Deck 10: Using Budgets for Planning and Coordination

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

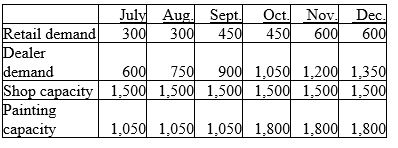

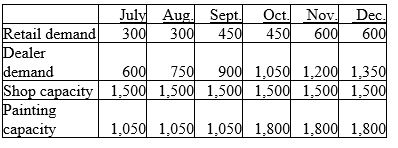

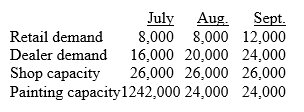

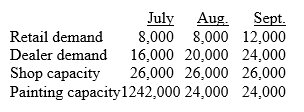

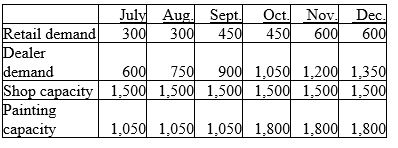

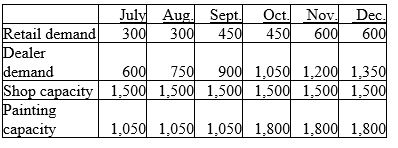

سؤال

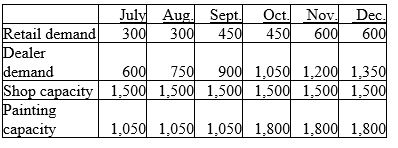

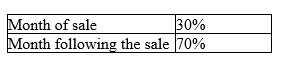

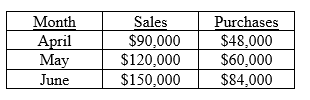

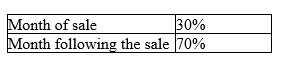

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

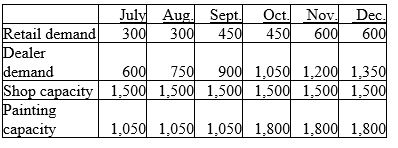

سؤال

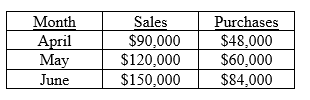

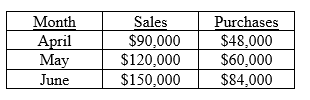

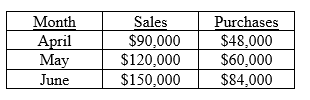

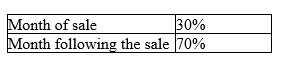

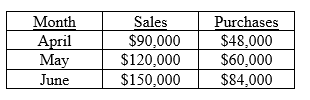

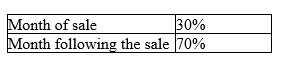

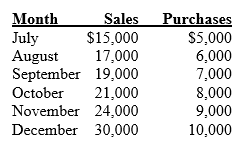

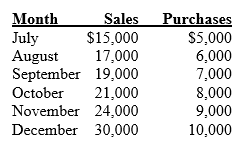

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/139

العب

ملء الشاشة (f)

Deck 10: Using Budgets for Planning and Coordination

1

What is budgeting? What is its role?

Budgeting is the process of preparing budgets, plans, schedules, and forecasts, and the process requires several important skills, including forecasting, a knowledge of how activities affect costs, and the ability to see how the organization's different activities fit together.

The role of budgets includes planning, control, coordination of activities of organization, problem signaling, communication of short-term goals to members and problem-solving activities as organization control.

The role of budgets includes planning, control, coordination of activities of organization, problem signaling, communication of short-term goals to members and problem-solving activities as organization control.

2

A budget is a qualitative expression of the cash inflows and outflows that show whether the current operating plan will meet the firm's organizational objectives.

False

3

A budget should/can do all of the following EXCEPT that it:

A)should be prepared by managers from different functional areas working independently of each other.

B)should be adjusted if new opportunities become available during the year.

C)can help management allocate limited resources.

D)can become the performance standard against which firms can compare the actual results.

A)should be prepared by managers from different functional areas working independently of each other.

B)should be adjusted if new opportunities become available during the year.

C)can help management allocate limited resources.

D)can become the performance standard against which firms can compare the actual results.

should be prepared by managers from different functional areas working independently of each other.

4

Are negative variances always unfavorable and positive variances always favorable? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

5

Budgeting provides all of the following EXCEPT:

A)a means to communicate the organization's short-term goals to its members.

B)support for the management functions of planning and coordination.

C)a means to anticipate problems.

D)an ethical framework for decision making.

A)a means to communicate the organization's short-term goals to its members.

B)support for the management functions of planning and coordination.

C)a means to anticipate problems.

D)an ethical framework for decision making.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

6

The production plan should be based on the sales plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

7

If initial budgets prove unacceptable,planners achieve the MOST benefit from:

A)repeating the budgeting cycle with a new set of decisions.

B)deciding not to budget this year.

C)accepting an unbalanced budget.

D)using last year's budget.

A)repeating the budgeting cycle with a new set of decisions.

B)deciding not to budget this year.

C)accepting an unbalanced budget.

D)using last year's budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

8

Operating budgets and financial budgets:

A)combined form the master budget.

B)are prepared before the master budget.

C)are prepared after the master budget.

D)have nothing to do with the master budget.

A)combined form the master budget.

B)are prepared before the master budget.

C)are prepared after the master budget.

D)have nothing to do with the master budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

9

Budgeting does NOT require:

A)knowledge of the organization's activities.

B)specialized expertise in financial management and control.

C)knowledge about how activities affect costs.

D)the ability to see how the organization's different activities fit together.

A)knowledge of the organization's activities.

B)specialized expertise in financial management and control.

C)knowledge about how activities affect costs.

D)the ability to see how the organization's different activities fit together.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

10

When discussing the roles of budgets,a planning role in the budgeting process includes:

A)measuring outcomes against planned amounts.

B)developing the master budget.

C)assessing performance.

D)reporting actual amounts at the end of the budgeting period.

A)measuring outcomes against planned amounts.

B)developing the master budget.

C)assessing performance.

D)reporting actual amounts at the end of the budgeting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

11

The first step in developing a budget is for the accounting department to prepare the sales forecast.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

12

The usual starting point in budgeting is to make a forecast of production.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

13

Which of the following is NOT a role of budgeting in organizations?

A)performance evaluation.

B)historical financial statements.

C)allocation of resources.

D)motivation of employees.

A)performance evaluation.

B)historical financial statements.

C)allocation of resources.

D)motivation of employees.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

14

If amounts in the sales forecast change,amounts in the production budgets will also change.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

15

All of the following are true statements about the role of budgets and budgeting EXCEPT that:

A)a budget is a quantitative summary of the expected allocations and financial consequences of the organization's short-term operating activities.

B)budgeting includes the process of estimating money inflows and outflows to determine a financial plan that will meet an organization's objectives.

C)the difference between actual results and the budget plan are called variances.

D)budgeting solves most business challenges because it coordinates activities and communicates the organization's short-term goals to its members.

A)a budget is a quantitative summary of the expected allocations and financial consequences of the organization's short-term operating activities.

B)budgeting includes the process of estimating money inflows and outflows to determine a financial plan that will meet an organization's objectives.

C)the difference between actual results and the budget plan are called variances.

D)budgeting solves most business challenges because it coordinates activities and communicates the organization's short-term goals to its members.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

16

Once authorized,discretionary spending budgets are committed or fixed and do not vary with levels of production or service.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

17

When discussing the roles of budgets,a control role includes:

A)identifying organizational objectives and short-term goals.

B)developing long-term strategies and short-term plans.

C)measuring and assessing performance against budgeted amounts.

D)developing the master budget.

A)identifying organizational objectives and short-term goals.

B)developing long-term strategies and short-term plans.

C)measuring and assessing performance against budgeted amounts.

D)developing the master budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

18

In regard to the amount of detail,a budget should:

A)show the detail for each product.

B)group products into pools of products.

C)strike a balance between detail and aggregated information.

D)not consider the cost of gathering the information.

A)show the detail for each product.

B)group products into pools of products.

C)strike a balance between detail and aggregated information.

D)not consider the cost of gathering the information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

19

Budgets can play both planning and control roles for management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

20

Describe the benefits to an organization of preparing an operating budget.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

21

The ________ summarizes planned revenues from each product.

A)capital spending plan

B)production plan

C)administrative and discretionary spending plan

D)sales plan

A)capital spending plan

B)production plan

C)administrative and discretionary spending plan

D)sales plan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

22

All of the following are true regarding the labor hiring and training plan EXCEPT that it:

A)may include retraining plans to redeploy employees to other parts of the organization.

B)determines discretionary spending for research and development.

C)works backward from the date when personnel are needed.

D)can include plans for both expansion and contraction.

A)may include retraining plans to redeploy employees to other parts of the organization.

B)determines discretionary spending for research and development.

C)works backward from the date when personnel are needed.

D)can include plans for both expansion and contraction.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

23

________ specifies when items such as acquisitions for buildings and special-purpose equipment must be made to meet activity level objectives.

A)The capital-spending plan

B)The production plan

C)The materials purchasing plan

D)The administrative and discretionary spending plan

A)The capital-spending plan

B)The production plan

C)The materials purchasing plan

D)The administrative and discretionary spending plan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

24

________ provide(s)the starting point for developing the operating budget.

A)The demand forecast

B)Projected income statement

C)The production plan

D)Expected cash flows

A)The demand forecast

B)Projected income statement

C)The production plan

D)Expected cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

25

In which order are the following developed? A = Production plan B = Materials purchasing plan

C = Demand forecast D = Sales plan

A)first to last: A, B, C, D

B)first to last: C, D, A, B

C)first to last: D, C, B, A

D)first to last: C,A,D,B

C = Demand forecast D = Sales plan

A)first to last: A, B, C, D

B)first to last: C, D, A, B

C)first to last: D, C, B, A

D)first to last: C,A,D,B

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

26

Operating budgets include the:

A)projected balance sheet.

B)projected income statement.

C)capital spending plan.

D)expected cash flow statement.

A)projected balance sheet.

B)projected income statement.

C)capital spending plan.

D)expected cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

27

Aggregate planning:

A)determines the projected financial statements.

B)compares the sales plan with the demand forecast.

C)assesses the feasibility of the proposed production plan.

D)provides a detailed production schedule for all product lines.

A)determines the projected financial statements.

B)compares the sales plan with the demand forecast.

C)assesses the feasibility of the proposed production plan.

D)provides a detailed production schedule for all product lines.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

28

Operating budgets include all of the following EXCEPT:

A)a sales plan.

B)a labor hiring and training plan.

C)an administrative and discretionary spending plan.

D)projected balance sheet.

A)a sales plan.

B)a labor hiring and training plan.

C)an administrative and discretionary spending plan.

D)projected balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

29

Financial analysts use the expected cash flow statement to do all of the following EXCEPT:

A)plan for when excess cash is generated.

B)plan for short-term cash investments.

C)project cash shortages and plan a strategy to deal with the shortages.

D)project sales.

A)plan for when excess cash is generated.

B)plan for short-term cash investments.

C)project cash shortages and plan a strategy to deal with the shortages.

D)project sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

30

A demand forecast is:

A)an estimate of sales demand at a specified selling price for each product.

B)developed primarily to prepare next year's marketing campaign.

C)an estimate of market demand based on the amount sold in the previous year.

D)a summary of product costs that influence pricing decisions.

A)an estimate of sales demand at a specified selling price for each product.

B)developed primarily to prepare next year's marketing campaign.

C)an estimate of market demand based on the amount sold in the previous year.

D)a summary of product costs that influence pricing decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

31

The sales plan identifies:

A)expected cash flows from the sales of each product.

B)actual sales from last year for each product.

C)the budgeted level of sales for each product.

D)the variance of sales from actual for each product.

A)expected cash flows from the sales of each product.

B)actual sales from last year for each product.

C)the budgeted level of sales for each product.

D)the variance of sales from actual for each product.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

32

Financial budgets are prepared:

A)to specify expectations for selling, purchasing, and production.

B)to evaluate the financial results of the proposed decisions.

C)so that financial statements can be prepared for shareholders.

D)to plan for production capacity.

A)to specify expectations for selling, purchasing, and production.

B)to evaluate the financial results of the proposed decisions.

C)so that financial statements can be prepared for shareholders.

D)to plan for production capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

33

Discretionary expenditures:

A)are usually planned for first.

B)are amounts paid for the use of flexible resources.

C)are not determined by the organization's level of production.

D)increase in amount during periods of greater activity.

A)are usually planned for first.

B)are amounts paid for the use of flexible resources.

C)are not determined by the organization's level of production.

D)increase in amount during periods of greater activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which of the following statements is TRUE regarding capacity resources?

A)Raw materials and supplies are examples of intermediate-term resources.

B)Long-term capacity usually varies directly with production levels.

C)Flexible resources are usually purchased to acquire intermediate-term capacity.

D)Long-term capacity resources are expensive and referred to as "committed" resources.

A)Raw materials and supplies are examples of intermediate-term resources.

B)Long-term capacity usually varies directly with production levels.

C)Flexible resources are usually purchased to acquire intermediate-term capacity.

D)Long-term capacity resources are expensive and referred to as "committed" resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

35

Financial budgets include the:

A)capital spending plan.

B)production plan.

C)labor hiring and training plan.

D)expected cash flow statement.

A)capital spending plan.

B)production plan.

C)labor hiring and training plan.

D)expected cash flow statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

36

The budgeting process is MOST strongly influenced by the:

A)capital spending plan.

B)statement of expected cash flows.

C)demand forecasts.

D)production plan.

A)capital spending plan.

B)statement of expected cash flows.

C)demand forecasts.

D)production plan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

37

The sales plan and inventory plan is compared to available productive capacity levels and ________ is determined.

A)an aggregate plan

B)a new sales plan

C)a materials purchasing plan

D)an administrative and discretionary spending plan

A)an aggregate plan

B)a new sales plan

C)a materials purchasing plan

D)an administrative and discretionary spending plan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

38

The ________ provides the foundation for the materials purchasing plan.

A)inventory policy

B)sales plan

C)production plan

D)capital spending plan

A)inventory policy

B)sales plan

C)production plan

D)capital spending plan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

39

________ summarizes expenditures for advertising and research and development.

A)The labor hiring and training plan

B)The production plan

C)The administrative and discretionary spending plan

D)The aggregate plan

A)The labor hiring and training plan

B)The production plan

C)The administrative and discretionary spending plan

D)The aggregate plan

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

40

________ include an expected cash flow statement,the projected balance sheet,and the projected income statement.

A)Annual reports

B)Financial budgets

C)Operating budgets

D)Capital budgets

A)Annual reports

B)Financial budgets

C)Operating budgets

D)Capital budgets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

41

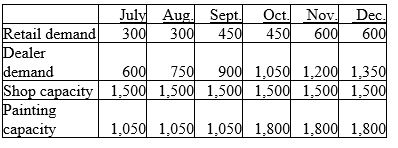

For the next six months, Kurtz Company projects the following information (in units).

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

The number of dealer units that will be produced and sold in September is:

A)900 units.

B)1,050 units.

C)1,500 units.

D)600 units.

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

The number of dealer units that will be produced and sold in September is:

A)900 units.

B)1,050 units.

C)1,500 units.

D)600 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

42

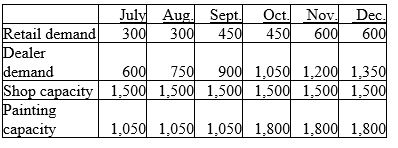

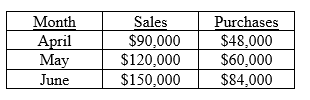

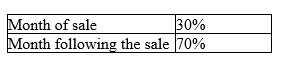

The following information for the second quarter of 2011 pertains to Huffington Company:

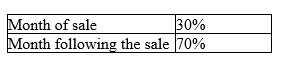

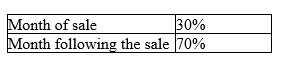

•Cash is collected from customers in the following manner:

•40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

•Labor costs are 20% of sales. Other operating costs are $45,000 per month (including $12,000 of depreciation). Both of these are paid in the month incurred.

•The cash balance on June 1 is $6,000. A minimum cash balance of $4,500 is required at the end of the month. Money can be borrowed in multiples of $3,000.

•No loans outstanding on June 1.

How much cash will be paid to suppliers in June?

A)$69,600

B)$56,000

C)$88,000

D)None of the above is correct.

•Cash is collected from customers in the following manner:

•40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

•Labor costs are 20% of sales. Other operating costs are $45,000 per month (including $12,000 of depreciation). Both of these are paid in the month incurred.

•The cash balance on June 1 is $6,000. A minimum cash balance of $4,500 is required at the end of the month. Money can be borrowed in multiples of $3,000.

•No loans outstanding on June 1.

How much cash will be paid to suppliers in June?

A)$69,600

B)$56,000

C)$88,000

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

43

For the next six months, Kurtz Company projects the following information (in units).

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

The production for July is projected to be:

A)300 units.

B)900 units.

C)1,050 units.

D)1,500 units.

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

The production for July is projected to be:

A)300 units.

B)900 units.

C)1,050 units.

D)1,500 units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

44

The following information pertains to the October operating budget for Flockhart Corporation.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

For October,budgeted cash payments for purchases are:

A)$14,000.

B)$60,000.

C)$70,000.

D)None of the above is correct.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

For October,budgeted cash payments for purchases are:

A)$14,000.

B)$60,000.

C)$70,000.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

45

The following information for the second quarter of 2011 pertains to Huffington Company:

•Cash is collected from customers in the following manner:

•40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

•Labor costs are 20% of sales. Other operating costs are $45,000 per month (including $12,000 of depreciation). Both of these are paid in the month incurred.

•The cash balance on June 1 is $6,000. A minimum cash balance of $4,500 is required at the end of the month. Money can be borrowed in multiples of $3,000.

•No loans outstanding on June 1.

How much cash will be collected from customers in June?

A)$129,000

B)$141,000

C)$150,000

D)None of the above is correct.

•Cash is collected from customers in the following manner:

•40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

•Labor costs are 20% of sales. Other operating costs are $45,000 per month (including $12,000 of depreciation). Both of these are paid in the month incurred.

•The cash balance on June 1 is $6,000. A minimum cash balance of $4,500 is required at the end of the month. Money can be borrowed in multiples of $3,000.

•No loans outstanding on June 1.

How much cash will be collected from customers in June?

A)$129,000

B)$141,000

C)$150,000

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

46

Describe operating and financial budgets and give at least two examples of each that are discussed in the textbook.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

47

The following information for the second quarter of 2011 pertains to Huffington Company:

•Cash is collected from customers in the following manner:

•40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

•Labor costs are 20% of sales. Other operating costs are $45,000 per month (including $12,000 of depreciation). Both of these are paid in the month incurred.

•The cash balance on June 1 is $6,000. A minimum cash balance of $4,500 is required at the end of the month. Money can be borrowed in multiples of $3,000.

•No loans outstanding on June 1.

What is the ending cash balance for June?

A)($50,000)

B)$6,000

C)$5,400

D)$11,400

•Cash is collected from customers in the following manner:

•40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

•Labor costs are 20% of sales. Other operating costs are $45,000 per month (including $12,000 of depreciation). Both of these are paid in the month incurred.

•The cash balance on June 1 is $6,000. A minimum cash balance of $4,500 is required at the end of the month. Money can be borrowed in multiples of $3,000.

•No loans outstanding on June 1.

What is the ending cash balance for June?

A)($50,000)

B)$6,000

C)$5,400

D)$11,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

48

The following information pertains to the October operating budget for Flockhart Corporation.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

For October,budgeted net income is:

A)$20,000.

B)$30,000.

C)$40,000.

D)None of the above is correct.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

For October,budgeted net income is:

A)$20,000.

B)$30,000.

C)$40,000.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

49

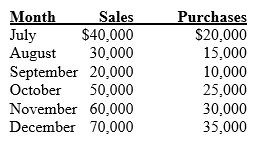

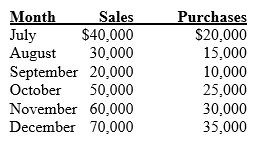

For the next quarter,Charter Manufacturing projects the following information (in units).

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

Required:

a. Prepare a schedule that shows the number of retail and dealer units to be made and sold each month.

b. Review the above information and comment on your observations. What suggestions do you have for Charter Manufacturing?

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

Required:

a. Prepare a schedule that shows the number of retail and dealer units to be made and sold each month.

b. Review the above information and comment on your observations. What suggestions do you have for Charter Manufacturing?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

50

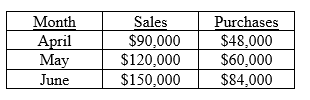

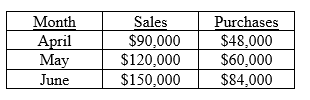

The following information pertains to Ortega Corporation:

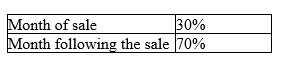

∙ Cash is collected from customers in the following manner:

Month of sale (2% cash discount) 30%

Month following sale 50%

Two months following sale 15%

Amount uncollectible 5%

∙ 40% of purchases are paid for in cash in the month of purchase,and the balance is paid the following month.

Required:

a. Prepare a summary of cash collections for the 4th quarter.

b. Prepare a summary of cash disbursements for the 4th quarter.

∙ Cash is collected from customers in the following manner:

Month of sale (2% cash discount) 30%

Month following sale 50%

Two months following sale 15%

Amount uncollectible 5%

∙ 40% of purchases are paid for in cash in the month of purchase,and the balance is paid the following month.

Required:

a. Prepare a summary of cash collections for the 4th quarter.

b. Prepare a summary of cash disbursements for the 4th quarter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

51

For the next six months, Kurtz Company projects the following information (in units).

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

In November,production appears to be limited by:

A)short-term capacity.

B)intermediate-term capacity.

C)long-term capacity.

D)total demand.

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

In November,production appears to be limited by:

A)short-term capacity.

B)intermediate-term capacity.

C)long-term capacity.

D)total demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

52

The following information for the second quarter of 2011 pertains to Huffington Company:

•Cash is collected from customers in the following manner:

•40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

•Labor costs are 20% of sales. Other operating costs are $45,000 per month (including $12,000 of depreciation). Both of these are paid in the month incurred.

•The cash balance on June 1 is $6,000. A minimum cash balance of $4,500 is required at the end of the month. Money can be borrowed in multiples of $3,000.

•No loans outstanding on June 1.

How much cash will be disbursed for labor and operating costs in June?

A)$63,000

B)$70,000

C)$88,400

D) $96,400

•Cash is collected from customers in the following manner:

•40% of purchases are paid for in cash in the month of purchase, and the balance is paid the following month.

•Labor costs are 20% of sales. Other operating costs are $45,000 per month (including $12,000 of depreciation). Both of these are paid in the month incurred.

•The cash balance on June 1 is $6,000. A minimum cash balance of $4,500 is required at the end of the month. Money can be borrowed in multiples of $3,000.

•No loans outstanding on June 1.

How much cash will be disbursed for labor and operating costs in June?

A)$63,000

B)$70,000

C)$88,400

D) $96,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

53

The following information pertains to the October operating budget for Flockhart Corporation.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

For October,budgeted cash collections are:

A)$20,000.

B)$60,000.

C)$80,000.

D)None of the above is correct.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

For October,budgeted cash collections are:

A)$20,000.

B)$60,000.

C)$80,000.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

54

The following information pertains to the October operating budget for Flockhart Corporation.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

At the end of October,budgeted accounts receivable is:

A)$20,000.

B)$40,000.

C)$60,000.

D)None of the above is correct.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

At the end of October,budgeted accounts receivable is:

A)$20,000.

B)$40,000.

C)$60,000.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

55

The following information pertains to the October operating budget for Flockhart Corporation.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

For October,budgeted cost of goods sold is:

A)$20,000.

B)$30,000.

C)$40,000.

D)None of the above is correct.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

For October,budgeted cost of goods sold is:

A)$20,000.

B)$30,000.

C)$40,000.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

56

The following information pertains to the October operating budget for Flockhart Corporation.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

At the end of October,budgeted ending inventory is:

A)$20,000.

B)$28,000.

C)$40,000.

D)None of the above is correct.

∙ Budgeted sales for October $100,000 and November $200,000.

∙ Collections for sales are 60% in the month of sale and 40% the next month.

∙ Gross margin is 30% of sales.

∙ Administrative costs are $10,000 each month.

∙ Beginning accounts receivable (October 1)$20,000.

∙ Beginning inventory (October 1)$14,000.

∙ Beginning accounts payable (October 1)$60,000. (All from inventory purchases.)

∙ Purchases are paid in full the following month.

∙ Desired ending inventory is 20% of next month's cost of goods sold (COGS).

∙ No loans are outstanding on October 1

At the end of October,budgeted ending inventory is:

A)$20,000.

B)$28,000.

C)$40,000.

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following information pertains to Maxi Corporation:

∙ Cash is collected from customers in the following manner:

Month of sale 20%

Month following the sale 50%

Two months following sale 28%

Amount uncollectible 2%

∙ Thirty percent of purchases are paid for in cash in the month of purchase,and the balance is paid the following month. A 2% discount is allowed on purchases paid for in the month of purchase.

∙ Labor costs equal 20% of sales; other operating costs of $5,000 per month (including $2,000)of depreciation. Both are paid in the month incurred.

∙ The cash balance on October 1 is $4,300. A minimum cash balance of $4,000 is required at the end of the month. Money is borrowed in multiples of $1,000.

∙ The company will issue $6,000 of common stock and pay $10,000 in dividends in October.

∙ There is no debt outstanding at October 1.

Required:

Prepare a projected cash flow statement in good form for the month ended October 31.

∙ Cash is collected from customers in the following manner:

Month of sale 20%

Month following the sale 50%

Two months following sale 28%

Amount uncollectible 2%

∙ Thirty percent of purchases are paid for in cash in the month of purchase,and the balance is paid the following month. A 2% discount is allowed on purchases paid for in the month of purchase.

∙ Labor costs equal 20% of sales; other operating costs of $5,000 per month (including $2,000)of depreciation. Both are paid in the month incurred.

∙ The cash balance on October 1 is $4,300. A minimum cash balance of $4,000 is required at the end of the month. Money is borrowed in multiples of $1,000.

∙ The company will issue $6,000 of common stock and pay $10,000 in dividends in October.

∙ There is no debt outstanding at October 1.

Required:

Prepare a projected cash flow statement in good form for the month ended October 31.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

58

For the next six months, Kurtz Company projects the following information (in units).

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

Painting capacity appears to be:

A)short-term capacity.

B)intermediate-term capacity.

C)long-term capacity.

D)total demand.

Demand drives production for that month and cannot be carried over from one month to another. Retail customers are satisfied first.

Painting capacity appears to be:

A)short-term capacity.

B)intermediate-term capacity.

C)long-term capacity.

D)total demand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

59

The financing section of the expected cash flow statement includes:

A)cash flows from retail sales.

B)dividends paid.

C)amounts paid for advertising costs.

D)cash outflows for asset acquisitions.

A)cash flows from retail sales.

B)dividends paid.

C)amounts paid for advertising costs.

D)cash outflows for asset acquisitions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

60

The expected cash flow statement does NOT include:

A)cash inflows from the collection of receivables.

B)cash outflows paid toward committed resources.

C)all sales revenues.

D)interest paid and collected.

A)cash inflows from the collection of receivables.

B)cash outflows paid toward committed resources.

C)all sales revenues.

D)interest paid and collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

61

Variance analysis explains the difference between planned costs and actual costs by evaluating differences between standard prices and actual prices and budgeted quantities and actual quantities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

62

(CPA adapted)The strategy MOST LIKELY to reduce the break-even point would be to:

A)increase both the capacity-related (fixed)costs and the contribution margin per unit.

B)decrease both the capacity-related (fixed)costs and the contribution margin per unit.

C)decrease the capacity-related (fixed)costs and increase the contribution margin per unit.

D)increase the capacity-related (fixed)costs and decrease the contribution margin per unit.

A)increase both the capacity-related (fixed)costs and the contribution margin per unit.

B)decrease both the capacity-related (fixed)costs and the contribution margin per unit.

C)decrease the capacity-related (fixed)costs and increase the contribution margin per unit.

D)increase the capacity-related (fixed)costs and decrease the contribution margin per unit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

63

________ requires that each discretionary expenditure be justified.

A)Zero-based budgeting

B)Periodic budgeting

C)Incremental budgeting

D)Continuous budgeting

A)Zero-based budgeting

B)Periodic budgeting

C)Incremental budgeting

D)Continuous budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

64

Discuss the importance of the sales forecast and items that influence its accuracy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

65

________ is the process of varying key estimates to identify those estimates that are the most critical to a decision.

A)A demand forecast

B)A sensitivity analysis

C)A pro forma income statement

D)The cash flow statement

A)A demand forecast

B)A sensitivity analysis

C)A pro forma income statement

D)The cash flow statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

66

________ bases a period's expenditure level for a discretionary item on the amount spent on that item during the previous period.

A)Zero-based budgeting

B)Periodic budgeting

C)Incremental budgeting

D)Continuous budgeting

A)Zero-based budgeting

B)Periodic budgeting

C)Incremental budgeting

D)Continuous budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

67

Assume only the specified parameters change in a sensitivity analysis.If the contribution margin increases by $10 per unit then operating profits will:

A)also increase by $10 per unit.

B)increase by less than $10 per unit.

C)decrease by $10 per unit.

D)be indeterminable.

A)also increase by $10 per unit.

B)increase by less than $10 per unit.

C)decrease by $10 per unit.

D)be indeterminable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

68

Sensitivity analysis is the process of selectively varying a plan's or a budget's key estimates for the purpose of identifying over what range a decision option is preferred.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

69

Budgets can be prepared for any time period,but are usually developed for one year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

70

Suppose that L&M Manufacturing's management believes that a $1,600 increase in the monthly advertising expense will result in a considerable increase in sales.How much must sales increase in a month to justify this additional expenditure?

A)200 units

B)334 units

C)500 units

D)None of the above is correct.

A)200 units

B)334 units

C)500 units

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

71

Sun Inc.sells a single product.The company's 2012 income statement is given below.

Sales (4,000 units) $800,000

Less flexible (variable)expenses $200,000

Less capacity-related (fixed)expenses $300,000

In an attempt to improve performance,Jo,the manager is considering a number of alternative actions.Each situation is to be evaluated separately.

Required:

a. Calculate operating income and the break-even point in units and dollars for 2012

b. Jo believes that a $100,000 increase in equipment improvements will increase sales considerably.How much must sales increase to justify this capital expenditure?

c. Jo believes that flexible costs can be decreased by 10%.As a result,she wants to reduce the selling price by 2% in anticipation of a 5% increase in sales.What are projected profits if these proposals are implemented?

Sales (4,000 units) $800,000

Less flexible (variable)expenses $200,000

Less capacity-related (fixed)expenses $300,000

In an attempt to improve performance,Jo,the manager is considering a number of alternative actions.Each situation is to be evaluated separately.

Required:

a. Calculate operating income and the break-even point in units and dollars for 2012

b. Jo believes that a $100,000 increase in equipment improvements will increase sales considerably.How much must sales increase to justify this capital expenditure?

c. Jo believes that flexible costs can be decreased by 10%.As a result,she wants to reduce the selling price by 2% in anticipation of a 5% increase in sales.What are projected profits if these proposals are implemented?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

72

Suppose that L&M Manufacturing's management believes that a 10% reduction in the selling price will result in a 30% increase in sales.If this proposed reduction in selling price is implemented,then:

A)profit will decrease by $12,800 in a month.

B)profit will increase by $12,800 in a month.

C)profit will decrease by $32,000 in a month.

D)profit will increase by $32,000 in a month.

A)profit will decrease by $12,800 in a month.

B)profit will increase by $12,800 in a month.

C)profit will decrease by $32,000 in a month.

D)profit will increase by $32,000 in a month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

73

The break-even point in units decreases if the:

A)flexible (variable)cost per unit increases.

B)total capacity-related (fixed)costs decrease.

C)contribution margin per unit decreases.

D)selling price per unit decreases.

A)flexible (variable)cost per unit increases.

B)total capacity-related (fixed)costs decrease.

C)contribution margin per unit decreases.

D)selling price per unit decreases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

74

Assume that only the specified parameters change in a sensitivity analysis.The contribution margin ratio increases when:

A)total capacity-related (fixed)costs increase.

B)total capacity-related (fixed)costs decrease.

C)flexible (variable)costs per unit increase.

D)flexible (variable)costs per unit decrease.

A)total capacity-related (fixed)costs increase.

B)total capacity-related (fixed)costs decrease.

C)flexible (variable)costs per unit increase.

D)flexible (variable)costs per unit decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

75

Explain when a manager would use what-if analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

76

In ________,as one budget period passes,planners delete that budget period from the master budget and add another one.

A)zero-based budgeting

B)periodic budgeting

C)incremental budgeting

D)continuous budgeting

A)zero-based budgeting

B)periodic budgeting

C)incremental budgeting

D)continuous budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

77

Although planners update or revise the budgets during the period,________ is typically performed once per year.

A)zero-based budgeting

B)periodic budgeting

C)incremental budgeting

D)continuous budgeting

A)zero-based budgeting

B)periodic budgeting

C)incremental budgeting

D)continuous budgeting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

78

What is the current break-even point in terms of number of units for the next month?

A)1,500 units

B)2,250 units

C)3,333 units

D)None of the above is correct.

A)1,500 units

B)2,250 units

C)3,333 units

D)None of the above is correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

79

Discuss the terms discretionary expenditures and committed expenditures and give an example of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck

80

In zero-based budgeting:

A)the prior year's budgeted amounts or actual results are used to build the new operating budget.

B)the budget is prepared by the top managers.

C)managers must justify each item within the operating budget as if it were a new budget item.

D)the budget is updated every month.

A)the prior year's budgeted amounts or actual results are used to build the new operating budget.

B)the budget is prepared by the top managers.

C)managers must justify each item within the operating budget as if it were a new budget item.

D)the budget is updated every month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 139 في هذه المجموعة.

فتح الحزمة

k this deck