Deck 14: Money, banks, and the Federal Reserve System

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

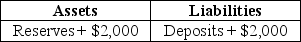

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/146

العب

ملء الشاشة (f)

Deck 14: Money, banks, and the Federal Reserve System

1

Liquidity is defined as

A) the ease with which a given asset can be converted to a store of value.

B) the ease with which a given asset can be converted to a unit of account.

C) the ease with which a given asset can be converted to a medium of exchange.

D) the ease with which a given asset can be converted to a standard of deferred payment.

A) the ease with which a given asset can be converted to a store of value.

B) the ease with which a given asset can be converted to a unit of account.

C) the ease with which a given asset can be converted to a medium of exchange.

D) the ease with which a given asset can be converted to a standard of deferred payment.

the ease with which a given asset can be converted to a medium of exchange.

2

Paper currency is a

A) commodity money.

B) fiat money.

C) barter money.

D) bond.

A) commodity money.

B) fiat money.

C) barter money.

D) bond.

fiat money.

3

Which of the following is the most liquid asset?

A) a Renoir painting

B) bonds

C) a car

D) money

A) a Renoir painting

B) bonds

C) a car

D) money

money

4

During World War II,prisoners of war used ________ as money.

A) bullets

B) cowrie shells

C) chocolate

D) cigarettes

A) bullets

B) cowrie shells

C) chocolate

D) cigarettes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

5

When a grocery store accepts your $5 bill in exchange for bread and milk,the $5 bill serves as a

A) medium of exchange.

B) unit of account.

C) store of value.

D) standard of deferred payment.

A) medium of exchange.

B) unit of account.

C) store of value.

D) standard of deferred payment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is a function that money serves?

A) medium of exchange

B) unit of account

C) store of value

D) All of the above are correct.

A) medium of exchange

B) unit of account

C) store of value

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

7

A farm worker gets paid today in money,but plans to spend the money next week.This illustrates which function of money?

A) medium of exchange

B) unit of account

C) store of value

D) standard of deferred payment

A) medium of exchange

B) unit of account

C) store of value

D) standard of deferred payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

8

Commodity money is a good

A) used as money that has no secondary use.

B) that is designated as money by law.

C) used as money that also has value independent of its use as money.

D) used as money that has no intrinsic value.

A) used as money that has no secondary use.

B) that is designated as money by law.

C) used as money that also has value independent of its use as money.

D) used as money that has no intrinsic value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

9

Fiat money

A) has no or very little value except as money.

B) is rarely used in modern economies.

C) functions well only if can be redeemed for gold or other precious metals.

D) serves well as a medium of exchange, but not as a store of value.

A) has no or very little value except as money.

B) is rarely used in modern economies.

C) functions well only if can be redeemed for gold or other precious metals.

D) serves well as a medium of exchange, but not as a store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

10

By making exchange ________,money allows for ________ and higher ________.

A) harder; specialization; costs

B) easier; specialization; productivity

C) harder; generalization; productivity

D) easier; specialization; costs

A) harder; specialization; costs

B) easier; specialization; productivity

C) harder; generalization; productivity

D) easier; specialization; costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

11

A car dealer sells you a car today in exchange for money in the future.This illustrates which function of money?

A) medium of exchange

B) unit of account

C) store of value

D) standard of deferred payment

A) medium of exchange

B) unit of account

C) store of value

D) standard of deferred payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

12

Among potential stores of value,money

A) offers the highest rate of return.

B) increases in value during periods of inflation.

C) has the advantage of being the most liquid asset.

D) provides more services than the other assets.

A) offers the highest rate of return.

B) increases in value during periods of inflation.

C) has the advantage of being the most liquid asset.

D) provides more services than the other assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

13

Gold is an example of

A) commodity money.

B) fiat money.

C) barter money.

D) M1.

A) commodity money.

B) fiat money.

C) barter money.

D) M1.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

14

Money is

A) an asset that people are willing to accept in exchange for goods and services.

B) a liability that people are willing to accept in exchange for goods and services.

C) the income one earns over a period of time.

D) one's assets net of one's liabilities at any point in time.

A) an asset that people are willing to accept in exchange for goods and services.

B) a liability that people are willing to accept in exchange for goods and services.

C) the income one earns over a period of time.

D) one's assets net of one's liabilities at any point in time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

15

The statement "This Dell laptop costs $1,200" illustrates which function of money?

A) medium of exchange

B) unit of account

C) store of value

D) standard of deferred payment

A) medium of exchange

B) unit of account

C) store of value

D) standard of deferred payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

16

A major source of inefficiency in barter economies is that they require

A) a standard of deferred payment to make trade possible.

B) a double coincidence of wants in exchange.

C) more liquid stores of value than do monetary economies.

D) All of the above are correct.

A) a standard of deferred payment to make trade possible.

B) a double coincidence of wants in exchange.

C) more liquid stores of value than do monetary economies.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following criteria would make gold a poor medium of exchange?

A) its value depends on its purity, and its purity is not easy to visibly identify

B) durability so that value is not lost by spoilage

C) value relative to its weight so that amounts large enough to be useful in trade can be easily transported

D) divisibility because different goods are valued differently

A) its value depends on its purity, and its purity is not easy to visibly identify

B) durability so that value is not lost by spoilage

C) value relative to its weight so that amounts large enough to be useful in trade can be easily transported

D) divisibility because different goods are valued differently

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which is not one of the criteria necessary for a commodity to make a suitable medium of exchange?

A) It should be durable.

B) It should be of standardized quality.

C) It should be valuable relative to its weight.

D) It should have intrinsic value.

A) It should be durable.

B) It should be of standardized quality.

C) It should be valuable relative to its weight.

D) It should have intrinsic value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

19

One reason Zimbabwe suffered from hyperinflation is that the government had decided to pay for all of its expenses by

A) selling Treasury bonds to foreign governments.

B) selling its government-run oil company to a private company, which then defaulted on its payment.

C) raising interest rates to attract foreign direct investment, then nationalizing the foreign-owned facilities.

D) printing more and more money.

A) selling Treasury bonds to foreign governments.

B) selling its government-run oil company to a private company, which then defaulted on its payment.

C) raising interest rates to attract foreign direct investment, then nationalizing the foreign-owned facilities.

D) printing more and more money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

20

A barter economy is an economy where

A) goods and services are exchanged for money.

B) money is exchanged for goods and services.

C) goods and services are exchanged for other goods and services.

D) goods and services are exchanged for liabilities.

A) goods and services are exchanged for money.

B) money is exchanged for goods and services.

C) goods and services are exchanged for other goods and services.

D) goods and services are exchanged for liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

21

In an economy with money,as opposed to barter,people are more likely to specialize in the production of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

22

In the United States,currency includes

A) gold, silver, and paper money.

B) checking and savings account deposits.

C) paper money and coins in circulation.

D) traveler's checks.

A) gold, silver, and paper money.

B) checking and savings account deposits.

C) paper money and coins in circulation.

D) traveler's checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

23

The solution proposed by Francois Velde,an economist at the Federal Reserve Bank of Chicago,to the "problem of the penny" includes

A) declaring Lincoln pennies to be worth five cents.

B) suspending production of Jefferson nickels.

C) producing no one cent coins.

D) all of the above.

A) declaring Lincoln pennies to be worth five cents.

B) suspending production of Jefferson nickels.

C) producing no one cent coins.

D) all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

24

________ is the profit made by the government from issuing fiat money.

A) Seigniorage

B) The liquidity premium

C) Circulation revenue

D) The currency commission

A) Seigniorage

B) The liquidity premium

C) Circulation revenue

D) The currency commission

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

25

A good can serve as money only if

A) government mandates that the good must be accepted in payment of debts.

B) it is declared by authorities to be legal tender.

C) it has intrinsic value or if it is backed by precious metals.

D) citizens accept the good as a means of payment for transactions and debts.

A) government mandates that the good must be accepted in payment of debts.

B) it is declared by authorities to be legal tender.

C) it has intrinsic value or if it is backed by precious metals.

D) citizens accept the good as a means of payment for transactions and debts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

26

Fiat money is generally issued by

A) private banks.

B) central banks.

C) brokerage firms.

D) major multinational corporations.

A) private banks.

B) central banks.

C) brokerage firms.

D) major multinational corporations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

27

M1 includes

A) currency in circulation, checking account deposits in banks, and holdings of traveler's checks.

B) currency in circulation, savings account balances, and checking account deposits in banks.

C) currency in circulation, savings account balances, checking account deposits in banks, and holdings of traveler's checks.

D) coins, savings account balances, traveler's checks.

A) currency in circulation, checking account deposits in banks, and holdings of traveler's checks.

B) currency in circulation, savings account balances, and checking account deposits in banks.

C) currency in circulation, savings account balances, checking account deposits in banks, and holdings of traveler's checks.

D) coins, savings account balances, traveler's checks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

28

The supply of money is easier to control with commodity money than it is with fiat money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

29

Because Federal Reserve Notes (paper currency)are legal tender,

A) U.S. workers must accept them as payment for labor services.

B) U.S. creditors must accept them in payment of debts.

C) U.S. firms must accept them as payment for goods and services.

D) All of he above are correct.

A) U.S. workers must accept them as payment for labor services.

B) U.S. creditors must accept them in payment of debts.

C) U.S. firms must accept them as payment for goods and services.

D) All of he above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

30

If you transfer all of your currency to your checking account,then initially,M1 will ________ and M2 will ________.

A) increase; not change

B) not change; increase

C) not change; not change

D) decrease; increase

A) increase; not change

B) not change; increase

C) not change; not change

D) decrease; increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

31

M2 includes M1 plus

A) currency in circulation, checking account deposits in banks, and holdings of traveler's checks.

B) savings account balances, money market deposit accounts in banks, small-denomination time deposits, and noninstitutional money market fund shares.

C) checking account deposits, large-denomination time deposits, and noninstitutional money market fund shares.

D) currency in circulation, savings account balances, and small-denomination time deposits.

A) currency in circulation, checking account deposits in banks, and holdings of traveler's checks.

B) savings account balances, money market deposit accounts in banks, small-denomination time deposits, and noninstitutional money market fund shares.

C) checking account deposits, large-denomination time deposits, and noninstitutional money market fund shares.

D) currency in circulation, savings account balances, and small-denomination time deposits.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

32

If households in the economy decide to take money out of checking account deposits and put this money into savings accounts,this will initially

A) decrease M1 and increase M2.

B) decrease M1 and decrease M2.

C) decrease M1 and not change M2.

D) increase M1 and decrease M2.

A) decrease M1 and increase M2.

B) decrease M1 and decrease M2.

C) decrease M1 and not change M2.

D) increase M1 and decrease M2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

33

If households in the economy decide to take money out of checking account deposits and hold it as currency,this will initially

A) not change M1 and increase M2.

B) decrease M1 and decrease M2.

C) decrease M1 and not change M2.

D) not change M1 and not change M2.

A) not change M1 and increase M2.

B) decrease M1 and decrease M2.

C) decrease M1 and not change M2.

D) not change M1 and not change M2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

34

Most payments in the United States for goods and services are made using

A) currency.

B) checking account deposits.

C) traveler's checks.

D) gold.

A) currency.

B) checking account deposits.

C) traveler's checks.

D) gold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

35

The narrowest official definition of the money supply is

A) M1.

B) M2.

C) M3.

D) L.

A) M1.

B) M2.

C) M3.

D) L.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

36

A person's wealth

A) is a measure of how much money the person has.

B) equals the value the person's assets minus his or her liabilities.

C) is measured independent of his or her current and expected future income.

D) All of the above are correct.

A) is a measure of how much money the person has.

B) equals the value the person's assets minus his or her liabilities.

C) is measured independent of his or her current and expected future income.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

37

An economy without money would have no exchanges of goods and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

38

A problem confronting government regarding the penny is that

A) it often costs more to produce than its face value.

B) it costs less to produce than its face value.

C) the metals used to produce the penny are in limited supply.

D) it no longer serves as store of value.

A) it often costs more to produce than its face value.

B) it costs less to produce than its face value.

C) the metals used to produce the penny are in limited supply.

D) it no longer serves as store of value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

39

Using the five criteria in the book,explain how U.S.currency is suitable to use as a medium of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

40

Money cannot serve as a medium of exchange unless it also serves as a store of value. Is this statement true or false? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

41

A bank's largest liability is its

A) short-term borrowing.

B) long-term debt.

C) deposits of its customers.

D) shareholder equity.

A) short-term borrowing.

B) long-term debt.

C) deposits of its customers.

D) shareholder equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

42

Reserves of a bank equal its

A) vault cash.

B) deposits with the Federal Reserve.

C) vault cash plus deposits with the Federal Reserve.

D) vault cash plus deposits of its customers.

A) vault cash.

B) deposits with the Federal Reserve.

C) vault cash plus deposits with the Federal Reserve.

D) vault cash plus deposits of its customers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

43

The portion of ________ that a bank does not loan out or spend on securities is known as ________.

A) loans; reserves

B) deposits; reserves

C) deposits; securities

D) loans; securities

A) loans; reserves

B) deposits; reserves

C) deposits; securities

D) loans; securities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

44

Innovations,including new products and services,in financial markets and institutions have made the job of defining the money supply easier.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

45

Economists agree that the "rounding tax" which would be imposed on consumers if we eliminated the penny is substantial,as high as $600 million.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

46

A person's wealth is the same as his income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

47

Suppose that you decide that you no longer want to hold currency,and deposit all of your currency holdings to your checking account.What is the immediate or initial impact of this transaction on M1 and M2?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

48

If you liquidate $3,000 of your mutual fund and transfer the funds to your checking account,then initially,M1 will ________ and M2 will ________.

A) not change; decrease

B) increase; decrease

C) increase; not change

D) not change; not change

A) not change; decrease

B) increase; decrease

C) increase; not change

D) not change; not change

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

49

Suppose you transfer $2,000 from your mutual fund account to your checking account.What is the immediate impact of this transfer on M1 and M2?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is a true statement?

A) excess reserves = actual reserves - required reserves

B) excess reserves = deposits - required reserves

C) excess reserves = deposits - loans

D) excess reserves = loans - required reserves

A) excess reserves = actual reserves - required reserves

B) excess reserves = deposits - required reserves

C) excess reserves = deposits - loans

D) excess reserves = loans - required reserves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

51

Typically,a bank's largest asset is its

A) reserves.

B) holdings of securities.

C) deposits of its customers.

D) loans.

A) reserves.

B) holdings of securities.

C) deposits of its customers.

D) loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

52

A bank is legally required to hold a fraction of its ________ as ________.

A) deposits; required reserves

B) deposits; excess reserves

C) loans; excess reserves

D) loans; required reserves

A) deposits; required reserves

B) deposits; excess reserves

C) loans; excess reserves

D) loans; required reserves

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following is counted as a liability for a bank?

A) customer deposits

B) bank reserves

C) securities

D) bank loans

A) customer deposits

B) bank reserves

C) securities

D) bank loans

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

54

A bank's liabilities are

A) things owned by or owed to the bank.

B) things the bank owes to someone else.

C) a measure of the bank's net losses.

D) included as part of the bank's reserves.

A) things owned by or owed to the bank.

B) things the bank owes to someone else.

C) a measure of the bank's net losses.

D) included as part of the bank's reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

55

Most U.S.currency held outside the U.S.banking system is held by foreigners.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

56

Credit card balances are

A) part of M1.

B) part of M2.

C) part of M3.

D) not part of the money supply.

A) part of M1.

B) part of M2.

C) part of M3.

D) not part of the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

57

Net worth is

A) a measure of a firm's profits.

B) part of stockholder equity.

C) the difference between a firm's assets and liabilities.

D) listed on the asset side of a firm's balance sheet.

A) a measure of a firm's profits.

B) part of stockholder equity.

C) the difference between a firm's assets and liabilities.

D) listed on the asset side of a firm's balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

58

A bank's assets are

A) things owned by or owed to the bank.

B) things the bank owes to someone else.

C) a measure of the bank's net worth.

D) always greater than the bank's liabilities.

A) things owned by or owed to the bank.

B) things the bank owes to someone else.

C) a measure of the bank's net worth.

D) always greater than the bank's liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following is an asset for a bank?

A) deposits of its customers

B) short-term borrowing

C) shareholders' equity

D) loans

A) deposits of its customers

B) short-term borrowing

C) shareholders' equity

D) loans

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

60

A bank holds its reserves as ________ and ________.

A) securities; loans

B) securities; deposits at the Federal Reserve

C) vault cash; deposits at the Federal Reserve

D) vault cash; loans

A) securities; loans

B) securities; deposits at the Federal Reserve

C) vault cash; deposits at the Federal Reserve

D) vault cash; loans

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

61

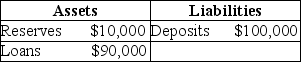

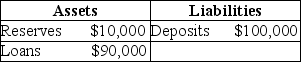

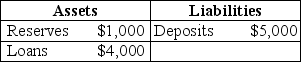

Consider the following T-account for National City Bank

If the required reserve ratio is lowered to 8 percent,how much can National City loan out?

A) $10,000

B) $8,000

C) $2,000

D) $0

If the required reserve ratio is lowered to 8 percent,how much can National City loan out?

A) $10,000

B) $8,000

C) $2,000

D) $0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

62

A balance sheet

A) measures flows of income and expenditure over a given period of time.

B) measures assets, liabilities, and net worth at a giving instance in time.

C) equates flows of revenue with flows of expenditure.

D) None of the above are correct.

A) measures flows of income and expenditure over a given period of time.

B) measures assets, liabilities, and net worth at a giving instance in time.

C) equates flows of revenue with flows of expenditure.

D) None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

63

The ________ the reserve ratio,the ________ the money multiplier.

A) smaller; smaller

B) smaller; larger

C) larger; larger

D) None of the above are correct.

A) smaller; smaller

B) smaller; larger

C) larger; larger

D) None of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

64

If banks do not loan out all their excess reserves,then the real world multiplier is

A) smaller than 1/RR.

B) larger than 1/RR.

C) equal to 1/RR.

D) not related to 1/RR.

A) smaller than 1/RR.

B) larger than 1/RR.

C) equal to 1/RR.

D) not related to 1/RR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

65

If the bank of Waterloo receives a $10,000 deposit,and the reserve requirement is 10 percent,how much can the bank loan out? (Assume that before the deposit this bank is just meeting its legal reserve requirement.)

A) $1,000

B) $9,000

C) $10,000

D) $11,000

A) $1,000

B) $9,000

C) $10,000

D) $11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

66

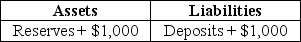

Suppose a transaction changes the balance sheet of Wells Fargo bank as indicated in the following T-account.

At this point,what percentage of the new deposits does Wells Fargo hold in reserves?

A) 100 percent

B) 10 percent

C) 5 percent

D) 1 percent

At this point,what percentage of the new deposits does Wells Fargo hold in reserves?

A) 100 percent

B) 10 percent

C) 5 percent

D) 1 percent

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

67

Suppose you deposit $2,000 into Bank of America and that the required reserve ratio is 10 percent.How does this affect the bank's balance sheet?

A) Reserves rise by $200.

B) Required reserves rise by $2,000.

C) Deposits rise by $1,000.

D) Excess reserves rise by $1,800.

A) Reserves rise by $200.

B) Required reserves rise by $2,000.

C) Deposits rise by $1,000.

D) Excess reserves rise by $1,800.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

68

A cash withdrawal from the banking system

A) decreases reserves.

B) decreases deposits.

C) decreases excess reserves.

D) All of the above are correct.

A) decreases reserves.

B) decreases deposits.

C) decreases excess reserves.

D) All of the above are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

69

Suppose the reserve ratio is RR.Then,

A) required reserves = RR × actual reserves.

B) required reserves = RR × excess reserves.

C) required reserves = RR × deposits.

D) required reserves = RR × loans.

A) required reserves = RR × actual reserves.

B) required reserves = RR × excess reserves.

C) required reserves = RR × deposits.

D) required reserves = RR × loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

70

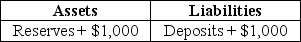

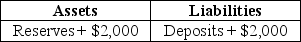

Suppose a transaction changes a bank's balance sheet as indicated in the following T-account,and the required reserve ratio is 10 percent.

As a result of the transaction,the bank can make a maximum loan of

A) $0.

B) $200.

C) $1,800.

D) $2,000.

As a result of the transaction,the bank can make a maximum loan of

A) $0.

B) $200.

C) $1,800.

D) $2,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

71

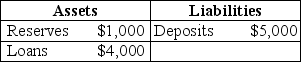

Consider the following T-account for a bank

If the required reserve ratio is 20 percent and the bank is holding no excess reserves,the bank at this point can make no more loans.

If the required reserve ratio is 20 percent and the bank is holding no excess reserves,the bank at this point can make no more loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

72

The simple deposit multiplier is the ratio of the amount of

A) new reserves created by the banks to the amount of deposits.

B) new reserves created by the banks to the amount of loans.

C) deposits created by the banks to the amount of new reserves.

D) deposits created by the banks.

A) new reserves created by the banks to the amount of deposits.

B) new reserves created by the banks to the amount of loans.

C) deposits created by the banks to the amount of new reserves.

D) deposits created by the banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

73

When you open a checking account at Bank of America,Bank of America

A) has more reserves and more excess reserves.

B) has more reserves, but excess reserves remain unchanged.

C) has more deposits and less in excess reserves.

D) has more deposits, but excess reserves remain unchanged.

A) has more reserves and more excess reserves.

B) has more reserves, but excess reserves remain unchanged.

C) has more deposits and less in excess reserves.

D) has more deposits, but excess reserves remain unchanged.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

74

If the required reserve ratio is RR,the simple deposit multiplier is defined as

A)

B)

C) × change in bank reserves.

× change in bank reserves.

D) × change in bank reserves.

× change in bank reserves.

A)

B)

C)

× change in bank reserves.

× change in bank reserves.D)

× change in bank reserves.

× change in bank reserves.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

75

When banks gain ________,they can ________ their loans; and the money supply ________.

A) reserves; increase; contracts

B) withdrawals; increase; expands

C) withdrawals; decrease; expands

D) reserves; increase; expands

A) reserves; increase; contracts

B) withdrawals; increase; expands

C) withdrawals; decrease; expands

D) reserves; increase; expands

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

76

With a required reserve ratio of 20 percent,an increase in reserves of $10,000 could lead to a maximum increase in checking account deposits in the entire banking system of

A) $2,000.

B) $8,000.

C) $50,000.

D) $100,000.

A) $2,000.

B) $8,000.

C) $50,000.

D) $100,000.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

77

If,during a deposit expansion,not all money gets redeposited into the banking system and some leaks out as currency,then the real world multiplier is

A) smaller than 1/RR.

B) larger than 1/RR.

C) equal to 1/RR.

D) not related to 1/RR.

A) smaller than 1/RR.

B) larger than 1/RR.

C) equal to 1/RR.

D) not related to 1/RR.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

78

Your checking account balance is included in your bank's assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

79

A commercial bank like Comerica creates money by

A) printing paper money.

B) earning profits.

C) selling corporate bonds.

D) making loans.

A) printing paper money.

B) earning profits.

C) selling corporate bonds.

D) making loans.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck

80

If the required reserve ratio is 5 percent,then the simple deposit multiplier is

A) 2.

B) 5.

C) 10.

D) 20.

A) 2.

B) 5.

C) 10.

D) 20.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 146 في هذه المجموعة.

فتح الحزمة

k this deck