Deck 3: Operating Processes: Planning and Control

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

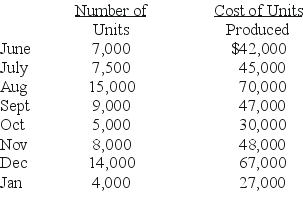

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

سؤال

Match between columns

سؤال

Match between columns

سؤال

سؤال

سؤال

Match between columns

سؤال

سؤال

Match between columns

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/69

العب

ملء الشاشة (f)

Deck 3: Operating Processes: Planning and Control

1

A sales invoice originates with the:

A)Vendor

B)Purchasing Department

C)Sales Department

D)Accounting Department

A)Vendor

B)Purchasing Department

C)Sales Department

D)Accounting Department

Sales Department

2

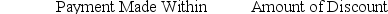

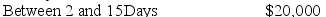

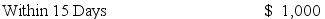

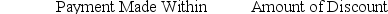

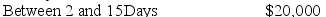

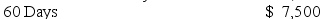

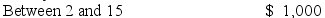

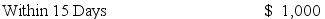

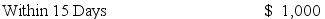

The Banner Company ordered $50,000 of fertilizer from Farmland Industries and were given terms of 2/15 net/60.Which of the following describes how soon the payment must be made in order to receive a discount and the amount of the discount available.

A)

B)

C)

D)

A)

B)

C)

D)

3

Which of the following is not part of the revenue process?

A)Receive and accept order for goods and services

B)Receive goods and services

C)Receive payments for goods and services rendered

D)Provide customer support

A)Receive and accept order for goods and services

B)Receive goods and services

C)Receive payments for goods and services rendered

D)Provide customer support

Receive goods and services

4

Which of the following would not be collected from the customer when an order is received?

A)Type of inventory ordered

B)Name of common carrier that will deliver the goods

C)Price Quoted

D)Delivery Date

E)All of the above will be collected

A)Type of inventory ordered

B)Name of common carrier that will deliver the goods

C)Price Quoted

D)Delivery Date

E)All of the above will be collected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following would not be collected from the customer when an order is received?

A)Price Quoted

B)Amount and type of inventory ordered

C)Sellers cost of the product

D)Delivery Date

E)All of the above will be collected

A)Price Quoted

B)Amount and type of inventory ordered

C)Sellers cost of the product

D)Delivery Date

E)All of the above will be collected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

6

A document sent by the purchasing department to order a specific quantity of goods or services is called a:

A)Vendor invoice

B)Purchasing report

C)Purchase order

D)Purchase requisition

A)Vendor invoice

B)Purchasing report

C)Purchase order

D)Purchase requisition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

7

The Quinter Corporation ordered material for its manufacturing process with a price of $75,000 and that had terms of 1/10 net/30.What is the lowest amount of cash Quinter will have to pay if it meets the terms of the discount agreement?

A)$67,500

B)$75,000

C)$74,250

D)$52,500

A)$67,500

B)$75,000

C)$74,250

D)$52,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following is part of the revenue process?

A)Provide customer support

B)Pay suppliers for inventory

C)Convert raw material into inventory for sale

D)Order inventory for resale

A)Provide customer support

B)Pay suppliers for inventory

C)Convert raw material into inventory for sale

D)Order inventory for resale

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

9

Decatron,Inc.purchased $76,500 of parts from a vendor who offered credit terms of 3/15,n/45.If Decatron takes advantage of the discount,the amount paid to the vendor (rounded to the nearest dollar)will be:

A)$74,205

B)$76,500

C)$76,271

D)cannot be determined from the information given

A)$74,205

B)$76,500

C)$76,271

D)cannot be determined from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

10

Veta Corporation purchased $14,650 in supplies from a vendor offering credit terms of 2/10,n/30.If Veta takes advantage of the discount,the amount paid to the vendor (rounded to the nearest dollar)will be:

A)$14,650

B)$14,621

C)$14,357

D)$13,185

A)$14,650

B)$14,621

C)$14,357

D)$13,185

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

11

Determining the credit and payment policies for customers is part of the:

A)Revenue process

B)Collection process

C)Expenditure process

D)Conversion Process

A)Revenue process

B)Collection process

C)Expenditure process

D)Conversion Process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

12

Determining the company's needs for goods and services is associated with which of the following processes?

A)Revenue process

B)Expenditure process

C)Conversion process

D)Evaluation process

A)Revenue process

B)Expenditure process

C)Conversion process

D)Evaluation process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

13

Selecting suppliers for a company's goods and services is part of the:

A)Revenue process

B)Expenditure process

C)Selection process

D)Conversion process

A)Revenue process

B)Expenditure process

C)Selection process

D)Conversion process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

14

Which of the following is not part of the expenditure process?

A)Receiving goods and services

B)Paying suppliers

C)Ordering goods and services

D)Using equipment to manufacture products

A)Receiving goods and services

B)Paying suppliers

C)Ordering goods and services

D)Using equipment to manufacture products

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is not information that a company should collect from a customer when it receive an order?

A)Address

B)Inventory ordered

C)Credit information

D)How goods will reach the customer

E)All of the above should be collected

A)Address

B)Inventory ordered

C)Credit information

D)How goods will reach the customer

E)All of the above should be collected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

16

Delivery of goods is associated with which of the following process?

A)Revenue process

B)Expenditure process

C)Conversion process

D)Evaluation process

A)Revenue process

B)Expenditure process

C)Conversion process

D)Evaluation process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is not part of the conversion process?

A)Machine set ups.

B)Paying for the raw material used in production.

C)Storing the raw material used in production.

D)Storing finished manufactured goods until sold

A)Machine set ups.

B)Paying for the raw material used in production.

C)Storing the raw material used in production.

D)Storing finished manufactured goods until sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is part of the conversion process?

A)Storing finished manufactured goods until they are sold

B)Accepting orders for manufactured goods.

C)Paying salaries for the sales personnel who sell the product

D)Pay the freight to deliver the product to the customer

A)Storing finished manufactured goods until they are sold

B)Accepting orders for manufactured goods.

C)Paying salaries for the sales personnel who sell the product

D)Pay the freight to deliver the product to the customer

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

19

Norton Corporation has purchased raw materials from a vendor and was offered credit terms of 2/10,n/30.Which of the following reflects these terms?

A)20% discount (2/10)if paid within 30 days

B)2% discount if paid within 10 days

C)10% discount if paid within 30 days and 2% after 30 days

D)2% discount if paid between 10 and 30 days.

A)20% discount (2/10)if paid within 30 days

B)2% discount if paid within 10 days

C)10% discount if paid within 30 days and 2% after 30 days

D)2% discount if paid between 10 and 30 days.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

20

Manufacturing products is associated with which of the following processes?

A)Revenue process

B)Expenditure process

C)Conversion process

D)Evaluation process

A)Revenue process

B)Expenditure process

C)Conversion process

D)Evaluation process

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

21

Y = m(X)is the formula for a(n):

A)Activity cost

B)Variable cost

C)Fixed cost

D)Mixed cost

A)Activity cost

B)Variable cost

C)Fixed cost

D)Mixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

22

Which of the following is not a fixed cost?

A)President's salary

B)Supervisor's salary

C)Monthly rent of factory equipment

D)Utility cost

A)President's salary

B)Supervisor's salary

C)Monthly rent of factory equipment

D)Utility cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

23

Carmen Corporation ordered materials from Bizet Manufacturing on November 1,2010,Bizet shipped the materials by barge on November 5 and the barge company notified Carmen on November 22,that the goods had arrived.Carmen picked up the materials on November 23.The terms of the sale are FOB destination.On what date should Carmen consider this a purchase?

A)November 1

B)November 5

C)November 22

D)November 23

A)November 1

B)November 5

C)November 22

D)November 23

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

24

A linear regression analysis indicated a constant of 6,025.50,an X coefficient of 24.75,and an R-squared of 0.65.The estimated cost when the independent variable is 350 is:

A)$55,386

B)$14,688

C)$11,657

D)$10,629

A)$55,386

B)$14,688

C)$11,657

D)$10,629

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

25

The document listing the quantities of materials and parts needed by the production department is referred to as a:

A)Operations list

B)Bill of lading

C)Production order

D)Materials requisition

A)Operations list

B)Bill of lading

C)Production order

D)Materials requisition

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

26

Goods shipped from a seller's warehouse on June 10,2010,arrived at the buyer's warehouse on June 16,2010.The invoice for the goods arrived at the buyer's accounting department on June 13,2010 and was paid on June 20,2010.If the goods were sold FOB destination,the buyer took legal title on:

A)June 20,2008

B)June 13,2008

C)June 10,2008

D)June 16,2008

A)June 20,2008

B)June 13,2008

C)June 10,2008

D)June 16,2008

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

27

Goods shipped from a seller's warehouse on April 10 using the terms FOB Shipping Point.On the way to the buyer's warehouse the truck hauling the goods wrecked and the

Goods were destroyed.Who will get the insurance check covering the loss?

A)The seller

B)The buyer

C)The seller and buyer split the loss.

D)The delivery company.

Goods were destroyed.Who will get the insurance check covering the loss?

A)The seller

B)The buyer

C)The seller and buyer split the loss.

D)The delivery company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

28

The formula for a fixed cost is:

A)Y = m(X)+ b where m is equal to 0.

B)Y = m(X)+ b where m is equal to 1.

C)Y = m(X)+ b

D)Y = m(X)+ b(X)

A)Y = m(X)+ b where m is equal to 0.

B)Y = m(X)+ b where m is equal to 1.

C)Y = m(X)+ b

D)Y = m(X)+ b(X)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

29

In linear regression analysis,the dependent variable is:

A)Labeled X in the linear equation

B)Referred to as the intercept

C)The cost driver

D)The total cost

A)Labeled X in the linear equation

B)Referred to as the intercept

C)The cost driver

D)The total cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

30

A cost that is constant per unit but varies in total is called a(n):

A)Activity cost

B)Variable cost

C)Fixed cost

D)Mixed cost

A)Activity cost

B)Variable cost

C)Fixed cost

D)Mixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

31

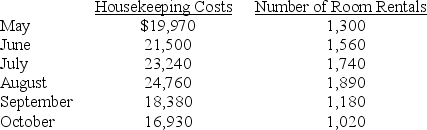

Use the following to answer questions

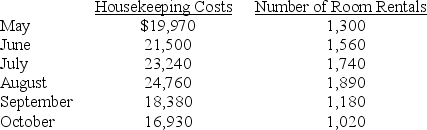

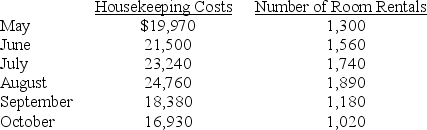

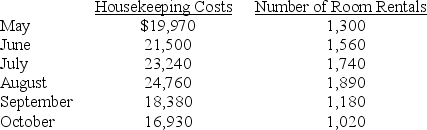

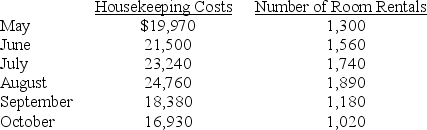

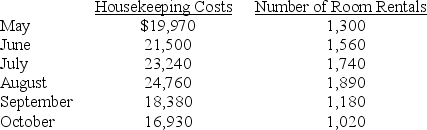

The TLC Motel, which uses the high/low method to estimate its total cost formula, gathered the following data for the first six months of its current fiscal year:

The variable housekeeping cost per room rental is:

A)$14.36

B)$10.13

C)$ 9.06

D)$ 9.00

The TLC Motel, which uses the high/low method to estimate its total cost formula, gathered the following data for the first six months of its current fiscal year:

The variable housekeeping cost per room rental is:

A)$14.36

B)$10.13

C)$ 9.06

D)$ 9.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

32

The purchase order originates with the:

A)Vendor

B)Receiving department

C)Purchasing department

D)Manufacturing department needing the goods or services

A)Vendor

B)Receiving department

C)Purchasing department

D)Manufacturing department needing the goods or services

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

33

A linear regression analysis indicated a constant of 895.00,an X coefficient of 125.60,and an R-squared of 0.72.The dollar value of the dependent variable given an independent variable of 275 is:

A)$35,435

B)$35,184

C)$25,764

D)$27,555

A)$35,435

B)$35,184

C)$25,764

D)$27,555

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

34

A cost that increases in total but decreases per unit as the cost driver increase is a(n):

A)Activity cost

B)Variable cost

C)Fixed cost

D)Mixed cost

A)Activity cost

B)Variable cost

C)Fixed cost

D)Mixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

35

FOB shipping point indicates that goods in transit belong to the:

A)Seller

B)Buyer

C)Common carrier

D)either the buyer or seller depending upon the terms of the bill of lading

A)Seller

B)Buyer

C)Common carrier

D)either the buyer or seller depending upon the terms of the bill of lading

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

36

The formula for a mixed cost is:

A)Y = b

B)Y = m(X)

C)Y = m(X)+ b

D)Y = m(X)+ b(X)

A)Y = b

B)Y = m(X)

C)Y = m(X)+ b

D)Y = m(X)+ b(X)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

37

Goods shipped from a seller's warehouse on Nov 10,2010,arrived at the buyer's warehouse on Nov 16,2010.The invoice for the goods arrived at the buyer's accounting

Department on Nov 13,2010 and was paid on Nov 20,2010.If the goods were sold FOB

Shipping point,the buyer took legal title on:

A)Nov 20,2010

B)Nov 13,2010

C)Nov 10,2010

D)Nov 16,2010

Department on Nov 13,2010 and was paid on Nov 20,2010.If the goods were sold FOB

Shipping point,the buyer took legal title on:

A)Nov 20,2010

B)Nov 13,2010

C)Nov 10,2010

D)Nov 16,2010

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

38

Shipping terms indicating that legal title passes to the buyer when goods arrive at the buyer's warehouse are:

A)FOB destination

B)FOB shipping point

C)FOB shipping invoice

D)FOB purchase order

A)FOB destination

B)FOB shipping point

C)FOB shipping invoice

D)FOB purchase order

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is not a variable cost?

A)Sales Commission

B)Material used to produce product

C)Salary of product inspectors

D)Cost of packaging product

A)Sales Commission

B)Material used to produce product

C)Salary of product inspectors

D)Cost of packaging product

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

40

Tri-State Corporation ordered materials from Down-State Manufacturing on October 1,2006.Down-State shipped the materials by rail on October 5 and the railroad notified Tri-State on October 12,that the goods had arrived.Tri-State picked up the materials on October 13.The terms of the sale are FOB shipping point.On what date should Tri-State consider this a purchase?

A)October 1

B)October 5

C)October 12

D)October 13

A)October 1

B)October 5

C)October 12

D)October 13

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

41

Contrast the conversion process with the revenue/expenditure process.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

42

Explain why the cost estimation ratio of the high/low method differs from the regression method.Explain the role of the R2 when using regression to forecast cost? What will the manufacturing cost be if Tempo wants to produce 18,000 units?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

43

The accounting department at Alaska Enterprises,Inc.is running low on office supplies.The accounting manager has asked you to obtain additional supplies.Describe all the steps necessary to arrange for the acquisition and payment for the supplies.Identify all documents that would be utilized during this process,as well as the person or department that would prepare the document.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

44

Use the following to answer questions

The TLC Motel, which uses the high/low method to estimate its total cost formula, gathered the following data for the first six months of its current fiscal year:

The fixed housekeeping cost per month is:

A)$7,750

B)$7,830

C)$7,882

D)$8,813

The TLC Motel, which uses the high/low method to estimate its total cost formula, gathered the following data for the first six months of its current fiscal year:

The fixed housekeeping cost per month is:

A)$7,750

B)$7,830

C)$7,882

D)$8,813

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

45

Use the following to answer questions

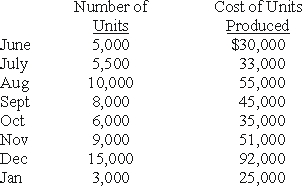

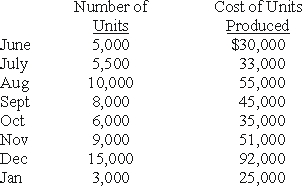

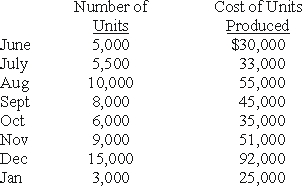

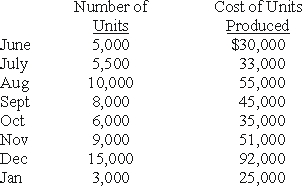

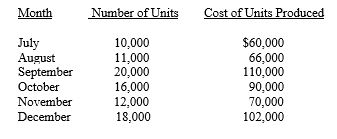

The Tempo Manufacturing Company has kept track of the number of units they have produced each month and the cost to produce those units for the past 8 months

Using the information above calculate the cost estimation equation using the high/low

method.If Tempo expects to produce 7,000 units in Feb what cost should Tempo budget

for?

The Tempo Manufacturing Company has kept track of the number of units they have produced each month and the cost to produce those units for the past 8 months

Using the information above calculate the cost estimation equation using the high/low

method.If Tempo expects to produce 7,000 units in Feb what cost should Tempo budget

for?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

46

Define the following terms as they relate to cost behavior,draw their graphical representation,and give an example of each: (1)fixed cost,(2)variable cost,and (3)mixed cost.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

47

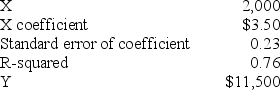

Use the following to answer questions

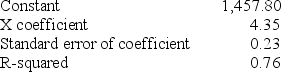

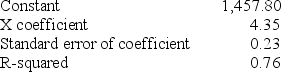

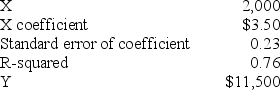

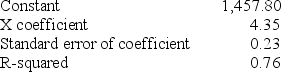

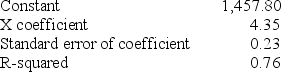

Bob's Bowlarama performed a linear regression analysis on the monthly cost of operating its concession stand, using the number of customers serviced as the cost driver. The results were as follows:

The cost equation is:

A)Y = $4.35X + $1,457.80

B)Y = ($4.35 + $.23)X - $.76Z

C)$1,457.80 = $4.35X + $.76Y

D)$4.35Y = ($.23 + $.76)X - $1,457.80

Bob's Bowlarama performed a linear regression analysis on the monthly cost of operating its concession stand, using the number of customers serviced as the cost driver. The results were as follows:

The cost equation is:

A)Y = $4.35X + $1,457.80

B)Y = ($4.35 + $.23)X - $.76Z

C)$1,457.80 = $4.35X + $.76Y

D)$4.35Y = ($.23 + $.76)X - $1,457.80

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

48

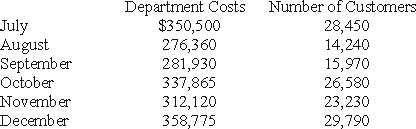

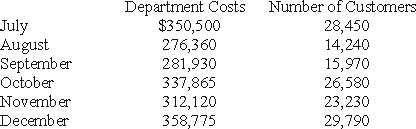

The customer service department at Mall Mart gathered the following data for the first six months of its fiscal year:

Using the high/low estimation method:

Using the high/low estimation method:

A)Determine the cost estimation equation.

b)Estimate the total department costs during a month where 18,500

customers are serviced.

c)Estimate the total department cost during a month where 35,000 customers are

serviced.

Using the high/low estimation method:

Using the high/low estimation method:A)Determine the cost estimation equation.

b)Estimate the total department costs during a month where 18,500

customers are serviced.

c)Estimate the total department cost during a month where 35,000 customers are

serviced.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following to answer questions

The TLC Motel, which uses the high/low method to estimate its total cost formula, gathered the following data for the first six months of its current fiscal year:

The estimated total housekeeping cost for a month with 1,400 room rentals is:

A)$22,012

B)$21,740

C)$20,350

D)$15,715

The TLC Motel, which uses the high/low method to estimate its total cost formula, gathered the following data for the first six months of its current fiscal year:

The estimated total housekeeping cost for a month with 1,400 room rentals is:

A)$22,012

B)$21,740

C)$20,350

D)$15,715

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following activity bases would be the best cost driver for flour costs for a pizzeria?

A)Number of customers

B)Hours of operation

C)Number of employees

D)Number of pizzas

A)Number of customers

B)Hours of operation

C)Number of employees

D)Number of pizzas

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

51

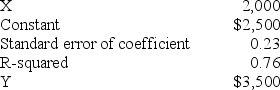

The following is from a linear regression analysis,what is the constant in the cost

equation?

A)$9,500

B)$4,500

C)$2,714

D)$9,980

equation?

A)$9,500

B)$4,500

C)$2,714

D)$9,980

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the follow statements is true about a regression's r2?

A)The greater the r2 the greater the relationship between the independent and dependant variable.

B)An r2 that is greater than 1 means that there is more than a 100 percent relationship between the independent and dependant variable.

C)When a r2 has a negative value the independent variable is inversely related to the dependent variable.

D)When a r2 is less than 1 the greater the inverse relationship between the independent and dependant variables.

A)The greater the r2 the greater the relationship between the independent and dependant variable.

B)An r2 that is greater than 1 means that there is more than a 100 percent relationship between the independent and dependant variable.

C)When a r2 has a negative value the independent variable is inversely related to the dependent variable.

D)When a r2 is less than 1 the greater the inverse relationship between the independent and dependant variables.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

53

Describe the effect of an increase in activity,within the relevant range,on variable and fixed cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

54

The "I Can't Believe It's Yogurt" shop sells only yogurt and only in cups.Which of the following would be a variable cost if number of customers is the cost driver?

A)Rent on the shop

B)Wages

C)Spoons

D)Electricity

A)Rent on the shop

B)Wages

C)Spoons

D)Electricity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

55

Explain why it is inappropriate to calculate the cost of an expected activity (using a cost

formula generated by either the High/Low method or linear regression)that is outside the

relevant range of activity.

formula generated by either the High/Low method or linear regression)that is outside the

relevant range of activity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

56

Non Troppo Corporation has the following cost formula: Y=30(X)+ $250,000.If Non Troppo sells 7,000 units,what will its total cost be?

A)$210,000

B)$250,000

C)$460,000

D)Unable to determine from the information given

A)$210,000

B)$250,000

C)$460,000

D)Unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

57

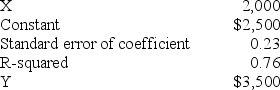

Given the information below from a linear regression what is the X coefficient of the regression equation?

A).50

B)3.00

C).75

D)1.00

A).50

B)3.00

C).75

D)1.00

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following to answer questions

The Tempo Manufacturing Company has kept track of the number of units they have produced each month and the cost to produce those units for the past 8 months

Using regression determine the cost estimation equation and the R2 for the equation.If Tempo expects to produce 7,000 units in February what cost should Tempo budget for?

The Tempo Manufacturing Company has kept track of the number of units they have produced each month and the cost to produce those units for the past 8 months

Using regression determine the cost estimation equation and the R2 for the equation.If Tempo expects to produce 7,000 units in February what cost should Tempo budget for?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following to answer questions

Bob's Bowlarama performed a linear regression analysis on the monthly cost of operating its concession stand, using the number of customers serviced as the cost driver. The results were as follows:

The cost of operating the concession stand for a month in which the concession services 250 customers is estimated at:

A)$2,792.80

B)$2,602.80

C)$2,545.30

D)$ 627.20

Bob's Bowlarama performed a linear regression analysis on the monthly cost of operating its concession stand, using the number of customers serviced as the cost driver. The results were as follows:

The cost of operating the concession stand for a month in which the concession services 250 customers is estimated at:

A)$2,792.80

B)$2,602.80

C)$2,545.30

D)$ 627.20

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

60

Largo Company's highest and lowest monthly costs during the past year were $108,000 and $72,000,respectively.Activity levels were 5,000 hours and 3,000 hours,respectively.Determine Largo's cost formula.

A)Y=24.60(X)+ 36,000

B)Y=21.60(X)+ 0

C)Y=18(X)+ 18,000

D)unable to determine from the information given

A)Y=24.60(X)+ 36,000

B)Y=21.60(X)+ 0

C)Y=18(X)+ 18,000

D)unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

61

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

62

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

63

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

64

Create your own data set that reflects an activity and its related cost.You must explain the basis of the relationship represented by the data.

Required:

Calculate a cost estimation ratio using the High/Low method

Calculate a cost estimation ratio and R2 using the regression method.

Required:

Calculate a cost estimation ratio using the High/Low method

Calculate a cost estimation ratio and R2 using the regression method.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

65

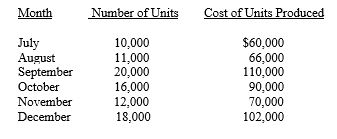

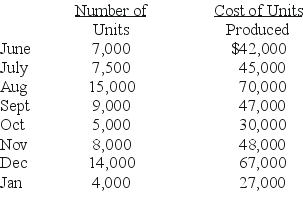

The Pacioli Manufacturing Company has kept track of the number of units they have

produced each month and the cost to produce those units for the past 6 months.

Using regression determine the cost estimation equation and the R2 for the equation.If Pacioli expects to produce 14,000 units in January what cost should Pacioli budget for? How does the R2 help when forecasting cost and what impact does this R2 have on this estimate?

produced each month and the cost to produce those units for the past 6 months.

Using regression determine the cost estimation equation and the R2 for the equation.If Pacioli expects to produce 14,000 units in January what cost should Pacioli budget for? How does the R2 help when forecasting cost and what impact does this R2 have on this estimate?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

66

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

67

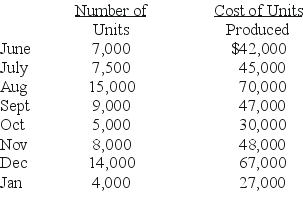

Use the following to answer

The Riga Manufacturing Company has kept track of the number of units they have produced each month and the cost to produce those units for the past 8 months

Using the information above calculate the cost estimation equation using the high/low

method.If Riga expects to produced 8,500 units in Feb what cost should Riga budget

for?

The Riga Manufacturing Company has kept track of the number of units they have produced each month and the cost to produce those units for the past 8 months

Using the information above calculate the cost estimation equation using the high/low

method.If Riga expects to produced 8,500 units in Feb what cost should Riga budget

for?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

68

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck

69

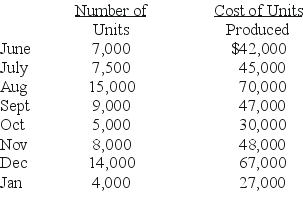

Use the following to answer

The Riga Manufacturing Company has kept track of the number of units they have produced each month and the cost to produce those units for the past 8 months

Using regression determine the cost estimation equation and the R2 for the equation.If Riga expects to produce 8,500 units in February what cost should Riga budget for?

The Riga Manufacturing Company has kept track of the number of units they have produced each month and the cost to produce those units for the past 8 months

Using regression determine the cost estimation equation and the R2 for the equation.If Riga expects to produce 8,500 units in February what cost should Riga budget for?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 69 في هذه المجموعة.

فتح الحزمة

k this deck