) Canadian borrowers want to borrow more from the domestic market than is available.

C) foreign lenders have more to lend in international capital markets than meets demand.

D) Canadian borrowers want to borrow less in international capital markets than is available.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

65

The higher the real interest rate,the ________ investment projects firms can profitably undertake,and the ________ the quantity of loanable funds they will demand.

A) more; smaller

B) more; greater

C) fewer; greater

D) fewer; smaller

A) more; smaller

B) more; greater

C) fewer; greater

D) fewer; smaller

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

66

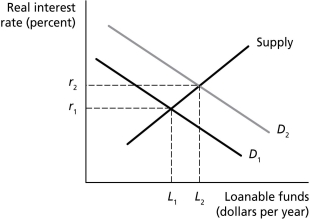

Figure 5.2

Refer to Figure 5.2.A shift from D₁ to D₂ will result from which of the following?

A) an increase in expected future profits

B) an increase in corporate taxes

C) an increase in tax credits for savings

D) a decrease in the desire of households to consume today

Refer to Figure 5.2.A shift from D₁ to D₂ will result from which of the following?

A) an increase in expected future profits

B) an increase in corporate taxes

C) an increase in tax credits for savings

D) a decrease in the desire of households to consume today

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following best represents total saving?

A) T - (G + TR)

B) (Y - TR) + I

C) (Y - C - G - NX)

D) (Y + TR - T) + C

A) T - (G + TR)

B) (Y - TR) + I

C) (Y - C - G - NX)

D) (Y + TR - T) + C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

68

Figure 5.4

Suppose the world consists of two large open economies, Canada and the rest of the world. The figures above represent loanable funds graphs for these two economies.

Refer to Figure 5.4.At an interest rate of 7%,

A) foreign borrowers have an incentive to offer lenders in Canada an interest rate greater than 7%.

B) foreign lenders have an incentive to offer borrowers in Canada an interest rate less than 7%.

C) Canadian lenders have an incentive to offer borrowers in the rest of the world an interest rate of 7%.

D) Canadian borrowers have an incentive to offer Canadian lenders an interest rate greater than 7%.

Suppose the world consists of two large open economies, Canada and the rest of the world. The figures above represent loanable funds graphs for these two economies.

Refer to Figure 5.4.At an interest rate of 7%,

A) foreign borrowers have an incentive to offer lenders in Canada an interest rate greater than 7%.

B) foreign lenders have an incentive to offer borrowers in Canada an interest rate less than 7%.

C) Canadian lenders have an incentive to offer borrowers in the rest of the world an interest rate of 7%.

D) Canadian borrowers have an incentive to offer Canadian lenders an interest rate greater than 7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

69

All else equal,an increase in net exports accompanied by a decrease in expected future profits would definitely result in

A) an increase in the equilibrium real interest rate.

B) a decrease in the equilibrium real interest rate.

C) an increase in the equilibrium level of saving and investment.

D) a decrease in the equilibrium level of saving and investment.

A) an increase in the equilibrium real interest rate.

B) a decrease in the equilibrium real interest rate.

C) an increase in the equilibrium level of saving and investment.

D) a decrease in the equilibrium level of saving and investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

70

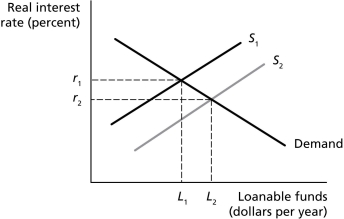

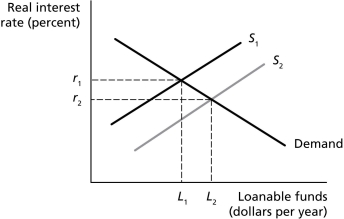

Figure 5.1

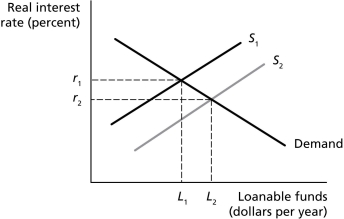

Refer to Figure 5.1.A shift from S₂ to S₁ will result from which of the following?

A) an increase in expected future profits

B) an increase in net exports

C) a decrease in corporate taxes

D) an increase in tax credits for savings

Refer to Figure 5.1.A shift from S₂ to S₁ will result from which of the following?

A) an increase in expected future profits

B) an increase in net exports

C) a decrease in corporate taxes

D) an increase in tax credits for savings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

71

The domestic real interest rate in a small open economy is

A) determined by the intersection of the supply curve and demand curve for loanable funds in the country.

B) equal to the world real interest rate.

C) the same as its nominal interest rate.

D) determined by the total value of net exports in the country.

A) determined by the intersection of the supply curve and demand curve for loanable funds in the country.

B) equal to the world real interest rate.

C) the same as its nominal interest rate.

D) determined by the total value of net exports in the country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

72

Figure 5.3

Refer to Figure 5.3.All else equal,an increase in net exports accompanied by a decrease in expected future profits would cause which of the following shifts?

A) S₁ to S₂ and D₁ to D₂

B) S₂ to S₁ and D₁ to D₂

C) S₁ to S₂ and D₂ to D₁

D) S₂ to S₁ and D₂ to D₁

Refer to Figure 5.3.All else equal,an increase in net exports accompanied by a decrease in expected future profits would cause which of the following shifts?

A) S₁ to S₂ and D₁ to D₂

B) S₂ to S₁ and D₁ to D₂

C) S₁ to S₂ and D₂ to D₁

D) S₂ to S₁ and D₂ to D₁

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

73

Figure 5.2

Refer to Figure 5.2.A shift from D₂ to D₁ will result from which of the following?

A) an increase in expected future profits

B) an increase in net exports

C) an increase in corporate taxes

D) a decrease in tax credits for savings

Refer to Figure 5.2.A shift from D₂ to D₁ will result from which of the following?

A) an increase in expected future profits

B) an increase in net exports

C) an increase in corporate taxes

D) a decrease in tax credits for savings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

74

Figure 5.1

Refer to Figure 5.1.All else equal,a decrease in the government's budget deficit will cause

A) a shift from S₁ to S₂.

B) a shift from S₂ to S₁.

C) a change in the interest rate from r₂ to r₁.

D) a change in loanable funds from L₂ to L₁.

Refer to Figure 5.1.All else equal,a decrease in the government's budget deficit will cause

A) a shift from S₁ to S₂.

B) a shift from S₂ to S₁.

C) a change in the interest rate from r₂ to r₁.

D) a change in loanable funds from L₂ to L₁.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

75

Figure 5.3

Refer to Figure 5.3.All else equal,a decrease in the desire of households to consume today accompanied by an increase in corporate taxes would cause which of the following shifts?

A) S₁ to S₂ and D₁ to D₂

B) S₂ to S₁ and D₁ to D₂

C) S₁ to S₂ and D₂ to D₁

D) S₂ to S₁ and D₂ to D₁

Refer to Figure 5.3.All else equal,a decrease in the desire of households to consume today accompanied by an increase in corporate taxes would cause which of the following shifts?

A) S₁ to S₂ and D₁ to D₂

B) S₂ to S₁ and D₁ to D₂

C) S₁ to S₂ and D₂ to D₁

D) S₂ to S₁ and D₂ to D₁

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

76

Figure 5.1

Refer to Figure 5.1.A shift from S₁ to S₂ will result from all of the following except

A) a decrease in the government's budget deficit.

B) a decrease in net exports.

C) a decrease in corporate taxes.

D) a decrease in the desire of households to consume today.

Refer to Figure 5.1.A shift from S₁ to S₂ will result from all of the following except

A) a decrease in the government's budget deficit.

B) a decrease in net exports.

C) a decrease in corporate taxes.

D) a decrease in the desire of households to consume today.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

77

Suppose the federal government is successful in reducing the budget deficit,households decide to increase their saving,corporate taxes are reduced,and businesses expect to see an increase in future profits.Use the loanable funds model to explain how each of these events affects the demand and supply of loanable funds and illustrate your answer with a graph.Describe what should happen to the equilibrium real interest rate and the equilibrium levels of saving and investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

78

What determines the supply of loanable funds and the demand for loanable funds?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

79

All else equal,an increase in the government's budget deficit accompanied by a decrease in corporate taxes would definitely result in

A) an increase in the equilibrium real interest rate.

B) a decrease in the equilibrium real interest rate.

C) an increase in the equilibrium level of saving and investment.

D) a decrease in the equilibrium level of saving and investment.

A) an increase in the equilibrium real interest rate.

B) a decrease in the equilibrium real interest rate.

C) an increase in the equilibrium level of saving and investment.

D) a decrease in the equilibrium level of saving and investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck

80

If the world real interest rate were 6% and the domestic real interest rate in Denmark were 9%,borrowers in Denmark would borrow at the rate of ________ and lenders in Denmark would lend at the rate of ________.

A) 6%; 6%

B) 6%; 9%

C) 9%; 6%

D) 9%; 9%

A) 6%; 6%

B) 6%; 9%

C) 9%; 6%

D) 9%; 9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 81 في هذه المجموعة.

فتح الحزمة

k this deck