Deck 1: The Demand for Audit and Other Assurance Services

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 1: The Demand for Audit and Other Assurance Services

1

The auditor and the entities should agree on the criteria to be used in the audit

A) before the audit starts.

B) after the audit planning has been done.

C) as they progress with the audit, as they can determine which criteria are most suitable.

D) at the end of the audit.

A) before the audit starts.

B) after the audit planning has been done.

C) as they progress with the audit, as they can determine which criteria are most suitable.

D) at the end of the audit.

A

2

Because an external auditor is paid a fee by a client company, he or she

A) is absolutely independent and may conduct an audit.

B) may be sufficiently independent to conduct an audit.

C) is never considered to be independent.

D) must receive approval from the relevant provincial securities commission before conducting an audit.

A) is absolutely independent and may conduct an audit.

B) may be sufficiently independent to conduct an audit.

C) is never considered to be independent.

D) must receive approval from the relevant provincial securities commission before conducting an audit.

B

3

Which of the following illustrates the definition of auditing with respect to the reporting process?

A) accumulation and evaluation of evidence about balance sheet accounts

B) reporting on the degree of correspondence between financial statements and ASPE

C) writing an operational audit report that is tailored to the client's situation

D) making sure that the auditor is competent and understands evidence gathering

A) accumulation and evaluation of evidence about balance sheet accounts

B) reporting on the degree of correspondence between financial statements and ASPE

C) writing an operational audit report that is tailored to the client's situation

D) making sure that the auditor is competent and understands evidence gathering

B

4

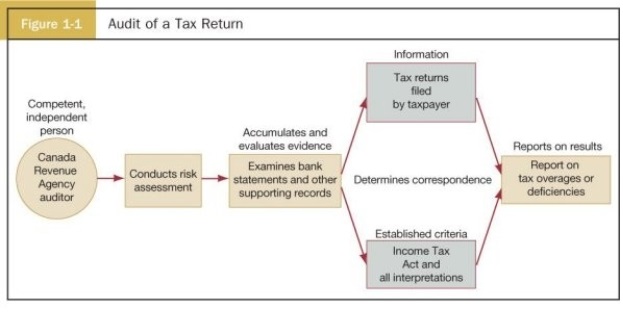

Use your knowledge of the definition of auditing and Figure 1-1: Audit of a Tax Return to explain how an auditor would conduct a privacy audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

Joe is recording sales transactions in the accounting system so that they can be summarized in a logical manner for the purpose of providing financial information for decision-making. Joe is performing

A) accounting.

B) auditing.

C) review.

D) management consulting.

A) accounting.

B) auditing.

C) review.

D) management consulting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

The need to implement philosophies and practices commonly referred to as "improved business practices" comes from

A) increased competition resulting in public accounting firms being concerned about keeping clients and maintaining a reasonable profit.

B) a CAS pronouncement.

C) a GAAP pronouncement.

D) a need to increase profitability on assurance type mandates.

A) increased competition resulting in public accounting firms being concerned about keeping clients and maintaining a reasonable profit.

B) a CAS pronouncement.

C) a GAAP pronouncement.

D) a need to increase profitability on assurance type mandates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the audit of a corporate tax return, the report provided by the Canada Revenue Agency auditor would describe

A) an opinion on the likelihood of tax return error.

B) the likely accounting errors that could contribute to tax errors.

C) management issues with respect to accurately reporting taxes.

D) corporate income tax overages or income tax underpayments.

A) an opinion on the likelihood of tax return error.

B) the likely accounting errors that could contribute to tax errors.

C) management issues with respect to accurately reporting taxes.

D) corporate income tax overages or income tax underpayments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

In the audit of an individual's tax return, the auditor should demonstrate competence in the use of

A) external databases that contain economic statistics.

B) standard personal and corporate tax preparation software.

C) the Income Tax Act and accompanying regulations.

D) database management software for the use of client based research.

A) external databases that contain economic statistics.

B) standard personal and corporate tax preparation software.

C) the Income Tax Act and accompanying regulations.

D) database management software for the use of client based research.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

George had a conversation with the accounting personnel and documented information about how the accounting systems function. He has also placed copies of accounting forms in his files. George is performing which task?

A) accounting procedures

B) evidence gathering

C) tax audit

D) audit report preparation

A) accounting procedures

B) evidence gathering

C) tax audit

D) audit report preparation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

Auditing should be done by a qualified

A) chartered accountant.

B) certified management accountant.

C) competent and independent person.

D) professional accountant.

A) chartered accountant.

B) certified management accountant.

C) competent and independent person.

D) professional accountant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is an example of accounting rather than auditing?

A) gathering evidence about the quality of accounts receivable

B) entering sales transactions into the sales order system

C) reviewing sales invoices to see if they have been calculated correctly

D) comparing bank deposit documents to the recorded cash received

A) gathering evidence about the quality of accounts receivable

B) entering sales transactions into the sales order system

C) reviewing sales invoices to see if they have been calculated correctly

D) comparing bank deposit documents to the recorded cash received

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following illustrates the definition of auditing with respect to the evidence analysis process?

A) accumulation and evaluation of evidence about balance sheet accounts

B) learning about different types of computing technology, such as mainframes

C) writing an operational audit report that is tailored to the client's situation

D) making sure that the auditor is competent and understands evidence gathering

A) accumulation and evaluation of evidence about balance sheet accounts

B) learning about different types of computing technology, such as mainframes

C) writing an operational audit report that is tailored to the client's situation

D) making sure that the auditor is competent and understands evidence gathering

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

In the audit of historical financial statements by PA firms, the criteria used are

A) generally accepted auditing standards.

B) generally accepted accounting principles.

C) regulations of the Canada Revenue Agency.

D) regulations of the provincial securities commissions.

A) generally accepted auditing standards.

B) generally accepted accounting principles.

C) regulations of the Canada Revenue Agency.

D) regulations of the provincial securities commissions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

The independent auditor's report is the

A) communication of the result of the audit to the users.

B) set of audited financial statements.

C) invoice of the auditor detailing the work they have performed.

D) report presented to management about the possible improvements.

A) communication of the result of the audit to the users.

B) set of audited financial statements.

C) invoice of the auditor detailing the work they have performed.

D) report presented to management about the possible improvements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

In the audit of an individual's tax return, the criteria used would be

A) an accounting framework.

B) the Income Tax Act.

C) the client's policies for taxable income.

D) the auditor's judgment.

A) an accounting framework.

B) the Income Tax Act.

C) the client's policies for taxable income.

D) the auditor's judgment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

In auditing accounting data, the concern is with

A) determining whether recorded information properly reflects the economic events that occurred during the accounting period.

B) determining if fraud has occurred.

C) determining if taxable income has been calculated correctly.

D) analyzing the financial information to be sure that it complies with government requirements.

A) determining whether recorded information properly reflects the economic events that occurred during the accounting period.

B) determining if fraud has occurred.

C) determining if taxable income has been calculated correctly.

D) analyzing the financial information to be sure that it complies with government requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

One of the reasons that an auditor must be competent is so that they can

A) select the type and amount of evidence to accumulate.

B) explain to staff how the bookkeeping should be done.

C) record the transactions properly for the underlying records.

D) capture the information properly in the computer files.

A) select the type and amount of evidence to accumulate.

B) explain to staff how the bookkeeping should be done.

C) record the transactions properly for the underlying records.

D) capture the information properly in the computer files.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

One of the reasons that an auditor must be competent is so that they can

A) understand the engagement risks and the criteria used by the client.

B) explain to staff how the bookkeeping should be done.

C) record the transactions properly for the underlying records.

D) capture the information properly in the computer files.

A) understand the engagement risks and the criteria used by the client.

B) explain to staff how the bookkeeping should be done.

C) record the transactions properly for the underlying records.

D) capture the information properly in the computer files.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

A large PA firm has assessed evidence collected during an engagement. Criteria used to assess the financial statements were International Financial Reporting Standards (IFRS). A high level of assurance was obtained. The type of engagement conducted was

A) an audit.

B) a review.

C) management consulting.

D) a compilation.

A) an audit.

B) a review.

C) management consulting.

D) a compilation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

It is important for the auditor to be independent because

A) otherwise the auditor would not charge a fair rate to the client.

B) otherwise the auditor might not be as knowledgeable of the subject matter and the criteria.

C) this will prevent bias in accumulating and evaluating evidence.

D) the Canadian tax authorities require that the auditor be independent.

A) otherwise the auditor would not charge a fair rate to the client.

B) otherwise the auditor might not be as knowledgeable of the subject matter and the criteria.

C) this will prevent bias in accumulating and evaluating evidence.

D) the Canadian tax authorities require that the auditor be independent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

Discuss the differences and similarities between the roles of accountants and auditors. What additional expertise must an auditor possess beyond that of an accountant?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is an example of auditing rather than accounting?

A) recording purchase amounts in the expense accounts

B) posting the daily sales totals to the general ledger

C) recording cash received in the customer account files

D) evaluating whether accounts receivable are collectible

A) recording purchase amounts in the expense accounts

B) posting the daily sales totals to the general ledger

C) recording cash received in the customer account files

D) evaluating whether accounts receivable are collectible

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

An accountant records information. When conducting an audit, the auditor must possess

A) an ability to interpret generally accepted accounting frameworks.

B) an education beyond the bachelor's degree.

C) an ability to classify transactions by type.

D) an ability to organize and summarize economic events.

A) an ability to interpret generally accepted accounting frameworks.

B) an education beyond the bachelor's degree.

C) an ability to classify transactions by type.

D) an ability to organize and summarize economic events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

As part of its loan agreement, Big Bank requires that only accounts receivable less than 60 days old be used as collateral. An auditor has been engaged to provide assurance that the accounts receivable on the list provided to the bank are indeed less than 60 days old. What type of engagement is the auditor conducting?

A) financial statement

B) compliance

C) operational

D) review

A) financial statement

B) compliance

C) operational

D) review

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

Blader Ng. Inc. has recently placed new air-cleaning systems in their smokestacks to meet air quality regulations. An auditing firm has been engaged to assess air quality and compare results to legislated requirements. What type of audit or engagement is the auditor conducting?

A) financial statement

B) compliance

C) operational

D) review

A) financial statement

B) compliance

C) operational

D) review

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

What is the primary difference between internal and external auditors?

A) the methodology used to conduct financial statement audits

B) the level of competence required

C) the parties to whom the auditor is responsible

D) the level of objectivity required

A) the methodology used to conduct financial statement audits

B) the level of competence required

C) the parties to whom the auditor is responsible

D) the level of objectivity required

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

What is the nature of the service provided when a auditor evaluates information using suitable criteria and issues a report that attests to the reliability of the information?

A) internal audit engagement

B) review engagement

C) compilation engagement

D) attestation engagement

A) internal audit engagement

B) review engagement

C) compilation engagement

D) attestation engagement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is most difficult to evaluate objectively?

A) efficiency and effectiveness of operations

B) compliance with government regulations

C) presentation of financial statements in accordance with a generally accepted accounting framework

D) internal controls in use at a small company

A) efficiency and effectiveness of operations

B) compliance with government regulations

C) presentation of financial statements in accordance with a generally accepted accounting framework

D) internal controls in use at a small company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following terms best describes the increased likelihood that unreliable information will be provided to decision makers?

A) audit risk

B) information risk

C) inherent risk

D) business risk

A) audit risk

B) information risk

C) inherent risk

D) business risk

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

A typical objective of an operational audit is for the auditor to

A) determine whether the financial statements fairly present the entity's operations.

B) evaluate the feasibility of attaining the entity's operational objectives.

C) evaluate the effectiveness of an internal process.

D) report on the entity's relative success in attaining profit maximization.

A) determine whether the financial statements fairly present the entity's operations.

B) evaluate the feasibility of attaining the entity's operational objectives.

C) evaluate the effectiveness of an internal process.

D) report on the entity's relative success in attaining profit maximization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

What is the most appropriate method for an organization to lower information risk related to its financial statements?

A) Have good bookkeeping work completed on the accounts.

B) Use a high quality software package keep track of information.

C) Have an independent financial statement audit conducted.

D) Have an independent operational audit conducted on effectiveness.

A) Have good bookkeeping work completed on the accounts.

B) Use a high quality software package keep track of information.

C) Have an independent financial statement audit conducted.

D) Have an independent operational audit conducted on effectiveness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following audits can be regarded as being solely "compliance" audits?

A) Canada Revenue Agency's examinations of the returns of taxpayers

B) the Auditor General's evaluation of the computer operations of governmental units

C) an internal auditor's review of his employer's payroll authorization procedures

D) a public accounting firm's audit of the local school district

A) Canada Revenue Agency's examinations of the returns of taxpayers

B) the Auditor General's evaluation of the computer operations of governmental units

C) an internal auditor's review of his employer's payroll authorization procedures

D) a public accounting firm's audit of the local school district

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

Frederic is an account manager at a large Canadian bank. Frederic has to decide if the bank will make a loan to Frost Corp, a snow removal company. Further, Frederic has to decide how much they will lend to Frost and at what rate.

Assuming that Frederic makes the loan, what factors will he use to decide the rate of interest? What factors are impacted by auditing and how?

Assuming that Frederic makes the loan, what factors will he use to decide the rate of interest? What factors are impacted by auditing and how?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following organizations establishes ethical standards and standards for the practice of Internal Auditing?

A) Information Systems Audit and Control Association (ISACA)

B) Institute of Internal Auditors (IIA)

C) Society of Management Accountants of Canada (SMAC)

D) Canadian Institute of Chartered Accountants (CICA)

A) Information Systems Audit and Control Association (ISACA)

B) Institute of Internal Auditors (IIA)

C) Society of Management Accountants of Canada (SMAC)

D) Canadian Institute of Chartered Accountants (CICA)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following is an example of a financial statement audit?

A) determining whether ABC's financial statements overall do not violate any debt covenants

B) determining whether ABC's overall financial statements are stated in conformity with IFRS

C) evaluating the effectiveness and efficiency of internal controls used to create account balance

D) evaluating the effectiveness and efficiency of internal controls used to record transactions

A) determining whether ABC's financial statements overall do not violate any debt covenants

B) determining whether ABC's overall financial statements are stated in conformity with IFRS

C) evaluating the effectiveness and efficiency of internal controls used to create account balance

D) evaluating the effectiveness and efficiency of internal controls used to record transactions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

How does a financial statement audit affect a bank manager's decisions in providing loans to a corporate client?

A) Information risk could be reduced, so the bank manager may lower the interest rate charged.

B) The bank manager will lower the risk-free interest rate that applies to the corporation.

C) The business risk for the client will be reduced, so the borrowing costs will decline.

D) The business risk for the client will be increased, so the borrowing costs will be lowered.

A) Information risk could be reduced, so the bank manager may lower the interest rate charged.

B) The bank manager will lower the risk-free interest rate that applies to the corporation.

C) The business risk for the client will be reduced, so the borrowing costs will decline.

D) The business risk for the client will be increased, so the borrowing costs will be lowered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

Who is responsible for developing financial statement audit and assurance standards in Canada?

A) AASB (Auditing and Assurance Standards Board)

B) standards staff at the CICA (Canadian Institute of Chartered Accountants)

C) national accounting bodies such as CGA Canada

D) the accounting firms who conduct financial statement audits

A) AASB (Auditing and Assurance Standards Board)

B) standards staff at the CICA (Canadian Institute of Chartered Accountants)

C) national accounting bodies such as CGA Canada

D) the accounting firms who conduct financial statement audits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

Auditors General are responsible for auditing which types of organizations?

A) public companies with shares issued to investors

B) private companies that have loans outstanding to banks or other creditors

C) ministries, departments, agencies, and crown corporations

D) any organization that submits tax returns to the tax authorities

A) public companies with shares issued to investors

B) private companies that have loans outstanding to banks or other creditors

C) ministries, departments, agencies, and crown corporations

D) any organization that submits tax returns to the tax authorities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not a cause of information risk?

A) simple exchange transactions

B) voluminous data

C) remoteness of information

D) biases and motives of the provider

A) simple exchange transactions

B) voluminous data

C) remoteness of information

D) biases and motives of the provider

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

A review of any part of an organization's procedures and methods for the purpose of evaluating efficiency and effectiveness is classified as a(n)

A) audit of financial statements.

B) compliance audit.

C) operational audit.

D) production audit.

A) audit of financial statements.

B) compliance audit.

C) operational audit.

D) production audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

When do individuals and organizations typically need assurance services?

A) usually only when organizations obtain debt or other loans

B) for five years from the start of an organization until debt is retired

C) only when historical data, such as financial information, needs to be audited

D) on an ongoing basis, as demand for forward-looking information increases

A) usually only when organizations obtain debt or other loans

B) for five years from the start of an organization until debt is retired

C) only when historical data, such as financial information, needs to be audited

D) on an ongoing basis, as demand for forward-looking information increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

To do an audit, it is necessary to have information in a verifiable form and some criteria by which the auditor can evaluate the information.

Required:

A) What information and criteria would a public accounting firm use when auditing a company's financial statements?

B) What information and criteria would a Canada Revenue Agency auditor use when auditing that same company's tax return?

C) What information and criteria would an internal auditor use when performing an operational audit to evaluate whether the company's computerized payroll processing system is operating efficiently and effectively?

Required:

A) What information and criteria would a public accounting firm use when auditing a company's financial statements?

B) What information and criteria would a Canada Revenue Agency auditor use when auditing that same company's tax return?

C) What information and criteria would an internal auditor use when performing an operational audit to evaluate whether the company's computerized payroll processing system is operating efficiently and effectively?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

What type of information is available from www.sedar.com (System for Electronic Document Analysis and Retrieval)?

A) minutes of shareholders and directors meetings

B) transaction reports from major credit card companies

C) annual reports and management discussion and analysis

D) listings of all of the shareholders on record

A) minutes of shareholders and directors meetings

B) transaction reports from major credit card companies

C) annual reports and management discussion and analysis

D) listings of all of the shareholders on record

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following is an advantage of a review engagement as compared to an audit engagement?

A) For the review engagement, information risk is reduced more than for an audit.

B) For the review engagement, the documentation to be provided by the client is greater.

C) For the review engagement, the financial statements assessed will have more detail.

D) The review engagement requires considerably less work, so is less costly.

A) For the review engagement, information risk is reduced more than for an audit.

B) For the review engagement, the documentation to be provided by the client is greater.

C) For the review engagement, the financial statements assessed will have more detail.

D) The review engagement requires considerably less work, so is less costly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

What impact is the presence of factors such as real-time information (such as via the Internet) expected to have upon the demand for assurance services?

A) Demand is expected to decline due to the lack of adequate resources.

B) Demand is expected to grow due to the increase in large corporations.

C) Demand is expected to grow due to the need for forward-looking information.

D) Demand is expected to decline as small businesses use the Internet more.

A) Demand is expected to decline due to the lack of adequate resources.

B) Demand is expected to grow due to the increase in large corporations.

C) Demand is expected to grow due to the need for forward-looking information.

D) Demand is expected to decline as small businesses use the Internet more.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

The extent and the scope of the audits conducted by Auditors General are determined by

A) legislation in the Auditor General's jurisdiction.

B) audit partner planning and audit program development.

C) the Auditor General and his/her staff.

D) the financial statement auditors of the client.

A) legislation in the Auditor General's jurisdiction.

B) audit partner planning and audit program development.

C) the Auditor General and his/her staff.

D) the financial statement auditors of the client.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

Jordan set up a nonprofit corporation several years ago to provide scholarships to disadvantaged youth in his community. Scholarships Get Up and Go Foundation now has assets of over $5 million and provides about ten university scholarships every year. Jordan is proud of the new doctors, dentists, and other healthcare practitioners that his foundation has funded.

Jordan is thinking of starting another foundation in an old building that he has purchased. It would be a youth drop-in centre offering music lessons, art facilities, and gym facilities, and would have links to local highschools to offer homework clubs to encourage good grades.

Required:

A) Why should Jordan have the financial statements of both of these foundations audited?

B) Who would be the users of the financial statements of the foundations?

C) What other types of services could PAs provide to Jordan and the foundations?

Jordan is thinking of starting another foundation in an old building that he has purchased. It would be a youth drop-in centre offering music lessons, art facilities, and gym facilities, and would have links to local highschools to offer homework clubs to encourage good grades.

Required:

A) Why should Jordan have the financial statements of both of these foundations audited?

B) Who would be the users of the financial statements of the foundations?

C) What other types of services could PAs provide to Jordan and the foundations?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

We discuss four types of auditors: public accountants, government auditors, Canada Revenue Agency auditors, and internal auditors. Briefly describe the work and responsibilities of each type of auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following services provides a moderate level of assurance about the client's financial statements?

A) forecasts and projections

B) compliance

C) review

D) audit

A) forecasts and projections

B) compliance

C) review

D) audit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

The No-Name Agency conducts an independent service for a company to determine if its suppliers have complied with health and safety regulations, child labour guidelines, and other employee welfare issues. What type of service is No-Name providing?

A) assurance

B) attest

C) review

D) compilation

A) assurance

B) attest

C) review

D) compilation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

A reason for a nonprofit organization to be audited is to

A) comply with the laws requiring them to be audited.

B) meet requirements of lenders or funding sources.

C) have a professional accountant perform their bookkeeping.

D) ensure that their financial statements do not contain errors.

A) comply with the laws requiring them to be audited.

B) meet requirements of lenders or funding sources.

C) have a professional accountant perform their bookkeeping.

D) ensure that their financial statements do not contain errors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

Mega Manufacturing Company (Mega) is thinking about acquiring Localized Small Producer Inc. (LSP), a small manufacturing company that produces related products. Mega has examined the financial statements of LSP, which show only a small profit in the last five years. Management of LSP has taken reasonable salaries, and cost of goods sold is higher than the industry average for LSP. Mega believes that it will be able to introduce operational efficiencies at LSP, improving the profitability of the small company, if acquired.

Required:

A) What type of engagement should be conducted to assess the operational efficiencies of LSP? Justify your response.

B) Who should be engaged to conduct the engagement?

C) What major problems might the auditors encounter when conducting the audit and writing the report?

Required:

A) What type of engagement should be conducted to assess the operational efficiencies of LSP? Justify your response.

B) Who should be engaged to conduct the engagement?

C) What major problems might the auditors encounter when conducting the audit and writing the report?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

A major type of assurance service performed by large public accounting firms is

A) auditing.

B) reviewing.

C) compilation.

D) management consulting.

A) auditing.

B) reviewing.

C) compilation.

D) management consulting.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

The reasoning behind the requirements of the Sarbanes Oxley Act's section 404 (attestation on internal control over financial reporting) is that

A) effective controls result in greater profits to organizations, reducing business failures.

B) effective controls reduce the likelihood of future misstatements in the financial statements.

C) better internal controls can be implemented at lower cost, improving product quality.

D) automated controls improve customer service, resulting in higher product sales.

A) effective controls result in greater profits to organizations, reducing business failures.

B) effective controls reduce the likelihood of future misstatements in the financial statements.

C) better internal controls can be implemented at lower cost, improving product quality.

D) automated controls improve customer service, resulting in higher product sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

A shareholder of a public Canadian firm can have access to the audited financial statements

A) on the Internet.

B) by calling the accounting department of the company.

C) by requesting a copy from the auditors.

D) if he/she holds more than 1% of the shares of the company.

A) on the Internet.

B) by calling the accounting department of the company.

C) by requesting a copy from the auditors.

D) if he/she holds more than 1% of the shares of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

The internal audit group typically reports directly to the

A) board of directors.

B) management of the company.

C) external auditor.

D) audit committee.

A) board of directors.

B) management of the company.

C) external auditor.

D) audit committee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

To operate effectively, an internal auditor must be independent of the

A) line functions of the organization.

B) entity that is being audited.

C) employer-employee relationship that exists for other employees in the organization.

D) outsourcing organizations used.

A) line functions of the organization.

B) entity that is being audited.

C) employer-employee relationship that exists for other employees in the organization.

D) outsourcing organizations used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

In Canada, publicly traded companies are

A) required to have audits.

B) strongly encouraged to have audits.

C) not required to have an audit if they have a review.

D) not required to have an audit.

A) required to have audits.

B) strongly encouraged to have audits.

C) not required to have an audit if they have a review.

D) not required to have an audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is an example of an attestation engagement?

A) accounting and bookkeeping services for the accounts

B) an audit of internal controls over financial reporting

C) preparation of the annual financial statements with notes

D) completion of provincial and federal tax returns

A) accounting and bookkeeping services for the accounts

B) an audit of internal controls over financial reporting

C) preparation of the annual financial statements with notes

D) completion of provincial and federal tax returns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

The Sarbanes-Oxley Act requires the auditor to attest to the

A) accuracy of the financial statements.

B) efficiency of the internal controls in financial reporting.

C) effectiveness of internal controls.

D) compliance of the company with the generally accepted accounting framework.

A) accuracy of the financial statements.

B) efficiency of the internal controls in financial reporting.

C) effectiveness of internal controls.

D) compliance of the company with the generally accepted accounting framework.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following services results in assurance that the company's e-commerce activities on its website comply with Trust Services principles?

A) review engagement

B) internal controls assessment

C) SysTrust

D) WebTrust

A) review engagement

B) internal controls assessment

C) SysTrust

D) WebTrust

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

Trust Services principles and criteria for controls relate to ensuring that

A) controls over security availability, processing integrity, and confidentiality or privacy have been complied with.

B) information systems are reliable in areas such as security, data integrity, and program quality.

C) controls over information systems implemented by the company are used consistently and reliably.

D) there will not be any unauthorized access to the website or other systems used by the client organization.

A) controls over security availability, processing integrity, and confidentiality or privacy have been complied with.

B) information systems are reliable in areas such as security, data integrity, and program quality.

C) controls over information systems implemented by the company are used consistently and reliably.

D) there will not be any unauthorized access to the website or other systems used by the client organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

Herbert Zora is having financial statements prepared by his PA to accompany his tax return. His primary concern is cost. Of the following, the lowest-cost engagement that the PA can perform for Zora's financial statements is

A) compilation.

B) review.

C) audit.

D) WebTrust.

A) compilation.

B) review.

C) audit.

D) WebTrust.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

As a PA, you have been asked to prepare your sister Betty's year-end financial statements. Betty is a photographer and is the sole shareholder of a small company called Best Weddings Ltd. She photographs weddings, graduations, and schools, and earns about $75 000 per year. Betty has said that she only needs the financial statements for her tax returns and would like you to prepare the tax returns too.

Required:

A) Would you be able to prepare the financial statements for your sister? Why or why not?

B) If yes, what type of report would you prepare to accompany the financial statements?

C) Would you be able to prepare the tax returns for your sister? Why or why not?

Required:

A) Would you be able to prepare the financial statements for your sister? Why or why not?

B) If yes, what type of report would you prepare to accompany the financial statements?

C) Would you be able to prepare the tax returns for your sister? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

When readers are cautioned that the financial statements may not be appropriate for their purposes, the non-assurance service is called a(n)

A) SysTrust.

B) compilation.

C) review.

D) audit.

A) SysTrust.

B) compilation.

C) review.

D) audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

Two types of services provided by public accounting firms are audits and reviews. Discuss the similarities and differences between these two types of services. Which type provides the most assurance?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

There is an increasing demand for assurance about computer controls surrounding financial information transacted electronically and the security of the information related to the transaction. This is in large part due to

A) the increasing presence of Internet sales in many businesses.

B) the use of computer-assisted auditing tools.

C) the large volume of transactions and information shared online and in real-time by companies.

D) client's uncertainty about the proper functioning of their computer systems.

A) the increasing presence of Internet sales in many businesses.

B) the use of computer-assisted auditing tools.

C) the large volume of transactions and information shared online and in real-time by companies.

D) client's uncertainty about the proper functioning of their computer systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following services provides no assurance about the client's financial statements?

A) compilation

B) review

C) audit

D) SysTrust

A) compilation

B) review

C) audit

D) SysTrust

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

A PA is attempting to sell a service to clients that will provide assurance on the accuracy, availability, and security of information systems.The PA is attempting to sell a(n)

A) WebTrust service.

B) compilation service.

C) SysTrust service.

D) audit engagement.

A) WebTrust service.

B) compilation service.

C) SysTrust service.

D) audit engagement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck