Deck 5: Activity-Based Cost Systems

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

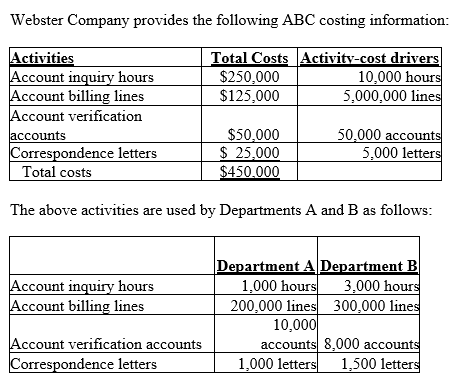

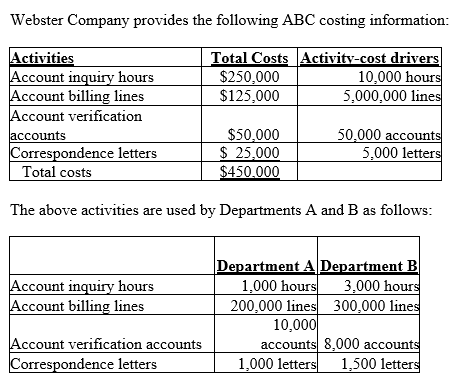

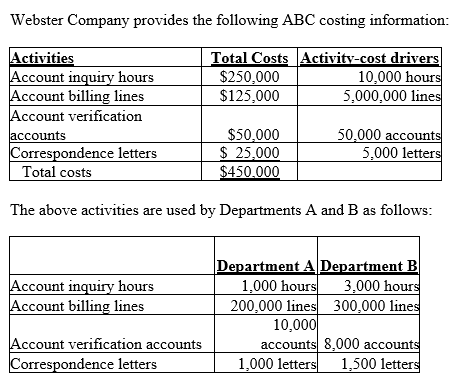

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

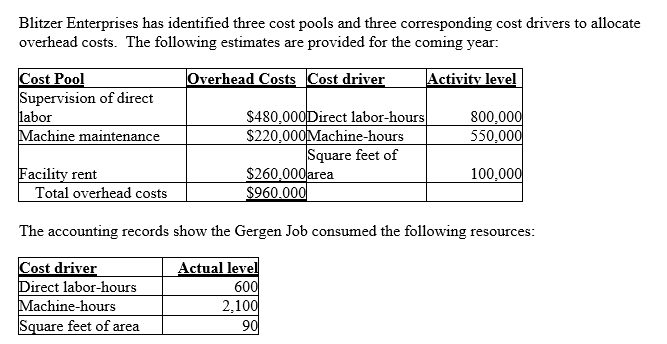

سؤال

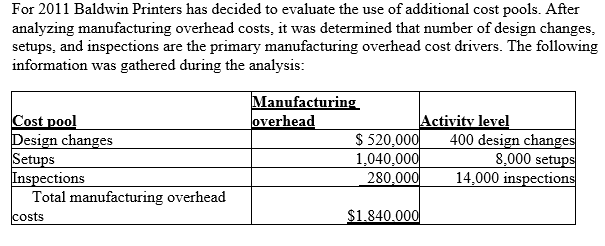

سؤال

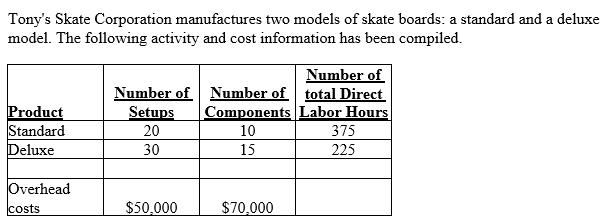

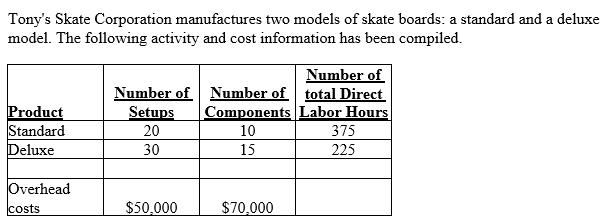

سؤال

سؤال

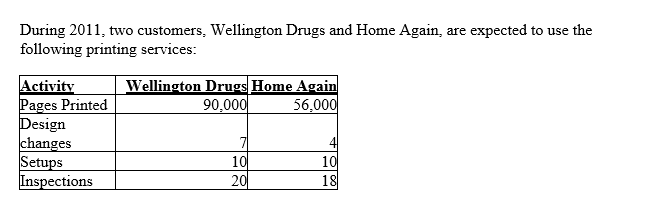

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

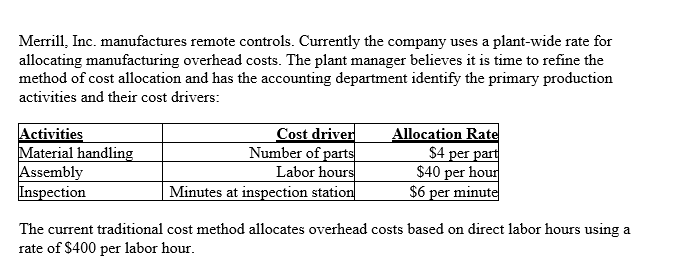

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

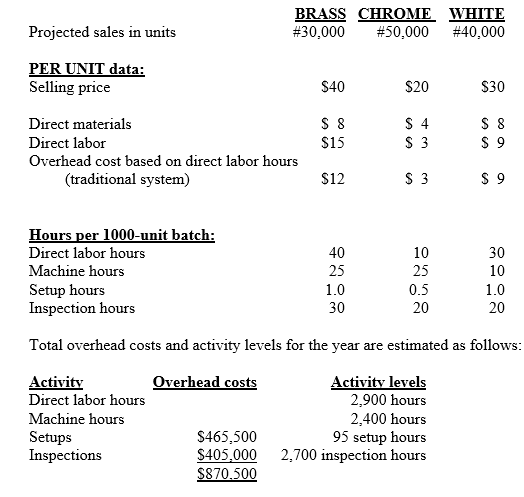

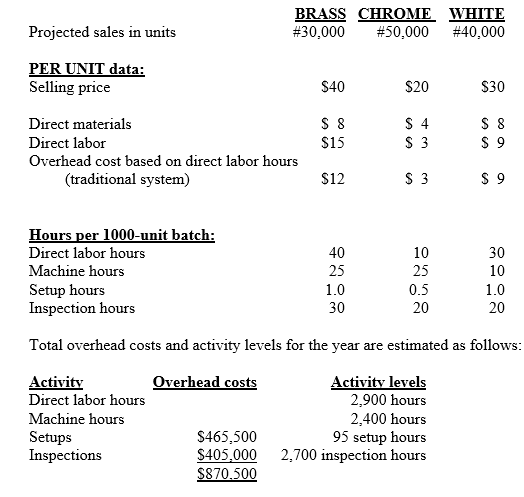

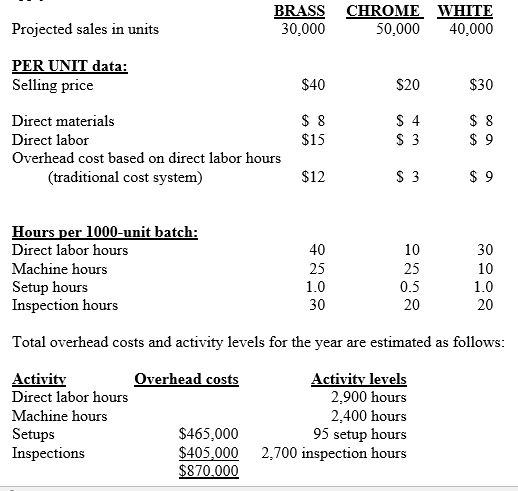

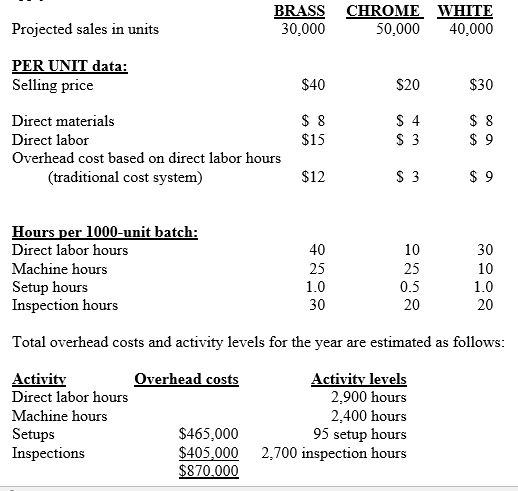

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/113

العب

ملء الشاشة (f)

Deck 5: Activity-Based Cost Systems

1

Different products consume different proportions of overhead costs because of differences in all of the following EXCEPT:

A)sales prices.

B)customers' customization specifications.

C)setup times.

D)product design.

A)sales prices.

B)customers' customization specifications.

C)setup times.

D)product design.

sales prices.

2

Product lines that produce different variations (models,styles,or colors)often require specialized activities that translate into lower overhead costs for each product line.

False

3

Traditional cost systems distort product costs because:

A)they do not know how to identify the appropriate units.

B)excess capacity costs are ignored.

C)they emphasize financial accounting requirements.

D)they use unit-level cost drivers to allocate overhead costs to products.

A)they do not know how to identify the appropriate units.

B)excess capacity costs are ignored.

C)they emphasize financial accounting requirements.

D)they use unit-level cost drivers to allocate overhead costs to products.

they use unit-level cost drivers to allocate overhead costs to products.

4

The first step in designing an activity-based cost system is to develop an activity dictionary.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

5

Explain how traditional cost systems,using only unit level cost drivers,distort customer costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

6

Explain how traditional cost systems,using only unit level cost drivers,distort product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

7

Traditional cost systems are likely to overcost complex products with lower production volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

8

It is important that the product costs reflect as much of the diversity and complexity of the manufacturing process so that:

A)product costs will reflect their relative consumption of resources.

B)better information related to resource constraints can be captured and communicated.

C)there is more likelihood of cost distortions.

D)All of the above are correct.

A)product costs will reflect their relative consumption of resources.

B)better information related to resource constraints can be captured and communicated.

C)there is more likelihood of cost distortions.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

9

Specialized engineering drawings of products,product quality specifications and quality control testing,inventoried raw materials,and material control systems are examples of activities that equate to greater overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

10

Misleading product cost numbers are MOST likely the result of misallocating:

A)direct material costs.

B)direct manufacturing labor costs.

C)overhead costs.

D)All of the above are correct.

A)direct material costs.

B)direct manufacturing labor costs.

C)overhead costs.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

11

Traditional cost systems are likely to overcost simple products with higher production volume.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

12

Smaller cost distortions occur when the traditional cost systems' unit-level assignments and the alternative activity cost driver assignments:

A)are different in proportion to each other.

B)are similar in proportion to each other.

C)are more different than alike.

D)use the same cost driver units.

A)are different in proportion to each other.

B)are similar in proportion to each other.

C)are more different than alike.

D)use the same cost driver units.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

13

Overcosting a particular product may result in:

A)gain of market share for the product.

B)higher profits per unit for the product.

C)operating efficiencies.

D)overstating total costs of all the products.

A)gain of market share for the product.

B)higher profits per unit for the product.

C)operating efficiencies.

D)overstating total costs of all the products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

14

Traditional cost systems use actual departments or cost centers for defining cost pools to accumulate and redistribute costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

15

Activity-based cost systems use cost centers to accumulate costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

16

________ and ________ are typically the measures of volume of activity in traditional volume-based cost systems.

A)Practical capacity; products sold

B)Direct labor hours; practical capacity

C)Direct labor hours; machine hours

D)Square footage; machine hours

A)Practical capacity; products sold

B)Direct labor hours; practical capacity

C)Direct labor hours; machine hours

D)Square footage; machine hours

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

17

Unit-level cost drivers in traditional cost systems distort product costs because they:

A)assume that all overhead activities affect all products.

B)recognize specific activities that are required to produce a product.

C)do not consistently record costs.

D)fail to measure the correct amount of total costs for all products.

A)assume that all overhead activities affect all products.

B)recognize specific activities that are required to produce a product.

C)do not consistently record costs.

D)fail to measure the correct amount of total costs for all products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

18

Activity-based costing (ABC)can eliminate cost distortions because ABC:

A)develops cost drivers that directly link the activities performed to the products manufactured.

B)establishes multiple cost pools.

C)employs capacity-related cost drivers.

D)recognizes interactions between different departments in assigning overhead costs.

A)develops cost drivers that directly link the activities performed to the products manufactured.

B)establishes multiple cost pools.

C)employs capacity-related cost drivers.

D)recognizes interactions between different departments in assigning overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

19

Undercosting of a product is MOST likely to result from:

A)misallocating direct labor costs.

B)underpricing the product.

C)overcosting another product.

D)understating total product costs.

A)misallocating direct labor costs.

B)underpricing the product.

C)overcosting another product.

D)understating total product costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

20

The use of unit-related measures to assign overhead costs is more likely to:

A)undercost high-volume products.

B)undercost specialty low-volume products.

C)undercost complex products.

D)undercost specialty low-volume and complex products.

A)undercost high-volume products.

B)undercost specialty low-volume products.

C)undercost complex products.

D)undercost specialty low-volume and complex products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

21

Given this change in the cost:

A)PQ-6 costing results under the new system depend on the adequacy and quality of the estimated sales and sales revenue used by the system.

B)PQ-6 will now command a higher sales price.

C)PQ-6 will now command a lower sales price.

D)Schiff's other products will be assigned a smaller share of overhead costs.

A)PQ-6 costing results under the new system depend on the adequacy and quality of the estimated sales and sales revenue used by the system.

B)PQ-6 will now command a higher sales price.

C)PQ-6 will now command a lower sales price.

D)Schiff's other products will be assigned a smaller share of overhead costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

22

An activity-based costing system is necessary for costing services that are different.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is a sign that an ABC system may be useful?

A)There are small amounts of overhead costs.

B)Products make diverse demands on resources because of differences in volume, process steps, batch size, or complexity.

C)Products a company all show large profits.

D)Operations throughout the plant are fairly similar.

A)There are small amounts of overhead costs.

B)Products make diverse demands on resources because of differences in volume, process steps, batch size, or complexity.

C)Products a company all show large profits.

D)Operations throughout the plant are fairly similar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

24

The selection of activity cost drivers requires making choices related to the usage of transaction drivers,duration drivers,and intensity drivers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

25

Units of production are most appropriate as an overhead cost assignment base when:

A)it is a service department.

B)only one product is manufactured.

C)direct labor costs are low.

D)factories produce a complex and varied mix of products.

A)it is a service department.

B)only one product is manufactured.

C)direct labor costs are low.

D)factories produce a complex and varied mix of products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

26

The goal of a properly constructed ABC system is to:

A)have the most accurate cost system.

B)identify more indirect overhead costs.

C)develop the best cost system for an economically reasonable cost.

D)have separate allocation rates for each department.

A)have the most accurate cost system.

B)identify more indirect overhead costs.

C)develop the best cost system for an economically reasonable cost.

D)have separate allocation rates for each department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

27

How much of the account inquiry cost will be assigned to Department A?

A)$5,000

B)$25,000

C)$75,000

D)$250,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

28

The total amount of overhead costs assigned to product PQ-6 using the traditional cost method is ________ the total amount assigned using ABC.

A)more than

B)less than

C)identical to

D)approximately the same

A)more than

B)less than

C)identical to

D)approximately the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

29

In general,the selection of activity cost drivers requires making trade-offs between accuracy and the cost of measurement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

30

For activity-based cost systems,activity costs are assigned to products in the proportion of the demand they place on activity resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

31

ABC systems seek an activity cost allocation driver that has a cause-and-effect relationship with costs in the cost pool.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

32

In general,factories producing a more varied and complex mix of products have higher costs than factories producing only a narrow range of products.Explain why this is generally true.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

33

Design of an activity-based cost system requires that:

A)the job bid process be redesigned.

B)resource costs be linked to the activities performed.

C)the cost of activities be linked to cost objects.

D)resource costs be linked to the activities performed and the cost of activities be linked to cost objects.

A)the job bid process be redesigned.

B)resource costs be linked to the activities performed.

C)the cost of activities be linked to cost objects.

D)resource costs be linked to the activities performed and the cost of activities be linked to cost objects.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

34

Designing an activity-based cost system includes:

A)classifying as many costs as indirect costs as is feasible.

B)creating as many cost pools as possible.

C)identifying the activities performed by the plant's resources.

D)seeking a broader focus rather than detail.

A)classifying as many costs as indirect costs as is feasible.

B)creating as many cost pools as possible.

C)identifying the activities performed by the plant's resources.

D)seeking a broader focus rather than detail.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

35

Greater manufacturing overhead costs are associated with:

A)specialized engineering drawings of new products.

B)quality specifications for products and quality control testing.

C)inventoried materials and material control systems.

D)All of the above are correct.

A)specialized engineering drawings of new products.

B)quality specifications for products and quality control testing.

C)inventoried materials and material control systems.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

36

When a company manufactures a variety of complex products,several unit-level cost drivers can capture the complexity and diversity of the production processes:

A)always.

B)frequently.

C)infrequently.

D)never.

A)always.

B)frequently.

C)infrequently.

D)never.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

37

A company produces three products; if one product is undercosted then:

A)one product is overcosted.

B)one or two products are overcosted.

C)two products are overcosted.

D)no products are overcosted.

A)one product is overcosted.

B)one or two products are overcosted.

C)two products are overcosted.

D)no products are overcosted.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

38

Provide at least two examples of types of costs that would be higher for factories producing a more varied and complex mix of products than for factories producing only a narrow range of products.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

39

Product lines that produce different variations (models,styles,or colors)often require specialized activities that translate into:

A)lower overhead costs for each product line.

B)decisions to drop product variations.

C)more favorable direct labor cost ratios.

D)more overhead costs for each product line.

A)lower overhead costs for each product line.

B)decisions to drop product variations.

C)more favorable direct labor cost ratios.

D)more overhead costs for each product line.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following statements about activity-based costing is NOT true?

A)ABC is useful for allocating marketing and distribution costs.

B)ABC is more likely to result in major differences from traditional costing systems if the firm manufactures only one product rather than multiple products.

C)ABC seeks to distinguish batch-related, product-sustaining, and business-sustaining costs, especially when they are not proportionate to one another.

D)ABC differs from traditional costing systems in that products are not cross-subsidized.

A)ABC is useful for allocating marketing and distribution costs.

B)ABC is more likely to result in major differences from traditional costing systems if the firm manufactures only one product rather than multiple products.

C)ABC seeks to distinguish batch-related, product-sustaining, and business-sustaining costs, especially when they are not proportionate to one another.

D)ABC differs from traditional costing systems in that products are not cross-subsidized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

41

Using direct labor-hours as the only overhead cost driver,what is the amount of overhead costs allocated to the Gergen Job?

A)$320

B)$720

C)$1,200

D)$1,360

A)$320

B)$720

C)$1,200

D)$1,360

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

42

Assuming activity-cost pools are used,what are the activity-cost driver rates for design changes,setups,and inspections cost pools?

A)$1,300 per design change, $130.00per setup, $20 per inspection

B)$360 per design change, $3.20per setup, $6.40 per inspection

C)$1,680 per design change, $5.38 per setup, $42 per inspection

D)$286 per design change,$15.38 per setup,$20 per inspection

A)$1,300 per design change, $130.00per setup, $20 per inspection

B)$360 per design change, $3.20per setup, $6.40 per inspection

C)$1,680 per design change, $5.38 per setup, $42 per inspection

D)$286 per design change,$15.38 per setup,$20 per inspection

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

43

Number of setups and number of components are identified as activity-cost drivers for overhead costs.Assuming an activity-based costing system is used,what is the total amount of overhead costs assigned to the standard model?

A)$20,000

B)$29,000

C)$48,000

D)$60,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

44

A manufacturing firm produces multiple families of products requiring various combinations of different types of parts.Of the following,the MOST appropriate cost driver for assigning materials handling costs to the various products is:

A)direct labor hours.

B)number of units produced.

C)number of parts used.

D)number of suppliers involved.

A)direct labor hours.

B)number of units produced.

C)number of parts used.

D)number of suppliers involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

45

When overhead costs are assigned using the single cost driver,number of pages printed,then

A)Baldwin Printers will want to retain this highly-profitable customer.

B)Wellington Drugs will likely seek to do business with competitors in the future.

C)Wellington Drugs is unfairly overbilled for its use of printing resources.

D)Wellington Drugs is grossly underbilled for the job,while other jobs will be unfairly overbilled.

A)Baldwin Printers will want to retain this highly-profitable customer.

B)Wellington Drugs will likely seek to do business with competitors in the future.

C)Wellington Drugs is unfairly overbilled for its use of printing resources.

D)Wellington Drugs is grossly underbilled for the job,while other jobs will be unfairly overbilled.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

46

Logical cost allocation bases for overhead costs include:

A)cubic feet of packages moved to measure distribution activity.

B)machine hours to measure setup activity.

C)direct manufacturing labor hours to measure product designing activity.

D)All of the above are correct.

A)cubic feet of packages moved to measure distribution activity.

B)machine hours to measure setup activity.

C)direct manufacturing labor hours to measure product designing activity.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

47

Using the three cost pools to allocate overhead costs,what is the total amount of overhead costs to be allocated to the Gergen Job?

A)$1,434

B)$1,400

C)$1,350

D)$1,074

A)$1,434

B)$1,400

C)$1,350

D)$1,074

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

48

What is the cost driver rate if manufacturing overhead costs are considered one large cost pool and are assigned based on 20 million pages of production capacity?

A)$0.10 per page

B)$0.07 per page

C)$0.092 per page

D)$1.84 per page

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

49

How much of the account billing costs will be assigned to Department B?

A)$7,500

B)$12.500

C)$15,000

D)$25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which method of allocation probably best estimates actual overhead costs used for Blitzer Enterprises? Why?

A)Single direct labor-hours cost driver, because it is best to allocate total costs uniformly to individual jobs.

B)Single direct labor-hours cost driver, because it is easiest to analyze and interpret.

C)Three activity-cost drivers, because it best reflects the relative consumption of resources.

D)Three activity-cost drivers,because product costs can be significantly cross-subsidized.

A)Single direct labor-hours cost driver, because it is best to allocate total costs uniformly to individual jobs.

B)Single direct labor-hours cost driver, because it is easiest to analyze and interpret.

C)Three activity-cost drivers, because it best reflects the relative consumption of resources.

D)Three activity-cost drivers,because product costs can be significantly cross-subsidized.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

51

If products are alike,then for costing purposes:

A)a simple costing system will yield accurate cost numbers.

B)an activity-based costing system should be used.

C)multiple unit-level cost rates should be used.

D)varying demands will be placed on resources.

A)a simple costing system will yield accurate cost numbers.

B)an activity-based costing system should be used.

C)multiple unit-level cost rates should be used.

D)varying demands will be placed on resources.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

52

If Blitzer Enterprises uses the three activity cost pools to allocate overhead costs,what are the activity-cost driver rates for the supervision of direct labor,machine maintenance,and facility rent,respectively?

A)$1.20 per direct labor hour, $0.50 per machine hour, $3.60 per sq ft

B)$2.50 per direct labor hour, $0.50 per machine hour, $1.00 per sq ft

C)$0.80 per direct labor hour, $0.10 per machine hour, $2.40 per sq ft

D)$0.60 per direct labor hour,$0.40 per machine hour,$2.60 per sq ft

A)$1.20 per direct labor hour, $0.50 per machine hour, $3.60 per sq ft

B)$2.50 per direct labor hour, $0.50 per machine hour, $1.00 per sq ft

C)$0.80 per direct labor hour, $0.10 per machine hour, $2.40 per sq ft

D)$0.60 per direct labor hour,$0.40 per machine hour,$2.60 per sq ft

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

53

What are the manufacturing overhead costs per remote control assuming the traditional cost method is used and a batch of 500 remote controls are produced? The batch requires 1,000 parts,10 direct labor hours,and 15 minutes of inspection time.

A)$4,000.00 per remote control

B)$0.50 per remote control

C)$4.00 per remote control

D)$8.00 per remote control

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

54

Using the three cost pools to allocate overhead costs,what is the total manufacturing overhead cost estimate for Wellington Drugs during 2011?

A)$5,400

B)$9,100

C)$10,800

D)$10,192

A)$5,400

B)$9,100

C)$10,800

D)$10,192

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

55

Activity-based costing systems provide better product costs when they:

A)employ more activity cost drivers.

B)employ fewer activity cost drivers.

C)identify and cost more overhead cost differences among products.

D)always yield more accurate product costs than traditional cost systems.

A)employ more activity cost drivers.

B)employ fewer activity cost drivers.

C)identify and cost more overhead cost differences among products.

D)always yield more accurate product costs than traditional cost systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

56

Assume a traditional costing system applies the $120,000 of overhead costs based on direct labor hours.What is the total amount of overhead costs assigned to the standard model?

A)$40,000

B)$75,000

C)$50,000

D)$70,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

57

What are the manufacturing overhead costs per remote control assuming an activity-based costing method is used and a batch of 50 remote controls are produced? The batch requires 100 parts,6 direct manufacturing labor hours,and 2.5 minutes of inspection time.

A)$8.00 per remote control

B)$13.10 per remote control

C)$48.00 per remote control

D)$655.00 per remote control

A)$8.00 per remote control

B)$13.10 per remote control

C)$48.00 per remote control

D)$655.00 per remote control

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

58

If direct labor-hours are considered as the only overhead cost driver,what is the single cost driver rate for Blitzer Enterprises?

A)$0.60 per direct labor-hour

B)$0.80 per direct labor-hour

C)$1.20 per direct labor-hour

D)$6.00 per direct labor-hour

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

59

How much of account verification costs will be assigned to Department A?

A)$10,000

B)$25,000

C)$40,000

D)$50,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

60

Using pages printed as the only overhead cost driver,what is the manufacturing overhead cost estimate for Wellington Drugs during 2011?

A)$5,000

B)$8,280

C)$11,200

D)$18,500

A)$5,000

B)$8,280

C)$11,200

D)$18,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

61

According to an ABC system,M5 uses a disproportionately:

A)smaller amount of unit-level costs.

B)larger amount of unit-level costs.

C)smaller amount of batch-level costs.

D)larger amount of batch-level costs.

A)smaller amount of unit-level costs.

B)larger amount of unit-level costs.

C)smaller amount of batch-level costs.

D)larger amount of batch-level costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

62

Practical capacity is generally smaller than theoretical capacity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

63

Provide a diagram of how the activity-based cost system model works and explain the two major components of the model.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

64

The goal of a properly constructed ABC system is to:

A)develop the best cost system by staying within the economizing constraints (relevant benefit versus cost tradeoff for the system).

B)have the most accurate cost system.

C)clone the ABC model processes.

D)adapt the ABC model exactly to the organization.

A)develop the best cost system by staying within the economizing constraints (relevant benefit versus cost tradeoff for the system).

B)have the most accurate cost system.

C)clone the ABC model processes.

D)adapt the ABC model exactly to the organization.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

65

How are cost drivers selected in activity-based costing systems?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

66

According to an ABC system,A8 is ________ under the traditional cost system.

A)undercosted

B)overcosted

C)fairly costed

D)accurately costed

A)undercosted

B)overcosted

C)fairly costed

D)accurately costed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

67

ABC systems:

A)reveal activities that can be eliminated.

B)help control nonfinancial items such as number of setup hours.

C)help identify new designs to reduce costs.

D)All of the above are correct.

A)reveal activities that can be eliminated.

B)help control nonfinancial items such as number of setup hours.

C)help identify new designs to reduce costs.

D)All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

68

Transaction drivers:

A)count the frequency of an activity.

B)involve directly charging for the resources used each time an activity is performed.

C)are the most expensive and accurate type of cost driver.

D)often apply a weighted index approach by estimating the difficulty of the task for various types of situations.

A)count the frequency of an activity.

B)involve directly charging for the resources used each time an activity is performed.

C)are the most expensive and accurate type of cost driver.

D)often apply a weighted index approach by estimating the difficulty of the task for various types of situations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

69

A well-designed,activity-based cost system helps managers make better decisions because information derived from an ABC analysis:

A)can be used to eliminate nonvalue-added activities.

B)is easy to analyze and interpret.

C)takes the choices and judgment challenges away from the managers.

D)emphasizes how managers can achieve higher sales.

A)can be used to eliminate nonvalue-added activities.

B)is easy to analyze and interpret.

C)takes the choices and judgment challenges away from the managers.

D)emphasizes how managers can achieve higher sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

70

Explain how activity-based costing systems can provide more accurate product costs than traditional cost systems.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

71

Transaction drivers count how often an activity is performed.

Duration drivers represent the amount of time required to perform an activity.

Intensity drivers directly charge for the resources used each time an activity is performed.

Also,a weighted index approach might be used to simulate an intensity driver.

a.Give an example of each of the four types of drivers described above.

b.Explain when each of the four types of drivers should be used.

c.For each of the first three types of drivers,explain the assumptions about the activity and the object of the activity.

d.For each of the following activities identify a transaction driver,a duration driver,and an intensity driver.

Machine maintenance

Machine setup

Quality control

Material ordering

Production scheduling

Warehouse expense

Engineering design

Duration drivers represent the amount of time required to perform an activity.

Intensity drivers directly charge for the resources used each time an activity is performed.

Also,a weighted index approach might be used to simulate an intensity driver.

a.Give an example of each of the four types of drivers described above.

b.Explain when each of the four types of drivers should be used.

c.For each of the first three types of drivers,explain the assumptions about the activity and the object of the activity.

d.For each of the following activities identify a transaction driver,a duration driver,and an intensity driver.

Machine maintenance

Machine setup

Quality control

Material ordering

Production scheduling

Warehouse expense

Engineering design

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

72

Do activity-based costing systems always provide more accurate product costs than conventional cost systems? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

73

Activity-based management (ABM)includes decisions about all of the following EXCEPT:

A)pricing and product mix.

B)smoothing costs.

C)reducing costs.

D)improving efficiency of activities.

A)pricing and product mix.

B)smoothing costs.

C)reducing costs.

D)improving efficiency of activities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

74

Reducing the number of production runs provides an economic benefit even though resources remain at the same level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

75

Brilliant Accents Company manufactures and sells three styles of kitchen faucets: brass,chrome,and white. Production takes 25,25,and 10 machine hours to manufacture 1000-unit batches of brass,chrome,and white faucets,respectively. The following additional data apply:

a. Using the traditional cost system,determine the operating profit per unit for each style of faucet.

b. Determine the activity cost driver rates for setup overhead costs and inspection overhead costs.

c. Using the ABC system,for each style of faucet:

1. compute the estimated overhead costs per unit; and

2. compute the estimated operating profit per unit.

d. Explain the differences between the profits obtained from the traditional cost system and the ABC system.Which system provides a better estimate of profitability? Why?

a. Using the traditional cost system,determine the operating profit per unit for each style of faucet.

b. Determine the activity cost driver rates for setup overhead costs and inspection overhead costs.

c. Using the ABC system,for each style of faucet:

1. compute the estimated overhead costs per unit; and

2. compute the estimated operating profit per unit.

d. Explain the differences between the profits obtained from the traditional cost system and the ABC system.Which system provides a better estimate of profitability? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

76

Transaction drivers,duration drivers,and intensity drivers.

a.For machine maintenance,identify a transaction driver,a duration driver,and an intensity driver.

b.Explain when the intensity driver should be used.

c.Explain the conditions that are assumed when the duration driver is used.

a.For machine maintenance,identify a transaction driver,a duration driver,and an intensity driver.

b.Explain when the intensity driver should be used.

c.Explain the conditions that are assumed when the duration driver is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

77

Prepackaged ABC software packages must be customized to the products,services and related activities of the company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

78

With traditional costing systems,products manufactured in large batches and in large annual volumes may be ________ because batch-related and product-sustaining costs are assigned using unit-related cost drivers..

A)overcosted

B)undercosted

C)fairly costed

D)ignored

A)overcosted

B)undercosted

C)fairly costed

D)ignored

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

79

Brilliant Accents Company manufactures and sells three styles of kitchen faucets: brass,chrome,and white. Production takes 25,25,and 10 machine hours to manufacture 1,000-unit batches of brass,chrome,and white faucets,respectively. The following additional data apply:

a. Using the traditional cost system,determine the operating profit per unit for the brass style of faucet.

b. Determine the activity cost driver rate for setup overhead costs and inspection overhead costs.

c. Using the ABC system,for the brass style of faucet:

1.compute the estimated overhead costs per unit; and

2.compute the estimated operating profit per unit.

d. Explain the difference between the profits obtained from the traditional cost system and the ABC system.Which system provides a better estimate of profitability? Why?

a. Using the traditional cost system,determine the operating profit per unit for the brass style of faucet.

b. Determine the activity cost driver rate for setup overhead costs and inspection overhead costs.

c. Using the ABC system,for the brass style of faucet:

1.compute the estimated overhead costs per unit; and

2.compute the estimated operating profit per unit.

d. Explain the difference between the profits obtained from the traditional cost system and the ABC system.Which system provides a better estimate of profitability? Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck

80

Capacity cost rates also change when the denominator,practical capacity,changes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 113 في هذه المجموعة.

فتح الحزمة

k this deck