Deck 24: Completing the Audit

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

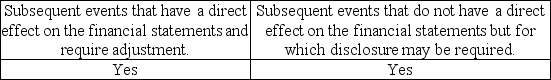

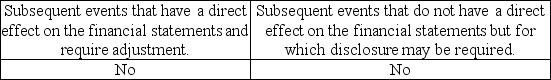

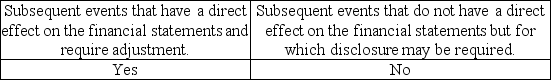

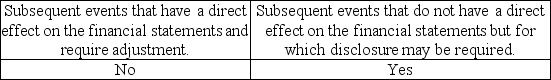

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/120

العب

ملء الشاشة (f)

Deck 24: Completing the Audit

1

Which of the following is not considered a commitment?

A)Agreements to purchase raw materials

B)Pension plans

C)Agreements to lease facilities at set prices

D)Each of the above is a commitment.

A)Agreements to purchase raw materials

B)Pension plans

C)Agreements to lease facilities at set prices

D)Each of the above is a commitment.

D

2

You are auditing Rodgers and Company.You are aware of a potential loss due to non-compliance with environmental regulations.Management has assessed that there is a 40% chance that a $10M payment could result from the non-compliance.The appropriate financial statement treatment is to:

A)accrue a $4 million liability.

B)disclose a liability and provide a range of outcomes.

C)since there is less than a 50% chance of occurrence, ignore.

D)since there is greater that a remote chance of occurrence, accrue the $10 million.

A)accrue a $4 million liability.

B)disclose a liability and provide a range of outcomes.

C)since there is less than a 50% chance of occurrence, ignore.

D)since there is greater that a remote chance of occurrence, accrue the $10 million.

B

3

Define the term contingent liability and discuss the criteria accountants and auditors use to classify these accounting events.

Contingent liability: a potential future obligation to an outside party for an unknown amount resulting from activities that have already taken place.Three conditions are required for a contingent liability to exist: (1)there is a potential future payment to an outside party or the impairment of an asset that resulted from an existing condition; (2)there is uncertainty about the amount for the future payment or impairment; and (3)the outcome will be resolved by some future event or events.Accounting standards describe three levels of likelihood of occurrence and the appropriate financial statement treatment for each likelihood as follows:

a.Probable-future event likely to occur and amount can be reasonably estimated then the financial statement accounts are adjusted.If amount cannot be reasonably estimated, then a footnote disclosure is necessary.

b.Reasonably possible-chance of occurring is more than remote, but less than probable.Footnote disclosure is necessary.

c.Remote-chance of occurrence is slight, no disclosure is necessary.

a.Probable-future event likely to occur and amount can be reasonably estimated then the financial statement accounts are adjusted.If amount cannot be reasonably estimated, then a footnote disclosure is necessary.

b.Reasonably possible-chance of occurring is more than remote, but less than probable.Footnote disclosure is necessary.

c.Remote-chance of occurrence is slight, no disclosure is necessary.

4

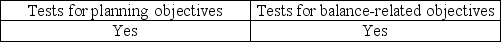

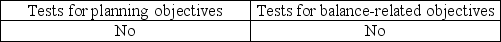

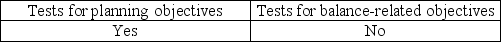

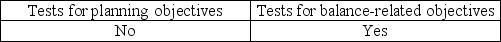

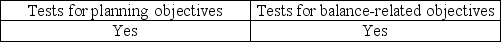

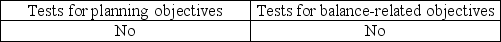

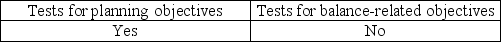

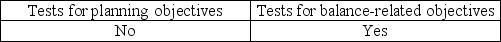

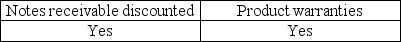

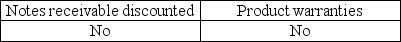

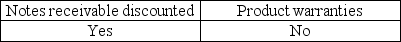

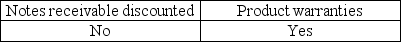

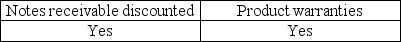

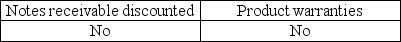

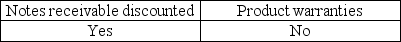

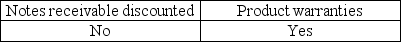

Auditors often integrate procedures for presentation and disclosure objectives with:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

5

When using the probability threshold for contingencies, the likelihood of the occurrence of the event is classified as:

A)not likely, likely, or highly likely.

B)remote, reasonably possible, or probable.

C)slight, moderate, great.

D)remote, likely, possible.

A)not likely, likely, or highly likely.

B)remote, reasonably possible, or probable.

C)slight, moderate, great.

D)remote, likely, possible.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

6

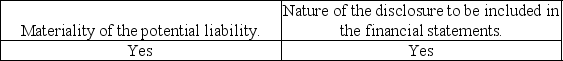

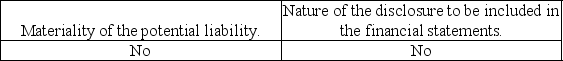

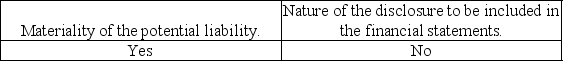

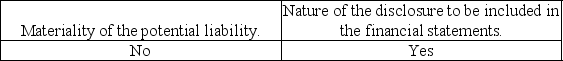

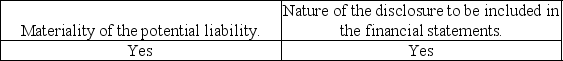

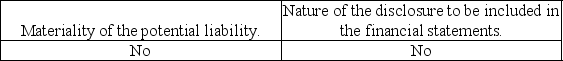

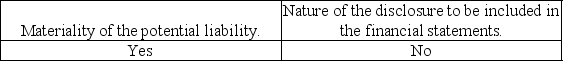

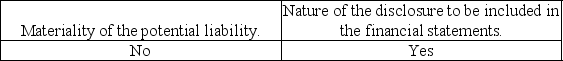

If an auditor concludes there are contingent liabilities, then he or she must evaluate the:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

7

Distinguish between contingent liabilities and commitments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

8

Audit procedures related to contingent liabilities are initially focused on:

A)accuracy.

B)completeness.

C)existence.

D)occurrence.

A)accuracy.

B)completeness.

C)existence.

D)occurrence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which of the following is not a common audit procedure used to search for contingent liabilities?

A)Examine letters of credit.

B)Examine payroll reports.

C)Review internal revenue agent reports.

D)Analyze legal expense.

A)Examine letters of credit.

B)Examine payroll reports.

C)Review internal revenue agent reports.

D)Analyze legal expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following groups has the responsibility for identifying and deciding the appropriate accounting treatment for recording or disclosing contingent liabilities?

A)Auditors

B)Legal counsel

C)Management

D)Management and the auditors

A)Auditors

B)Legal counsel

C)Management

D)Management and the auditors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following is a contingent liability with which an auditor is particularly concerned?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

12

When dealing with contingencies:

A)all material contingencies must be disclosed or footnoted.

B)the auditor must exercise considerable professional judgment when evaluating whether the client has applied the appropriate treatment.

C)it is easy for the auditor to uncover contingencies without management's cooperation.

D)the review for contingent liabilities is only performed at the beginning and the end of the audit.

A)all material contingencies must be disclosed or footnoted.

B)the auditor must exercise considerable professional judgment when evaluating whether the client has applied the appropriate treatment.

C)it is easy for the auditor to uncover contingencies without management's cooperation.

D)the review for contingent liabilities is only performed at the beginning and the end of the audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

13

With which of the following client personnel would it generally not be appropriate to inquire about commitments or contingent liabilities?

A)Controller

B)President

C)Accounts receivable clerk

D)Vice president of sales

A)Controller

B)President

C)Accounts receivable clerk

D)Vice president of sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

14

Inquiries of management regarding the possibility of unrecorded contingencies will be useful in uncovering:

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the auditor concludes that there are contingent liabilities, he or she must evaluate the significance of the potential liability and the nature of the disclosure needed in the financial statements.Which of the following statements is not true?

A)The potential liability is sufficiently well known in some instances to be included in the financial statements as an actual liability.

B)Disclosure may be unnecessary if the contingency is highly remote or immaterial.

C)A CPA firm often obtains a separate evaluation of the potential liability from its own legal counsel rather than relying on management or management's attorneys.

D)The client's attorneys must remain independent when evaluating the likelihood of losing the lawsuit.

A)The potential liability is sufficiently well known in some instances to be included in the financial statements as an actual liability.

B)Disclosure may be unnecessary if the contingency is highly remote or immaterial.

C)A CPA firm often obtains a separate evaluation of the potential liability from its own legal counsel rather than relying on management or management's attorneys.

D)The client's attorneys must remain independent when evaluating the likelihood of losing the lawsuit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

16

The auditor's primary concern relative to presentation and disclosure-related objectives is:

A)accuracy.

B)existence.

C)completeness.

D)occurrence.

A)accuracy.

B)existence.

C)completeness.

D)occurrence.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

17

A commitment is best described as:

A)an agreement to commit the firm to a set of fixed conditions in the future.

B)an agreement to commit the firm to a set of fixed conditions in the future that depends on company profitability.

C)an agreement to commit the firm to a set of fixed conditions in the future that depends on current market conditions.

D)a potential future obligation to an outside party for an as yet to be determined amount.

A)an agreement to commit the firm to a set of fixed conditions in the future.

B)an agreement to commit the firm to a set of fixed conditions in the future that depends on company profitability.

C)an agreement to commit the firm to a set of fixed conditions in the future that depends on current market conditions.

D)a potential future obligation to an outside party for an as yet to be determined amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

18

One of the primary approaches in dealing with uncertainties in loss contingencies uses a ________ threshold.

A)monetary

B)materiality

C)probability

D)analytical

A)monetary

B)materiality

C)probability

D)analytical

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

19

If a potential loss on a contingent liability is remote, the liability usually is:

A)disclosed in footnotes, but not accrued.

B)neither accrued nor disclosed in footnotes.

C)accrued and indicated in the body of the financial statements.

D)disclosed in the auditor's report but not disclosed on the financial statements.

A)disclosed in footnotes, but not accrued.

B)neither accrued nor disclosed in footnotes.

C)accrued and indicated in the body of the financial statements.

D)disclosed in the auditor's report but not disclosed on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

20

Contingent liability disclosure in the footnotes of the financial statements would normally be made when:

A)the outcome of the accounting event is deemed probable, but a reasonable estimation as to the amount cannot be made by the client or auditor.

B)a reasonable estimation of the loss can be made, but the outcome is not probable.

C)the outcome of the accounting event is deemed probable, and a reasonable estimation as to the amount can be made.

D)the outcome of the accounting event as well as a reasonable estimation of the loss cannot be made.

A)the outcome of the accounting event is deemed probable, but a reasonable estimation as to the amount cannot be made by the client or auditor.

B)a reasonable estimation of the loss can be made, but the outcome is not probable.

C)the outcome of the accounting event is deemed probable, and a reasonable estimation as to the amount can be made.

D)the outcome of the accounting event as well as a reasonable estimation of the loss cannot be made.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

21

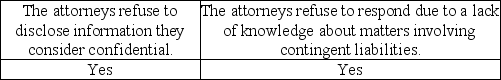

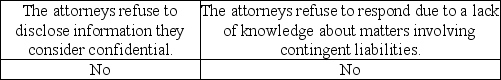

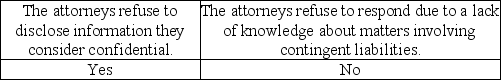

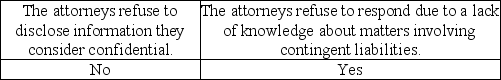

What is one of the main reasons an attorney may refuse to provide auditors with complete information about contingent liabilities?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

22

Auditors, as part of completing the audit, will request the client to send a letter of inquiry to those attorneys the company has been consulting with during the year under audit regarding legal matters of concern to the company.The primary reason the auditor requests this information is to:

A)determine the range of probable loss for asserted claims.

B)corroborate of information supplied by management concerning litigation, claims, and assessments.

C)outside opinion of probability of losses in determining accruals for contingencies.

D)outside opinion of probability of losses in determining the proper footnote disclosure.

A)determine the range of probable loss for asserted claims.

B)corroborate of information supplied by management concerning litigation, claims, and assessments.

C)outside opinion of probability of losses in determining accruals for contingencies.

D)outside opinion of probability of losses in determining the proper footnote disclosure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

23

A lawsuit has been filed against your client.If, in the opinion of legal counsel, the likelihood your client will lose the lawsuit is remote, no financial statement accrual or disclosure of the potential loss would generally be required.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

24

In a standard inquiry of client's attorney letter, the attorney is requested to communicate about contingencies up to the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

25

When preparing a standard inquiry of client's attorney letter, the client's letterhead should be used, and the letter should be signed by the client company's officials.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

26

An attorney is aware of a violation of a patent agreement that could result in a significant loss to the client if it were known.This is an example of a(n):

A)commitment.

B)unasserted claim.

C)pending litigation.

D)subsequent event.

A)commitment.

B)unasserted claim.

C)pending litigation.

D)subsequent event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

27

What are the three required conditions for a contingent liability to exist?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

28

Auditors will generally send a standard inquiry letter to:

A)only those attorneys who have devoted substantial time to client matters during the year.

B)every attorney that the client has been involved with in the current or preceding year, plus any attorney the client engages on occasion.

C)those attorneys whom the client relies on for advice related to substantial legal matters.

D)only the attorney who represents the client in proceeding where the client is defendant.

A)only those attorneys who have devoted substantial time to client matters during the year.

B)every attorney that the client has been involved with in the current or preceding year, plus any attorney the client engages on occasion.

C)those attorneys whom the client relies on for advice related to substantial legal matters.

D)only the attorney who represents the client in proceeding where the client is defendant.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

29

What needs to be included in a letter of inquiry sent to a client's legal counsel?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

30

State three items that should be included in a standard "inquiry of attorney" letter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

31

With what types of contingencies might an auditor be concerned?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

32

An attorney is responding to an independent auditor as a result of the client's letter of inquiry.The attorney may appropriately limit the response to:

A)asserted claims and litigation.

B)asserted, overtly threatened, or pending claims and litigation.

C)items which have an extremely high probability of being resolved to the client's detriment.

D)matters to which the attorney has given substantive attention in the form of legal consultation or representation.

A)asserted claims and litigation.

B)asserted, overtly threatened, or pending claims and litigation.

C)items which have an extremely high probability of being resolved to the client's detriment.

D)matters to which the attorney has given substantive attention in the form of legal consultation or representation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

33

If an attorney refuses to provide the auditor with information about material existing lawsuits or unasserted claims, current professional standards require that the auditor consider the refusal as a scope limitation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

34

Many of the audit procedures for finding contingencies are usually performed as an integral part of various segments of the audit rather than as a separate activity near the end of the audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

35

The standard letter of inquiry to the client's legal counsel should be prepared on:

A)plain paper (no letterhead)and be unsigned.

B)lawyer's stationery and signed by the lawyer.

C)auditor's stationery and signed by an audit partner.

D)client's stationery and signed by a company official.

A)plain paper (no letterhead)and be unsigned.

B)lawyer's stationery and signed by the lawyer.

C)auditor's stationery and signed by an audit partner.

D)client's stationery and signed by a company official.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

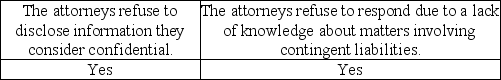

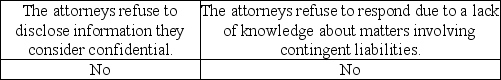

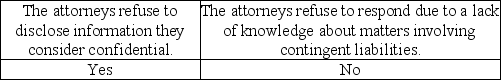

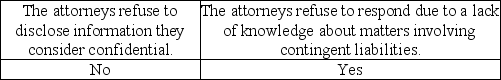

36

Attorneys in recent years have become reluctant to provide certain information to auditors because of their own exposure to legal liability for providing incorrect or confidential information.State the two main reasons that attorneys refuse to provide the auditors with complete information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

37

Current professional auditing standards make it clear that management, not the auditor, is responsible for identifying and deciding the appropriate accounting treatment for contingent liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

38

Discuss three audit procedures commonly used to search for contingent liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

39

Management furnishes the independent auditor with information concerning litigation, claims, and assessments.Which of the following is the auditor's primary means of initiating action to corroborate such information?

A)Request that client lawyers undertake a reconsideration of matters of litigation, claims, and assessments with which they were consulted during the period under examination.

B)Request that client management send a letter of inquiry to those lawyers with whom management consulted concerning litigation, claims, and assessments.

C)Request that client lawyers provide a legal opinion concerning the policies and procedures adopted by management to identify, evaluate, and account for litigation, claims, and assessments.

D)Request that client management engage outside attorneys to suggest wording for the text of a footnote explaining the nature and probable outcome of existing litigation, claims, and assessments.

A)Request that client lawyers undertake a reconsideration of matters of litigation, claims, and assessments with which they were consulted during the period under examination.

B)Request that client management send a letter of inquiry to those lawyers with whom management consulted concerning litigation, claims, and assessments.

C)Request that client lawyers provide a legal opinion concerning the policies and procedures adopted by management to identify, evaluate, and account for litigation, claims, and assessments.

D)Request that client management engage outside attorneys to suggest wording for the text of a footnote explaining the nature and probable outcome of existing litigation, claims, and assessments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

40

An environmental clean-up lawsuit is pending against your client.What information about the lawsuit would you as the auditor need in order to determine the proper accounting treatment?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

41

In connection with the annual audit, which of the following is not a "subsequent events" procedure?

A)Prepare any necessary closing journal entries.

B)Examine the minutes of stockholders and directors meetings subsequent to the balance sheet date.

C)Review journals and ledgers.

D)Obtain a letter of representation.

A)Prepare any necessary closing journal entries.

B)Examine the minutes of stockholders and directors meetings subsequent to the balance sheet date.

C)Review journals and ledgers.

D)Obtain a letter of representation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

42

An auditor performs interim work at various times throughout the year.The auditor's subsequent events work should be extended to the date of:

A)the auditor's report.

B)a post-dated footnote.

C)the next scheduled interim visit.

D)the final billing for audit services rendered.

A)the auditor's report.

B)a post-dated footnote.

C)the next scheduled interim visit.

D)the final billing for audit services rendered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

43

Subsequent events affecting the realization of assets ordinarily will require adjustments of the financial statements under examination because such events typically represent:

A)the culmination of conditions that existed at the balance sheet date.

B)additional new information related to events that were in existence on the balance sheet date.

C)final estimates of losses relating to casualties occurring in the subsequent events period.

D)preliminary estimate of losses relating to new events that occurred subsequent to the balance sheet date.

A)the culmination of conditions that existed at the balance sheet date.

B)additional new information related to events that were in existence on the balance sheet date.

C)final estimates of losses relating to casualties occurring in the subsequent events period.

D)preliminary estimate of losses relating to new events that occurred subsequent to the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

44

The audit procedures for the subsequent events review can be divided into two categories: (1)procedures normally integrated as a part of the verification of year-end account balances, and (2)those performed specifically for the purpose of discovering subsequent events.Which of the following procedures is in the second category?

A)Correspond with attorneys.

B)Test the collectability of accounts receivable by reviewing subsequent period cash receipts.

C)Subsequent period sales and purchases transactions are examined to determine whether the cutoff is accurate.

D)Compare the subsequent-period purchase price of inventory with the recorded cost as a test of lower of cost or market valuation.

A)Correspond with attorneys.

B)Test the collectability of accounts receivable by reviewing subsequent period cash receipts.

C)Subsequent period sales and purchases transactions are examined to determine whether the cutoff is accurate.

D)Compare the subsequent-period purchase price of inventory with the recorded cost as a test of lower of cost or market valuation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

45

The audit procedures for the subsequent events review can be divided into two categories: (1)procedures integrated as a part of the verification of year-end account balances, and (2)those performed specifically for the purpose of discovering subsequent events.Which of the following procedures is in the first category?

A)Inquire of client regarding contingent liabilities.

B)Obtain a letter of representation written by client.

C)Subsequent period sales and purchases transactions are examined to determine whether the cutoff is accurate.

D)Review journals and ledgers of year 2 to determine the existence of any transactions related to year 1.

A)Inquire of client regarding contingent liabilities.

B)Obtain a letter of representation written by client.

C)Subsequent period sales and purchases transactions are examined to determine whether the cutoff is accurate.

D)Review journals and ledgers of year 2 to determine the existence of any transactions related to year 1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

46

The auditor's responsibility for "reviewing the subsequent events" of a public company that is about to issue new securities is normally limited to the period of time:

A)beginning with the balance sheet date and ending with the date of the auditor's report.

B)beginning with the start of the fiscal year under audit and ending with the balance sheet date.

C)beginning with the start of the fiscal year under audit and ending with the date of the auditor's report.

D)beginning with the balance sheet date and ending with the date the registration statement becomes effective.

A)beginning with the balance sheet date and ending with the date of the auditor's report.

B)beginning with the start of the fiscal year under audit and ending with the balance sheet date.

C)beginning with the start of the fiscal year under audit and ending with the date of the auditor's report.

D)beginning with the balance sheet date and ending with the date the registration statement becomes effective.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which event that occurred after the end of the fiscal year under audit but prior to issuance of the auditor's report would not require disclosure in the financial statements?

A)Sale of a bond or capital stock issue

B)Loss of plant or inventories as a result of fire or flood

C)A significant decline in the market price of the corporation's stock

D)A merger or acquisition

A)Sale of a bond or capital stock issue

B)Loss of plant or inventories as a result of fire or flood

C)A significant decline in the market price of the corporation's stock

D)A merger or acquisition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

48

The auditor has completed her assessment of subsequent events.The proper accounting for subsequent events that have a direct effect on the financial statements is to:

A)adjust the financial statements for the year under audit.

B)disclose in the notes to financial statement the amount of the adjustment.

C)duly note in the audit workpapers that next year's financial statements need to be adjusted.

D)make no adjustment of the financial statements for the year under audit.

A)adjust the financial statements for the year under audit.

B)disclose in the notes to financial statement the amount of the adjustment.

C)duly note in the audit workpapers that next year's financial statements need to be adjusted.

D)make no adjustment of the financial statements for the year under audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

49

After the balance sheet date, but prior to the issuance of the audit report, the client suffers an uninsured loss of their inventory as a result of a fire.The amount of the loss is material.The auditor should:

A)adjust the financial statements for the year under audit.

B)add a paragraph to the audit report.

C)advise the client to disclose the event in the notes to the financial statements.

D)advise the client to delay issuing the financial statements until the economic loss can be determined.

A)adjust the financial statements for the year under audit.

B)add a paragraph to the audit report.

C)advise the client to disclose the event in the notes to the financial statements.

D)advise the client to delay issuing the financial statements until the economic loss can be determined.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following material events occurring subsequent to the balance sheet date would require an adjustment to the financial statements before they could be issued?

A)Loss of a plant as a result of a flood

B)Sale of long-term debt or capital stock

C)Settlement of litigation in excess of the recorded liability

D)Major purchase of a business that is expected to double the sales volume

A)Loss of a plant as a result of a flood

B)Sale of long-term debt or capital stock

C)Settlement of litigation in excess of the recorded liability

D)Major purchase of a business that is expected to double the sales volume

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

51

The auditor has a responsibility to review transactions and activities occurring after the balance sheet date to determine whether anything occurred that might affect the statements being audited.The procedures required to verify these transactions are commonly referred to as the review for:

A)contingent liabilities.

B)subsequent year's transactions.

C)late unusual occurrences.

D)subsequent events.

A)contingent liabilities.

B)subsequent year's transactions.

C)late unusual occurrences.

D)subsequent events.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

52

An auditor has the responsibility to actively search for subsequent events that occur subsequent to the:

A)balance sheet date.

B)date of the auditor's report.

C)balance sheet date, but prior to the audit report.

D)date of the management representation letter.

A)balance sheet date.

B)date of the auditor's report.

C)balance sheet date, but prior to the audit report.

D)date of the management representation letter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

53

An auditor's decision concerning whether or not to dual date an audit report is primarily based on the auditor's decision to:

A)extend appropriate audit procedures.

B)assume responsibility for events after the date of the auditor's report.

C)assume responsibility for event from fiscal year end to the date of the audit report.

D)roll the dice and hope for a successful outcome.

A)extend appropriate audit procedures.

B)assume responsibility for events after the date of the auditor's report.

C)assume responsibility for event from fiscal year end to the date of the audit report.

D)roll the dice and hope for a successful outcome.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

54

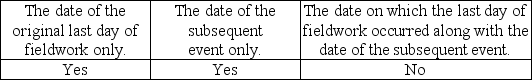

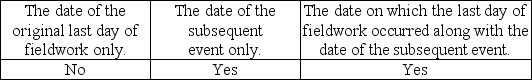

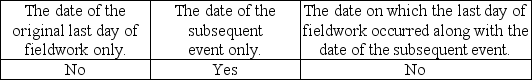

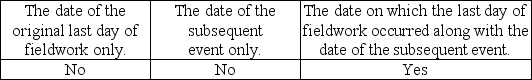

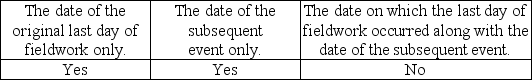

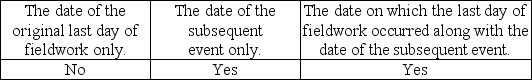

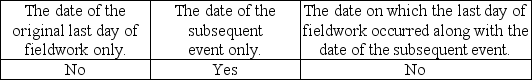

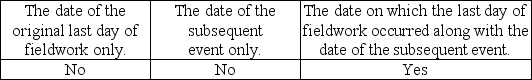

If the auditor determines that a subsequent event that affects the current period financial statements occurred after fieldwork was completed but before the audit report was issued, what date(s)may the auditor use on the report?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

55

An auditor's decision concerning whether or not to "dual date" the audit report is based upon the auditor's willingness to:

A)extend auditing procedures and assume responsibility for a greater period of time.

B)accept responsibility for subsequent events.

C)permit inclusion of a footnote captioned: event (unaudited)subsequent to the date of the auditor's report.

D)assume responsibility for events subsequent to the issuance of the auditor's report.

A)extend auditing procedures and assume responsibility for a greater period of time.

B)accept responsibility for subsequent events.

C)permit inclusion of a footnote captioned: event (unaudited)subsequent to the date of the auditor's report.

D)assume responsibility for events subsequent to the issuance of the auditor's report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following would be a subsequent discovery of facts which would not require a response by the auditor?

A)Discovery of the inclusion of material nonexistent sales

B)Discovery of the failure to write off material obsolete inventory

C)Discovery of the omission of a material footnote

D)Discovery of management's intent to increase selling prices in the future

A)Discovery of the inclusion of material nonexistent sales

B)Discovery of the failure to write off material obsolete inventory

C)Discovery of the omission of a material footnote

D)Discovery of management's intent to increase selling prices in the future

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following subsequent events is most likely to result in an adjustment to a company's financial statements?

A)Merger or acquisition activities

B)Bankruptcy (due to deteriorating financial condition)of a customer with an outstanding accounts receivable balance

C)Issuance of common stock

D)An uninsured loss of inventories due to a fire

A)Merger or acquisition activities

B)Bankruptcy (due to deteriorating financial condition)of a customer with an outstanding accounts receivable balance

C)Issuance of common stock

D)An uninsured loss of inventories due to a fire

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which type of subsequent event requires consideration by management and evaluation by the auditor?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

59

Whenever subsequent events are used to evaluate the amounts included in the statements, care must be taken to distinguish between conditions that existed at the balance sheet date and those that come into being after the balance sheet date.The subsequent information should not be incorporated directly into the statements if the conditions causing the change in valuation:

A)took place before the balance sheet date.

B)did not take place until after the balance sheet date.

C)occurred both before and after the balance sheet date.

D)are reimbursable through insurance policies.

A)took place before the balance sheet date.

B)did not take place until after the balance sheet date.

C)occurred both before and after the balance sheet date.

D)are reimbursable through insurance policies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

60

After an auditor has issued an audit report on a nonpublic entity, there is no obligation to make any further audit tests or inquiries with respect to the audited financial statements covered by that report unless:

A)material adverse events occur after the date of the auditor's report.

B)final determination or resolution was made of a contingency which had been disclosed in the financial statements.

C)final determination or resolution was made on matters which had resulted in a qualification in the auditor's report.

D)new information comes to the auditor's attention concerning an event that occurred prior to the date of the auditor's report that may have affected the auditor's report.

A)material adverse events occur after the date of the auditor's report.

B)final determination or resolution was made of a contingency which had been disclosed in the financial statements.

C)final determination or resolution was made on matters which had resulted in a qualification in the auditor's report.

D)new information comes to the auditor's attention concerning an event that occurred prior to the date of the auditor's report that may have affected the auditor's report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

61

A client has a calendar year-end.Listed below are four events that occurred after December 31.Which one of these subsequent events might result in adjustment of the December 31 financial statements?

A)Sale of a major subsidiary

B)Adoption of accelerated depreciation methods

C)Write-off of a substantial portion of inventory as obsolete

D)Collection of 90% of the accounts receivable existing at December 31

A)Sale of a major subsidiary

B)Adoption of accelerated depreciation methods

C)Write-off of a substantial portion of inventory as obsolete

D)Collection of 90% of the accounts receivable existing at December 31

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

62

The letter of representation obtained from an audit client should be:

A)dated as of the end of the period under audit.

B)dated as of the audit report date.

C)dated as of any date decided upon by the client and auditor.

D)dated as of the issuance of the financial statement.

A)dated as of the end of the period under audit.

B)dated as of the audit report date.

C)dated as of any date decided upon by the client and auditor.

D)dated as of the issuance of the financial statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

63

The issuance of bonds by the client subsequent to the balance sheet date would require a footnote disclosure in, but no adjustment to, the financial statements under audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

64

Subsequent events which require adjustment to the financial statements provide additional information about significant conditions/events which did not exist at the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

65

The auditor's responsibility with respect to events occurring between the balance sheet date and the end of the audit examination is best expressed by which of the following statements?

A)The auditor is fully responsible for events occurring in the subsequent period and should extend all detailed procedures through the last day of fieldwork.

B)The auditor is responsible for determining that a proper cutoff has been made and performing a general review of events occurring in the subsequent period.

C)The auditor's responsibility is to determine that a proper cutoff has been made and that transactions recorded on or before the balance sheet date actually occurred.

D)The auditor has no responsibility for events occurring in the subsequent period unless these events affect transactions recorded on or before the balance sheet date.

A)The auditor is fully responsible for events occurring in the subsequent period and should extend all detailed procedures through the last day of fieldwork.

B)The auditor is responsible for determining that a proper cutoff has been made and performing a general review of events occurring in the subsequent period.

C)The auditor's responsibility is to determine that a proper cutoff has been made and that transactions recorded on or before the balance sheet date actually occurred.

D)The auditor has no responsibility for events occurring in the subsequent period unless these events affect transactions recorded on or before the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following is not one of the categories of items included in the client letter of representation?

A)Subsequent events

B)Completeness of information

C)Recognition, measurement, and disclosure

D)Materiality

A)Subsequent events

B)Completeness of information

C)Recognition, measurement, and disclosure

D)Materiality

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following audit procedures would most likely assist an auditor in identifying conditions and events that may indicate there could be substantial doubt about an entity's ability to continue as a going concern?

A)Review compliance with the terms of debt agreements

B)Confirmation of accounts receivable from principal customers

C)Reconciliation of interest expense with debt outstanding

D)Confirmation of bank balances

A)Review compliance with the terms of debt agreements

B)Confirmation of accounts receivable from principal customers

C)Reconciliation of interest expense with debt outstanding

D)Confirmation of bank balances

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

68

Refusal by a client to prepare and sign the representation letter would require the auditor to issue a:

A)qualified opinion or a disclaimer of opinion.

B)adverse opinion or a disclaimer of opinion.

C)qualified or an adverse opinion.

D)unqualified opinion with an explanatory paragraph.

A)qualified opinion or a disclaimer of opinion.

B)adverse opinion or a disclaimer of opinion.

C)qualified or an adverse opinion.

D)unqualified opinion with an explanatory paragraph.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

69

When should auditors generally assess a client's ability to continue as a going concern?

A)Upon completion of the audit

B)During the planning stages of the audit

C)Throughout the entire audit process

D)During testing and completion phases of the audit

A)Upon completion of the audit

B)During the planning stages of the audit

C)Throughout the entire audit process

D)During testing and completion phases of the audit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

70

The date of the management representation letter received from the client should coincide with which of the following?

A)Date of latest subsequent event disclosed in the notes to the financial statements

B)Date of the auditor's report

C)Balance sheet date

D)Engagement agreement

A)Date of latest subsequent event disclosed in the notes to the financial statements

B)Date of the auditor's report

C)Balance sheet date

D)Engagement agreement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

71

Auditing standards require auditors to evaluate whether there is a substantial doubt about a client's ability to continue as a going concern.One of the most important audit procedures to perform to assess the going concern question is:

A)analytical procedures.

B)confirmations from creditors.

C)statistical sampling procedures.

D)inquiries of client and its legal counsel.

A)analytical procedures.

B)confirmations from creditors.

C)statistical sampling procedures.

D)inquiries of client and its legal counsel.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the following would the auditor expect to find in the client's management representation letter?

A)Management's recommendations for internal control effectiveness improvements

B)Management's plans for improving product quality

C)Management's compliance with contractual arrangements that impact the financial statements

D)Management's goals for improving earnings per share

A)Management's recommendations for internal control effectiveness improvements

B)Management's plans for improving product quality

C)Management's compliance with contractual arrangements that impact the financial statements

D)Management's goals for improving earnings per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following statements regarding the letter of representation is not correct?

A)It is prepared on the client's letterhead.

B)It is addressed to the CPA firm.

C)It is signed by high-level corporate officials, usually the president and chief financial officer.

D)It is optional, not required, that the auditor obtain such a letter from management.

A)It is prepared on the client's letterhead.

B)It is addressed to the CPA firm.

C)It is signed by high-level corporate officials, usually the president and chief financial officer.

D)It is optional, not required, that the auditor obtain such a letter from management.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

74

Auditing standards require that the auditor evaluate whether there is a substantial doubt about a client's ability to continue as a going concern for at least:

A)one quarter beyond the balance sheet date.

B)one quarter beyond the date of the auditor's report.

C)one year beyond the balance sheet date.

D)one year beyond the date of the auditor's report.

A)one quarter beyond the balance sheet date.

B)one quarter beyond the date of the auditor's report.

C)one year beyond the balance sheet date.

D)one year beyond the date of the auditor's report.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

75

When subsequent events are used to evaluate the amounts included in the year-end financial statements, auditors must distinguish between conditions that existed at the balance sheet date and those that came into being after the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

76

Which of the following is correct regarding supplementary information?

A)The auditor must express an opinion on the supplementary information.

B)When reporting on supplementary information, the auditor uses a different materiality threshold from that used in forming an opinion on the basic financial statements.

C)If the auditor's report on the audited financial statements contains an adverse opinion, the auditor can still issue an unqualified opinion on the supplementary information.

D)The auditor can issue a separate report on the supplementary information; it does not need to be part of the report on the financial statements.

A)The auditor must express an opinion on the supplementary information.

B)When reporting on supplementary information, the auditor uses a different materiality threshold from that used in forming an opinion on the basic financial statements.

C)If the auditor's report on the audited financial statements contains an adverse opinion, the auditor can still issue an unqualified opinion on the supplementary information.

D)The auditor can issue a separate report on the supplementary information; it does not need to be part of the report on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

77

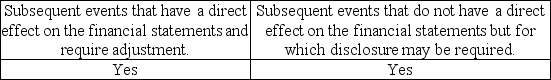

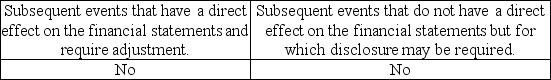

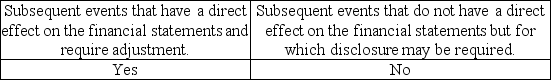

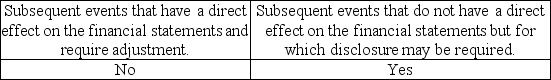

State the two primary types of subsequent events that require consideration by management and evaluation by the auditor, and give two examples of each type.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

78

The fieldwork for the December 31, 2013 audit of Schmidt Corporation ended on March 17, 2014.The financial statements and auditor's report were issued on March 29, 2014.In each of the material situations (1 through 5)below, indicate the appropriate action (a, b, c ).The possible actions are as follows:

a.Adjust the December 31, 2013 financial statements.

b.Disclose the information in a footnote in the December 31, 2013 financial statements.

c.No action is required.

The situations are as follows:

________ 1.On March 1, 2014, one of Schmidt Corporation's major customers declared bankruptcy.The customer's financial condition in 2013 was deteriorating and they owed Schmidt Corporation a large sum of money as of the balance sheet date.

________ 2.On February 17, 2014, Schmidt Corporation sold some machinery for its book value.

________ 3.On February 20, 2014, a flood destroyed the entire uninsured inventory in one of Schmidt's warehouses.

________ 4.On January 5, 2014, there was a significant decline in the market value of the securities held for resale from their value as of the balance sheet date.

________ 5.On March 10, 2014, the company settled a lawsuit at an amount significantly higher than the amount recorded as a liability on the books as of the balance sheet date.

a.Adjust the December 31, 2013 financial statements.

b.Disclose the information in a footnote in the December 31, 2013 financial statements.

c.No action is required.

The situations are as follows:

________ 1.On March 1, 2014, one of Schmidt Corporation's major customers declared bankruptcy.The customer's financial condition in 2013 was deteriorating and they owed Schmidt Corporation a large sum of money as of the balance sheet date.

________ 2.On February 17, 2014, Schmidt Corporation sold some machinery for its book value.

________ 3.On February 20, 2014, a flood destroyed the entire uninsured inventory in one of Schmidt's warehouses.

________ 4.On January 5, 2014, there was a significant decline in the market value of the securities held for resale from their value as of the balance sheet date.

________ 5.On March 10, 2014, the company settled a lawsuit at an amount significantly higher than the amount recorded as a liability on the books as of the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

79

A client representation letter is:

A)prepared on the CPA's letterhead.

B)addressed to the client.

C)signed by high-level corporate officials.

D)dated as of the balance sheet date.

A)prepared on the CPA's letterhead.

B)addressed to the client.

C)signed by high-level corporate officials.

D)dated as of the balance sheet date.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following procedures and methods are important in assessing a company's ability to continue as a going concern?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 120 في هذه المجموعة.

فتح الحزمة

k this deck