Deck 11: Translation Exposure

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/59

العب

ملء الشاشة (f)

Deck 11: Translation Exposure

1

Which of the following is NOT an economic indicator used by FASB for determining a subsidiary's functional currency?

A) cash flow indicators

B) sales price indicators

C) expense indicators

D) These are all economic indicators used by FASB.

A) cash flow indicators

B) sales price indicators

C) expense indicators

D) These are all economic indicators used by FASB.

These are all economic indicators used by FASB.

2

If an imbalance results from the accounting method used for translation, the imbalance is taken either to ________ or ________.

A) the bank; the post office

B) depreciation; the market for foreign exchange swaps

C) current income; equity reserves

D) current liabilities; equity reserves

A) the bank; the post office

B) depreciation; the market for foreign exchange swaps

C) current income; equity reserves

D) current liabilities; equity reserves

current income; equity reserves

3

The temporal rate method is the most prevalent method today for the translation of financial statements.

False

4

Exchange rate imbalances that are passed through the balance sheet affect a firm's reported income, but imbalances transferred to the income statement do not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

5

The two basic methods for the translation of foreign subsidiary financial statements are the ________ method and the ________ method.

A) current rate; temporal

B) temporal; proper timing

C) current rate; future rate

D) none of the above

A) current rate; temporal

B) temporal; proper timing

C) current rate; future rate

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

6

A/an ________ subsidiary is one in which the firm operates as an extension of the parent company with cash flows highly interrelated with the parent.

A) self-sustaining foreign

B) integrated foreign entity

C) foreign

D) none of the above

A) self-sustaining foreign

B) integrated foreign entity

C) foreign

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

7

Consider two different foreign subsidiaries of Georgia-Pacific Wood Products Inc. The first subsidiary mills trees in Canada and ships its entire product to the Georgia-Pacific U.S. The second subsidiary is also owned by the parent firm but is located in Japan and retails tropical hardwood furniture that it buys from many different sources. The first subsidiary is likely a/an ________ foreign entity with most of its cash flows in U.S. dollars, and the second subsidiary is more of a/an ________ foreign entity.

A) domestic; integrated

B) self-sustaining; domestic

C) integrated; self-sustaining

D) self-sustaining; integrated

A) domestic; integrated

B) self-sustaining; domestic

C) integrated; self-sustaining

D) self-sustaining; integrated

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

8

The biggest advantage of the current rate method of reporting translation adjustments is the fact that the gain or loss goes directly to the reserve account on the consolidated balance sheet and does not pass through the consolidated income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

9

Translation exposure measures

A) changes in the value of outstanding financial obligations incurred prior to a change in exchange rates.

B) the potential for an increase or decrease in the parent company's net worth and reported net income caused by a change in exchange rates since the last consolidation of international operations.

C) an unexpected change in exchange rates impact on short run expected cash flows.

D) none of the above.

A) changes in the value of outstanding financial obligations incurred prior to a change in exchange rates.

B) the potential for an increase or decrease in the parent company's net worth and reported net income caused by a change in exchange rates since the last consolidation of international operations.

C) an unexpected change in exchange rates impact on short run expected cash flows.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

10

________ exposure is the potential for an increase or decrease in the parent company's net worth and reported net income caused by a change in exchange rates since the last transaction.

A) Transaction

B) Operating

C) Currency

D) Translation

A) Transaction

B) Operating

C) Currency

D) Translation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

11

Translation exposure may also be called ________ exposure.

A) transaction

B) operating

C) accounting

D) currency

A) transaction

B) operating

C) accounting

D) currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

12

The ________ determines accounting policy for U.S. firms.

A) Securities and Exchange Commission (SEC)

B) Federal Reserve System (Fed)

C) Financial Accounting Standards Board (FASB)

D) General Agreement on Tariffs and Trade (GATT)

A) Securities and Exchange Commission (SEC)

B) Federal Reserve System (Fed)

C) Financial Accounting Standards Board (FASB)

D) General Agreement on Tariffs and Trade (GATT)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

13

The current rate method is the most prevalent method today for the translation of financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

14

Generally speaking, translation methods by country define the translation process as a function of what two factors?

A) size; location

B) a firm's functional currency; location

C) location; foreign subsidiary independence

D) foreign subsidiary independence; a firm's functional currency

A) size; location

B) a firm's functional currency; location

C) location; foreign subsidiary independence

D) foreign subsidiary independence; a firm's functional currency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

15

If the same exchange rate were used to remeasure every line on a financial statement, then there would be no imbalances from remeasuring.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

16

Gains or losses caused by translation adjustments when using the current rate method are reported separately on the ________.

A) consolidated statement of cash flow

B) consolidated income statement

C) consolidated balance sheet

D) none of the above

A) consolidated statement of cash flow

B) consolidated income statement

C) consolidated balance sheet

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

17

A foreign subsidiary's ________ currency is the currency used in the firm's day-to-day operations.

A) local

B) integrated

C) notational dollar

D) functional

A) local

B) integrated

C) notational dollar

D) functional

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

18

According to your authors, the main purpose of translation is

A) to prepare consolidated financial statements.

B) to help management assess the performance of foreign subsidiaries.

C) to act as an interpreter for managers without foreign language skills.

D) none of the above.

A) to prepare consolidated financial statements.

B) to help management assess the performance of foreign subsidiaries.

C) to act as an interpreter for managers without foreign language skills.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

19

Historical exchange rates may be used for ________, while current exchange rates may be used for ________.

A) fixed asses and current assets; income and expense items

B) equity accounts and fixed assets; current assets and liabilities

C) current assets and liabilities; equity accounts and fixed assets

D) equity accounts and current liabilities; current assets and fixed assets

A) fixed asses and current assets; income and expense items

B) equity accounts and fixed assets; current assets and liabilities

C) current assets and liabilities; equity accounts and fixed assets

D) equity accounts and current liabilities; current assets and fixed assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

20

It is possible to use different exchange rates for different line items on a financial statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

21

If the parent firm and all subsidiaries denominate all exposed assets and liabilities in the parent's reporting currency this will ________ exposure but each subsidiary would have ________ exposure.

A) maximize translation; no transaction

B) eliminate translation; transaction

C) maximize transaction; no translation

D) eliminate transaction; translation

A) maximize translation; no transaction

B) eliminate translation; transaction

C) maximize transaction; no translation

D) eliminate transaction; translation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

22

A balance sheet hedge requires that the amount of exposed foreign currency assets and liabilities

A) have a 2:1 ratio of assets to liabilities.

B) have a 2:1 ratio of liabilities to assets.

C) have a 2:1 ratio of liabilities to equity.

D) be equal.

A) have a 2:1 ratio of assets to liabilities.

B) have a 2:1 ratio of liabilities to assets.

C) have a 2:1 ratio of liabilities to equity.

D) be equal.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

23

A Canadian subsidiary of a U.S. parent firm is instructed to bill an export to the parent in U.S. dollars. The Canadian subsidiary records the accounts receivable in Canadian dollars and notes a profit on the sale of goods. Later, when the U.S. parent pays the subsidiary the contracted U.S. dollar amount, the Canadian dollar has appreciated 10% against the U.S. dollar. In this example, the Canadian subsidiary will record a

A) 10% foreign exchange loss on the U.S. dollar accounts receivable.

B) 10% foreign exchange gain on the U.S. dollar accounts receivable.

C) since the Canadian firm is a U.S. subsidiary neither a gain nor loss will be recorded.

D) any gain or loss will be recoded only by the parent firm.

A) 10% foreign exchange loss on the U.S. dollar accounts receivable.

B) 10% foreign exchange gain on the U.S. dollar accounts receivable.

C) since the Canadian firm is a U.S. subsidiary neither a gain nor loss will be recorded.

D) any gain or loss will be recoded only by the parent firm.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

24

Under the U.S. method of translation procedures, if the financial statements of the foreign subsidiary of a U.S. company are maintained in the local currency, and the local currency is the functional currency, then

A) the translation method to be used is not obvious.

B) translation is accomplished through the temporal method.

C) translation is not required.

D) translation is accomplished through the current rate method.

A) the translation method to be used is not obvious.

B) translation is accomplished through the temporal method.

C) translation is not required.

D) translation is accomplished through the current rate method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

25

Under the current rate method, specific assets and liabilities are translated at exchange rates consistent with the timing of the item's creation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

26

The current rate method of foreign currency translation gains or losses resulting from remeasurement are carried directly to current consolidated income and thus introduces volatility to consolidated earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

27

Under the U.S. method of translation procedures, if the financial statements of the foreign subsidiary of a U.S. company are maintained in U.S. dollars,

A) translation is accomplished through the current rate method.

B) translation is accomplished through the temporal method.

C) translation is not required.

D) the translation method to be used is not obvious.

A) translation is accomplished through the current rate method.

B) translation is accomplished through the temporal method.

C) translation is not required.

D) the translation method to be used is not obvious.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

28

The main technique to minimize translation exposure is called a/an ________ hedge.

A) balance sheet

B) income statement

C) forward

D) translation

A) balance sheet

B) income statement

C) forward

D) translation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

29

A balance sheet hedge is the main technique for managing ________.

A) transaction

B) operating

C) translation

D) money market

A) transaction

B) operating

C) translation

D) money market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

30

Translation gains and losses can be quite different from operating gains and losses

A) in magnitude only.

B) in sign only.

C) in neither magnitude nor sign.

D) in both magnitude and sign.

A) in magnitude only.

B) in sign only.

C) in neither magnitude nor sign.

D) in both magnitude and sign.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

31

If a firm's subsidiary is using the local currency as the functional currency, which of the following is NOT a circumstance that could justify the use of a balance sheet hedge?

A) The foreign subsidiary is about to be liquidated, so that the value of its Cumulative Translation Adjustment (CTA) would be realized.

B) The firm has debt covenants or bank agreements that state the firm's debt/equity ratio will be maintained within specific limits.

C) The foreign subsidiary is operating is a hyperinflationary environment.

D) All of the above are appropriate reasons to use a balance sheet hedge.

A) The foreign subsidiary is about to be liquidated, so that the value of its Cumulative Translation Adjustment (CTA) would be realized.

B) The firm has debt covenants or bank agreements that state the firm's debt/equity ratio will be maintained within specific limits.

C) The foreign subsidiary is operating is a hyperinflationary environment.

D) All of the above are appropriate reasons to use a balance sheet hedge.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

32

Under the U.S. method of translation procedures, if the financial statements of the foreign subsidiary of a U.S. company are maintained in the local currency, and the U.S. dollar is the functional currency, then

A) translation is not required.

B) translation is accomplished through the current rate method.

C) translation is accomplished through the temporal method.

D) none of the above.

A) translation is not required.

B) translation is accomplished through the current rate method.

C) translation is accomplished through the temporal method.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

33

________ gains and losses are "realized" whereas ________ gains and losses are only "paper."

A) Translation; transaction

B) Transaction; translation

C) Translation; operating

D) None of the above

A) Translation; transaction

B) Transaction; translation

C) Translation; operating

D) None of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

34

Under the temporal rate method, specific assets and liabilities are translated at exchange rates consistent with the timing of the item's creation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

35

The basic advantage of the ________ method of foreign currency translation is that foreign nonmonetary assets are carried at their original cost in the parent's consolidated statement while the most important advantage of the ________ method is that the gain or loss from translation does not pass through the income statement.

A) monetary; current rate

B) temporal; current rate

C) temporal; monetary

D) current rate; temporal

A) monetary; current rate

B) temporal; current rate

C) temporal; monetary

D) current rate; temporal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

36

The dominant currency used by a subsidiary in its day-to-day operations is known as its ________ currency.

A) operational

B) transactional

C) functional

D) foreign

A) operational

B) transactional

C) functional

D) foreign

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

37

It is possible that efforts to decrease translation exposure may result in an increase in transaction exposure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

38

The temporal method of foreign currency translation gains or losses resulting from remeasurement are carried directly to current consolidated income and thus introduces volatility to consolidated earnings.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

39

A major problem for international foreign currency transaction is that FASB and the International Accounting Standards Committee (IASC) do NOT use the same basic translation procedure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

40

If a firm's balance sheet has an equal amount of exposed foreign currency assets and liabilities and the firm translates by the temporal method, then

A) the net exposed position is called monetary balance.

B) the change is value of liabilities and assets due to a change in exchange rates will be of equal but opposite direction.

C) both B and C are true.

D) none of the above.

A) the net exposed position is called monetary balance.

B) the change is value of liabilities and assets due to a change in exchange rates will be of equal but opposite direction.

C) both B and C are true.

D) none of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

41

When using FASB-52, translated gains and losses due to changes in foreign currency values are usually reported as ________.

A) gains (losses) due to foreign exchange

B) net income (loss)

C) stockholder equity

D) none of the above

A) gains (losses) due to foreign exchange

B) net income (loss)

C) stockholder equity

D) none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

42

If the British subsidiary of a European firm has net exposed assets of £250,000, and the pound increases in value from euro 1.40/£ to euro 1.45/£, the European firm has a translation ________.

A) gain of euro 25,000

B) loss of euro 25,000

C) gain of £25,000

D) loss of £25,000

A) gain of euro 25,000

B) loss of euro 25,000

C) gain of £25,000

D) loss of £25,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

43

As required by FASB-52, which exchange rate is required to be used to translate assets and liabilities of a foreign entity from its functional currency to the reporting currency?

A) forward

B) current

C) historical

D) The exchange rate to be used varies with the situation.

A) forward

B) current

C) historical

D) The exchange rate to be used varies with the situation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

44

Under the current rate method, when management anticipates appreciation of a foreign currency it

A) may move funds from cash to savings.

B) may move funds from cash into plant and equipment.

C) may try to decrease net exposed assets in that country.

D) may try to increase net exposed assets in that country.

A) may move funds from cash to savings.

B) may move funds from cash into plant and equipment.

C) may try to decrease net exposed assets in that country.

D) may try to increase net exposed assets in that country.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

45

Gains from forward contracts to hedge translation exposure are taxable whereas losses from hedging translation exposure are not.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

46

If a European subsidiary of a U.S. firm has net exposed liabilities of euro 500,000, and the euro drops in value from $1.40/euro to $1.30/euro then the U.S. firm has a translation ________.

A) gain of $50,000

B) loss of $50,000

C) gain of $450,000

D) loss of euro 450,000

A) gain of $50,000

B) loss of $50,000

C) gain of $450,000

D) loss of euro 450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

47

Gains from forward contracts to hedge translation exposure are not taxable whereas losses from hedging translation exposure are.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

48

Multinational enterprises always completely hedge translation exposure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

49

If the European subsidiary of a U.S. firm has net exposed assets of euro 500,000, and the euro increases in value from $1.30/euro to $1.35/euro the U.S. firm has a translation ________.

A) gain of $25,000

B) loss of $25,000

C) gain of $525,000

D) loss of euro 525,000

A) gain of $25,000

B) loss of $25,000

C) gain of $525,000

D) loss of euro 525,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

50

U.S. multinational firms must use ________ as their functional currency.

A) the currency of the primary economic environment where they operate

B) the U.S. dollar

C) the local currency

D) the euro

A) the currency of the primary economic environment where they operate

B) the U.S. dollar

C) the local currency

D) the euro

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

51

If the British subsidiary of a European firm has net exposed assets of £250,000, and the pound drops in value from euro 1.40/£ to euro 1.30/£, the European firm has a translation ________.

A) gain of euro 12,500

B) loss of euro 12,500

C) loss of £12,500

D) gain of £12,500

A) gain of euro 12,500

B) loss of euro 12,500

C) loss of £12,500

D) gain of £12,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

52

The two methods for the translation of foreign subsidiary financial statements are the current rate and temporal methods. Briefly, describe how each of these methods translates the foreign subsidiary financial statements into the parent company's consolidated statements. Identify when each technique should be used and the major advantage(s) of each.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

53

If a European subsidiary of a U.S. firm has net exposed liabilities of euro 500,000, and the euro increases in value from $1.30/euro to $1.35/euro then the U.S. firm has a translation ________.

A) gain of $25,000

B) loss of $25,000

C) gain of $525,000

D) loss of euro 525,000

A) gain of $25,000

B) loss of $25,000

C) gain of $525,000

D) loss of euro 525,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

54

Management can easily offset both translation and transaction exposure through

A) a passive hedging strategy.

B) an active hedging strategy.

C) either an active or passive hedging strategy.

D) It is almost impossible to offset both translation and transaction exposure simultaneously.

A) a passive hedging strategy.

B) an active hedging strategy.

C) either an active or passive hedging strategy.

D) It is almost impossible to offset both translation and transaction exposure simultaneously.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

55

Describe a balance sheet hedge and give at least two examples of when such a hedge could be justified.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following firms would NOT bear risk caused by translation exposure?

A) A U.S based manufacturing firm with a fully owned subsidiary that generates earnings in Japan. The subsidiary always keeps and reinvests the earnings.

B) A U.S. based retailer with a fully owned subsidiary in Canada that generates losses in Canada that the parent firm occasionally covers.

C) A U.S. based firm with a subsidiary in Britain that occasionally remits earnings to the parent firm.

D) All of the above are subject to translation exposure.

A) A U.S based manufacturing firm with a fully owned subsidiary that generates earnings in Japan. The subsidiary always keeps and reinvests the earnings.

B) A U.S. based retailer with a fully owned subsidiary in Canada that generates losses in Canada that the parent firm occasionally covers.

C) A U.S. based firm with a subsidiary in Britain that occasionally remits earnings to the parent firm.

D) All of the above are subject to translation exposure.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

57

Under the current rate method, translation gains of losses are reported in an equity reserve account called ________.

A) reserve for accounting losses

B) accounting reserve adjustment account

C) cumulative translation adjustment account

D) none of the above; translation gains and losses flow through into the income statement

A) reserve for accounting losses

B) accounting reserve adjustment account

C) cumulative translation adjustment account

D) none of the above; translation gains and losses flow through into the income statement

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

58

If the European subsidiary of a U.S. firm has net exposed assets of euro 500,000, and the euro drops in value from $1.40/euro to $1.30/euro the U.S. firm has a translation ________.

A) gain of $50,000

B) loss of $50,000

C) gain of $450,000

D) loss of euro 450,000

A) gain of $50,000

B) loss of $50,000

C) gain of $450,000

D) loss of euro 450,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck

59

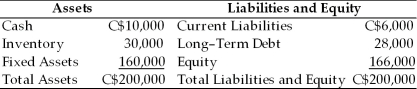

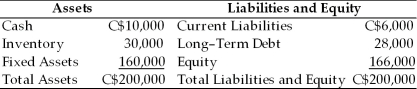

Using the table below, estimate the net exposure for Souris River Manufacturing of its' wholly-owned Canadian subsidiary.

Souris River Manufacturing (Canada)Balance Sheet December 31 200X

A) C$40,000

B) C$160,000

C) C$166,000

D) C$200,000

Souris River Manufacturing (Canada)Balance Sheet December 31 200X

A) C$40,000

B) C$160,000

C) C$166,000

D) C$200,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 59 في هذه المجموعة.

فتح الحزمة

k this deck