Deck 4: Short-Term Decision Making

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

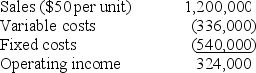

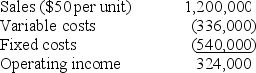

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/103

العب

ملء الشاشة (f)

Deck 4: Short-Term Decision Making

1

Using the items below classify each of the cost as U - unit related,B - batch related,P - product sustaining,F - facility sustaining,and N - non of the above

_____ 1.Cost of the cables used in the equipment

_____ 2.Set up cost to change from one piece of equipment to another

_____ 3.Research cost incurred to develop new types of equipment

_____ 4.Salary of the quality control inspector

_____ 5.Cost of the oil used to cut metal tubing

_____ 6.Insurance on factory equipment

_____ 7.Wages of employees who put the equipment together

_____ 8.Salary of warehouse foreman where raw material is stored

_____ 9.Cost of shipping equipment to customers

_____ 10.Shipping cost paid to get raw materials

_____ 1.Cost of the cables used in the equipment

_____ 2.Set up cost to change from one piece of equipment to another

_____ 3.Research cost incurred to develop new types of equipment

_____ 4.Salary of the quality control inspector

_____ 5.Cost of the oil used to cut metal tubing

_____ 6.Insurance on factory equipment

_____ 7.Wages of employees who put the equipment together

_____ 8.Salary of warehouse foreman where raw material is stored

_____ 9.Cost of shipping equipment to customers

_____ 10.Shipping cost paid to get raw materials

1.U; 2.B; 3.P; 4.B; 5.U; 6.F; 7.U; 8.F; 9.U; 10.B

2

If only the selling price increase the breakeven point

A)Decreases

B)Increases

C)Stays the same

D)Depends on customer demand

A)Decreases

B)Increases

C)Stays the same

D)Depends on customer demand

Increases

3

Dreary Days,Inc.sells raincoats at a selling price of $25.00 for each rain coat.The variable cost per coat is $16.25.Total fixed costs are $142,000.The contribution margin ratio is:

A).65

B).54

C).30

D).35

A).65

B).54

C).30

D).35

.35

4

Short-term decision making differs from normal operating decision in two ways, which of the following are the two ways?

A)Short-term decision can not be planned and address routine operating decision.

B)Short-term operating decisions are unique and can not be planned

C)Short-term operating decisions are routine and anticipated

D)Short-term operating decisions are unique and will expand plant capacity

A)Short-term decision can not be planned and address routine operating decision.

B)Short-term operating decisions are unique and can not be planned

C)Short-term operating decisions are routine and anticipated

D)Short-term operating decisions are unique and will expand plant capacity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

5

Selling price less variable costs equals:

A)markup

B)net income

C)gross margin

D)contribution margin

A)markup

B)net income

C)gross margin

D)contribution margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following is the formula for the contribution margin ratio?

A)Selling price per unit - variable cost per unit/ selling price per unit

B)Selling price per unit - fixed cost per unit/ selling price per unit

C)Variable cost per unit/selling price per unit

D)Fixed cost per unit/selling price per unit

A)Selling price per unit - variable cost per unit/ selling price per unit

B)Selling price per unit - fixed cost per unit/ selling price per unit

C)Variable cost per unit/selling price per unit

D)Fixed cost per unit/selling price per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

7

Sit-well Corporation Manufactures an exclusive line of chairs and recliners.Determine whether each of the following would be considered a product or nonproduct cost for Sit-well by using a P to identify the product cost and NP to identify nonproduct costs.

_____

A.Cost of the wood used in the chairs.

_____

B.Cost of office supplies

_____

C.Cost of the fabric used on the recliners.

_____

D.Cost of the utilities incurred to run the manufacturing plant.

_____

E.The salary of the foreman who oversees the raw materials warehouse

_____

_____ F.Depreciation on salespersons' cars

_____ G.The president of the corporation's salary

_____ H.Wages paid to employees who assemble the chairs

_____ I.Cost of the glue used to assemble the chairs

_____ J.Cost of shipping the finished product to consumers.

_____

A.Cost of the wood used in the chairs.

_____

B.Cost of office supplies

_____

C.Cost of the fabric used on the recliners.

_____

D.Cost of the utilities incurred to run the manufacturing plant.

_____

E.The salary of the foreman who oversees the raw materials warehouse

_____

_____ F.Depreciation on salespersons' cars

_____ G.The president of the corporation's salary

_____ H.Wages paid to employees who assemble the chairs

_____ I.Cost of the glue used to assemble the chairs

_____ J.Cost of shipping the finished product to consumers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

8

Short-term decision making differs from long-term decision making because:

A)Short-term decision making assumes capacity is fixed.

B)Short-term decision making assumes that variable costs are fixed.

C)Short-term decision making assumes selling prices are fixed.

D)Short-term decision making assumes the accounting data is fixed.

A)Short-term decision making assumes capacity is fixed.

B)Short-term decision making assumes that variable costs are fixed.

C)Short-term decision making assumes selling prices are fixed.

D)Short-term decision making assumes the accounting data is fixed.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

9

Dreary Days,Inc.sells raincoats at a selling price of $25.00 for each raincoat.The variable cost per raincoat is $16.25.Total fixed costs are $142,000.The breakeven point in units is:

A)5,680

B)8,738

C)16,229

D)16,000

A)5,680

B)8,738

C)16,229

D)16,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

10

JJ Corporation manufactures exercise equipment.From this list below indicate whether the item would be classified as DM - direct material,DL - direct labor,MOH - manufacturing overhead,or NP - nonproduct cost.

_____ 1.Cost of the cables used in the equipment

_____ 2.Set up cost to change from one piece of equipment to another

_____ 3.Research cost incurred to develop new types of equipment

_____ 4.Salary of the quality control inspector

_____ 5.Cost of the oil used to cut metal tubing

_____ 6.Insurance on factory equipment

_____ 7.Wages of employees who put the equipment together

_____ 8.Salary of warehouse foreman where raw material is stored

_____ 9.Cost of shipping equipment to customers

_____ 10.Shipping cost paid to get raw materials

_____ 1.Cost of the cables used in the equipment

_____ 2.Set up cost to change from one piece of equipment to another

_____ 3.Research cost incurred to develop new types of equipment

_____ 4.Salary of the quality control inspector

_____ 5.Cost of the oil used to cut metal tubing

_____ 6.Insurance on factory equipment

_____ 7.Wages of employees who put the equipment together

_____ 8.Salary of warehouse foreman where raw material is stored

_____ 9.Cost of shipping equipment to customers

_____ 10.Shipping cost paid to get raw materials

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following generates the contribution margin?

A)Variable cost per unit - fixed cost per unit

B)Selling price per unit - fixed cost per unit

C)Selling price per unit - variable cost per unit

D)Fixed cost per unit - Selling price per unit

A)Variable cost per unit - fixed cost per unit

B)Selling price per unit - fixed cost per unit

C)Selling price per unit - variable cost per unit

D)Fixed cost per unit - Selling price per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

12

If only the fixed cost increase the breakeven point

A)Decreases

B)Increases

C)Stays the same

D)Depends on customer demand

A)Decreases

B)Increases

C)Stays the same

D)Depends on customer demand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

13

The point where the total revenue line intersects the total cost line is called the:

A)origin

B)breakeven point

C)X axis intercept

D)Y axis intercept

A)origin

B)breakeven point

C)X axis intercept

D)Y axis intercept

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

14

Contribution Margin is defined as:

A)Selling price less variable cost

B)Selling price less operating expenses

C)Sales less fixed cost

D)Sales less variable cost and mixed cost

A)Selling price less variable cost

B)Selling price less operating expenses

C)Sales less fixed cost

D)Sales less variable cost and mixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

15

The breakeven point is the point at which:

A)total contribution margin equals total fixed costs

B)total fixed costs equal total variable costs

C)the total revenue line intersects the Y axis

D)the total cost line intersects the X axis

A)total contribution margin equals total fixed costs

B)total fixed costs equal total variable costs

C)the total revenue line intersects the Y axis

D)the total cost line intersects the X axis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

16

True Fruit,Inc.sells frozen raspberry fruit bars for $2.50 each.The variable cost per bar is $1.35.Total fixed costs are $25,645.The contribution margin ratio is:

A).54

B).46

C).22

D).19

A).54

B).46

C).22

D).19

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

17

True Fruit,Inc.sells frozen raspberry fruit bars for $2.50 each.The variable cost per bar is $1.35.Total fixed costs are $25,645.The breakeven point in units is:

A)10,258

B)18,996

C)22,300

D)25,260

A)10,258

B)18,996

C)22,300

D)25,260

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

18

The contribution margin ratio is calculated as:

A)variable cost per unit/fixed cost per unit

B)selling price per unit/variable cost per unit

C)total fixed cost/contribution margin per unit

D)contribution margin per unit/selling price per unit

A)variable cost per unit/fixed cost per unit

B)selling price per unit/variable cost per unit

C)total fixed cost/contribution margin per unit

D)contribution margin per unit/selling price per unit

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

19

If only the variable cost decreases the breakeven point

A)Decreases

B)Increases

C)Stays the same

D)Depends on customer demand

A)Decreases

B)Increases

C)Stays the same

D)Depends on customer demand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following is a short-term operating decision?

A)Decision to make a new product

B)Decision to buy a new plant

C)Decision to discontinue a product line

D)Decision to reduce the normal price to get large order from one customer

A)Decision to make a new product

B)Decision to buy a new plant

C)Decision to discontinue a product line

D)Decision to reduce the normal price to get large order from one customer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

21

Use the following to answer questions

Ogallah Inc. sells its product for $9.25 per unit. The variable costs per units are $2.50 and total fixed costs are $452,250. If Ogallah buys new software for the production process at a cost of $55,250, variable costs will be reduced by 20%.

Assuming Ogallah purchases the software,the breakeven point will be:

A)70,000

B)62,379

C)50,000

D)30,000

Ogallah Inc. sells its product for $9.25 per unit. The variable costs per units are $2.50 and total fixed costs are $452,250. If Ogallah buys new software for the production process at a cost of $55,250, variable costs will be reduced by 20%.

Assuming Ogallah purchases the software,the breakeven point will be:

A)70,000

B)62,379

C)50,000

D)30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Manhattan Company sells its one and only product for $89.00 per unit.Variable costs per unit amount to $63.50,and total fixed costs are $3,697,500.If Manhattan increases its total fixed costs by $267,500 it can reduce variable costs by $5.00 per unit.How will this affect the breakeven point in units?

A)The breakeven point will increase 48,415 units

B)The breakeven point will decrease 15,000 units

C)The breakeven point will increase 22,317 units

D)The breakeven point will decrease 32,540 units

A)The breakeven point will increase 48,415 units

B)The breakeven point will decrease 15,000 units

C)The breakeven point will increase 22,317 units

D)The breakeven point will decrease 32,540 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

23

Kapalua,Inc.manufactures hand held planners.The selling price per unit is $355.00,with variable costs per unit of $91.50.The corporate tax rate is 35%.If Kapalua can sell 15,000 units and can earn an after-tax profit of $1,513,000,total fixed costs must be:

A)$3,812,000

B)$3,952,000

C)$1,624,808

D)$1,372,500

A)$3,812,000

B)$3,952,000

C)$1,624,808

D)$1,372,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

24

The Foggy Daze Company sells a "one size fits all" rain poncho for $11.50.Variable costs per unit are $3.86,while total fixed costs amount to $572,200.The corporate tax rate is 30% and the company wants to earn an after-tax profit of $209,000.How many units must be sold to achieve the after-tax profit goal?

A)102,251

B)113,975

C)75,720

D)74,896

A)102,251

B)113,975

C)75,720

D)74,896

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

25

Bug-Ez Corporation manufactures one product,Itch-A-Way,which,when applied to a bug bite,soothes the itch.The unit contribution margin for Itch-A-Way is $4.20,while total fixed costs amount to $537,000.Given a selling price of $8.25 per unit and a target profit of $147,000,Bug-Ez must sell:

A)35,000 units

B)168,889 units

C)82,909 units

D)162,858 units

A)35,000 units

B)168,889 units

C)82,909 units

D)162,858 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

26

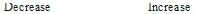

If selling price per unit increases,how will this affect the contribution margin and breakeven point?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

27

The Foggy Daze Company sells a "one size fits all" rain poncho for $11.50.Variable costs per unit are $3.86,while total fixed costs amount to $572,200.The corporate tax rate is 30% and the company wants to earn an after-tax profit of $209,000.The breakeven point in units is:

A)102,251

B)113,975

C)75,720

D)74,896

A)102,251

B)113,975

C)75,720

D)74,896

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

28

Bug-Ez Corporation manufactures one product,Itch-A-Way,which,when applied to a bug bite soothes the itch.The unit contribution margin for Itch-A-Way is $4.20,while total fixed costs amount to $537,000.Given a selling price of $8.25 per unit,the breakeven point in units is:

A)127,858

B)130,000

C)132,597

D)65,091

A)127,858

B)130,000

C)132,597

D)65,091

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

29

Kapalua,Inc.manufactures hand held planners.Total fixed costs are $3,950,000,with variable costs per unit of $148.28.The corporate tax rate is 35%.If Kapalua can sell 39,242 units,the per unit selling price necessary to earn an after-tax profit of $1,430,000 must be:

A)$305.00

B)$285.38

C)$353.05

D)$248.94

A)$305.00

B)$285.38

C)$353.05

D)$248.94

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

30

Use the following to answer questions

Ogallah Inc. sells its product for $9.25 per unit. The variable costs per units are $2.50 and total fixed costs are $452,250. If Ogallah buys new software for the production process at a cost of $55,250, variable costs will be reduced by 20%.

The breakeven point prior to the purchase of the computer is:

A)180,900

B)70,000

C)67,000

D)48,892

Ogallah Inc. sells its product for $9.25 per unit. The variable costs per units are $2.50 and total fixed costs are $452,250. If Ogallah buys new software for the production process at a cost of $55,250, variable costs will be reduced by 20%.

The breakeven point prior to the purchase of the computer is:

A)180,900

B)70,000

C)67,000

D)48,892

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the following to answer questions

Ogallah Inc. sells its product for $9.25 per unit. The variable costs per units are $2.50 and total fixed costs are $452,250. If Ogallah buys new software for the production process at a cost of $55,250, variable costs will be reduced by 20%.

If Ogallah raised the selling price of its product,what effect would that have on the breakeven point prior to and after the purchase of the computer,respectively?

A)decrease/decrease

B)increase/increase

C)decrease/increase

D)increase/decrease

Ogallah Inc. sells its product for $9.25 per unit. The variable costs per units are $2.50 and total fixed costs are $452,250. If Ogallah buys new software for the production process at a cost of $55,250, variable costs will be reduced by 20%.

If Ogallah raised the selling price of its product,what effect would that have on the breakeven point prior to and after the purchase of the computer,respectively?

A)decrease/decrease

B)increase/increase

C)decrease/increase

D)increase/decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

32

Bug-Ez Corporation manufactures one product,Itch-A-Way,which,when applied to a bug bite,soothes the itch.The unit contribution margin for Itch-A-Way is $4.20,while total fixed costs amount to $537,000.Given a selling price of $8.25 per unit and a target profit of $147,000,Bug-Ez must have total sales of:

A)$1,054,821

B)$709,334

C)$683,999

D)$1,343,578

A)$1,054,821

B)$709,334

C)$683,999

D)$1,343,578

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

33

The Foggy Daze Company sells a "one size fits all" rain poncho for $11.50.Variable costs per unit are $3.86,while total fixed costs amount to $572,200.The corporate tax rate is 30% and the company wants to earn an after-tax profit of $209,000.The total sales needed to break even are:

A)$1,175,886

B)$1,310,712

C)$870,780

D)$861,304

A)$1,175,886

B)$1,310,712

C)$870,780

D)$861,304

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

34

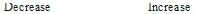

If variable cost per unit increases,how will this affect the contribution margin and breakeven point?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

35

The Manhattan Company sells its one and only product for $89.00 per unit.Variable costs per unit amount to $63.50,and total fixed costs are $3,697,500.If management desires a before tax profit of $765,000,total sales revenue must equal:

A)$ 2,670,000

B)$ 4,462,500

C)$15,575,000

D)$68,085,000

A)$ 2,670,000

B)$ 4,462,500

C)$15,575,000

D)$68,085,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

36

Adagio Company had sales of 2,500 units more than breakeven point.Adagio 's fixed costs are $500,000 and its contribution margin was $20 per unit.How many units did Adagio sell?

A)2,500

B)25,000

C)27,500

D)unable to determine from the information given

A)2,500

B)25,000

C)27,500

D)unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

37

The Manhattan Company sells its one and only product for $89.00 per unit.Variable costs per unit amount to $63.50,and total fixed costs are $3,697,500.If Manhattan increases its selling price to $95 how will this affect the breakeven point in units?

A)The breakeven point will increase 28,889 units

B)The breakeven point will decrease 116,111 units

C)The breakeven point will increase 116,111 units

D)The breakeven point will decrease 28,889 units

A)The breakeven point will increase 28,889 units

B)The breakeven point will decrease 116,111 units

C)The breakeven point will increase 116,111 units

D)The breakeven point will decrease 28,889 units

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

38

If fixed costs increase,how will this affect the contribution margin and profit?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

39

Andante Company had sales of 1,500 units more than breakeven point.Andante's fixed costs are $450,000 and its contribution margin was $30 per unit.How much profit did Andante have?

A)$45,000

B)$405,000

C)$495,000

D)unable to determine from the information given

A)$45,000

B)$405,000

C)$495,000

D)unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

40

True Fruit,Inc.sells frozen raspberry fruit bars for $2.50 each.The variable cost per bar is $1.35.Total fixed costs are $25,645.The breakeven point in sales dollars is:

A)$25,645

B)$47,490

C)$55,750

D)$63,150

A)$25,645

B)$47,490

C)$55,750

D)$63,150

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

41

Use the following to answer questions

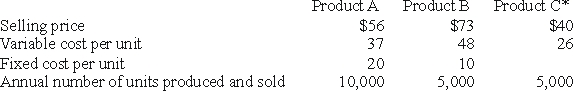

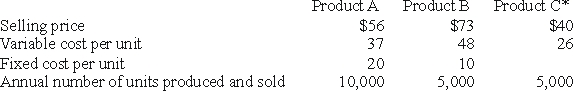

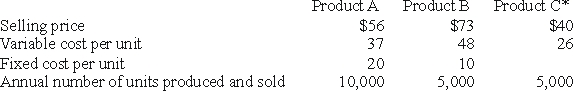

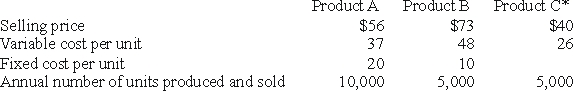

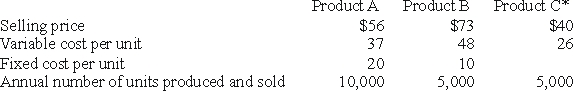

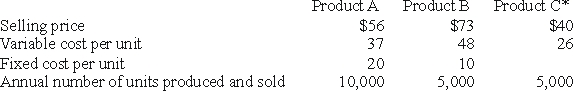

JJ Enterprises currently manufactures two products, A and B. It is considering adding a new product, Product C. The following table shows current information for products A and B, as well as projected data for Product C.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

If JJ Enterprises adds Product C,the total incremental revenue will be:

A)$1,125,000

B)$ 200,000

C)$ 70,000

D)$ 7,500

JJ Enterprises currently manufactures two products, A and B. It is considering adding a new product, Product C. The following table shows current information for products A and B, as well as projected data for Product C.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.If JJ Enterprises adds Product C,the total incremental revenue will be:

A)$1,125,000

B)$ 200,000

C)$ 70,000

D)$ 7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

42

If a company decreases its fixed cost and decreases its variable cost,what is the impact on its contribution margin and breakeven point?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

43

If a company decreases its fixed cost and decreases its variable cost,what is the impact on its contribution margin and breakeven point?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

44

All of the following are steps in incremental analysis except:

A)identify the alternative actions

B)determine the incremental revenue

C)determine the relevant costs of each alternative

D)choose the alternative that produces the highest revenue

A)identify the alternative actions

B)determine the incremental revenue

C)determine the relevant costs of each alternative

D)choose the alternative that produces the highest revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

45

The salary of an executive who decides to quit her job and return to school full time is a(n):

A)sunk cost

B)incremental cost

C)opportunity cost

D)incremental revenue

A)sunk cost

B)incremental cost

C)opportunity cost

D)incremental revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the following to answer questions

JJ Enterprises currently manufactures two products, A and B. It is considering adding a new product, Product C. The following table shows current information for products A and B, as well as projected data for Product C.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

The incremental income in the decision whether or not to manufacture Product C is:

A)$200,000

B)$135,000

C)$ 70,000

D)$ 62,500

JJ Enterprises currently manufactures two products, A and B. It is considering adding a new product, Product C. The following table shows current information for products A and B, as well as projected data for Product C.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.The incremental income in the decision whether or not to manufacture Product C is:

A)$200,000

B)$135,000

C)$ 70,000

D)$ 62,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

47

In making a decision regarding whether or not to sell a tract of land,the purchase price of the land is a(n):

A)incremental cost

B)opportunity cost

C)relevant cost

D)sunk cost

A)incremental cost

B)opportunity cost

C)relevant cost

D)sunk cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

48

The change in total revenue,if one alternative is implemented instead of another,is referred to as:

A)sales revenue

B)joint revenue

C)operating revenue

D)incremental revenue

A)sales revenue

B)joint revenue

C)operating revenue

D)incremental revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

49

If a manufacturer's cost of direct material increases,how will this affect breakeven point?

A)no effect

B)decrease

C)increase

D)unable to determine from the information given

A)no effect

B)decrease

C)increase

D)unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

50

The rule for making sound economic decisions is that one should choose the alternative with the

A)highest contribution margin

B)lowest opportunity cost

C)lowest sunk costs

D)highest revenue

A)highest contribution margin

B)lowest opportunity cost

C)lowest sunk costs

D)highest revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

51

Opportunity costs:

A)are irrelevant

B)are the foregone benefits of the next best alternative

C)are the costs associated with the selected alternative

D)are the combined benefits of all alternatives other than the one selected

A)are irrelevant

B)are the foregone benefits of the next best alternative

C)are the costs associated with the selected alternative

D)are the combined benefits of all alternatives other than the one selected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

52

Use the following to answer questions

JJ Enterprises currently manufactures two products, A and B. It is considering adding a new product, Product C. The following table shows current information for products A and B, as well as projected data for Product C.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

If JJ Enterprises adds Product C,the total incremental cost will be:

A)$740,000

B)$330,000

C)$137,500

D)$130,000

JJ Enterprises currently manufactures two products, A and B. It is considering adding a new product, Product C. The following table shows current information for products A and B, as well as projected data for Product C.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.

*NOTE: If Product C is produced, one-fourth of the company's common costs, which are fixed costs, will be allocated to Product C, with one-half and one-fourth allocated to products A and B, respectively.If JJ Enterprises adds Product C,the total incremental cost will be:

A)$740,000

B)$330,000

C)$137,500

D)$130,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

53

Expenditures associated with items already purchased,that are irrelevant to future decisions are called:

A)opportunity costs

B)incremental costs

C)sunk costs

D)joint costs

A)opportunity costs

B)incremental costs

C)sunk costs

D)joint costs

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

54

Meadow Glow Company desires an after-tax profit of $140,000.Its sales price and variable costs are $100 and $40 per unit,respectively.Fixed costs total $340,000.Assuming a 30% tax rate,how many units must Meadow Glow sell to achieve its desired profit?

A)14,000

B)9,000

C)8,000

D)5,667

A)14,000

B)9,000

C)8,000

D)5,667

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

55

Purinton Company has prepared the following income statement for the year:  How far above breakeven point is Purinton operating?

How far above breakeven point is Purinton operating?

A)9,000 units

B)6,480 units

C)15,000 units

D)unable to determine from the information given

How far above breakeven point is Purinton operating?

How far above breakeven point is Purinton operating?A)9,000 units

B)6,480 units

C)15,000 units

D)unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

56

When analyzing the incremental costs used to help make a short-term operating decision:

A)fixed costs are irrelevant

B)variable costs are irrelevant

C)both fixed costs and variable costs are relevant

D)incremental revenues are irrelevant

A)fixed costs are irrelevant

B)variable costs are irrelevant

C)both fixed costs and variable costs are relevant

D)incremental revenues are irrelevant

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

57

Short-term operating decisions:

A)assume current capacity is fixed

B)arise during the planning phase of the management cycle

C)arise during the evaluating phase of the management cycle

D)are usually routine decisions which are not unique to any particular situation

A)assume current capacity is fixed

B)arise during the planning phase of the management cycle

C)arise during the evaluating phase of the management cycle

D)are usually routine decisions which are not unique to any particular situation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

58

The change in total cost,if one alternative is implemented instead of another,is referred to as:

A)incremental cost

B)opportunity cost

C)changing cost

D)joint cost

A)incremental cost

B)opportunity cost

C)changing cost

D)joint cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

59

When deciding to purchase new equipment the cost of equipment being replaced is a(n):

A)sunk cost

B)incremental cost

C)opportunity cost

D)incremental revenue

A)sunk cost

B)incremental cost

C)opportunity cost

D)incremental revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

60

If a company increases the sales commission rate from 5% to 8% how will this impact the contribution margin and the breakeven point?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

61

Qualco inspects 10% of each raw material shipment received.The inspection costs are an example of a/an

A)unit-related cost.

B)batch-related cost.

C)facility-sustaining cost.

D)product-sustaining cost.

A)unit-related cost.

B)batch-related cost.

C)facility-sustaining cost.

D)product-sustaining cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use the following to answer questions

Knockdown Products normally sells boxing gloves for $85 a pair. Knockdown just received a special order for 1,500 pair at a price of $50 a pair. To purchase, store, and ship the gloves, it costs a total of $55 a pair, which consists of $43 in variable costs and $12 in fixed costs.

Assuming Knockdown has enough excess gloves on hand to fill the special order,it should:

A)reject the offer since income will decrease by $7,500

B)accept the offer since income will increase by $7,500

C)reject the offer since income will decrease by $10,500

D)accept the offer since income will increase by $10,500

Knockdown Products normally sells boxing gloves for $85 a pair. Knockdown just received a special order for 1,500 pair at a price of $50 a pair. To purchase, store, and ship the gloves, it costs a total of $55 a pair, which consists of $43 in variable costs and $12 in fixed costs.

Assuming Knockdown has enough excess gloves on hand to fill the special order,it should:

A)reject the offer since income will decrease by $7,500

B)accept the offer since income will increase by $7,500

C)reject the offer since income will decrease by $10,500

D)accept the offer since income will increase by $10,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

63

A product line should be temporarily discontinued if

A)it is operating at a loss.

B)it is failing to produce the desired profit.

C)the relevant costs saved exceed the relevant revenue lost

D)dropping the product line will adversely affect remaining workers.

A)it is operating at a loss.

B)it is failing to produce the desired profit.

C)the relevant costs saved exceed the relevant revenue lost

D)dropping the product line will adversely affect remaining workers.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

64

Direct labor is an example of a:

A)unit-related cost.

B)batch-related cost.

C)facility-sustaining cost.

D)product-sustaining cost.

A)unit-related cost.

B)batch-related cost.

C)facility-sustaining cost.

D)product-sustaining cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

65

The cost associated with maintaining the manufacturing equipment daily is a/an

A)unit-related cost.

B)batch-related cost

C)facility-sustaining cost

D)product-sustaining cost

A)unit-related cost.

B)batch-related cost

C)facility-sustaining cost

D)product-sustaining cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use the following to answer questions

Knockdown Products normally sells boxing gloves for $85 a pair. Knockdown just received a special order for 1,500 pair at a price of $50 a pair. To purchase, store, and ship the gloves, it costs a total of $55 a pair, which consists of $43 in variable costs and $12 in fixed costs.

Assuming Knockdown has no way of purchasing any additional gloves,and,that accepting this order will mean losing an equivalent quantity of sales to regular customers,Knockdown should:

A)reject the offer since income will decrease by $7,500

B)accept the offer since income will increase by $7,500

C)reject the offer since income will decrease by $52,500

D)accept the offer since income will increase by $52,500

Knockdown Products normally sells boxing gloves for $85 a pair. Knockdown just received a special order for 1,500 pair at a price of $50 a pair. To purchase, store, and ship the gloves, it costs a total of $55 a pair, which consists of $43 in variable costs and $12 in fixed costs.

Assuming Knockdown has no way of purchasing any additional gloves,and,that accepting this order will mean losing an equivalent quantity of sales to regular customers,Knockdown should:

A)reject the offer since income will decrease by $7,500

B)accept the offer since income will increase by $7,500

C)reject the offer since income will decrease by $52,500

D)accept the offer since income will increase by $52,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

67

Define and distinguish between a sunk cost and an opportunity cost,and give an example of each.Is each one relevant to decision making? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

68

Nichols Corporation is trying to decide whether to sell its carpet-quality thread or to manufacture the carpets itself.Under which of the following conditions should Nichols sell its thread?

A)The incremental revenue from further processing is less than the incremental costs.

B)The incremental revenue from further processing is greater than the incremental costs.

C)The incremental cost from further processing is less than the cost of manufacturing the thread.

D)The incremental cost from further processing is greater than the cost of manufacturing the thread.

A)The incremental revenue from further processing is less than the incremental costs.

B)The incremental revenue from further processing is greater than the incremental costs.

C)The incremental cost from further processing is less than the cost of manufacturing the thread.

D)The incremental cost from further processing is greater than the cost of manufacturing the thread.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

69

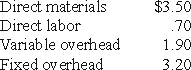

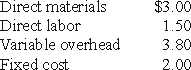

Marquette Company currently produces all its product components.Another firm has offered to supply the casings at $6 each.Marquette's total cost per casing is as follows:  The fixed overhead is based on production of 3,000 casings,and none of it would be eliminated if Marquette accepted the offer.By how much would profit change if Leggier accepts this offer and purchases 3,000 casings?

The fixed overhead is based on production of 3,000 casings,and none of it would be eliminated if Marquette accepted the offer.By how much would profit change if Leggier accepts this offer and purchases 3,000 casings?

A)$7,500 increase

B)$9,900 decrease

C)$5,400 increase

D)$300 decrease

The fixed overhead is based on production of 3,000 casings,and none of it would be eliminated if Marquette accepted the offer.By how much would profit change if Leggier accepts this offer and purchases 3,000 casings?

The fixed overhead is based on production of 3,000 casings,and none of it would be eliminated if Marquette accepted the offer.By how much would profit change if Leggier accepts this offer and purchases 3,000 casings?A)$7,500 increase

B)$9,900 decrease

C)$5,400 increase

D)$300 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

70

Explain the effect on breakeven point of an (

A)increase in sales price,(b)a decrease in materials cost,and (c)an increase in insurance cost on the factory.

A)increase in sales price,(b)a decrease in materials cost,and (c)an increase in insurance cost on the factory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

71

Use the following to answer questions

Naui Industries produces flowered shirts which normally sell for $24 each. The total cost to manufacture each shirt is $17, which consists of $11 of variable costs and $6 of fixed costs. A hotel chain has approached Naui with a special order for 2,000 shirts at $15 each.

Assuming Naui has sufficient excess capacity to fill this special order without affecting sales to current customers,it should:

A)reject the offer since income will decrease by $8,000

B)accept the offer since income will increase by $8,000

C)reject the offer since income will decrease by $4,000

D)accept the offer since income will increase by $4,000

Naui Industries produces flowered shirts which normally sell for $24 each. The total cost to manufacture each shirt is $17, which consists of $11 of variable costs and $6 of fixed costs. A hotel chain has approached Naui with a special order for 2,000 shirts at $15 each.

Assuming Naui has sufficient excess capacity to fill this special order without affecting sales to current customers,it should:

A)reject the offer since income will decrease by $8,000

B)accept the offer since income will increase by $8,000

C)reject the offer since income will decrease by $4,000

D)accept the offer since income will increase by $4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

72

Cameron Company is considering discontinuing production of one of its products and buying the product instead.Which of the following would not be relevant to this decision?

A)opportunity costs

B)incremental costs

C)product quality

D)sales price

A)opportunity costs

B)incremental costs

C)product quality

D)sales price

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

73

Brio Company is considering eliminating a product line.If it eliminates the product,equipment,which originally cost $250,000,will be disposed of for $6,000.The equipment has a book value of $75,000 and annual depreciation of $25,000.Ignoring income tax,what is the relevant amount for the product-elimination decision?

A)$250,000

B)$75,000

C)$25,000

D)$6,000

A)$250,000

B)$75,000

C)$25,000

D)$6,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

74

Nowlin & Rudder is a manufacturer of sports equipment.It has been approached by a large European retailer about the possibility of producing a special order of tennis rackets.Under which of the following conditions should Nowlin & Rudder accept this offer?

A)The firm has the capacity to produce the special order.

B)The firm has the capacity to produce the special order and the special-order price exceeds the fixed cost related to of the special order.

C)The firm has the capacity to produce the special order and the special-order price exceeds the total variable cost of the special order.

D)The firm has the capacity to produce the special order and the special-order price exceeds the incremental cost of the special order.

A)The firm has the capacity to produce the special order.

B)The firm has the capacity to produce the special order and the special-order price exceeds the fixed cost related to of the special order.

C)The firm has the capacity to produce the special order and the special-order price exceeds the total variable cost of the special order.

D)The firm has the capacity to produce the special order and the special-order price exceeds the incremental cost of the special order.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

75

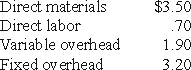

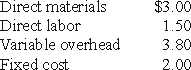

Bean Town Company currently produces and sells 12,000 units of its product each month at $15 each.Another firm has offered to buy an additional 1,000 units at $10 per unit.Bean Town's total cost per unit is as follows:  Fixed overhead costs per unit are based on production of 12,000 units per month.Bean Town currently has the capacity to produce 15,000 units per month.By how much would profit change if Bean Town accepts this offer?

Fixed overhead costs per unit are based on production of 12,000 units per month.Bean Town currently has the capacity to produce 15,000 units per month.By how much would profit change if Bean Town accepts this offer?

A)$7,000 increase

B)$5,500 increase

C)$1,700 increase

D)$300 decrease

Fixed overhead costs per unit are based on production of 12,000 units per month.Bean Town currently has the capacity to produce 15,000 units per month.By how much would profit change if Bean Town accepts this offer?

Fixed overhead costs per unit are based on production of 12,000 units per month.Bean Town currently has the capacity to produce 15,000 units per month.By how much would profit change if Bean Town accepts this offer?A)$7,000 increase

B)$5,500 increase

C)$1,700 increase

D)$300 decrease

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

76

Managers of Prestissimo Corporation are thinking about eliminating one of their products,EasyGlo.EasyGlo sells for $8 per unit.Unit-related costs are $5,batch-related costs are $300 per batch,and 3 batches of EasyGlo have been required each month.Prestissimo spends $3,000 each month to advertise EasyGlo.Rent and insurance on the factory allocated to EasyGlo total $4,000.If Prestissimo is currently producing and selling 1,500 units of EasyGlo each month,what is the relevant profit for the product-elimination decision?

A)$4,500

B)$3,600

C)$ 600

D)($3,400)

A)$4,500

B)$3,600

C)$ 600

D)($3,400)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

77

Managers of Pianissimo Corporation are thinking about eliminating one of their products,MoreGlo.MoreGlo sells for $10 per unit.Unit-related costs are $6,batch-related costs are $400 per batch,and 4 batches of MoreGlo have been required each month.Pianissimo spends $4,000 each month to advertise MoreGlo.Rent and insurance on the factory allocated to MoreGlo total $2,000.If Pianissimo is currently producing and selling 1,500 units of MoreGlo each month,it should not eliminate MoreGlo as long as relevant profit is at least

A)$1

B)$400

C)$2,000

D)$4,400

A)$1

B)$400

C)$2,000

D)$4,400

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

78

Salaries of product-line managers are an example of a/an

A)unit-related cost.

B)batch-related cost.

C)facility-sustaining cost.

D)product-sustaining cost.

A)unit-related cost.

B)batch-related cost.

C)facility-sustaining cost.

D)product-sustaining cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

79

Explain the effect on breakeven point of an increase in (

A)direct labor cost and (b)factory rent.

A)direct labor cost and (b)factory rent.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck

80

Use the following to answer questions

Naui Industries produces flowered shirts which normally sell for $24 each. The total cost to manufacture each shirt is $17, which consists of $11 of variable costs and $6 of fixed costs. A hotel chain has approached Naui with a special order for 2,000 shirts at $15 each.

Assuming Naui presently sells all the shirts it produces,and therefore would have to cancel some of its current orders to fill the special order,Naui should:

A)reject the offer since income will decrease by $18,000

B)accept the offer since income will increase by $18,000

C)reject the offer since income will decrease by $14,000

D)accept the offer since income will increase by $14,000

Naui Industries produces flowered shirts which normally sell for $24 each. The total cost to manufacture each shirt is $17, which consists of $11 of variable costs and $6 of fixed costs. A hotel chain has approached Naui with a special order for 2,000 shirts at $15 each.

Assuming Naui presently sells all the shirts it produces,and therefore would have to cancel some of its current orders to fill the special order,Naui should:

A)reject the offer since income will decrease by $18,000

B)accept the offer since income will increase by $18,000

C)reject the offer since income will decrease by $14,000

D)accept the offer since income will increase by $14,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 103 في هذه المجموعة.

فتح الحزمة

k this deck