Deck 15: Government Spending and Its Financing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/96

العب

ملء الشاشة (f)

Deck 15: Government Spending and Its Financing

1

From the 1950s to the 2010s,transfer payments' share of GDP

A)steadily increased.

B)steadily decreased.

C)remained fairly steady.

D)increased during Democratic administrations and decreased during Republican administrations.

A)steadily increased.

B)steadily decreased.

C)remained fairly steady.

D)increased during Democratic administrations and decreased during Republican administrations.

steadily increased.

2

The largest source of tax receipts for the government is

A)personal taxes.

B)contributions for social insurance.

C)taxes on production and imports.

D)corporate taxes.

A)personal taxes.

B)contributions for social insurance.

C)taxes on production and imports.

D)corporate taxes.

personal taxes.

3

Compared with other countries in the OECD,French government spending relative to GDP is

A)among the highest.

B)about average.

C)slightly below average.

D)among the lowest.

A)among the highest.

B)about average.

C)slightly below average.

D)among the lowest.

among the highest.

4

The primary deficit is equal to

A)the amount by which government purchases, transfers, and net interest exceed tax revenues.

B)the amount by which government purchases and transfers exceed tax revenues.

C)the deficit plus net interest payments.

D)total tax revenues minus net interest minus government expenditures.

A)the amount by which government purchases, transfers, and net interest exceed tax revenues.

B)the amount by which government purchases and transfers exceed tax revenues.

C)the deficit plus net interest payments.

D)total tax revenues minus net interest minus government expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

5

From the late 1960s to the late 1990s,the share of GDP devoted to government purchases

A)drifted gradually upward.

B)drifted gradually downward.

C)remained fairly steady.

D)increased, but only after the onset of a war or a military buildup.

A)drifted gradually upward.

B)drifted gradually downward.

C)remained fairly steady.

D)increased, but only after the onset of a war or a military buildup.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

6

The primary current deficit is

A)current expenditures - tax revenues.

B)current expenditures + transfers + net interest - tax revenues.

C)current expenditures - net interest - tax revenues.

D)current expenditures + transfers - tax revenues.

A)current expenditures - tax revenues.

B)current expenditures + transfers + net interest - tax revenues.

C)current expenditures - net interest - tax revenues.

D)current expenditures + transfers - tax revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

7

The deficit is

A)the amount by which government purchases, transfers, and net interest exceed tax revenues.

B)the amount by which government purchases and transfers exceed tax revenues.

C)the primary deficit minus net interest payments.

D)total tax revenues minus net interest minus government expenditures.

A)the amount by which government purchases, transfers, and net interest exceed tax revenues.

B)the amount by which government purchases and transfers exceed tax revenues.

C)the primary deficit minus net interest payments.

D)total tax revenues minus net interest minus government expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

8

Net interest payments by the government are usually

A)small and sometimes negative for both the federal, and state and local governments.

B)small and sometimes negative for the federal government, but large and positive for state and local governments.

C)small and sometimes negative for state and local governments, but large and positive for the federal government.

D)large and positive for both the federal, and state and local governments.

A)small and sometimes negative for both the federal, and state and local governments.

B)small and sometimes negative for the federal government, but large and positive for state and local governments.

C)small and sometimes negative for state and local governments, but large and positive for the federal government.

D)large and positive for both the federal, and state and local governments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

9

Government consumption expenditures equal

A)government outlays minus transfer payments.

B)government outlays minus net interest payments.

C)government purchases minus government investment.

D)the government primary deficit plus net interest payments.

A)government outlays minus transfer payments.

B)government outlays minus net interest payments.

C)government purchases minus government investment.

D)the government primary deficit plus net interest payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

10

The type of tax receipts that has shown the slowest growth since World War II has been

A)personal taxes.

B)contributions for social insurance.

C)taxes on production and imports.

D)corporate taxes.

A)personal taxes.

B)contributions for social insurance.

C)taxes on production and imports.

D)corporate taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

11

State and local governments rely on ________ as their primary source of tax receipts.

A)personal taxes

B)contributions for social insurance

C)indirect business taxes

D)corporate taxes

A)personal taxes

B)contributions for social insurance

C)indirect business taxes

D)corporate taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

12

The primary deficit is equal to

A)outlays - tax revenues.

B)government purchases + transfers + net interest - tax revenues.

C)outlays + net interest - tax revenues.

D)government purchases + transfers - tax revenues.

A)outlays - tax revenues.

B)government purchases + transfers + net interest - tax revenues.

C)outlays + net interest - tax revenues.

D)government purchases + transfers - tax revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

13

The amount by which government purchases and transfers exceed tax revenues is known as the

A)primary surplus.

B)primary deficit.

C)primary current deficit.

D)government debt.

A)primary surplus.

B)primary deficit.

C)primary current deficit.

D)government debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

14

Compared with other countries in the OECD,U.S.government spending relative to GDP is

A)among the highest.

B)about average.

C)slightly below average.

D)among the lowest.

A)among the highest.

B)about average.

C)slightly below average.

D)among the lowest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

15

Interest payments by the government as a share of GDP

A)have steadily increased from the 1940s to the 2010s.

B)remained fairly steady from the 1940s to the 2010s.

C)increased in the 2000s and 2010s, but were fairly steady before that.

D)increased sharply in the 1940s and 1980s.

A)have steadily increased from the 1940s to the 2010s.

B)remained fairly steady from the 1940s to the 2010s.

C)increased in the 2000s and 2010s, but were fairly steady before that.

D)increased sharply in the 1940s and 1980s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

16

Subtracting government investment from government purchases gives us the amount of government

A)outlays.

B)primary expenditures.

C)secondary spending.

D)consumption expenditures.

A)outlays.

B)primary expenditures.

C)secondary spending.

D)consumption expenditures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

17

The type of tax receipts that has shown the largest growth since the end of World War II has been

A)personal taxes.

B)contributions for social insurance.

C)taxes on production and imports.

D)corporate taxes.

A)personal taxes.

B)contributions for social insurance.

C)taxes on production and imports.

D)corporate taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

18

The current deficit is

A)the deficit plus net interest payments.

B)current expenditures minus tax revenues.

C)outlays minus tax revenues.

D)the deficit minus depreciation.

A)the deficit plus net interest payments.

B)current expenditures minus tax revenues.

C)outlays minus tax revenues.

D)the deficit minus depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

19

The three main categories of government outlays are

A)net interest payments, government investment, and government consumption expenditures.

B)net government subsidies, the government deficit, and government purchases.

C)government purchases, transfer payments, and net interest payments.

D)government consumption expenditures, government investment, and transfer payments.

A)net interest payments, government investment, and government consumption expenditures.

B)net government subsidies, the government deficit, and government purchases.

C)government purchases, transfer payments, and net interest payments.

D)government consumption expenditures, government investment, and transfer payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

20

The current deficit is

A)the deficit minus government investment.

B)the deficit plus net interest payments.

C)the deficit minus current expenditures.

D)the deficit minus depreciation.

A)the deficit minus government investment.

B)the deficit plus net interest payments.

C)the deficit minus current expenditures.

D)the deficit minus depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

21

Provisions in the budget that cause government spending to rise or taxes to fall without legislation when GDP falls are known as

A)primary deficit enhancers.

B)expansionary fiscal stimulus.

C)non-political fiscal policy.

D)automatic stabilizers.

A)primary deficit enhancers.

B)expansionary fiscal stimulus.

C)non-political fiscal policy.

D)automatic stabilizers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following would not act as an automatic stabilizer?

A)Unemployment insurance

B)Government purchases

C)Personal income taxes

D)Corporate income taxes

A)Unemployment insurance

B)Government purchases

C)Personal income taxes

D)Corporate income taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

23

The amount the government budget deficit would be if the economy were at full employment is known as the

A)primary deficit.

B)full-employment deficit.

C)natural deficit.

D)current deficit.

A)primary deficit.

B)full-employment deficit.

C)natural deficit.

D)current deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

24

An increase in the marginal tax rate,with the average tax rate held constant,will

A)increase the amount of labor supplied at any real wage.

B)not affect the amount of labor supplied at any real wage.

C)decrease the amount of labor supplied at any real wage.

D)increase the amount of labor supplied at any real wage if the average tax rate is above the marginal tax rate, but decrease the amount of labor supplied at any real wage if the average tax rate is below the marginal tax rate.

A)increase the amount of labor supplied at any real wage.

B)not affect the amount of labor supplied at any real wage.

C)decrease the amount of labor supplied at any real wage.

D)increase the amount of labor supplied at any real wage if the average tax rate is above the marginal tax rate, but decrease the amount of labor supplied at any real wage if the average tax rate is below the marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

25

The total amount of taxes paid divided by before-tax income is the

A)median taxpayer rate.

B)rate of hysteresis.

C)average tax rate.

D)marginal tax rate.

A)median taxpayer rate.

B)rate of hysteresis.

C)average tax rate.

D)marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

26

At the beginning of year one,there is no government debt outstanding.The government runs a $100 billion deficit in year one.Interest at a nominal rate of 10% must be paid starting in year two.Assume nominal GDP in year one is $2000 billion and the nominal growth rate of GDP is 4%.Assume the government balances its primary budget in the future and the interest rate and growth rate do not change.

(a)What will be the government deficit in years two,three,four,and five?

(b)What will be the value of government bonds outstanding at the end of the fifth year?

(c)What will be the debt-GDP ratio at the end of year five?

(a)What will be the government deficit in years two,three,four,and five?

(b)What will be the value of government bonds outstanding at the end of the fifth year?

(c)What will be the debt-GDP ratio at the end of year five?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

27

An increase in the average tax rate,with the marginal tax rate held constant,will

A)increase the amount of labor supplied at any real wage.

B)not affect the amount of labor supplied at any real wage.

C)decrease the amount of labor supplied at any real wage.

D)increase the amount of labor supplied at any real wage if the average tax rate is above the marginal tax rate, but decrease the amount of labor supplied at any real wage if the average tax rate is below the marginal tax rate.

A)increase the amount of labor supplied at any real wage.

B)not affect the amount of labor supplied at any real wage.

C)decrease the amount of labor supplied at any real wage.

D)increase the amount of labor supplied at any real wage if the average tax rate is above the marginal tax rate, but decrease the amount of labor supplied at any real wage if the average tax rate is below the marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

28

The current deficit minus net interest is called the

A)primary deficit.

B)net current deficit.

C)current surplus.

D)primary current deficit.

A)primary deficit.

B)net current deficit.

C)current surplus.

D)primary current deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

29

All of the following are government capital except

A)roads.

B)schools.

C)Treasury securities.

D)mass-transit systems.

A)roads.

B)schools.

C)Treasury securities.

D)mass-transit systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

30

An example of an automatic stabilizer is

A)consumer spending.

B)inflation.

C)unemployment insurance.

D)discretionary fiscal policy.

A)consumer spending.

B)inflation.

C)unemployment insurance.

D)discretionary fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

31

A decrease in the marginal tax rate,with the average tax rate held constant,will

A)increase the amount of labor supplied at any real wage.

B)not affect the amount of labor supplied at any real wage.

C)decrease the amount of labor supplied at any real wage.

D)increase the amount of labor supplied at any real wage if the average tax rate is above the marginal tax rate, but decrease the amount of labor supplied at any real wage if the average tax rate is below the marginal tax rate.

A)increase the amount of labor supplied at any real wage.

B)not affect the amount of labor supplied at any real wage.

C)decrease the amount of labor supplied at any real wage.

D)increase the amount of labor supplied at any real wage if the average tax rate is above the marginal tax rate, but decrease the amount of labor supplied at any real wage if the average tax rate is below the marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

32

A decrease in the average tax rate,with the marginal tax rate held constant,will

A)increase the amount of labor supplied at any real wage.

B)not affect the amount of labor supplied at any real wage.

C)decrease the amount of labor supplied at any real wage.

D)increase the amount of labor supplied at any real wage if the average tax rate is above the marginal tax rate, but decrease the amount of labor supplied at any real wage if the average tax rate is below the marginal tax rate.

A)increase the amount of labor supplied at any real wage.

B)not affect the amount of labor supplied at any real wage.

C)decrease the amount of labor supplied at any real wage.

D)increase the amount of labor supplied at any real wage if the average tax rate is above the marginal tax rate, but decrease the amount of labor supplied at any real wage if the average tax rate is below the marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

33

Classical economists think that lump-sum tax changes

A)should be used to smooth business cycles.

B)have a powerful effect on the economy.

C)affect aggregate demand after a lag.

D)have no effect because of Ricardian equivalence.

A)should be used to smooth business cycles.

B)have a powerful effect on the economy.

C)affect aggregate demand after a lag.

D)have no effect because of Ricardian equivalence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

34

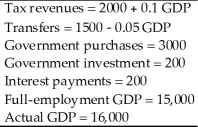

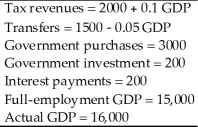

The following data describe government spending and revenue.

(a)How much is the budget deficit?

(b)How much is the primary budget deficit?

(c)How much is the full-employment budget deficit?

(d)How much is the current deficit?

(e)How much is the current primary deficit?

(a)How much is the budget deficit?

(b)How much is the primary budget deficit?

(c)How much is the full-employment budget deficit?

(d)How much is the current deficit?

(e)How much is the current primary deficit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

35

The political process by which fiscal policy is made

A)is relatively rapid, contributing to the effectiveness of fiscal policy.

B)requires only that the president approve changes to the budget, a decision that takes several months.

C)is efficient in reaching a decision within a year.

D)is slow and results in a long time lag for fiscal policy.

A)is relatively rapid, contributing to the effectiveness of fiscal policy.

B)requires only that the president approve changes to the budget, a decision that takes several months.

C)is efficient in reaching a decision within a year.

D)is slow and results in a long time lag for fiscal policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

36

Government capital consists of

A)money owned by the government.

B)securities owned by the government.

C)the buildings owned by the government in Washington, D.C.

D)long-lived physical assets owned by the government.

A)money owned by the government.

B)securities owned by the government.

C)the buildings owned by the government in Washington, D.C.

D)long-lived physical assets owned by the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

37

Since 1960,the only period of several years when the full-employment government budget deficit was negative (that is,there was a full-employment surplus)was

A)from 2000 to 2005.

B)the late 1990s and early 2000s.

C)the mid-1980s.

D)the early 1970s.

A)from 2000 to 2005.

B)the late 1990s and early 2000s.

C)the mid-1980s.

D)the early 1970s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

38

Because of automatic stabilizers,in recessions the government budget deficit ________,while in expansions the deficit ________.

A)falls; rises

B)falls; falls

C)rises; falls

D)rises; rises

A)falls; rises

B)falls; falls

C)rises; falls

D)rises; rises

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

39

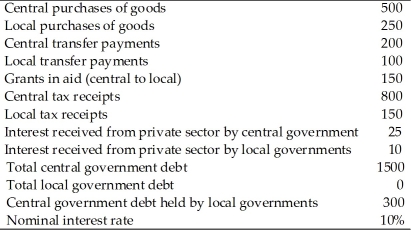

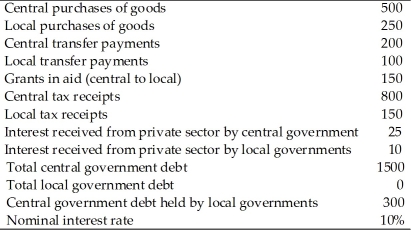

You are given the following budget data for a country that has both a central government and local governments.

(a)How much is the deficit for the central government,the local government,and the total of the central and local governments?

(b)How much is the primary deficit for the central government,the local government,and the total of the central and local governments?

(a)How much is the deficit for the central government,the local government,and the total of the central and local governments?

(b)How much is the primary deficit for the central government,the local government,and the total of the central and local governments?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

40

The marginal tax rate is

A)the fraction of an additional dollar of income that must be paid in taxes.

B)the total amount of taxes paid divided by after-tax income.

C)the total amount of taxes paid divided by before-tax income.

D)the average amount of government spending that is financed by taxes.

A)the fraction of an additional dollar of income that must be paid in taxes.

B)the total amount of taxes paid divided by after-tax income.

C)the total amount of taxes paid divided by before-tax income.

D)the average amount of government spending that is financed by taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the deficit is 0.1 times GDP,the existing debt-GDP ratio is 0.5,and the growth rate of nominal GDP is 0.04,then the change in the debt-GDP ratio is

A)+0.08

B)+0.075.

C)0)

D)-0.075.

A)+0.08

B)+0.075.

C)0)

D)-0.075.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

42

Suppose that the federal income tax on individuals is set up as follows:

Income above Income below Taxes

0 $8000 0.10 × income

$8000 $35,000 $800 + [0.15 × (income - $8000)]

$35,000 & up $4850 + [0.25 × (income - $35,000)]

Calculate the average tax rate and marginal tax rate for workers with the following levels of income:

(a)$6500

(b)$27,000

(c)$72,000

(d)$250,000

Income above Income below Taxes

0 $8000 0.10 × income

$8000 $35,000 $800 + [0.15 × (income - $8000)]

$35,000 & up $4850 + [0.25 × (income - $35,000)]

Calculate the average tax rate and marginal tax rate for workers with the following levels of income:

(a)$6500

(b)$27,000

(c)$72,000

(d)$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

43

Suppose that all workers place a value on their leisure of 40 goods per day.The production function relating output per day Y to the number of people working per day N is Y = 200N - 2N2

And the marginal product of labor is

MPN = 200 - 2N.

A 20% tax is levied on wages.Output per day would be

A)5625.

B)7250.

C)9375.

D)11,250.

And the marginal product of labor is

MPN = 200 - 2N.

A 20% tax is levied on wages.Output per day would be

A)5625.

B)7250.

C)9375.

D)11,250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

44

From 1945 to 1995,the debt-GDP ratio in the United States

A)steadily fell.

B)steadily increased.

C)fell from 1945 until around 1970 and rose thereafter.

D)fell from 1945 until around 1980 and rose thereafter.

A)steadily fell.

B)steadily increased.

C)fell from 1945 until around 1970 and rose thereafter.

D)fell from 1945 until around 1980 and rose thereafter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

45

From 2001 to 2015,the debt-GDP ratio in the United States

A)steadily fell.

B)steadily increased.

C)was about constant.

D)fell from 1995 to 1998, then rose sharply.

A)steadily fell.

B)steadily increased.

C)was about constant.

D)fell from 1995 to 1998, then rose sharply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

46

The total value of government bonds outstanding at any particular time is called the

A)government debt.

B)government deficit.

C)seignorage revenue.

D)yield curve.

A)government debt.

B)government deficit.

C)seignorage revenue.

D)yield curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

47

From 1995 to 2001,the debt-GDP ratio in the United States

A)steadily fell.

B)steadily increased.

C)was about constant.

D)fell from 1995 to 1998, then rose sharply.

A)steadily fell.

B)steadily increased.

C)was about constant.

D)fell from 1995 to 1998, then rose sharply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

48

Taxes distort economic behavior because they

A)change the composition of income and spending.

B)cause deviations in economic behavior from the efficient, free-market outcome.

C)change the balance between private and public expenditures.

D)change the composition of consumption, investment, government spending, and net exports.

A)change the composition of income and spending.

B)cause deviations in economic behavior from the efficient, free-market outcome.

C)change the balance between private and public expenditures.

D)change the composition of consumption, investment, government spending, and net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

49

A Social Security system in which payroll taxes that workers and their employers pay in go directly to retirees and other beneficiaries is known as

A)a pay-as-you-go system.

B)an individual-account system.

C)a primary-deficit system.

D)a social-lockbox system.

A)a pay-as-you-go system.

B)an individual-account system.

C)a primary-deficit system.

D)a social-lockbox system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

50

Suppose that all workers place a value on their leisure of 75 goods per day.The production function relating output per day Y to the number of people working per day N is

Y = 500N - 0.4 N2,

and the marginal product of labor is

MPN = 500 - 0.8 N.

A 25% tax is levied on wages.

(a)How much is output per day?

(b)In terms of lost output,what is the cost of the distortion introduced by this tax?

Y = 500N - 0.4 N2,

and the marginal product of labor is

MPN = 500 - 0.8 N.

A 25% tax is levied on wages.

(a)How much is output per day?

(b)In terms of lost output,what is the cost of the distortion introduced by this tax?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

51

Suppose that all workers place a value on their leisure of 40 goods per day.The production function relating output per day Y to the number of people working per day N is Y = 200N - N2

And the marginal product of labor is

MPN = 200 - 2N.

A 20% tax is levied on wages.In terms of lost output,what is the cost of the distortion introduced by this tax?

A)25

B)75

C)150

D)225

And the marginal product of labor is

MPN = 200 - 2N.

A 20% tax is levied on wages.In terms of lost output,what is the cost of the distortion introduced by this tax?

A)25

B)75

C)150

D)225

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

52

An example of tax smoothing is provided by evidence of

A)temporary changes in defense expenditures by the government.

B)reductions in tax rates prior to presidential elections.

C)Keynesian tax cuts designed to help the economy recover from a recession.

D)reliance on debt financing rather than taxation during World War II.

A)temporary changes in defense expenditures by the government.

B)reductions in tax rates prior to presidential elections.

C)Keynesian tax cuts designed to help the economy recover from a recession.

D)reliance on debt financing rather than taxation during World War II.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

53

The idea that all aspects of economic behavior,such as labor supply,saving,and investment,respond to economic incentives,especially tax rates,is known as

A)New Keynesian economics.

B)new classical economics.

C)tax-structured classical economics.

D)supply-side economics.

A)New Keynesian economics.

B)new classical economics.

C)tax-structured classical economics.

D)supply-side economics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

54

If the deficit is 0.08 times GDP,the existing debt-GDP ratio is 0.8,and the growth rate of nominal GDP is 0.05,then the change in the debt-GDP ratio is

A)+0.08

B)+0.04.

C)0)

D)-0.08.

A)+0.08

B)+0.04.

C)0)

D)-0.08.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

55

Increases in the debt-GDP ratio are primarily caused by

A)a high growth rate of GDP.

B)a high government deficit relative to GDP.

C)increases in government borrowing through bonds.

D)increases in interest rates.

A)a high growth rate of GDP.

B)a high government deficit relative to GDP.

C)increases in government borrowing through bonds.

D)increases in interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

56

U.S.data suggest that the U.S.economy is located where on the Laffer curve?

A)On the right side, after the peak in tax revenue.

B)On the left side, before the peak in tax revenue.

C)At the peak in tax revenue.

D)The economy was on the right side before the 1980s and on the left side after 1980.

A)On the right side, after the peak in tax revenue.

B)On the left side, before the peak in tax revenue.

C)At the peak in tax revenue.

D)The economy was on the right side before the 1980s and on the left side after 1980.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

57

If the deficit is 0.02 times GDP,the existing debt-GDP ratio is 0.5,and the growth rate of nominal GDP is 0.03,then the change in the debt-GDP ratio is

A)+0.05

B)+0.025.

C)0)

D)-0.025.

A)+0.05

B)+0.025.

C)0)

D)-0.025.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

58

The graph plotting the tax rate on the horizontal axis and tax revenues on the vertical axis,which was used by supply-side economists to suggest that tax rates were too high,in known as the

A)Beveridge curve.

B)Phillips curve.

C)Taylor rule.

D)Laffer curve.

A)Beveridge curve.

B)Phillips curve.

C)Taylor rule.

D)Laffer curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

59

The average cost of the distortion created by taxes

A)increases proportionately with the tax rate.

B)is lower when the tax rate is constant than when it fluctuates.

C)is higher when the tax rate is constant than when it fluctuates.

D)equals the square root of the tax rate.

A)increases proportionately with the tax rate.

B)is lower when the tax rate is constant than when it fluctuates.

C)is higher when the tax rate is constant than when it fluctuates.

D)equals the square root of the tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

60

Assume that the lost output due to tax distortions is proportional to the square of the tax rate.If the average cost of the distortion created by taxes is currently $1000,and the tax rate is increased from 40% to 50%,the average cost of the distortion created by taxes will increase to

A)$383.33.

B)$450.00.

C)$640.

D)$1562.50.

A)$383.33.

B)$450.00.

C)$640.

D)$1562.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

61

Recent proposals to allow the Social Security trust fund to invest in the stock market (instead of buying government bonds)are based on the premise that

A)the returns to stocks are higher than the returns to bonds.

B)the returns to stocks aren't as risky as the returns to bonds.

C)the transactions costs for investing in stocks are lower than the transactions costs for investing in bonds.

D)stocks are more liquid than bonds.

A)the returns to stocks are higher than the returns to bonds.

B)the returns to stocks aren't as risky as the returns to bonds.

C)the transactions costs for investing in stocks are lower than the transactions costs for investing in bonds.

D)stocks are more liquid than bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

62

In which case would you be most likely to expect inflation to occur?

A)The government runs a sustained government deficit by lowering taxes.

B)The government runs a sustained government deficit by increasing purchases.

C)The government runs a sustained primary deficit by increasing purchases.

D)The government funds its sustained deficit by increasing the money supply.

A)The government runs a sustained government deficit by lowering taxes.

B)The government runs a sustained government deficit by increasing purchases.

C)The government runs a sustained primary deficit by increasing purchases.

D)The government funds its sustained deficit by increasing the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

63

Find the largest nominal deficit that the government can run without raising the debt-GDP ratio,under each of the following sets of assumptions:

(a)Suppose that real GDP is 20,000 and remains constant,nominal GDP is initially 30,000,inflation is 4%,and the debt-GDP ratio is 1.2.

(b)Suppose that nominal GDP growth is 5% and outstanding nominal debt is 1500.

(a)Suppose that real GDP is 20,000 and remains constant,nominal GDP is initially 30,000,inflation is 4%,and the debt-GDP ratio is 1.2.

(b)Suppose that nominal GDP growth is 5% and outstanding nominal debt is 1500.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

64

Social Security benefits could be reduced in each of the following ways except

A)cutting the promised monthly benefit.

B)increasing the retirement age.

C)investing the trust fund in the stock market.

D)reducing the degree to which benefits are adjusted for inflation.

A)cutting the promised monthly benefit.

B)increasing the retirement age.

C)investing the trust fund in the stock market.

D)reducing the degree to which benefits are adjusted for inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

65

Seignorage is the revenue a government raises by

A)taxation.

B)printing money.

C)borrowing money.

D)charging fees for services.

A)taxation.

B)printing money.

C)borrowing money.

D)charging fees for services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

66

The stimulus package of 2009 had the effect of

A)causing higher rates of inflation to occur.

B)giving new foreign aid to help less developed countries.

C)significantly raising the debt to GDP ratio.

D)reducing the primary government deficit.

A)causing higher rates of inflation to occur.

B)giving new foreign aid to help less developed countries.

C)significantly raising the debt to GDP ratio.

D)reducing the primary government deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

67

The revenue that a government raises by printing money is called

A)seignorage.

B)monetary revenue.

C)currency credit.

D)currency inflation.

A)seignorage.

B)monetary revenue.

C)currency credit.

D)currency inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

68

State governments in the United States can raise revenue by all the following means except

A)increasing income taxes.

B)increasing taxes on corporate profits.

C)increasing sales taxes.

D)increasing the money supply.

A)increasing income taxes.

B)increasing taxes on corporate profits.

C)increasing sales taxes.

D)increasing the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

69

According to the Ricardian equivalence proposition,current deficits

A)will not affect consumption or national saving.

B)will affect consumption but not national saving.

C)will affect national saving but not consumption.

D)will affect both consumption and national saving.

A)will not affect consumption or national saving.

B)will affect consumption but not national saving.

C)will affect national saving but not consumption.

D)will affect both consumption and national saving.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

70

What are the main reasons (give at least three)that Ricardian equivalence might not hold?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

71

Deficits are a burden on future generations if they

A)cause higher rates of inflation to occur.

B)are not used for government capital formation.

C)cause national saving to fall.

D)are always a primary government deficit.

A)cause higher rates of inflation to occur.

B)are not used for government capital formation.

C)cause national saving to fall.

D)are always a primary government deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

72

A decreased government deficit created by a lump-sum tax increase will increase national saving if

A)the value of government bonds outstanding grows slower than the public's wealth.

B)it causes consumption to fall.

C)the government runs a primary surplus as a result.

D)the real interest rate is less than the growth rate of real GNP.

A)the value of government bonds outstanding grows slower than the public's wealth.

B)it causes consumption to fall.

C)the government runs a primary surplus as a result.

D)the real interest rate is less than the growth rate of real GNP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

73

Who bears the burden of the government debt? Explain why.Under what circumstances is there no burden to be borne?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

74

Why is the Social Security system in crisis at a time when it's running large surpluses? What's the source of the problem? What solutions have been proposed?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

75

According to the Ricardian equivalence proposition,a government budget deficit created by a temporary tax cut

A)does not affect desired national saving.

B)does not affect expected future taxes.

C)reduces desired investment spending.

D)increases the real interest rate.

A)does not affect desired national saving.

B)does not affect expected future taxes.

C)reduces desired investment spending.

D)increases the real interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

76

To earn a higher return on the assets in the Social Security trust fund,a suggestion has been made to allow the trust fund to

A)buy government bonds.

B)sell limited partnerships.

C)sell insurance.

D)invest in the stock market.

A)buy government bonds.

B)sell limited partnerships.

C)sell insurance.

D)invest in the stock market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

77

According to current projections,in about 2034,the Social Security trust fund will

A)own all the government bonds that have been issued.

B)own about half of all the stock issued on the New York Stock Exchange.

C)run out of assets.

D)start to run deficits.

A)own all the government bonds that have been issued.

B)own about half of all the stock issued on the New York Stock Exchange.

C)run out of assets.

D)start to run deficits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following policies would not prevent the Social Security trust fund from running out of assets?

A)Reduce promised benefits

B)Reduce taxes

C)Increase taxes

D)Earn a higher rate of return

A)Reduce promised benefits

B)Reduce taxes

C)Increase taxes

D)Earn a higher rate of return

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

79

The relationship between the government deficit and the change in the monetary base is

A)deficit equals change in government debt held by the public minus change in monetary base.

B)deficit equals change in government debt held by the public plus change in monetary base.

C)deficit equals change in government debt outstanding plus change in monetary base.

D)deficit equals change in government debt outstanding minus change in monetary base.

A)deficit equals change in government debt held by the public minus change in monetary base.

B)deficit equals change in government debt held by the public plus change in monetary base.

C)deficit equals change in government debt outstanding plus change in monetary base.

D)deficit equals change in government debt outstanding minus change in monetary base.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck

80

Suppose that real GDP is 10,000 and remains constant,nominal GDP is initially 30,000,inflation is 3%,and the debt-GDP ratio is 0.7.Find the largest nominal deficit that the government can run without raising the debt-GDP ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 96 في هذه المجموعة.

فتح الحزمة

k this deck