Deck 8: Reporting and Interpreting Receivables,bad Debt Expense,and Interest Revenue

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/230

العب

ملء الشاشة (f)

Deck 8: Reporting and Interpreting Receivables,bad Debt Expense,and Interest Revenue

1

The direct write-off method for uncollectible accounts is not allowed by either GAAP or IFRS,but is required by the Internal Revenue Service (IRS)for tax purposes.

True

2

The decision to sell to extend credit to customers will decrease wage costs.

False

3

When a company routinely sells on credit,it is inevitable that some of its customers will not pay the amount owed.

True

4

The allowance method for uncollectible accounts conforms to the expense recognition principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

5

Factoring refers to an arrangement in which a company sells its receivables to another company and receives cash immediately.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

6

Because it is easier to use,the direct write-off method for uncollectible accounts is typically used instead of the allowance method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

7

The accounts receivable account for each customer is called a subsidiary account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a company factors its receivables,its receivables turnover ratio will be lower than it would have been if the receivables had not been factored.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

9

The receivables turnover ratio is calculated using the total net receivables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

10

Interest on a two-month,7%,$1,000 note would be calculated as $1,000 × 0.07 × 2.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

11

Under the allowance method for uncollectible accounts,the write-off of a specific account will not affect total assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

12

Notes receivable are typically only used when a company sells large dollar value items (such as cars).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

13

When credit card sales occur,the seller may receive cash immediately,or within a few days,depending upon the specific credit card program being used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

14

Interest revenue from notes receivable is typically reported on a multiple step income statement as a part of Income from Operations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

15

The Allowance for Doubtful Accounts account is a temporary account which is closed to Retained Earnings at the end of the accounting period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

16

The percentage of credit sales method focuses on estimating the ending balance to be reported in the Allowance for Doubtful Account,whereas the aging of accounts receivable method focuses on estimating Bad Debt Expense for the period.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

17

If the receivables turnover ratio rises significantly,the increase may be a signal that the company is extending credit to high-risk borrowers or allowing an overly generous repayment schedule.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

18

The allowance method for uncollectible accounts is used for accounts receivable,but not for notes receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

19

The aging of accounts receivable method is based upon the principle that the longer an account is overdue,the higher the risk of nonpayment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

20

The direct write-off method for uncollectible accounts is not allowed by GAAP because it overstates the net realizable value of accounts receivable and violates the expense recognition principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

21

IBM signs an agreement to lend one of its customers $200,000 to be repaid in one year at 5% interest.IBM would record this loan as:

A) Notes Payable.

B) Accounts Receivable.

C) Notes Receivable.

D) Unearned Revenue.

A) Notes Payable.

B) Accounts Receivable.

C) Notes Receivable.

D) Unearned Revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

22

Countryside Corporation provides $6,000 worth of lawn care on account during the month.Experience suggests that about 2% of net credit sales will not be collected.In conformity with the expense recognition principle,the company should:

A) record an estimate of Bad Debt Expense in the same period as the lawn care is provided.

B) not report the sales revenue until it collects payment.

C) increase the value of its liabilities with an adjustment.

D) wait until the accounts are determined to be uncollectible before making an entry to record the related Bad Debt Expense.

A) record an estimate of Bad Debt Expense in the same period as the lawn care is provided.

B) not report the sales revenue until it collects payment.

C) increase the value of its liabilities with an adjustment.

D) wait until the accounts are determined to be uncollectible before making an entry to record the related Bad Debt Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

23

The potential disadvantages of extending credit include all of the following except:

A) increased bad debt costs.

B) customers buying too much.

C) the need to hire employees to undertake collection efforts.

D) higher wage costs in the accounting department.

A) increased bad debt costs.

B) customers buying too much.

C) the need to hire employees to undertake collection efforts.

D) higher wage costs in the accounting department.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

24

Although there are some clear disadvantages associated with extending credit to customers,such as bad debt costs,most managers believe a particular advantage outweighs the costs.To which primary advantage do they refer?

A) Increased labor costs

B) Increased bad debt expense

C) Delayed receipt of cash

D) Additional sales revenue

A) Increased labor costs

B) Increased bad debt expense

C) Delayed receipt of cash

D) Additional sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

25

Which of the following are similarities between a six-month note receivable and an account receivable? They both are:

A) formal written contracts.

B) interest bearing.

C) current liabilities.

D) current assets.

A) formal written contracts.

B) interest bearing.

C) current liabilities.

D) current assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

26

Companies are concerned about the cost of extending credit for all the following reasons except the:

A) time delay in receiving payment.

B) expense of the extra goods that must be produced or purchased for resale.

C) risk of nonpayment.

D) administrative costs associated with extending credit.

A) time delay in receiving payment.

B) expense of the extra goods that must be produced or purchased for resale.

C) risk of nonpayment.

D) administrative costs associated with extending credit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

27

Extending credit to customers will introduce all of the following additional costs except:

A) increased wage costs will be incurred to hire people to evaluate whether each customer is creditworthy, track how much each customer owes, and follow up to collect the receivable from each customer.

B) bad debt costs will result when amounts cannot be collected from customers.

C) delayed receipt of cash may result in requiring the company to take out short-term loans and incur interest costs.

D) decreased gross profit from reduced sales.

A) increased wage costs will be incurred to hire people to evaluate whether each customer is creditworthy, track how much each customer owes, and follow up to collect the receivable from each customer.

B) bad debt costs will result when amounts cannot be collected from customers.

C) delayed receipt of cash may result in requiring the company to take out short-term loans and incur interest costs.

D) decreased gross profit from reduced sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

28

The potential advantages of extending credit to customers include all of the following except higher:

A) wage expenses.

B) profits.

C) customer satisfaction.

D) revenues.

A) wage expenses.

B) profits.

C) customer satisfaction.

D) revenues.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

29

Accounts receivable:

A) arise from the purchase of goods or services on credit

B) are amounts owed to a business by its customers.

C) will be collected within the discount period or when due.

D) are reported on the income statement.

A) arise from the purchase of goods or services on credit

B) are amounts owed to a business by its customers.

C) will be collected within the discount period or when due.

D) are reported on the income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

30

Why are estimates of bad debts used to record uncollectible amounts of accounts receivable?

A) Doing so avoids violating the expense recognition ("matching") principle.

B) It is an easier method than waiting for accounts to actually become uncollectible.

C) Because the actual amount of uncollectible accounts can never be known.

D) It is the most conservative approach.

A) Doing so avoids violating the expense recognition ("matching") principle.

B) It is an easier method than waiting for accounts to actually become uncollectible.

C) Because the actual amount of uncollectible accounts can never be known.

D) It is the most conservative approach.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

31

There are advantages and disadvantages to extending credit to customers.Which of the following statements below expresses the general reason for extending credit?

A) Lower sales revenues exceed bad debt savings.

B) Wage cost savings exceed delayed receipt of cash.

C) Gross profits exceed bad debt costs.

D) The speed of cash receipts exceeds bad debt costs.

A) Lower sales revenues exceed bad debt savings.

B) Wage cost savings exceed delayed receipt of cash.

C) Gross profits exceed bad debt costs.

D) The speed of cash receipts exceeds bad debt costs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following statements about the tradeoffs of extending credit is not correct?

A) Extending credit to at least some customers is necessary in a competitive market to avoid losing sales to competitors.

B) Even if a company were to collect in full from customers, there would be other additional costs introduced by extending credit to customers.

C) Even though additional costs are incurred if credit is extended, a company expects that the additional revenue will be more than sufficient to offset the additional costs.

D) Even if there are no bad debts from credit sales, the delayed receipt of cash will always increase additional costs beyond the increased revenue from the credit sales.

A) Extending credit to at least some customers is necessary in a competitive market to avoid losing sales to competitors.

B) Even if a company were to collect in full from customers, there would be other additional costs introduced by extending credit to customers.

C) Even though additional costs are incurred if credit is extended, a company expects that the additional revenue will be more than sufficient to offset the additional costs.

D) Even if there are no bad debts from credit sales, the delayed receipt of cash will always increase additional costs beyond the increased revenue from the credit sales.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

33

All of the following will likely be incurred by a company that extends credit except:

A) increased revenues.

B) increased wage costs.

C) increased advertising expenses.

D) a delay in the receipt of cash.

A) increased revenues.

B) increased wage costs.

C) increased advertising expenses.

D) a delay in the receipt of cash.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

34

Countryside Corporation is owed $11,890 from a customer for landscaping.The account is overdue and the customer is having difficulty paying.Countryside might ask the customer to sign a note for the unpaid amount to:

A) decrease its net income for tax reporting purposes.

B) strengthen Countryside Corporation's legal right to be repaid with interest.

C) reduce its tax liability.

D) eliminate any doubts of collection of the amount due.

A) decrease its net income for tax reporting purposes.

B) strengthen Countryside Corporation's legal right to be repaid with interest.

C) reduce its tax liability.

D) eliminate any doubts of collection of the amount due.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

35

Which of the following statements about extending credit is not correct?

A) It is common for companies to sell on account to other companies.

B) Some companies extend credit to individual consumers.

C) Bad debts arise from credit sales to individual consumers, but not from credit sales to other companies.

D) When credit is available, customers often buy more products and services.

A) It is common for companies to sell on account to other companies.

B) Some companies extend credit to individual consumers.

C) Bad debts arise from credit sales to individual consumers, but not from credit sales to other companies.

D) When credit is available, customers often buy more products and services.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

36

The Allowance for Doubtful Accounts account is a contra-account that offsets:

A) Bad Debt Expense.

B) Cash.

C) Net Income.

D) Accounts Receivable.

A) Bad Debt Expense.

B) Cash.

C) Net Income.

D) Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

37

If a company did not extend credit to customers:

A) gross revenue would increase.

B) costs would increase but so would sales revenue.

C) costs would decrease but so would sales revenue.

D) gross profit would increase.

A) gross revenue would increase.

B) costs would increase but so would sales revenue.

C) costs would decrease but so would sales revenue.

D) gross profit would increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

38

Credit card companies charge a fee to the seller that accepts the credit cards.This fee is recorded by the seller as a non-operating expense on its income statement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

39

Notes Receivable differ from Accounts Receivable in that Notes Receivable:

A) generally charge interest from the day they are signed to the day they are collected

B) are noncurrent assets

C) do not have to be created for every new transaction, so they are used more frequently

D) are generally considered a weaker legal claim

A) generally charge interest from the day they are signed to the day they are collected

B) are noncurrent assets

C) do not have to be created for every new transaction, so they are used more frequently

D) are generally considered a weaker legal claim

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

40

The advantage of extending credit to customers is that it helps customers to buy products and services,thereby increasing the seller's revenue.The disadvantages of extending credit are costs related to:

A) increased sales.

B) bad debt expense.

C) increased notes receivable.

D) marketing.

A) increased sales.

B) bad debt expense.

C) increased notes receivable.

D) marketing.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

41

The entry to adjust the Allowance for Doubtful Accounts causes total:

A) assets to increase.

B) liabilities to increase.

C) stockholders' equity to increase.

D) stockholders' equity to decrease.

A) assets to increase.

B) liabilities to increase.

C) stockholders' equity to increase.

D) stockholders' equity to decrease.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

42

Allowance for Doubtful Accounts is a:

A) permanent account so its balance carries forward to the next accounting period

B) permanent account so its balance is closed (zeroed out) at the end of the accounting period

C) temporary account so its balance is closed (zeroed out) at the end of the accounting period

D) temporary account so its balance carries forward to the next accounting period

A) permanent account so its balance carries forward to the next accounting period

B) permanent account so its balance is closed (zeroed out) at the end of the accounting period

C) temporary account so its balance is closed (zeroed out) at the end of the accounting period

D) temporary account so its balance carries forward to the next accounting period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

43

For billing and collection purposes,companies keep a separate accounts receivable account for each customer called a:

A) subsidized account

B) temporary account

C) subsidiary account

D) temporal account

A) subsidized account

B) temporary account

C) subsidiary account

D) temporal account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

44

The adjusting entry to record the allowance for doubtful accounts includes a:

A) debit to Bad Debt Expense.

B) debit to Allowance for Doubtful Accounts.

C) debit to Sales Revenue.

D) credit to Accounts Receivable.

A) debit to Bad Debt Expense.

B) debit to Allowance for Doubtful Accounts.

C) debit to Sales Revenue.

D) credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

45

The accounting principle that governs the recording of bad debt expense in the same period as sales revenue is called the:

A) expense recognition principle ("matching")

B) time period assumption

C) revenue recognition principle

D) separate entity assumption

A) expense recognition principle ("matching")

B) time period assumption

C) revenue recognition principle

D) separate entity assumption

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

46

Assume the Hart Company uses the allowance method.When the company writes off a customer's account balance that has no chance of collection:

A) total assets will decrease.

B) total liabilities will increase.

C) expenses and revenues will both increase.

D) total assets will decrease and expenses will increase.

A) total assets will decrease.

B) total liabilities will increase.

C) expenses and revenues will both increase.

D) total assets will decrease and expenses will increase.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

47

Using the allowance method,which is the correct adjusting journal entry to record bad debt expense?

A) Debit Bad Debt Expense and credit Allowance for Doubtful Accounts

B) Debit Allowance for Bad Debt Expense and credit Bad Debt Expense

C) Debit Bad Debt Expense and credit Sales Revenue

D) Debit Bad Debt Expense and credit Accounts Receivable

A) Debit Bad Debt Expense and credit Allowance for Doubtful Accounts

B) Debit Allowance for Bad Debt Expense and credit Bad Debt Expense

C) Debit Bad Debt Expense and credit Sales Revenue

D) Debit Bad Debt Expense and credit Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

48

The adjusting entry to record the estimated bad debts in the period credit sales occur would normally include a debit to:

A) Accounts Receivable and a credit to Allowance for Doubtful Accounts.

B) Bad Debt Expense and a credit to Allowance for Doubtful Accounts.

C) Allowance for Doubtful Accounts and a credit to Accounts Receivable.

D) Bad Debt Expense and a credit to Accounts Receivable.

A) Accounts Receivable and a credit to Allowance for Doubtful Accounts.

B) Bad Debt Expense and a credit to Allowance for Doubtful Accounts.

C) Allowance for Doubtful Accounts and a credit to Accounts Receivable.

D) Bad Debt Expense and a credit to Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

49

A contra-asset account,such as Allowance for Doubtful Accounts or Accumulated Depreciation,has a normal balance of a ______ and causes total assets to:

A) credit; decrease

B) debit; increase

C) debit; decrease

D) credit; increase

A) credit; decrease

B) debit; increase

C) debit; decrease

D) credit; increase

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

50

Bad Debt Expense is a:

A) permanent account so its balance carries forward to the next accounting period

B) permanent account so its balance is closed (zeroed out) at the end of the accounting period

C) temporary account so its balance is closed (zeroed out) at the end of the accounting period

D) temporary account so its balance carries forward to the next accounting period

A) permanent account so its balance carries forward to the next accounting period

B) permanent account so its balance is closed (zeroed out) at the end of the accounting period

C) temporary account so its balance is closed (zeroed out) at the end of the accounting period

D) temporary account so its balance carries forward to the next accounting period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

51

On the balance sheet,the Allowance for Doubtful Accounts:

A) is included in current liabilities.

B) increases the reported Accounts Receivable, Net.

C) is reported under the heading "Other Assets."

D) is subtracted from Accounts Receivable.

A) is included in current liabilities.

B) increases the reported Accounts Receivable, Net.

C) is reported under the heading "Other Assets."

D) is subtracted from Accounts Receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

52

For billing and collection purposes,a company will internally keep a separate accounts receivable account for each customer called a:

A) customer record.

B) subsidiary account.

C) subsidiary ledger.

D) debit memorandum.

A) customer record.

B) subsidiary account.

C) subsidiary ledger.

D) debit memorandum.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

53

The adjusting entry to record the estimated bad debts in the period credit sales occur includes a debit to an:

A) asset account and a credit to a liability account.

B) expense account and a credit to an asset account.

C) expense account and a credit to a revenue account.

D) expense account and a credit to a contra-asset account.

A) asset account and a credit to a liability account.

B) expense account and a credit to an asset account.

C) expense account and a credit to a revenue account.

D) expense account and a credit to a contra-asset account.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

54

Failing to record bad debt expense in the same period as the related revenue violates which principle?

A) Expense recognition principle ("matching")

B) Revenue recognition principle

C) Lower-of-cost-or-market value principle

D) Cost principle

A) Expense recognition principle ("matching")

B) Revenue recognition principle

C) Lower-of-cost-or-market value principle

D) Cost principle

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

55

Recording the estimate of bad debt expense:

A) increases assets.

B) increases net income.

C) is done at the same time the credit sale is recorded.

D) follows the expense recognition ("matching") principle.

A) increases assets.

B) increases net income.

C) is done at the same time the credit sale is recorded.

D) follows the expense recognition ("matching") principle.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

56

The adjusting entry used to record the estimated bad debts in the period credit sales occur decreases:

A) both net income and net accounts receivable.

B) net income and increases liabilities.

C) assets and increases liabilities.

D) both selling expenses and net income.

A) both net income and net accounts receivable.

B) net income and increases liabilities.

C) assets and increases liabilities.

D) both selling expenses and net income.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

57

The challenge businesses face when estimating the allowance for previously recorded sales is that:

A) at the time of the sale, it is not known which particular customer will be a "bad" customer

B) past default rates are not a good predictor of future default rates

C) in bad economic times, fewer customers will have problems with their payments

D) those sales have been closed into retained earnings

A) at the time of the sale, it is not known which particular customer will be a "bad" customer

B) past default rates are not a good predictor of future default rates

C) in bad economic times, fewer customers will have problems with their payments

D) those sales have been closed into retained earnings

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

58

Accounts Receivable,Net (or Net Accounts Receivable)equals Accounts Receivable (gross)minus:

A) Cost of Goods Sold.

B) Bad Debt Expense.

C) Allowance for Doubtful Accounts.

D) Current Liabilities.

A) Cost of Goods Sold.

B) Bad Debt Expense.

C) Allowance for Doubtful Accounts.

D) Current Liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

59

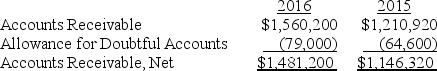

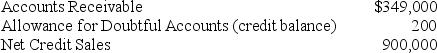

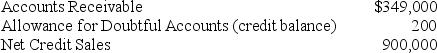

Assume the Murtha Company reported the following adjusted account balances at year-end.

Assume the company recorded no write-offs or recoveries during 2016.What was the amount of Bad Debt Expense reported in 2016?

A) $79,000

B) $64,600

C) $28,800

D) $14,400

Assume the company recorded no write-offs or recoveries during 2016.What was the amount of Bad Debt Expense reported in 2016?

A) $79,000

B) $64,600

C) $28,800

D) $14,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

60

An objective of the expense recognition principle ("matching")is to have bad debt expense debited in:

A) the same period that the related accounts receivable is determined to be uncollectible

B) the same period the related credit sales are recorded

C) a later period after the related credit sales are recorded

D) the period that a customer eventually becomes bankrupt

A) the same period that the related accounts receivable is determined to be uncollectible

B) the same period the related credit sales are recorded

C) a later period after the related credit sales are recorded

D) the period that a customer eventually becomes bankrupt

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

61

Accounts Receivable has a $2,300 balance,and the Allowance for Doubtful Accounts has a $200 credit balance.An $80 account receivable is written-off.Net receivables (net realizable value)after the write-off equals:

A) $2,020.

B) $2,100.

C) $2,180.

D) $2,220.

A) $2,020.

B) $2,100.

C) $2,180.

D) $2,220.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

62

Cary Inc.reported net credit sales of $300,000 for the current year.The unadjusted credit balance in its Allowance for Doubtful Accounts is $500.The company has experienced bad debt losses of 1% of credit sales in prior periods.Using the percentage of credit sales method,what amount should the company record as an estimate of Bad Debt Expense?

A) $2,500

B) $3,000

C) $2,980

D) $3,200

A) $2,500

B) $3,000

C) $2,980

D) $3,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

63

Plasma Inc.uses the percentage of credit sales method to estimate Bad Debt Expense.The company reported net credit sales of $500,000 during the year.Plasma has experienced bad debt losses of 2% of credit sales in prior periods.At the beginning of the year,Plasma has a credit balance in its Allowance for Doubtful Accounts of $4,000.No write-offs or recoveries were recorded during the year.What amount of Bad Debt Expense should Plasma recognize for the year?

A) $4,000

B) $6,000

C) $10,000

D) $14,000

A) $4,000

B) $6,000

C) $10,000

D) $14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

64

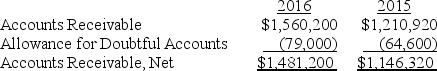

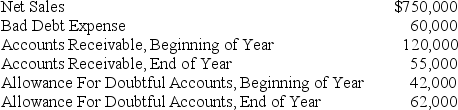

Labrador Inc.has the following information available for the current year:

What was the amount of write-offs during the year?

A) $62,000

B) $0

C) $55,000

D) $40,000

What was the amount of write-offs during the year?

A) $62,000

B) $0

C) $55,000

D) $40,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

65

Kata Company uses the allowance method.On May 1,Kata wrote off a $22,000 customer account balance when it becomes clear that the particular customer will never pay.The journal entry to record the write-off on May 1 would include which of the following?

A) Debit to Bad Debt Expense and credit to Allowance for Doubtful Accounts

B) Debit to Accounts Receivable and credit to Allowance for Doubtful Accounts

C) Debit to Allowance for Doubtful Accounts and credit to Bad Debt Expense

D) Debit to Allowance for Doubtful Accounts and credit to Accounts Receivable

A) Debit to Bad Debt Expense and credit to Allowance for Doubtful Accounts

B) Debit to Accounts Receivable and credit to Allowance for Doubtful Accounts

C) Debit to Allowance for Doubtful Accounts and credit to Bad Debt Expense

D) Debit to Allowance for Doubtful Accounts and credit to Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

66

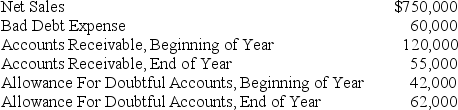

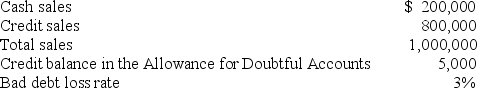

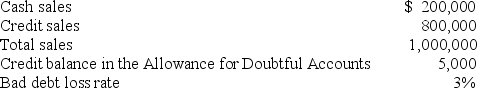

Wrangler Inc.uses the percentage of credit sales method to estimate Bad Debt Expense.At the end of the year,the company's unadjusted trial balance includes the following:

Wrangler has experienced bad debt losses of 0.5% of credit sales in prior periods.What is the Bad Debt Expense to be recorded for the year?

A) $4,500

B) $4,300

C) $4,700

D) $45,000

Wrangler has experienced bad debt losses of 0.5% of credit sales in prior periods.What is the Bad Debt Expense to be recorded for the year?

A) $4,500

B) $4,300

C) $4,700

D) $45,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

67

Removing an uncollectible account and its corresponding allowance from the accounting records is called:

A) a write-off

B) a write-up

C) double entry accounting

D) elimination accounting

A) a write-off

B) a write-up

C) double entry accounting

D) elimination accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

68

XYZ Corp.uses the percentage of credit sales method in determining its bad debt expense.The following information comes from the accounting records of XYZ Corp.:

What is the estimate of bad debt expense?

A) $24,000

B) $25,000

C) $29,000

D) $30,000

What is the estimate of bad debt expense?

A) $24,000

B) $25,000

C) $29,000

D) $30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

69

Countryside Corporation uses the allowance method.Countryside writes off a $350 customer account balance when it becomes clear that the customer will never pay.Countryside Corporation should debit:

A) Bad Debt Expense and credit Accounts Receivable for $350.

B) Allowance for Doubtful Accounts and credit Accounts Receivable for $350.

C) Bad Debt Expense and credit Cash for $350.

D) Accounts Receivable and credit Bad Debt Expense for $350.

A) Bad Debt Expense and credit Accounts Receivable for $350.

B) Allowance for Doubtful Accounts and credit Accounts Receivable for $350.

C) Bad Debt Expense and credit Cash for $350.

D) Accounts Receivable and credit Bad Debt Expense for $350.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

70

Daley Company uses the allowance method.At December 31,2015,the company's balance sheet reports Accounts Receivable,Net in the amount of $17,000.On January 2,2016,Daley writes off a $1,500 customer account balance when it becomes clear that the customer will never pay.What is the amount of Accounts Receivable,Net after the write-off?

A) $17,000

B) $1,500

C) $18,500

D) $15,500

A) $17,000

B) $1,500

C) $18,500

D) $15,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

71

Countryside Corporation provides $6,000 worth of lawn care on account during the month.Experience suggests that about 2% of net credit sales will not be collected.To record the potential bad debts,Countryside Corporation would debit:

A) Accounts Receivable and credit Allowance for Doubtful Accounts for $120.

B) Allowance for Doubtful Accounts and credit Bad Debt Expense for $120.

C) Bad Debt Expense and credit Allowance for Doubtful Accounts for $120.

D) Bad Debt Expense and credit Accounts Receivable for $120.

A) Accounts Receivable and credit Allowance for Doubtful Accounts for $120.

B) Allowance for Doubtful Accounts and credit Bad Debt Expense for $120.

C) Bad Debt Expense and credit Allowance for Doubtful Accounts for $120.

D) Bad Debt Expense and credit Accounts Receivable for $120.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

72

When the allowance method is used,the entry to record the write-off of specific uncollectible accounts would decrease:

A) the Allowance for Doubtful Accounts account.

B) Net Income.

C) Accounts Receivable, Net.

D) Bad Debt Expense.

A) the Allowance for Doubtful Accounts account.

B) Net Income.

C) Accounts Receivable, Net.

D) Bad Debt Expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which method for estimating bad debts is generally considered to be the most accurate?

A) Percentage of credit sales

B) Allowance method

C) Specific account method

D) Aging of accounts receivable method

A) Percentage of credit sales

B) Allowance method

C) Specific account method

D) Aging of accounts receivable method

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

74

Wasco Company has experienced bad debt losses of 5% of credit sales in prior periods.At the end of the year,the balance of Accounts Receivable is $100,000 and the Allowance for Doubtful Accounts has an unadjusted credit balance of $500.Net credit sales during the year were $150,000.Using the percentage of credit sales method,what is the estimated Bad Debt Expense for the year?

A) $5,000

B) $7,000

C) $7,500

D) $8,000

A) $5,000

B) $7,000

C) $7,500

D) $8,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

75

Samuel,Inc.has Accounts Receivable of $200,000 and an Allowance for Doubtful Accounts of $10,000.If it writes-off a customer account balance of $1,000,what is the amount of its net accounts receivable?

A) $199,000

B) $200,000

C) $190,000

D) $189,000

A) $199,000

B) $200,000

C) $190,000

D) $189,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

76

Langley Company uses the allowance method.During January 2016,Langley writes off a $500 customer account balance when it becomes clear that the customer will never pay.The entry to record the write-off will:

A) decrease total assets by $500.

B) decrease net income for 2016 by $500.

C) decrease net accounts receivable by $500.

D) not increase the expenses for 2016.

A) decrease total assets by $500.

B) decrease net income for 2016 by $500.

C) decrease net accounts receivable by $500.

D) not increase the expenses for 2016.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

77

The entry that includes a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable is a(n):

A) write-off of a specific customer's account

B) adjusting entry to allow for estimated bad debts

C) subsidiary entry to increase a customer's account for credit sales

D) net realizable entry to report the amount expected to be collected

A) write-off of a specific customer's account

B) adjusting entry to allow for estimated bad debts

C) subsidiary entry to increase a customer's account for credit sales

D) net realizable entry to report the amount expected to be collected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

78

Jensen Company uses the percentage of credit sales method for calculating Bad Debt Expense.The company reported $216,000 in total sales during the year; $178,000 of which were on credit.Jensen has experienced bad debt losses of 6% of credit sales in prior periods.What is the estimated amount of Bad Debt Expense for the year?

A) $12,960

B) $10,680

C) $38,000

D) $11,000

A) $12,960

B) $10,680

C) $38,000

D) $11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

79

The write-off of a specific customer account receivable involves decreasing an asset account and:

A) increasing an expense account

B) decreasing a liability account

C) decreasing a revenue account

D) increasing a contra-asset account

A) increasing an expense account

B) decreasing a liability account

C) decreasing a revenue account

D) increasing a contra-asset account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck

80

Lakeview Inc.uses the allowance method.During the year,Lakeview concludes that specific customers will never pay their account balances,which total $6,844.The entry to record the write-off of these accounts receivable would debit:

A) Accounts Receivable and credit Allowance for Doubtful Accounts for $6,844.

B) Accounts Receivable and credit Bad Debt Expense for $6,844.

C) Bad Debt Expense and credit Accounts Receivable for $6,844.

D) Allowance for Doubtful Accounts and credit Accounts Receivable for $6,844.

A) Accounts Receivable and credit Allowance for Doubtful Accounts for $6,844.

B) Accounts Receivable and credit Bad Debt Expense for $6,844.

C) Bad Debt Expense and credit Accounts Receivable for $6,844.

D) Allowance for Doubtful Accounts and credit Accounts Receivable for $6,844.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 230 في هذه المجموعة.

فتح الحزمة

k this deck