Deck 22: Audit of the Capital Acquisition and Repayment Cycle

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/92

العب

ملء الشاشة (f)

Deck 22: Audit of the Capital Acquisition and Repayment Cycle

1

All corporations must have

A)preferred stock.

B)capital stock.

C)paid-in capital in excess of par.

D)dividends payable.

A)preferred stock.

B)capital stock.

C)paid-in capital in excess of par.

D)dividends payable.

B

2

Which of the following statements regarding the capital acquisition and repayment cycle is most correct?

A)A relatively few transactions affect the cycle,and most are smaller amounts.

B)A large numbers of transactions affect the cycle,and most are smaller amounts.

C)A relatively few transactions affect the cycle,and most are highly material.

D)A large number of transaction affect the cycle,and most are highly material.

A)A relatively few transactions affect the cycle,and most are smaller amounts.

B)A large numbers of transactions affect the cycle,and most are smaller amounts.

C)A relatively few transactions affect the cycle,and most are highly material.

D)A large number of transaction affect the cycle,and most are highly material.

C

3

When auditing the capital acquisition and repayment cycle,it is common to verify each transaction taking place in the cycle for the entire year as a part of verifying the balance sheet accounts.

True

4

The capital acquisition and repayment cycle does not include

A)payment of interest.

B)payment of dividends.

C)payment of vendor invoices.

D)acquisition of capital through interest-bearing debt.

A)payment of interest.

B)payment of dividends.

C)payment of vendor invoices.

D)acquisition of capital through interest-bearing debt.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following is not an objective of the auditor's examination of notes payable?

A)to determine whether internal controls are adequate

B)to determine whether client's financing arrangements are effective and efficient

C)to determine whether transactions regarding the principal and interest of notes are properly authorized

D)to determine whether the liability for notes and related interest expense and accrued liabilities are properly stated

A)to determine whether internal controls are adequate

B)to determine whether client's financing arrangements are effective and efficient

C)to determine whether transactions regarding the principal and interest of notes are properly authorized

D)to determine whether the liability for notes and related interest expense and accrued liabilities are properly stated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

6

The primary audit objectives to focus on when auditing accounts in the capital acquisition and repayment cycle are

A)accuracy and completeness.

B)accuracy and existence.

C)completeness and valuation.

D)accuracy and valuation.

A)accuracy and completeness.

B)accuracy and existence.

C)completeness and valuation.

D)accuracy and valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following statements is correct regarding the capital acquisition and payment cycle?

A)Bonds are frequently issued by companies in small amounts.

B)There are relatively few transactions and each transaction is typically highly material.

C)A primary emphasis in auditing debt is on existence.

D)Audit procedures for notes payable and interest income are often performed simultaneously.

A)Bonds are frequently issued by companies in small amounts.

B)There are relatively few transactions and each transaction is typically highly material.

C)A primary emphasis in auditing debt is on existence.

D)Audit procedures for notes payable and interest income are often performed simultaneously.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

8

List the four characteristics of the capital acquisition and repayment cycle that make it unique from other cycles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

9

Performance materiality is often set at a(n)________ level for notes payable.

A)high

B)moderate

C)low

D)unknown

A)high

B)moderate

C)low

D)unknown

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

10

Auditors seldom learn about the capital acquisition and repayment cycle when gaining an understanding of the client's business and industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

11

An auditor is determining whether an issuance of notes payable for cash was correctly recorded.Her best course of action would be to

A)confirm with the bond trustee as to the amount of bonds issued.

B)confirm with the underwriter as to the appropriate market yield on the bonds.

C)trace the cash received from the proceeds to the accounting records.

D)verify that the amount was included in a footnote disclosure.

A)confirm with the bond trustee as to the amount of bonds issued.

B)confirm with the underwriter as to the appropriate market yield on the bonds.

C)trace the cash received from the proceeds to the accounting records.

D)verify that the amount was included in a footnote disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

12

In the audit of the transactions and amounts in the capital acquisition and repayment cycle,the auditor must take great care in making sure that the significant legal requirements affecting the financial statements have been properly fulfilled and

A)any violations are reported to the SEC.

B)are adequately disclosed in the financial statements.

C)must issue a disclaimer if they haven't been fulfilled.

D)any departures from the agreements are made with management's knowledge and consent.

A)any violations are reported to the SEC.

B)are adequately disclosed in the financial statements.

C)must issue a disclaimer if they haven't been fulfilled.

D)any departures from the agreements are made with management's knowledge and consent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

13

The auditor's independent estimate of interest expense from notes payable uses average interest rates and

A)average notes payable outstanding.

B)year-end notes payable outstanding.

C)only notes payable above the level of materiality.

D)only notes payable to major lenders.

A)average notes payable outstanding.

B)year-end notes payable outstanding.

C)only notes payable above the level of materiality.

D)only notes payable to major lenders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

14

One unique characteristic of the capital acquisition and repayment cycle is that relatively few transactions affect the account balances,but each transaction is often highly material in amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

15

Assessed control risk and results of substantive tests of transactions are normally unimportant for designing tests of details of balances for which of the following accounts?

A)accounts receivable

B)inventory

C)accounts payable

D)notes payable

A)accounts receivable

B)inventory

C)accounts payable

D)notes payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

16

List six accounts in the capital acquisition and repayment cycle commonly found on balance sheets of corporations.What characteristics do these accounts have in common that distinguish them from other accounts?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

17

When auditing interest-bearing debt,the auditor should ________ verify the related interest expense and interest payable.

A)not

B)attempt to

C)simultaneously

D)never

A)not

B)attempt to

C)simultaneously

D)never

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

18

Responsibility for the issuance of new notes payable would normally be vested in the

A)board of directors.

B)purchasing department.

C)accounting department.

D)accounts payable department.

A)board of directors.

B)purchasing department.

C)accounting department.

D)accounts payable department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

19

There is an indirect relationship between the interest and dividends accounts and debt and equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

20

The tests of details of balances procedure which requires the auditor to trace the totals of the notes payable list to the general ledger satisfies the audit objective of

A)accuracy.

B)existence.

C)detail tie-in.

D)completeness.

A)accuracy.

B)existence.

C)detail tie-in.

D)completeness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following audit tests would provide evidence regarding the balance-related audit objective of existence for an audit of notes payable?

A)Examine due dates on duplicate copies of notes.

B)Examine balance sheet for proper presentation and disclosure of notes payable.

C)Examine corporate minutes for loan approval.

D)Foot the notes payable list for notes payable and accrued interest.

A)Examine due dates on duplicate copies of notes.

B)Examine balance sheet for proper presentation and disclosure of notes payable.

C)Examine corporate minutes for loan approval.

D)Foot the notes payable list for notes payable and accrued interest.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

22

During the course of an audit,a CPA observes that the recorded interest expense seems to be excessive in relation to the balance in the long-term debt account.This observation could lead the auditor to suspect that

A)long-term debt is understated.

B)discount on bonds payable is overstated.

C)long-term debt is overstated.

D)premium on bonds payable is understated.

A)long-term debt is understated.

B)discount on bonds payable is overstated.

C)long-term debt is overstated.

D)premium on bonds payable is understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following is not an important control over notes payable?

A)There is proper authorization over the issuance of new notes payable.

B)Notes payable are issued when the business climate is favorable.

C)Adequate controls exist over repayment of interest and principal.

D)There exist proper documents and records.

A)There is proper authorization over the issuance of new notes payable.

B)Notes payable are issued when the business climate is favorable.

C)Adequate controls exist over repayment of interest and principal.

D)There exist proper documents and records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

24

Why are substantive analytical procedures essential for notes payable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is an accurate statement regarding the audit of the capital acquisition and repayment schedule?

A)When internal controls over notes payable are deficient,auditors are required to confirm the notes payable.

B)As auditors perform tests of details of balances for balance-related audit objectives,the evidence obtained helps satisfy the notes payable presentation and disclosure requirements.

C)The normal starting point for the audit of notes payable is a list of fixed asset acquisitions.

D)The schedule of notes payable and accrued interest must be prepared regardless of the number of transactions involved.

A)When internal controls over notes payable are deficient,auditors are required to confirm the notes payable.

B)As auditors perform tests of details of balances for balance-related audit objectives,the evidence obtained helps satisfy the notes payable presentation and disclosure requirements.

C)The normal starting point for the audit of notes payable is a list of fixed asset acquisitions.

D)The schedule of notes payable and accrued interest must be prepared regardless of the number of transactions involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

26

Which of the following balance-related audit objectives is not applicable to the audit of notes payable?

A)realizable value

B)detail tie-in

C)cutoff

D)classification

A)realizable value

B)detail tie-in

C)cutoff

D)classification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

27

You are auditing the long-term notes payable account for a client.Which of the following audit procedures would you most likely employ?

A)Compare interest expense recorded by the client with the notes payable account for reasonableness.

B)Confirm bonds payable with individual bond holders.

C)Perform analytical procedures on the bond discount or premium account.

D)Examine bond documents for the presence of hybrid securities.

A)Compare interest expense recorded by the client with the notes payable account for reasonableness.

B)Confirm bonds payable with individual bond holders.

C)Perform analytical procedures on the bond discount or premium account.

D)Examine bond documents for the presence of hybrid securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

28

Actual interest expense is significantly higher than the auditor's estimate.This would most likely lead the auditor to conclude that the client has not

A)recorded all long-term interest bearing debt in the accounting records.

B)recorded all interest expense paid or accrued.

C)properly accounted for the discount of bonds payable account.

D)properly recorded interest income.

A)recorded all long-term interest bearing debt in the accounting records.

B)recorded all interest expense paid or accrued.

C)properly accounted for the discount of bonds payable account.

D)properly recorded interest income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

29

In the audit of notes payable,it is common to include tests of principal and interest payments as a part of the audit of the acquisitions and payment cycle because the payments are in the cash disbursements journal that is being sampled.It is also normal to test these transactions as part of the capital acquisitions and repayment cycle because

A)it is not unusual for the auditor to duplicate a process,thereby gathering a larger quantity of evidence.

B)replicating the evidence will provide the auditor with a higher level of assurance.

C)the tests done in the acquisitions and payments cycle will look only at the cash credit side so the tests done in the capital acquisitions and repayment cycle will look at the debit side of the transaction.

D)due to the infrequency of these transactions,in many cases no transactions involving notes payable are included in the sample tests of acquisitions and payments.

A)it is not unusual for the auditor to duplicate a process,thereby gathering a larger quantity of evidence.

B)replicating the evidence will provide the auditor with a higher level of assurance.

C)the tests done in the acquisitions and payments cycle will look only at the cash credit side so the tests done in the capital acquisitions and repayment cycle will look at the debit side of the transaction.

D)due to the infrequency of these transactions,in many cases no transactions involving notes payable are included in the sample tests of acquisitions and payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

30

The audit objective that requires that existing notes payable be included in the notes payable schedule is satisfied by performing which of the following audit procedures?

A)Confirm notes payable.

B)Trace the total of the notes payable schedule to the general ledger.

C)Review the notes payable schedule to determine whether any are related parties.

D)Review the bank reconciliation for new notes credited directly to the bank account by the bank.

A)Confirm notes payable.

B)Trace the total of the notes payable schedule to the general ledger.

C)Review the notes payable schedule to determine whether any are related parties.

D)Review the bank reconciliation for new notes credited directly to the bank account by the bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

31

To determine if notes payable are included in the proper period,the auditor should

A)trace the cash received from the issuance to the accounting records.

B)examine duplicate copies of notes to determine whether the notes were dated on or before the balance sheet date.

C)examine duplicate copies of notes for principal and interest rates.

D)trace the individual notes payable to the master file.

A)trace the cash received from the issuance to the accounting records.

B)examine duplicate copies of notes to determine whether the notes were dated on or before the balance sheet date.

C)examine duplicate copies of notes for principal and interest rates.

D)trace the individual notes payable to the master file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

32

When there are not numerous transactions involving notes payable during the year,the normal starting point for the audit of notes payable is

A)a schedule of notes payable and accrued interest prepared by the audit team.

B)a schedule of notes payable and accrued interest obtained from the client.

C)a schedule of only those notes with unpaid balances at the end of the year prepared by the client.

D)the notes payable account in the general ledger.

A)a schedule of notes payable and accrued interest prepared by the audit team.

B)a schedule of notes payable and accrued interest obtained from the client.

C)a schedule of only those notes with unpaid balances at the end of the year prepared by the client.

D)the notes payable account in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

33

The audit objective that requires the auditor to determine that notes payable on the notes payable schedule are properly classified can be tested by performing the procedure to

A)confirm notes payable.

B)examine corporate minutes for loan approval.

C)examine notes,minutes,and bank confirmations for restrictions.

D)review the notes to determine whether any are with related parties.

A)confirm notes payable.

B)examine corporate minutes for loan approval.

C)examine notes,minutes,and bank confirmations for restrictions.

D)review the notes to determine whether any are with related parties.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

34

Which balance-related audit objective is important for uncovering both errors and fraud?

A)completeness

B)existence

C)accuracy

D)detail tie-in

A)completeness

B)existence

C)accuracy

D)detail tie-in

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

35

The tests of details of balances procedure which requires the auditor to examine notes paid after year-end to determine whether they were liabilities at the balance sheet date is an attempt to satisfy the audit objective of

A)existence.

B)completeness.

C)accuracy.

D)classification.

A)existence.

B)completeness.

C)accuracy.

D)classification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

36

What are the two most important balance-related audit objectives in notes payable?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

37

The two most important balance-related audit objectives for notes payable are

A)completeness and detail tie-in.

B)completeness and valuation.

C)accuracy and valuation.

D)accuracy and completeness.

A)completeness and detail tie-in.

B)completeness and valuation.

C)accuracy and valuation.

D)accuracy and completeness.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

38

The starting point for the audit of notes payable is a schedule of notes payable and accrued interest.Discuss the information typically included in the schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

39

Identify three substantive analytical procedures commonly performed for notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

40

The audit objective to determine that notes payable in the schedule actually exist is verified by the test of details of balances procedure to

A)foot the notes payable list.

B)confirm notes payable.

C)recalculate interest expense.

D)examine the balance sheet for proper disclosure of noncurrent portions.

A)foot the notes payable list.

B)confirm notes payable.

C)recalculate interest expense.

D)examine the balance sheet for proper disclosure of noncurrent portions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

41

Notes payable are generally for a period of sixty days or less.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

42

The audit procedure "Foot the notes payable list and trace the totals to the general ledger" is performed when verifying the accuracy objective for notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

43

When a company maintains its own records of stock transactions and outstanding stock,internal controls must be adequate to ensure that

A)actual owners are recorded in the bylaws.

B)the correct amount of dividends is paid to stockholders owning the stock on the dividend record date.

C)the correct amount of dividends is paid to stockholders owning the stock on the declaration date.

D)actual owners are recorded in the minutes.

A)actual owners are recorded in the bylaws.

B)the correct amount of dividends is paid to stockholders owning the stock on the dividend record date.

C)the correct amount of dividends is paid to stockholders owning the stock on the declaration date.

D)actual owners are recorded in the minutes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

44

The balance-related audit objective realizable value is not applicable when auditing notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

45

The audit procedure "Review the notes to determine whether any are related party notes or accounts payable" is performed when verifying the classification objective for notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

46

If loans require significant restrictions on the activities of the company,they must be disclosed in the footnotes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

47

The authorization of an issuance of capital stock normally includes all but which of the following?

A)type of stock to be issued

B)number of shares to be issued

C)date shares are to be issued

D)amount of dividend to be paid on shares issued

A)type of stock to be issued

B)number of shares to be issued

C)date shares are to be issued

D)amount of dividend to be paid on shares issued

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

48

When a dividend is declared by the board of directors,the source for determining who should receive dividend checks is the

A)shareholders' capital stock master file.

B)stock certificate books.

C)common stock account in the general ledger.

D)corporate directory.

A)shareholders' capital stock master file.

B)stock certificate books.

C)common stock account in the general ledger.

D)corporate directory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following would generally not need to be approved by the board of directors?

A)issuing capital stock

B)repurchasing capital stock

C)declaration of a dividend

D)payment of a dividend

A)issuing capital stock

B)repurchasing capital stock

C)declaration of a dividend

D)payment of a dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

50

Any company with stock listed on a securities exchange is required to engage a(n)

A)equity analyst.

B)stock transfer agent.

C)independent registrar.

D)equity placement specialist.

A)equity analyst.

B)stock transfer agent.

C)independent registrar.

D)equity placement specialist.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

51

The amount of time spent verifying owners' equity is frequently minimal for closely held corporations because

A)these companies are so small that it is not necessary to audit the capital section.

B)the few owners all have access to the books so the auditor spends more time on accounts like liabilities,which affect outsiders.

C)there are few if any transactions during the year for the capital stock accounts,except for earnings and dividends.

D)there is no public interest in these companies.

A)these companies are so small that it is not necessary to audit the capital section.

B)the few owners all have access to the books so the auditor spends more time on accounts like liabilities,which affect outsiders.

C)there are few if any transactions during the year for the capital stock accounts,except for earnings and dividends.

D)there is no public interest in these companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

52

When performing substantive analytical procedures for notes payable,if actual interest expense is materially larger than the auditor's expectation,one possible cause would be interest payments on unrecorded notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following types of owners' equity transactions would require authorization by the board of directors?

A)issuance of capital stock

B)repurchase of capital stock

C)declaration of dividends

D)all of the above

A)issuance of capital stock

B)repurchase of capital stock

C)declaration of dividends

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

54

Discuss the overall objectives of the audit of notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

55

The record of the issuance and repurchase of capital stock for the life of the corporation is maintained in the

A)shareholders' capital stock master file.

B)capital stock certificate record.

C)schedule of stock owners.

D)corporate directory.

A)shareholders' capital stock master file.

B)capital stock certificate record.

C)schedule of stock owners.

D)corporate directory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

56

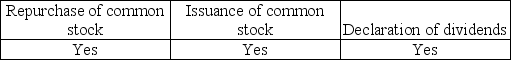

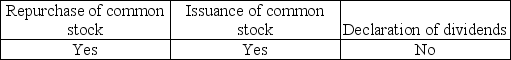

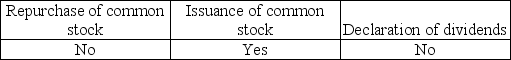

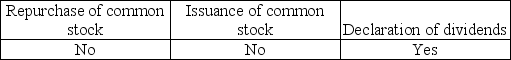

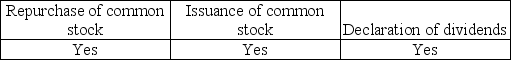

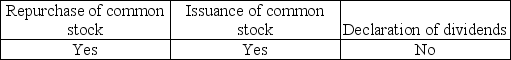

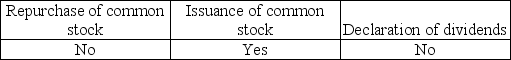

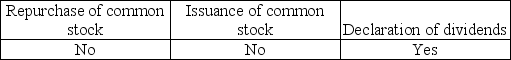

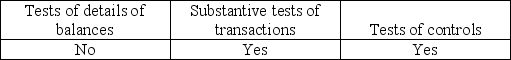

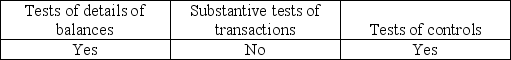

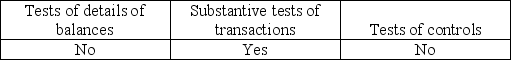

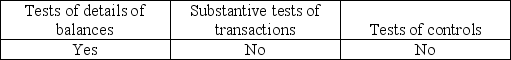

Which of the following owners' equity transactions usually require specific authorization from a company's board of directors?

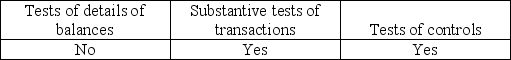

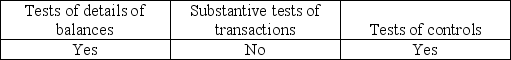

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

57

The record of the outstanding shares at any given time is maintained in the

A)corporate directory.

B)stock certificate books.

C)schedule of stock owners.

D)shareholders' capital stock master file.

A)corporate directory.

B)stock certificate books.

C)schedule of stock owners.

D)shareholders' capital stock master file.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

58

Discuss the four key controls over notes payable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

59

You are employing tests of details of balances for notes payable and interest expense.Describe below specific audit procedures you would perform for the balance-related audit objectives of detail tie-in and existence.List at least two for each objective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

60

The three most important balance-related audit objectives for notes payable are existence,realizable value,and accuracy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

61

The Securities and Exchange Commission requires companies listed on exchanges to employ stock transfer agents.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

62

When verifying if capital stock is accurately recorded,

A)the ending balance in the account does not need to verified.

B)the number of shares outstanding at the balance sheet date is verified by examining the corporate minutes.

C)the recorded par value can be determined by multiplying the number of shares by the market price of the stock.

D)a confirmation from the transfer agent is the simplest way to verify the number of shares outstanding at the balance sheet date.

A)the ending balance in the account does not need to verified.

B)the number of shares outstanding at the balance sheet date is verified by examining the corporate minutes.

C)the recorded par value can be determined by multiplying the number of shares by the market price of the stock.

D)a confirmation from the transfer agent is the simplest way to verify the number of shares outstanding at the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

63

Most closely held corporations have numerous transactions during the year for capital stock accounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

64

A shareholders' capital stock master file is a record of the issuance and repurchase of capital stock over the life of the corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the difference between an independent registrar and a stock transfer agent?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

66

When a company maintains its own records of stock transactions and capital stock outstanding,its internal controls must be adequate to accomplish three objectives.List them below.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

67

In auditing debits and credits to retained earnings,other than net income and dividends,the auditors first concern is

A)whether the transactions should have been included in retained earnings.

B)whether the transactions have been accurately recorded.

C)whether the transactions are classified correctly in the footnotes.

D)whether the transactions existed as of the balance sheet date.

A)whether the transactions should have been included in retained earnings.

B)whether the transactions have been accurately recorded.

C)whether the transactions are classified correctly in the footnotes.

D)whether the transactions existed as of the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

68

Public companies whose stock is listed on a stock exchange must employ an independent registrar.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

69

Few large companies employ stock transfer agents,but small companies commonly do so.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

70

Discuss the internal controls related to owners' equity that are of concern to the auditor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

71

Independent registrars commonly disburse cash dividends to shareholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following audit objectives is least important in the audit of capital stock and paid-in-capital in excess of par?

A)completeness

B)accuracy

C)rights and obligations

D)presentation and disclosure

A)completeness

B)accuracy

C)rights and obligations

D)presentation and disclosure

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is an important source of information for determining whether the presentation and disclosure-related objectives for capital stock activities are satisfied?

A)the corporate charter

B)the minutes of board of directors meetings

C)the auditor's analysis of capital stock transactions

D)all of the above

A)the corporate charter

B)the minutes of board of directors meetings

C)the auditor's analysis of capital stock transactions

D)all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

74

What are two important internal control procedures that companies should implement to prevent misstatements in owners' equity when a company maintains its own records of stock transactions and outstanding stock?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

75

What type of audit test will auditors use when testing to see if the amounts of capital stock transactions are accurately recorded?

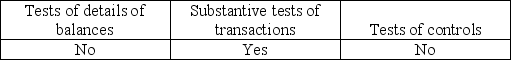

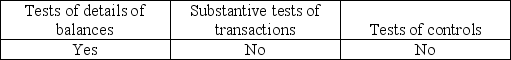

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

76

The shareholders' capital stock master file is used as the basis for the payment of dividends and also acts as a check on the accuracy of the common stock balance in the general ledger.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

77

All of the following are owners' equity accounts except for

A)common stock.

B)paid-in-capital in excess of par.

C)sales.

D)retained earnings.

A)common stock.

B)paid-in-capital in excess of par.

C)sales.

D)retained earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

78

The board of directors must authorize the amount of the dividend per share and the dates of record and payment of the dividend.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

79

The primary concern in determining whether retained earnings is correctly disclosed on the balance sheet is

A)correct calculation of the net income or loss for the year.

B)correct calculation of dividend payments for the year.

C)whether prior-period adjustments have been made correctly.

D)whether there are any restrictions on the payment of dividends.

A)correct calculation of the net income or loss for the year.

B)correct calculation of dividend payments for the year.

C)whether prior-period adjustments have been made correctly.

D)whether there are any restrictions on the payment of dividends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

80

When conducting the audit of stockholders' equity,it is normal practice to verify all capital stock transactions

A)only when the client is small.

B)that are in excess of a material amount.

C)if there aren't very many during the year.

D)regardless of the controls in existence,because of their materiality and permanence in the records.

A)only when the client is small.

B)that are in excess of a material amount.

C)if there aren't very many during the year.

D)regardless of the controls in existence,because of their materiality and permanence in the records.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck