Deck 11: Oligopoly

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/41

العب

ملء الشاشة (f)

Deck 11: Oligopoly

1

Two firms (A and B)have marginal costs MCA and MCB,marginal revenues MRA and MRB,and market marginal revenue MR.If both firms produce as a cartel,they should produce so that:

A) MCA = MCB = MR.

B) MCA = MRA and MCB = MCB.

C) MCA + MCB = MR.

D) MCA + MCB = MRA + MRB, not necessarily MCA = MRA.

E) MCA = MCB = MRA + MRB.

A) MCA = MCB = MR.

B) MCA = MRA and MCB = MCB.

C) MCA + MCB = MR.

D) MCA + MCB = MRA + MRB, not necessarily MCA = MRA.

E) MCA = MCB = MRA + MRB.

A

2

When an economist says an oligopoly has a "small" number of firms,the economist means:

A) exactly 1.

B) exactly 2, 3, or 4.

C) few enough to allow for interdependence.

D) few enough to allow for perfectly inelastic demand curves.

E) few enough to allow for four stages of industry development.

A) exactly 1.

B) exactly 2, 3, or 4.

C) few enough to allow for interdependence.

D) few enough to allow for perfectly inelastic demand curves.

E) few enough to allow for four stages of industry development.

C

3

A cartel is:

A) the name for firms in any oligopoly market.

B) a collusive organization.

C) an oligopolist that competes with other oligopolists.

D) a group of firms using price leadership.

E) a group of firms using preemptive strategies.

A) the name for firms in any oligopoly market.

B) a collusive organization.

C) an oligopolist that competes with other oligopolists.

D) a group of firms using price leadership.

E) a group of firms using preemptive strategies.

B

4

Cartels can only exist:

A) in oligopoly markets.

B) when products are homogeneous.

C) when products are not homogeneous.

D) in countries where they are legal.

E) when demand curves are perfectly inelastic.

A) in oligopoly markets.

B) when products are homogeneous.

C) when products are not homogeneous.

D) in countries where they are legal.

E) when demand curves are perfectly inelastic.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

5

In the United States most cartels were declared illegal by the:

A) Sherman Antitrust Act.

B) Interstate Commerce Commission.

C) Supreme Court.

D) Constitution.

E) Declaration of Independence.

A) Sherman Antitrust Act.

B) Interstate Commerce Commission.

C) Supreme Court.

D) Constitution.

E) Declaration of Independence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

6

Profit-maximizing cartels choose price equal to:

A) marginal cost.

B) average total cost of the last unit.

C) marginal revenue.

D) the monopolistically competitive price.

E) the monopoly price.

A) marginal cost.

B) average total cost of the last unit.

C) marginal revenue.

D) the monopolistically competitive price.

E) the monopoly price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

7

The OPEC oil cartel lost its market power and world oil prices fell in the 1980s because:

A) OPEC expanded its membership to include all international producers of oil.

B) world consumers boycotted OPEC oil.

C) a limit pricing strategy was pursued by some members of the cartel.

D) members began to cheat on cartel agreements.

E) the United States refused to buy oil from OPEC.

A) OPEC expanded its membership to include all international producers of oil.

B) world consumers boycotted OPEC oil.

C) a limit pricing strategy was pursued by some members of the cartel.

D) members began to cheat on cartel agreements.

E) the United States refused to buy oil from OPEC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

8

Profit-maximizing cartels allocate sales according to:

A) precartel sales.

B) potential to cheat on the cartel.

C) geographic location.

D) quantities where all firms' marginal revenues are equal.

E) quantities where all firms' marginal costs are equal.

A) precartel sales.

B) potential to cheat on the cartel.

C) geographic location.

D) quantities where all firms' marginal revenues are equal.

E) quantities where all firms' marginal costs are equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

9

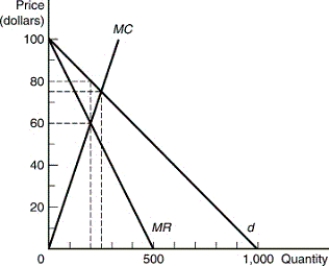

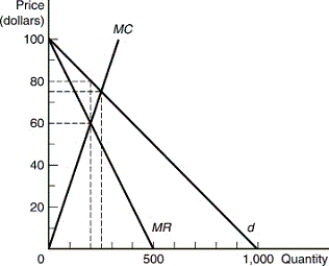

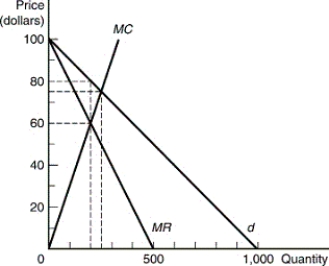

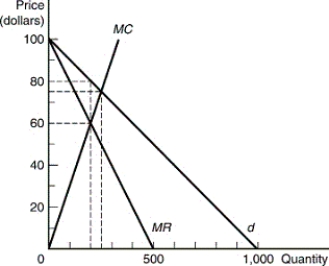

The optimal output and price for the cartel shown in the accompanying diagram is:

A) Q = 200 and P = $80.

B) Q = 260 and P = $60.

C) Q = 250 and P = $80.

D) Q = 500 and P = $75.

E) none of the above.

A) Q = 200 and P = $80.

B) Q = 260 and P = $60.

C) Q = 250 and P = $80.

D) Q = 500 and P = $75.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

10

A market where there are only a few sellers is known as:

A) perfectly competitive.

B) monopolistically competitive.

C) oligopolistic.

D) monopolistic.

E) cartelized.

A) perfectly competitive.

B) monopolistically competitive.

C) oligopolistic.

D) monopolistic.

E) cartelized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

11

Oligopoly is the only market structure in which one finds:

A) barriers to entry.

B) competing brand names.

C) minimum average total cost pricing.

D) advertising.

E) firm interdependence.

A) barriers to entry.

B) competing brand names.

C) minimum average total cost pricing.

D) advertising.

E) firm interdependence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

12

If Gulfstream and Bombardier,both producers of upscale jet airplanes,were to collude rather than compete,consumers could expect:

A) higher prices and lower quantities offered for sale.

B) lower prices and lower quantities offered for sale.

C) higher prices and higher quantities offered for sale.

D) each firm to cheat on the cartel agreement.

E) one firm to emerge as the price leader in the oligopoly.

A) higher prices and lower quantities offered for sale.

B) lower prices and lower quantities offered for sale.

C) higher prices and higher quantities offered for sale.

D) each firm to cheat on the cartel agreement.

E) one firm to emerge as the price leader in the oligopoly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

13

Duopolists A and B face the following demand curves: QA = 120 - 2PA + PB and QB = 120 - 2PB + PA.If both firms have zero marginal cost and they form a cartel,what is the profit-maximizing price and quantity?

A) P = 30, Q = 180.

B) P = 40, Q = 160.

C) P = 60, Q = 120.

D) P = 80, Q = 80.

E) P = 75, Q = 90.

A) P = 30, Q = 180.

B) P = 40, Q = 160.

C) P = 60, Q = 120.

D) P = 80, Q = 80.

E) P = 75, Q = 90.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

14

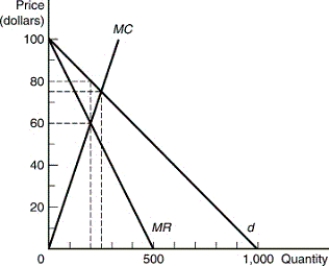

If the cartel described by the accompanying diagram is broken up and forced into a perfectly competitive market situation,the optimal output and price will be:

A) Q = 200 and P = $80.

B) Q = 260 and P = $60.

C) Q = 250 and P = $80.

D) Q = 250 and P = $75.

E) Q = 500 and P = $60.

A) Q = 200 and P = $80.

B) Q = 260 and P = $60.

C) Q = 250 and P = $80.

D) Q = 250 and P = $75.

E) Q = 500 and P = $60.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

15

In the model of oligopoly,there:

A) are many firms producing differentiated products.

B) is one firm producing undifferentiated products.

C) are a few firms producing differentiated or undifferentiated products.

D) are many firms producing undifferentiated products.

E) is one firm producing a highly differentiated product.

A) are many firms producing differentiated products.

B) is one firm producing undifferentiated products.

C) are a few firms producing differentiated or undifferentiated products.

D) are many firms producing undifferentiated products.

E) is one firm producing a highly differentiated product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

16

Duopolists A and B face the following demand curves: QA = 150 - 5PA + 4PB and QB = 150 - 5PB + 4PA.If both firms have zero marginal cost and they form a cartel,what is the profit-maximizing price and quantity?

A) P = 25, Q = 250.

B) P = 40, Q = 100.

C) P = 60, Q = 120.

D) P = 80, Q = 80.

E) P = 75, Q = 150.

A) P = 25, Q = 250.

B) P = 40, Q = 100.

C) P = 60, Q = 120.

D) P = 80, Q = 80.

E) P = 75, Q = 150.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

17

Oligopoly is a market structure that necessarily has:

A) cartels.

B) a large number of firms with homogeneous products.

C) a large number of firms with slightly different products.

D) a small number of firms but more than one.

E) only one firm.

A) cartels.

B) a large number of firms with homogeneous products.

C) a large number of firms with slightly different products.

D) a small number of firms but more than one.

E) only one firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

18

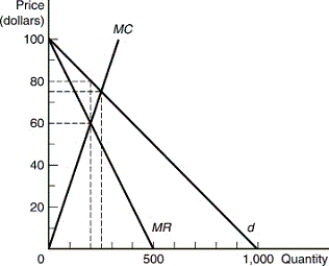

If the market described in the accompanying diagram is dominated by a cartel,the loss in total surplus relative to perfectly competitive market conditions will be:

A) $500.

B) $1,000.

C) $2,000.

D) $3,000.

E) $4,000.

A) $500.

B) $1,000.

C) $2,000.

D) $3,000.

E) $4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a cartel is working properly,its firms will likely be producing where (MCi is each firm i's marginal cost,MR is market marginal revenue,and P is price):

A) MCi = MR.

B) MCi > MR.

C) MCi < MR.

D) P = MR.

E) P < MR.

A) MCi = MR.

B) MCi > MR.

C) MCi < MR.

D) P = MR.

E) P < MR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

20

While a cartel is holding together,its individual members' demand curves are likely to be:

A) significantly elastic.

B) significantly inelastic.

C) close to unitary in elasticity.

D) kinked.

E) upward-sloping.

A) significantly elastic.

B) significantly inelastic.

C) close to unitary in elasticity.

D) kinked.

E) upward-sloping.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

21

An oligopolist that faces a kinked demand curve is charging price P = 6.Demand for an increase in price is Q = 280 - 40P and demand for a decrease in price is Q = 100 - 10P.Over what range of marginal cost would the optimal price remain unchanged?

A) Between 3 and 5.

B) Between 2 and 5.

C) Between 1 and 4.

D) Between 2 and 4.

E) Between 3 and 4.

A) Between 3 and 5.

B) Between 2 and 5.

C) Between 1 and 4.

D) Between 2 and 4.

E) Between 3 and 4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

22

Glyde Air Fresheners is the dominant firm in the solid room aromatizer industry,which has a total market demand given by Q = 80 - 2P.Glyde has competition from a fringe of four small firms that produce where their individual marginal costs equal the market price.The fringe firms each have total costs given by TCi = 10Qi + 2Q2i .If Glyde's total costs are given by TCG = 100 + 6QG,what is Glyde's maximum profit?

A) $148.

B) $184.

C) $240.

D) $332.

E) $362.

A) $148.

B) $184.

C) $240.

D) $332.

E) $362.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

23

Duopolists who compete on the basis of price will:

A) end up with price equal to marginal cost.

B) charge a price greater than marginal cost.

C) charge a price less than marginal cost.

D) price discriminate.

E) charge a price equal to marginal revenue.

A) end up with price equal to marginal cost.

B) charge a price greater than marginal cost.

C) charge a price less than marginal cost.

D) price discriminate.

E) charge a price equal to marginal revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

24

The price leadership strategy is most appropriate when a market is:

A) perfectly competitive.

B) monopolistic.

C) monopolistic competitive.

D) oligopolistic.

E) all of the above.

A) perfectly competitive.

B) monopolistic.

C) monopolistic competitive.

D) oligopolistic.

E) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

25

Two local ready-mix cement manufacturers,Here and There,have combined demand given by Q = 105 - P.Their total costs are given by TCHere = 5QHere + 0.5Q2Here and TCThere = 5QThere + 0.5Q2There.If they successfully collude,their total output will be:

A) 10 units.

B) 20 units.

C) 40 units.

D) 50 units.

E) 66.67 units.

A) 10 units.

B) 20 units.

C) 40 units.

D) 50 units.

E) 66.67 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

26

If duopolists engage in price competition,the result is:

A) always zero profits.

B) always zero profits unless the firms produce differentiated products.

C) always zero profits unless the two goods are perfect substitutes.

D) always zero profits unless the two firms collude.

E) never zero profits.

A) always zero profits.

B) always zero profits unless the firms produce differentiated products.

C) always zero profits unless the two goods are perfect substitutes.

D) always zero profits unless the two firms collude.

E) never zero profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

27

Two local ready-mix cement manufacturers,Here and There,have combined demand given by Q = 105 - P.Their total costs are given by TCHere = 5QHere + 0.5Q2Here and TCThere = 5QThere + 0.5Q2There.If they cannot successfully collude and instead produce where the market price equals marginal cost,each firm's profits will be:

A) $111.11.

B) $222.22.

C) $333.33.

D) $444.44.

E) $555.55.

A) $111.11.

B) $222.22.

C) $333.33.

D) $444.44.

E) $555.55.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

28

Sticky prices are an outcome of the kinked demand model because:

A) firms in an oligopoly will collude to hold prices fixed.

B) marginal costs are constant in oligopolistic industries.

C) marginal costs can vary to some extent, but firms will have no incentive to change their prices in oligopolistic industries.

D) demand is perfectly elastic in oligopolistic industries.

E) firms will set price equal to marginal cost in oligopolistic industries.

A) firms in an oligopoly will collude to hold prices fixed.

B) marginal costs are constant in oligopolistic industries.

C) marginal costs can vary to some extent, but firms will have no incentive to change their prices in oligopolistic industries.

D) demand is perfectly elastic in oligopolistic industries.

E) firms will set price equal to marginal cost in oligopolistic industries.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

29

With the price leadership strategy:

A) the many small firms set the market price, and the large firm must follow their behavior.

B) the large firm sets the market price, and the many small firms must follow its behavior.

C) firms collude to determine optimal price and output for the industry.

D) firms determine price and output independent of one another.

E) firms are not profit maximizers.

A) the many small firms set the market price, and the large firm must follow their behavior.

B) the large firm sets the market price, and the many small firms must follow its behavior.

C) firms collude to determine optimal price and output for the industry.

D) firms determine price and output independent of one another.

E) firms are not profit maximizers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

30

Glyde Air Fresheners is the dominant firm in the solid room aromatizer industry,which has a total market demand given by Q = 80 - 2P.Glyde has competition from a fringe of four small firms that produce where their individual marginal costs equal the market price.The fringe firms each have total costs given by TCi = 10Qi + 2Q2i.If Glyde's total costs are given by TCG = 100 + 6QG,what price should Glyde establish for air fresheners?

A) $10.

B) $12.

C) $14.

D) $16.

E) $18.

A) $10.

B) $12.

C) $14.

D) $16.

E) $18.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

31

What is the advantage to a particular firm of cheating on an otherwise effective cartel?

A) The industry can then act like a monopoly.

B) It decreases risk.

C) It enhances credibility.

D) It always pays in the short run and may pay in the long run.

E) It always pays in the long run and may pay in the short run.

A) The industry can then act like a monopoly.

B) It decreases risk.

C) It enhances credibility.

D) It always pays in the short run and may pay in the long run.

E) It always pays in the long run and may pay in the short run.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

32

Suppose duopolists in the market for spring water share a market demand curve given by P = 50 - 0.02Q,where P is the price per gallon and Q is thousands of gallons of water per day.The marginal cost of producing water is near zero for both firms.Optimal output for Cournot duopolists moving simultaneously is:

A) 0 gallons of water per day per firm.

B) 625 gallons of water per day per firm.

C) 833 gallons of water per day per firm.

D) 1,250 gallons of water per day per firm.

E) 2,500 gallons of water per day per firm.

A) 0 gallons of water per day per firm.

B) 625 gallons of water per day per firm.

C) 833 gallons of water per day per firm.

D) 1,250 gallons of water per day per firm.

E) 2,500 gallons of water per day per firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

33

Two local ready-mix cement manufacturers,Here and There,have combined demand given by Q = 105 - P.Their total costs are given by TCHere = 5QHere + 0.5Q2Here and TCThere = 5QThere + 0.5Q2There.If they successfully collude,their maximum joint profits will be:

A) $500.

B) $1,000.

C) $1,600.

D) $2,000.

E) $2,500.

A) $500.

B) $1,000.

C) $1,600.

D) $2,000.

E) $2,500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

34

Two local ready-mix cement manufacturers,Here and There,have combined demand given by Q = 105 - P.Their total costs are given by TCHere = 5QHere + 0.5Q2Here and TCThere = 5QThere + 0.5Q2There.If they cannot successfully collude and instead produce where the market price equals marginal cost,their total output will be:

A) 50.

B) 60.

C) 66.67.

D) 75.

E) 85.

A) 50.

B) 60.

C) 66.67.

D) 75.

E) 85.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

35

Glyde Air Fresheners is the dominant firm in the solid room aromatizer industry,which has a total market demand given by Q = 80 - 2P.Glyde has competition from a fringe of four small firms that produce where their individual marginal costs equal the market price.The fringe firms each have total costs given by TCi = 10Qi + 2Q2i.If Glyde's total costs are given by TCG = 100 + 6QG,what are the total profits of the fringe firms?

A) $32.

B) $64.

C) $96.

D) $128.

E) $160.

A) $32.

B) $64.

C) $96.

D) $128.

E) $160.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

36

Duopolists A and B face the following demand curves: QA = 100 - 2PA + 2PB and QB = 100 - 2PB + 2PA.If both firms have zero marginal cost,what are the profit-maximizing prices and quantities?

A) PA = 100, QA = 60, PB = 80, QB = 140.

B) PA = 25, QA = 100, PB = 25, QB = 100.

C) PA = 50, QA = 80, PB = 40, QB = 120.

D) PA = 50, QA = 100, PB = 50, QB = 100.

E) PA = 60, QA = 60, PB = 40, QB = 140.

A) PA = 100, QA = 60, PB = 80, QB = 140.

B) PA = 25, QA = 100, PB = 25, QB = 100.

C) PA = 50, QA = 80, PB = 40, QB = 120.

D) PA = 50, QA = 100, PB = 50, QB = 100.

E) PA = 60, QA = 60, PB = 40, QB = 140.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

37

Duopolists A and B face the following demand curves: QA = 100 - 2PA + 5PB and QB = 120 - 3PB + 4PA.If both firms have zero marginal cost,what are the profit-maximizing prices and quantities?

A) PA = 300, QA = 600, PB = 220, QB = 660.

B) PA = 200, QA = 400, PB = 200, QB = 400.

C) PA = 200, QA = 700, PB = 200, QB = 320.

D) PA = 300, QA = 750, PB = 250, QB = 570.

E) PA = 300, QA = 1,250, PB = 350, QB = 270.

A) PA = 300, QA = 600, PB = 220, QB = 660.

B) PA = 200, QA = 400, PB = 200, QB = 400.

C) PA = 200, QA = 700, PB = 200, QB = 320.

D) PA = 300, QA = 750, PB = 250, QB = 570.

E) PA = 300, QA = 1,250, PB = 350, QB = 270.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

38

Suppose duopolists in the market for spring water share a market demand curve given by P = 50 - 0.02Q,where P is the price per gallon and Q is thousands of gallons of water per day.The marginal cost of producing water is near zero for both firms.If one firm acts as a first mover,the second firm will produce:

A) 0 gallons of water per day per firm.

B) 625 gallons of water per day.

C) 833 gallons of water per day.

D) 1,250 gallons of water per day.

E) 2,500 gallons of water per day.

A) 0 gallons of water per day per firm.

B) 625 gallons of water per day.

C) 833 gallons of water per day.

D) 1,250 gallons of water per day.

E) 2,500 gallons of water per day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

39

Whopper Stoppers Inc.chooses a price for its sink stoppers,and other firms always charge the same price.Whopper Stoppers Inc.is:

A) colluding.

B) losing money in the long run.

C) threatening competitors.

D) a price leader.

E) preempting the competitors.

A) colluding.

B) losing money in the long run.

C) threatening competitors.

D) a price leader.

E) preempting the competitors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

40

Suppose duopolists in the market for spring water share a market demand curve given by P = 50 - 0.02Q,where P is the price per gallon and Q is thousands of gallons of water per day.The marginal cost of producing water is near zero for both firms.If firm A produces zero,firm B's best response is producing:

A) 0 gallons of water per day.

B) 48 gallons of water per day.

C) 833 gallons of water per day.

D) 1,250 gallons of water per day.

E) 2,500 gallons of water per day.

A) 0 gallons of water per day.

B) 48 gallons of water per day.

C) 833 gallons of water per day.

D) 1,250 gallons of water per day.

E) 2,500 gallons of water per day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck

41

The kinked demand model assumes firms will:

A) ignore the price increases of rivals.

B) follow the price decreases of rivals.

C) ignore all price changes of rivals.

D) follow all price changes of rivals.

E) a and b

A) ignore the price increases of rivals.

B) follow the price decreases of rivals.

C) ignore all price changes of rivals.

D) follow all price changes of rivals.

E) a and b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 41 في هذه المجموعة.

فتح الحزمة

k this deck