Deck 7: Cash and Receivables

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/165

العب

ملء الشاشة (f)

Deck 7: Cash and Receivables

1

Separation of duties is essential for internal control over cash receipts and cash payments.

True

2

Cash is one of the least vulnerable assets that a business has.

False

3

The cash register provides control over the cash receipts for a retail business.

True

4

In a bank reconciliation, the bank balance and the book balance must be adjusted to be reconciled.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

5

Bank reconciliations are an important part of internal control that should be performed daily.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

6

A bank statement shows the:

A)ending book balance as of a specific date.

B)ending bank balance as of a specific date.

C)reconciled balance as of a specific date.

D)book errors as of a specific date.

A)ending book balance as of a specific date.

B)ending bank balance as of a specific date.

C)reconciled balance as of a specific date.

D)book errors as of a specific date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

7

As part of the procedure to properly control cash payments received in the mail, after the mailroom employee opens the cash receipts, the remittance advices go to the:

A)Controller.

B)accounting department.

C)Treasurer.

D)bank.

A)Controller.

B)accounting department.

C)Treasurer.

D)bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

8

Once the merchandise is received from the supplier, the company:

A)issues an invoice.

B)issues a check.

C)completes a purchase order.

D)completes a receiving report.

A)issues an invoice.

B)issues a check.

C)completes a purchase order.

D)completes a receiving report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

9

Good internal control policies dictate that the purchasing agent should prepare the:

A)checks for payment.

B)purchase order.

C)receiving report.

D)purchase order and receiving report.

A)checks for payment.

B)purchase order.

C)receiving report.

D)purchase order and receiving report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

10

To prevent a second payment for an invoice, the check signer should ________ the documents relating to the transaction.

A)deface

B)sign

C)file

D)throw away

A)deface

B)sign

C)file

D)throw away

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

11

Differences between when a company records a transaction and when the bank records the same transaction are called "timing" differences.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

12

Before signing a check to pay for a purchase, the ________ should examine the documents supporting the purchase.

A)Controller

B)purchasing agent

C)Treasurer

D)manager

A)Controller

B)purchasing agent

C)Treasurer

D)manager

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

13

Online banking should NOT be used to reconcile the bank account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

14

Cash receipts should never be deposited more than once a business day.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

15

In the last step of the procedure to properly control cash payments received in the mail, the ________ verifies the amount of the deposit and the total amount posted to the cash account.

A)bank

B)accounting department

C)Treasurer

D)Controller

A)bank

B)accounting department

C)Treasurer

D)Controller

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

16

If possible, the bank reconciler should have no other duties relating to cash transactions in the business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

17

The process of acquiring merchandise from a supplier begins with the:

A)check for payment.

B)receiving report.

C)purchase order.

D)invoice.

A)check for payment.

B)receiving report.

C)purchase order.

D)invoice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

18

Streamlined payment procedures now involve the use of electronic data interchange and electronic funds transfer between and among suppliers and merchandisers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

19

Which of the following situations would cause Danio Corp. to have an NSF check amount on its bank reconciliation?

A)Danio writes a check to a supplier that bounces.

B)A customer writes a check to pay Danio and that check bounces.

C)Both situations A and B will cause Danio to have an NSF check on its' bank reconciliation.

D)Neither situation A nor B will cause Danio to have an NSF check on its' bank reconciliation.

A)Danio writes a check to a supplier that bounces.

B)A customer writes a check to pay Danio and that check bounces.

C)Both situations A and B will cause Danio to have an NSF check on its' bank reconciliation.

D)Neither situation A nor B will cause Danio to have an NSF check on its' bank reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

20

As part of the procedure to properly control cash payments received in the mail, after the mailroom employee opens the cash receipts, the checks then go to the:

A)bank.

B)Controller.

C)Treasurer.

D)accounting department.

A)bank.

B)Controller.

C)Treasurer.

D)accounting department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

21

Pirates Party Supply deposited a check for $695, but it was recorded on their books as a check for $536. This error of $159 would be:

A)added to the bank balance.

B)added to Pirate's book balance.

C)subtracted from the bank balance.

D)subtracted from Pirate's book balance.

A)added to the bank balance.

B)added to Pirate's book balance.

C)subtracted from the bank balance.

D)subtracted from Pirate's book balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

22

Cash equivalents may include money orders and traveler's checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

23

Cash equivalents are:

A)very liquid and carry high risk.

B)not liquid and carry little risk.

C)very liquid and carry little risk.

D)not liquid and carry high risk.

A)very liquid and carry high risk.

B)not liquid and carry little risk.

C)very liquid and carry little risk.

D)not liquid and carry high risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

24

The bank recorded a $49 deposit as $66. On a bank reconciliation this error would be corrected by:

A)subtracting $17 from the bank balance.

B)adding $17 to the bank balance.

C)adding $17 to the book balance.

D)subtracting $17 from the book balance.

A)subtracting $17 from the bank balance.

B)adding $17 to the bank balance.

C)adding $17 to the book balance.

D)subtracting $17 from the book balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

25

Cash is listed first on the Balance Sheet because it is the least liquid asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

26

Each cash account is listed separately on the Balance Sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

27

A $575 collection on a note from a customer was reflected on Ronaldo Co's bank statement. When doing the bank reconciliation, Ronaldo Co. should:

A)add $575 to the bank balance.

B)subtract $575 from the bank balance.

C)add $575 to their book balance.

D)subtract $575 from their book balance.

A)add $575 to the bank balance.

B)subtract $575 from the bank balance.

C)add $575 to their book balance.

D)subtract $575 from their book balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

28

Leo's Leather Shoppe has a checking account that earns interest. The current bank statement shows interest earned of $22.14. This amount should be:

A)added to Leo's book balance.

B)subtracted from Leo's book balance.

C)ignored, as the bank has added it to Leo's book balance.

D)subtracted from Leo's bank balance.

A)added to Leo's book balance.

B)subtracted from Leo's book balance.

C)ignored, as the bank has added it to Leo's book balance.

D)subtracted from Leo's bank balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

29

Northwest Plumbing's bank statement shows a bank balance of $43,667. The statement shows a bank service charge of $95. Northwest Plumbing's book balance shows outstanding checks of $5,292 and deposits in transit of $9,325. The adjusted balance on the bank side of the reconciliation would be:

A)$43,667.

B)$43,572.

C)$39,634.

D)$47,700.

A)$43,667.

B)$43,572.

C)$39,634.

D)$47,700.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

30

Cash consists of anything that a bank will take as a deposit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

31

Deposits in transit are:

A)subtracted from the book balance.

B)added to the book balance.

C)subtracted from the bank balance.

D)added to the bank balance.

A)subtracted from the book balance.

B)added to the book balance.

C)subtracted from the bank balance.

D)added to the bank balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

32

After a bank reconciliation is prepared, journal entries must be made for ______ on the book side of the reconciliation and for _______ on the bank side of the reconciliation.

A)no items; all items

B)all items; service charges

C)receivable accounts; all items

D)all items; no items

A)no items; all items

B)all items; service charges

C)receivable accounts; all items

D)all items; no items

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following would NOT be considered cash?

A)Currency

B)Money market funds

C)Money orders

D)Checking accounts

A)Currency

B)Money market funds

C)Money orders

D)Checking accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following would NOT be considered a cash equivalent?

A)Money market funds

B)Foreign currency

C)90-day treasury notes

D)2 month certificates of deposits

A)Money market funds

B)Foreign currency

C)90-day treasury notes

D)2 month certificates of deposits

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

35

Ninety-day U.S. Treasury notes are considered cash equivalents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

36

On a bank reconciliation, outstanding checks are:

A)added to the book balance.

B)added to the bank balance.

C)subtracted from the book balance.

D)subtracted from the bank balance.

A)added to the book balance.

B)added to the bank balance.

C)subtracted from the book balance.

D)subtracted from the bank balance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

37

Illusions, Inc. deposited $1,000 into its bank account at the end of the month, but the bank statement does not show the deposit. This $1,000 is an example of a(n):

A)outstanding check.

B)bank error.

C)bank collection.

D)deposit in transit.

A)outstanding check.

B)bank error.

C)bank collection.

D)deposit in transit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

38

Cesario Auto's bank statement shows a bank balance of $43,567. The statement shows a bank service charge of $20 and a note collection of $840 on Cesario Auto's behalf. Cesario Auto's book balance should be adjusted by a total of:

A)+$860.

B)+$840.

C)+$820.

D)-$820.

A)+$860.

B)+$840.

C)+$820.

D)-$820.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

39

During a bank reconciliation, Bach Inc. discovered a NSF check from their customer, Larry Bobble for $70. The journal entry required to update the cash balance would be:

A)Debit cash, credit Accounts Receivable

B)Debit Accounts Receivable, credit Cash

C)Debit Accounts Receivable - L. Bobble, credit Cash

D)No journal entry is required.

A)Debit cash, credit Accounts Receivable

B)Debit Accounts Receivable, credit Cash

C)Debit Accounts Receivable - L. Bobble, credit Cash

D)No journal entry is required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following is NOT true concerning NSF checks:

A)NSF checks represent customer checks that the business previously deposited but have turned out to be worthless.

B)The amount of the NSF check will need to be subtracted from the book balance.

C)The amount of the NSF check will need to be added to the book balance.

D)NSF stands for nonsufficient funds.

A)NSF checks represent customer checks that the business previously deposited but have turned out to be worthless.

B)The amount of the NSF check will need to be subtracted from the book balance.

C)The amount of the NSF check will need to be added to the book balance.

D)NSF stands for nonsufficient funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

41

The simplest way to account for an uncollectible account is to use the allowance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

42

A company may have receivables such as loans to employees and interest receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

43

U.S. Treasury notes must mature within ________ days of the Balance Sheet date in order to be considered cash equivalents.

A) 60

B) 90

C)120

D)180

A) 60

B) 90

C)120

D)180

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

44

An example of good internal control over Accounts Receivable is:

A)the employee who handles the daily cash receipts also records Accounts Receivable transactions.

B)the employee who opens the mail is also in charge of recording Accounts Receivable.

C)there are separate employees for cash-handling and cash-accounting duties.

D)All of the above are examples of good internal controls.

A)the employee who handles the daily cash receipts also records Accounts Receivable transactions.

B)the employee who opens the mail is also in charge of recording Accounts Receivable.

C)there are separate employees for cash-handling and cash-accounting duties.

D)All of the above are examples of good internal controls.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

45

Accounts Receivable are more formal and usually longer in terms than notes receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

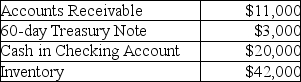

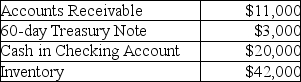

46

Given the following information from Mozart & Co, what would the current assets section of the balance sheet include?

A)Cash $23,000; Accounts Receivable $11,000; Inventory $42,000

B)Cash $20,000; Accounts Receivable$11,000; Inventory $42,000

C)Cash & Cash Equivalents $34,000; Inventory $42,000

D)Cash $20,000; Accounts Receivable $11,000

A)Cash $23,000; Accounts Receivable $11,000; Inventory $42,000

B)Cash $20,000; Accounts Receivable$11,000; Inventory $42,000

C)Cash & Cash Equivalents $34,000; Inventory $42,000

D)Cash $20,000; Accounts Receivable $11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following would be considered a cash equivalent?

A)Currency

B)Time deposits

C)Checks

D)Money orders

A)Currency

B)Time deposits

C)Checks

D)Money orders

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

48

Which of the following would indicate poor internal control over Accounts Receivable?

A)The person handling cash receipts passes the receipts to someone who enters them into Accounts Receivable.

B)The same person handling cash receipts also records the Accounts Receivable transactions.

C)The mailroom employees open the mail and give the cash receipts to another employee.

D)The person who handles Accounts Receivable would not write off accounts as uncollectible.

A)The person handling cash receipts passes the receipts to someone who enters them into Accounts Receivable.

B)The same person handling cash receipts also records the Accounts Receivable transactions.

C)The mailroom employees open the mail and give the cash receipts to another employee.

D)The person who handles Accounts Receivable would not write off accounts as uncollectible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

49

GAAP generally allows the direct write-off method for accounting for bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

50

Notes receivable generally include a charge for interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

51

Accounts Receivable are classified as Current Assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

52

A cost incurred by the seller when credit customers do not pay is called:

A)a write down.

B)bad debt expense.

C)accounts deceivable.

D)an unallowable account.

A)a write down.

B)bad debt expense.

C)accounts deceivable.

D)an unallowable account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

53

A fund that contains a small amount of cash and is used to pay for minor expenditures is known as:

A)the emergency fund.

B)the checking account.

C)the petty cash fund.

D)the cash account.

A)the emergency fund.

B)the checking account.

C)the petty cash fund.

D)the cash account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

54

When writing off an account using the direct write-off method, the journal entry would include a debit to Bad Debt Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

55

To ensure consistency, a good internal control policy would be to have the same person who grants credit be in charge of writing off bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

56

Cash on the Balance Sheet includes:

A)checks on hand.

B)traveler's checks.

C)petty cash.

D)all of the above.

A)checks on hand.

B)traveler's checks.

C)petty cash.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

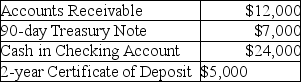

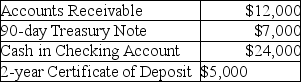

57

Given the following information from Leo Company, what would the current assets section of the balance sheet include?

A)Cash $36,000; Accounts Receivable $12,000

B)Cash & Cash Equivalents $48,000

C)Cash $31,000; Accounts Receivable $12,000

D)Cash $24,000; Cash Equivalents $12,000; Accounts Receivable $12,000

A)Cash $36,000; Accounts Receivable $12,000

B)Cash & Cash Equivalents $48,000

C)Cash $31,000; Accounts Receivable $12,000

D)Cash $24,000; Cash Equivalents $12,000; Accounts Receivable $12,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which is NOT a benefit to extending credit to customers?

A)Bad debt expenses

B)Increased revenues

C)Increased profits

D)Wider range of customers

A)Bad debt expenses

B)Increased revenues

C)Increased profits

D)Wider range of customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

59

The direct write-off method always adheres to the matching principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

60

Companies who sell on account expect:

A)the benefit to outweigh the cost.

B)to incur bad debt expense.

C)to reach a wider range of customers.

D)all of the above.

A)the benefit to outweigh the cost.

B)to incur bad debt expense.

C)to reach a wider range of customers.

D)all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

61

The journal entry to write off a customer's account under the allowance method is:

A)Bad Debt Expense, debit; Allowance for Uncollectible Accounts, credit.

B)not required.

C)Allowance for Uncollectible Accounts, debit; Accounts Receivable/customer name, credit.

D)Bad Debt Expense, debit; Accounts Receivable/customer name, credit.

A)Bad Debt Expense, debit; Allowance for Uncollectible Accounts, credit.

B)not required.

C)Allowance for Uncollectible Accounts, debit; Accounts Receivable/customer name, credit.

D)Bad Debt Expense, debit; Accounts Receivable/customer name, credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

62

What type of account is Allowance for Doubtful Accounts?

A)A contra-asset account

B)An expense account

C)A contra-liability account

D)A revenue account

A)A contra-asset account

B)An expense account

C)A contra-liability account

D)A revenue account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

63

The end of period adjusting entry for bad debt expense under the allowance method is:

A)Bad Debt Expense, debit; Allowance for Uncollectible Accounts, credit.

B)not required.

C)Cash, debit; Accounts Receivable/customer name, credit.

D)Bad Debt Expense, debit; Accounts Receivable/customer name, credit.

A)Bad Debt Expense, debit; Allowance for Uncollectible Accounts, credit.

B)not required.

C)Cash, debit; Accounts Receivable/customer name, credit.

D)Bad Debt Expense, debit; Accounts Receivable/customer name, credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

64

Receivables of a company CANNOT be long-term assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

65

The allowance method of accounting for bad debts is required by GAAP because of the materiality principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

66

A company has $275,000 in credit sales. The company uses the allowance method to account for uncollectible accounts. The Allowance for Doubtful Accounts now has a $7,550 credit balance. If the company estimates 5% of credit sales will be uncollectible, what will be the amount of the journal entry to record estimated uncollectible accounts?

A)$13,750

B)$7,550

C)$21,300

D)$6,200

A)$13,750

B)$7,550

C)$21,300

D)$6,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

67

Under the direct write-off method, to record the receipt of cash after an account has previously been written off, you would first:

A)debit Cash and credit the customer's account.

B)reinstate the customer's account.

C)debit Allowance for Doubtful Accounts.

D)debit Bad Debt Expense.

A)debit Cash and credit the customer's account.

B)reinstate the customer's account.

C)debit Allowance for Doubtful Accounts.

D)debit Bad Debt Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

68

There are two methods for accounting for uncollectible receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

69

The journal entry to write off a customer's account under the direct write-off method is:

A)Bad Debt Expense, debit; Allowance for Uncollectible Accounts, credit.

B)not required.

C)Cash, debit; Accounts Receivable/customer name, credit.

D)Bad Debt Expense, debit; Accounts Receivable/customer name, credit.

A)Bad Debt Expense, debit; Allowance for Uncollectible Accounts, credit.

B)not required.

C)Cash, debit; Accounts Receivable/customer name, credit.

D)Bad Debt Expense, debit; Accounts Receivable/customer name, credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

70

Under the allowance method, to record the receipt of cash after an account has previously being written off, you would first:

A)debit Cash and credit the customer's account.

B)reinstate the customer's account.

C)debit Allowance for Doubtful Accounts.

D)debit Bad Debt Expense.

A)debit Cash and credit the customer's account.

B)reinstate the customer's account.

C)debit Allowance for Doubtful Accounts.

D)debit Bad Debt Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

71

The end of period adjusting entry for bad debt expense under the direct write-off method is:

A)Bad Debt Expense, debit; Allowance for Uncollectible Accounts, credit.

B)not required.

C)Cash, debit; Accounts Receivable/customer name, credit.

D)Bad Debt Expense, debit; Accounts Receivable/customer name, credit.

A)Bad Debt Expense, debit; Allowance for Uncollectible Accounts, credit.

B)not required.

C)Cash, debit; Accounts Receivable/customer name, credit.

D)Bad Debt Expense, debit; Accounts Receivable/customer name, credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following is TRUE?

A)The allowance method requires a business to estimate bad debt expense.

B)The allowance method requires a business to record only actual bad debt expense.

C)The allowance method allows a business to choose between recording actual or estimated bad debt expense.

D)The allowance method does not relate to bad debts expense. It is a method used to prepare a bank reconciliation.

A)The allowance method requires a business to estimate bad debt expense.

B)The allowance method requires a business to record only actual bad debt expense.

C)The allowance method allows a business to choose between recording actual or estimated bad debt expense.

D)The allowance method does not relate to bad debts expense. It is a method used to prepare a bank reconciliation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

73

The percent of sales method is the only method allowed by GAAP to estimate the amount of uncollectible accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

74

The net realizable value of Accounts Receivable is computed by subtracting the allowance for doubtful accounts from the amount in the Accounts Receivable control account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

75

The materiality principle allows companies with low amounts of uncollectible accounts to use the direct write-off method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

76

When using the aging method, the amount calculated to be the uncollectible accounts is always the amount used for the adjusting entry at the end of the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

77

Once an Account Receivable is written off, can a business ever collect that money?

A)No, GAAP does not allow a company to collect any amounts from a customer who has had an account written off.

B)Only when using the direct write-off method can a company collect from a customer who has had an account written off.

C)Only when using the allowance method can a company collect from a customer who has had an account written off.

D)Both the allowance and direct write-off methods permit a company to collect from a customer who has had an account written off.

A)No, GAAP does not allow a company to collect any amounts from a customer who has had an account written off.

B)Only when using the direct write-off method can a company collect from a customer who has had an account written off.

C)Only when using the allowance method can a company collect from a customer who has had an account written off.

D)Both the allowance and direct write-off methods permit a company to collect from a customer who has had an account written off.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

78

A company has $321,000 in credit sales. The company uses the allowance method to account for uncollectible accounts. The Allowance for Doubtful Accounts now has an $8,150 debit balance. If the company estimates 5% of credit sales will be uncollectible, what will be the amount of the journal entry to record estimated uncollectible accounts?

A)$8,150

B)$24,200

C)$7,900

D)$16,050

A)$8,150

B)$24,200

C)$7,900

D)$16,050

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

79

When a customer fails to pay on their account, it creates a(n):

A)note receivable.

B)uncollectible account.

C)account receivable.

D)decrease in revenue.

A)note receivable.

B)uncollectible account.

C)account receivable.

D)decrease in revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck

80

The contra-account, Allowance for Doubtful Accounts, is credited when journal entries are made for estimates of bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 165 في هذه المجموعة.

فتح الحزمة

k this deck