Deck 11: Cash Flows and Other Topics in Capital Budgeting

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/160

العب

ملء الشاشة (f)

Deck 11: Cash Flows and Other Topics in Capital Budgeting

1

Toyota's capital budgeting analysis for the Prius,a gas-electric hybrid,was faulty because the car line has not made a profit to date.

False

2

TRL,Inc.has spent $2,000,000 in nonrefundable engineering fees in contemplation of building a convention center and the additional costs to complete the project are $18,000,000.The present value of all benefits the center will produce in its lifetime are $19,000,000,so TRL should not build the convention center.

False

3

Hershey's expects to sell $2 million of its new candy bar,although $200,000 of this amount would have been spent on its existing candy bar.The $2 million is the appropriate cash inflow for the new candy bar project,while the $200,000 will be counted against the return on the old candy bar.

False

4

Additional investment in working capital,even if it may be recovered at the end of a project,must be included in capital budgeting analysis because of the time value of money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

5

Interest payments on a loan obtained specifically to fund a new project should be considered an incremental cash flow for the new project when determining the accept/reject decision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

6

Adding gourmet coffee stations to my convenience store is expected to increase sales of my breakfast sandwiches; however,the sales of breakfast sandwiches should not be included in the evaluation of the gourmet coffee project because only relevant,incremental cash flows should be considered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

7

A grocery store decides to offer beer for sale and this decision results in more potato chip sales.This is an example of a synergistic effect.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

8

In measuring cash flows,we are interested only in the incremental or incremental after-tax cash flows that are attributed to the investment proposal being evaluated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

9

The guiding rule in deciding if a free cash flow is incremental is to look at the company with,versus without,the new project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

10

As a rule,any cash flows that are not affected by the accept/reject criterion should not be included in capital-budgeting analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

11

Synergistic benefits from an investment project include cannibalism.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

12

Accounting profits,adjusted for taxes and differences in accounting methods,provide the best measure of relevant cash flows for capital budgeting purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

13

Sunk costs are cash outflows that will occur regardless of the current accept/reject decision,and therefore should be excluded from the analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

14

Accounting profits are used to make capital budgeting decisions because generally accepted accounting principles ensure that profits are the best measure of a company's economic activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

15

If a project uses an asset the corporation already owns,the cost of that asset for capital budgeting purposes is zero to reflect the advantage the project has over projects that require the purchase of new assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

16

The initial outlay for a new project is an example of an opportunity cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

17

For companies in competitive markets,the evolution and introduction of new products may serve more to preserve market share than to expand it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

18

To be included in a capital budgeting analysis,all incremental free cash flows must be expensed on the company's books,otherwise generally accepted accounting principles will be violated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

19

Capital budgeting decisions are based on free cash flow because free cash flow better reflects when money is received and available for reinvestment than account profits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

20

Overhead costs are sometimes incremental cash flows and other times are considered sunk costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

21

It is important to consider a new project's affect on the cash flows of existing projects because of

A) cannibalism.

B) synergy.

C) sunk costs.

D) A and B above.

A) cannibalism.

B) synergy.

C) sunk costs.

D) A and B above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

22

Butler Automotive developed a new diagnostic testing procedure that is expected to increase sales by $10,000 per month.As more drivers bring in their vehicles,Butler expects to also do more oil changes and brake repairs.As a result,inventory levels of oil and brake parts must be increased by $5,000.Revenues from oil changes and brake jobs are expected to increase by $4,000 per month.An example of a synergistic effect from the new diagnostic testing procedure is the

A) increase in inventory levels of oil and brake parts.

B) increase in revenue of $10,000 per month for the diagnostic testing.

C) increase in revenues from oil changes and brake jobs of $4,000 per month.

D) increase in all activities totaling $19,000 per month.

A) increase in inventory levels of oil and brake parts.

B) increase in revenue of $10,000 per month for the diagnostic testing.

C) increase in revenues from oil changes and brake jobs of $4,000 per month.

D) increase in all activities totaling $19,000 per month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

23

If an old asset is sold for its depreciated,or book,value,then no taxes result and there is no tax effect from the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

24

Solar Confectionary develops a new candy bar and plans to sell each bar for $1.Solar predicts that 1 million candy bars will be sold in the first year if the new candy bar is produced and sold,and includes $1 million of incremental revenues in its capital budgeting analysis.A senior executive in the company believes that 1 million candy bars will be sold,but lowers the estimate of incremental revenue to $700,000.What would explain this change?

A) cannibalization of 300,000 of Solar Confectionary's other candy bars

B) excessive marketing costs to sell the 1 million candy bars

C) a lower discount rate

D) a higher selling price for the new candy bars

A) cannibalization of 300,000 of Solar Confectionary's other candy bars

B) excessive marketing costs to sell the 1 million candy bars

C) a lower discount rate

D) a higher selling price for the new candy bars

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

25

If an old asset is sold for less than its book value,the resulting loss will save the company taxes,hence lowering the cost of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

26

Incremental cash flows refer to

A) the difference between after-tax cash flows and before-tax accounting profits.

B) the new cash flows that will be generated if a project is undertaken.

C) the cash flows of a project, minus financing costs.

D) the cash flows that are foregone if a firm does not undertake a project.

A) the difference between after-tax cash flows and before-tax accounting profits.

B) the new cash flows that will be generated if a project is undertaken.

C) the cash flows of a project, minus financing costs.

D) the cash flows that are foregone if a firm does not undertake a project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

27

The calculation of incremental free cash flows over a project's life should include

A) labor and material saving.

B) additional revenue.

C) interest to bondholders.

D) A and B.

A) labor and material saving.

B) additional revenue.

C) interest to bondholders.

D) A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

28

As part of its expansion project,A.J.Industries Equipment Division has expanded its office space by 200 square feet.The company's administrative overhead is allocated based on the square footage of each business segment.Although the total administrative overhead for the company will remain the same,the Equipment Division will be charged more for administrative overhead.For the Equipment Division expansion project,the administrative overhead is an example of a(n)

A) incremental cash flow.

B) sunk cost.

C) opportunity cost.

D) incremental opportunity cash flow.

A) incremental cash flow.

B) sunk cost.

C) opportunity cost.

D) incremental opportunity cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

29

Butler Automotive developed a new diagnostic testing procedure that is expected to increase sales by $10,000 per month.As more drivers bring in their vehicles,Butler expects to also do more oil changes and brake repairs.As a result,inventory levels of oil and brake parts must be increased by $5,000.Revenues from oil changes and brake jobs are expected to increase by $4,000 per month.An example of an increase in net working capital requirements from the new diagnostic testing procedure is the

A) increase in inventory levels of oil and brake parts of $5,000.

B) increase in revenue of $10,000 per month for the diagnostic testing.

C) increase in revenues from oil changes and brake jobs of $4,000 per month.

D) increase in all activities totaling $19,000 per month.

A) increase in inventory levels of oil and brake parts of $5,000.

B) increase in revenue of $10,000 per month for the diagnostic testing.

C) increase in revenues from oil changes and brake jobs of $4,000 per month.

D) increase in all activities totaling $19,000 per month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following should be included in an analysis of a new project's cash flows?

A) any sales from existing products that would be lost if customers were expected to purchase a new product instead

B) all financing costs

C) all sunk costs

D) no opportunity costs

A) any sales from existing products that would be lost if customers were expected to purchase a new product instead

B) all financing costs

C) all sunk costs

D) no opportunity costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

31

A company is expanding and has already signed a lease on new office space that costs $10,000 per month.The company also needs a new information system and hired a consultant to recommend new software.The consultant was paid $5,000 for her recommendation.Now the company is trying to make a choice between three competing software products.In the capital budgeting decision to purchase new software,the monthly rent for the office space is ________ and the consultant's fee is ________.

A) a sunk cost; a sunk cost

B) an opportunity cost; a sunk cost

C) incremental cash outflow; an opportunity cost

D) a sunk cost; a part of the initial outlay

A) a sunk cost; a sunk cost

B) an opportunity cost; a sunk cost

C) incremental cash outflow; an opportunity cost

D) a sunk cost; a part of the initial outlay

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

32

A local restaurant owner is considering expanding into another rural area.The expansion project will be financed through a line of credit with City Bank.The administrative costs of obtaining the line of credit are $500,and the interest payments are expected to be $1,000 per month.The new restaurant will occupy an existing building that can be rented for $2,500 per month.The incremental cash flows for the new restaurant include

A) $500 administrative costs, $1,000 per month interest payments, $2,500 per month rent.

B) $500 administrative costs, $2,500 per month rent.

C) $1,000 per month interest payments, $2,500 per month rent.

D) $2,500 per month rent.

A) $500 administrative costs, $1,000 per month interest payments, $2,500 per month rent.

B) $500 administrative costs, $2,500 per month rent.

C) $1,000 per month interest payments, $2,500 per month rent.

D) $2,500 per month rent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

33

Redrock Inc.is a household products firm that is considering developing a new detergent.In evaluating whether to go ahead with the new detergent project,which of the following statements is MOST correct?

A) The company will produce the detergent in a building that they already own. The cost of the building is therefore zero and should be excluded from the analysis.

B) The company will need to use some equipment that it could have leased to another company. This equipment lease could have generated $200,000 per year in after-tax income. The $200,000 should be excluded because the equipment can no longer be leased.

C) The company will need to hire 10 new workers whose salaries and benefits will total $400,000 per year. Labor costs are not part of capital budgeting and should be excluded.

D) The company will produce the detergent in a building that it renovated 2 years ago for $300,000. The $300,000 should be excluded from the analysis.

A) The company will produce the detergent in a building that they already own. The cost of the building is therefore zero and should be excluded from the analysis.

B) The company will need to use some equipment that it could have leased to another company. This equipment lease could have generated $200,000 per year in after-tax income. The $200,000 should be excluded because the equipment can no longer be leased.

C) The company will need to hire 10 new workers whose salaries and benefits will total $400,000 per year. Labor costs are not part of capital budgeting and should be excluded.

D) The company will produce the detergent in a building that it renovated 2 years ago for $300,000. The $300,000 should be excluded from the analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

34

Sunk costs are

A) recoverable.

B) incremental.

C) not relevant in capital budgeting.

D) not deductible for tax purposes.

A) recoverable.

B) incremental.

C) not relevant in capital budgeting.

D) not deductible for tax purposes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

35

In general,a project's free cash flows will fall in one of the following three categories: initial outlay,differential cash flows over the project's life,and the terminal cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

36

An opportunity cost is a relevant incremental cost for capital budgeting decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

37

Tillamook Farms invests in a new kind of frozen dessert called polar cream that becomes very popular.So many new customers come to the store that the sales of existing ice cream products are increased.The extra sales revenue

A) should not be counted as incremental revenue for the polar cream project because the sales come from existing products.

B) are synergistic effects that should be counted as incremental revenues for the polar cream project.

C) are cannibalized sales that should be excluded from the analysis.

D) should be included in the analysis, but not the cost of the ice cream that is sold as that is a recurring expense.

A) should not be counted as incremental revenue for the polar cream project because the sales come from existing products.

B) are synergistic effects that should be counted as incremental revenues for the polar cream project.

C) are cannibalized sales that should be excluded from the analysis.

D) should be included in the analysis, but not the cost of the ice cream that is sold as that is a recurring expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

38

Which of the following expenses associated with a project should NOT be included in a capital budgeting analysis?

A) additional allocated fixed overhead from corporate headquarters

B) additional maintenance expenses associated with new equipment

C) reengineering of a production line associated with a new project

D) training sales staff on a new product

A) additional allocated fixed overhead from corporate headquarters

B) additional maintenance expenses associated with new equipment

C) reengineering of a production line associated with a new project

D) training sales staff on a new product

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

39

AFB Systems is considering a new marketing campaign that will require the addition of a new computer programmer and new software.The programmer will occupy an office in AFB's current building and will be paid $8,000 per month.The software license costs $1,000 per month.The rent for the building is $4,000 per month.AFB's computer system is always on,so running the new software will not change the current monthly electric bill of $900.The incremental expenses for the new marketing campaign are

A) $13,900 per month.

B) $9,000 per month.

C) $13,000 per month.

D) $8,000 per month.

A) $13,900 per month.

B) $9,000 per month.

C) $13,000 per month.

D) $8,000 per month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

40

What is an incremental cash flow? What is a sunk cost? Why must you account for opportunity costs?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

41

If the increase in net working capital is recovered entirely at the end of the project,then it may be ignored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

42

Cash flows associated with a project's termination generally include the salvage value of the project net of any taxes associated with the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

43

Terminal cash flows are always positive because they result from the shutting down of a project with the sale of any assets with remaining value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

44

The initial outlay includes the cost of purchasing the asset and getting is operational,but this excludes any training costs for employees which should be included as part of differential cash flows over the life of the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

45

Any increase in interest payments caused by a project should be counted in the incremental cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

46

Proceeds from the issuance of new debt and principal payments upon maturity of debt used to finance a project should be included in the calculation of the project's after-tax cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

47

Capital budgeting projects that expand sales are more likely to involve increases in working capital than are projects that involve the replacement of existing assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

48

One example of a terminal cash flow is the recapture of the net working capital associated with the project.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

49

Increases in working capital needs should be included as part of the initial outlay of a project,but decreases in working capital for a project should not be considered because they are not guaranteed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

50

The initial outlay of a project may be reduced by the after-tax salvage value of replaced equipment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

51

Increasing depreciation expense results in a decrease of the incremental after-tax free cash flow.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

52

Increases in inventory and accounts receivable expected to occur if a proposed advertising campaign is undertaken are examples of sunk costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

53

A weakness in the capital budgeting process is the funds for an investment proposal obtained by issuing bonds,and the respective interest payments,are not considered in the capital budgeting process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

54

The initial outlay includes the immediate cash outflow necessary to purchase the asset and put it in operating order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

55

Free cash flow calculations can be broken down into three parts: cash flows from operations,cash flows associated with working-capital requirements,and financing cash flows relating to interest and dividend payments.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

56

Depreciation expense produces a cash inflow equal to the depreciation expense multiplied by the firm's marginal tax rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

57

In general,a project's free cash flows will fall into one of three categories: (1)incremental costs,(2)sunk costs,and (3)opportunity costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

58

Depreciation is a non-cash deduction so it may be ignored in the calculation of a project's incremental after-tax cash flows.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

59

The initial outlay includes the cost of purchasing the asset and getting it operational,including the purchase price,shipping and installation,and any training costs for employees who will be operating the equipment,and any increases in working capital requirements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

60

Interest payments on debt are not included in a project's incremental cash flows,but are instead accounted for in the project's discount rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

61

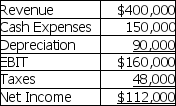

Smith Manufacturing Inc.expects the following results in year one of a new project:

The annual change in operating cash flow is equal to

A) $298,000.

B) $202,000.

C) $160,000.

D) $250,000.

The annual change in operating cash flow is equal to

A) $298,000.

B) $202,000.

C) $160,000.

D) $250,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

62

Your company is considering the replacement of an old delivery van with a new one that is more efficient.The old van cost $40,000 when it was purchased 5 years ago.The old van is being depreciated using the simplified straight-line method over a useful life of 8 years.The old van could be sold today for $7,000.The new van has an invoice price of $80,000,and it will cost $6,000 to modify the van to carry the company's products.Cost savings from use of the new van are expected to be $28,000 per year for 5 years,at which time the van will be sold for its estimated salvage value of $18,000.The new van will be depreciated using the simplified straight-line method over its 5-year useful life.The company's tax rate is 35%.Working capital is expected to increase by $5,000 at the inception of the project,but this amount will be recaptured at the end of year five.What is the incremental free cash flow for year one?

A) $18,875

B) $19,985

C) $22,305

D) $24,220

A) $18,875

B) $19,985

C) $22,305

D) $24,220

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is NOT considered in the calculation of incremental cash flows?

A) tax saving due to increased depreciation expense

B) interest payments if new debt is issued

C) increased dividend payments if additional preferred stock is issued

D) B and C

A) tax saving due to increased depreciation expense

B) interest payments if new debt is issued

C) increased dividend payments if additional preferred stock is issued

D) B and C

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

64

Your company is considering the replacement of an old delivery van with a new one that is more efficient.The old van cost $40,000 when it was purchased 5 years ago.The old van is being depreciated using the simplified straight-line method over a useful life of 8 years.The old van could be sold today for $7,000.The new van has an invoice price of $80,000,and it will cost $6,000 to modify the van to carry the company's products.Cost savings from use of the new van are expected to be $28,000 per year for 5 years,at which time the van will be sold for its estimated salvage value of $18,000.The new van will be depreciated using the simplified straight-line method over its 5-year useful life.The company's tax rate is 35%.Working capital is expected to increase by $5,000 at the inception of the project,but this amount will be recaptured at the end of year five.What is the terminal cash flow?

A) $23,000

B) $18,000

C) $17,250

D) $16,700

A) $23,000

B) $18,000

C) $17,250

D) $16,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

65

If depreciation expense in year one of a project increases for a highly profitable company,

A) net income decreases and incremental free cash flow decreases.

B) net income increases and incremental free cash flow increases.

C) the book value of the depreciating asset increases at the end of year one.

D) net income decreases and incremental free cash flow increases.

A) net income decreases and incremental free cash flow decreases.

B) net income increases and incremental free cash flow increases.

C) the book value of the depreciating asset increases at the end of year one.

D) net income decreases and incremental free cash flow increases.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

66

Which of the following cash flows are NOT considered in the calculation of the initial outlay for a capital investment proposal?

A) increase in accounts receivable

B) cost of issuing new bonds if the project is financed by a new bond issue

C) installation costs

D) None of the above-all are considered.

A) increase in accounts receivable

B) cost of issuing new bonds if the project is financed by a new bond issue

C) installation costs

D) None of the above-all are considered.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

67

Changes in capital spending are not incorporated directly into capital budgeting problems because the amounts are included in the operating cash flows through the inclusion of depreciation expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

68

In a replacement decision,the initial outlay is equal to the cost of the new asset less the reduction in depreciation from elimination of the old asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

69

Interest expenses are not included as incremental free cash flows because the cost of funds is recognized when cash flows are discounted back to present value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

70

A project's annual free cash flow is the change in operating cash flow less any change in net working capital and less any change in capital spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

71

You are analyzing the purchase of new equipment.Since you are not an expert on this type of equipment,you hire a consulting firm to make recommendations.The consultant charged you $1,500 and recommended the purchase of the latest model from ACME Corp.of America.The equipment costs $80,000,and it will cost another $10,000 to modify it for special use by your firm.The equipment will be depreciated on a straight-line basis over six years with no salvage value.You expect the equipment will be sold after three years for $28,000.Use of the equipment will require an increase in your company's net working capital of $4,000,but this $4,000 will be recovered at the end of year three.The use of the equipment will have no effect on revenues,but it is expected to save the firm $50,000 per year in before-tax operating costs.Your company's marginal tax rate is 35%.What is the initial outlay required to fund this project?

A) $80,000

B) $84,000

C) $90,000

D) $94,000

A) $80,000

B) $84,000

C) $90,000

D) $94,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

72

Blackjack Inc.wants to replace a 9-year-old machine with a new machine that is more efficient.The old machine cost $70,000 when new and has a current book value of $15,000.Blackjack can sell the machine to a foreign buyer for $14,000.Blackjack's tax rate is 35%.The effect of the sale of the old machine on the initial outlay for the new machine is

A) ($14,350).

B) ($13,650).

C) ($9,100).

D) $1,000.

A) ($14,350).

B) ($13,650).

C) ($9,100).

D) $1,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

73

You are analyzing the purchase of new equipment.Since you are not an expert on this type of equipment,you hire a consulting firm to make recommendations.The consultant charged you $1,500 and recommended the purchase of the latest model from ACME Corp.of America.The equipment costs $80,000,and it will cost another $10,000 to modify it for special use by your firm.The equipment will be depreciated on a straight-line basis over six years with no salvage value.You expect the equipment will be sold after three years for $28,000.Use of the equipment will require an increase in your company's net working capital of $4,000,but this $4,000 will be recovered at the end of year three.The use of the equipment will have no effect on revenues,but it is expected to save the firm $50,000 per year in before-tax operating costs.Your company's marginal tax rate is 35%.What is the terminal cash flow for this project?

A) ($17,000)

B) $24,500

C) $33,950

D) $37,950

A) ($17,000)

B) $24,500

C) $33,950

D) $37,950

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

74

Salvage value would most likely NOT be considered by

A) net present value.

B) internal rate of return.

C) payback.

D) A and B.

A) net present value.

B) internal rate of return.

C) payback.

D) A and B.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

75

XYZ,Inc.has developed a project which results in additional accounts receivable of $400,000,additional inventory of $180,000,and additional accounts payable of $70,000.What is the additional investment in net working capital?

A) $580,000

B) $510,000

C) $270,000

D) $150,000

A) $580,000

B) $510,000

C) $270,000

D) $150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

76

A project's annual free cash flow is the change in operating cash flow less any change in net working capital and less any change in capital spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

77

The recapture of net working capital at the end of a project will

A) increase terminal year free cash flow.

B) decrease terminal year free cash flow by the change in net working capital times the corporate tax rate.

C) increase terminal year free cash flow by the change in net working capital times the corporate tax rate.

D) have no effect on the terminal year free cash flow because the net working capital change has already been included in a prior year.

A) increase terminal year free cash flow.

B) decrease terminal year free cash flow by the change in net working capital times the corporate tax rate.

C) increase terminal year free cash flow by the change in net working capital times the corporate tax rate.

D) have no effect on the terminal year free cash flow because the net working capital change has already been included in a prior year.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

78

A new project is expected to generate $800,000 in revenues,$250,000 in cash operating expenses,and depreciation expense of $150,000 in each year of its 10-year life.The corporation's tax rate is 35%.The project will require an increase in net working capital of $85,000 in year one and a decrease in net working capital of $75,000 in year ten.What is the free cash flow from the project in year one?

A) $298,000

B) $375,000

C) $380,000

D) $410,000

A) $298,000

B) $375,000

C) $380,000

D) $410,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

79

You are analyzing the purchase of new equipment.Since you are not an expert on this type of equipment,you hire a consulting firm to make recommendations.The consultant charged you $1,500 and recommended the purchase of the latest model from ACME Corp.of America.The equipment costs $80,000,and it will cost another $10,000 to modify it for special use by your firm.The equipment will be depreciated on a straight-line basis over six years with no salvage value.You expect the equipment will be sold after three years for $28,000.Use of the equipment will require an increase in your company's net working capital of $4,000,but this $4,000 will be recovered at the end of year three.The use of the equipment will have no effect on revenues,but it is expected to save the firm $50,000 per year in before-tax operating costs.Your company's marginal tax rate is 35%.What is the incremental free cash flow for the first year of the project?

A) $23,800

B) $29,850

C) $32,440

D) $37,750

A) $23,800

B) $29,850

C) $32,440

D) $37,750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck

80

Operating cash flow is equal to the change in EBIT less the change in interest expense,less the change in taxes,plus the change in depreciation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 160 في هذه المجموعة.

فتح الحزمة

k this deck