Deck 8: Application: the Costs of Taxation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/245

العب

ملء الشاشة (f)

Deck 8: Application: the Costs of Taxation

1

When a tax is levied on a good,the buyers and sellers of the good share the burden,

A)provided the tax is levied on the sellers.

B)provided the tax is levied on the buyers.

C)provided a portion of the tax is levied on the buyers, with the remaining portion levied on the sellers.

D)regardless of how the tax is levied.

A)provided the tax is levied on the sellers.

B)provided the tax is levied on the buyers.

C)provided a portion of the tax is levied on the buyers, with the remaining portion levied on the sellers.

D)regardless of how the tax is levied.

D

2

When a tax is imposed on a good,

A)the supply curve for the good always shifts.

B)the demand curve for the good always shifts.

C)the amount of the good that buyers are willing to buy at each price always remains unchanged.

D)the equilibrium quantity of the good always decreases.

A)the supply curve for the good always shifts.

B)the demand curve for the good always shifts.

C)the amount of the good that buyers are willing to buy at each price always remains unchanged.

D)the equilibrium quantity of the good always decreases.

D

3

When a tax is imposed on the sellers of a good,

A)the demand curve shifts downward by less than the amount of the tax.

B)the demand curve shifts downward by the amount of the tax.

C)the supply curve shifts upward by less than the amount of the tax.

D)the supply curve shifts upward by the amount of the tax.

A)the demand curve shifts downward by less than the amount of the tax.

B)the demand curve shifts downward by the amount of the tax.

C)the supply curve shifts upward by less than the amount of the tax.

D)the supply curve shifts upward by the amount of the tax.

D

4

During Ronald Reagan's presidency,the top tax rate on income fell from

A)36 percent to 22 percent.

B)50 percent to 22 percent.

C)50 percent to 28 percent.

D)70 percent to 28 percent.

A)36 percent to 22 percent.

B)50 percent to 22 percent.

C)50 percent to 28 percent.

D)70 percent to 28 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

5

A tax placed on buyers of tires shifts

A)the demand curve for tires downward, decreasing the price received by sellers of tires and causing the market for tires to expand.

B)the demand curve for tires downward, decreasing the price received by sellers of tires and causing the market for tires to shrink.

C)the supply curve for tires upward, decreasing the effective price paid by buyers of tires and causing the market for tires to expand.

D)the supply curve for tires upward, increasing the effective price paid by buyers of tires and causing the market for tires to shrink.

A)the demand curve for tires downward, decreasing the price received by sellers of tires and causing the market for tires to expand.

B)the demand curve for tires downward, decreasing the price received by sellers of tires and causing the market for tires to shrink.

C)the supply curve for tires upward, decreasing the effective price paid by buyers of tires and causing the market for tires to expand.

D)the supply curve for tires upward, increasing the effective price paid by buyers of tires and causing the market for tires to shrink.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

6

A tax on a good

A)raises the price that buyers effectively pay and raises the price that sellers effectively receive.

B)raises the price that buyers effectively pay and lowers the price that sellers effectively receive.

C)lowers the price that buyers effectively pay and raises the price that sellers effectively receive.

D)lowers the price that buyers effectively pay and lowers the price that sellers effectively receive.

A)raises the price that buyers effectively pay and raises the price that sellers effectively receive.

B)raises the price that buyers effectively pay and lowers the price that sellers effectively receive.

C)lowers the price that buyers effectively pay and raises the price that sellers effectively receive.

D)lowers the price that buyers effectively pay and lowers the price that sellers effectively receive.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

7

A tax levied on the sellers of a good shifts the

A)supply curve upward (or to the left).

B)supply curve downward (or to the right).

C)demand curve upward (or to the right).

D)demand curve downward (or to the left).

A)supply curve upward (or to the left).

B)supply curve downward (or to the right).

C)demand curve upward (or to the right).

D)demand curve downward (or to the left).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

8

When a good is taxed,

A)both buyers and sellers of the good are made worse off.

B)only buyers are made worse off, because they ultimately bear the burden of the tax.

C)only sellers are made worse off, because the government holds them responsible for sending in the tax payments.

D)neither buyers nor sellers are made worse off, since tax revenue is used to provide goods and services that would otherwise not be provided in a market economy.

A)both buyers and sellers of the good are made worse off.

B)only buyers are made worse off, because they ultimately bear the burden of the tax.

C)only sellers are made worse off, because the government holds them responsible for sending in the tax payments.

D)neither buyers nor sellers are made worse off, since tax revenue is used to provide goods and services that would otherwise not be provided in a market economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

9

To measure the gains and losses from a tax on a good,economists use the tools of

A)macroeconomics.

B)welfare economics.

C)international-trade theory.

D)circular-flow analysis.

A)macroeconomics.

B)welfare economics.

C)international-trade theory.

D)circular-flow analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

10

To fully understand how taxes affect economic well-being,we must

A)assume that economic well-being is not affected if all tax revenue is spent on goods and services for the people who are being taxed.

B)know the dollar amount of all taxes raised in the country each year.

C)compare the reduced welfare of buyers and sellers to the amount of revenue the government raises.

D)take into account the fact that almost all taxes reduce the welfare of buyers, increase the welfare of sellers, and raise revenue for the government.

A)assume that economic well-being is not affected if all tax revenue is spent on goods and services for the people who are being taxed.

B)know the dollar amount of all taxes raised in the country each year.

C)compare the reduced welfare of buyers and sellers to the amount of revenue the government raises.

D)take into account the fact that almost all taxes reduce the welfare of buyers, increase the welfare of sellers, and raise revenue for the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

11

When a tax is imposed on the buyers of a good,the demand curve shifts

A)downward by the amount of the tax.

B)upward by the amount of the tax.

C)downward by less than the amount of the tax.

D)upward by more than the amount of the tax.

A)downward by the amount of the tax.

B)upward by the amount of the tax.

C)downward by less than the amount of the tax.

D)upward by more than the amount of the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

12

Anger over British taxes played a significant role in bringing about

A)the election of John Adams as the second American president.

B)the American Revolution.

C)the War of 1812.

D)the "no new taxes" clause in the U.S.Constitution.

A)the election of John Adams as the second American president.

B)the American Revolution.

C)the War of 1812.

D)the "no new taxes" clause in the U.S.Constitution.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

13

In recent decades,which of the following U.S.presidents promised tax cuts and subsequently delivered tax cuts?

A)Jimmy Carter and Ronald Reagan

B)Ronald Reagan and Bill Clinton

C)Gerald Ford and George W.Bush

D)Ronald Reagan and George W.Bush

A)Jimmy Carter and Ronald Reagan

B)Ronald Reagan and Bill Clinton

C)Gerald Ford and George W.Bush

D)Ronald Reagan and George W.Bush

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

14

Buyers of a product will bear the larger part of the tax burden,and sellers will bear a smaller part of the tax burden,when

A)the tax is placed on the sellers of the product.

B)the tax is placed on the buyers of the product.

C)the supply of the product is more elastic than the demand for the product.

D)the demand for the product is more elastic than the supply of the product.

A)the tax is placed on the sellers of the product.

B)the tax is placed on the buyers of the product.

C)the supply of the product is more elastic than the demand for the product.

D)the demand for the product is more elastic than the supply of the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

15

In 1776,the American Revolution was sparked by anger over

A)the extravagant lifestyle of British royalty.

B)the crimes of British soldiers stationed in the American colonies.

C)British taxes imposed on the American colonies.

D)the failure of the British to protect American colonists from attack by hostile Native Americans.

A)the extravagant lifestyle of British royalty.

B)the crimes of British soldiers stationed in the American colonies.

C)British taxes imposed on the American colonies.

D)the failure of the British to protect American colonists from attack by hostile Native Americans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

16

A tax levied on the buyers of a good shifts the

A)supply curve upward (or to the left).

B)supply curve downward (or to the right).

C)demand curve downward (or to the left).

D)demand curve upward (or to the right).

A)supply curve upward (or to the left).

B)supply curve downward (or to the right).

C)demand curve downward (or to the left).

D)demand curve upward (or to the right).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which U.S.president lost his bid for re-election,in part because he had broken an earlier campaign promise to refrain from imposing any new taxes?

A)Lyndon B.Johnson

B)Jimmy Carter

C)George H.W.Bush

D)Bill Clinton

A)Lyndon B.Johnson

B)Jimmy Carter

C)George H.W.Bush

D)Bill Clinton

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

18

Oliver Wendell Holmes once said taxes

A)are the price we pay for a civilized society.

B)are a fact of life.

C)cannot be escaped unless you are in jail.

D)can be avoided only by the rich.

A)are the price we pay for a civilized society.

B)are a fact of life.

C)cannot be escaped unless you are in jail.

D)can be avoided only by the rich.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

19

Who once said that taxes are the price we pay for a civilized society?

A)Aristotle

B)George Washington

C)Oliver Wendell Holmes

D)Ronald Reagan

A)Aristotle

B)George Washington

C)Oliver Wendell Holmes

D)Ronald Reagan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

20

When Ronald Reagan ran for the presidency in 1980,he pledged to bring about

A)large cuts in personal income taxes.

B)large cuts in payroll taxes.

C)large increases in personal income taxes.

D)large increases in payroll taxes.

A)large cuts in personal income taxes.

B)large cuts in payroll taxes.

C)large increases in personal income taxes.

D)large increases in payroll taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

21

When a tax is imposed on a good for which demand is elastic and supply is elastic,

A)sellers effectively pay the majority of the tax.

B)buyers effectively pay the majority of the tax.

C)the tax burden is equally divided between buyers and sellers.

D)None of the above is correct; further information would be required to determine how the burden of the tax is distributed between buyers and sellers.

A)sellers effectively pay the majority of the tax.

B)buyers effectively pay the majority of the tax.

C)the tax burden is equally divided between buyers and sellers.

D)None of the above is correct; further information would be required to determine how the burden of the tax is distributed between buyers and sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

22

When a good is taxed,the burden of the tax

A)falls more heavily on the side of the market that is more elastic.

B)falls more heavily on the side of the market that is more inelastic.

C)falls more heavily on the side of the market that is closer to unit elastic.

D)is distributed independently of relative elasticities of supply and demand.

A)falls more heavily on the side of the market that is more elastic.

B)falls more heavily on the side of the market that is more inelastic.

C)falls more heavily on the side of the market that is closer to unit elastic.

D)is distributed independently of relative elasticities of supply and demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

23

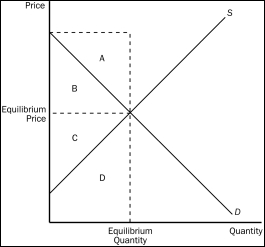

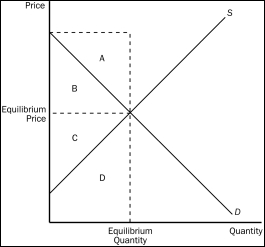

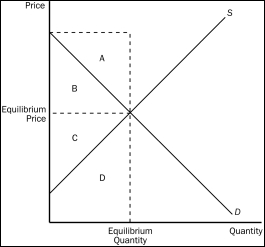

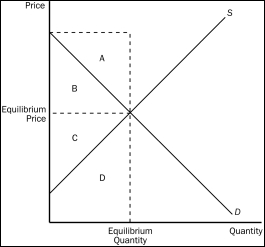

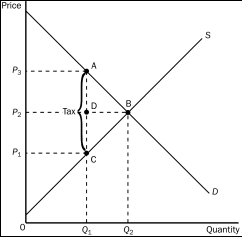

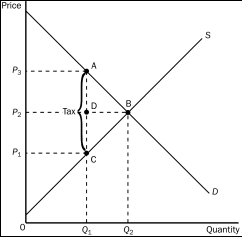

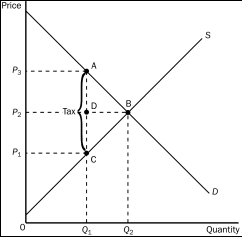

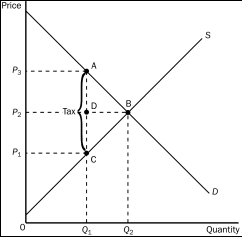

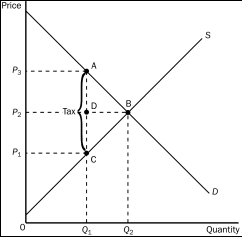

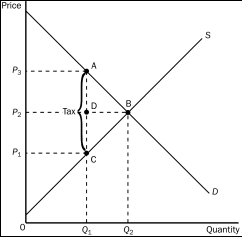

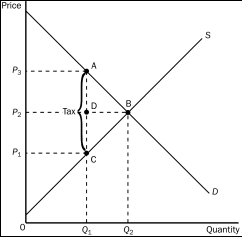

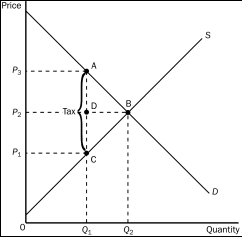

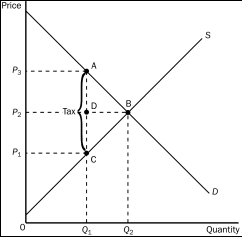

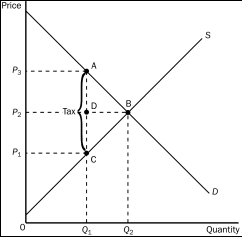

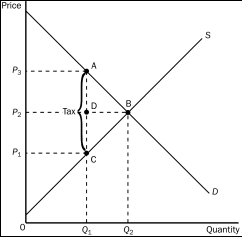

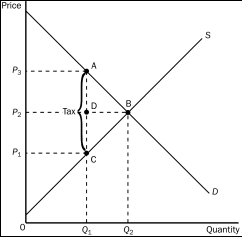

Figure 8-1

Refer to Figure 8-1.When the market is in equilibrium,producer surplus is represented by area

A)a.

B)B.

C)C.

D)D.

Refer to Figure 8-1.When the market is in equilibrium,producer surplus is represented by area

A)a.

B)B.

C)C.

D)D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

24

Suppose a tax is levied on the buyers of a good;

A)then the supply curve shifts upward by the amount of the tax.

B)then the quantity supplied decreases for all conceivable prices of the good.

C)this means that the buyers of the good will send tax payments to the government.

D)this means that the buyers of the good will pay a higher effective price for the good, not that they will send tax payments to the government.

A)then the supply curve shifts upward by the amount of the tax.

B)then the quantity supplied decreases for all conceivable prices of the good.

C)this means that the buyers of the good will send tax payments to the government.

D)this means that the buyers of the good will pay a higher effective price for the good, not that they will send tax payments to the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

25

A tax placed on a good

A)causes the effective price to sellers to increase.

B)affects the welfare of buyers of the good, but not the welfare of sellers.

C)causes the size of the market for the good to shrink.

D)creates a burden that is usually borne entirely by the sellers of the good.

A)causes the effective price to sellers to increase.

B)affects the welfare of buyers of the good, but not the welfare of sellers.

C)causes the size of the market for the good to shrink.

D)creates a burden that is usually borne entirely by the sellers of the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

26

Sellers of a product will bear the larger part of the tax burden,and buyers will bear a smaller part of the tax burden,when

A)the tax is placed on the sellers of the product.

B)the tax is placed on the buyers of the product.

C)the supply of the product is more elastic than the demand for the product.

D)the demand for the product is more elastic than the supply of the product.

A)the tax is placed on the sellers of the product.

B)the tax is placed on the buyers of the product.

C)the supply of the product is more elastic than the demand for the product.

D)the demand for the product is more elastic than the supply of the product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

27

A $2.00 tax placed on the sellers of potting soil,for every bag of potting soil they sell,will shift the supply curve

A)downward by exactly $2.00.

B)downward by less than $2.00.

C)upward by exactly $2.00.

D)upward by less than $2.00.

A)downward by exactly $2.00.

B)downward by less than $2.00.

C)upward by exactly $2.00.

D)upward by less than $2.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

28

When a tax is levied on buyers of a good,

A)government collects too little revenue to justify the tax if the equilibrium quantity of the good decreases as a result of the tax.

B)there is an increase in the quantity of the good supplied.

C)a wedge is placed between the price buyers pay and the price sellers effectively receive.

D)the effective price to buyers decreases because the demand curve shifts leftward.

A)government collects too little revenue to justify the tax if the equilibrium quantity of the good decreases as a result of the tax.

B)there is an increase in the quantity of the good supplied.

C)a wedge is placed between the price buyers pay and the price sellers effectively receive.

D)the effective price to buyers decreases because the demand curve shifts leftward.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

29

When a tax is imposed on a good for which the supply is relatively elastic and the demand is relatively inelastic,

A)buyers of the good will bear most of the burden of the tax.

B)sellers of the good will bear most of the burden of the tax.

C)the effective price paid by buyers of the good will decrease.

D)the size of the market for the good will expand.

A)buyers of the good will bear most of the burden of the tax.

B)sellers of the good will bear most of the burden of the tax.

C)the effective price paid by buyers of the good will decrease.

D)the size of the market for the good will expand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following statements is correct regarding the imposition of a tax on gasoline?

A)The incidence of the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

B)The incidence of the tax depends upon the price elasticities of demand and supply.

C)The amount of tax revenue raised by the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

D)The amount of tax revenue raised by the tax does not depend upon the amount of the tax per unit.

A)The incidence of the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

B)The incidence of the tax depends upon the price elasticities of demand and supply.

C)The amount of tax revenue raised by the tax depends upon whether the buyers or the sellers are required to remit tax payments to the government.

D)The amount of tax revenue raised by the tax does not depend upon the amount of the tax per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

31

When cigarettes are taxed and sellers of cigarettes are required to pay the tax to the government,

A)the size of the cigarette market is reduced.

B)the price paid by buyers of cigarettes decreases.

C)the demand for cigarettes decreases.

D)there is a movement downward and to the right along the demand curve for cigarettes.

A)the size of the cigarette market is reduced.

B)the price paid by buyers of cigarettes decreases.

C)the demand for cigarettes decreases.

D)there is a movement downward and to the right along the demand curve for cigarettes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

32

When a tax is levied on a good,

A)neither buyers nor sellers are made worse off.

B)only sellers are made worse off.

C)only buyers are made worse off.

D)both buyers and sellers are made worse off.

A)neither buyers nor sellers are made worse off.

B)only sellers are made worse off.

C)only buyers are made worse off.

D)both buyers and sellers are made worse off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

33

Suppose a tax is levied on the sellers of a good;

A)then the supply curve shifts upward by the amount of the tax.

B)then the quantity demanded decreases for all conceivable prices of the good.

C)this means that the sellers of the good will receive a lower price from buyers, not that the sellers are actually responsible for paying the tax to the government.

D)All of the above are correct.

A)then the supply curve shifts upward by the amount of the tax.

B)then the quantity demanded decreases for all conceivable prices of the good.

C)this means that the sellers of the good will receive a lower price from buyers, not that the sellers are actually responsible for paying the tax to the government.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

34

It does not matter whether a tax is levied on the buyers or the sellers of a good because

A)sellers always bear the full burden of the tax.

B)buyers always bear the full burden of the tax.

C)buyers and sellers will share the burden of the tax.

D)None of the above is correct; the incidence of the tax does depend on whether the buyers or the sellers are required to pay the tax.

A)sellers always bear the full burden of the tax.

B)buyers always bear the full burden of the tax.

C)buyers and sellers will share the burden of the tax.

D)None of the above is correct; the incidence of the tax does depend on whether the buyers or the sellers are required to pay the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

35

When a tax on a good is enacted,

A)buyers and sellers share the burden of the tax regardless of whether the tax is levied on buyers or on sellers.

B)buyers always bear the full burden of the tax.

C)sellers always bear the full burden of the tax.

D)sellers bear the full burden of the tax if the tax is levied on them; buyers bear the full burden of the tax if the tax is levied on them.

A)buyers and sellers share the burden of the tax regardless of whether the tax is levied on buyers or on sellers.

B)buyers always bear the full burden of the tax.

C)sellers always bear the full burden of the tax.

D)sellers bear the full burden of the tax if the tax is levied on them; buyers bear the full burden of the tax if the tax is levied on them.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

36

Figure 8-1

Refer to Figure 8-1.When the market is in equilibrium,total surplus is represented by area

A)A + B.

B)B + C.

C)C + D.

D)A + D.

Refer to Figure 8-1.When the market is in equilibrium,total surplus is represented by area

A)A + B.

B)B + C.

C)C + D.

D)A + D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

37

Suppose a tax is imposed on the buyers of fast-food hamburgers.The burden of the tax will

A)fall entirely on the buyers of fast-food hamburgers.

B)fall entirely on the sellers of fast-food hamburgers.

C)be shared equally by the buyers and sellers of fast-food hamburgers.

D)be shared by the buyers and sellers of fast-food hamburgers, but not necessarily equally.

A)fall entirely on the buyers of fast-food hamburgers.

B)fall entirely on the sellers of fast-food hamburgers.

C)be shared equally by the buyers and sellers of fast-food hamburgers.

D)be shared by the buyers and sellers of fast-food hamburgers, but not necessarily equally.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

38

When a tax is placed on the buyers of a product,a result is that

A)buyers effectively pay less than before and sellers effectively receive less than before.

B)buyers effectively pay less than before and sellers effectively receive more than before.

C)buyers effectively pay more than before and sellers effectively receive less than before.

D)buyers effectively pay more than before and sellers effectively receive more than before.

A)buyers effectively pay less than before and sellers effectively receive less than before.

B)buyers effectively pay less than before and sellers effectively receive more than before.

C)buyers effectively pay more than before and sellers effectively receive less than before.

D)buyers effectively pay more than before and sellers effectively receive more than before.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

39

One result of a tax,irrespective of whether the tax is placed on the buyers or the sellers,is that the

A)size of the market is unchanged.

B)price the seller effectively receives is higher.

C)supply curve for the good shifts upward by the amount of the tax.

D)tax reduces the welfare of both buyers and sellers.

A)size of the market is unchanged.

B)price the seller effectively receives is higher.

C)supply curve for the good shifts upward by the amount of the tax.

D)tax reduces the welfare of both buyers and sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

40

Figure 8-1

Refer to Figure 8-1.When the market is in equilibrium,consumer surplus is represented by area

A)a.

B)B.

C)C.

D)D.

Refer to Figure 8-1.When the market is in equilibrium,consumer surplus is represented by area

A)a.

B)B.

C)C.

D)D.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

41

Suppose a tax of $3 per unit is imposed on a good.The supply curve and the demand curve are straight lines.The tax decreases consumer surplus by $3,900 and it decreases producer surplus by $3,000.The tax generates tax revenue of $6,000.From this information it follows that the tax decreased the equilibrium quantity of the good

A)from 2,000 to 1,500.

B)from 2,400 to 2,000.

C)from 2,600 to 2,000.

D)from 3,000 to 2,400.

A)from 2,000 to 1,500.

B)from 2,400 to 2,000.

C)from 2,600 to 2,000.

D)from 3,000 to 2,400.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

42

The benefit that government receives from a tax is measured by

A)the change in the equilibrium quantity of the good.

B)the change in the equilibrium price of the good.

C)tax revenue.

D)total surplus.

A)the change in the equilibrium quantity of the good.

B)the change in the equilibrium price of the good.

C)tax revenue.

D)total surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

43

The decrease in total surplus that results from a market distortion,such as a tax,is called a

A)wedge loss.

B)revenue loss.

C)deadweight loss.

D)shrinkage of consumer surplus.

A)wedge loss.

B)revenue loss.

C)deadweight loss.

D)shrinkage of consumer surplus.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

44

For a good that is taxed,the area on the relevant supply-and-demand graph that represents government's tax revenue is

A)smaller than the area that represents the loss of consumer surplus and producer surplus caused by the tax.

B)bounded by the supply curve, the demand curve, the effective price paid by buyers, and the effective price received by sellers.

C)a right triangle.

D)a triangle, but not necessarily a right triangle.

A)smaller than the area that represents the loss of consumer surplus and producer surplus caused by the tax.

B)bounded by the supply curve, the demand curve, the effective price paid by buyers, and the effective price received by sellers.

C)a right triangle.

D)a triangle, but not necessarily a right triangle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

45

The benefit to buyers of participating in a market is measured by

A)the price elasticity of demand.

B)consumer surplus.

C)the amount buyers are willing to pay for the good.

D)the equilibrium price.

A)the price elasticity of demand.

B)consumer surplus.

C)the amount buyers are willing to pay for the good.

D)the equilibrium price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

46

For the purpose of analyzing the gains and losses from a tax on a good,we use tax revenue as a direct measure of

A)government's benefit from the tax.

B)government's loss from the tax.

C)the deadweight loss of the tax.

D)the overall net gain to society of the tax.

A)government's benefit from the tax.

B)government's loss from the tax.

C)the deadweight loss of the tax.

D)the overall net gain to society of the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

47

Total surplus with a tax is equal to

A)consumer surplus plus producer surplus.

B)consumer surplus minus producer surplus.

C)consumer surplus plus producer surplus minus tax revenue.

D)consumer surplus plus producer surplus plus tax revenue.

A)consumer surplus plus producer surplus.

B)consumer surplus minus producer surplus.

C)consumer surplus plus producer surplus minus tax revenue.

D)consumer surplus plus producer surplus plus tax revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

48

When the government places a tax on a product,

A)the cost of the tax to buyers and sellers is less than the revenue raised from the tax by the government.

B)the cost of the tax to buyers and sellers is equal to the revenue raised from the tax by the government.

C)the cost of the tax to buyers and sellers exceeds the revenue raised from the tax by the government.

D)Without additional information, such as the elasticity of demand for this product, it is impossible to compare the cost of a tax to buyers and sellers with tax revenue.

A)the cost of the tax to buyers and sellers is less than the revenue raised from the tax by the government.

B)the cost of the tax to buyers and sellers is equal to the revenue raised from the tax by the government.

C)the cost of the tax to buyers and sellers exceeds the revenue raised from the tax by the government.

D)Without additional information, such as the elasticity of demand for this product, it is impossible to compare the cost of a tax to buyers and sellers with tax revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

49

If T represents the size of the tax on a good and Q represents the quantity of the good that is sold,total tax revenue received by government can be expressed as

A)T/Q.

B)T + Q.

C)T x Q.

D)(T x Q)/Q.

A)T/Q.

B)T + Q.

C)T x Q.

D)(T x Q)/Q.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

50

Suppose a tax of $5 per unit is imposed on a good.The supply curve and the demand curve are straight lines.The tax decreases consumer surplus by $10,000 and it decreases producer surplus by $15,000.The deadweight loss of the tax is $2,500.From this information it follows that the tax decreased the equilibrium quantity of the good

A)from 6,500 to 5,500.

B)from 5,500 to 4,500.

C)from 5,000 to 3,000.

D)from 6,000 to 4,000.

A)from 6,500 to 5,500.

B)from 5,500 to 4,500.

C)from 5,000 to 3,000.

D)from 6,000 to 4,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

51

Relative to a situation in which liquor is not taxed,the imposition of a tax on liquor causes

A)the equilibrium quantity of liquor demanded to decrease and the equilibrium quantity of liquor supplied to decrease.

B)the equilibrium quantity of liquor demanded to decrease and the equilibrium quantity of liquor supplied to increase.

C)the equilibrium quantity of liquor demanded to increase and the equilibrium quantity of liquor supplied to decrease.

D)the equilibrium quantity of liquor demanded to increase and the equilibrium quantity of liquor supplied to increase.

A)the equilibrium quantity of liquor demanded to decrease and the equilibrium quantity of liquor supplied to decrease.

B)the equilibrium quantity of liquor demanded to decrease and the equilibrium quantity of liquor supplied to increase.

C)the equilibrium quantity of liquor demanded to increase and the equilibrium quantity of liquor supplied to decrease.

D)the equilibrium quantity of liquor demanded to increase and the equilibrium quantity of liquor supplied to increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

52

Suppose a tax of $4 per unit is imposed on a good,and the tax causes the equilibrium quantity of the good to decrease from 2,000 units to 1,700 units.The tax decreases consumer surplus by $3,000 and it decreases producer surplus by $4,400.The deadweight loss of the tax is

A)$200.

B)$400.

C)$600.

D)$1,200.

A)$200.

B)$400.

C)$600.

D)$1,200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

53

A tax of $0.25 is imposed on each bag of potato chips that is sold.The tax decreases producer surplus by $600 per day;

generates tax revenue of $1,220 per day;

decreases the equilibrium quantity of potato chips by 120 bags per day.

From this information,it follows that the tax

A)decreases consumer surplus by $645 per day.

B)decreases the equilibrium quantity from 6,000 bags per day to 5,880 bags per day.

C)decreases total surplus from $3,000 to $1,800 per day.

D)produces a deadweight loss of $15 per day.

generates tax revenue of $1,220 per day;

decreases the equilibrium quantity of potato chips by 120 bags per day.

From this information,it follows that the tax

A)decreases consumer surplus by $645 per day.

B)decreases the equilibrium quantity from 6,000 bags per day to 5,880 bags per day.

C)decreases total surplus from $3,000 to $1,800 per day.

D)produces a deadweight loss of $15 per day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

54

Taxes cause deadweight losses because they

A)lead to losses in surplus for consumers and for producers that, when taken together, exceed tax revenue collected by the government.

B)distort incentives to both buyers and sellers.

C)prevent buyers and sellers from realizing some of the gains from trade.

D)All of the above are correct.

A)lead to losses in surplus for consumers and for producers that, when taken together, exceed tax revenue collected by the government.

B)distort incentives to both buyers and sellers.

C)prevent buyers and sellers from realizing some of the gains from trade.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

55

A tax on a good

A)gives buyers an incentive to buy more of the good than they otherwise would buy.

B)gives sellers an incentive to produce less of the good than they otherwise would produce.

C)creates a benefit to the government, the size of which exceeds the loss in surplus to buyers and sellers.

D)All of the above are correct.

A)gives buyers an incentive to buy more of the good than they otherwise would buy.

B)gives sellers an incentive to produce less of the good than they otherwise would produce.

C)creates a benefit to the government, the size of which exceeds the loss in surplus to buyers and sellers.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

56

For a good that is taxed,the area on the relevant supply-and-demand graph that represents government's tax revenue is a

A)triangle.

B)rectangle.

C)trapezoid.

D)None of the above is correct; government's tax revenue is the area between the supply and demand curves, above the horizontal axis, and below the effective price to buyers.

A)triangle.

B)rectangle.

C)trapezoid.

D)None of the above is correct; government's tax revenue is the area between the supply and demand curves, above the horizontal axis, and below the effective price to buyers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

57

The benefit to sellers of participating in a market is measured by

A)the amount of taxes collected on sales of the good.

B)producer surplus.

C)the amount sellers receive for their product.

D)the sellers' willingness to sell.

A)the amount of taxes collected on sales of the good.

B)producer surplus.

C)the amount sellers receive for their product.

D)the sellers' willingness to sell.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

58

When a tax is levied on buyers,

A)the supply curves shifts upward by the amount of the tax.

B)the tax creates a wedge between the price buyers effectively pay and the price sellers receive.

C)the tax has no effect on the well-being of sellers.

D)All of the above are correct.

A)the supply curves shifts upward by the amount of the tax.

B)the tax creates a wedge between the price buyers effectively pay and the price sellers receive.

C)the tax has no effect on the well-being of sellers.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following quantities decrease in response to a tax on a good?

A)the size of the market for the good, the effective price of the good paid by buyers, and consumer surplus

B)the size of the market for the good, producer surplus, and the well-being of buyers of the good

C)the effective price received by sellers of the good, the wedge between the effective price paid by buyers and the effective price received by sellers, and consumer surplus

D)None of the above is necessarily correct unless we know whether the tax is levied on buyers or on sellers.

A)the size of the market for the good, the effective price of the good paid by buyers, and consumer surplus

B)the size of the market for the good, producer surplus, and the well-being of buyers of the good

C)the effective price received by sellers of the good, the wedge between the effective price paid by buyers and the effective price received by sellers, and consumer surplus

D)None of the above is necessarily correct unless we know whether the tax is levied on buyers or on sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

60

When the price of a good is measured in dollars,then the size of the deadweight loss that results from taxing that good is measured in

A)units of the good that is being taxed.

B)units of another good that is not being taxed.

C)dollars.

D)abstract units of measurement that reflect the well-being of the society.

A)units of the good that is being taxed.

B)units of another good that is not being taxed.

C)dollars.

D)abstract units of measurement that reflect the well-being of the society.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

61

The supply curve and the demand curve for a good are straight lines.When the good is taxed,the area on the relevant supply-and-demand graph that represents the deadweight loss is

A)larger than the area that represents consumer surplus in the absence of the tax.

B)larger than the area that represents government's tax revenue.

C)a triangle.

D)All of the above are correct.

A)larger than the area that represents consumer surplus in the absence of the tax.

B)larger than the area that represents government's tax revenue.

C)a triangle.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

62

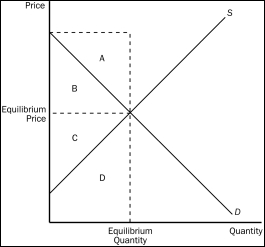

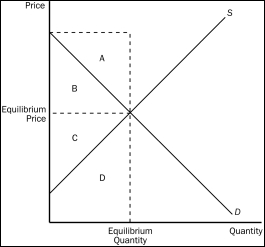

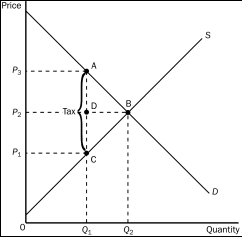

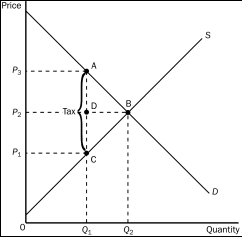

Figure 8-2

Refer to Figure 8-2.The price that buyers effectively pay after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

Refer to Figure 8-2.The price that buyers effectively pay after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

63

Figure 8-2

Refer to Figure 8-2.The per unit burden of the tax on buyers is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

Refer to Figure 8-2.The per unit burden of the tax on buyers is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

64

Taxes cause deadweight losses because

A)taxes reduce the sum of producer and consumer surpluses by more than the amount of tax revenue.

B)taxes prevent buyers and sellers from realizing some of the gains from trade.

C)taxes cause marginal buyers and marginal sellers to leave the market, causing the quantity sold to fall.

D)All of the above are correct.

A)taxes reduce the sum of producer and consumer surpluses by more than the amount of tax revenue.

B)taxes prevent buyers and sellers from realizing some of the gains from trade.

C)taxes cause marginal buyers and marginal sellers to leave the market, causing the quantity sold to fall.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

65

Figure 8-2

Refer to Figure 8-2.The equilibrium price before the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)None of the above is correct.

Refer to Figure 8-2.The equilibrium price before the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

66

The supply curve and the demand curve for widgets are straight lines.Suppose the equilibrium quantity in the market for widgets is 200 per month when there is no tax.Then a tax of $5 per widget is imposed.The price paid by buyers increases by $2 and the after-tax price received by sellers falls by $3.The government is able to raise $750 per month in revenue from the tax.The deadweight loss from the tax is

A)$250.

B)$125.

C)$75.

D)$50.

A)$250.

B)$125.

C)$75.

D)$50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

67

Deadweight loss is the

A)decline in total surplus that results from a tax.

B)decline in government revenue when taxes are reduced in a market.

C)decline in consumer surplus when a tax is placed on buyers.

D)loss of profits to business firms when a tax is imposed.

A)decline in total surplus that results from a tax.

B)decline in government revenue when taxes are reduced in a market.

C)decline in consumer surplus when a tax is placed on buyers.

D)loss of profits to business firms when a tax is imposed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

68

The loss in total surplus resulting from a tax is called

A)a deficit.

B)economic loss.

C)deadweight loss.

D)inefficiency.

A)a deficit.

B)economic loss.

C)deadweight loss.

D)inefficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

69

The supply curve and the demand curve for a good are straight lines.When the good is taxed,the area on the relevant supply-and-demand graph that represents

A)government's tax revenue is a rectangle.

B)the deadweight loss of the tax is a triangle.

C)the loss of consumer surplus caused by the tax is neither a rectangle nor a triangle.

D)All of the above are correct.

A)government's tax revenue is a rectangle.

B)the deadweight loss of the tax is a triangle.

C)the loss of consumer surplus caused by the tax is neither a rectangle nor a triangle.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

70

Taxes

A)distort incentives and this distortion causes markets to allocate resources inefficiently.

B)distort incentives and this distortion results in an inequitable allocation of resources.

C)do not distort incentives, but they do cause markets to allocate resources inefficiently.

D)do not distort incentives, but they do result in an inequitable allocation of resources.

A)distort incentives and this distortion causes markets to allocate resources inefficiently.

B)distort incentives and this distortion results in an inequitable allocation of resources.

C)do not distort incentives, but they do cause markets to allocate resources inefficiently.

D)do not distort incentives, but they do result in an inequitable allocation of resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

71

Figure 8-2

Refer to Figure 8-2.The amount of the tax on each unit of the good is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

Refer to Figure 8-2.The amount of the tax on each unit of the good is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

72

Deadweight loss measures the

A)loss in a market to buyers and sellers that is not offset by an increase in government revenue.

B)loss in revenue to the government when buyers choose to buy less of the product because of the tax.

C)loss of equity in a market due to government intervention.

D)loss of total revenue to business firms due to the price wedge caused by the tax.

A)loss in a market to buyers and sellers that is not offset by an increase in government revenue.

B)loss in revenue to the government when buyers choose to buy less of the product because of the tax.

C)loss of equity in a market due to government intervention.

D)loss of total revenue to business firms due to the price wedge caused by the tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

73

A deadweight loss is a consequence of a tax on a good because the tax

A)induces the government to increase its expenditures.

B)induces buyers to consume less, and sellers to produce less, of the good.

C)causes a disequilibrium in the market.

D)imposes a loss on buyers that is greater than the loss to sellers.

A)induces the government to increase its expenditures.

B)induces buyers to consume less, and sellers to produce less, of the good.

C)causes a disequilibrium in the market.

D)imposes a loss on buyers that is greater than the loss to sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

74

The supply curve and the demand curve for cigars are straight lines.Suppose the equilibrium quantity in the market for cigars is 1,000 per month when there is no tax.Then a tax of $0.50 per cigar is imposed.The effective price paid by buyers increases from $1.50 to $1.90 and the effective price received by sellers falls from $1.50 to $1.40.The government's tax revenue amounts to $475 per month.Which of the following statements is correct?

A)The demand for cigars is less elastic than the supply of cigars.

B)The tax causes a decrease in consumer surplus of $390 and a decrease in producer surplus of $97.50.

C)The deadweight loss of the tax is $12.50.

D)All of the above are correct.

A)The demand for cigars is less elastic than the supply of cigars.

B)The tax causes a decrease in consumer surplus of $390 and a decrease in producer surplus of $97.50.

C)The deadweight loss of the tax is $12.50.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

75

The supply curve and the demand curve for cigars are straight lines.Suppose the equilibrium quantity in the market for cigars is 1,000 per month when there is no tax.Then a tax of $0.50 per cigar is imposed.The effective price paid by buyers increases from $1.50 to $1.90 and the effective price received by sellers falls from $1.50 to $1.40.The government's tax revenue amounts to $475 per month.Which of the following statements is correct?

A)After the tax is imposed, the equilibrium quantity of cigars is 900 per month.

B)The demand for cigars is more elastic than the supply of cigars.

C)The deadweight loss of the tax is $12.50.

D)The tax causes a decrease in consumer surplus of $380.

A)After the tax is imposed, the equilibrium quantity of cigars is 900 per month.

B)The demand for cigars is more elastic than the supply of cigars.

C)The deadweight loss of the tax is $12.50.

D)The tax causes a decrease in consumer surplus of $380.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

76

Suppose the equilibrium quantity in the market for widgets is 200 per month when there is no tax.Then a tax of $5 per widget is imposed.As a result,the government is able to raise $750 per month in tax revenue.We can conclude that the equilibrium quantity of widgets has fallen by

A)25 per month.

B)50 per month.

C)75 per month.

D)100 per month.

A)25 per month.

B)50 per month.

C)75 per month.

D)100 per month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

77

A tax of $10 per unit is imposed on a certain good.The supply curve and the demand curve are straight lines.The tax reduces the equilibrium quantity in the market by 200 units.The deadweight loss from the tax is

A)$2,000.

B)$,1000.

C)$500.

D)$250.

A)$2,000.

B)$,1000.

C)$500.

D)$250.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

78

Figure 8-2

Refer to Figure 8-2.The amount of tax revenue received by the government is equal to the area

A)P₃ A C P₁.

B)A B C.

C)P₂ D A P₃.

D)P₁ C D P₂.

Refer to Figure 8-2.The amount of tax revenue received by the government is equal to the area

A)P₃ A C P₁.

B)A B C.

C)P₂ D A P₃.

D)P₁ C D P₂.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

79

Figure 8-2

Refer to Figure 8-2.The per-unit burden of the tax on sellers is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

Refer to Figure 8-2.The per-unit burden of the tax on sellers is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck

80

Figure 8-2

Refer to Figure 8-2.The price that sellers effectively receive after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

Refer to Figure 8-2.The price that sellers effectively receive after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 245 في هذه المجموعة.

فتح الحزمة

k this deck