Deck 16: Completing the Tests in the Sales and Collection Cycle: Accounts Receivable

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

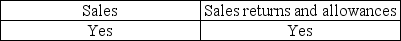

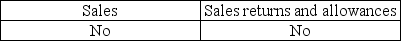

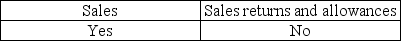

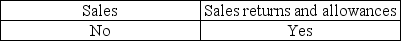

سؤال

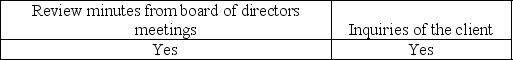

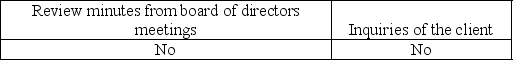

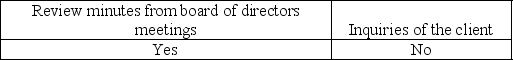

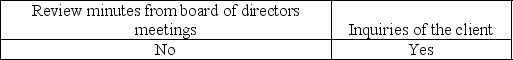

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

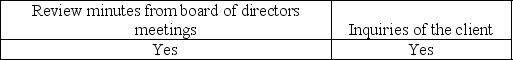

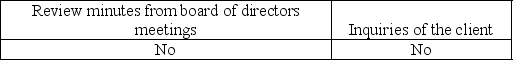

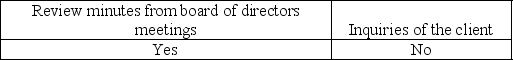

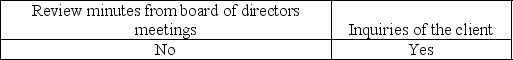

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/112

العب

ملء الشاشة (f)

Deck 16: Completing the Tests in the Sales and Collection Cycle: Accounts Receivable

1

An auditor is comparing the write-off of uncollectible accounts as a percentage of total accounts receivable with previous years.A possible misstatement this procedure could uncover is

A)overstatement or understatement of sales.

B)overstatement or understatement of accounts receivable.

C)overstatement or understatement of bad debt expense.

D)overstatement or understatement of sales returns and allowances.

A)overstatement or understatement of sales.

B)overstatement or understatement of accounts receivable.

C)overstatement or understatement of bad debt expense.

D)overstatement or understatement of sales returns and allowances.

C

2

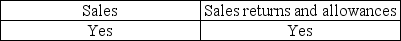

For sales,the completeness transaction-related audit objective affects the existence balance-related audit objective.

False

3

The results of the tests of controls determine whether assessed control risk for sales and cash receipts needs to be revised.

True

4

Which of the following types of receivables would not deserve the special attention of the auditor?

A)accounts receivables with credit balances

B)accounts that have been outstanding for a long time

C)receivables from related parties

D)each of the above would receive special attention.

A)accounts receivables with credit balances

B)accounts that have been outstanding for a long time

C)receivables from related parties

D)each of the above would receive special attention.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

5

Auditors are especially concerned with three aspects of internal control for the sales and collection cycle.Which of the following is not one of their major concerns?

A)controls over cutoff

B)controls that prevent or detect embezzlements

C)controls over sales discounts

D)controls related to the allowance for uncollectible accounts

A)controls over cutoff

B)controls that prevent or detect embezzlements

C)controls over sales discounts

D)controls related to the allowance for uncollectible accounts

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

6

For sales,the occurrence transaction-related audit objective affects which of the following balance-related audit objectives?

A)existence

B)completeness

C)rights

D)detail tie-in

A)existence

B)completeness

C)rights

D)detail tie-in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

7

For cash receipts,the occurrence transaction-related audit objective affects which of the following balance-related audit objectives?

A)existence

B)completeness

C)rights

D)detail tie-in

A)existence

B)completeness

C)rights

D)detail tie-in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

8

Favorable results from analytical procedures may reduce the extent to which the auditor needs to test details of balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is a correct statement regarding analytical procedures?

A)If an auditor identifies a possible misstatement in sales using analytical procedures,accounts payable will be the likely offsetting misstatement.

B)Auditors should also compare the results of their analytical procedures to budgets and industry trends.

C)If sales are overstated,the income statement will be incorrect,but the balance sheet will be correct.

D)If an analytical procedure uncovers an unusual fluctuation,the auditor must assume fraud is involved.

A)If an auditor identifies a possible misstatement in sales using analytical procedures,accounts payable will be the likely offsetting misstatement.

B)Auditors should also compare the results of their analytical procedures to budgets and industry trends.

C)If sales are overstated,the income statement will be incorrect,but the balance sheet will be correct.

D)If an analytical procedure uncovers an unusual fluctuation,the auditor must assume fraud is involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

10

Analytical procedures

A)are only done during the planning of the audit and when performing detailed tests.

B)performed during the detailed testing phase are done before tests of details of balances.

C)performed during the detailed testing phase are done before the balance sheet date.

D)are performed only on accounts receivable,not on the entire sales and collection cycle.

A)are only done during the planning of the audit and when performing detailed tests.

B)performed during the detailed testing phase are done before tests of details of balances.

C)performed during the detailed testing phase are done before the balance sheet date.

D)are performed only on accounts receivable,not on the entire sales and collection cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

11

Analytical procedures are substantive tests and,if the results of the analytical procedures are favorable,the auditor would normally

A)reduce the extent of tests of details of balances.

B)reduce the extent of tests of controls.

C)reduce the tests of transactions.

D)reduce all of the other tests.

A)reduce the extent of tests of details of balances.

B)reduce the extent of tests of controls.

C)reduce the tests of transactions.

D)reduce all of the other tests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

12

Recording a sale that did not occur violates the occurrence transaction-related audit objective and the existence balance-related audit objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

13

Auditors use the results of the substantive tests of transactions of sales and the collection cycle to determine the extent to which inherent risk is satisfied for each accounts receivable balance-related audit objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

14

When analytical procedures in the sales and collection cycle uncover unusual fluctuations,the auditor should make additional inquiries of management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

15

For most audits,revenue recognition is considered to be a significant risk.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

16

The appropriate and sufficient evidence to be obtained from tests of details must be decided on an

A)efficiency basis.

B)effectiveness basis.

C)objective-by-objective basis.

D)none of the above

A)efficiency basis.

B)effectiveness basis.

C)objective-by-objective basis.

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

17

The accounts receivable balance-related audit objective net realizable value is not affected by assessed control risk for sales or cash receipts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is an accurate statement regarding the risk assessment process of phase I of the audit process for the sales and collection cycle?

A)Auditors must perform substantive tests related to assertions deemed to have significant risks.

B)The auditor must relate control risk for transaction-related audit objectives to balance-related audit objectives in deciding planned inherent risk.

C)The realizable value balance-related audit objectives are affected by assessed control risk for classes of transactions.

D)All of the above are accurate statements.

A)Auditors must perform substantive tests related to assertions deemed to have significant risks.

B)The auditor must relate control risk for transaction-related audit objectives to balance-related audit objectives in deciding planned inherent risk.

C)The realizable value balance-related audit objectives are affected by assessed control risk for classes of transactions.

D)All of the above are accurate statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

19

The two primary classes of transactions in the sales and collection cycle are

A)sales and sales discounts.

B)sales and cash receipts.

C)sales and sales returns.

D)sales and accounts receivable.

A)sales and sales discounts.

B)sales and cash receipts.

C)sales and sales returns.

D)sales and accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

20

Below are listed possible misstatements that could occur in the sales and collections cycle.Provide the analytical procedure that would be most useful in detecting the possible misstatement.

a. overstatement of sales and accounts receivable

b. uncollectible accounts receivable that have not been provided for

c. overstatement of sales returns and allowances

a. overstatement of sales and accounts receivable

b. uncollectible accounts receivable that have not been provided for

c. overstatement of sales returns and allowances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

21

An auditor is performing a credit analysis of customers with balances over 60 days due.She is most likely obtaining evidence for which audit related objective?

A)realizable value

B)existence

C)completeness

D)occurrence

A)realizable value

B)existence

C)completeness

D)occurrence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

22

When do most companies record sales returns and allowances?

A)during the month in which the sale occurs

B)during the accounting period in which the return occurs

C)whenever the customer contacts the company regarding the credit

D)during the month after the sale occurs

A)during the month in which the sale occurs

B)during the accounting period in which the return occurs

C)whenever the customer contacts the company regarding the credit

D)during the month after the sale occurs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

23

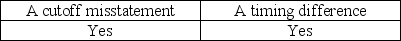

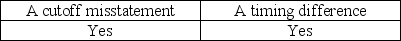

A customer mails and records a check to a client for payment of an unpaid account on December 30.The client receives and records the amount on January 2.The records of the two organizations will be different on December 31.This represents

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

24

Because of its central role in auditing of accounts receivable,which of the following would normally be one of the first items tested?

A)accounts receivable master file

B)customer file

C)aged trial balance

D)sales register

A)accounts receivable master file

B)customer file

C)aged trial balance

D)sales register

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

25

Cutoff misstatements occur

A)either by error or fraud.

B)by error only.

C)by fraud only.

D)randomly without causes related to errors or fraud.

A)either by error or fraud.

B)by error only.

C)by fraud only.

D)randomly without causes related to errors or fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

26

The understatement of sales and accounts receivable is best uncovered by

A)testing internal controls.

B)testing the aged accounts receivable trial balance.

C)substantive tests of transactions for shipments made but not recorded.

D)substantive tests of transactions for bad debts.

A)testing internal controls.

B)testing the aged accounts receivable trial balance.

C)substantive tests of transactions for shipments made but not recorded.

D)substantive tests of transactions for bad debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

27

The most important test of details of balances to determine the existence of recorded accounts receivable is

A)tracing details of sales invoices to shipping documents.

B)tracing the credits in accounts receivable to bank deposits.

C)tracing sales returns entries to credit memos issued and receiving room reports.

D)the confirmation of customers' balances.

A)tracing details of sales invoices to shipping documents.

B)tracing the credits in accounts receivable to bank deposits.

C)tracing sales returns entries to credit memos issued and receiving room reports.

D)the confirmation of customers' balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

28

The most important aspect of evaluating the client's method of obtaining a reliable cutoff is to

A)perform extensive detailed testing of cutoff.

B)evaluate the client's control procedures around cutoff.

C)confirm a sample of transactions near period end with customers.

D)confirm transaction with customers.

A)perform extensive detailed testing of cutoff.

B)evaluate the client's control procedures around cutoff.

C)confirm a sample of transactions near period end with customers.

D)confirm transaction with customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

29

Most tests of accounts receivable are based on what schedule,file,or listing?

A)sales master file

B)aged accounts receivable trial balance

C)accounts receivable master file

D)accounts receivable general ledger account

A)sales master file

B)aged accounts receivable trial balance

C)accounts receivable master file

D)accounts receivable general ledger account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

30

Confirmation of accounts receivable selected from the trial balance is the most common test of details of balances for the ________ of accounts receivable.

A)presentation

B)valuation

C)accuracy.

D)detail tie-in

A)presentation

B)valuation

C)accuracy.

D)detail tie-in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

31

If the client's internal control for recording sales returns and allowances is evaluated as ineffective,

A)a larger sample may be needed to verify cutoff.

B)sampling is not appropriate.

C)all sales returns must be traced to supporting documentation.

D)all sales returns must be confirmed with the customer.

A)a larger sample may be needed to verify cutoff.

B)sampling is not appropriate.

C)all sales returns must be traced to supporting documentation.

D)all sales returns must be confirmed with the customer.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is likely to be determined first when performing tests of details for accounts receivable?

A)Recorded accounts receivable exist.

B)Accounts receivable in the aged trial balance agree with related master file amounts,and the total is correctly added and agrees with the general ledger.

C)The client has a right to the accounts receivable.

D)Existing accounts receivable are included.

A)Recorded accounts receivable exist.

B)Accounts receivable in the aged trial balance agree with related master file amounts,and the total is correctly added and agrees with the general ledger.

C)The client has a right to the accounts receivable.

D)Existing accounts receivable are included.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

33

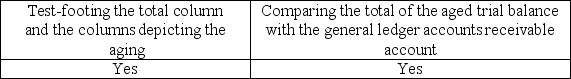

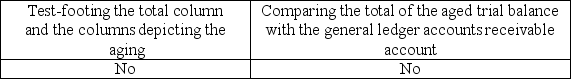

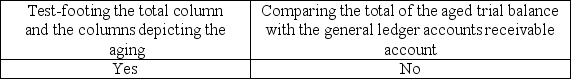

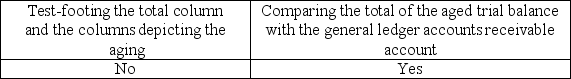

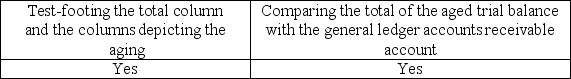

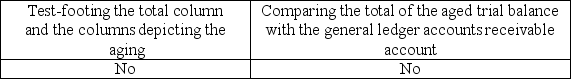

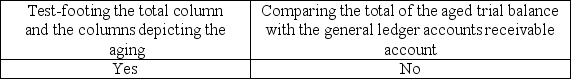

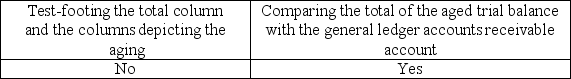

Testing the information on the aged trial balance for detail tie-in is a necessary audit procedure,which would normally include

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

34

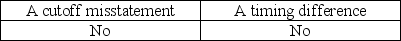

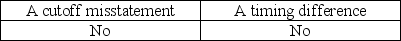

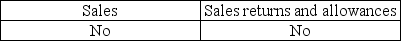

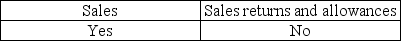

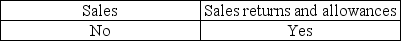

Cutoff misstatements can occur for

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following audit procedures would not likely detect a client's decision to pledge or factor accounts receivable?

A)a review of the minutes of the board of directors' meetings

B)discussions with the client

C)confirmation of receivables

D)examination of correspondence files

A)a review of the minutes of the board of directors' meetings

B)discussions with the client

C)confirmation of receivables

D)examination of correspondence files

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

36

Tests of which balance-related audit objective are normally performed first in an audit of the sales and collection?

A)accuracy

B)completeness

C)rights

D)detail tie-in

A)accuracy

B)completeness

C)rights

D)detail tie-in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

37

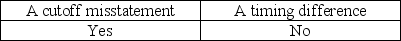

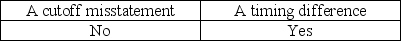

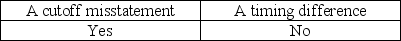

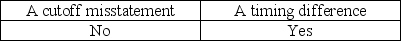

Cutoff misstatements occur when

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

38

Audit procedures designed to uncover credit sales made after the client's fiscal year-end that relate to the current year being audited provide evidence for which of the following audit objectives?

A)realizable value

B)accuracy

C)cutoff

D)existence

A)realizable value

B)accuracy

C)cutoff

D)existence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

39

A listing of the balances in the accounts receivable master file at the balance sheet date,including individual customer balances outstanding and a breakdown of each balance by the time passed between the date of the sale and the balance sheet date,is the

A)customer list.

B)aged trial balance.

C)accounts receivable ledger.

D)schedule of accounts receivable.

A)customer list.

B)aged trial balance.

C)accounts receivable ledger.

D)schedule of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

40

A high inherent risk increases planned detection risk and decreases planned substantive tests.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

41

Tests of detail tie-in are normally conducted last in the audit of the sales and collections cycle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

42

A procedure to test for a cash receipts cutoff error is

A)reconciling the bank statement.

B)performing a four-column proof-of-cash.

C)observing the counting of cash at the balance sheet date.

D)tracing recorded cash receipts to subsequent period bank deposits on the bank statement.

A)reconciling the bank statement.

B)performing a four-column proof-of-cash.

C)observing the counting of cash at the balance sheet date.

D)tracing recorded cash receipts to subsequent period bank deposits on the bank statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

43

Describe how the auditor tests the accuracy objective for accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

44

An auditor selects a sample from the file of shipping documents to determine whether invoices were prepared.This test is to satisfy the audit objective of

A)accuracy.

B)existence.

C)control.

D)completeness.

A)accuracy.

B)existence.

C)control.

D)completeness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

45

The net realizable value of accounts receivable is equal to:

A)gross accounts receivable less allowance for uncollectible accounts.

B)gross accounts receivable less bad debt expense.

C)gross accounts receivable less returns and allowances.

D)gross accounts receivable less sales discounts.

A)gross accounts receivable less allowance for uncollectible accounts.

B)gross accounts receivable less bad debt expense.

C)gross accounts receivable less returns and allowances.

D)gross accounts receivable less sales discounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

46

For which of the following accounts is cutoff least important?

A)sales

B)sales returns and allowances

C)cash collections

D)inventory

A)sales

B)sales returns and allowances

C)cash collections

D)inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

47

For most audits,a proper cash receipts cutoff is less important than the sales cutoff because the improper cutoff of cash

A)is detected and correct when cash is separately audited.

B)is unlikely to have a material impact on the balance sheet or the income statement.

C)affects items on the balance sheet but does not affect net income.

D)rarely occurs given the control consciousness of most entities.

A)is detected and correct when cash is separately audited.

B)is unlikely to have a material impact on the balance sheet or the income statement.

C)affects items on the balance sheet but does not affect net income.

D)rarely occurs given the control consciousness of most entities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

48

Assuming the client's internal controls are effective,describe how the auditor can verify proper cutoff of sales transactions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

49

For effective internal control,employees maintaining the accounts receivable subsidiary ledger should not also approve

A)employee overtime wages.

B)credit granted to customers.

C)write-offs of customer accounts.

D)cash disbursements.

A)employee overtime wages.

B)credit granted to customers.

C)write-offs of customer accounts.

D)cash disbursements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

50

Generally accepted accounting principles require that revenue be reported net of sales returns and allowances

A)if practical.

B)if required by industry practice.

C)if the amounts are material.

D)any of the above

A)if practical.

B)if required by industry practice.

C)if the amounts are material.

D)any of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

51

If material,all of the following are required to be separately disclosed in the financial statements except for

A)accounts receivable from officers.

B)accounts receivable from affiliates.

C)sales and assets for different business segments.

D)sales for the last ten days of the fiscal year.

A)accounts receivable from officers.

B)accounts receivable from affiliates.

C)sales and assets for different business segments.

D)sales for the last ten days of the fiscal year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

52

When an auditor tests to determine if all existing accounts receivable are included in the aged trial balance,

A)they cannot rely on the self-balancing nature of the accounts receivable master file.

B)if all sales to a customer are omitted from the sales journal,it is easy to uncover the understatement of accounts receivable by tests of details of balances.

C)auditors rarely send accounts receivable confirmations to customers with zero balances.

D)unrecorded sales to a new customer are easy to identify for confirmation because that customer is included in the accounts receivable master file.

A)they cannot rely on the self-balancing nature of the accounts receivable master file.

B)if all sales to a customer are omitted from the sales journal,it is easy to uncover the understatement of accounts receivable by tests of details of balances.

C)auditors rarely send accounts receivable confirmations to customers with zero balances.

D)unrecorded sales to a new customer are easy to identify for confirmation because that customer is included in the accounts receivable master file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

53

Discuss the audit procedures performed when testing the detail tie-in objective for accounts receivable,and explain why this objective is ordinarily tested before any other objectives for accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

54

One of the shortcomings in evaluating the allowance for uncollectible accounts by reviewing individual noncurrent balances on the aged trial balance is I. it is difficult to compare the results of the current year with those of the previous year.

II) current accounts are ignored in establishing the adequacy of the allowance.

A)I only

B)II only

C)both I and II

D)neither I nor II

II) current accounts are ignored in establishing the adequacy of the allowance.

A)I only

B)II only

C)both I and II

D)neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

55

How might the auditor determine whether a client has limited rights to accounts receivable?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

56

You are reviewing sales to discover cutoff problems.If the client's policy is to record sales when title to the merchandise passes to the buyer,then the books and records would contain errors if the December 31 entries were for sales recorded

A)before the merchandise was shipped.

B)at the time the merchandise was shipped.

C)several days subsequent to shipment.

D)at a time after the point at which title passed.

A)before the merchandise was shipped.

B)at the time the merchandise was shipped.

C)several days subsequent to shipment.

D)at a time after the point at which title passed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

57

When designing tests of details of balances,an important point to remember is

A)auditors emphasize income statement accounts.

B)the audit procedures selected depends heavily on whether planned evidence for a given objective is low,medium,or high.

C)if accounts receivable are overstated,then sales will be understated.

D)sales cutoff is the most important test of details of accounts receivable.

A)auditors emphasize income statement accounts.

B)the audit procedures selected depends heavily on whether planned evidence for a given objective is low,medium,or high.

C)if accounts receivable are overstated,then sales will be understated.

D)sales cutoff is the most important test of details of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following most likely would be detected by a review of a client's sales cutoff?

A)excessive sales discounts

B)unrecorded sales for the year

C)unauthorized goods returned for credit

D)lapping of year-end accounts receivable

A)excessive sales discounts

B)unrecorded sales for the year

C)unauthorized goods returned for credit

D)lapping of year-end accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

59

Cutoff misstatements can occur for sales,sales returns,and cash receipts.List below the threefold approach an auditor performs for each account above to determine the reasonableness of the cutoff.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following audit procedures would normally be included in the audit plan when auditing the allowance for doubtful accounts?

A)Send positive confirmations.

B)Inquire of the client's credit manager.

C)Send negative confirmations.

D)Examine sales invoices.

A)Send positive confirmations.

B)Inquire of the client's credit manager.

C)Send negative confirmations.

D)Examine sales invoices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

61

The most effective audit evidence gathered for accounts receivable is the

A)detail tie-in of the records.

B)analysis of the allowance for doubtful accounts.

C)confirmation of accounts receivable.

D)examination of sales invoices.

A)detail tie-in of the records.

B)analysis of the allowance for doubtful accounts.

C)confirmation of accounts receivable.

D)examination of sales invoices.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

62

After the auditor is satisfied with the allowance for uncollectible accounts,it is easy to verify bad debt expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

63

Communication addressed to the debtor requesting him or her to confirm whether the balance as stated on the communication is correct or incorrect is a

A)representation letter.

B)negative confirmation.

C)bank confirmation.

D)positive confirmation.

A)representation letter.

B)negative confirmation.

C)bank confirmation.

D)positive confirmation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

64

The audit procedure that provides the auditor with the most appropriate evidence when performing test of details of balances for accounts receivable is

A)confirmations.

B)recalculation of the aged receivables and uncollectible accounts.

C)tracing credit memos for returned merchandise to receiving room reports.

D)tracing from shipping documents to journals to the accounts receivable ledger.

A)confirmations.

B)recalculation of the aged receivables and uncollectible accounts.

C)tracing credit memos for returned merchandise to receiving room reports.

D)tracing from shipping documents to journals to the accounts receivable ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

65

Tests of the realizable value balance-related audit objective are for the purpose of evaluating the allowance for doubtful accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

66

For most audits,a proper cash receipts cutoff is less important than either the sales or the sales returns and allowances cutoff since cash only affects the balance sheet,and not earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

67

The most reliable evidence from confirmations is obtained when they are sent

A)as close to the balance sheet date as possible.

B)at various times throughout the year to different segments of the sample,so that the entire sample is representative of account balances scattered throughout the year.

C)several months before the year-end,so the auditor will have adequate time to perform alternate procedures if they are required.

D)at various times throughout the year to the same group in the sample,so that the sample will not have a time bias.

A)as close to the balance sheet date as possible.

B)at various times throughout the year to different segments of the sample,so that the entire sample is representative of account balances scattered throughout the year.

C)several months before the year-end,so the auditor will have adequate time to perform alternate procedures if they are required.

D)at various times throughout the year to the same group in the sample,so that the sample will not have a time bias.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

68

If the auditor decides not to confirm accounts receivable that are material,the auditor should

A)always use alternative procedures to audit the accounts receivable.

B)include copies of customer statements in the audit files.

C)document the reasons for such a decision in the audit files.

D)include copies of customer sales invoices in the audit files.

A)always use alternative procedures to audit the accounts receivable.

B)include copies of customer statements in the audit files.

C)document the reasons for such a decision in the audit files.

D)include copies of customer sales invoices in the audit files.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

69

Tests of the presentation and disclosure-related objectives are generally done as part of the completion phase of the audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

70

Confirmation of accounts receivable balances normally provides evidence concerning the

A)valuation of the balances.

B)rights of the balances.

C)existence of the balances.

D)completeness of the balances.

A)valuation of the balances.

B)rights of the balances.

C)existence of the balances.

D)completeness of the balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

71

A type of positive confirmation known as a blank confirmation

A)requests the recipient to fill in the amount of the balance.

B)is considered less reliable than the regular positive confirmation.

C)generates as high a response rate as the regular positive confirmation form.

D)is used when the auditor is confirming several small balances.

A)requests the recipient to fill in the amount of the balance.

B)is considered less reliable than the regular positive confirmation.

C)generates as high a response rate as the regular positive confirmation form.

D)is used when the auditor is confirming several small balances.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

72

When positive confirmations are used,auditing standards require alternative procedures for confirmations not returned by the customer.Which of the following would not be considered an alternative procedure?

A)Send a second confirmation request.

B)Examine subsequent cash receipts to determine if the receivable has been paid.

C)Examine shipping documents to verify that the merchandise was shipped.

D)Examine sales invoice to verify the actual issuance of a sales invoice and the actual date of the billing.

A)Send a second confirmation request.

B)Examine subsequent cash receipts to determine if the receivable has been paid.

C)Examine shipping documents to verify that the merchandise was shipped.

D)Examine sales invoice to verify the actual issuance of a sales invoice and the actual date of the billing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

73

A positive confirmation is more reliable evidence than a negative confirmation because

A)fewer confirmations can be sent out.

B)the auditor has a document which can be used in court.

C)the debtor's lack of response indicates agreement with the stated balance.

D)follow-up procedures are performed if a response is not received from the debtor.

A)fewer confirmations can be sent out.

B)the auditor has a document which can be used in court.

C)the debtor's lack of response indicates agreement with the stated balance.

D)follow-up procedures are performed if a response is not received from the debtor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

74

The criterion used by most merchandising and manufacturing clients for determining when revenue recognition takes place is whether title to the goods has passed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

75

Confirmation is the most common test of details of balances for the accuracy of accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

76

When should auditors not perform alternative procedures in testing the accounts receivable balance?

A)when customers do not return positive confirmation requests

B)when customers do not return negative confirmation requests

C)when confirmations are deemed to be ineffective as an audit procedure

D)when confirmations are too costly to use

A)when customers do not return positive confirmation requests

B)when customers do not return negative confirmation requests

C)when confirmations are deemed to be ineffective as an audit procedure

D)when confirmations are too costly to use

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following is the principle "weakness" of using negative confirmations for the tests of details of balances for accounts receivable?

A)They can only be used for large balance accounts.

B)They cannot not be used when account balances "bunch" around a mean value.

C)Conclusions drawn from receiving no reply may not be correct.

D)Response rates are generally too low to draw any conclusions.

A)They can only be used for large balance accounts.

B)They cannot not be used when account balances "bunch" around a mean value.

C)Conclusions drawn from receiving no reply may not be correct.

D)Response rates are generally too low to draw any conclusions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

78

A type of positive confirmation in which an individual invoice is confirmed,rather than the customer's entire accounts receivable balance is the ________ confirmation.

A)invoice

B)specific

C)balance

D)voucher

A)invoice

B)specific

C)balance

D)voucher

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

79

An auditor should perform alternative procedures to substantiate the existence of accounts receivable when

A)no reply to a positive confirmation request is received.

B)no reply to a negative confirmation request is received.

C)collectibility of the receivables is in doubt.

D)pledging of the receivables is probable.

A)no reply to a positive confirmation request is received.

B)no reply to a negative confirmation request is received.

C)collectibility of the receivables is in doubt.

D)pledging of the receivables is probable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck

80

The positive (as opposed to the negative)form of receivables confirmation may be preferred when

A)internal control surrounding accounts receivable is considered to be effective.

B)there is reason to believe that a substantial number of accounts may be in dispute.

C)a large number of small balances are involved.

D)the auditor believes that the recipients of the confirmations will give the requests adequate consideration.

A)internal control surrounding accounts receivable is considered to be effective.

B)there is reason to believe that a substantial number of accounts may be in dispute.

C)a large number of small balances are involved.

D)the auditor believes that the recipients of the confirmations will give the requests adequate consideration.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 112 في هذه المجموعة.

فتح الحزمة

k this deck