Deck 9: Current Liabilities and Long-Term Debt

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/90

العب

ملء الشاشة (f)

Deck 9: Current Liabilities and Long-Term Debt

1

An obligation resulting from an event that has not yet occurred is an example of a(n) __________.

contingent liability

2

Accrued liabilities, such as interest payable, would be considered a(n) __________.

known liability

3

A liability, such as warranties payable, would be an example of a(n) __________.

estimated liability

4

Which of the following would be considered a known liability?

A) Federal income tax payable

B) Warranties payable

C) Pending litigation

D) Notes payable

E) Both federal income tax payable and notes payable

A) Federal income tax payable

B) Warranties payable

C) Pending litigation

D) Notes payable

E) Both federal income tax payable and notes payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

5

The majority of a company's liabilities are estimated liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

6

A company receives a note payable for $3,500 at 9% for 45 days. How much interest (to the nearest cent) will the customer owe using a 360-day year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

7

Accounts payable would be an example of a(n) __________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company receives a note payable for $5,000 at 10% for 50 days. How much interest (to the nearest cent) will the customer owe?

A) $10.00

B) $500.00

C) $68.49

D) $1.36

E) $86.49

A) $10.00

B) $500.00

C) $68.49

D) $1.36

E) $86.49

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

9

A contingent liability arises because of a past event, but is dependent upon a future event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

10

Journalize the following transactions for Alpha Company:

May 13 Purchased inventory on account from ABC for $4,000.

May 22 Purchased inventory on account from Sara for $2,500.

May 27 Paid off the account from ABC.

May 13 Purchased inventory on account from ABC for $4,000.

May 22 Purchased inventory on account from Sara for $2,500.

May 27 Paid off the account from ABC.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following would be considered an estimated liability?

A) Notes payable

B) Warranties payable

C) Pending litigation

D) Sales tax payable

E) Federal tax payable

A) Notes payable

B) Warranties payable

C) Pending litigation

D) Sales tax payable

E) Federal tax payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following would be considered a contingent liability?

A) Federal income tax payable

B) Warranties payable

C) Pending litigation

D) Contingency payable

E) Sales tax payable

A) Federal income tax payable

B) Warranties payable

C) Pending litigation

D) Contingency payable

E) Sales tax payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

13

Unearned revenues are typically classified as current liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

14

The largest portion of accounts payable for most merchandising companies is related to the purchase of inventory on account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a liability is not properly classified, it will have an effect on the:

A) quick ratio.

B) current ratio.

C) both the quick and current ratio.

D) total dollars of liabilities.

E) total dollars of current assets.

A) quick ratio.

B) current ratio.

C) both the quick and current ratio.

D) total dollars of liabilities.

E) total dollars of current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

16

Does the amount of an obligation need to be known in order for a liability to exist? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

17

A past transaction or event must have occurred for a __________ to exist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

18

Identify the general ledger accounts that would be debited and credited when making a payment on account, such as a telephone bill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

19

What is a major difference between an account payable and a note payable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

20

Notes payable would be an example of a known liability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

21

A mortgage is a secured note because the building serves as collateral.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

22

There are times when contingent liabilities are never recorded.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

23

Tim Hortons is a public company and prepares its financial statements in accordance to IFRS. The company has a contingent liability estimated at $232,000. The likelihood of the obligation occurring is remote or < 5%. What is the appropriate accounting treatment for the company?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

24

A mortgage is a special type of long-term note payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

25

Bonds are interest-bearing notes that are issued to a single lender.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

26

When the likelihood of an obligation occurring is virtually certain, what is the accounting treatment under IFRS and Canadian ASPE?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

27

Record the following sales transactions for Meranda Company:

Oct 3 Had sales of $3,500 in cash and $6,000 in credit. The harmonized

sales tax (HST) is 13%.

Oct 8 Had cash sales of $12,000 plus 13% HST.

Nov 15 Paid HST for Oct. 3 and Oct. 8 sales.

Nov 30 Received customer payment for Oct. 3 outstanding accounts receivable.

Oct 3 Had sales of $3,500 in cash and $6,000 in credit. The harmonized

sales tax (HST) is 13%.

Oct 8 Had cash sales of $12,000 plus 13% HST.

Nov 15 Paid HST for Oct. 3 and Oct. 8 sales.

Nov 30 Received customer payment for Oct. 3 outstanding accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

28

Journalize the following transactions:

A magazine sells a 12-month magazine subscription for $60 per year. The company has collected cash for 1,200 subscriptions. Record the journal entries for:

Receipt of cash for the subscriptions (Feb 13).

Amount of revenue earned after mailing out 7 months of magazines (Sept 13).

A magazine sells a 12-month magazine subscription for $60 per year. The company has collected cash for 1,200 subscriptions. Record the journal entries for:

Receipt of cash for the subscriptions (Feb 13).

Amount of revenue earned after mailing out 7 months of magazines (Sept 13).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

29

Which of the following would be considered a contingent liability?

A) Sales tax obligation

B) Mortgage obligation

C) Accounts payable obligation

D) Pending legal action

E) Notes obligation

A) Sales tax obligation

B) Mortgage obligation

C) Accounts payable obligation

D) Pending legal action

E) Notes obligation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

30

Are estimated liabilities generally classified as current or long-term liabilities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

31

Even liabilities of unknown amounts are required to be placed on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

32

Bonds payable are supported by a promissory note.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

33

Under IFRS, a __________ is a liability that has an uncertain timing or an uncertain amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

34

Amanda Industries, a private company, has a contingent liability estimated at $125,000 with a 70%-95% likelihood of the obligation occurring What is the appropriate accounting treatment for the company?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

35

A warranty is an example of a(n):

A) contingent liability.

B) known liability.

C) estimated liability.

D) settled liability.

E) unknown obligation.

A) contingent liability.

B) known liability.

C) estimated liability.

D) settled liability.

E) unknown obligation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

36

Contingent liabilities represent actual and not potential obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

37

When the likelihood of an obligation occurring is possible, under Canadian ASPE what is the accounting treatment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

38

A person or business who pays another party for the use of an asset is a lessee.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

39

Casey Company purchases inventory for $100,000, paying $40,000 in cash and signing a 3-year, 5% note payable for the remainder. The company has $90,000 sales in the month of March and estimates that 5% of product sales will require warranty repairs. Journalize the transactions below and identify which accounts are known liabilities and which are estimated liabilities.

Inventory purchase

Sales for March (25% on account, 75% in cash).

Estimated dollars for warranties.

Inventory purchase

Sales for March (25% on account, 75% in cash).

Estimated dollars for warranties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

40

Disclosure is required under IFRS when the likelihood of the outcome (measurement) is:

A) virtually certain: > 95%.

B) possible: 5% - 50%.

C) remote: < 5%.

D) probable: 50% - 95%.

E) likely: 70% - 95%.

A) virtually certain: > 95%.

B) possible: 5% - 50%.

C) remote: < 5%.

D) probable: 50% - 95%.

E) likely: 70% - 95%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

41

The rate of interest that is printed on the bond is called the __________ rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

42

The rate of interest at which investors are willing to pay for similar bonds of equal risk at the current time is the __________ rate of interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

43

A $300,000 issue of bonds that sold at 105 will cost __________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

44

A lessor is a person who gives/ grants a lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

45

A $10,000 bond issue with a stated rate of interest of 7%, when the market rate of interest is 8%, means that the bond will be sold for:

A) $10,000.

B) $10,800.

C) less than $10,000.

D) the maturity value.

E) $10,700.

A) $10,000.

B) $10,800.

C) less than $10,000.

D) the maturity value.

E) $10,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

46

If a bond's stated rate of interest is equal to the market rate of interest, the bond will be issued at __________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

47

The amount that a borrower must pay back to the bondholders on the maturity date is the __________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

48

Bonds that are backed by collateral are __________ bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

49

If a $6,000, 10% , 10-year bond was issued at 104 on October 1, 2011, how much interest will accrue on December 31 if interest payments are made annually?

A) None

B) $104

C) $150

D) $500

E) $105

A) None

B) $104

C) $150

D) $500

E) $105

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

50

Rental agreements are typically:

A) capital leases.

B) operating leases.

C) expense leases.

D) revenue leases.

E) financial leases.

A) capital leases.

B) operating leases.

C) expense leases.

D) revenue leases.

E) financial leases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

51

On October 31, 2011, Isaiah Industries recorded its semi-annual bond interest expense, which contained a credit to discount on bonds payable of $1,200. The adjusting entry on December 31, 2011 will show a credit to discount on bonds payable of:

A) $1,200.

B) $800.

C) $600.

D) $400.

E) $200.

A) $1,200.

B) $800.

C) $600.

D) $400.

E) $200.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

52

Debenture bonds are the same as __________ bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

53

A $25,000 bond issue with a stated interest rate of 5%, when the market rate of interest is 4%, means that the bond will sell for:

A) $25,000.

B) more than $25,000.

C) $24,000

D) $24,750.

E) $23,750.

A) $25,000.

B) more than $25,000.

C) $24,000

D) $24,750.

E) $23,750.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

54

Leases that are treated as financed purchases are called:

A) capital leases.

B) operating leases.

C) expense leases.

D) revenue leases.

E) non-financial leases.

A) capital leases.

B) operating leases.

C) expense leases.

D) revenue leases.

E) non-financial leases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is NOT a requirement of a capital lease?

A) There is no transfer of ownership at the end of the lease.

B) The agreement has a bargain purchase option.

C) The lease must cover at least 75% of asset's useful life.

D) The present value of lease payments must be 90% or more of market value of asset.

E) The present value of lease payments equals substantially all of the fair value of the leased property at the inception of the lease.

A) There is no transfer of ownership at the end of the lease.

B) The agreement has a bargain purchase option.

C) The lease must cover at least 75% of asset's useful life.

D) The present value of lease payments must be 90% or more of market value of asset.

E) The present value of lease payments equals substantially all of the fair value of the leased property at the inception of the lease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

56

Operating lease payments are expenses to the lessee and revenue to the lessor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

57

Bonds that can be exchanged for stock are called __________ bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

58

If the bond's stated rate of interest is greater than the market rate of interest, the bond will be issued at __________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

59

If the market rate of interest is greater than the bond's stated rate of interest, the bond will be issued at __________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

60

A $150,000 issue of bonds that sold at 93.8 will cost __________.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

61

Journalize the following annual bond interest payments on June 30:

June 30 a. 10-year 8% $250,000 bond that sold for $300,000.

June 30 b. 5-year 5% $300,000 bond that sold for $280,000.

June 30 c. 5-year 10% $500,000 bond that sold for $500,000.

June 30 a. 10-year 8% $250,000 bond that sold for $300,000.

June 30 b. 5-year 5% $300,000 bond that sold for $280,000.

June 30 c. 5-year 10% $500,000 bond that sold for $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

62

Having liabilities classified incorrectly will have a big impact on the company's current and quick ratios.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

63

John Company has current assets of $59,000; long term assets of $129,000; current liabilities of $31,000, and long-term liabilities of $83,000. Calculate John Company's current ratio and debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

64

Journalize the following semi-annual bond interest payments on June 30:

June 30 a. 10-year 8% $250,000 bond that sold for $300,000.

June 30 b. 5-year 5% $300,000 bond that sold for $280,000.

June 30 c. 15-year 10% $500,000 bond that sold for $500,000.

June 30 a. 10-year 8% $250,000 bond that sold for $300,000.

June 30 b. 5-year 5% $300,000 bond that sold for $280,000.

June 30 c. 15-year 10% $500,000 bond that sold for $500,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

65

According to the text, which current liability is generally listed first?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

66

Using the information below, write the journal entry to record the payment of the bond on the maturity date.

A $400,000 issue of bonds that sold for $363,000 matures on August 1, 2015.

A $400,000 issue of bonds that sold for $363,000 matures on August 1, 2015.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

67

Using the information below, write the journal entry to record the payment of the bond on the maturity date.

A $250,000 issue of bonds that sold for $275,000 matures on June 25, 2020.

A $250,000 issue of bonds that sold for $275,000 matures on June 25, 2020.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

68

Journalize the following bond issues:

June 12 Issued $500,000 at 98.

June 18 Issued $250,000 at 106.

June 22 Issued $350,000 at 100.

June 12 Issued $500,000 at 98.

June 18 Issued $250,000 at 106.

June 22 Issued $350,000 at 100.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

69

Bill Company had total assets of $560,000; total liabilities of $250,000; and total shareholders' equity of $310,000. Bill Company's debt ratio is:

A) 55.4%.

B) 80.6%.

C) 44.6%.

D) 28.7%.

E) 66.4%.

A) 55.4%.

B) 80.6%.

C) 44.6%.

D) 28.7%.

E) 66.4%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

70

Jewell Company has current assets of $56,000; long-term assets of $135,000; current liabilities of $44,000; and long-term liabilities of $90,000. Jewell Company's debt ratio is:

A) 127.3%.

B) 78.6%.

C) 239.3%.

D) 70.2%.

E) 20.7%.

A) 127.3%.

B) 78.6%.

C) 239.3%.

D) 70.2%.

E) 20.7%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

71

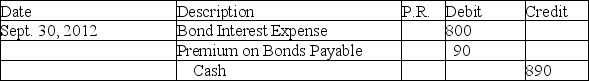

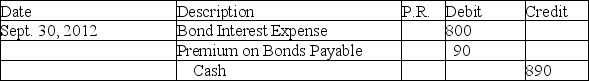

The September 30, 2012 semi-annual interest entry for Casey Company's bond interest expense was:

Journalize the December 31, 2012 adjusting entry.

Journalize the December 31, 2012 adjusting entry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

72

Both the formulas for current ratio and debt ratio use current liabilities in the computation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

73

Amanda Industries had total assets of $600,000; total liabilities of $175,000; and total shareholders' equity of $425,000. Calculate Amanda Industries' debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

74

Mackey Company has a 5-year mortgage for $100,000. In the first year of the mortgage, Mackey will report this liability as a:

A) current liability of $100,000.

B) long-term liability of $100,000.

C) current liability of $80,000 and a long-term liability of $20,000.

D) current liability of $20,000 and a long-term liability of $80,000.

E) current liability of $80,000 and a long-term debt of $20,000.

A) current liability of $100,000.

B) long-term liability of $100,000.

C) current liability of $80,000 and a long-term liability of $20,000.

D) current liability of $20,000 and a long-term liability of $80,000.

E) current liability of $80,000 and a long-term debt of $20,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

75

Is a high debt ratio a bad thing? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

76

Casey Industries issues a $250,000, 6%, 20-year mortgage note to finance the purchase of a new building on Jan. 1, 2012. Payments of $9,375 are made on June 30 and December 31 of each year. Prepare the amortization schedule for the first 5 payments of this mortgage note. (Round amounts to nearest dollar when necessary.)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

77

Journalize the following bond issues:

Dec. 17 $175,000 at 100.

Dec. 28 $425,000 at 96.7.

Dec. 30 $710,000 at 103.4.

Dec. 17 $175,000 at 100.

Dec. 28 $425,000 at 96.7.

Dec. 30 $710,000 at 103.4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

78

Journalize the following annual bond interest payments on Apr 30:

April 30 a. 10-year 7% $250,000 bond that sold for $250,000.

April 30 b. 8-year 9% $450,000 bond that sold for $426,000.

April 30 c. 15-year 10% $500,000 bond that sold for $410,000.

April 30 a. 10-year 7% $250,000 bond that sold for $250,000.

April 30 b. 8-year 9% $450,000 bond that sold for $426,000.

April 30 c. 15-year 10% $500,000 bond that sold for $410,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

79

What effect will there be on reported liabilities and net income if a company does NOT accrue warranty expense?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck

80

The percentage of total assets of a company that it would take to pay off all of the company's liabilities is called the debt ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 90 في هذه المجموعة.

فتح الحزمة

k this deck