Deck 16: Adverse Selection

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/15

العب

ملء الشاشة (f)

Deck 16: Adverse Selection

1

Which of the following is the best example of adverse selection?

A) Smokers are more likely to obtain health insurance.

B) Safe drivers tend to get auto insurance.

C) All drivers are required to have auto insurance if they are to register their cars legally in Connecticut.

D) Both healthy and unhealthy people tend to buy life insurance.

E) Given the existence of government-funded flood insurance, people continue to build homes in floodplains.

A) Smokers are more likely to obtain health insurance.

B) Safe drivers tend to get auto insurance.

C) All drivers are required to have auto insurance if they are to register their cars legally in Connecticut.

D) Both healthy and unhealthy people tend to buy life insurance.

E) Given the existence of government-funded flood insurance, people continue to build homes in floodplains.

A

2

Suppose the Ajax Insurance Company provides insurance for skydivers whose wealth before diving is $400.An accident will leave divers with a wealth of $100.The company divides the divers into two classes: safe (probability of an accident = 0.2)and unsafe (probability of an accident = 0.5).The utility of wealth for all divers is given by the function: U(w)= w0.5.The utility of no insurance for the safe diver is:

A) 15.

B) 17.3.

C) 18.

D) 18.3.

E) none of the above.

A) 15.

B) 17.3.

C) 18.

D) 18.3.

E) none of the above.

C

3

Good drivers have a 20% chance,and bad drivers have a 50% chance,of getting into an accident.A car is worth $900,and an accident would reduce its value to $400.Both types of drivers have utility U = (car value)0.5.What is a good driver's expected utility without insurance?

A) 20.

B) 25.

C) 28.

D) 30.

E) None of the above.

A) 20.

B) 25.

C) 28.

D) 30.

E) None of the above.

C

4

Most states require car owners to provide evidence that they have auto insurance when they register their cars and obtain license plates.For the sellers of insurance policies,this may help to limit the severity of the:

A) information asymmetry.

B) moral hazard problem.

C) signaling problem.

D) adverse selection problem.

E) Akerlof problem.

A) information asymmetry.

B) moral hazard problem.

C) signaling problem.

D) adverse selection problem.

E) Akerlof problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

5

Insurance companies are able to offset the adverse selection in markets for life insurance by:

A) requiring premiums that are above the expected value of receipts.

B) only insuring people who appear to be sick.

C) insuring a wide variety of people so that gains on some policies offset losses on others.

D) requiring medical exams from people whom they insure.

E) requiring higher premiums from healthy people than from sick people.

A) requiring premiums that are above the expected value of receipts.

B) only insuring people who appear to be sick.

C) insuring a wide variety of people so that gains on some policies offset losses on others.

D) requiring medical exams from people whom they insure.

E) requiring higher premiums from healthy people than from sick people.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

6

Suppose the Ajax Insurance Company provides insurance for skydivers whose wealth before diving is $400.An accident will leave divers with a wealth of $100.The company divides the divers into two classes: safe (probability of an accident = 0.2)and unsafe (probability of an accident = 0.5).The utility of wealth for all divers is given by the function: U(w)= w0.5.If only the unsafe divers buy insurance and the premium is $100,the insurance company will:

A) earn a profit of $100 per unsafe diver.

B) break even.

C) incur a loss of $200 per unsafe diver.

D) incur a loss of $300 per unsafe diver.

E) experience none of the above.

A) earn a profit of $100 per unsafe diver.

B) break even.

C) incur a loss of $200 per unsafe diver.

D) incur a loss of $300 per unsafe diver.

E) experience none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

7

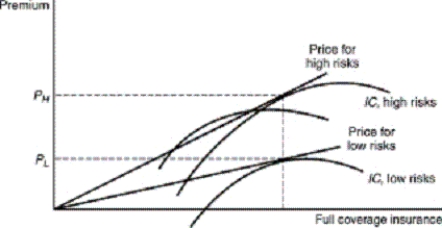

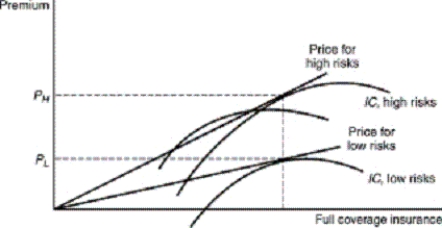

The best possible pricing scheme in this figure would:

A) encourage high-risk individuals to obtain full coverage.

B) encourage all individuals to obtain full coverage.

C) establish a single premium for all individuals.

D) encourage only low-risk individuals to buy any insurance.

E) result in no coverage purchased by low- or high-risk individuals.

A) encourage high-risk individuals to obtain full coverage.

B) encourage all individuals to obtain full coverage.

C) establish a single premium for all individuals.

D) encourage only low-risk individuals to buy any insurance.

E) result in no coverage purchased by low- or high-risk individuals.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

8

Good drivers have a 20% chance,and bad drivers have a 50% chance,of getting into an accident.A car is worth $900,and an accident would reduce its value to $400.Both types of drivers have utility U = (car value)0.5.What is a bad driver's expected utility without insurance?

A) 20.

B) 25.

C) 28.

D) 30.

E) None of the above.

A) 20.

B) 25.

C) 28.

D) 30.

E) None of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

9

Requiring applicants for life insurance to undergo a physical examination is an effective way to:

A) reduce moral hazard.

B) increase information asymmetry.

C) reduce adverse selection.

D) increase sales.

E) none of the above.

A) reduce moral hazard.

B) increase information asymmetry.

C) reduce adverse selection.

D) increase sales.

E) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

10

The signaling model of education would be ineffective if:

A) skills learned in school were useful in employment and could be effectively tested.

B) the costs of acquiring education were equal for individuals of different abilities.

C) individuals could not identify their own abilities.

D) b and c.

E) all of the above.

A) skills learned in school were useful in employment and could be effectively tested.

B) the costs of acquiring education were equal for individuals of different abilities.

C) individuals could not identify their own abilities.

D) b and c.

E) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

11

Suppose the Ajax Insurance Company provides insurance for skydivers whose wealth before diving is $400.An accident will leave divers with a wealth of $100.The company divides the divers into two classes,safe (probability of an accident = 0.2)and unsafe (probability of an accident = 0.5).The utility of wealth for all divers is given by the function: U(w)= w0.5.Given this information,the divers are:

A) risk-averse.

B) risk seeking.

C) risk-neutral.

D) indifferent to risk.

E) risk-averse, risk seeking, or risk-neutral; we cannot tell from this information.

A) risk-averse.

B) risk seeking.

C) risk-neutral.

D) indifferent to risk.

E) risk-averse, risk seeking, or risk-neutral; we cannot tell from this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose that in Milford,Connecticut,owners of used cars that are lemons value their cars at $2,500,and owners of used cars that are reliable value their cars at $6,000.There are equal quantities of each type of car on the market.Buyers value low-quality cars at $1,500 and high-quality cars at $7,000.In this market:

A) only low-quality cars will be sold at a price of $1,500.

B) only low-quality cars will be sold at a price of $2,500.

C) all cars will sell at a price of $4,250.

D) only high-quality cars will be sold at a price of $6,000.

E) only high-quality cars will be sold at a price of $7,000.

A) only low-quality cars will be sold at a price of $1,500.

B) only low-quality cars will be sold at a price of $2,500.

C) all cars will sell at a price of $4,250.

D) only high-quality cars will be sold at a price of $6,000.

E) only high-quality cars will be sold at a price of $7,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

13

From whom would you prefer to buy a used car,everything else being equal?

A) A mechanic.

B) A used-car dealer.

C) A family that is moving to China.

D) A person who is buying a new car.

E) You would have no preference among these choices.

A) A mechanic.

B) A used-car dealer.

C) A family that is moving to China.

D) A person who is buying a new car.

E) You would have no preference among these choices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is a credible signal of product quality?

A) A money-back guarantee.

B) High price.

C) A warranty.

D) Assurances by a salesperson.

E) a and c.

A) A money-back guarantee.

B) High price.

C) A warranty.

D) Assurances by a salesperson.

E) a and c.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck

15

Adverse selection implies that:

A) the market for used cars is perfectly competitive.

B) the market for used cars will contain more cars of higher than average quality.

C) the market for used cars will contain more cars of lower than average quality.

D) all used cars will be of equal quality.

E) the government overinsures the market for used cars.

A) the market for used cars is perfectly competitive.

B) the market for used cars will contain more cars of higher than average quality.

C) the market for used cars will contain more cars of lower than average quality.

D) all used cars will be of equal quality.

E) the government overinsures the market for used cars.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 15 في هذه المجموعة.

فتح الحزمة

k this deck