Deck 4: B: Supply and Demand: Applications and Extensions

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/98

العب

ملء الشاشة (f)

Deck 4: B: Supply and Demand: Applications and Extensions

1

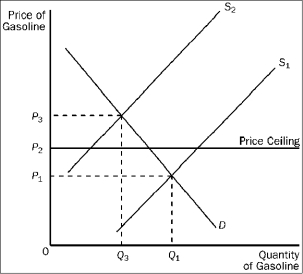

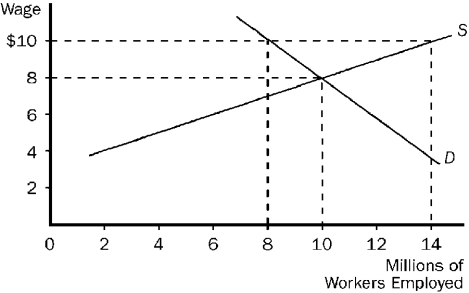

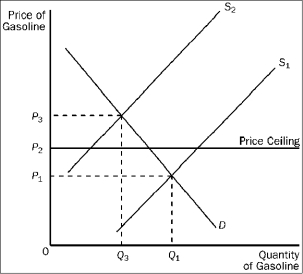

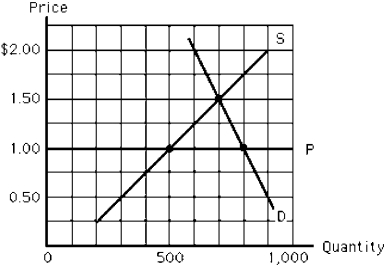

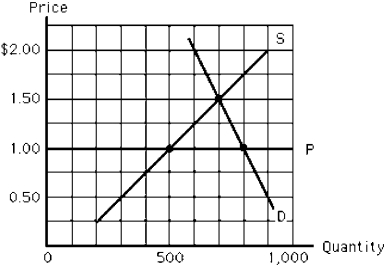

Figure 4-19

Refer to Figure 4-19. When the price ceiling applies in this market and the supply curve for gasoline shifts from S₁ to S₂, the resulting quantity of gasoline that is bought and sold is

A)less than Q₃.

B)Q₃

C)between Q₁ and Q₃.

D)at least Q₁.

Refer to Figure 4-19. When the price ceiling applies in this market and the supply curve for gasoline shifts from S₁ to S₂, the resulting quantity of gasoline that is bought and sold is

A)less than Q₃.

B)Q₃

C)between Q₁ and Q₃.

D)at least Q₁.

A

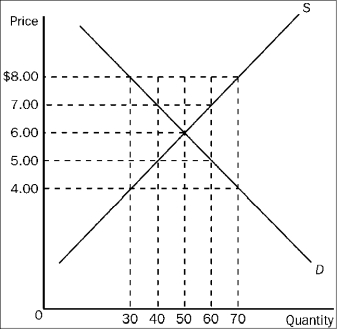

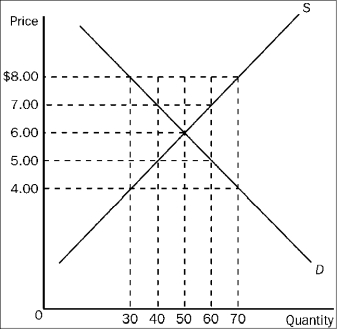

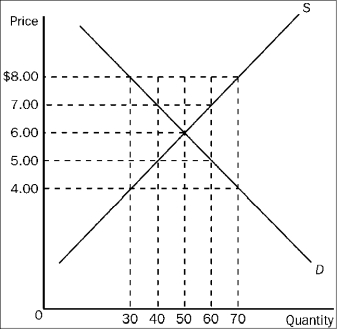

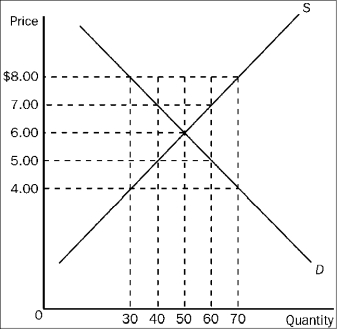

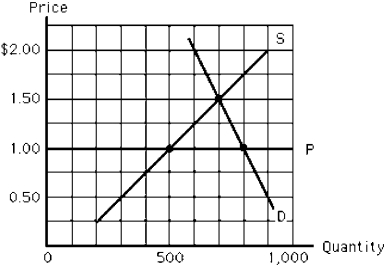

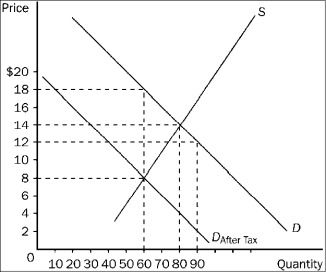

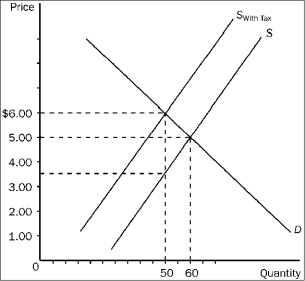

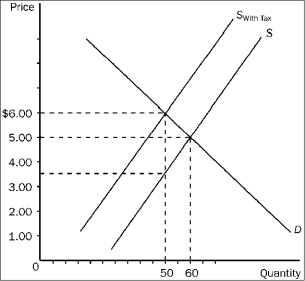

2

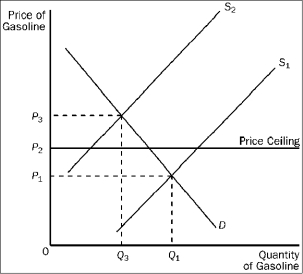

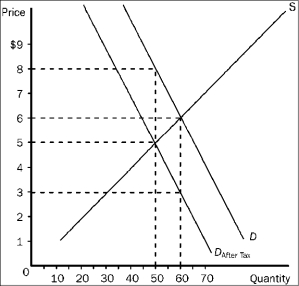

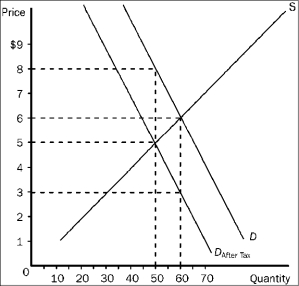

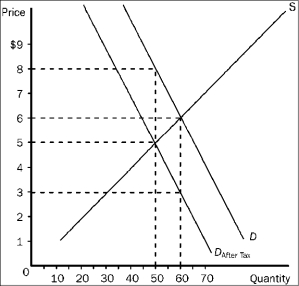

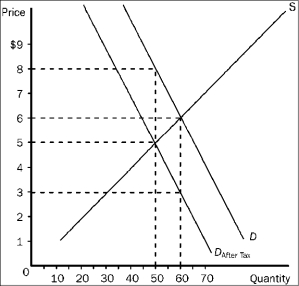

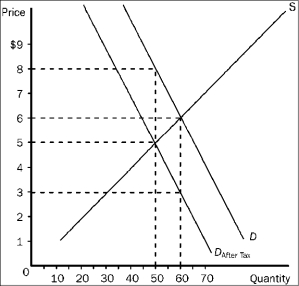

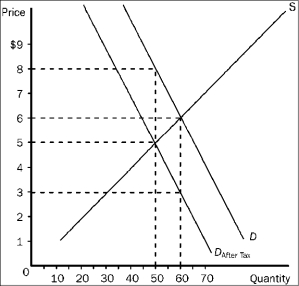

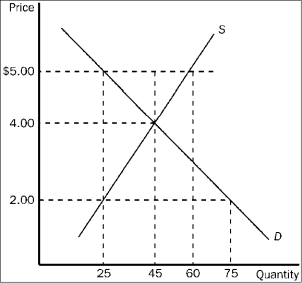

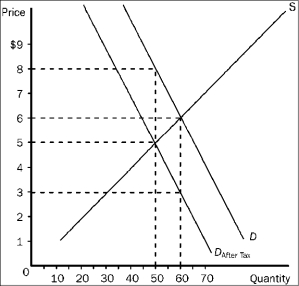

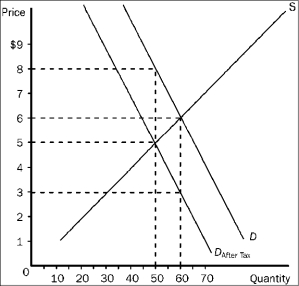

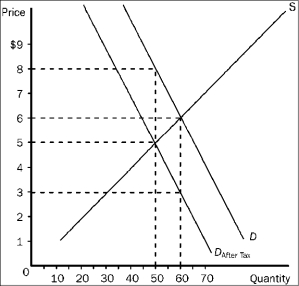

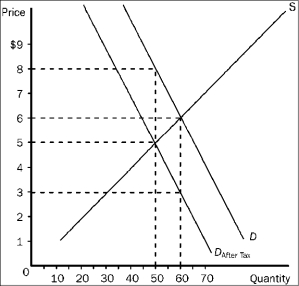

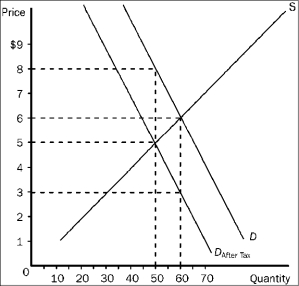

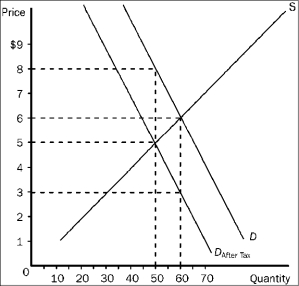

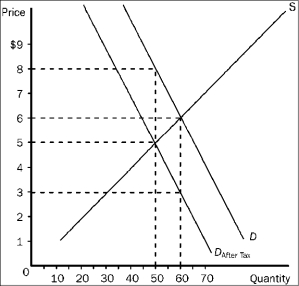

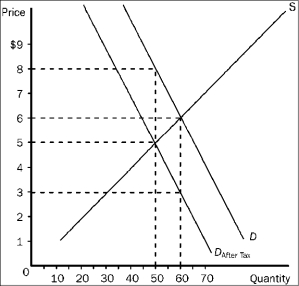

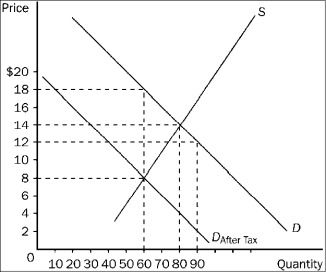

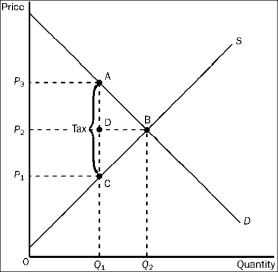

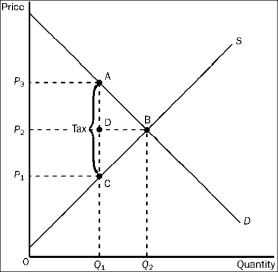

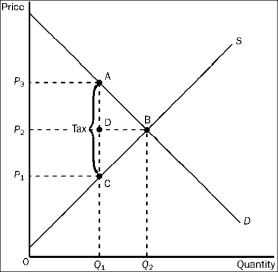

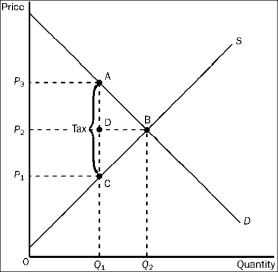

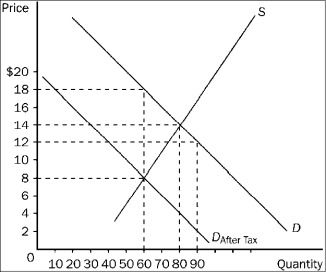

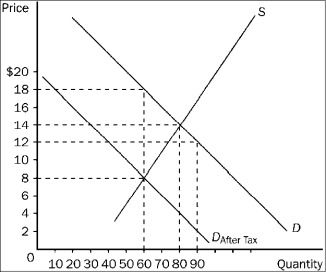

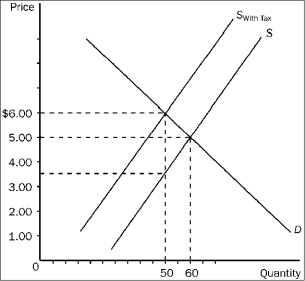

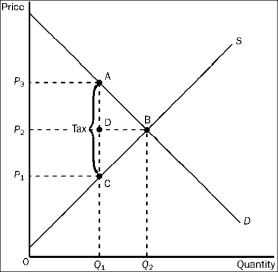

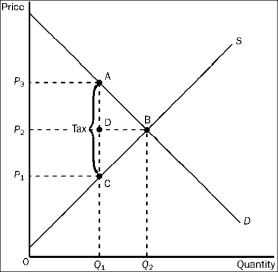

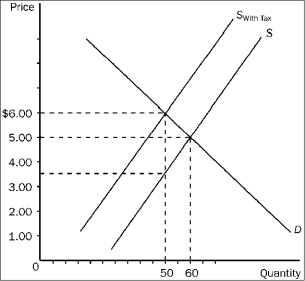

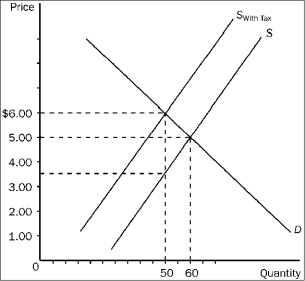

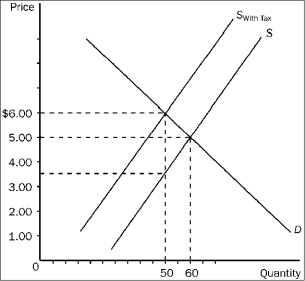

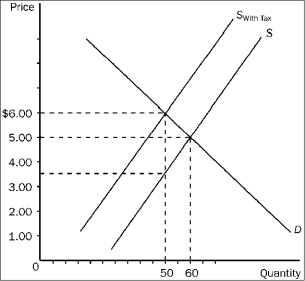

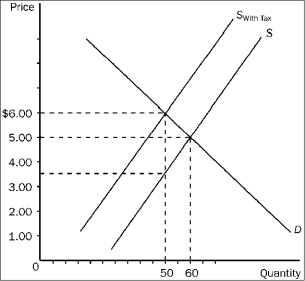

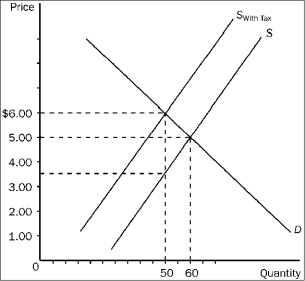

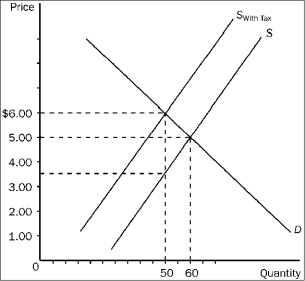

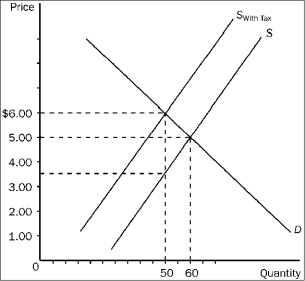

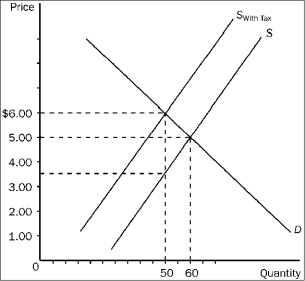

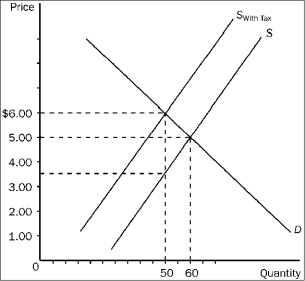

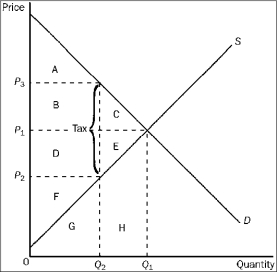

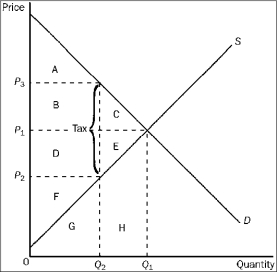

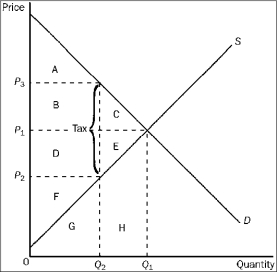

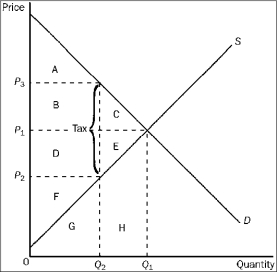

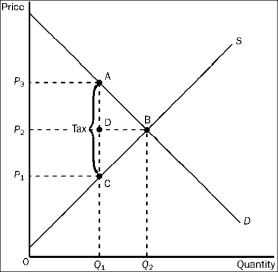

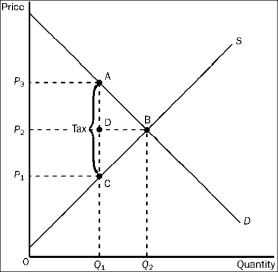

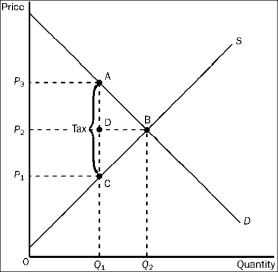

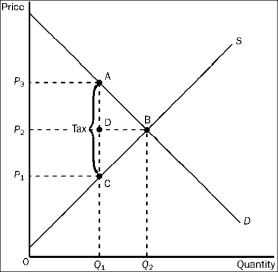

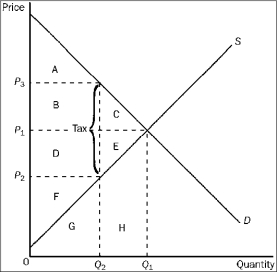

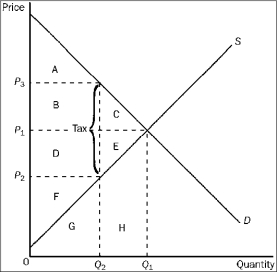

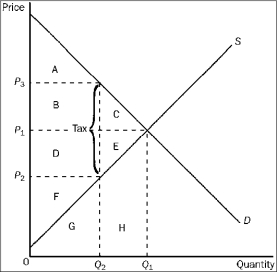

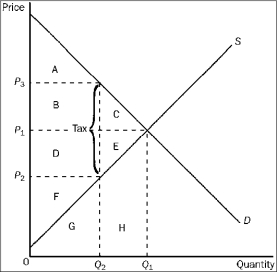

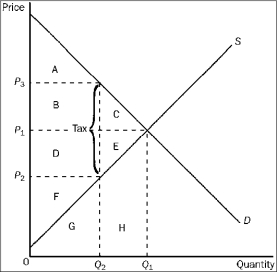

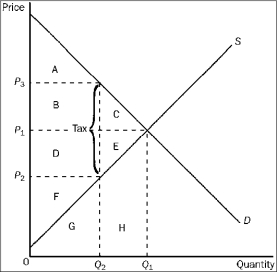

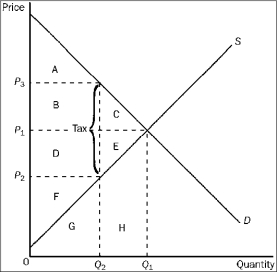

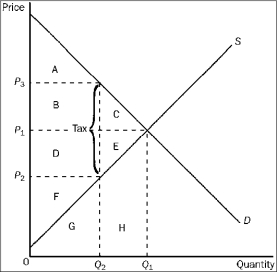

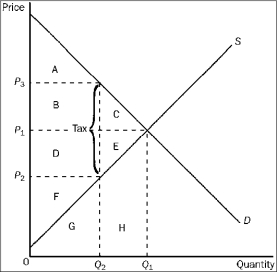

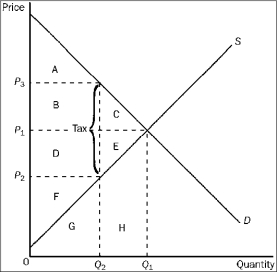

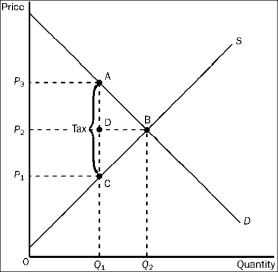

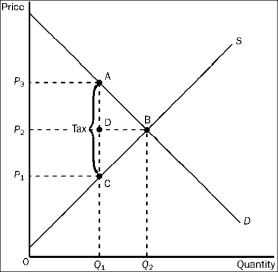

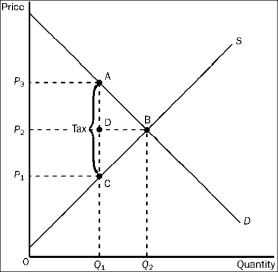

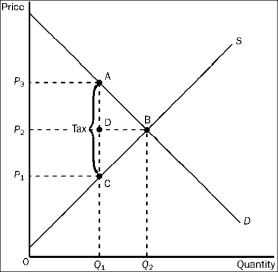

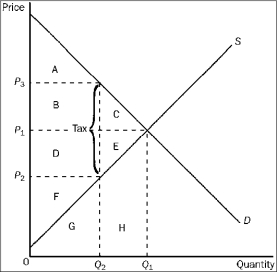

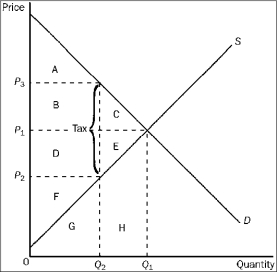

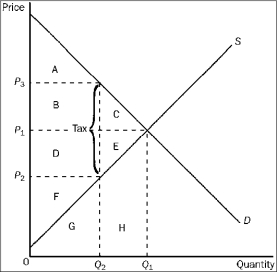

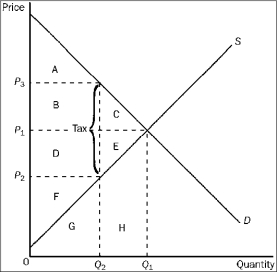

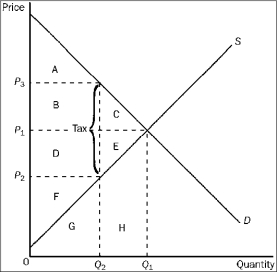

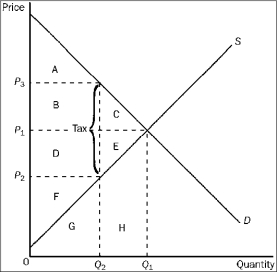

Figure 4-20

Refer to Figure 4-20. As the figure is drawn, who sends the tax payments to the government?

A)the buyers

B)the sellers

C)A portion of the tax payments is sent by the buyers and the remaining portion is sent by the sellers.

D)The question of who sends the tax payments cannot be determined from the figure.

Refer to Figure 4-20. As the figure is drawn, who sends the tax payments to the government?

A)the buyers

B)the sellers

C)A portion of the tax payments is sent by the buyers and the remaining portion is sent by the sellers.

D)The question of who sends the tax payments cannot be determined from the figure.

A

3

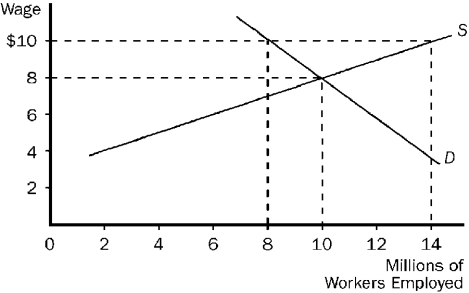

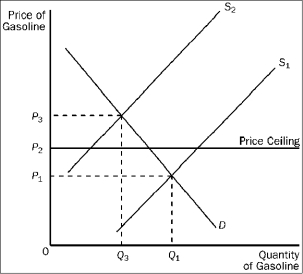

Figure 4-16

Refer to Figure 4-16. Some policymakers have argued that the government should establish a "living wage." A living wage would provide workers a reasonable standard of living in their city or region. If a living wage of $10 per hour is established in the market pictured here, we would expect

A)employment will increase to 14 million.

B)employment will decrease to 8 million.

C)the wage will actually rise to $20 per hour.

D)there will be a surplus of 14 million workers.

Refer to Figure 4-16. Some policymakers have argued that the government should establish a "living wage." A living wage would provide workers a reasonable standard of living in their city or region. If a living wage of $10 per hour is established in the market pictured here, we would expect

A)employment will increase to 14 million.

B)employment will decrease to 8 million.

C)the wage will actually rise to $20 per hour.

D)there will be a surplus of 14 million workers.

B

4

Figure 4-19

Refer to Figure 4-19. When the price ceiling applies in this market and the supply curve for gasoline shifts from S₁ to S₂,

A)the price will increase to P₃.

B)a surplus will occur at the new market price of P₂.

C)the market price will stay at P₁ due to the price ceiling.

D)a shortage will occur at the price ceiling of P₂.

Refer to Figure 4-19. When the price ceiling applies in this market and the supply curve for gasoline shifts from S₁ to S₂,

A)the price will increase to P₃.

B)a surplus will occur at the new market price of P₂.

C)the market price will stay at P₁ due to the price ceiling.

D)a shortage will occur at the price ceiling of P₂.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

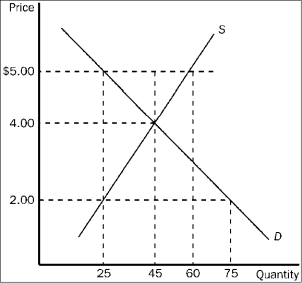

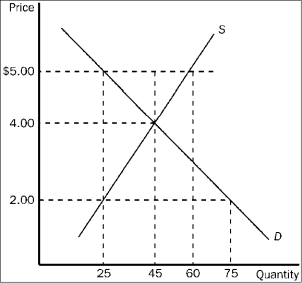

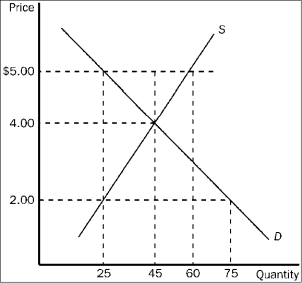

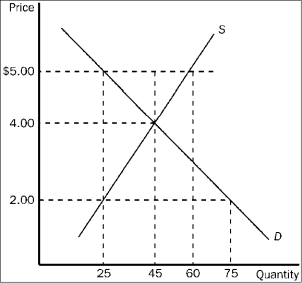

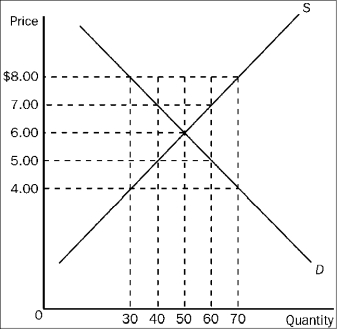

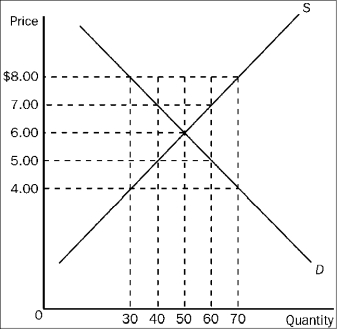

5

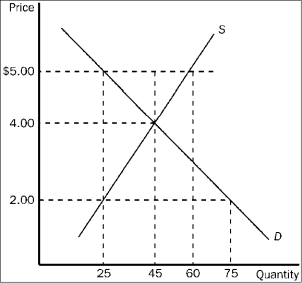

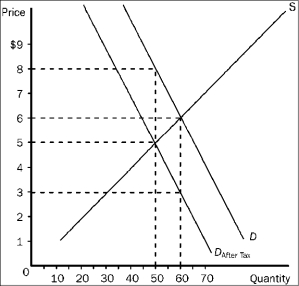

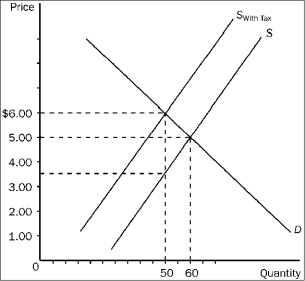

Figure 4-18

Refer to Figure 4-18. The price of the good would continue to serve as the rationing mechanism if

A)a price ceiling of $4.00 were imposed.

B)a price ceiling of $5.00 were imposed.

C)a price floor of $3.00 were imposed.

D)All of the above are correct.

Refer to Figure 4-18. The price of the good would continue to serve as the rationing mechanism if

A)a price ceiling of $4.00 were imposed.

B)a price ceiling of $5.00 were imposed.

C)a price floor of $3.00 were imposed.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

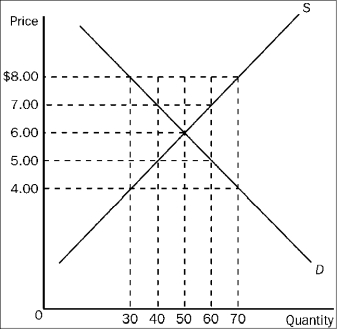

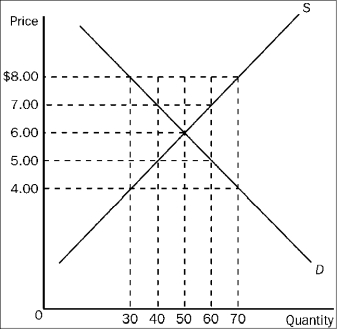

6

Figure 4-17

Refer to Figure 4-17. Suppose a price floor of $7.00 is imposed. As a result,

A)buyers' total expenditure on the good decreases by $20.00.

B)the supply curve will shift to the left so as to now pass through the point (Q = 40, P = $7.00).

C)the quantity of the good demanded decreases by 20 units.

D)the price of the good continues to serve as the rationing mechanism.

Refer to Figure 4-17. Suppose a price floor of $7.00 is imposed. As a result,

A)buyers' total expenditure on the good decreases by $20.00.

B)the supply curve will shift to the left so as to now pass through the point (Q = 40, P = $7.00).

C)the quantity of the good demanded decreases by 20 units.

D)the price of the good continues to serve as the rationing mechanism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

7

Figure 4-20

Refer to Figure 4-20. The amount of the tax per unit is

A)$1.

B)$2.

C)$3.

D)$5.

Refer to Figure 4-20. The amount of the tax per unit is

A)$1.

B)$2.

C)$3.

D)$5.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

8

Figure 4-20

Refer to Figure 4-20. The burden of the tax on buyers is

A)$1.00 per unit.

B)$1.50 per unit.

C)$2.00 per unit.

D)$3.00 per unit.

Refer to Figure 4-20. The burden of the tax on buyers is

A)$1.00 per unit.

B)$1.50 per unit.

C)$2.00 per unit.

D)$3.00 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

9

Figure 4-18

Refer to Figure 4-18. In this market, which of the following price controls would be binding?

A)a price ceiling of $2.00, and it would cause a shortage

B)a price ceiling of $5.00, and it would cause a surplus

C)a price floor of $2.00, and it would cause a shortage

D)All of the above are correct.

Refer to Figure 4-18. In this market, which of the following price controls would be binding?

A)a price ceiling of $2.00, and it would cause a shortage

B)a price ceiling of $5.00, and it would cause a surplus

C)a price floor of $2.00, and it would cause a shortage

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

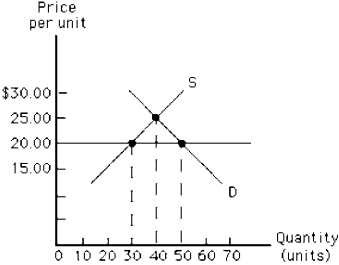

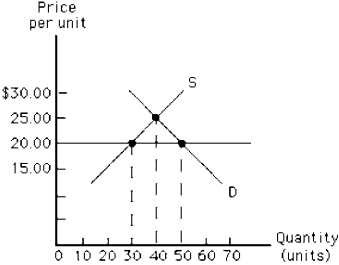

10

Figure 4-15

In Figure 4-15, suppose a price floor is established at $20.00. What is the result?

A)a shortage of 10 units

B)a surplus of 10 units

C)a shortage of 20 units

D)a surplus of 20 units

E)there is no change from the situation that exists at the equilibrium price

In Figure 4-15, suppose a price floor is established at $20.00. What is the result?

A)a shortage of 10 units

B)a surplus of 10 units

C)a shortage of 20 units

D)a surplus of 20 units

E)there is no change from the situation that exists at the equilibrium price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

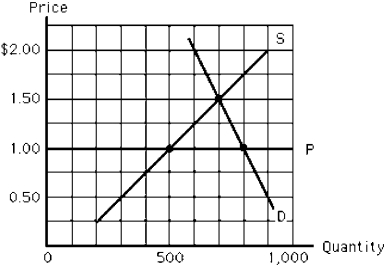

11

Figure 4-14

Figure 4-14 depicts the milk market. The horizontal line, P, represents a price ceiling imposed by the government. Which of the following is true?

A)In equilibrium, the quantity demanded is 800 gallons.

B)At the ceiling price, there is a surplus.

C)The quantity demanded at the price ceiling will equal the quantity supplied.

D)The equilibrium price would be $1 per unit without the price ceiling.

E)The quantity sold will be 500 gallons.

Figure 4-14 depicts the milk market. The horizontal line, P, represents a price ceiling imposed by the government. Which of the following is true?

A)In equilibrium, the quantity demanded is 800 gallons.

B)At the ceiling price, there is a surplus.

C)The quantity demanded at the price ceiling will equal the quantity supplied.

D)The equilibrium price would be $1 per unit without the price ceiling.

E)The quantity sold will be 500 gallons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

12

Figure 4-18

Refer to Figure 4-18. If the government imposes a price ceiling of $2.00 in this market, the result is a

A)surplus of 30 units of the good.

B)shortage of 20 units of the good.

C)shortage of 30 units of the good.

D)shortage of 50 units of the good.

Refer to Figure 4-18. If the government imposes a price ceiling of $2.00 in this market, the result is a

A)surplus of 30 units of the good.

B)shortage of 20 units of the good.

C)shortage of 30 units of the good.

D)shortage of 50 units of the good.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

13

Figure 4-20

Refer to Figure 4-20. The price that buyers pay after the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Refer to Figure 4-20. The price that buyers pay after the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

14

Figure 4-20

Refer to Figure 4-20. The burden of the tax on sellers is

A)$1.00 per unit.

B)$1.50 per unit.

C)$2.00 per unit.

D)$3.00 per unit.

Refer to Figure 4-20. The burden of the tax on sellers is

A)$1.00 per unit.

B)$1.50 per unit.

C)$2.00 per unit.

D)$3.00 per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

15

Figure 4-17

Refer to Figure 4-17. Suppose a price ceiling of $4.50 is imposed. As a result,

A)there is a shortage of 15 units of the good.

B)the demand curve will shift to the left so as to now pass through the point (Q = 35, P = $4.50).

C)the situation is very much like the one created by a binding minimum wage.

D)the quantity of the good that is bought and sold is the same as it would have been had a price floor of $7.50 been imposed.

Refer to Figure 4-17. Suppose a price ceiling of $4.50 is imposed. As a result,

A)there is a shortage of 15 units of the good.

B)the demand curve will shift to the left so as to now pass through the point (Q = 35, P = $4.50).

C)the situation is very much like the one created by a binding minimum wage.

D)the quantity of the good that is bought and sold is the same as it would have been had a price floor of $7.50 been imposed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

16

Figure 4-17

Refer to Figure 4-17. If the government imposes a price ceiling in this market at a price of $5.00, the result would be a

A)shortage of 20 units.

B)shortage of 10 units.

C)surplus of 20 units.

D)surplus of 10 units.

Refer to Figure 4-17. If the government imposes a price ceiling in this market at a price of $5.00, the result would be a

A)shortage of 20 units.

B)shortage of 10 units.

C)surplus of 20 units.

D)surplus of 10 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

17

Figure 4-20

Refer to Figure 4-20. The price that sellers receive after the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Refer to Figure 4-20. The price that sellers receive after the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

18

Figure 4-20

Refer to Figure 4-20. The equilibrium price in the market before the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

Refer to Figure 4-20. The equilibrium price in the market before the tax is imposed is

A)$8.

B)$6.

C)$5.

D)$3.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

19

Figure 4-17

Refer to Figure 4-17. Which of the following price controls would cause a shortage of 10 units of the good?

A)a price ceiling of $5.50

B)a price floor of $5.50

C)a price ceiling of $6.50

D)a price floor of $6.50

Refer to Figure 4-17. Which of the following price controls would cause a shortage of 10 units of the good?

A)a price ceiling of $5.50

B)a price floor of $5.50

C)a price ceiling of $6.50

D)a price floor of $6.50

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

20

Figure 4-14

In Figure 4-14, which of the following is true at the price ceiling, P?

A)The excess quantity supplied equals 300 gallons.

B)The excess quantity demanded equals 300 gallons.

C)The excess quantity supplied equals 500 gallons.

D)The excess quantity demanded equals 800 gallons.

E)Sales will be equal to 800 gallons.

In Figure 4-14, which of the following is true at the price ceiling, P?

A)The excess quantity supplied equals 300 gallons.

B)The excess quantity demanded equals 300 gallons.

C)The excess quantity supplied equals 500 gallons.

D)The excess quantity demanded equals 800 gallons.

E)Sales will be equal to 800 gallons.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

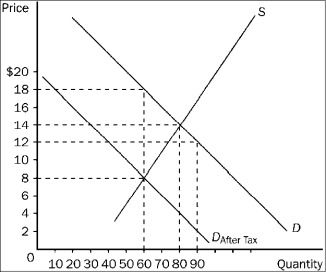

21

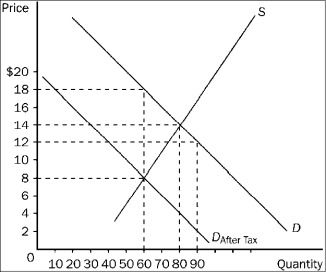

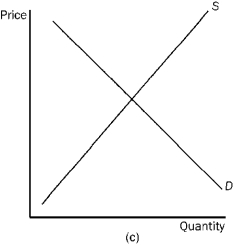

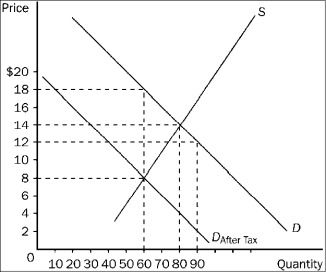

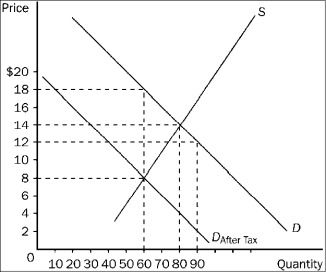

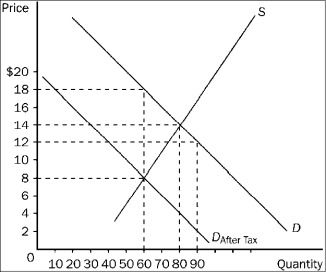

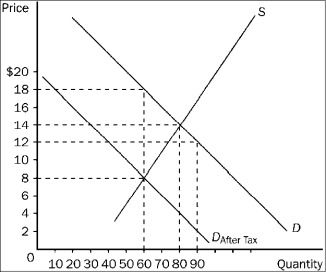

Figure 4-21

Refer to Figure 4-21. The price received by sellers after the tax is imposed is

A)$18.

B)$14.

C)$12.

D)$8.

Refer to Figure 4-21. The price received by sellers after the tax is imposed is

A)$18.

B)$14.

C)$12.

D)$8.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

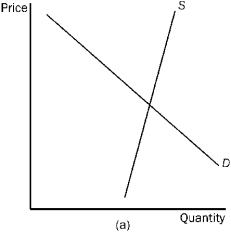

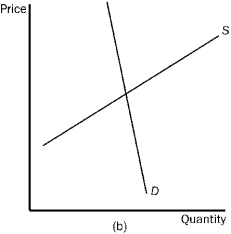

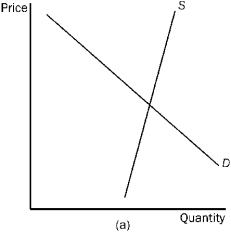

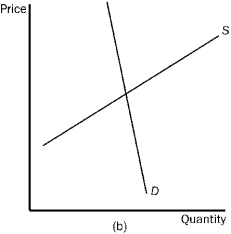

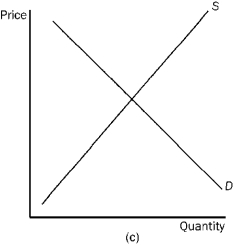

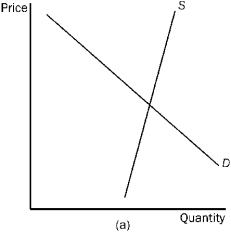

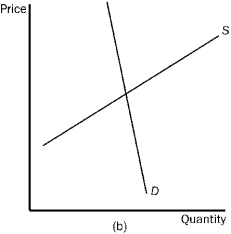

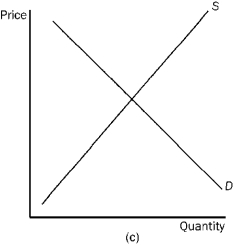

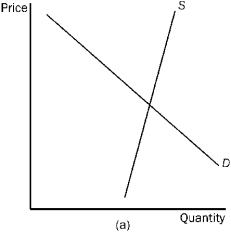

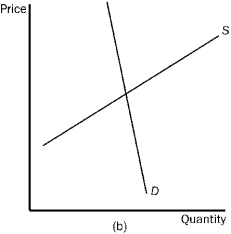

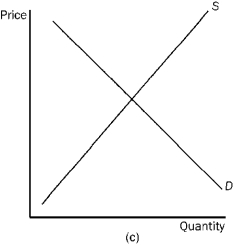

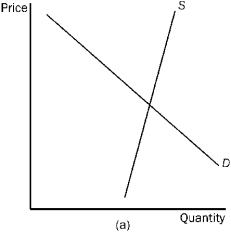

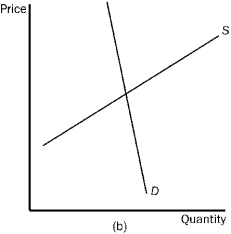

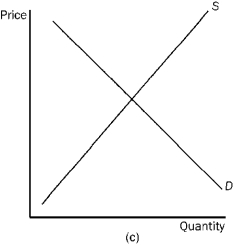

22

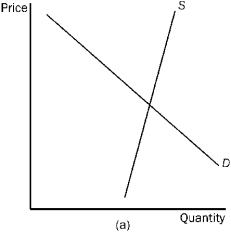

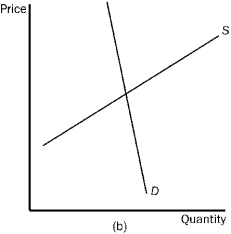

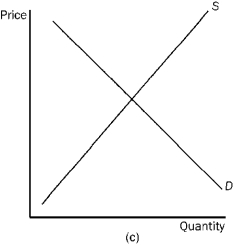

Figure 4-23

Refer to Figure 4-23. In which market will the majority of the tax burden fall on the buyer?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Refer to Figure 4-23. In which market will the majority of the tax burden fall on the buyer?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

23

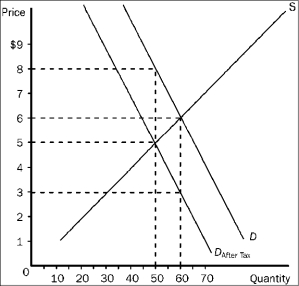

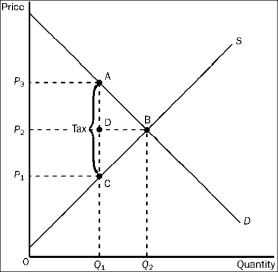

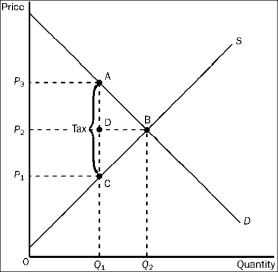

Figure 4-24

Refer to Figure 4-24. The equilibrium price before the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)None of the above is correct.

Refer to Figure 4-24. The equilibrium price before the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

24

Figure 4-21

Refer to Figure 4-21. The price paid by buyers after the tax is imposed is

A)$18.

B)$14.

C)$12.

D)$8.

Refer to Figure 4-21. The price paid by buyers after the tax is imposed is

A)$18.

B)$14.

C)$12.

D)$8.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

25

Figure 4-23

Refer to Figure 4-23. In which market will the majority of the tax burden fall on the seller?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Refer to Figure 4-23. In which market will the majority of the tax burden fall on the seller?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

26

Figure 4-21

Refer to Figure 4-21. The per-unit burden of the tax is

A)$4 on buyers and $4 on sellers.

B)$5 on buyers and $5 on sellers.

C)$4 on buyers and $6 on sellers.

D)$6 on buyers and $4 on sellers.

Refer to Figure 4-21. The per-unit burden of the tax is

A)$4 on buyers and $4 on sellers.

B)$5 on buyers and $5 on sellers.

C)$4 on buyers and $6 on sellers.

D)$6 on buyers and $4 on sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

27

Figure 4-24

Refer to Figure 4-24. The price that buyers pay after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

Refer to Figure 4-24. The price that buyers pay after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

28

Figure 4-20

Refer to Figure 4-20. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. Now, relative to the case depicted in the figure,

A)the burden on buyers will be larger and the burden on sellers will be smaller.

B)the burden on buyers will be smaller and the burden on sellers will be larger.

C)the burden on buyers will be the same and the burden on sellers will be the same.

D)The relative burdens in the two cases cannot be determined without further information.

Refer to Figure 4-20. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the sellers of the good, rather than the buyers, are required to pay the tax to the government. Now, relative to the case depicted in the figure,

A)the burden on buyers will be larger and the burden on sellers will be smaller.

B)the burden on buyers will be smaller and the burden on sellers will be larger.

C)the burden on buyers will be the same and the burden on sellers will be the same.

D)The relative burdens in the two cases cannot be determined without further information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

29

Figure 4-21

Refer to Figure 4-21. How much tax revenue does this tax produce for the government?

A)$480

B)$600

C)$800

D)$1,080

Refer to Figure 4-21. How much tax revenue does this tax produce for the government?

A)$480

B)$600

C)$800

D)$1,080

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

30

Figure 4-22

Refer to Figure 4-22. Buyers pay how much of the tax per unit?

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.00.

Refer to Figure 4-22. Buyers pay how much of the tax per unit?

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

31

Figure 4-22

Refer to Figure 4-22. Sellers pay how much of the tax per unit?

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.00.

Refer to Figure 4-22. Sellers pay how much of the tax per unit?

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

32

Figure 4-24

Refer to Figure 4-24. The price that sellers receive after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

Refer to Figure 4-24. The price that sellers receive after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

33

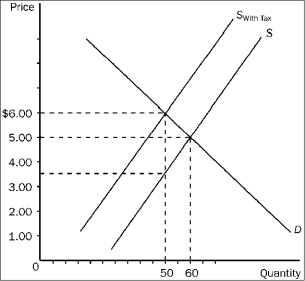

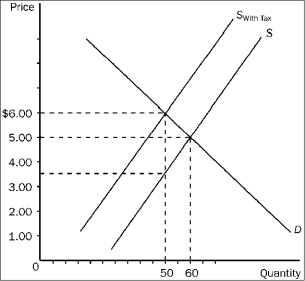

Figure 4-22

Refer to Figure 4-22. The equilibrium price in the market before the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Refer to Figure 4-22. The equilibrium price in the market before the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

34

Figure 4-22

Refer to Figure 4-22. The price paid by buyers after the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Refer to Figure 4-22. The price paid by buyers after the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

35

Figure 4-23

Refer to Figure 4-23. In which market will the tax burden be most equally divided between the buyer and the seller?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

Refer to Figure 4-23. In which market will the tax burden be most equally divided between the buyer and the seller?

A)market (a)

B)market (b)

C)market (c)

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

36

Figure 4-22

Refer to Figure 4-22. From this tax the government will collect a total of

A)$125.00.

B)$175.00.

C)$200.00.

D)$250.00.

Refer to Figure 4-22. From this tax the government will collect a total of

A)$125.00.

B)$175.00.

C)$200.00.

D)$250.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

37

Figure 4-22

Refer to Figure 4-22. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

a.the burden on buyers will be larger than in the case illustrated in Figure 4-22.

b.the burden on sellers will be smaller than in the case illustrated in Figure 4-22.

c.a downward shift of the demand curve replaces the upward shift of the supply curve.

d.All of the above are correct.

Refer to Figure 4-22. Suppose the same S and D curves apply, and a tax of the same amount per unit as shown here is imposed. Now, however, the buyers of the good, rather than the sellers, are required to pay the tax to the government. Now,

a.the burden on buyers will be larger than in the case illustrated in Figure 4-22.

b.the burden on sellers will be smaller than in the case illustrated in Figure 4-22.

c.a downward shift of the demand curve replaces the upward shift of the supply curve.

d.All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

38

Figure 4-21

Refer to Figure 4-21. The amount of the tax per unit is

A)$10.

B)$6.

C)$4.

D)$2.

Refer to Figure 4-21. The amount of the tax per unit is

A)$10.

B)$6.

C)$4.

D)$2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

39

Figure 4-22

Refer to Figure 4-22. The effective price sellers receive after the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

Refer to Figure 4-22. The effective price sellers receive after the tax is imposed is

A)$1.00.

B)$3.50.

C)$5.00.

D)$6.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

40

Figure 4-22

Refer to Figure 4-22. The amount of the tax per unit is

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.50.

Refer to Figure 4-22. The amount of the tax per unit is

A)$1.00.

B)$1.50.

C)$2.50.

D)$3.50.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

41

Figure 4-25

Refer to Figure 4-25. Consumer surplus before the tax was levied is represented by area

A)A.

B)A + B + C.

C)D + E + F.

D)F.

Refer to Figure 4-25. Consumer surplus before the tax was levied is represented by area

A)A.

B)A + B + C.

C)D + E + F.

D)F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

42

Figure 4-25

Refer to Figure 4-25. Producer surplus before the tax was levied is represented by area

A)A.

B)A + B + C.

C)D + E + F.

D)F.

Refer to Figure 4-25. Producer surplus before the tax was levied is represented by area

A)A.

B)A + B + C.

C)D + E + F.

D)F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

43

Figure 4-24

Refer to Figure 4-24. The per-unit burden of the tax on sellers is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

Refer to Figure 4-24. The per-unit burden of the tax on sellers is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

44

Figure 4-24

Refer to Figure 4-24. The per unit burden of the tax on buyers is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

Refer to Figure 4-24. The per unit burden of the tax on buyers is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

45

Figure 4-25

Refer to Figure 4-25. The equilibrium price before the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

Refer to Figure 4-25. The equilibrium price before the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

46

If an increase in the government-imposed minimum wage pushes the price (wage) of unskilled labor above market equilibrium, which of the following will most likely occur in the unskilled labor market?

A)an increase in demand for unskilled labor

B)a decrease in the supply of unskilled labor

C)a shortage of unskilled labor

D)a surplus of unskilled labor

A)an increase in demand for unskilled labor

B)a decrease in the supply of unskilled labor

C)a shortage of unskilled labor

D)a surplus of unskilled labor

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

47

The average tax rate (ATR) is defined as

A)taxable income divided by tax liability.

B)change in tax liability divided by change in taxable income.

C)tax liability divided by taxable income.

D)change in taxable income divided by change in tax liability.

A)taxable income divided by tax liability.

B)change in tax liability divided by change in taxable income.

C)tax liability divided by taxable income.

D)change in taxable income divided by change in tax liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

48

Figure 4-24

Refer to Figure 4-24. The amount of deadweight loss associated with the tax is equal to

A)P₃ A C P₁.

B)A B C.

C)P₂ A D P₃.

D)P₁ D C P₂.

Refer to Figure 4-24. The amount of deadweight loss associated with the tax is equal to

A)P₃ A C P₁.

B)A B C.

C)P₂ A D P₃.

D)P₁ D C P₂.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

49

Figure 4-25

Refer to Figure 4-25. The tax causes a reduction in producer surplus that is represented by area

A)A.

B)B + C.

C)D + E.

D)F.

Refer to Figure 4-25. The tax causes a reduction in producer surplus that is represented by area

A)A.

B)B + C.

C)D + E.

D)F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

50

Figure 4-25

Refer to Figure 4-25. After the tax is levied, consumer surplus is represented by area

A)A.

B)A + B + C.

C)D + E + F.

D)F.

Refer to Figure 4-25. After the tax is levied, consumer surplus is represented by area

A)A.

B)A + B + C.

C)D + E + F.

D)F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

51

Figure 4-25

Refer to Figure 4-25. The tax causes a reduction in consumer surplus that is represented by area

A)A.

B)B + C.

C)D + E.

D)F.

Refer to Figure 4-25. The tax causes a reduction in consumer surplus that is represented by area

A)A.

B)B + C.

C)D + E.

D)F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

52

Figure 4-25

Refer to Figure 4-25. After the tax is levied, producer surplus is represented by area

A)A.

B)A + B + C.

C)D + E + F.

D)F.

Refer to Figure 4-25. After the tax is levied, producer surplus is represented by area

A)A.

B)A + B + C.

C)D + E + F.

D)F.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

53

An increase in the demand for a product will cause output to

A)increase and both the demand for and prices of the resources used to produce the product to increase.

B)increase and both the demand for and prices of the resources used to produce the product to decrease.

C)decrease; the demand for the resources used to produce the product will remain constant.

D)decrease; the price of resources used to produce the product will decrease.

A)increase and both the demand for and prices of the resources used to produce the product to increase.

B)increase and both the demand for and prices of the resources used to produce the product to decrease.

C)decrease; the demand for the resources used to produce the product will remain constant.

D)decrease; the price of resources used to produce the product will decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

54

Figure 4-24

Refer to Figure 4-24. The amount of the tax on each unit of the good is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

Refer to Figure 4-24. The amount of the tax on each unit of the good is

A)P₃ - P₁.

B)P₃ - P₂.

C)P₂ - P₁.

D)Q₂ - Q₁.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

55

Figure 4-24

Refer to Figure 4-24. The amount of tax revenue received by the government is equal to the area

A)P₃ A C P₁.

B)A B C.

C)P₂ D A P₃.

D)P₁ C D P₂.

Refer to Figure 4-24. The amount of tax revenue received by the government is equal to the area

A)P₃ A C P₁.

B)A B C.

C)P₂ D A P₃.

D)P₁ C D P₂.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is a true statement regarding the economic impact of a subsidy?

A)The distribution of the benefits from a subsidy will depend on whether the subsidy is legally granted to the buyer or seller.

B)When demand is relatively inelastic, the benefits of a subsidy will mainly accrue to sellers.

C)When supply is relatively elastic, the benefits of a subsidy will mainly accrue to buyers.

D)When demand is relatively elastic, the benefits of a subsidy will mainly accrue to buyers.

A)The distribution of the benefits from a subsidy will depend on whether the subsidy is legally granted to the buyer or seller.

B)When demand is relatively inelastic, the benefits of a subsidy will mainly accrue to sellers.

C)When supply is relatively elastic, the benefits of a subsidy will mainly accrue to buyers.

D)When demand is relatively elastic, the benefits of a subsidy will mainly accrue to buyers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

57

Figure 4-25

Refer to Figure 4-25. The price that buyers pay after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

Refer to Figure 4-25. The price that buyers pay after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

58

During the imposition of price controls in the 1970s, long gasoline lines were common. In the absence of price controls, markets would have eliminated such excess demand by

A)allowing the price to rise, so gas was rationed to those willing to pay the most for it.

B)increasing the gap between supply and demand.

C)allowing price to decline, so the poor could afford to buy more gas.

D)mandating a 50-mile-per-hour speed limit to reduce consumption.

A)allowing the price to rise, so gas was rationed to those willing to pay the most for it.

B)increasing the gap between supply and demand.

C)allowing price to decline, so the poor could afford to buy more gas.

D)mandating a 50-mile-per-hour speed limit to reduce consumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

59

Figure 4-25

Refer to Figure 4-25. The benefit to the government is

A)measured by tax revenue and is represented by area A + B.

B)measured by tax revenue and is represented by area B + D.

C)measured by the net gain in total surplus and is represented by area B + D.

D)measured by the net gain in total surplus and is represented by area D + E.

Refer to Figure 4-25. The benefit to the government is

A)measured by tax revenue and is represented by area A + B.

B)measured by tax revenue and is represented by area B + D.

C)measured by the net gain in total surplus and is represented by area B + D.

D)measured by the net gain in total surplus and is represented by area D + E.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

60

Figure 4-25

Refer to Figure 4-25. The price that sellers receive after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

Refer to Figure 4-25. The price that sellers receive after the tax is imposed is

A)P₁.

B)P₂.

C)P₃.

D)impossible to determine from the figure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

61

The deadweight loss resulting from levying a tax on an economic activity is

A)the tax revenue directed to the government as the result of the tax.

B)the loss of potential gains from trade from activities forgone because of the tax.

C)the increase in the price of an activity as the result of the tax levied on it.

D)the marginal benefits derived from the expansion in government activities made possible by the increase in tax revenues.

A)the tax revenue directed to the government as the result of the tax.

B)the loss of potential gains from trade from activities forgone because of the tax.

C)the increase in the price of an activity as the result of the tax levied on it.

D)the marginal benefits derived from the expansion in government activities made possible by the increase in tax revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

62

Suppose there is an increase in the excise tax imposed on cigarettes, a good for which the demand is relatively inelastic. The short-run burden of the tax increase will be borne primarily by

A)consumers, because the increase in market price will be large relative to the increase in the excise tax.

B)firms, because the increase in market price will be large relative to the increase in the excise tax.

C)consumers, because the increase in market price will be small relative to the increase in the excise tax.

D)firms, because the increase in market price will be small relative to the increase in the excise tax.

A)consumers, because the increase in market price will be large relative to the increase in the excise tax.

B)firms, because the increase in market price will be large relative to the increase in the excise tax.

C)consumers, because the increase in market price will be small relative to the increase in the excise tax.

D)firms, because the increase in market price will be small relative to the increase in the excise tax.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

63

With a price ceiling above the equilibrium price,

A)quantity demanded would exceed quantity supplied.

B)quantity supplied would exceed quantity demanded.

C)the market would be in equilibrium.

D)the equilibrium price would be expected to fall over time.

A)quantity demanded would exceed quantity supplied.

B)quantity supplied would exceed quantity demanded.

C)the market would be in equilibrium.

D)the equilibrium price would be expected to fall over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

64

A legal minimum wage is an example of

A)the invisible hand principle.

B)a price floor.

C)a price ceiling.

D)a fringe benefit.

A)the invisible hand principle.

B)a price floor.

C)a price ceiling.

D)a fringe benefit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following statements regarding black markets is true?

A)The reliability of products sold in black markets is generally higher than the reliability of products sold in legal markets.

B)The prices of goods in black markets are generally lower than the prices of similar products in legal markets.

C)The laws of supply and demand do not affect the prices of goods exchanged in black markets.

D)The rate of violence is higher in black markets than in legal markets.

A)The reliability of products sold in black markets is generally higher than the reliability of products sold in legal markets.

B)The prices of goods in black markets are generally lower than the prices of similar products in legal markets.

C)The laws of supply and demand do not affect the prices of goods exchanged in black markets.

D)The rate of violence is higher in black markets than in legal markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

66

Currently, federal and state gasoline taxes (imposed statutorily on the sellers of gasoline) amount to about $.45 per gallon. Suppose the current price of gasoline is $1.20 per gallon, and that if the tax was not in place, the price would be only $.80.

A)The full incidence of the tax is falling on consumers.

B)The full incidence of the tax is falling on suppliers.

C)A $.05 burden is being borne by sellers and $.40 by consumers.

D)A $.05 burden is being borne by consumers and $.40 by sellers.

A)The full incidence of the tax is falling on consumers.

B)The full incidence of the tax is falling on suppliers.

C)A $.05 burden is being borne by sellers and $.40 by consumers.

D)A $.05 burden is being borne by consumers and $.40 by sellers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

67

Because illegal drug markets operate outside the legal system,

A)the quality of these drugs has increased.

B)the sellers of illegal drugs earn less money.

C)there is less violence in these markets than if they were legal.

D)none of the above.

A)the quality of these drugs has increased.

B)the sellers of illegal drugs earn less money.

C)there is less violence in these markets than if they were legal.

D)none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

68

The market pricing system corrects an excess supply by

A)raising the product price and increasing producer profits.

B)lowering the product price and decreasing producer profits.

C)raising the product price and decreasing producer profits.

D)lowering the product price and increasing producer profits.

A)raising the product price and increasing producer profits.

B)lowering the product price and decreasing producer profits.

C)raising the product price and decreasing producer profits.

D)lowering the product price and increasing producer profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

69

If Joan pays $5,000 in taxes when she earns $20,000 and must pay $12,000 in taxes when she earns $30,000, she faces a marginal tax rate in this income range of

A)25 percent.

B)30 percent.

C)40 percent.

D)70 percent.

A)25 percent.

B)30 percent.

C)40 percent.

D)70 percent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

70

The Laffer Curve indicates that

A)when tax rates are high, a rate reduction may lead to an increase in tax revenue.

B)when tax rates are low, an increase in tax rates will generally lead to a reduction in tax revenues.

C)an increase in tax rates will always lead to an increase in tax revenues.

D)the deadweight losses resulting from taxation are small at the tax rate that maximizes the revenues derived by the government.

A)when tax rates are high, a rate reduction may lead to an increase in tax revenue.

B)when tax rates are low, an increase in tax rates will generally lead to a reduction in tax revenues.

C)an increase in tax rates will always lead to an increase in tax revenues.

D)the deadweight losses resulting from taxation are small at the tax rate that maximizes the revenues derived by the government.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

71

In the mid-1940s, the marginal income tax rate in the top income tax bracket was 94 percent. In the 1960s, the top rate was lowered to 70 percent, and in the 1980s, the top rate was again lowered to 28 percent. The data show that as a result of these tax rate reductions, tax revenue (particularly from the rich) increased. This is consistent with the idea illustrated with the

A)Laffer curve.

B)production possibilities curve.

C)supply of loanable funds curve.

D)demand for unskilled labor curve.

A)Laffer curve.

B)production possibilities curve.

C)supply of loanable funds curve.

D)demand for unskilled labor curve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

72

When the price of a good is legally set below the equilibrium level, a shortage often results. This shortage

A)is a temporary failure of the market mechanism.

B)is the result of a shift in demand.

C)is the result of a shift in supply.

D)occurs because the price ceiling prevents the market mechanism from establishing an equilibrium price.

A)is a temporary failure of the market mechanism.

B)is the result of a shift in demand.

C)is the result of a shift in supply.

D)occurs because the price ceiling prevents the market mechanism from establishing an equilibrium price.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

73

The Laffer curve illustrates the principle that

A)when tax rates are quite high, reducing tax rates will increase tax revenue.

B)when tax rates are quite low, reducing tax rates will increase tax revenue.

C)when tax rates are quite high, reducing tax rates will decrease tax revenue.

D)increasing tax rates always increases tax revenue.

A)when tax rates are quite high, reducing tax rates will increase tax revenue.

B)when tax rates are quite low, reducing tax rates will increase tax revenue.

C)when tax rates are quite high, reducing tax rates will decrease tax revenue.

D)increasing tax rates always increases tax revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

74

An effective minimum wage

A)imposes a price ceiling on the wages of various categories of low-skill workers.

B)increases the demand for low-skill workers.

C)makes it easier for low skill workers to find jobs.

D)increases the earnings of some low-skill workers while reducing the employment and training opportunities available to others.

A)imposes a price ceiling on the wages of various categories of low-skill workers.

B)increases the demand for low-skill workers.

C)makes it easier for low skill workers to find jobs.

D)increases the earnings of some low-skill workers while reducing the employment and training opportunities available to others.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

75

Both price floors and price ceilings, when effective, lead to

A)shortages.

B)surpluses.

C)an increase in the quantity traded.

D)a reduction in the quantity traded.

A)shortages.

B)surpluses.

C)an increase in the quantity traded.

D)a reduction in the quantity traded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

76

An income tax is regressive if

A)the tax liability of high-income recipients exceeds the tax liability of those with low incomes.

B)the tax liability of high-income recipients is less than the tax liability of those with low incomes.

C)high-income recipients pay a higher percentage of their incomes in taxes than those with low incomes.

D)high-income recipients pay a lower percentage of their incomes in taxes than those whose incomes are low.

A)the tax liability of high-income recipients exceeds the tax liability of those with low incomes.

B)the tax liability of high-income recipients is less than the tax liability of those with low incomes.

C)high-income recipients pay a higher percentage of their incomes in taxes than those with low incomes.

D)high-income recipients pay a lower percentage of their incomes in taxes than those whose incomes are low.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

77

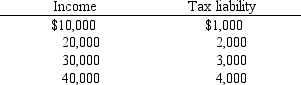

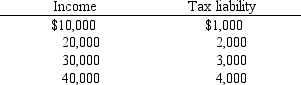

Use the table below to choose the correct answer.

For the income range illustrated, the tax shown here is

A)regressive.

B)proportional.

C)progressive.

D)progressive up to $30,000 but regressive beyond that.

For the income range illustrated, the tax shown here is

A)regressive.

B)proportional.

C)progressive.

D)progressive up to $30,000 but regressive beyond that.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

78

If there was an increase in the excise tax on beer, what would be the effect on the equilibrium price and quantity of beer?

A)price increases, quantity decreases

B)price decreases, quantity decreases

C)price increases, quantity increases

D)price decreases, quantity increases

A)price increases, quantity decreases

B)price decreases, quantity decreases

C)price increases, quantity increases

D)price decreases, quantity increases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

79

Rent controls generally fix the price of rental housing below market equilibrium. Economic analysis suggests these controls

A)are effective in helping the poor find housing.

B)improve the quality of housing available to consumers.

C)create a surplus of rental housing.

D)reduce the future supply of rental housing.

A)are effective in helping the poor find housing.

B)improve the quality of housing available to consumers.

C)create a surplus of rental housing.

D)reduce the future supply of rental housing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

80

The more elastic the supply of a product, the more likely it is that the burden of a tax will

A)fall on sellers.

B)fall on buyers.

C)fall equally on both buyers and sellers.

D)be borne by the public sector, and not by market participants.

A)fall on sellers.

B)fall on buyers.

C)fall equally on both buyers and sellers.

D)be borne by the public sector, and not by market participants.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck