Deck 31: He Financial Crisis and the Great Recession

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/66

العب

ملء الشاشة (f)

Deck 31: He Financial Crisis and the Great Recession

1

In hindsight, mortgage-backed securities implied very limited risk because the underlying mortgages were spread across different geographic areas.

False

2

In 2008, interest rates on Treasury securities fell even though most other interest rates were rising.

True

3

Spending on newly constructed homes is part of the investment component of GDP.

True

4

In response to the economic downturn, the federal government enacted a fiscal stimulus bill with funding in excess of $700 billion.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

5

An increase in the price of a particular bond implies an increase in the interest rate for that bond.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

6

The first signs of major financial problems associated with the financial sector and real estate investment appeared in 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

7

A larger interest rate spread in 2003-2006 is one of the factors that led to the recession of 2007.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

8

The United States has not experienced a recession as severe as the 2007-2009 downturn since the 1930s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

9

During the 2000 to 2006 time period, housing prices increased but only to a limited degree.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

10

Both monetary policy and fiscal policy were used in response to the recession of 2007-2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

11

It would be impossible to have an unlevered bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

12

The monetary and fiscal stimulus response to the Great Recession resulted in an immediate increase in real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

13

Leverage is essential to a bank's profitability but it also increases risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

14

If a 10-year Treasury bond pays 1.5% and a 10-year corporate bond pays 4.4%, then the spread on this particular corporate bond is 5.9%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Federal Reserve helped J.P.Morgan purchased Bear Stearns by agreeing to purchase some unwanted Bear Stearns assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

16

Subprime mortgages frequently featured small or zero down payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

17

There is essentially no risk of default for U.S.government securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

18

During the real estate boom of the early 2000s, some banks operated with leverage ratios in excess of 30-to-1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

19

During the financial crisis associated with the Great Recession, the interest rate spread between Treasury bills and bank-to-bank lending increased substantially.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

20

Borrowed funds are used in financing every component of GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

21

Most economists feel that overly strict financial regulation from 2000 to 2006 contributed to the financial crisis of 2007-2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

22

When the housing bubble burst, prices fell particularly severely in

A)Georgia.

B)Nevada.

C)Pennsylvania.

D)West Virginia.

A)Georgia.

B)Nevada.

C)Pennsylvania.

D)West Virginia.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

23

Despite both monetary and fiscal policy actions, real GDP declined at an annualized rate of 6% during the last quarter of 2008 and the first quarter of 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

24

Assume that Sharon purchases $5,000 worth of a stock.To do so she uses $1,000 of her own money and borrows the remaining $4,000 at a 7.0% interest rate.If the stock's value decreases by 10% in one year and she has to sell the stock at that time, what is her rate of return?

A)−10%

B)−50%

C)−78%

D)−156%

A)−10%

B)−50%

C)−78%

D)−156%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

25

The increased level of excess reserves that many banks held in 2008 made traditional monetary policy less effective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

26

The central idea behind the Troubled Asset Relief Program was for the Treasury to sell mortgage-backed securities to interested investors, wait for prices to increase, and then buy these securities back for a profit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following was not a typical characteristic of subprime mortgages?

A)low down payments

B)loans to borrowers with poor credit histories

C)limited incomes with which to make loan payments

D)fixed interest rates

A)low down payments

B)loans to borrowers with poor credit histories

C)limited incomes with which to make loan payments

D)fixed interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

28

The Fed's loan that effectively nationalized AIG was approved by Congress.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

29

A bank would be considered insolvent when the value of its liabilities exceed its

A)assets.

B)required reserves.

C)actual reserves.

D)net worth.

A)assets.

B)required reserves.

C)actual reserves.

D)net worth.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

30

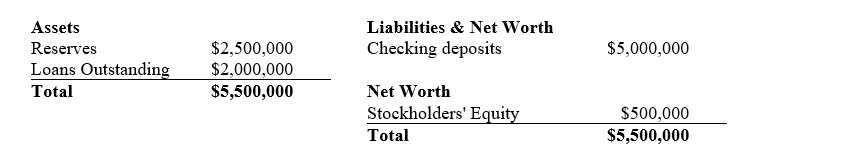

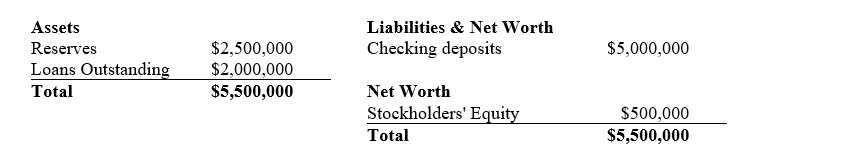

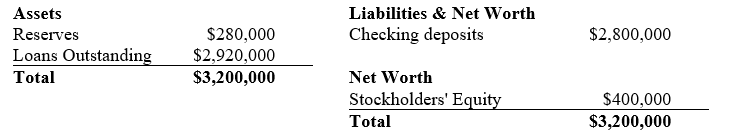

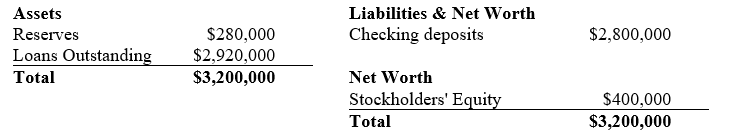

If the reserve ratio was 10% for the bank with the balance sheet listed below, then this bank is being

A)aggressive as indicated by a small amount of excess reserves.

B)aggressive as indicated by a large amount of excess reserves.

C)cautious as indicated by a small amount of excess reserves.

D)cautious as indicated by a large amount of excess reserves.

A)aggressive as indicated by a small amount of excess reserves.

B)aggressive as indicated by a large amount of excess reserves.

C)cautious as indicated by a small amount of excess reserves.

D)cautious as indicated by a large amount of excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

31

When the housing bubble burst, prices fell particularly severely in all of these states except:

A)Arizona.

B)California.

C)Nevada.

D)Florida

E)Prices fell severely in all of the above states.

A)Arizona.

B)California.

C)Nevada.

D)Florida

E)Prices fell severely in all of the above states.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

32

What is the leverage implied by the bank balance sheet listed below?

A)2-to-1

B)7-to-1

C)8-to-1

D)10-to-1

A)2-to-1

B)7-to-1

C)8-to-1

D)10-to-1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

33

If a 10-year Treasury bond pays 1.5% and a 10-year corporate bond pays 6.0%, what is the interest rate spread on this particular corporate bond?

A)4.0%

B)4.5%

C)7.5%

D)9.0%

A)4.0%

B)4.5%

C)7.5%

D)9.0%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

34

A bubble is best defined as

A)an increase in the price of an asset resulting from fundamentals causes.

B)an increase in the price of an asset resulting from factors other than fundamentals causes.

C)a decrease in the price of an asset resulting from fundamentals causes.

D)a decrease in the price of an asset resulting from factors other than fundamentals causes.

A)an increase in the price of an asset resulting from fundamentals causes.

B)an increase in the price of an asset resulting from factors other than fundamentals causes.

C)a decrease in the price of an asset resulting from fundamentals causes.

D)a decrease in the price of an asset resulting from factors other than fundamentals causes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

35

If a 10-year Treasury bond pays 3.1% and a 10-year corporate bond pays 7.4%, what is the interest rate spread on this particular corporate bond?

A)4.3%

B)7.4%

C)10.5%

D)22.9%

A)4.3%

B)7.4%

C)10.5%

D)22.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

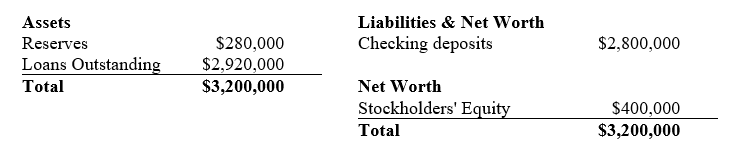

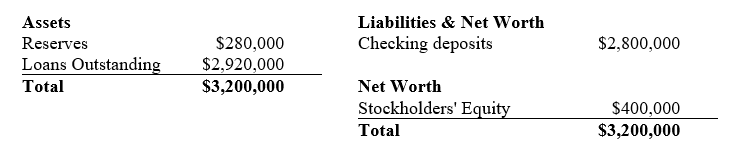

36

Assuming that the reserve ratio is 10%, what amount of excess reserves are held by with the bank balance sheet listed below?

A)zero

B)$240,000

C)$280,000

D)$320,000

A)zero

B)$240,000

C)$280,000

D)$320,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

37

Assume that Michaela purchases $12,000 worth of a stock.To do so she uses $2,000 of her own money and borrows the remaining $10,000 at an 8.0% interest rate.If the stock's value increases by 20% in one year and she sells the stock at that time, what is her rate of return?

A)13%

B)16%

C)20%

D)80%

A)13%

B)16%

C)20%

D)80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

38

Expansionary monetary policy is essentially finished once the Fed reduces the federal funds rate to zero.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

39

The recession of 2007-2009 was the most severe economic downturn in the U.S.since the

A)1930s.

B)1950s.

C)1970s.

D)1980s.

A)1930s.

B)1950s.

C)1970s.

D)1980s.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

40

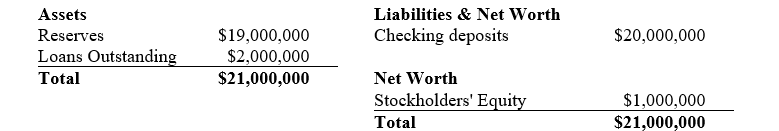

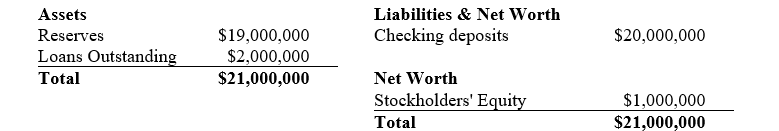

What is the leverage implied by the bank balance sheet listed below?

A)10-to-1

B)12-to-1

C)20-to-1

D)21-to-1

A)10-to-1

B)12-to-1

C)20-to-1

D)21-to-1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

41

What was the lowest federal funds rate target the Fed set in response to the financial crisis?

A)0%

B)1.8%

C)2.0%

D)2.2%

A)0%

B)1.8%

C)2.0%

D)2.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

42

As a result of the Great Recession, job growth did not resume until

A)September 2008

B)March 2009

C)September 2009

D)March 2010

A)September 2008

B)March 2009

C)September 2009

D)March 2010

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

43

As a result of the Great Recession, most financial markets hit bottom around

A)September 2008

B)March 2009

C)September 2009

D)March 2010

A)September 2008

B)March 2009

C)September 2009

D)March 2010

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

44

As a result of Lehman's collapse, real GDP first began to fall in

A)the fourth quarter of 2007.

B)the second quarter of 2008.

C)the third quarter of 2008.

D)the first quarter of 2009.

A)the fourth quarter of 2007.

B)the second quarter of 2008.

C)the third quarter of 2008.

D)the first quarter of 2009.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

45

The intended use of TARP funds was to

A)support the FDIC.

B)increase consumers' disposable income.

C)fund "shovel-ready" projects.

D)purchase unwanted securities.

A)support the FDIC.

B)increase consumers' disposable income.

C)fund "shovel-ready" projects.

D)purchase unwanted securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

46

In computing GDP, new home construction adds to

A)consumption.

B)investment.

C)government spending.

D)net exports.

A)consumption.

B)investment.

C)government spending.

D)net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

47

The Federal Reserve stepped in to help

A)Bear Stearns but not Lehman Brothers.

B)Lehman Brothers but not Bear Stearns.

C)both Bear Stearns and Lehman Brothers.

D)neither Bear Stearns nor Lehman Brothers.

A)Bear Stearns but not Lehman Brothers.

B)Lehman Brothers but not Bear Stearns.

C)both Bear Stearns and Lehman Brothers.

D)neither Bear Stearns nor Lehman Brothers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

48

The Lehman Brothers bankruptcy triggered a financial panic that featured

A)an increase in Treasury interest rates and an increase in most other interest rates.

B)an increase in Treasury interest rates and a decrease in most other interest rates.

C)a decrease in Treasury interest rates and an increase in most other interest rates.

D)a decrease in Treasury interest rates and a decrease in most other interest rates.

A)an increase in Treasury interest rates and an increase in most other interest rates.

B)an increase in Treasury interest rates and a decrease in most other interest rates.

C)a decrease in Treasury interest rates and an increase in most other interest rates.

D)a decrease in Treasury interest rates and a decrease in most other interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

49

In 2007, which U.S.firm showed the first indication of significant problems in the financial sector?

A)AIG

B)Bear Stearns

C)J.P.Morgan Chase

D)Lehman Brothers

A)AIG

B)Bear Stearns

C)J.P.Morgan Chase

D)Lehman Brothers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following was not a factor that contributed to the subprime mortgage crisis?

A)false security derived from FDIC insurance on mortgage loans

B)lower down payments

C)households devoting 25% or more of their income to mortgage payments

D)lending to households with adverse credit ratings

A)false security derived from FDIC insurance on mortgage loans

B)lower down payments

C)households devoting 25% or more of their income to mortgage payments

D)lending to households with adverse credit ratings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

51

The 2009 fiscal stimulus bill represented approximately

A)5.5% of GDP and was designed to close the expansionary gap.

B)5.5% of GDP and was designed to close the recessionary gap.

C)7.8% of GDP and was designed to close the expansionary gap.

D)7.8% of GDP and was designed to close the recessionary gap.

A)5.5% of GDP and was designed to close the expansionary gap.

B)5.5% of GDP and was designed to close the recessionary gap.

C)7.8% of GDP and was designed to close the expansionary gap.

D)7.8% of GDP and was designed to close the recessionary gap.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following was not a lesson from the 2007-2009 financial crisis?

A)Financial regulations were too "light" prior to the crisis.

B)Excessive complexity made the financial system more fragile and dangerous.

C)Both monetary policy and fiscal policy are needed in order for the economy to recover.

D)Regulatory failures were based primarily on poor job performance.

A)Financial regulations were too "light" prior to the crisis.

B)Excessive complexity made the financial system more fragile and dangerous.

C)Both monetary policy and fiscal policy are needed in order for the economy to recover.

D)Regulatory failures were based primarily on poor job performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which elements of GDP were affected by the financial crisis and the lack of available credit?

A)consumption and business investment only

B)consumption and government spending only

C)consumption, business investment and government spending only

D)consumption, business investment, government spending and imports/exports

A)consumption and business investment only

B)consumption and government spending only

C)consumption, business investment and government spending only

D)consumption, business investment, government spending and imports/exports

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

54

In 2008, the Fed utilized expansionary monetary policy which was made

A)more effective as banks held more excess reserves.

B)less effective as banks held more excess reserves.

C)more effective as banks held less excess reserves.

D)less effective as banks held less excess reserves.

A)more effective as banks held more excess reserves.

B)less effective as banks held more excess reserves.

C)more effective as banks held less excess reserves.

D)less effective as banks held less excess reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

55

What amount of money was appropriated by Congress for the Troubled Asset Relief Program?

A)$225 billion

B)$252 billion

C)$700 billion

D)$787 billion

A)$225 billion

B)$252 billion

C)$700 billion

D)$787 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following are not valid arguments against the effectiveness of the fiscal stimulus bill?

A)Employment continued to fall into early 2010.

B)Without stimulus recessions come to an end naturally.

C)State and local government spending increased.

D)Monetary policy played a large role in stimulating the economy.

A)Employment continued to fall into early 2010.

B)Without stimulus recessions come to an end naturally.

C)State and local government spending increased.

D)Monetary policy played a large role in stimulating the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following are accurate arguments suggesting that the fiscal stimulus did work?

A)Real GDP growth moved from negative to positive in 2009.

B)Employment increased in 2009.

C)The economy has natural self-correcting mechanisms.

D)The return on bailout assets reduced the deficit.

A)Real GDP growth moved from negative to positive in 2009.

B)Employment increased in 2009.

C)The economy has natural self-correcting mechanisms.

D)The return on bailout assets reduced the deficit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

58

Mortgage-backed securities became a significant issue becauseI.housing prices fell across all regions.II.these securities were not as widely distributed as previously thought.

A)I above only

B)II above only

C)both I and II above

D)neither I nor II above

A)I above only

B)II above only

C)both I and II above

D)neither I nor II above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following was a lesson from the 2007-2009 financial crisis?

A)The financial system needed more leverage in order to operate.

B)The job of stabilizing the economy should be assigned exclusively to monetary policy.

C)Monetary policy is finished once the Fed reduces the federal funds rate to zero.

D)The business cycle still exists.

A)The financial system needed more leverage in order to operate.

B)The job of stabilizing the economy should be assigned exclusively to monetary policy.

C)Monetary policy is finished once the Fed reduces the federal funds rate to zero.

D)The business cycle still exists.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

60

What amount of money was appropriated by Congress for fiscal stimulus bill of 2009?

A)$225 billion

B)$252 billion

C)$700 billion

D)$787 billion

A)$225 billion

B)$252 billion

C)$700 billion

D)$787 billion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following was not a lesson from the 2007-2009 financial crisis?

A)Regulatory failures were the result of weaknesses across the regulatory structure.

B)The financial system operated with too much leverage.

C)The business cycle no longer applies to economic analysis.

D)Monetary policy alone may not be sufficient to stabilize aggregate demand.

A)Regulatory failures were the result of weaknesses across the regulatory structure.

B)The financial system operated with too much leverage.

C)The business cycle no longer applies to economic analysis.

D)Monetary policy alone may not be sufficient to stabilize aggregate demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

62

When the housing price bubble burst, there were some obvious effects on the economy, and some that were not so obvious.Explain these.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

63

Why did observers at first believe that the damage from the impending subprime mortgage crisis would be too small to cause a recession?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

64

Because the U.S.economy failed to snap back from a mild recession in 2001, the Fed pushed the federal funds rate down to 1%.What effect did this have on the economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

65

Did President Obama's $787 billion fiscal stimulus package of early 2009 work?

Name several facts in support of the proposition that it did.Also, list the arguments of the skeptics.

Name several facts in support of the proposition that it did.Also, list the arguments of the skeptics.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck

66

Name some important lessons learned from the financial crisis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 66 في هذه المجموعة.

فتح الحزمة

k this deck