Deck 13: Amoney and the Banking System

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

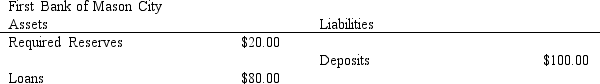

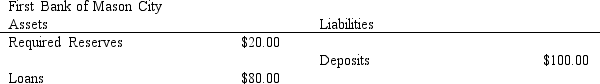

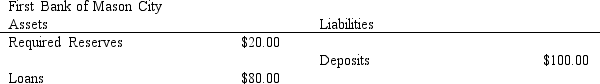

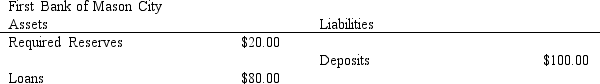

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

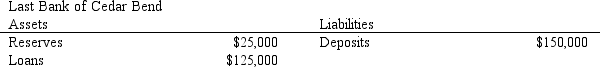

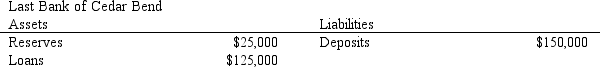

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/260

العب

ملء الشاشة (f)

Deck 13: Amoney and the Banking System

1

The primary benefit of a monetary system of exchange compared to a barter system is the increased

A)ability to record transactions.

B)time necessary to find trading partners.

C)time devoted to shopping.

D)efficiency in arranging transactions.

A)ability to record transactions.

B)time necessary to find trading partners.

C)time devoted to shopping.

D)efficiency in arranging transactions.

D

2

In the modern U.S.economy,most transactions are made with

A)cash.

B)gold and silver.

C)credit cards.

D)checking deposits.

A)cash.

B)gold and silver.

C)credit cards.

D)checking deposits.

D

3

Which of the following is not a component of the M1 money supply?

A)demand deposits

B)large-denomination (more than $100)bills

C)interest-earning checking deposits

D)outstanding balances on credit cards

A)demand deposits

B)large-denomination (more than $100)bills

C)interest-earning checking deposits

D)outstanding balances on credit cards

D

4

Stores need not accept your check but must accept currency because

A)currency is backed by gold.

B)checks are not money but currency is.

C)currency is legal tender;checks are not.

D)currency is easier to handle.

E)currency is a medium of exchange;checks are not.

A)currency is backed by gold.

B)checks are not money but currency is.

C)currency is legal tender;checks are not.

D)currency is easier to handle.

E)currency is a medium of exchange;checks are not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

5

When the Federal Reserve sells government bonds to the public,it directly

A)increases the M1 money supply and increases the reserves of the commercial banking system.

B)increases the M1 money supply,while reducing the reserves of the commercial banking system.

C)reduces the M1 money supply,while increasing the reserves of the commercial banking system.

D)reduces the M1 money supply and decreases the reserves of the commercial banking system.

A)increases the M1 money supply and increases the reserves of the commercial banking system.

B)increases the M1 money supply,while reducing the reserves of the commercial banking system.

C)reduces the M1 money supply,while increasing the reserves of the commercial banking system.

D)reduces the M1 money supply and decreases the reserves of the commercial banking system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is the best definition of money?

A)anything generally accepted as a payment for goods or repayment of debt

B)anything that is a liability of the federal government

C)anything that is a liability of a commercial bank

D)the outstanding balances of households on credit cards

A)anything generally accepted as a payment for goods or repayment of debt

B)anything that is a liability of the federal government

C)anything that is a liability of a commercial bank

D)the outstanding balances of households on credit cards

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

7

Comparing how many dollars it takes you to run your car each year to annual earnings on a job instead of keeping track of costs in terms of gallons of gasoline and quarts of oil represents the use of money as

A)means of payment.

B)unit of account.

C)store of purchasing power.

D)form of plastic money.

A)means of payment.

B)unit of account.

C)store of purchasing power.

D)form of plastic money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

8

Money is

A)valuable because it is backed by gold.

B)whatever is generally accepted in exchange for goods and services.

C)anything that is a liability of a commercial bank

D)an object to be consumed.

A)valuable because it is backed by gold.

B)whatever is generally accepted in exchange for goods and services.

C)anything that is a liability of a commercial bank

D)an object to be consumed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

9

As the number of goods and services increases,barter becomes

A)easier because the chance of there being a double coincidence of wants increases.

B)harder because the chance of there being a double coincidence of wants increases.

C)easier because the chance of there being a double coincidence of wants decreases.

D)harder because the chance of there being a double coincidence of wants decreases.

E)easier because people have more choice.

A)easier because the chance of there being a double coincidence of wants increases.

B)harder because the chance of there being a double coincidence of wants increases.

C)easier because the chance of there being a double coincidence of wants decreases.

D)harder because the chance of there being a double coincidence of wants decreases.

E)easier because people have more choice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

10

In order for barter to occur,traders must have a

A)unit of account.

B)coincidence of wants.

C)medium of exchange.

D)central banking facility.

A)unit of account.

B)coincidence of wants.

C)medium of exchange.

D)central banking facility.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following compose the reserves of a commercial bank?

A)demand deposits and time deposits

B)vault cash and deposits of the bank with the Federal Reserve

C)U.S.securities and stock equity

D)cash and U.S.securities

A)demand deposits and time deposits

B)vault cash and deposits of the bank with the Federal Reserve

C)U.S.securities and stock equity

D)cash and U.S.securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

12

Suppose the Fed purchases $100 million of U.S.securities from the public.If the reserve requirement is 20 percent,the currency holdings of the public are unchanged,and banks have zero excess reserves both before and after the transaction,the total impact on the money supply will be a

A)$100 million decrease in the money supply.

B)$100 million increase in the money supply.

C)$200 million increase in the money supply.

D)$500 million increase in the money supply.

A)$100 million decrease in the money supply.

B)$100 million increase in the money supply.

C)$200 million increase in the money supply.

D)$500 million increase in the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

13

Money is

A)whatever is generally accepted in exchange for goods and services.

B)an object to be consumed.

C)a highly illiquid asset.

D)widely used in a barter economy.

A)whatever is generally accepted in exchange for goods and services.

B)an object to be consumed.

C)a highly illiquid asset.

D)widely used in a barter economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

14

Ordinary commercial banks can expand the supply of money by

A)printing up currency when they need it.

B)buying and selling government bonds to the general public.

C)using a portion of their deposits to extend additional loans.

D)reducing their vault cash and increasing their deposits with the Fed.

A)printing up currency when they need it.

B)buying and selling government bonds to the general public.

C)using a portion of their deposits to extend additional loans.

D)reducing their vault cash and increasing their deposits with the Fed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

15

In order for barter trades to occur,there must be a

A)singularity of interests.

B)bargaining intermediary.

C)double coincidence of wants.

D)sufficient supply of cash.

A)singularity of interests.

B)bargaining intermediary.

C)double coincidence of wants.

D)sufficient supply of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

16

Why did the monetary base increase rapidly during the economic crisis of 2008?

A)The Fed sold financial assets and extended fewer loans.

B)The Fed increased both its purchase of assets and quantity of loans extended.

C)The Fed increased its purchases of assets,but offset this with an increase in the reserve requirement.

D)The Fed sold financial assets,but offset this with a reduction in the reserve requirement.

A)The Fed sold financial assets and extended fewer loans.

B)The Fed increased both its purchase of assets and quantity of loans extended.

C)The Fed increased its purchases of assets,but offset this with an increase in the reserve requirement.

D)The Fed sold financial assets,but offset this with a reduction in the reserve requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the Fed wanted to use all four of its major monetary control tools to decrease the money supply,it would

A)buy bonds,reduce the discount rate,reduce reserve requirements,and reduce the interest rate paid on excess reserves.

B)sell bonds,reduce the discount rate,reduce reserve requirements,and reduce the interest rate paid on excess reserves.

C)sell bonds,increase the discount rate,increase reserve requirements,and increase the interest rate paid on excess reserves.

D)buy bonds,increase the discount rate,increase reserve requirements,and increase the interest rate paid on excess reserves.

A)buy bonds,reduce the discount rate,reduce reserve requirements,and reduce the interest rate paid on excess reserves.

B)sell bonds,reduce the discount rate,reduce reserve requirements,and reduce the interest rate paid on excess reserves.

C)sell bonds,increase the discount rate,increase reserve requirements,and increase the interest rate paid on excess reserves.

D)buy bonds,increase the discount rate,increase reserve requirements,and increase the interest rate paid on excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

18

What restricts the Fed's ability to write checks and purchase U.S.securities?

A)Congress;the Fed must receive a budget allocation from Congress before it can write a check.

B)The gold requirement;the Fed cannot write a check unless it has a sufficient amount of gold to back the expenditure.

C)Reserve requirements;the Fed must maintain 20 percent of its assets in the form of cash against the deposits that it is holding for commercial banks.

D)Nothing;the Fed can create money simply by writing a check on itself.

A)Congress;the Fed must receive a budget allocation from Congress before it can write a check.

B)The gold requirement;the Fed cannot write a check unless it has a sufficient amount of gold to back the expenditure.

C)Reserve requirements;the Fed must maintain 20 percent of its assets in the form of cash against the deposits that it is holding for commercial banks.

D)Nothing;the Fed can create money simply by writing a check on itself.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

19

In the United States,the purchasing power of money is determined by

A)the underlying precious metals that back each unit of currency.

B)the value of U.S.treasury bonds that back each unit of currency.

C)Federal Reserve policy,which controls the money supply.

D)Congress,which controls the money supply.

A)the underlying precious metals that back each unit of currency.

B)the value of U.S.treasury bonds that back each unit of currency.

C)Federal Reserve policy,which controls the money supply.

D)Congress,which controls the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

20

One advantage of a money system compared to a barter system is that

A)barter never works.

B)money creates the need for banks.

C)money is more efficient.

D)everyone has money.

A)barter never works.

B)money creates the need for banks.

C)money is more efficient.

D)everyone has money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

21

What is meant by the expression,"There is too much money chasing too few goods"?

A)People spend too much time chasing after money.

B)An expansion in the supply of money relative to the availability of goods and services is causing an increase in the general level of prices.

C)The value of money will tend to decline when the supply of gold increases.

D)People would be better off if the monetary authorities increased the supply of money more rapidly.

A)People spend too much time chasing after money.

B)An expansion in the supply of money relative to the availability of goods and services is causing an increase in the general level of prices.

C)The value of money will tend to decline when the supply of gold increases.

D)People would be better off if the monetary authorities increased the supply of money more rapidly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

22

When the monetary authorities expand the supply of money rapidly,

A)its purchasing power tends to increase.

B)holding money is a poor method of storing value.

C)the long-run sustainable real growth rate of the economy will tend to increase.

D)the prices of goods and services will generally decline.

A)its purchasing power tends to increase.

B)holding money is a poor method of storing value.

C)the long-run sustainable real growth rate of the economy will tend to increase.

D)the prices of goods and services will generally decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

23

Compared to a barter economy,using money increases efficiency by reducing

A)transaction costs.

B)the need to exchange goods.

C)the need to specialize.

D)inflation.

A)transaction costs.

B)the need to exchange goods.

C)the need to specialize.

D)inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

24

The demand for money varies

A)directly with both the price level and the level of real GDP.

B)inversely with both the price level and the level of real GDP.

C)inversely with the price level and directly with the level of real GDP.

D)directly with the price level and inversely with the level of real GDP.

E)inversely with the level of nominal GDP.

A)directly with both the price level and the level of real GDP.

B)inversely with both the price level and the level of real GDP.

C)inversely with the price level and directly with the level of real GDP.

D)directly with the price level and inversely with the level of real GDP.

E)inversely with the level of nominal GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

25

A decrease in the interest rate,other things being equal,causes

A)an upward movement along the demand curve for money.

B)a downward movement along the demand curve for money.

C)a rightward shift of the demand curve for money.

D)a leftward shift of the demand curve for money.

A)an upward movement along the demand curve for money.

B)a downward movement along the demand curve for money.

C)a rightward shift of the demand curve for money.

D)a leftward shift of the demand curve for money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

26

Are funds available on a credit card included in a definition of the money supply?

A)Yes,because these funds can be used to pay for goods and services.

B)Yes,because these funds are included in M2.

C)No,because these funds are hard to measure total credit card spending.

D)No,because these funds are not a store of value.

A)Yes,because these funds can be used to pay for goods and services.

B)Yes,because these funds are included in M2.

C)No,because these funds are hard to measure total credit card spending.

D)No,because these funds are not a store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

27

Suppose you transfer $1,000 from your checking account to your savings account.How does this action affect the M1 and M2 money supplies?

A)M1 and M2 are both unchanged.

B)M1 falls by $1,000,and M2 rises by $1,000.

C)M1 is unchanged,and M2 rises by $1,000.

D)M1 falls by $1,000,and M2 is unchanged.

A)M1 and M2 are both unchanged.

B)M1 falls by $1,000,and M2 rises by $1,000.

C)M1 is unchanged,and M2 rises by $1,000.

D)M1 falls by $1,000,and M2 is unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following assets is most liquid?

A)funds in a checking account

B)a car

C)a home

D)a municipal bond

A)funds in a checking account

B)a car

C)a home

D)a municipal bond

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

29

Other things being equal,an increase in the rate of interest causes

A)an upward movement along the demand for money curve.

B)a downward movement along the demand for money curve.

C)a rightward shift of the demand for money curve.

D)a leftward shift of the demand for money curve.

A)an upward movement along the demand for money curve.

B)a downward movement along the demand for money curve.

C)a rightward shift of the demand for money curve.

D)a leftward shift of the demand for money curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

30

Fiat money is money

A)that has little intrinsic value and is not backed by a commodity.

B)that is not included as part of the M1 money supply.

C)that is backed by gold or silver held on reserve by the government.

D)such as coins that are made from metal.

A)that has little intrinsic value and is not backed by a commodity.

B)that is not included as part of the M1 money supply.

C)that is backed by gold or silver held on reserve by the government.

D)such as coins that are made from metal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

31

If money were not used as a medium of exchange,

A)the gains from trade would be severely limited.

B)our standard of living would probably improve.

C)the transaction costs of exchange would be lower.

D)economic efficiency would increase.

A)the gains from trade would be severely limited.

B)our standard of living would probably improve.

C)the transaction costs of exchange would be lower.

D)economic efficiency would increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

32

Are "smart cards" or E-cash cards part of the money supply?

A)Yes,because they can be given away to make a payment.

B)Yes,because they will soon completely replace cash.

C)No,because they are not issued by banks.

D)No,because they are merely means to transfer checking deposits.

A)Yes,because they can be given away to make a payment.

B)Yes,because they will soon completely replace cash.

C)No,because they are not issued by banks.

D)No,because they are merely means to transfer checking deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

33

The value (purchasing power)of each unit of money

A)is largely independent of the money supply.

B)tends to increase as the money supply expands.

C)increases as the general level of prices rise.

D)is inversely related to the general level of prices.

A)is largely independent of the money supply.

B)tends to increase as the money supply expands.

C)increases as the general level of prices rise.

D)is inversely related to the general level of prices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following provides the best explanation of why money is valuable?

A)Money is valuable because it is declared legal tender by the government issuing it.

B)Money is valuable because it is scarce relative to the demand for the services it provides.

C)Money is valuable because it is backed by precious metals,primarily gold and silver.

D)Money is valuable because it has intrinsic value,independent of its use as a means of exchange.

A)Money is valuable because it is declared legal tender by the government issuing it.

B)Money is valuable because it is scarce relative to the demand for the services it provides.

C)Money is valuable because it is backed by precious metals,primarily gold and silver.

D)Money is valuable because it has intrinsic value,independent of its use as a means of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

35

When the interest rate decreases,the opportunity cost of holding money

A)increases,so the quantity of money demanded increases.

B)increases,so the quantity of money demanded decreases.

C)decreases,so the quantity of money demanded increases.

D)decreases,so the quantity of money demanded decreases.

A)increases,so the quantity of money demanded increases.

B)increases,so the quantity of money demanded decreases.

C)decreases,so the quantity of money demanded increases.

D)decreases,so the quantity of money demanded decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

36

Though many assets can be used as a store of value,money is a particularly attractive method to store value because

A)it increases in value as prices rise.

B)its purchasing power does not decline when prices rise.

C)it is the most liquid of all assets.

D)it is backed by gold.

A)it increases in value as prices rise.

B)its purchasing power does not decline when prices rise.

C)it is the most liquid of all assets.

D)it is backed by gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

37

A barter economy is one in which

A)money serves as a medium of exchange.

B)only precious metals are accepted as money.

C)goods are traded directly for other goods.

D)paper money is backed by gold.

A)money serves as a medium of exchange.

B)only precious metals are accepted as money.

C)goods are traded directly for other goods.

D)paper money is backed by gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

38

People are likely to want to hold more money if the interest rate

A)increases making the opportunity cost of holding money rise.

B)increases making the opportunity cost of holding money fall.

C)decreases making the opportunity cost of holding money rise.

D)decreases making the opportunity cost of holding money fall.

A)increases making the opportunity cost of holding money rise.

B)increases making the opportunity cost of holding money fall.

C)decreases making the opportunity cost of holding money rise.

D)decreases making the opportunity cost of holding money fall.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

39

Money is used as a unit of account.This means

A)money cannot store value for use in the future.

B)money is used to measure the exchange value and costs of goods,services,assets and resources.

C)money has little or no intrinsic value.

D)money is dependent on the quantity of gold held by the Federal Reserve.

A)money cannot store value for use in the future.

B)money is used to measure the exchange value and costs of goods,services,assets and resources.

C)money has little or no intrinsic value.

D)money is dependent on the quantity of gold held by the Federal Reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

40

If the prices of goods and services fall,the value of money (its purchasing power)

A)increases.

B)decreases.

C)stays the same.

D)can either increase or decrease.

A)increases.

B)decreases.

C)stays the same.

D)can either increase or decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

41

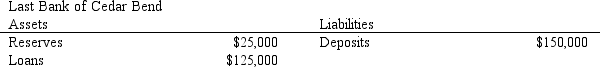

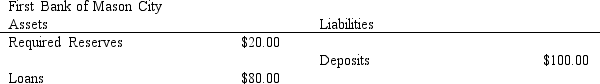

Table 13-2

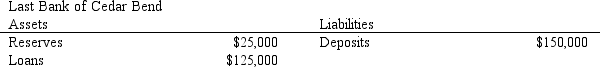

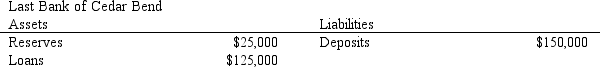

Refer to Table 13-2.The reserve requirement is 10 percent and then someone deposits an additional $50,000 into the bank,then if the bank takes no other action it will

A)have $65,000 in excess reserves.

B)have $55,000 in excess reserves.

C)need to raise an additional $5,000 of reserves to meet the reserve requirement

D)none of the above is correct.

Refer to Table 13-2.The reserve requirement is 10 percent and then someone deposits an additional $50,000 into the bank,then if the bank takes no other action it will

A)have $65,000 in excess reserves.

B)have $55,000 in excess reserves.

C)need to raise an additional $5,000 of reserves to meet the reserve requirement

D)none of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

42

Widespread use of credit cards

A)will increase the M1 money supply figures.

B)will increase the M2 money supply figures but not those for M1.

C)tends to reduce the average quantity of money that people will choose to hold.

D)tends to increase the average quantity of money that people will choose to hold.

A)will increase the M1 money supply figures.

B)will increase the M2 money supply figures but not those for M1.

C)tends to reduce the average quantity of money that people will choose to hold.

D)tends to increase the average quantity of money that people will choose to hold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

43

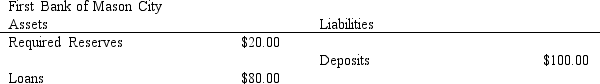

Table 13-1

Refer to Table 13-1.If $1,000 is deposited into the First Bank of Mason City,and the bank takes no other actions,it's

A)total reserves will increase by $200.

B)liabilities will decrease by $1,000.

C)assets will increase by $1,000.

D)required reserves will increase by $800.

Refer to Table 13-1.If $1,000 is deposited into the First Bank of Mason City,and the bank takes no other actions,it's

A)total reserves will increase by $200.

B)liabilities will decrease by $1,000.

C)assets will increase by $1,000.

D)required reserves will increase by $800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

44

If you deposit $100 of currency into a demand deposit at a bank,this action by itself

A)does not change the money supply.

B)increases the money supply.

C)decreases the money supply.

D)has an indeterminate effect on the money supply.

A)does not change the money supply.

B)increases the money supply.

C)decreases the money supply.

D)has an indeterminate effect on the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

45

Table 13-1

Refer to Table 13-1.If someone deposits $400 into the First Bank of Mason City,

A)the bank will be able to make additional loans totaling $320.

B)excess reserves initially increase by $320.

C)required reserves initially increase by $80.

D)all of the above are correct.

Refer to Table 13-1.If someone deposits $400 into the First Bank of Mason City,

A)the bank will be able to make additional loans totaling $320.

B)excess reserves initially increase by $320.

C)required reserves initially increase by $80.

D)all of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

46

The M1 money supply

A)is composed of assets that reflect the medium of exchange function of money.

B)is larger than the M2 money supply.

C)includes credit card balances since they are used to purchase things.

D)is composed of only currency.

A)is composed of assets that reflect the medium of exchange function of money.

B)is larger than the M2 money supply.

C)includes credit card balances since they are used to purchase things.

D)is composed of only currency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

47

The main source of profit for financial institutions is

A)their ownership of stocks in commercial corporations.

B)their ownership of real assets received in foreclosures on loans to households.

C)the fees charged for holding and servicing checking accounts.

D)the difference between interest paid on deposits and interest received on loans.

E)the difference between the cost of creating new money and the interest paid on loans.

A)their ownership of stocks in commercial corporations.

B)their ownership of real assets received in foreclosures on loans to households.

C)the fees charged for holding and servicing checking accounts.

D)the difference between interest paid on deposits and interest received on loans.

E)the difference between the cost of creating new money and the interest paid on loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

48

Demand deposits are

A)deposits held by individuals at one of the twelve Federal Reserve District Banks.

B)interest-earning savings deposits held by individuals at a banking institution.

C)deposits of commercial banks at one of the twelve Federal Reserve District Banks.

D)deposits of individuals that can either be withdrawn or made payable on demand to a third party by a check.

A)deposits held by individuals at one of the twelve Federal Reserve District Banks.

B)interest-earning savings deposits held by individuals at a banking institution.

C)deposits of commercial banks at one of the twelve Federal Reserve District Banks.

D)deposits of individuals that can either be withdrawn or made payable on demand to a third party by a check.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

49

Checking account deposits are counted as part of the M1 money supply because

A)they earn interest income for the depositor.

B)they are widely used as a means of making payment.

C)banks hold currency equal to the value of their outstanding checking account deposits.

D)they are ultimately the obligations of the Treasury.

A)they earn interest income for the depositor.

B)they are widely used as a means of making payment.

C)banks hold currency equal to the value of their outstanding checking account deposits.

D)they are ultimately the obligations of the Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

50

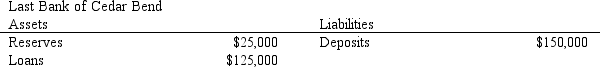

Table 13-2

Refer to Table 13-2.If the Last Bank of Cedar Bend is holding $10,000 in excess reserves,then the reserve requirement is

A)2 percent.

B)5 percent.

C)7 percent.

D)10 percent.

Refer to Table 13-2.If the Last Bank of Cedar Bend is holding $10,000 in excess reserves,then the reserve requirement is

A)2 percent.

B)5 percent.

C)7 percent.

D)10 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

51

If you have a checking account at a local bank,your bank account there is

A)an asset to the bank and an asset to you.

B)a liability of the bank and a liability of yours.

C)a liability of the bank and an asset to you.

D)an asset to the bank and a liability of yours.

A)an asset to the bank and an asset to you.

B)a liability of the bank and a liability of yours.

C)a liability of the bank and an asset to you.

D)an asset to the bank and a liability of yours.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

52

Are outstanding credit card balances counted as part of the money supply?

A)Yes;they are used to purchase things,and therefore,they are included in the money supply figures.

B)No;money is an asset,while the credit card balances are a liability.Thus,they are not included in the money supply figures.

C)Partly;credit card balances of $100 or less are included in the M1 money supply,but the money supply figures do not include balances in excess of $100.

D)Partly;credit card balances are included in the M1 money supply,but not the M2 money supply.

A)Yes;they are used to purchase things,and therefore,they are included in the money supply figures.

B)No;money is an asset,while the credit card balances are a liability.Thus,they are not included in the money supply figures.

C)Partly;credit card balances of $100 or less are included in the M1 money supply,but the money supply figures do not include balances in excess of $100.

D)Partly;credit card balances are included in the M1 money supply,but not the M2 money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

53

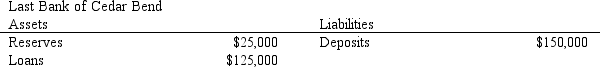

Table 13-2

Refer to Table 13-2.If the reserve requirement is 10 percent,then this bank

A)is in a position to make a new loan of $15,000.

B)has less reserves than required.

C)has excess reserves of less than $15,000.

D)none of the above is correct.

Refer to Table 13-2.If the reserve requirement is 10 percent,then this bank

A)is in a position to make a new loan of $15,000.

B)has less reserves than required.

C)has excess reserves of less than $15,000.

D)none of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

54

Table 13-2

Refer to Table 13-2.If the reserve requirement is 20 percent,this bank

A)has $10,000 of excess reserves.

B)needs $10,000 more reserves to meet its reserve requirements.

C)needs $5,000 more reserves to meet its reserve requirements.

D)just meets its reserve requirement.

Refer to Table 13-2.If the reserve requirement is 20 percent,this bank

A)has $10,000 of excess reserves.

B)needs $10,000 more reserves to meet its reserve requirements.

C)needs $5,000 more reserves to meet its reserve requirements.

D)just meets its reserve requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

55

Economists who stress the store of value function of money generally

A)argue that M1 is the best measure of the money supply.

B)prefer the M2 measure of the money supply to the M1 measure.

C)argue that M1 is too broad a definition of the money supply.

D)prefer the M1 measure of the money supply to the M2 measure.

A)argue that M1 is the best measure of the money supply.

B)prefer the M2 measure of the money supply to the M1 measure.

C)argue that M1 is too broad a definition of the money supply.

D)prefer the M1 measure of the money supply to the M2 measure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which one of the following is the largest component of the money supply (M1)in the United States?

A)demand and other checking deposits

B)gold certificates

C)credit cards and traveler's checks

D)Federal Reserve notes

A)demand and other checking deposits

B)gold certificates

C)credit cards and traveler's checks

D)Federal Reserve notes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

57

In the United States,the money supply (M1)consists of

A)paper currency and coins.

B)coins,paper currency,demand deposits,other checkable deposits,and traveler's checks.

C)paper currency,coins,demand deposits,and savings deposits.

D)government bonds,currency,demand deposits,other checkable deposits,and traveler's checks.

A)paper currency and coins.

B)coins,paper currency,demand deposits,other checkable deposits,and traveler's checks.

C)paper currency,coins,demand deposits,and savings deposits.

D)government bonds,currency,demand deposits,other checkable deposits,and traveler's checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following compose the M2 money supply?

A)currency only

B)currency,demand deposits,other checkable deposits,and traveler's checks

C)M1 plus large denomination time deposits and Eurodollar deposits

D)M1 plus savings deposits,small-denomination time deposits,and money market mutual funds (retail)

A)currency only

B)currency,demand deposits,other checkable deposits,and traveler's checks

C)M1 plus large denomination time deposits and Eurodollar deposits

D)M1 plus savings deposits,small-denomination time deposits,and money market mutual funds (retail)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

59

In defining the money supply (M1),economists exclude savings deposits on the grounds that

A)the purchasing power of savings deposits is much less stable than that of checkable deposits and currency.

B)savings deposits are a form of investment and,thus,a better store of value than money.

C)savings deposits are liabilities of commercial banks,whereas checkable deposits are assets of the banks.

D)savings deposits are not generally used as a means of payment.

A)the purchasing power of savings deposits is much less stable than that of checkable deposits and currency.

B)savings deposits are a form of investment and,thus,a better store of value than money.

C)savings deposits are liabilities of commercial banks,whereas checkable deposits are assets of the banks.

D)savings deposits are not generally used as a means of payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

60

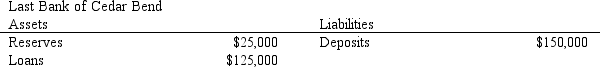

Table 13-1

Refer to Table 13-1.The reserve ratio is

A)0 percent.

B)20 percent.

C)80 percent.

D)100 percent.

Refer to Table 13-1.The reserve ratio is

A)0 percent.

B)20 percent.

C)80 percent.

D)100 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

61

Banks are considered a safer place to deposit money now than they were prior to 1933 because

A)gold reserves have increased.

B)reserve requirements are higher.

C)the creation of the FDIC reduced the likelihood of bank runs.

D)the commercial banks are no longer permitted to extend loans to the Federal Government.

A)gold reserves have increased.

B)reserve requirements are higher.

C)the creation of the FDIC reduced the likelihood of bank runs.

D)the commercial banks are no longer permitted to extend loans to the Federal Government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

62

Modern bankers

A)expand the money supply by printing currency when they need it.

B)decrease the supply of money when they extend additional loans.

C)hold only a fraction of their assets in the form of reserves against their deposits.

D)can increase their profits by increasing their holdings of excess reserves.

A)expand the money supply by printing currency when they need it.

B)decrease the supply of money when they extend additional loans.

C)hold only a fraction of their assets in the form of reserves against their deposits.

D)can increase their profits by increasing their holdings of excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

63

A system that permits banks to hold less than 100 percent of their deposits as reserves is called a

A)federal reserve system.

B)fractional reserve banking system.

C)partially funded deposit insurance system.

D)gold standard banking system.

A)federal reserve system.

B)fractional reserve banking system.

C)partially funded deposit insurance system.

D)gold standard banking system.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

64

Which of the following assets can a commercial bank count as reserves?

A)its holdings of U.S.Treasury bills

B)its vault cash and deposits with the Fed

C)its outstanding loans

D)the savings accounts of its depositors

A)its holdings of U.S.Treasury bills

B)its vault cash and deposits with the Fed

C)its outstanding loans

D)the savings accounts of its depositors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following will limit the money creation process to an amount less than the potential amount?

A)bank pursuit of profits

B)increase in currency holdings by the public

C)business demand for loans

D)increased use of credit cards

A)bank pursuit of profits

B)increase in currency holdings by the public

C)business demand for loans

D)increased use of credit cards

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

66

When a banker accepts a deposit of $1,000 in cash and puts $200 aside as required reserves and then makes a loan of $800 to a new borrower,this set of transactions

A)decreases the money supply by $1,000.

B)decreases the money supply by $200.

C)does not change the money supply.

D)increases the money supply by $200.

E)increases the money supply by $800.

A)decreases the money supply by $1,000.

B)decreases the money supply by $200.

C)does not change the money supply.

D)increases the money supply by $200.

E)increases the money supply by $800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following will be classified as a liability on the balance sheet of a commercial bank?

A)vault cash

B)loans extended to customers

C)checking deposits of customers

D)deposits held at a Federal Reserve bank

A)vault cash

B)loans extended to customers

C)checking deposits of customers

D)deposits held at a Federal Reserve bank

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

68

The legal requirement that commercial banks hold reserves equal to some fraction of their deposits

A)limits the ability of banks to expand the money supply by extending additional loans.

B)prevents the Fed from controlling the money supply since commercial banks can always offset the actions of the Fed.

C)prevents runs on banks by depositors who fear that banks have insufficient assets to meet the claims of their depositors.

D)limits the ability of the Treasury to expand the national debt.

A)limits the ability of banks to expand the money supply by extending additional loans.

B)prevents the Fed from controlling the money supply since commercial banks can always offset the actions of the Fed.

C)prevents runs on banks by depositors who fear that banks have insufficient assets to meet the claims of their depositors.

D)limits the ability of the Treasury to expand the national debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

69

A bank receives a demand deposit of $1,000.The bank loans out $600 of this deposit and increases its excess reserves by $300.What is the legal reserve requirement?

A)10 percent

B)20 percent

C)30 percent

D)60 percent

A)10 percent

B)20 percent

C)30 percent

D)60 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

70

The fraction that banks must,by law,hold as reserves against the checking deposits of their customers is called the

A)federal deposit insurance premium.

B)vault cash quota.

C)excess reserve requirement.

D)required reserve ratio.

A)federal deposit insurance premium.

B)vault cash quota.

C)excess reserve requirement.

D)required reserve ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

71

The funds that banks are required by law to hold in the form of either vault cash or deposits with the Fed are called

A)excess reserves.

B)fractional reserves.

C)required reserves.

D)certificates of deposit.

A)excess reserves.

B)fractional reserves.

C)required reserves.

D)certificates of deposit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is not a depository institution?

A)commercial bank

B)credit union

C)finance company

D)savings and loan association

A)commercial bank

B)credit union

C)finance company

D)savings and loan association

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

73

If the banking system has $50 billion in excess reserves,and the required reserve ratio is 25 percent,what is the maximum amount by which the money supply can be increased?

A)$250 billion

B)$200 billion

C)$50 billion

D)$25 billion

A)$250 billion

B)$200 billion

C)$50 billion

D)$25 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

74

When a customer deposits $100 into a checking account,the effect is to

A)increase the bank's liabilities.

B)decrease the bank's liabilities.

C)increase the bank's assets.

D)decrease the bank's assets.

E)increase both the bank's liabilities and its assets.

A)increase the bank's liabilities.

B)decrease the bank's liabilities.

C)increase the bank's assets.

D)decrease the bank's assets.

E)increase both the bank's liabilities and its assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following guarantees the deposits in almost all banks up to a $250,000 limit per account?

A)the Federal Reserve

B)the FDIC

C)the U.S.Treasury

D)Bank of America Corporation

A)the Federal Reserve

B)the FDIC

C)the U.S.Treasury

D)Bank of America Corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following would appear on the liability side of the balance sheet of a commercial bank?

A)demand and other transaction deposits

B)loans outstanding

C)U.S.government securities

D)vault cash

A)demand and other transaction deposits

B)loans outstanding

C)U.S.government securities

D)vault cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

77

When commercial banks extend loans,they are able to expand the supply of money in the United States because the U.S.has

A)a fiat supply of money.

B)money that is backed by gold.

C)a fractional reserve banking system.

D)a system of federal deposit insurance.

A)a fiat supply of money.

B)money that is backed by gold.

C)a fractional reserve banking system.

D)a system of federal deposit insurance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

78

If a customer deposits $1,000 cash into her checking account,the bank's

A)assets rise by $1,000 and liabilities fall by $1,000.

B)assets fall by $1,000 and liabilities rise by $1,000.

C)assets and liabilities both fall by $1,000.

D)assets and liabilities both rise by $1,000.

E)profits rise by $1,000.

A)assets rise by $1,000 and liabilities fall by $1,000.

B)assets fall by $1,000 and liabilities rise by $1,000.

C)assets and liabilities both fall by $1,000.

D)assets and liabilities both rise by $1,000.

E)profits rise by $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

79

The primary source of earnings of commercial banks is income derived from

A)the checking account services provided to customers.

B)the use of deposits to extend loans and undertake investments.

C)vault cash and deposits held with the Fed.

D)services provided to the U.S.Treasury.

A)the checking account services provided to customers.

B)the use of deposits to extend loans and undertake investments.

C)vault cash and deposits held with the Fed.

D)services provided to the U.S.Treasury.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is true?

A)The FDIC sets the reserve requirements for commercial banks.

B)The Federal Reserve System guarantees the deposits in almost all banks up to a $250,000 limit per account.

C)Since the Federal Reserve System was established in 1913,bank failures due to panic withdrawals have been virtually eliminated.

D)If a bank should fail,the FDIC guarantees that depositors can get their funds up to a $250,000 limit per account.

A)The FDIC sets the reserve requirements for commercial banks.

B)The Federal Reserve System guarantees the deposits in almost all banks up to a $250,000 limit per account.

C)Since the Federal Reserve System was established in 1913,bank failures due to panic withdrawals have been virtually eliminated.

D)If a bank should fail,the FDIC guarantees that depositors can get their funds up to a $250,000 limit per account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 260 في هذه المجموعة.

فتح الحزمة

k this deck