Deck 13: Measuring and Evaluating Financial Performance

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/170

العب

ملء الشاشة (f)

Deck 13: Measuring and Evaluating Financial Performance

1

The higher the times interest earned ratio,the greater the risk of nonpayment of interest.

False

2

According to the full disclosure principle,financial reports should present detailed information about every transaction.

False

3

Gains or losses from discontinued operations are reported on a separate line on the income statement net of income tax effects.

True

4

If earnings per share (EPS)decreases,it must mean that the company's net income has fallen.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

5

Horizontal analysis involves:

A) Comparing individual financial statement line items with each other to understand the relationships between line items.

B) Comparing individual financial statement line items to some benchmark, typically similar competitors' financial statement line items.

C) Comparing individual financial statement line items over time.

D) Comparing individual financial statement line items that have been arranged horizontally from highest to lowest dollar amounts.

A) Comparing individual financial statement line items with each other to understand the relationships between line items.

B) Comparing individual financial statement line items to some benchmark, typically similar competitors' financial statement line items.

C) Comparing individual financial statement line items over time.

D) Comparing individual financial statement line items that have been arranged horizontally from highest to lowest dollar amounts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following statements is not true?

A) Horizontal analyses help financial statement users recognize changes that unfold over time.

B) Vertical analyses focus on relationships between items on the same financial statement.

C) Ratio analyses focus on relationships between items on one or more of the financial statements.

D) Horizontal analyses help financial statement users recognize changes that occur between companies.

A) Horizontal analyses help financial statement users recognize changes that unfold over time.

B) Vertical analyses focus on relationships between items on the same financial statement.

C) Ratio analyses focus on relationships between items on one or more of the financial statements.

D) Horizontal analyses help financial statement users recognize changes that occur between companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

7

Benchmarks are required to evaluate a company's performance.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

8

Liquidity measures the ability of a company to meet its current financial obligations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

9

Horizontal analysis is the comparison of each financial statement amount to another amount on the same financial statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

10

The general goal of horizontal analyses is to identify significant trends.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following analysis techniques does not pertain to changes over time?

A) Trend analysis

B) Horizontal analysis

C) Time-series analysis

D) Vertical analysis

A) Trend analysis

B) Horizontal analysis

C) Time-series analysis

D) Vertical analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

12

Trend data can be measured in dollar amounts or percentages.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

13

The higher the receivables turnover,the slower accounts receivable are being collected.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

14

Special items,such as gains or losses relating to changes in the value of certain balance sheet accounts,are reported below the net income line on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

15

The fixed asset turnover ratio is a profitability ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

16

The primary objective of external financial reporting is to:

A) enhance the ability of the company to acquire financial capital from external sources.

B) accurately provide financial results for tax purposes.

C) comply with external regulations and requirements of government and professional associations.

D) provide useful information to decision makers, especially investors and creditors.

A) enhance the ability of the company to acquire financial capital from external sources.

B) accurately provide financial results for tax purposes.

C) comply with external regulations and requirements of government and professional associations.

D) provide useful information to decision makers, especially investors and creditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

17

The going-concern assumption is also known as the continuity assumption.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

18

If the debt-to-assets ratio is 0.63,it means that 37% of the company's financing has been provided by stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

19

Vertical analysis is the comparison of a company's financial information over time.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

20

A company with a high inventory turnover requires a larger investment in inventory than another company of similar sales with a lower inventory turnover.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

21

A company's sales are $285,000 and $200,000 during the current and prior years,respectively.The percentage change is:

A) 42.5%.

B) 70%.

C) 29.8%.

D) 130%.

A) 42.5%.

B) 70%.

C) 29.8%.

D) 130%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

22

To analyze changes in a company's net income over the last ten years,you should perform:

A) horizontal analysis.

B) vertical analysis.

C) cross-section analysis.

D) ratio analysis.

A) horizontal analysis.

B) vertical analysis.

C) cross-section analysis.

D) ratio analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

23

In a common size balance sheet,each item on the balance sheet is expressed as a percentage of:

A) total assets.

B) total liabilities.

C) net income.

D) total stockholders' equity.

A) total assets.

B) total liabilities.

C) net income.

D) total stockholders' equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

24

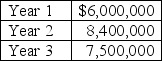

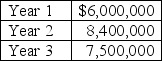

Assume the following sales data for a company:

By what percentage did sales differ between Years 1 and 2 and Years 2 and 3,respectively?

A) 40.0% and (10.7%)

B) 28.6% and (12.0%)

C) 40.0% and (15.0%)

D) 32.0% and (10.7%)

By what percentage did sales differ between Years 1 and 2 and Years 2 and 3,respectively?

A) 40.0% and (10.7%)

B) 28.6% and (12.0%)

C) 40.0% and (15.0%)

D) 32.0% and (10.7%)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

25

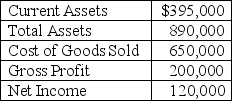

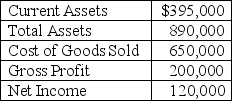

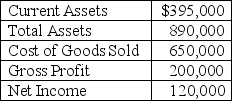

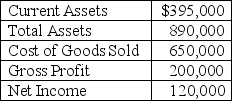

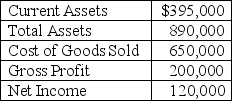

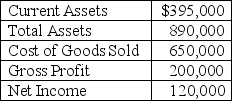

The following information is taken from the financial statements of a company for the current year:

Use the information above to answer the following question.On a common size income statement for the year,what is the percentage that would be shown next to the dollar amount of sales revenue?

A) 100%

B) 14%

C) 60%

D) Cannot be determined

Use the information above to answer the following question.On a common size income statement for the year,what is the percentage that would be shown next to the dollar amount of sales revenue?

A) 100%

B) 14%

C) 60%

D) Cannot be determined

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

26

Financial statement analysis is useful for:

A) evaluating a company's success in meeting the challenges that it faces.

B) selecting the most appropriate accounting rules to follow.

C) determining the market price of a company's stock.

D) comparing US companies with foreign companies.

A) evaluating a company's success in meeting the challenges that it faces.

B) selecting the most appropriate accounting rules to follow.

C) determining the market price of a company's stock.

D) comparing US companies with foreign companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

27

In a common size income statement,each item on the income statement is expressed as a percentage of:

A) net income.

B) gross profit.

C) total expenses.

D) sales revenue.

A) net income.

B) gross profit.

C) total expenses.

D) sales revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

28

A trend analysis to determine a year-to-year dollar amount change is calculated by subtracting the:

A) previous period amount from the current amount.

B) current period amount from the previous period amount.

C) current period amount from the previous period amount and then dividing the result by the previous period amount.

D) previous period amount from the current period amount and then dividing the result by the current period amount.

A) previous period amount from the current amount.

B) current period amount from the previous period amount.

C) current period amount from the previous period amount and then dividing the result by the previous period amount.

D) previous period amount from the current period amount and then dividing the result by the current period amount.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

29

To analyze changes in a company's sales over the last five years,you should perform:

A) vertical analysis.

B) ratio analysis.

C) horizontal analysis.

D) cross-sectional analysis.

A) vertical analysis.

B) ratio analysis.

C) horizontal analysis.

D) cross-sectional analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

30

Vertical analysis:

A) identifies the relative contribution made by each financial statement line item.

B) identifies trends over time .

C) provides an understanding of the relationships among various items on financial statements by expressing the differences in terms of dollars.

D) involves comparing amounts across different financial statements.

A) identifies the relative contribution made by each financial statement line item.

B) identifies trends over time .

C) provides an understanding of the relationships among various items on financial statements by expressing the differences in terms of dollars.

D) involves comparing amounts across different financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

31

Horizontal analysis:

A) is used to identify trends over time.

B) identifies the relative contribution made by each financial statement line item.

C) provides an understanding of the relationships among various items on financial statements.

D) involves comparing amounts across different financial statements.

A) is used to identify trends over time.

B) identifies the relative contribution made by each financial statement line item.

C) provides an understanding of the relationships among various items on financial statements.

D) involves comparing amounts across different financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

32

Net income was $418,600 in the current year and $364,000 in the prior year.The year-to-year percentage change in net income is closest to:

A) 15%.

B) 55%.

C) 87%.

D) 13%.

A) 15%.

B) 55%.

C) 87%.

D) 13%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

33

Which of the following statements about trend analysis is correct?

A) Time-series analysis is an example of trend analysis.

B) Trend data are always in dollars.

C) Trend analysis is also known as vertical analysis.

D) Common-size analysis is an example of trend analysis.

A) Time-series analysis is an example of trend analysis.

B) Trend data are always in dollars.

C) Trend analysis is also known as vertical analysis.

D) Common-size analysis is an example of trend analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

34

Often loan agreements require the borrower to comply with certain requirements,such as maintaining a particular current ratio or limiting future borrowing.To decide if a company has complied with its loan covenants,a creditor would look at the company's:

A) financial statements.

B) chart of accounts.

C) bank statements.

D) charter.

A) financial statements.

B) chart of accounts.

C) bank statements.

D) charter.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

35

Ratio analysis:

A) is required by GAAP as part of every company's income statement and balance sheet.

B) will always identify the best investment decision .

C) will tell you how a company will perform in the future.

D) allows you to evaluate how well a company has performed relative to other different-sized companies within the same industry.

A) is required by GAAP as part of every company's income statement and balance sheet.

B) will always identify the best investment decision .

C) will tell you how a company will perform in the future.

D) allows you to evaluate how well a company has performed relative to other different-sized companies within the same industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

36

A company's comparative balance sheet show total assets of $990,000 and $900,000,for the current and prior years,respectively.The percentage change to be reported in the horizontal analysis is an increase of:

A) 10%.

B) 9%.

C) 5%.

D) 4%.

A) 10%.

B) 9%.

C) 5%.

D) 4%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

37

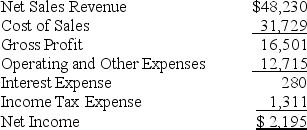

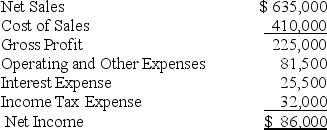

The following information is taken from the financial statements of a company for the current year:

Use the information above to answer the following question.The gross profit percentage for the current year rounded to the nearest whole percent is closest to:

A) 24%.

B) 76%.

C) 60%.

D) 31%.

Use the information above to answer the following question.The gross profit percentage for the current year rounded to the nearest whole percent is closest to:

A) 24%.

B) 76%.

C) 60%.

D) 31%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

38

The following information is taken from the financial statements of a company for the current year:

Use the information above to answer the following question.On a common size income statement for this year,what is the percentage that would be shown next to the dollar amount of cost of goods sold?

A) 76%

B) 24%

C) 31%

D) 18%

Use the information above to answer the following question.On a common size income statement for this year,what is the percentage that would be shown next to the dollar amount of cost of goods sold?

A) 76%

B) 24%

C) 31%

D) 18%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

39

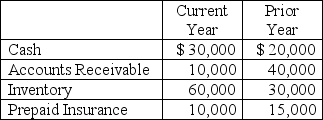

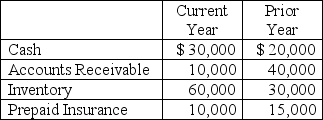

Which balance sheet line item has the highest percentage increase from the prior year to the current year?

A) Inventory

B) Cash

C) Accounts receivable

D) Prepaid insurance

A) Inventory

B) Cash

C) Accounts receivable

D) Prepaid insurance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

40

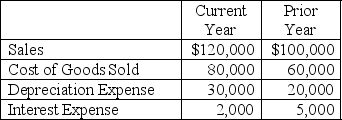

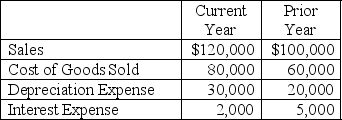

Which income statement line item had the largest percentage increase from the prior year to the current year?

A) Depreciation Expense

B) Cost of Goods Sold

C) Interest Expense

D) Sales

A) Depreciation Expense

B) Cost of Goods Sold

C) Interest Expense

D) Sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

41

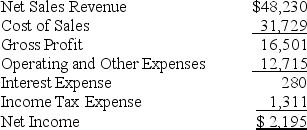

The following information pertains to the CJ Company:

What would be reported next to Interest Expense on a common sized income statement?

A) 12.7%

B) 1.7%

C) 0.6%

D) 0.9%

What would be reported next to Interest Expense on a common sized income statement?

A) 12.7%

B) 1.7%

C) 0.6%

D) 0.9%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

42

If you wish to examine how one aspect of a business is doing relative to other aspects of the business at the current time,you are most likely to use:

A) time-series analysis.

B) ratio analysis.

C) horizontal analysis. D cross-sectional analysis.

A) time-series analysis.

B) ratio analysis.

C) horizontal analysis. D cross-sectional analysis.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following measures would assist in assessing the liquidity of a company?

A) Return on equity

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Times interest earned

A) Return on equity

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Times interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

44

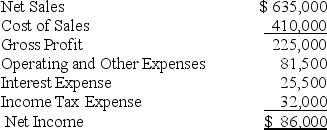

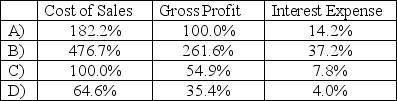

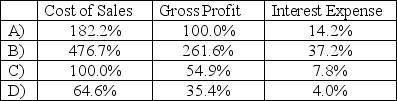

Cotton Products,Inc.prepared its income statement containing the information below.Using vertical analysis,what percentages would apply to cost of sales,gross profit,and interest expense,respectively?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which of the following ratios is used to evaluate solvency?

A) Earnings per share (EPS)

B) Fixed asset turnover

C) Debt-to-assets

D) Current ratio

A) Earnings per share (EPS)

B) Fixed asset turnover

C) Debt-to-assets

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

46

If an analyst wants to examine a company's current ability to generate income,which of the following would best be considered?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

A) Liquidity

B) Market share

C) Profitability

D) Solvency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following ratios is used to evaluate solvency?

A) Fixed asset turnover ratio

B) Days to sell ratio

C) Current ratio

D) Times interest earned

A) Fixed asset turnover ratio

B) Days to sell ratio

C) Current ratio

D) Times interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

48

If an analyst wanted to assess a company's long-run survival,which of the following categories of ratios would most likely be used?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

A) Liquidity

B) Market share

C) Profitability

D) Solvency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

49

If an analyst wants to examine a company's short-run ability to survive,which of the following would best be considered?

A) Liquidity

B) Market share

C) Profitability

D) Solvency

A) Liquidity

B) Market share

C) Profitability

D) Solvency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

50

To perform a vertical analysis of an income statement,you would divide each line item on the statement by:

A) sales.

B) cost of goods sold.

C) operating expenses.

D) net income.

A) sales.

B) cost of goods sold.

C) operating expenses.

D) net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following is a profitability measure?

A) Net income ÷ Revenues

B) Total assets ÷ Total stockholders' equity

C) Total liabilities ÷ Total stockholders' equity

D) Cost of goods sold ÷ Average inventory

A) Net income ÷ Revenues

B) Total assets ÷ Total stockholders' equity

C) Total liabilities ÷ Total stockholders' equity

D) Cost of goods sold ÷ Average inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following ratios is used to evaluate a company's liquidity?

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Return on equity ratio

D) Current ratio

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Return on equity ratio

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

53

Which of the following measures would assist in assessing the solvency of a company?

A) Debt-to-assets

B) Fixed asset turnover

C) Return on equity

D) Current ratio

A) Debt-to-assets

B) Fixed asset turnover

C) Return on equity

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

54

On a common size balance sheet what is the percentage that would be shown next to the dollar amount of current assets?

A) 100%

B) 44%

C) 30%

D) 33%

A) 100%

B) 44%

C) 30%

D) 33%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

55

Which of the following is a liquidity ratio?

A) Inventory turnover

B) Price/Earnings ratio

C) Net profit margin

D) Times interest earned

A) Inventory turnover

B) Price/Earnings ratio

C) Net profit margin

D) Times interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is not a profitability ratio?

A) Return on equity (ROE)

B) Earnings per share

C) Fixed asset turnover

D) Days to sell

A) Return on equity (ROE)

B) Earnings per share

C) Fixed asset turnover

D) Days to sell

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

57

Which of the following measures would assist in assessing the profitability of a company?

A) Fixed asset turnover

B) Times interest earned ratio

C) Inventory turnover ratio

D) Debt-to-assets ratio

A) Fixed asset turnover

B) Times interest earned ratio

C) Inventory turnover ratio

D) Debt-to-assets ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

58

Which of the following statements about liquidity and solvency ratios is correct?

A) Unlike solvency ratios, liquidity ratios relate to the company's long-run survival.

B) Both liquidity ratios and solvency ratios measure a company's ability to meet its financial obligations.

C) Liquidity ratios include the return on equity ratio and the times interest earned ratio.

D) Solvency ratios include the current ratio and the net profit margin ratio.

A) Unlike solvency ratios, liquidity ratios relate to the company's long-run survival.

B) Both liquidity ratios and solvency ratios measure a company's ability to meet its financial obligations.

C) Liquidity ratios include the return on equity ratio and the times interest earned ratio.

D) Solvency ratios include the current ratio and the net profit margin ratio.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

59

Solvency ratio data are primarily concerned with the ability of a company to:

A) produce profits.

B) maintain long-term survival and repay its debt.

C) manage its cash flow.

D) provide income for stockholders.

A) produce profits.

B) maintain long-term survival and repay its debt.

C) manage its cash flow.

D) provide income for stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

60

Which of the following measures would assist in assessing the profitability of a company?

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Current ratio

A) Debt-to-assets ratio

B) Fixed asset turnover ratio

C) Receivables turnover ratio

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

61

Which of the following is calculated by dividing net sales revenue by average net receivables?

A) Days to sell ratio

B) Current ratio

C) Profit margin

D) Receivables turnover ratio

A) Days to sell ratio

B) Current ratio

C) Profit margin

D) Receivables turnover ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

62

Company X has net sales revenue of $1,250,000,cost of goods sold of $760,000,and all other expenses of $290,000.The beginning balance of stockholders' equity is $400,000 and the beginning balance of fixed assets is $361,000.The ending balance of stockholders' equity is $600,000 and the ending balance of fixed assets is $389,000.The fixed asset turnover ratio is closest to:

A) 0.53.

B) 2.50.

C) 3.33.

D) 0.80.

A) 0.53.

B) 2.50.

C) 3.33.

D) 0.80.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

63

Company X has net sales revenue of $780,000,cost of goods sold of $343,200,and all other expenses of $327,600.The gross profit percentage is closest to:

A) 32%.

B) 56%.

C) 86%.

D) 14%.

A) 32%.

B) 56%.

C) 86%.

D) 14%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

64

Vesuvius Company has net sales revenue of $780,000,cost of goods sold of $343,200,net income of $119,200,and preferred dividends of $10,000 during the current year.At the beginning of the year,503,000 shares of common stock were outstanding,and,at the end of the year,537,000 shares of common stock were outstanding.A total of 1,000 preferred shares were outstanding throughout the year.The company's earnings per share for the current year is closest to:

A) $1.50.

B) $0.84.

C) $0.21.

D) $0.87.

A) $1.50.

B) $0.84.

C) $0.21.

D) $0.87.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following ratios is calculated by dividing net income by revenues?

A) Return on equity ratio

B) Net profit margin ratio

C) Current ratio

D) Fixed asset turnover ratio

A) Return on equity ratio

B) Net profit margin ratio

C) Current ratio

D) Fixed asset turnover ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

66

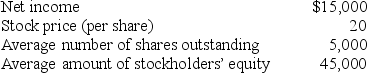

Thomas,Inc.has the following information:

What is the Price/Earnings ratio?

A) 2.2

B) 4.0

C) 6.7

D) 20.0

What is the Price/Earnings ratio?

A) 2.2

B) 4.0

C) 6.7

D) 20.0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

67

A share of stock sells for $20.The company has $64 million in earnings and 200 million outstanding shares.The Price/Earnings ratio for the company is closest to:

A) 62.5.

B) 200.

C) 0.31.

D) 6.4.

A) 62.5.

B) 200.

C) 0.31.

D) 6.4.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

68

Company X has net sales revenue of $780,000,cost of goods sold of $343,200,and all other expenses of $327,600.The net profit margin is closest to:

A) 0.32.

B) 0.56.

C) 0.86.

D) 0.14.

A) 0.32.

B) 0.56.

C) 0.86.

D) 0.14.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the measures below is used to assess profitability?

A) Current ratio

B) Debt-to-assets ratio

C) Asset turnover

D) Receivables turnover

A) Current ratio

B) Debt-to-assets ratio

C) Asset turnover

D) Receivables turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

70

A company has earnings per share of $1.20,it paid a dividend of $.50 per share,and the market price of the company's stock is $45 per share.The price/earnings ratio is closest to:

A) 37.50.

B) 64.29.

C) 2.40.

D) 2.0.

A) 37.50.

B) 64.29.

C) 2.40.

D) 2.0.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

71

Which ratio is a test of liquidity?

A) Net profit margin

B) Inventory turnover

C) Times interest earned

D) Debt-to-assets

A) Net profit margin

B) Inventory turnover

C) Times interest earned

D) Debt-to-assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

72

Which of the measures below is used to measure liquidity?

A) Current ratio

B) Debt-to-assets ratio

C) Price ÷ Earnings ratio

D) Times interest earned

A) Current ratio

B) Debt-to-assets ratio

C) Price ÷ Earnings ratio

D) Times interest earned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following actions would likely increase the Return on Equity (ROE)?

A) An increase in the cost of goods sold

B) The purchase of treasury stock

C) Issuing shares of preferred stock

D) An increase in the income tax rate

A) An increase in the cost of goods sold

B) The purchase of treasury stock

C) Issuing shares of preferred stock

D) An increase in the income tax rate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is calculated by dividing (net income less preferred dividends)by average common stockholders' equity?

A) Return on assets ratio

B) Return on equity ratio

C) Earnings per share

D) Net profit margin ratio

A) Return on assets ratio

B) Return on equity ratio

C) Earnings per share

D) Net profit margin ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following ratios is a solvency ratio?

A) Net profit margin ratio

B) Current ratio

C) Fixed asset turnover ratio

D) Debt-to-assets ratio

A) Net profit margin ratio

B) Current ratio

C) Fixed asset turnover ratio

D) Debt-to-assets ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

76

In which of the following company attributes would a long-term bond holder be most interested?

A) Quality of earnings

B) Solvency

C) Profitability

D) Liquidity

A) Quality of earnings

B) Solvency

C) Profitability

D) Liquidity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

77

Which of the following will increase earnings per share?

A) A ten percent increase in net income and a ten percent increase in the average number of shares of common stock outstanding

B) A ten percent decrease in net income and a ten percent increase in the average number of shares of common stock outstanding

C) A ten percent increase in net income and a ten percent decrease in the average number of shares of common stock outstanding

D) A ten percent decrease in net income and a ten percent decrease in the average number of shares of common stock outstanding

A) A ten percent increase in net income and a ten percent increase in the average number of shares of common stock outstanding

B) A ten percent decrease in net income and a ten percent increase in the average number of shares of common stock outstanding

C) A ten percent increase in net income and a ten percent decrease in the average number of shares of common stock outstanding

D) A ten percent decrease in net income and a ten percent decrease in the average number of shares of common stock outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following is calculated by dividing net revenue by average net fixed assets?

A) Net profit margin

B) Fixed asset turnover

C) Total asset turnover

D) Current ratio

A) Net profit margin

B) Fixed asset turnover

C) Total asset turnover

D) Current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

79

Net revenue divided by average net fixed assets is the calculation for which of the following ratios?

A) Net profit margin

B) Fixed asset turnover

C) Current ratio

D) Return on assets

A) Net profit margin

B) Fixed asset turnover

C) Current ratio

D) Return on assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following is calculated by dividing net income by revenues?

A) Gross profit margin

B) Current ratio

C) Net profit margin

D) Asset turnover

A) Gross profit margin

B) Current ratio

C) Net profit margin

D) Asset turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 170 في هذه المجموعة.

فتح الحزمة

k this deck