Deck 17: Bond Yields

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/34

العب

ملء الشاشة (f)

Deck 17: Bond Yields

1

What is the difference between the yield-to-maturity (YTM)and the realized compound yield (RCY)?

A)They are actually the same concept.

B)The YTM is the actual return,whereas,the RCY is the expected return at the beginning of the investment.

C)The RCY is the actual return,whereas,the YTM is the expected return at the beginning of the investment.

D)The YTM considers only coupon payments,whereas,the RCY includes all the bond's cash flows.

A)They are actually the same concept.

B)The YTM is the actual return,whereas,the RCY is the expected return at the beginning of the investment.

C)The RCY is the actual return,whereas,the YTM is the expected return at the beginning of the investment.

D)The YTM considers only coupon payments,whereas,the RCY includes all the bond's cash flows.

C

2

Relative to a decrease in interest rates,an increase in interest rates of the same size will produce:

A)a larger percentage change in a bond's price.

B)a smaller percentage change in a bond's price.

C)the same sized change in a bond's price.

D)no change in the bond's price since its coupon rate is fixed.

A)a larger percentage change in a bond's price.

B)a smaller percentage change in a bond's price.

C)the same sized change in a bond's price.

D)no change in the bond's price since its coupon rate is fixed.

B

3

An investor has three sources of dollar returns from a bond investment.Which of the following is not included among the three sources?

A)The semi-annual coupon payments

B)The interest earned on reinvesting the coupon payments

C)The principal paid at maturity

D)The interest earned on reinvesting the last coupon and the principal

A)The semi-annual coupon payments

B)The interest earned on reinvesting the coupon payments

C)The principal paid at maturity

D)The interest earned on reinvesting the last coupon and the principal

D

4

What is meant by "yield to maturity"?It is measured as the:

A)coupon payment divided by the face value of the bond.

B)coupon payment divided by the current price of the bond.

C)rate that equates the bond's current price with the PV of its expected future cash flows.

D)rate that equates the bond's face value with the PV of its expected future cash flows.

A)coupon payment divided by the face value of the bond.

B)coupon payment divided by the current price of the bond.

C)rate that equates the bond's current price with the PV of its expected future cash flows.

D)rate that equates the bond's face value with the PV of its expected future cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following bonds will be most sensitive to changes in market interest rates?

A)A bond with an 8 percent semiannual coupon and 8 years to maturity

B)A bond with a 6 percent semiannual coupon and 8 years to maturity

C)A bond with an 8 percent semiannual coupon and 6 years to maturity

D)A bond with a 6 percent semiannual coupon and 6 years to maturity

A)A bond with an 8 percent semiannual coupon and 8 years to maturity

B)A bond with a 6 percent semiannual coupon and 8 years to maturity

C)A bond with an 8 percent semiannual coupon and 6 years to maturity

D)A bond with a 6 percent semiannual coupon and 6 years to maturity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

6

Six years ago,Carl purchased an 8% coupon bond that had 10 years to maturity for $1,150.Since the bond purchase,the required return on the bond has remained constant.If Carl sells the bond now,the price he receives for the bond will be:

A)$1,150.

B)between $1,000 and $1,150.

C)higher than $1,150.

D)less than $1,000.

A)$1,150.

B)between $1,000 and $1,150.

C)higher than $1,150.

D)less than $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

7

The yield-to-maturity calculation assumes that coupon payments are reinvested at the:

A)coupon rate on the bond.

B)bond's current yield.

C)bond's yield to maturity.

D)forward interest rate.

A)coupon rate on the bond.

B)bond's current yield.

C)bond's yield to maturity.

D)forward interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

8

Assume an investor is considering purchasing an 8 percent semiannual bond with 8 years remaining to maturity when market rates are 6%.The bond's value is closest to:

A)$502.

B)$798.

C)$1,000.

D)$1,126.

A)$502.

B)$798.

C)$1,000.

D)$1,126.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

9

What is meant by the real risk-free rate of interest?It is the:

A)opportunity cost of foregoing consumption.

B)rate actually used in the market,not in textbooks.

C)rate quoted on long-term Treasury bonds.

D)the nominal risk-free interest rate,multiplied by 1 minus the marginal tax rate.

A)opportunity cost of foregoing consumption.

B)rate actually used in the market,not in textbooks.

C)rate quoted on long-term Treasury bonds.

D)the nominal risk-free interest rate,multiplied by 1 minus the marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following statements is most accurate? The real risk-free rate of interest is the:

A)rate quoted for the shortest term federal government securities.

B)rate quoted for the longest term federal government securities.

C)the rate on federal government securities adjusted to remove the effects of inflation.

D)the rate on federal government securities adjusted to remove the effects of taxes.

A)rate quoted for the shortest term federal government securities.

B)rate quoted for the longest term federal government securities.

C)the rate on federal government securities adjusted to remove the effects of inflation.

D)the rate on federal government securities adjusted to remove the effects of taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

11

Relative to interest rates,bond prices have:

A)an inverse and linear relationship.

B)a direct and linear relationship.

C)an inverse and convex relationship.

D)an inverse and concave relationship.

A)an inverse and linear relationship.

B)a direct and linear relationship.

C)an inverse and convex relationship.

D)an inverse and concave relationship.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

12

If a bond has a coupon rate that is greater than the bond's YTM,the bond:

A)will sell at a premium.

B)will sell at par.

C)will sell at a discount.

D)will not be called.

A)will sell at a premium.

B)will sell at par.

C)will sell at a discount.

D)will not be called.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is included in the "realized compound yield"?

A)The bond coupon payments,only.

B)The bond coupon and principal payments,only.

C)The bond principal payment,only.

D)The bond coupon and principal payments and the reinvestment income.

A)The bond coupon payments,only.

B)The bond coupon and principal payments,only.

C)The bond principal payment,only.

D)The bond coupon and principal payments and the reinvestment income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

14

In finding a bond's value,the rate used to discount the bond's future cash flows is:

A)the bond's required rate of return.

B)the firm's weighted average cost of capital.

C)the firm's after-tax cost of debt.

D)the bond's coupon rate

A)the bond's required rate of return.

B)the firm's weighted average cost of capital.

C)the firm's after-tax cost of debt.

D)the bond's coupon rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

15

Sam holds a $1 million bond portfolio with an average maturity of 9 years,whereas Walt holds a $1 million bond portfolio with an average maturity of 3 years.If interest rates increase substantially,Sam's portfolio will experience the:

A)larger decline in value of the two portfolios.

B)larger increase in value of the two portfolios.

C)smaller decline in value of the two portfolios.

D)smaller increase in value of the two portfolios.

A)larger decline in value of the two portfolios.

B)larger increase in value of the two portfolios.

C)smaller decline in value of the two portfolios.

D)smaller increase in value of the two portfolios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

16

To achieve the maximum price impact from an estimated interest rate decrease,a bond buyer should purchase bonds with relatively:

A)high coupon rates and long maturities.

B)high coupon rates and short maturities.

C)low coupon rates and long maturities.

D)low coupon rates and short maturities.

A)high coupon rates and long maturities.

B)high coupon rates and short maturities.

C)low coupon rates and long maturities.

D)low coupon rates and short maturities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

17

Assume an investor buys an 8 percent,semi-annual,10-year bond at par.He sells it two years later after market interest rates have decreased to 6 percent.The investor's capital gain is closest to:

A)$41.

B)$124.

C)$126.

D)$149.

A)$41.

B)$124.

C)$126.

D)$149.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is a situation in which an investor will not receive the promised yield to maturity?

A)The investor holds the bond until maturity and reinvests coupon payments at the original yield to maturity.

B)Interest rates do not change during the life of the bond.

C)The issuer calls the bond prior to original maturity.

D)The realized compound yield equals the promised yield to maturity.

A)The investor holds the bond until maturity and reinvests coupon payments at the original yield to maturity.

B)Interest rates do not change during the life of the bond.

C)The issuer calls the bond prior to original maturity.

D)The realized compound yield equals the promised yield to maturity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

19

What happens to the price of bonds if interest rates go up?

A)The price of bonds goes up.

B)The price of bonds stays the same.

C)The price of bonds goes down.

D)The direction of price change depends on the shape of the yield curve.

A)The price of bonds goes up.

B)The price of bonds stays the same.

C)The price of bonds goes down.

D)The direction of price change depends on the shape of the yield curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

20

Based on which of the following term structure theories are forward rates most useful?

A)Expectations theory

B)Liquidity preference theory

C)Preferred habitat theory

D)Market segmentation theory

A)Expectations theory

B)Liquidity preference theory

C)Preferred habitat theory

D)Market segmentation theory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

21

Yield spreads vary inversely with the: ______________________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

22

If interest rates rise,then price risk and reinvestment risk decline.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

23

Assume a bond has a YTM of 8% and its YTM increases by 2 basis points.What is the new YTM on the bond?

A)8.002%

B)8.020%

C)8.200%

D)10.000%

A)8.002%

B)8.020%

C)8.200%

D)10.000%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

24

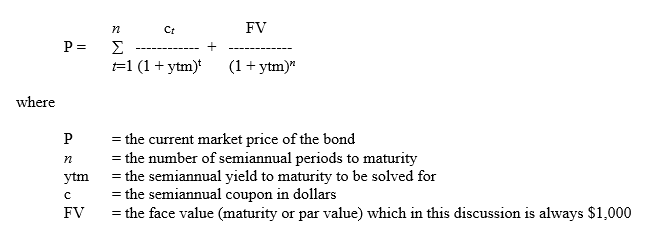

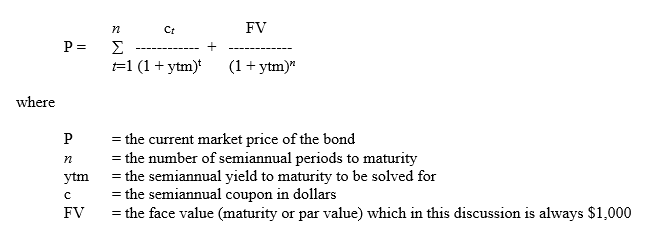

Correct bond calculations in the United States usually involve semiannual periods because bond interest is typically paid twice a year.

What does this formula imply about the term structure of interest rates?How would real-world bond investors price bonds to correct for this?

What does this formula imply about the term structure of interest rates?How would real-world bond investors price bonds to correct for this?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

25

Risk premiums,or yield spreads,refer to the issue characteristics of bonds.They are the result of which 7 factors:1)______ 2)______3)______4)______5)______6)_____7)_____

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

26

A financial crisis or an accounting scandal can just as easily cause yield spreads to widen as weak earnings at a company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

27

As interest rates increase,long bonds will decrease in price more slowly than shorter bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

28

If the yield curve has a steep upward slope,investors expect:

A)interest rates to increase and inflation rates to decrease.

B)interest rates to decrease and inflation rates to increase.

C)interest rates to increase and inflation rates to increase.

D)interest rates to decrease and inflation rates to decrease.

A)interest rates to increase and inflation rates to decrease.

B)interest rates to decrease and inflation rates to increase.

C)interest rates to increase and inflation rates to increase.

D)interest rates to decrease and inflation rates to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

29

The three most prominent theories proposed to explain the term structure of interest rates are: __________________,__________________,and __________________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

30

Bond traders use the term "basis point" to mean one percentage point in interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

31

The term structure of interest rates denotes the relationship between _____________ and _________________ for a specific category of bonds at a particular point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

32

Reinvestment risk represents the possibility that future payments cannot be reinvested at the assumed rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

33

Both stocks and bonds are valued by summing the discounted future flows of interest (or dividends)and the repayment of principal (or sale of the stock).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck

34

The vast majority of corporate bonds pay floating rates on a quarterly basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 34 في هذه المجموعة.

فتح الحزمة

k this deck