Deck 15: Monetary Policy

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/137

العب

ملء الشاشة (f)

Deck 15: Monetary Policy

1

Rising prices erode the value of money as a ________ and as a ________.

A) unit of barter; unit of account

B) store of value; unit of liquidity

C) medium of exchange; store of value

D) store of value; unit of barter

A) unit of barter; unit of account

B) store of value; unit of liquidity

C) medium of exchange; store of value

D) store of value; unit of barter

medium of exchange; store of value

2

The money demand curve,against possible levels of interest rates,has a

A) positive slope.

B) negative slope.

C) zero slope.

D) positive slope for low levels of money demand, a negative slope for high levels of money demand.

A) positive slope.

B) negative slope.

C) zero slope.

D) positive slope for low levels of money demand, a negative slope for high levels of money demand.

negative slope.

3

Which of the following are goals of monetary policy?

A) maximizing the value of the dollar relative to other currencies, economic growth, and high employment

B) price stability, maximizing the value of the dollar relative to other currencies, and high employment

C) price stability, economic growth, and high employment

D) price stability, economic growth, and maximizing the value of the dollar relative to other currencies

A) maximizing the value of the dollar relative to other currencies, economic growth, and high employment

B) price stability, maximizing the value of the dollar relative to other currencies, and high employment

C) price stability, economic growth, and high employment

D) price stability, economic growth, and maximizing the value of the dollar relative to other currencies

price stability, economic growth, and high employment

4

Federal Reserve Board Chairmen Paul Volcker,Alan Greenspan,and Ben Bernanke all have focused on which of the following as their main goal of monetary policy?

A) high employment

B) price stability

C) economic growth

D) stability of financial markets

A) high employment

B) price stability

C) economic growth

D) stability of financial markets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

5

The money demand curve has a negative slope because

A) lower interest rates cause households and firms to switch from money to financial assets.

B) lower interest rates cause households and firms to switch from financial assets to money.

C) lower interest rates cause households and firms to switch from money to stocks.

D) lower interest rates cause households and firms to switch from money to bonds.

A) lower interest rates cause households and firms to switch from money to financial assets.

B) lower interest rates cause households and firms to switch from financial assets to money.

C) lower interest rates cause households and firms to switch from money to stocks.

D) lower interest rates cause households and firms to switch from money to bonds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

6

A monetary policy target is a variable that

A) the Fed can affect directly.

B) equals one of the Fed's main policy goals.

C) the Fed has no ability to change.

D) the Fed cannot affect directly.

A) the Fed can affect directly.

B) equals one of the Fed's main policy goals.

C) the Fed has no ability to change.

D) the Fed cannot affect directly.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

7

When Congress established the Federal Reserve in 1913,what was its main responsibility? When did Congress broaden the Fed's responsibilities?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

8

The Fed seeks to promote stability of financial markets because

A) they want to lift the self-esteem of workers.

B) Congress directed them to do so by the Employment Act of 1946.

C) resources are lost when there is not an efficient matching of savers and borrowers.

D) unstable markets result in increased efficiency.

A) they want to lift the self-esteem of workers.

B) Congress directed them to do so by the Employment Act of 1946.

C) resources are lost when there is not an efficient matching of savers and borrowers.

D) unstable markets result in increased efficiency.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

9

The Fed's two main monetary policy targets are

A) the money supply and the inflation rate.

B) the money supply and the interest rate.

C) the interest rate and real GDP.

D) the inflation rate and real GDP.

A) the money supply and the inflation rate.

B) the money supply and the interest rate.

C) the interest rate and real GDP.

D) the inflation rate and real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

10

Maintaining a strong dollar in international currency markets is not one of the four monetary policy goals of the Fed listed in the textbook.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

11

The Federal Reserve did not lower interest rates to help the housing market in 2007 because

A) interest rates were already at historically low levels.

B) the unemployment rate was below the natural rate of unemployment.

C) banks held excess reserves instead of making loans.

D) the inflation rate was at or above the level the Fed considered acceptable.

A) interest rates were already at historically low levels.

B) the unemployment rate was below the natural rate of unemployment.

C) banks held excess reserves instead of making loans.

D) the inflation rate was at or above the level the Fed considered acceptable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

12

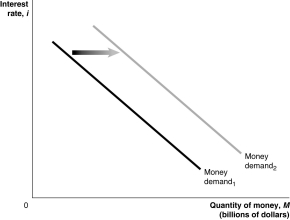

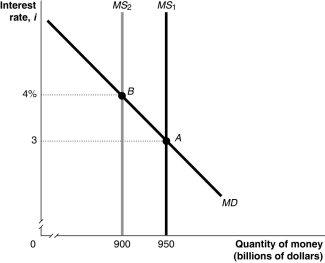

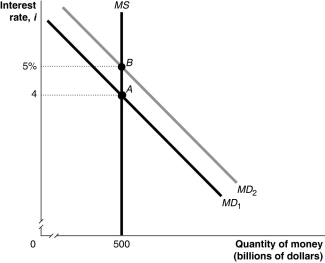

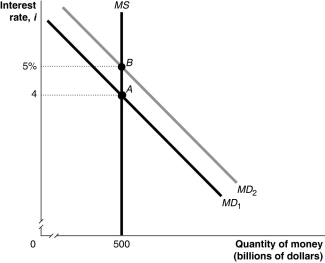

Figure 26-1

Refer to Figure 26-1.In the figure above,the money demand curve would move from Money demand₁ to Money demand₂ if

A) real GDP decreased.

B) the price level increased.

C) the interest rate increased.

D) the Federal Reserve sold Treasury securities.

Refer to Figure 26-1.In the figure above,the money demand curve would move from Money demand₁ to Money demand₂ if

A) real GDP decreased.

B) the price level increased.

C) the interest rate increased.

D) the Federal Reserve sold Treasury securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

13

If the Fed raises the interest rate,this will ________ inflation and ________ real GDP in the short run.

A) reduce; raise

B) increase; lower

C) increase; raise

D) reduce; lower

A) reduce; raise

B) increase; lower

C) increase; raise

D) reduce; lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

14

An increase in real GDP

A) increases the buying and selling of goods and increases the demand for money as a medium of exchange.

B) increases the buying and selling of goods and decreases the demand for money as a medium of exchange.

C) decreases the buying and selling of goods and increases the demand for money as a medium of exchange.

D) decreases the buying and selling of goods and decreases the demand for money as a medium of exchange.

A) increases the buying and selling of goods and increases the demand for money as a medium of exchange.

B) increases the buying and selling of goods and decreases the demand for money as a medium of exchange.

C) decreases the buying and selling of goods and increases the demand for money as a medium of exchange.

D) decreases the buying and selling of goods and decreases the demand for money as a medium of exchange.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

15

The main goal of monetary policy for recent Fed Chairmen has been to maintain high employment in labor markets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

16

Monetary policy refers to the actions the Federal Reserve takes to manage

A) the money supply and income tax rates to pursue its economic objectives.

B) the money supply and interest rates to pursue its economic objectives.

C) income tax rates and interest rates to pursue its economic objectives.

D) government spending and income tax rates to pursue its economic objectives.

A) the money supply and income tax rates to pursue its economic objectives.

B) the money supply and interest rates to pursue its economic objectives.

C) income tax rates and interest rates to pursue its economic objectives.

D) government spending and income tax rates to pursue its economic objectives.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

17

Monetary policy is conducted by the U.S.Treasury Department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

18

Increases in the price level

A) increase the opportunity cost of holding money.

B) decrease the opportunity cost of holding money.

C) increase the quantity of money needed for buying and selling.

D) decrease the quantity of money needed for buying and selling.

A) increase the opportunity cost of holding money.

B) decrease the opportunity cost of holding money.

C) increase the quantity of money needed for buying and selling.

D) decrease the quantity of money needed for buying and selling.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

19

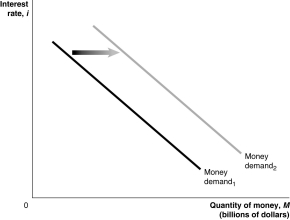

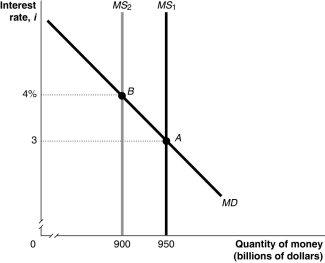

Figure 26-2

Refer to Figure 26-2.In the figure above,a movement from point A to point B would be caused by

A) a decrease in real GDP.

B) an increase in the price level.

C) a decrease in the price level.

D) an increase in the interest rate.

Refer to Figure 26-2.In the figure above,a movement from point A to point B would be caused by

A) a decrease in real GDP.

B) an increase in the price level.

C) a decrease in the price level.

D) an increase in the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

20

What problems can high inflation rates cause for the economy?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

21

Suppose the Fed decreases the money supply.In response households and firms will ________ short term assets and this will drive ________ interest rates.

A) buy; up

B) buy; down

C) sell; up

D) sell; down

A) buy; up

B) buy; down

C) sell; up

D) sell; down

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

22

The federal funds rate

A) is determined administratively by the Fed.

B) is determined by the supply of and demand for bank reserves.

C) is determined directly by household demand for funds.

D) is determined directly by firm demand for funds.

A) is determined administratively by the Fed.

B) is determined by the supply of and demand for bank reserves.

C) is determined directly by household demand for funds.

D) is determined directly by firm demand for funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

23

The rate of interest banks charge other banks for overnight loans of reserves is the

A) discount rate.

B) prime rate.

C) federal funds rate

D) real rate.

A) discount rate.

B) prime rate.

C) federal funds rate

D) real rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

24

Suppose the Fed increases the money supply.Which of the following is true?

A) At the original interest rate, the quantity of money demanded is equal to the quantity of money supplied.

B) At the original interest rate, the quantity of money demanded is less than the quantity of money supplied.

C) At the original interest rate, the quantity of money demanded is greater than the quantity of money supplied.

D) The interest rate must rise for the money market to clear.

A) At the original interest rate, the quantity of money demanded is equal to the quantity of money supplied.

B) At the original interest rate, the quantity of money demanded is less than the quantity of money supplied.

C) At the original interest rate, the quantity of money demanded is greater than the quantity of money supplied.

D) The interest rate must rise for the money market to clear.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

25

Buying a house during a recession may be a good idea if your job is secure because the Federal Reserve often

A) raises interest rates during recessions.

B) lowers interest rates during recessions.

C) lowers income taxes during recessions.

D) sells Treasury bills to help the housing market.

A) raises interest rates during recessions.

B) lowers interest rates during recessions.

C) lowers income taxes during recessions.

D) sells Treasury bills to help the housing market.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

26

A decrease in real GDP can

A) shift money demand to the right and decrease the interest rate.

B) shift money demand to the right and increase the interest rate.

C) shift money demand to the left and decrease the interest rate.

D) shift money demand to the left and increase the interest rate.

A) shift money demand to the right and decrease the interest rate.

B) shift money demand to the right and increase the interest rate.

C) shift money demand to the left and decrease the interest rate.

D) shift money demand to the left and increase the interest rate.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

27

If the Fed buys Treasury bills,this will shift the

A) money supply curve to the right.

B) money supply curve to the left.

C) money demand curve to the right.

D) money demand curve to the left.

A) money supply curve to the right.

B) money supply curve to the left.

C) money demand curve to the right.

D) money demand curve to the left.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

28

Ceteris paribus,an increase in the money supply will lower short-term interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

29

Give an example of a monetary policy target.Explain why the Fed uses policy targets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

30

Rising nominal GDP will increase the demand for money and short-term interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

31

Buying a house during a recession may be a good idea if your job seems secure because the Federal Reserve often lowers interest rates during a recession.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

32

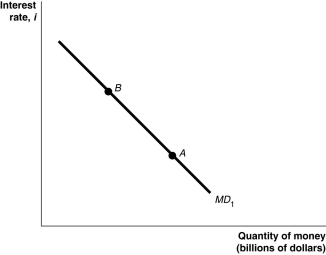

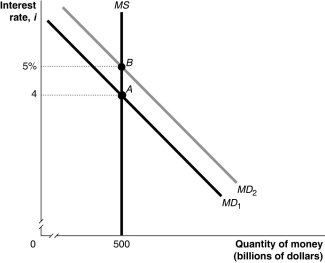

Figure 26-3

Refer to Figure 26-3.In the figure above,the movement from point A to point B in the money market would be caused by

A) an increase in the price level.

B) a decrease in real GDP.

C) an open market sale of Treasury securities by the Federal Reserve.

D) a decrease in the required reserve ratio by the Federal Reserve.

Refer to Figure 26-3.In the figure above,the movement from point A to point B in the money market would be caused by

A) an increase in the price level.

B) a decrease in real GDP.

C) an open market sale of Treasury securities by the Federal Reserve.

D) a decrease in the required reserve ratio by the Federal Reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

33

The money market model is concerned with ________ and the loanable funds market model is concerned with ________.

A) short-term real interest rates; long-term nominal interest rates

B) short-term nominal interest rates; long-term nominal interest rates

C) short-term real interest rates; long-term real interest rates

D) short-term nominal interest rates; long-term real interest rates

A) short-term real interest rates; long-term nominal interest rates

B) short-term nominal interest rates; long-term nominal interest rates

C) short-term real interest rates; long-term real interest rates

D) short-term nominal interest rates; long-term real interest rates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

34

When the price of a financial asset ________ its interest rate will ________.

A) rises; rise

B) falls; fall

C) falls; rise

D) rises; remain the same

A) rises; rise

B) falls; fall

C) falls; rise

D) rises; remain the same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

35

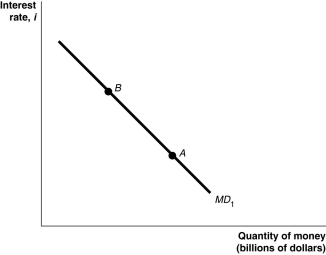

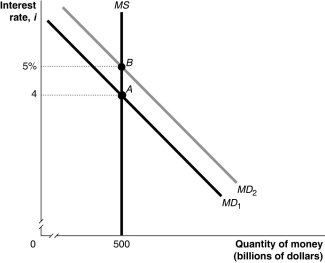

Figure 26-4

Refer to Figure 26-4.In the figure above,the movement from point A to point B in the money market would be caused by

A) an increase in the price level.

B) a decrease in real GDP.

C) an open market sale of Treasury securities by the Federal Reserve.

D) an increase in the required reserve ratio by the Federal Reserve.

Refer to Figure 26-4.In the figure above,the movement from point A to point B in the money market would be caused by

A) an increase in the price level.

B) a decrease in real GDP.

C) an open market sale of Treasury securities by the Federal Reserve.

D) an increase in the required reserve ratio by the Federal Reserve.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

36

The money supply curve is vertical if

A) banks and the Fed jointly determine the money supply.

B) the Fed is able to completely determine the money supply.

C) banks and households determine the money supply.

D) households and the Fed jointly determine the money supply.

A) banks and the Fed jointly determine the money supply.

B) the Fed is able to completely determine the money supply.

C) banks and households determine the money supply.

D) households and the Fed jointly determine the money supply.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

37

Describe how the Fed uses open market operations to change short-term and long-term interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

38

An increase in the money supply will

A) increase the interest rate.

B) decrease the interest rate.

C) have no affect on the interest rate.

D) decrease the equilibrium quantity of money in the economy.

A) increase the interest rate.

B) decrease the interest rate.

C) have no affect on the interest rate.

D) decrease the equilibrium quantity of money in the economy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

39

The federal funds rate is

A) the interest rate the Fed charges commercial banks.

B) the interest rate a bank charges its best customers.

C) the interest rate banks charge each other for overnight loans.

D) the interest rate on a Treasury Bill.

A) the interest rate the Fed charges commercial banks.

B) the interest rate a bank charges its best customers.

C) the interest rate banks charge each other for overnight loans.

D) the interest rate on a Treasury Bill.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following correctly describes what the Fed used as monetary targets in the past?

A) The Fed used M1 and M2 as targets after 1993.

B) The Fed focused on M1 as a target after deregulation of the financial markets.

C) The Fed increased its reliance on interest rate targets since the mid-1990s.

D) After 1980 and before the 1990s, the Fed focused on interest rate targets.

A) The Fed used M1 and M2 as targets after 1993.

B) The Fed focused on M1 as a target after deregulation of the financial markets.

C) The Fed increased its reliance on interest rate targets since the mid-1990s.

D) After 1980 and before the 1990s, the Fed focused on interest rate targets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

41

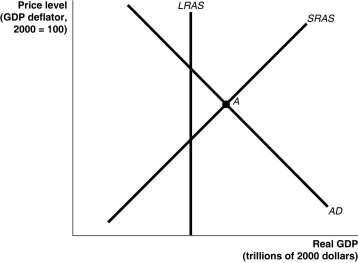

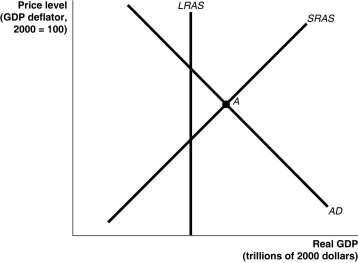

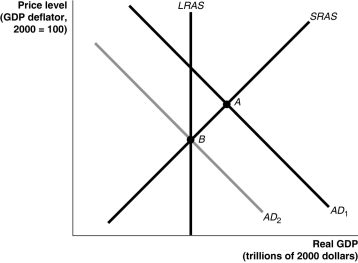

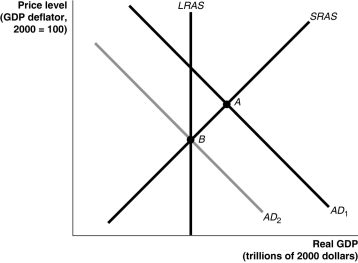

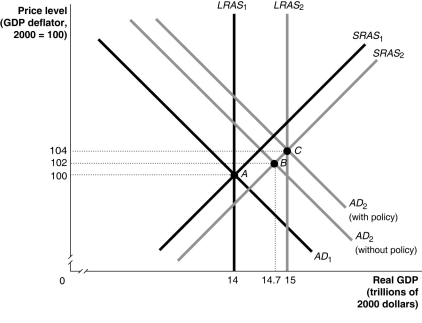

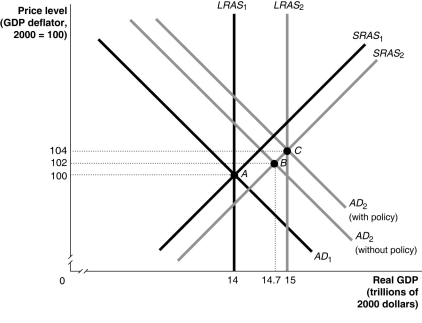

Figure 26-5

Refer to Figure 26-5.In the figure above,if the economy is at point A,the appropriate monetary policy by the Federal Reserve would be to

A) lower interest rates.

B) raise interest rates.

C) lower income taxes.

D) raise income taxes.

Refer to Figure 26-5.In the figure above,if the economy is at point A,the appropriate monetary policy by the Federal Reserve would be to

A) lower interest rates.

B) raise interest rates.

C) lower income taxes.

D) raise income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

42

When the Fed increases the money supply,

A) the interest rate rises and this stimulates consumption spending.

B) people spend less because they have more money.

C) the interest rate falls and this stimulates investment spending.

D) the interest rate rises and this stimulates investment spending.

A) the interest rate rises and this stimulates consumption spending.

B) people spend less because they have more money.

C) the interest rate falls and this stimulates investment spending.

D) the interest rate rises and this stimulates investment spending.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

43

Falling interest rates can

A) increase a firm's stock price, which causes firms to issue more stock shares, and thus increases funds for investment.

B) raise the cost of borrowing for firms and decrease investment.

C) raise the cost of buying new homes and fewer new homes will be purchased.

D) lower the cost of buying new homes and fewer new homes will be purchased.

A) increase a firm's stock price, which causes firms to issue more stock shares, and thus increases funds for investment.

B) raise the cost of borrowing for firms and decrease investment.

C) raise the cost of buying new homes and fewer new homes will be purchased.

D) lower the cost of buying new homes and fewer new homes will be purchased.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

44

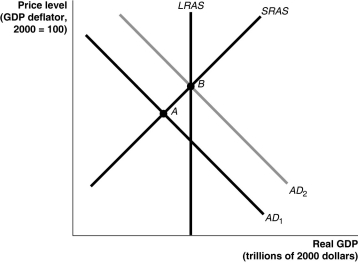

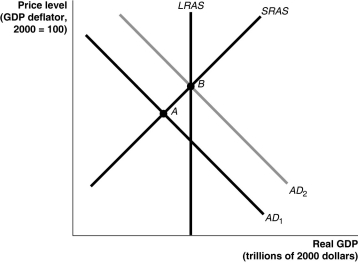

Figure 26-6

Refer to Figure 26-6.In the figure above suppose the economy is initially at point A.The movement of the economy to point B as shown in the graph illustrates the effect of which of the following policy actions by the Federal Reserve?

A) a decrease in income taxes

B) an increase in the required reserve ratio

C) an open market purchase of Treasury bills

D) an open market sale of Treasury bills

Refer to Figure 26-6.In the figure above suppose the economy is initially at point A.The movement of the economy to point B as shown in the graph illustrates the effect of which of the following policy actions by the Federal Reserve?

A) a decrease in income taxes

B) an increase in the required reserve ratio

C) an open market purchase of Treasury bills

D) an open market sale of Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

45

If the Fed's policy is contractionary,it will

A) use open market operations to buy Treasury bills.

B) use open market operations to sell Treasury bills.

C) lower the discount rate.

D) lower the reserve requirement.

A) use open market operations to buy Treasury bills.

B) use open market operations to sell Treasury bills.

C) lower the discount rate.

D) lower the reserve requirement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

46

In which of the following situations would the Fed conduct contractionary monetary policy?

A) The Fed believes that aggregate demand was growing too slowly to keep up with potential GDP.

B) The Fed fears that unemployment is climbing above the natural rate.

C) The Fed is concerned that aggregate demand would continue to exceed the growth in potential GDP.

D) The Fed is worried that deflation will become a problem.

A) The Fed believes that aggregate demand was growing too slowly to keep up with potential GDP.

B) The Fed fears that unemployment is climbing above the natural rate.

C) The Fed is concerned that aggregate demand would continue to exceed the growth in potential GDP.

D) The Fed is worried that deflation will become a problem.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

47

If the Fed pursues expansionary monetary policy,

A) aggregate demand will rise, and the price level will rise.

B) aggregate demand will fall, and the price level will fall.

C) aggregate demand will rise, and the price level will fall.

D) aggregate demand will fall, and the price level will rise.

A) aggregate demand will rise, and the price level will rise.

B) aggregate demand will fall, and the price level will fall.

C) aggregate demand will rise, and the price level will fall.

D) aggregate demand will fall, and the price level will rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

48

Lowering the interest rate will

A) decrease spending on consumer durables.

B) increase investment projects by firms.

C) decrease spending on new homes.

D) decrease the value of the dollar and lower net exports.

A) decrease spending on consumer durables.

B) increase investment projects by firms.

C) decrease spending on new homes.

D) decrease the value of the dollar and lower net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

49

Contractionary monetary policy causes

A) aggregate demand to rise and the price level to rise.

B) aggregate demand to fall and the price level to fall.

C) aggregate demand to rise and the price level to fall.

D) aggregate demand to fall and the price level to rise.

A) aggregate demand to rise and the price level to rise.

B) aggregate demand to fall and the price level to fall.

C) aggregate demand to rise and the price level to fall.

D) aggregate demand to fall and the price level to rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

50

If the Fed lowers its target for the federal funds rate,this indicates that

A) the Fed is pursuing an expansionary monetary policy.

B) the Fed is pursuing a contractionary monetary policy.

C) the Fed is attempting to combat inflation.

D) the Fed is concerned that the growth in aggregate demand will exceed potential GDP.

A) the Fed is pursuing an expansionary monetary policy.

B) the Fed is pursuing a contractionary monetary policy.

C) the Fed is attempting to combat inflation.

D) the Fed is concerned that the growth in aggregate demand will exceed potential GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

51

Use the money demand and money supply model to show graphically and explain the effect on interest rates of the Federal Reserve's open market purchase of Treasury securities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

52

If the Fed raises its target for the federal fund rate,this indicates that

A) the Fed is pursuing an expansionary monetary policy.

B) the Fed is pursuing a contractionary monetary policy.

C) the Fed is attempting to combat deflation.

D) The Fed is concerned that the growth in aggregate demand is too slow to keep up with potential GDP.

A) the Fed is pursuing an expansionary monetary policy.

B) the Fed is pursuing a contractionary monetary policy.

C) the Fed is attempting to combat deflation.

D) The Fed is concerned that the growth in aggregate demand is too slow to keep up with potential GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

53

If the Fed pursues expansionary monetary policy then

A) the money supply will decrease, interest rates will rise and GDP will fall.

B) the money supply will decrease, interest rates will fall and GDP will fall.

C) the money supply will increase, interest rates will rise and GDP will rise.

D) the money supply will increase, interest rates will fall and GDP will rise.

A) the money supply will decrease, interest rates will rise and GDP will fall.

B) the money supply will decrease, interest rates will fall and GDP will fall.

C) the money supply will increase, interest rates will rise and GDP will rise.

D) the money supply will increase, interest rates will fall and GDP will rise.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

54

Which of the following characterizes the Fed's ability to prevent recessions?

A) The Fed is able to "fine tune" the economy and entirely eliminate recessions.

B) The Fed is incapable of changing aggregate demand through its monetary policy tools.

C) The Fed is able to keep a recession shorter and milder than it would otherwise be.

D) The Fed is able to eliminate the business cycle and achieve absolute price stability.

A) The Fed is able to "fine tune" the economy and entirely eliminate recessions.

B) The Fed is incapable of changing aggregate demand through its monetary policy tools.

C) The Fed is able to keep a recession shorter and milder than it would otherwise be.

D) The Fed is able to eliminate the business cycle and achieve absolute price stability.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

55

If money demand is extremely sensitive to changes in the interest rate,the money demand curve becomes almost horizontal.If the Fed expands the money supply under these circumstances,then the interest rate will

A) fall substantially and investment and consumer spending will fall substantially.

B) rise substantially and investment and consumer spending will rise substantially.

C) fall substantially and investment and consumer spending will change very little.

D) change very little and investment and consumer spending will change very little.

A) fall substantially and investment and consumer spending will fall substantially.

B) rise substantially and investment and consumer spending will rise substantially.

C) fall substantially and investment and consumer spending will change very little.

D) change very little and investment and consumer spending will change very little.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

56

An increase in the domestic interest rate relative to other interest rates should

A) increase investment spending.

B) decrease consumption spending.

C) increase government spending.

D) increase net exports.

A) increase investment spending.

B) decrease consumption spending.

C) increase government spending.

D) increase net exports.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

57

Figure 26-7

Refer to Figure 26-7.In the figure above,suppose the economy is initially at point A.The movement of the economy to point B as shown in the graph illustrates the effect of which of the following policy actions by the Federal Reserve?

A) an increase in income taxes

B) a decrease in the required reserve ratio

C) an open market purchase of Treasury bills

D) an open market sale of Treasury bills

Refer to Figure 26-7.In the figure above,suppose the economy is initially at point A.The movement of the economy to point B as shown in the graph illustrates the effect of which of the following policy actions by the Federal Reserve?

A) an increase in income taxes

B) a decrease in the required reserve ratio

C) an open market purchase of Treasury bills

D) an open market sale of Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following situations is one in which the Fed will potentially pursue expansionary monetary policy?

A) Potential GDP is forecasted to be higher than equilibrium GDP.

B) Potential GDP is forecasted to be lower than equilibrium GDP.

C) Aggregate demand is growing too fast to keep the economy at full employment.

D) Aggregate demand is growing too slowly and the economy is in danger of producing GDP above full employment.

A) Potential GDP is forecasted to be higher than equilibrium GDP.

B) Potential GDP is forecasted to be lower than equilibrium GDP.

C) Aggregate demand is growing too fast to keep the economy at full employment.

D) Aggregate demand is growing too slowly and the economy is in danger of producing GDP above full employment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

59

When the Fed embarked on a policy known as quantitative easing,they

A) slowly lowered the federal funds rate target until it was equal to zero.

B) they reduced the required reserve ration by one-quarter point per month for 12 months.

C) bought longer-term securities than are usually bought in open market operations.

D) opened up lending to primary dealers, commercial banks, and investment banks.

A) slowly lowered the federal funds rate target until it was equal to zero.

B) they reduced the required reserve ration by one-quarter point per month for 12 months.

C) bought longer-term securities than are usually bought in open market operations.

D) opened up lending to primary dealers, commercial banks, and investment banks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

60

When the Fed decided to buy long-term Treasury securities while selling an equal amount of shorter-term treasury securities to keep long-term interest rates low,it was following a strategy known as

A) securitization.

B) operation twist.

C) quantitative easing.

D) indirect finance.

A) securitization.

B) operation twist.

C) quantitative easing.

D) indirect finance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

61

When calculating GDP,the Bureau of Economic Analysis releases its "advanced estimate" of a quarter's GDP approximately

A) three months before the quarter has ended.

B) one month after the quarter has ended.

C) three months after the quarter has ended.

D) one year after the quarter has ended.

A) three months before the quarter has ended.

B) one month after the quarter has ended.

C) three months after the quarter has ended.

D) one year after the quarter has ended.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

62

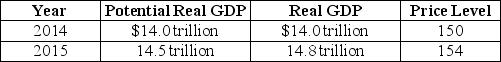

Table 26-2

Refer to Table 26-2.Consider the hypothetical information in the table above for potential real GDP,real GDP and the price level in 2014 and in 2015 if the Federal Reserve does not use monetary policy.If the Fed wants to keep real GDP at its potential level in 2015,it should

A) buy Treasury securities.

B) sell Treasury securities.

C) decrease the required reserve ratio.

D) decrease income taxes.

Refer to Table 26-2.Consider the hypothetical information in the table above for potential real GDP,real GDP and the price level in 2014 and in 2015 if the Federal Reserve does not use monetary policy.If the Fed wants to keep real GDP at its potential level in 2015,it should

A) buy Treasury securities.

B) sell Treasury securities.

C) decrease the required reserve ratio.

D) decrease income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use a graph to show the effects of a contractionary monetary policy to reduce inflation and move an economy back to potential real GDP.Explain what happens to aggregate demand,real GDP,and the price level.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

64

If the Fed orders an expansionary monetary policy,describe what will happen to the following variables relative to what would have happened without the policy:

a.The money supply

b.Interest rates

c.Investment

d.Consumption

e.Net Exports

f.The aggregate demand curve

g.Real GDP

h.The price level

a.The money supply

b.Interest rates

c.Investment

d.Consumption

e.Net Exports

f.The aggregate demand curve

g.Real GDP

h.The price level

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

65

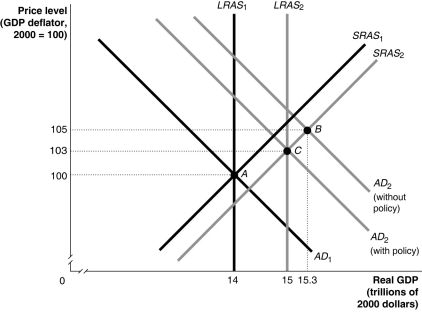

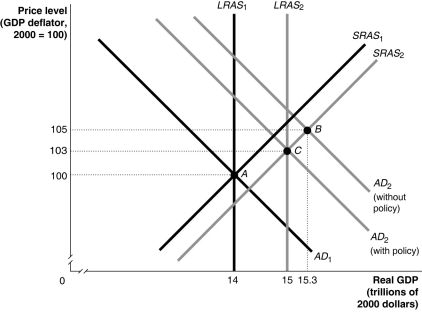

Figure 26-11

Refer to Figure 26-11.In the figure above,suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B.Which of the following policies could the Federal Reserve use to move the economy to point C?

A) decrease income taxes

B) decrease the required-reserve ratio

C) buy Treasury bills

D) sell Treasury bills

Refer to Figure 26-11.In the figure above,suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B.Which of the following policies could the Federal Reserve use to move the economy to point C?

A) decrease income taxes

B) decrease the required-reserve ratio

C) buy Treasury bills

D) sell Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

66

Expansionary monetary policy to prevent real GDP from falling below potential real GDP would cause the inflation rate to be ________ and real GDP to be ________.

A) higher; higher

B) higher; lower

C) lower; higher

D) lower; lower

A) higher; higher

B) higher; lower

C) lower; higher

D) lower; lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

67

The Fed

A) always engages in countercyclical policy.

B) always intends to engage in procyclical policy.

C) can engage in procyclical policy if it mistimes its policy response.

D) never intends to engage in countercyclical policy.

A) always engages in countercyclical policy.

B) always intends to engage in procyclical policy.

C) can engage in procyclical policy if it mistimes its policy response.

D) never intends to engage in countercyclical policy.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

68

Figure 26-9

Refer to Figure 26-9.In the figure above,if the economy in Year 1 is at point A and expected in Year 2 to be at point B,then the appropriate monetary policy by the Federal Reserve would be to

A) lower interest rates.

B) raise interest rates.

C) lower income taxes.

D) raise income taxes.

Refer to Figure 26-9.In the figure above,if the economy in Year 1 is at point A and expected in Year 2 to be at point B,then the appropriate monetary policy by the Federal Reserve would be to

A) lower interest rates.

B) raise interest rates.

C) lower income taxes.

D) raise income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

69

What actions should the Fed take if it believes the economy is about to experience a high rate of inflation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

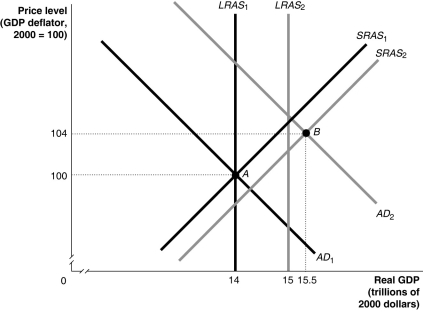

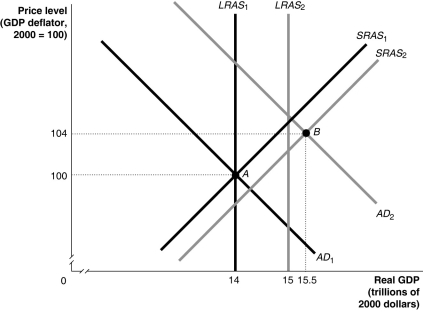

70

Figure 26-8

Refer to Figure 26-8.In the figure above,if the economy in Year 1 is at point A and expected in Year 2 to be at point B,then the appropriate monetary policy by the Federal Reserve would be to

A) lower interest rates.

B) raise interest rates.

C) lower income taxes.

D) raise income taxes.

Refer to Figure 26-8.In the figure above,if the economy in Year 1 is at point A and expected in Year 2 to be at point B,then the appropriate monetary policy by the Federal Reserve would be to

A) lower interest rates.

B) raise interest rates.

C) lower income taxes.

D) raise income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

71

The body that is responsible for dating the beginning and ending dates for a recession is

A) the Fed.

B) the Congress.

C) the National Bureau of Economic Research.

D) the Bureau of Economic Analysis.

A) the Fed.

B) the Congress.

C) the National Bureau of Economic Research.

D) the Bureau of Economic Analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

72

When the Federal Reserve increases the money supply,people spend more because they now have more money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

73

The Fed

A) can easily distinguish the minor ups and downs of the economy from a recession.

B) can have difficulty distinguishing the minor ups and downs of the economy from a recession.

C) always times its policy responses correctly.

D) can easily determine if a drop in production means a recession is inevitable.

A) can easily distinguish the minor ups and downs of the economy from a recession.

B) can have difficulty distinguishing the minor ups and downs of the economy from a recession.

C) always times its policy responses correctly.

D) can easily determine if a drop in production means a recession is inevitable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

74

Figure 26-10

Refer to Figure 26-10.In the figure above,suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B.Which of the following policies could the Federal Reserve use to move the economy to point C?

A) decrease income taxes

B) increase the required-reserve ratio

C) buy Treasury bills

D) sell Treasury bills

Refer to Figure 26-10.In the figure above,suppose the economy in Year 1 is at point A and expected in Year 2 to be at point B.Which of the following policies could the Federal Reserve use to move the economy to point C?

A) decrease income taxes

B) increase the required-reserve ratio

C) buy Treasury bills

D) sell Treasury bills

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

75

Suppose that the economy is producing below potential GDP and the Fed implements the correct change in monetary policy,but not until after the economy has passed the trough of the recession.Then

A) the Fed's contractionary policy will result in too large of a decrease in GDP.

B) the Fed's contractionary policy will result in too small of a decrease in GDP.

C) the Fed's expansionary policy will result in too small of a decrease in GDP.

D) the Fed's expansionary policy will result in too large of an increase in GDP.

A) the Fed's contractionary policy will result in too large of a decrease in GDP.

B) the Fed's contractionary policy will result in too small of a decrease in GDP.

C) the Fed's expansionary policy will result in too small of a decrease in GDP.

D) the Fed's expansionary policy will result in too large of an increase in GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

76

Suppose that the economy is producing above potential GDP and the Fed implements the correct change in monetary policy,but not until after the economy has passed the peak of the boom.Then

A) the Fed's contractionary policy will result in too large of a decrease in GDP.

B) the Fed's contractionary policy will result in too small of a decrease in GDP.

C) the Fed's expansionary policy will result in too small of a decrease in GDP.

D) the Fed's expansionary policy will result in too large of an increase in GDP.

A) the Fed's contractionary policy will result in too large of a decrease in GDP.

B) the Fed's contractionary policy will result in too small of a decrease in GDP.

C) the Fed's expansionary policy will result in too small of a decrease in GDP.

D) the Fed's expansionary policy will result in too large of an increase in GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

77

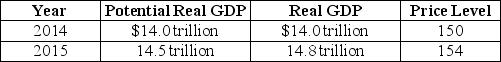

Table 26-1

Refer to Table 26-1.Consider the hypothetical information in the table above for potential real GDP,real GDP and the price level in 2014 and in 2015 if the Federal Reserve does not use monetary policy.If the Fed wants to keep real GDP at its potential level in 2015,it should

A) buy Treasury securities.

B) sell Treasury securities.

C) increase the required reserve ratio.

D) increase income taxes.

Refer to Table 26-1.Consider the hypothetical information in the table above for potential real GDP,real GDP and the price level in 2014 and in 2015 if the Federal Reserve does not use monetary policy.If the Fed wants to keep real GDP at its potential level in 2015,it should

A) buy Treasury securities.

B) sell Treasury securities.

C) increase the required reserve ratio.

D) increase income taxes.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

78

From an initial long-run macroeconomic equilibrium,if the Federal Reserve anticipated that next year aggregate demand would grow significantly slower than long-run aggregate supply,then the Federal Reserve would most likely

A) increase income tax rates.

B) decrease income tax rates.

C) increase interest rates.

D) decrease interest rates.

A) increase income tax rates.

B) decrease income tax rates.

C) increase interest rates.

D) decrease interest rates.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

79

Your income will increase if the Federal Reserve buys a Treasury bill from you and pays you with a check from the Fed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck

80

Contractionary monetary policy refers to the Fed's decreasing the money supply and decreasing interest rates to decrease real GDP.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 137 في هذه المجموعة.

فتح الحزمة

k this deck