Deck 7: Reporting and Interpreting Inventories and Cost of Goods Sold

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

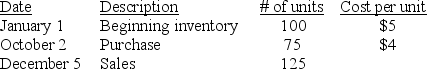

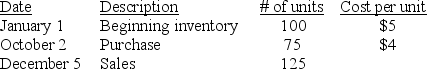

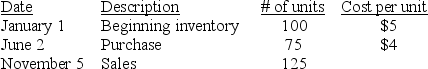

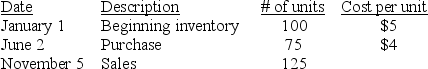

سؤال

سؤال

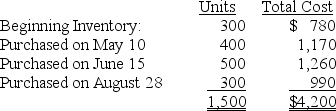

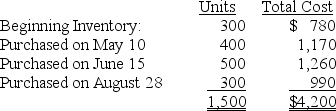

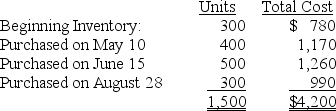

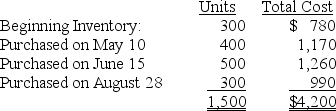

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/214

العب

ملء الشاشة (f)

Deck 7: Reporting and Interpreting Inventories and Cost of Goods Sold

1

When costs per unit are increasing,the inventory costing method that results in the higher income tax expense is the FIFO method.

True

2

A company can use LIFO to prepare its U.S.tax return and FIFO to prepare its financial statements.

False

3

LIFO and weighted average results will be the same using either a perpetual or periodic system.

False

4

In each accounting period,a manager can select the inventory costing method that yields the highest net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

5

Lower of cost or market can be applied on an item or product category basis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

6

If inventory is sold with terms of FOB shipping point,the goods belong to the customer while in transit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

7

Cost of goods sold = Beginning inventory + Purchases - Ending inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

8

A company can use different methods for inventories that differ in nature or use.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

9

When a company sells goods,it removes their cost from the Inventory account and reports the cost on the income statement as Selling Expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

10

Goods on consignment are goods shipped by the owner to another company that holds the goods and sells them on behalf of the owner.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

11

A lower of cost or market write-down would be recorded with a debit to Inventory Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

12

Assume the periodic inventory method is used.When LIFO is used,costs are assigned to cost of goods sold using the most recent purchase at the time of the sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

13

If inventory is sold with terms of FOB destination,the goods belong to the seller while in transit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

14

Inventory is reported on the balance sheet as a current asset.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

15

Consignment inventory is reported on the balance sheet of the company holding the inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

16

Goods placed in inventory are initially recorded at market value.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

17

Manufacturers have three types of inventory,which include raw materials,work in process,and finished goods,whereas merchandisers have only raw materials inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

18

When the periodic inventory system is in use,the choice of an inventory costing method usually has no impact on gross profit or cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

19

The primary goals of inventory managers are to maintain a sufficient quantity of inventory to meet customers' needs,ensure inventory quality meets customers' expectations and company standards,and minimize the cost of acquiring and carrying inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

20

Ending inventory = Beginning inventory + Purchases + Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

21

Which of the following would be in the raw materials inventory of a company making cheese?

A) Milk and cream used to make the cheese

B) Cheese that has been made but is curing before being ready to sell

C) Cured cheese that is waiting to be shipped to retailers

D) Partially processed cheese

A) Milk and cream used to make the cheese

B) Cheese that has been made but is curing before being ready to sell

C) Cured cheese that is waiting to be shipped to retailers

D) Partially processed cheese

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

22

An overstatement of ending inventory will cause an overstatement of assets and an understatement of stockholders' equity on the balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

23

Which of the following would be considered merchandise inventory?

A) Work in progress

B) Raw materials

C) Purchased finished goods

D) Cost of goods sold

A) Work in progress

B) Raw materials

C) Purchased finished goods

D) Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following statements about an auto manufacturer's inventory is not correct?

A) Tires, batteries, glass, paint, headlamp bulbs, and electric wiring would be included in raw materials inventory.

B) Incomplete cars that are still being processed would be included in work in process inventory.

C) Finished cars ready to be shipped to dealers would be included in finished goods inventory.

D) Cars that have been sold to dealers would be included in finished goods inventory.

A) Tires, batteries, glass, paint, headlamp bulbs, and electric wiring would be included in raw materials inventory.

B) Incomplete cars that are still being processed would be included in work in process inventory.

C) Finished cars ready to be shipped to dealers would be included in finished goods inventory.

D) Cars that have been sold to dealers would be included in finished goods inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following is merchandise inventory?

A) Goods held for sale in the normal course of business

B) Office supplies that a company plans to use in the next few months

C) Equipment used to manufacture products which will be sold later

D) Raw materials and work in process

A) Goods held for sale in the normal course of business

B) Office supplies that a company plans to use in the next few months

C) Equipment used to manufacture products which will be sold later

D) Raw materials and work in process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

26

Goods that a company holds that are not reported on the company's balance sheet are called:

A) finished goods.

B) consignment inventory.

C) raw materials.

D) work in process.

A) finished goods.

B) consignment inventory.

C) raw materials.

D) work in process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

27

Inventory levels increase by 10% at your company during the fourth quarter.Based on this increase,which of the following statements must be correct?

A) This must be good news because inventories are an asset to the company.

B) This could be good news if the company is ordering more goods because sales appear to be rising.

C) This could be bad news if the company is ordering more goods because unit costs are falling.

D) This must be bad news because higher inventories mean higher costs.

A) This must be good news because inventories are an asset to the company.

B) This could be good news if the company is ordering more goods because sales appear to be rising.

C) This could be bad news if the company is ordering more goods because unit costs are falling.

D) This must be bad news because higher inventories mean higher costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following would be in the finished goods inventory of a company making cheese?

A) Milk and cream used to make the cheese

B) Cheese that has been made but is curing before being ready to sell

C) Cured cheese that is waiting to be shipped to customers

D) Cured cheese that has been sold to customers

A) Milk and cream used to make the cheese

B) Cheese that has been made but is curing before being ready to sell

C) Cured cheese that is waiting to be shipped to customers

D) Cured cheese that has been sold to customers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

29

Angus Company agreed to sell goods for Longhorn Company on consignment,but wasn't willing to take ownership of the goods in case they were difficult to sell.Which of the following statements is true?

A) Angus owns the inventory and should report it on its balance sheet.

B) Longhorn owns the inventory, but should not report it on its balance sheet because Angus actually holds the inventory.

C) Angus owns the inventory, since possession is nineteenths of the law, but should not report it on its balance sheet.

D) Longhorn owns the inventory and should report it on its balance sheet.

A) Angus owns the inventory and should report it on its balance sheet.

B) Longhorn owns the inventory, but should not report it on its balance sheet because Angus actually holds the inventory.

C) Angus owns the inventory, since possession is nineteenths of the law, but should not report it on its balance sheet.

D) Longhorn owns the inventory and should report it on its balance sheet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

30

Which of the following is not a primary goal of inventory management?

A) Obtaining the lowest cost of inventory

B) Ensuring sufficient quantities of inventory are available to meet customers' needs

C) Ensuring inventory quality meets customers' expectations and company standards

D) Minimizing the costs of acquiring and carrying inventory

A) Obtaining the lowest cost of inventory

B) Ensuring sufficient quantities of inventory are available to meet customers' needs

C) Ensuring inventory quality meets customers' expectations and company standards

D) Minimizing the costs of acquiring and carrying inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

31

The assignment of costs to cost of goods sold and to inventory using the weighted average method usually yields different results depending on whether a perpetual or a periodic system is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following is not one of the primary goals of inventory management?

A) Maintain a sufficient quantity of inventory to meet customer needs.

B) Ensure inventory quality meets customers' expectations and company standards

C) Minimize the cost of acquiring and carrying inventory (including costs related to purchasing, production, storage, spoilage, theft, obsolescence, and financing).

D) Minimize the quantity of ending inventory.

A) Maintain a sufficient quantity of inventory to meet customer needs.

B) Ensure inventory quality meets customers' expectations and company standards

C) Minimize the cost of acquiring and carrying inventory (including costs related to purchasing, production, storage, spoilage, theft, obsolescence, and financing).

D) Minimize the quantity of ending inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

33

Inventory shipped FOB destination and in transit on the last day of the year should be included in:

A) the inventory balance of the seller.

B) the inventory balance of the buyer.

C) neither the inventory balance of the buyer or the seller.

D) both the inventory balance of the buyer and the seller.

A) the inventory balance of the seller.

B) the inventory balance of the buyer.

C) neither the inventory balance of the buyer or the seller.

D) both the inventory balance of the buyer and the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

34

Acme Company's balance sheet shows three inventory accounts-raw materials,work in process,and finished goods.Acme Company must be a:

A) manufacturer.

B) merchandiser.

C) service business.

D) wholesale distributor.

A) manufacturer.

B) merchandiser.

C) service business.

D) wholesale distributor.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

35

An understatement of beginning inventory causes net income to be understated.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

36

Inventory shipped FOB shipping point and in transit on the last day of the year should be included in:

A) the inventory balance of the seller.

B) the inventory balance of the buyer.

C) neither the inventory balance of the buyer or the seller.

D) both the inventory balance of the buyer and the seller.

A) the inventory balance of the seller.

B) the inventory balance of the buyer.

C) neither the inventory balance of the buyer or the seller.

D) both the inventory balance of the buyer and the seller.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

37

Goods placed in inventory are initially recorded at:

A) market value.

B) the amount paid to acquire the asset.

C) the amount paid to prepare the asset for sale to customers.

D) the amount paid to acquire the asset and prepare it for sale.

A) market value.

B) the amount paid to acquire the asset.

C) the amount paid to prepare the asset for sale to customers.

D) the amount paid to acquire the asset and prepare it for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

38

The cost assigned to cost of goods sold and to inventory under the FIFO method will be the same whether the perpetual or the periodic inventory system is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

39

Mountain People's Coop offers herbal tea for sale on consignment from Green Heron Company.Which company should report the inventory of unsold tea on its balance sheet?

A) Green Heron Company

B) Mountain People's Coop

C) Both companies

D) Neither company

A) Green Heron Company

B) Mountain People's Coop

C) Both companies

D) Neither company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

40

Carrying insufficient quantities of inventory on hand:

A) would not affect the company's profitability.

B) may result in lost sales.

C) has little effect on customer satisfaction.

D) will increase the costs of carrying inventory.

A) would not affect the company's profitability.

B) may result in lost sales.

C) has little effect on customer satisfaction.

D) will increase the costs of carrying inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

41

Axle Inc.updates its inventory perpetually.Its beginning inventory is $35,000,goods purchased during the period cost $120,000,and the cost of goods sold for the period is $140,000.What is the amount of the ending inventory?

A) $45,000

B) $20,000

C) $25,000

D) $15,000

A) $45,000

B) $20,000

C) $25,000

D) $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

42

Langston Company updates its inventory periodically.The company's cost of goods sold was $2,700 and purchases were $5,600 during the year.The company's ending inventory count was $5,000.What was the amount of beginning inventory?

A) $3,300

B) $13,300

C) $7,900

D) $2,100

A) $3,300

B) $13,300

C) $7,900

D) $2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following statements about inventory classifications is not correct?

A) Inventory may include materials used in producing goods for sale.

B) Manufacturers hold three types of inventory that are referred to as raw materials inventory, work in process inventory, and finished goods inventory.

C) Inventory is classified as a long-term asset on the balance sheet.

D) Merchandisers buy inventory in finished form ready for resale.

A) Inventory may include materials used in producing goods for sale.

B) Manufacturers hold three types of inventory that are referred to as raw materials inventory, work in process inventory, and finished goods inventory.

C) Inventory is classified as a long-term asset on the balance sheet.

D) Merchandisers buy inventory in finished form ready for resale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

44

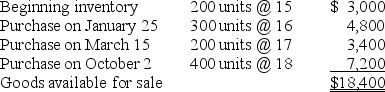

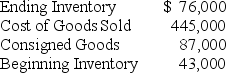

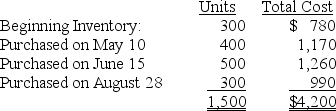

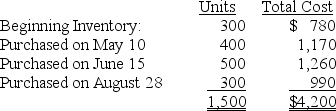

AAA Co.uses a periodic inventory system and has the following information in regard to its inventory:

There are 500 units in ending inventory.What is the amount of the ending inventory using the FIFO method?

A) $3,000

B) $7,200

C) $7,800

D) $8,900

There are 500 units in ending inventory.What is the amount of the ending inventory using the FIFO method?

A) $3,000

B) $7,200

C) $7,800

D) $8,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

45

If inventory is updated perpetually,which of the equations is correct?

A) Cost of goods sold = Beginning inventory - Purchases - Ending inventory

B) Cost of goods sold = Beginning inventory + Purchases + Ending inventory

C) Ending inventory = Beginning inventory + Purchases - Cost of goods sold

D) Ending inventory = Beginning inventory + Purchases + Cost of goods sold

A) Cost of goods sold = Beginning inventory - Purchases - Ending inventory

B) Cost of goods sold = Beginning inventory + Purchases + Ending inventory

C) Ending inventory = Beginning inventory + Purchases - Cost of goods sold

D) Ending inventory = Beginning inventory + Purchases + Cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

46

The specific identification method would probably be most appropriate for which of the following goods?

A) Boxes of brass 4-inch drywall screws at Home Depot

B) Bottles of suntan lotion in Wal-Mart's central warehouse

C) Sets of tires at the Goodyear plant

D) Diamond necklaces at a Tiffany & Co. jewelry store

A) Boxes of brass 4-inch drywall screws at Home Depot

B) Bottles of suntan lotion in Wal-Mart's central warehouse

C) Sets of tires at the Goodyear plant

D) Diamond necklaces at a Tiffany & Co. jewelry store

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

47

Lexington Company updates its inventory periodically.The company's beginning inventory was $1,000 and purchases were $5,000 during the year.The company's ending inventory count was $2,000.What was the amount of its cost of goods sold?

A) $6,000

B) $4,000

C) $8,000

D) $2,000

A) $6,000

B) $4,000

C) $8,000

D) $2,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

48

If inventory is updated periodically,which of the equations is correct?

A) Cost of goods sold = Beginning inventory + Purchases - Ending inventory

B) Cost of goods sold = Beginning inventory + Purchases + Ending inventory

C) Beginning inventory + Purchases = Ending inventory

D) Ending inventory = Beginning inventory + Purchases + Cost of goods sold.

A) Cost of goods sold = Beginning inventory + Purchases - Ending inventory

B) Cost of goods sold = Beginning inventory + Purchases + Ending inventory

C) Beginning inventory + Purchases = Ending inventory

D) Ending inventory = Beginning inventory + Purchases + Cost of goods sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

49

Goods in transit are:

A) inventory items being transported from a seller to a buyer.

B) always included in the transportation company's inventory.

C) always included in the selling company's inventory.

D) always included in the buying company's inventory.

A) inventory items being transported from a seller to a buyer.

B) always included in the transportation company's inventory.

C) always included in the selling company's inventory.

D) always included in the buying company's inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following kinds of inventory would be the best suited for the specific identification method?

A) Canned fruit

B) Custom made yachts

C) Baseball bats

D) Cattle feed

A) Canned fruit

B) Custom made yachts

C) Baseball bats

D) Cattle feed

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

51

Goods available for sale equals:

A) Cost of Goods Sold plus ending inventory.

B) Cost of Goods Sold minus ending inventory.

C) Beginning inventory plus Cost of Goods Sold.

D) Beginning inventory plus Purchases minus Cost of Goods Sold.

A) Cost of Goods Sold plus ending inventory.

B) Cost of Goods Sold minus ending inventory.

C) Beginning inventory plus Cost of Goods Sold.

D) Beginning inventory plus Purchases minus Cost of Goods Sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

52

Assume a periodic inventory system is used.The LIFO inventory costing method assumes that the cost of the units most recently purchased is the:

A) last to be assigned to cost of goods sold.

B) first to be assigned to ending inventory.

C) first to be assigned to cost of goods sold.

D) last to be assigned to units available for sale.

A) last to be assigned to cost of goods sold.

B) first to be assigned to ending inventory.

C) first to be assigned to cost of goods sold.

D) last to be assigned to units available for sale.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

53

Thompson Company updates its inventory records perpetually.The company's records showed a beginning inventory of $600,cost of goods sold of $1,400,and ending inventory of $800.How much inventory was purchased during the year?

A) $1,200

B) $1,000

C) $900

D) $1,600

A) $1,200

B) $1,000

C) $900

D) $1,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

54

Assume a periodic inventory system is used.Which inventory costing method generally results in the most recent costs being assigned to ending inventory?

A) LIFO

B) FIFO

C) Weighted average cost

D) Simple average cost

A) LIFO

B) FIFO

C) Weighted average cost

D) Simple average cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

55

Manning Company updates its inventory periodically.The company's beginning inventory was $2,700 and purchases were $5,600 during the year.The company's ending inventory count was $5,000.What was the amount of its cost of goods sold?

A) $3,300

B) $8,300

C) $13,300

D) $2,100

A) $3,300

B) $8,300

C) $13,300

D) $2,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

56

When a company sells goods,it removes their cost from the balance sheet and reports the cost on the income statement as:

A) Selling Expenses.

B) Cost of Goods Sold.

C) Finished Goods Inventory.

D) Inventory.

A) Selling Expenses.

B) Cost of Goods Sold.

C) Finished Goods Inventory.

D) Inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

57

The LIFO inventory cost flow assumes that the cost of the newest goods purchased are:

A) assumed to be the last ones to be sold.

B) not included in cost of goods sold or ending inventory.

C) assumed to be the first ones included ending inventory.

D) assumed to be the first ones sold.

A) assumed to be the last ones to be sold.

B) not included in cost of goods sold or ending inventory.

C) assumed to be the first ones included ending inventory.

D) assumed to be the first ones sold.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

58

Lock Security Company updates its inventory perpetually.The company reported a beginning inventory of $1,500.During the year,the company recorded inventory purchases of $4,500 and cost of goods sold of $5,000.What was the amount of its ending inventory?

A) $1,000

B) $2,500

C) $2,600

D) $2,700

A) $1,000

B) $2,500

C) $2,600

D) $2,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

59

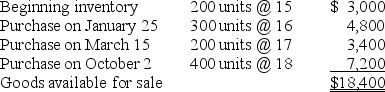

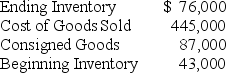

A fire destroyed some of Powell Company's records.Information from the documents found related to inventory is listed below.

What was the amount of inventory that was purchased during the year?

A) $478,000

B) $565,000

C) $412,000

D) $499,000

What was the amount of inventory that was purchased during the year?

A) $478,000

B) $565,000

C) $412,000

D) $499,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

60

Acme,Inc.had cost of goods sold of $2,000.If beginning inventory was $2,100 and ending inventory was $500,Acme's purchases must have been:

A) $400.

B) $600.

C) $1,600.

D) $3,600.

A) $400.

B) $600.

C) $1,600.

D) $3,600.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

61

The Acme Corporation starts the year with a beginning inventory of 300 units at $5 per unit.The company purchases 500 units at $4 each in February and 200 units at $6 each in October.Acme sells 150 units during the year.Acme has a periodic inventory system and uses the FIFO inventory costing method.What is the amount of cost of goods sold?

A) $600

B) $934

C) $750

D) $900

A) $600

B) $934

C) $750

D) $900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

62

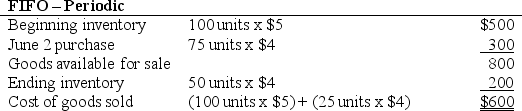

Mansfield Company has a periodic inventory system and uses the LIFO method to assign costs to inventory and cost of goods sold.Consider the following information:

What amounts would be reported as the cost of goods sold and ending inventory balances for the period?

A) Cost of goods sold $625; Ending inventory $175

B) Cost of goods sold $755; Ending inventory $225

C) Cost of goods sold $550; Ending inventory $250

D) Cost of goods sold $600; Ending inventory $200

What amounts would be reported as the cost of goods sold and ending inventory balances for the period?

A) Cost of goods sold $625; Ending inventory $175

B) Cost of goods sold $755; Ending inventory $225

C) Cost of goods sold $550; Ending inventory $250

D) Cost of goods sold $600; Ending inventory $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

63

Alphabet Company, which uses the periodic inventory method, purchases different letters for resale.Alphabet had no beginning inventory.It purchased A thru G in January at $4 per letter.In February, it purchased H thru L at $6 per letter.It purchased M thru R in March at $7 per letter.It sold A, D, E, H, J and N in October.There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.If Alphabet Company uses the LIFO method,what is the cost of its ending inventory?

A) $24

B) $42

C) $58

D) $76

Use the information above to answer the following question.If Alphabet Company uses the LIFO method,what is the cost of its ending inventory?

A) $24

B) $42

C) $58

D) $76

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

64

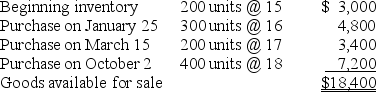

Bailey Company uses a periodic inventory system and its inventory records contain the following information:

The company sold 1,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 500 units were in its ending inventory at the end of the year.

Use the information above to answer the following question.If Bailey Company uses the LIFO costing method,what is the cost of its ending inventory?

A) $1,365

B) $1,494

C) $1,620

D) $2,835

The company sold 1,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 500 units were in its ending inventory at the end of the year.

Use the information above to answer the following question.If Bailey Company uses the LIFO costing method,what is the cost of its ending inventory?

A) $1,365

B) $1,494

C) $1,620

D) $2,835

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

65

Eaton Electronics uses a periodic inventory system.On March 31, Eaton has two plasma TVs on hand at a cost of $1,500 each (serial numbers 11534892 and 11534894).In April, the company purchases four more identical TVs from Toshiba for $1,450 each (serial numbers 11542631 through 11542634).In May, the company purchases five more identical TVs for $1,600 each (serial numbers 11550964 through 11550968).In June, Eaton sells two of these TVs (serial numbers 11534894 and 11542631).There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.Eaton Electronics reports $3,000 as the cost of goods sold.Eaton Electronics is using the:

A) specific identification method.

B) LIFO method.

C) FIFO method.

D) weighted average cost method.

Use the information above to answer the following question.Eaton Electronics reports $3,000 as the cost of goods sold.Eaton Electronics is using the:

A) specific identification method.

B) LIFO method.

C) FIFO method.

D) weighted average cost method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

66

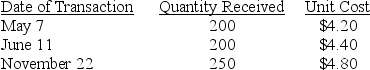

Hardware Inc.has a periodic inventory system and uses the weighted average method.The company began the year with 150 large brass switch plates on hand at a cost of $4.00 each.Purchases of switch plates during the year were as follows:

The switch plates sell for $7.00 each.If Hardware sells 570 switch plates during the year,what is the company's cost of goods sold?

A) $3,990

B) $2,508

C) $2,480

D) $2,560

The switch plates sell for $7.00 each.If Hardware sells 570 switch plates during the year,what is the company's cost of goods sold?

A) $3,990

B) $2,508

C) $2,480

D) $2,560

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

67

Eaton Electronics uses a periodic inventory system.On March 31, Eaton has two plasma TVs on hand at a cost of $1,500 each (serial numbers 11534892 and 11534894).In April, the company purchases four more identical TVs from Toshiba for $1,450 each (serial numbers 11542631 through 11542634).In May, the company purchases five more identical TVs for $1,600 each (serial numbers 11550964 through 11550968).In June, Eaton sells two of these TVs (serial numbers 11534894 and 11542631).There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.Eaton Electronics uses the specific identification method.What is its cost of goods sold?

A) $3,000

B) $2,950

C) $3,200

D) $3,033

Use the information above to answer the following question.Eaton Electronics uses the specific identification method.What is its cost of goods sold?

A) $3,000

B) $2,950

C) $3,200

D) $3,033

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

68

Eaton Electronics uses a periodic inventory system.On March 31, Eaton has two plasma TVs on hand at a cost of $1,500 each (serial numbers 11534892 and 11534894).In April, the company purchases four more identical TVs from Toshiba for $1,450 each (serial numbers 11542631 through 11542634).In May, the company purchases five more identical TVs for $1,600 each (serial numbers 11550964 through 11550968).In June, Eaton sells two of these TVs (serial numbers 11534894 and 11542631).There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.Eaton Electronics uses the FIFO method.What is the cost of its ending inventory?

A) $13,850

B) $13,800

C) $13,760

D) $13,600

Use the information above to answer the following question.Eaton Electronics uses the FIFO method.What is the cost of its ending inventory?

A) $13,850

B) $13,800

C) $13,760

D) $13,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

69

AAA Co.uses a periodic inventory system and has the following information in regard to its inventory:

There are 500 units in ending inventory.What is the amount of the ending inventory using the LIFO method?

A) $3,000

B) $7,200

C) $7,800

D) $8,900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

70

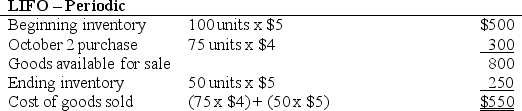

Allsop Company had no beginning inventory.The company purchases 300 units of inventory in January at $5 each,500 units at $4 each in August,and 200 units at $6 each in November.The company sells 150 units during the year.Allsop uses a periodic inventory system and the LIFO inventory costing method.What is the cost of goods sold?

A) $600

B) $934

C) $750

D) $900

A) $600

B) $934

C) $750

D) $900

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Xu Corporation uses a periodic inventory system.The company has a beginning inventory of 300 units at $5 each on January 1.Xu purchases 500 units at $4 each in February and 200 units at $6 each in March.There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.Xu sells 300 units during the quarter.If Xu uses the LIFO method,what is its cost of goods sold?

A) $1,600

B) $1,400

C) $1,500

D) $1,800

Use the information above to answer the following question.Xu sells 300 units during the quarter.If Xu uses the LIFO method,what is its cost of goods sold?

A) $1,600

B) $1,400

C) $1,500

D) $1,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

72

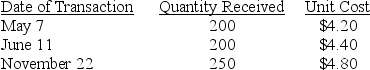

Maxell Company uses the FIFO method to assign costs to inventory and cost of goods sold.The company uses a periodic inventory system.Consider the following information:

What amounts would be reported as the cost of goods sold and ending inventory balances for the year?

A) Cost of goods sold $625; Ending inventory $175

B) Cost of goods sold $755; Ending inventory $225

C) Cost of goods sold $550; Ending inventory $250

D) Cost of goods sold $600; Ending inventory $200

What amounts would be reported as the cost of goods sold and ending inventory balances for the year?

A) Cost of goods sold $625; Ending inventory $175

B) Cost of goods sold $755; Ending inventory $225

C) Cost of goods sold $550; Ending inventory $250

D) Cost of goods sold $600; Ending inventory $200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

73

Alphabet Company, which uses the periodic inventory method, purchases different letters for resale.Alphabet had no beginning inventory.It purchased A thru G in January at $4 per letter.In February, it purchased H thru L at $6 per letter.It purchased M thru R in March at $7 per letter.It sold A, D, E, H, J and N in October.There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.If Alphabet Company uses the FIFO method,what is the cost of its ending inventory?

A) $24

B) $42

C) $58

D) $76

Use the information above to answer the following question.If Alphabet Company uses the FIFO method,what is the cost of its ending inventory?

A) $24

B) $42

C) $58

D) $76

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

74

Eaton Electronics uses a periodic inventory system.On March 31, Eaton has two plasma TVs on hand at a cost of $1,500 each (serial numbers 11534892 and 11534894).In April, the company purchases four more identical TVs from Toshiba for $1,450 each (serial numbers 11542631 through 11542634).In May, the company purchases five more identical TVs for $1,600 each (serial numbers 11550964 through 11550968).In June, Eaton sells two of these TVs (serial numbers 11534894 and 11542631).There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.Eaton Electronics uses the LIFO method.What is the cost of its ending inventory?

A) $13,850

B) $13,800

C) $13,760

D) $13,600

Use the information above to answer the following question.Eaton Electronics uses the LIFO method.What is the cost of its ending inventory?

A) $13,850

B) $13,800

C) $13,760

D) $13,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

75

Bailey Company uses a periodic inventory system and its inventory records contain the following information:

The company sold 1,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 500 units were in its ending inventory at the end of the year.

Use the information above to answer the following question.If Bailey Company uses the weighted average inventory costing method,what is the cost of its ending inventory? (Round the per unit cost to two decimal places and then round your answer to the nearest whole dollar.)

A) $4,200

B) $2,700

C) $1,400

D) $1,365

The company sold 1,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 500 units were in its ending inventory at the end of the year.

Use the information above to answer the following question.If Bailey Company uses the weighted average inventory costing method,what is the cost of its ending inventory? (Round the per unit cost to two decimal places and then round your answer to the nearest whole dollar.)

A) $4,200

B) $2,700

C) $1,400

D) $1,365

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

76

Eaton Electronics uses a periodic inventory system.On March 31, Eaton has two plasma TVs on hand at a cost of $1,500 each (serial numbers 11534892 and 11534894).In April, the company purchases four more identical TVs from Toshiba for $1,450 each (serial numbers 11542631 through 11542634).In May, the company purchases five more identical TVs for $1,600 each (serial numbers 11550964 through 11550968).In June, Eaton sells two of these TVs (serial numbers 11534894 and 11542631).There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.Eaton Electronics uses the weighted average method.What is the company's weighted average cost per unit? (Round the per unit cost to the nearest dollar.)

A) $1,500

B) $1,517

C) $1,527

D) $1,600

Use the information above to answer the following question.Eaton Electronics uses the weighted average method.What is the company's weighted average cost per unit? (Round the per unit cost to the nearest dollar.)

A) $1,500

B) $1,517

C) $1,527

D) $1,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

77

Bailey Company uses a periodic inventory system and its inventory records contain the following information:

The company sold 1,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 500 units were in its ending inventory at the end of the year.

Use the information above to answer the following question.If Bailey Company uses the FIFO costing method,what is the cost of its ending inventory?

A) $1,494

B) $2,290

C) $2,580

D) $2,706

The company sold 1,000 units during June.There were no additional purchases or sales during the remainder of the year.The company had 500 units were in its ending inventory at the end of the year.

Use the information above to answer the following question.If Bailey Company uses the FIFO costing method,what is the cost of its ending inventory?

A) $1,494

B) $2,290

C) $2,580

D) $2,706

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

78

Alphabet Company, which uses the periodic inventory method, purchases different letters for resale.Alphabet had no beginning inventory.It purchased A thru G in January at $4 per letter.In February, it purchased H thru L at $6 per letter.It purchased M thru R in March at $7 per letter.It sold A, D, E, H, J and N in October.There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.If Alphabet Company uses the weighted average method,what is the cost of its ending inventory? (Round the per unit cost to two decimal places and then round your answer to the nearest whole dollar.)

A) $38

B) $48

C) $67

D) $75

Use the information above to answer the following question.If Alphabet Company uses the weighted average method,what is the cost of its ending inventory? (Round the per unit cost to two decimal places and then round your answer to the nearest whole dollar.)

A) $38

B) $48

C) $67

D) $75

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

79

Alphabet Company, which uses the periodic inventory method, purchases different letters for resale.Alphabet had no beginning inventory.It purchased A thru G in January at $4 per letter.In February, it purchased H thru L at $6 per letter.It purchased M thru R in March at $7 per letter.It sold A, D, E, H, J and N in October.There were no additional purchases or sales during the remainder of the year.

Use the information above to answer the following question.If Alphabet Company uses the specific identification method,what is the cost of its ending inventory?

A) $31

B) $69

C) $76

D) $100

Use the information above to answer the following question.If Alphabet Company uses the specific identification method,what is the cost of its ending inventory?

A) $31

B) $69

C) $76

D) $100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck

80

Coachlight Inc.has a periodic inventory system.The company purchased 200 units of inventory at $9 per unit and 300 units at $10 per unit.What is the weighted average unit cost for these purchases of inventory?

A) $9.00.

B) $9.50.

C) $9.60.

D) $10.00.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 214 في هذه المجموعة.

فتح الحزمة

k this deck