Deck 20: Company Performance: Comprehensive Evaluation

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

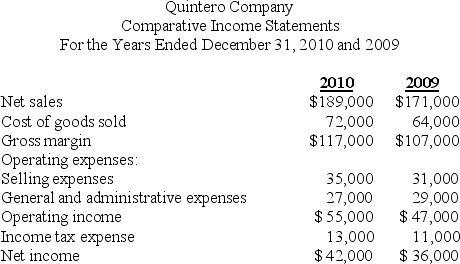

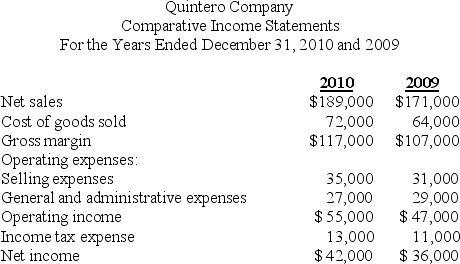

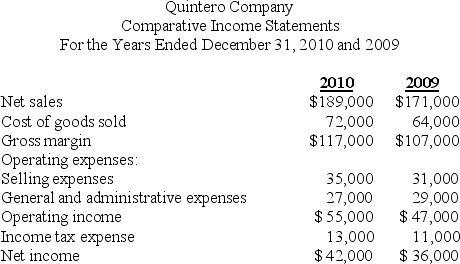

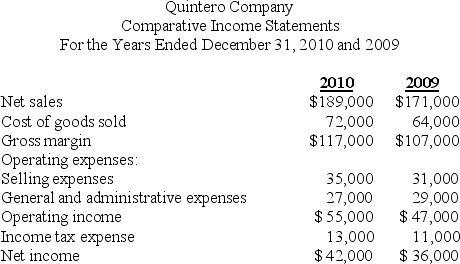

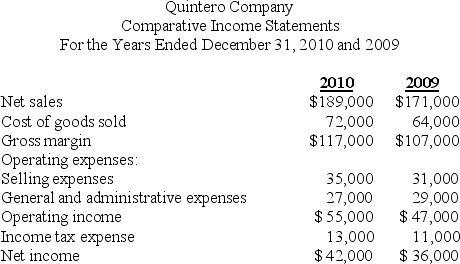

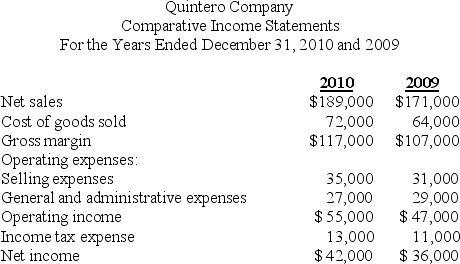

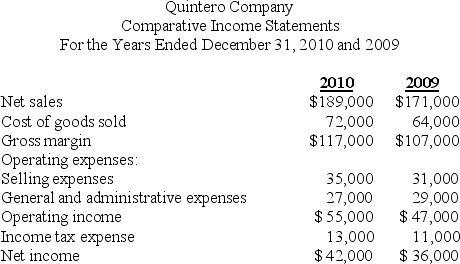

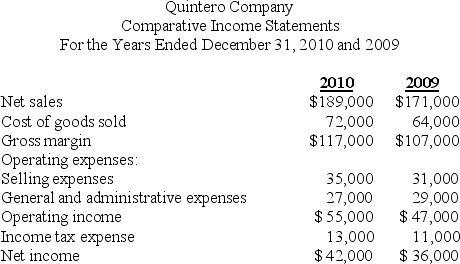

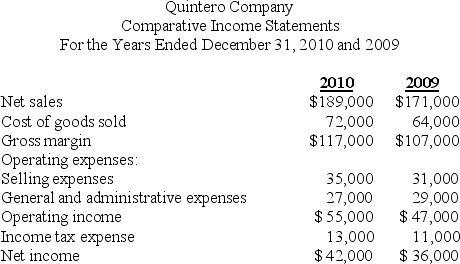

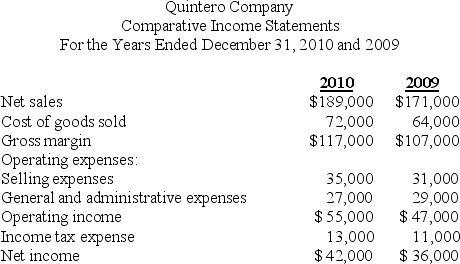

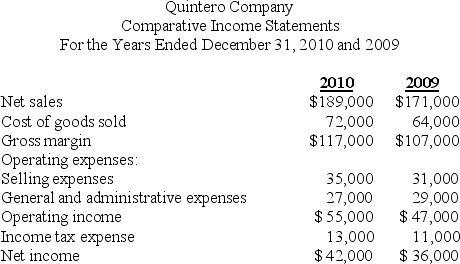

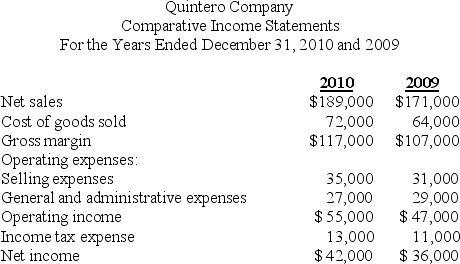

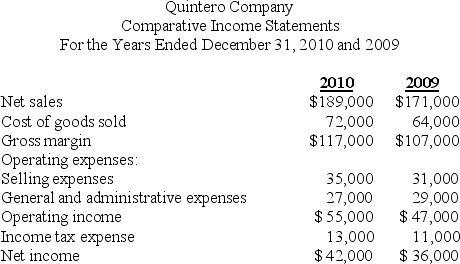

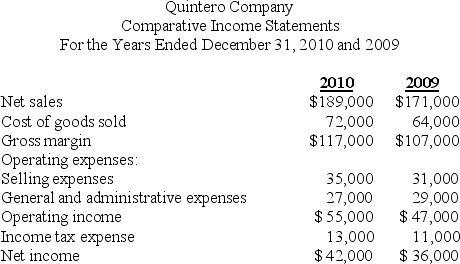

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/94

العب

ملء الشاشة (f)

Deck 20: Company Performance: Comprehensive Evaluation

1

The quick ratio is used to assess a firm's:

A)liquidity

B)efficiency

C)profitability

D)creditworthiness

A)liquidity

B)efficiency

C)profitability

D)creditworthiness

liquidity

2

The times interest earned ratio is generally used to assess a firm's:

A)liquidity

B)efficiency

C)profitability

D)creditworthiness

A)liquidity

B)efficiency

C)profitability

D)creditworthiness

creditworthiness

3

If a company's income statement showed sales equal to $365,000,a gross margin of $120,000,and net income of $45,000,then a vertical analysis of the income statement would show a percentage figure for net income equal to:

A)100.0%

B)37.5%

C)32.3%

D)12.3%

A)100.0%

B)37.5%

C)32.3%

D)12.3%

12.3%

4

A company's current ratio equals:

A)current assets x current liabilities

B)current liabilities/current assets

C)current assets/current liabilities

D)quick assets/quick liabilities

A)current assets x current liabilities

B)current liabilities/current assets

C)current assets/current liabilities

D)quick assets/quick liabilities

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

5

If total assets for 2010 and 2009 were $500,000 and $530,000,respectively,then the percentage change shown in a horizontal analysis would be:

A)6.0%

B)5.7%

C)(5.7%)D)(6.0%)

A)6.0%

B)5.7%

C)(5.7%)D)(6.0%)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

6

The numerator used to calculate accounts receivable turnover is:

A)gross cash sales

B)net credit sales

C)total net sales

D)gross sales

A)gross cash sales

B)net credit sales

C)total net sales

D)gross sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

7

Financial ratios that help judge a firm's efficiency in using its current assets and liabilities are collectively referred to as:

A)equity ratios

B)ability ratios

C)activity ratios

D)profitability ratios

A)equity ratios

B)ability ratios

C)activity ratios

D)profitability ratios

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

8

All of the following ratios are generally used to assess a firm's creditworthiness except:

A)debt to equity ratio

B)return on equity ratio

C)times interest earned ratio

D)long-term debt to equity ratio

A)debt to equity ratio

B)return on equity ratio

C)times interest earned ratio

D)long-term debt to equity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

9

When conducting an audit,the auditor can render one of the following.Which one indicates that the auditor was not able to complete the audit and the CPA can not render an opinion.

A)Adverse Opinion

B)Disclaimer

C)Unqualified Opinion

D)Qualified Opinion

A)Adverse Opinion

B)Disclaimer

C)Unqualified Opinion

D)Qualified Opinion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following two ratios measure the short-term solvency of a company?

A)Current Ratio and Times Interest Earned

B)Quick Ratio and Current Ratio

C)Quick Ratio and Accounts Receivable Turnover

D)Accounts Payable Turnover and Inventory Turnover

A)Current Ratio and Times Interest Earned

B)Quick Ratio and Current Ratio

C)Quick Ratio and Accounts Receivable Turnover

D)Accounts Payable Turnover and Inventory Turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following ratios indicates a firm's financial flexibility (the ability to issue stock or borrow fund)?

A)debt to equity ratio

B)return on equity ratio

C)current ratio

D)return on assets

A)debt to equity ratio

B)return on equity ratio

C)current ratio

D)return on assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

12

Consumer demand dictates the types of businesses that exist and how much of a given product or service is available in a:

A)monopolistic economy

B)oligopolistic economy

C)free market economy

D)product economy

A)monopolistic economy

B)oligopolistic economy

C)free market economy

D)product economy

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

13

When a CPA firm finds that the financial statements of the company being audited are not in compliance with Generally Accepted Accounting Principle the firm will issue which of the following?

A)Adverse Opinion

B)Disclaimer

C)Unqualified Opinion

D)Qualified Opinion

A)Adverse Opinion

B)Disclaimer

C)Unqualified Opinion

D)Qualified Opinion

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

14

All of the following ratios are generally used to assess a firm's liquidity except:

A)quick ratio

B)current ratio

C)asset turnover ratio

D)cash flow per share

A)quick ratio

B)current ratio

C)asset turnover ratio

D)cash flow per share

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

15

Which of the following is an opinion on the financial statements of the a company?

A)Unqualified Opinion

B)Qualified Opinion

C)Adverse Opinion

D)Disclaimer if Opinion

E)All are opinions

A)Unqualified Opinion

B)Qualified Opinion

C)Adverse Opinion

D)Disclaimer if Opinion

E)All are opinions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

16

The purpose of an audit opinion is.

A)Insure that financial statements are mathematically correct.

B)There was no fraud in the company.

C)Provide third party assurance that the financial statements are presented fairly

D)Certify that the company is a good investment.

A)Insure that financial statements are mathematically correct.

B)There was no fraud in the company.

C)Provide third party assurance that the financial statements are presented fairly

D)Certify that the company is a good investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

17

If a company's balance sheet reported accounts receivable equal to $38,500,total current assets of $205,000,and total assets of $510,000,then a vertical analysis of the balance sheet would show a percentage figure for accounts receivable equal to:

A)100.0%

B)40.2%

C)18.8%

D)7.5%

A)100.0%

B)40.2%

C)18.8%

D)7.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

18

The entire group of creditors and investors who provide capital to businesses to allow them to finance their investments is collectively referred to as a:

A)comparative market

B)capital market

C)stock market

D)free market

A)comparative market

B)capital market

C)stock market

D)free market

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

19

If sales for 2010 and 2009 were $680,000 and $625,000,respectively,then the percentage change shown in a horizontal analysis would be:

A)8.8%

B)8.1%

C)(8.1%)D)(8.8%)

A)8.8%

B)8.1%

C)(8.1%)D)(8.8%)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

20

Terms of creditors' lending agreements that restrict management's behavior are called:

A)debt covenants

B)comparative terms

C)activity restrictions

D)price earnings terms

A)debt covenants

B)comparative terms

C)activity restrictions

D)price earnings terms

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

21

All of the following ratios below are generally used to assess a firm's profitability except:

A)asset turnover

B)return on assets

C)gross margin percentage

D)times interest earned ratio

A)asset turnover

B)return on assets

C)gross margin percentage

D)times interest earned ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

22

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The asset turnover ratio for 2010 was:

A)74.8

B)73.1

C)33.8

D)10.8

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The asset turnover ratio for 2010 was:

A)74.8

B)73.1

C)33.8

D)10.8

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

23

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The DuPont ROI for 2010 was:

A)53.6 x 32.0% = 17.2%

B)73.1 x 9.5% =6.9%

C)74.8 x 14.5% = 10.8%

D)84.3 x 10.8% = 9.1%

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The DuPont ROI for 2010 was:

A)53.6 x 32.0% = 17.2%

B)73.1 x 9.5% =6.9%

C)74.8 x 14.5% = 10.8%

D)84.3 x 10.8% = 9.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

24

Which of the following pairs of ratios measure the profitability of a company?

A)Inventory Turnover and Asset turnover

B)Dividend Payout and Return on Sales

C)Gross margin and Asset Turnover

D)Price-Earnings ratio and Accounts Receivable Turnover

A)Inventory Turnover and Asset turnover

B)Dividend Payout and Return on Sales

C)Gross margin and Asset Turnover

D)Price-Earnings ratio and Accounts Receivable Turnover

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

25

The denominator in the gross margin percentage is:

A)net sales

B)net income

C)average inventory

D)cost of goods sold

A)net sales

B)net income

C)average inventory

D)cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

26

Use the following to answer questions

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The dividend payout ratio was:

A)65%

B)70%

C)75%

D)80%

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The dividend payout ratio was:

A)65%

B)70%

C)75%

D)80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

27

Which of the following ratios commonly used by investors to evaluate a potential stock investment uses the market price of the stock as part of the calculation?

A)earnings per share

B)price earnings ratio

C)dividend yield ratio

D)both b and c are correct

A)earnings per share

B)price earnings ratio

C)dividend yield ratio

D)both b and c are correct

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

28

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on assets for 2010 was:

A)9.5%

B)10.6%

C)10.8%

D)33.8%

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on assets for 2010 was:

A)9.5%

B)10.6%

C)10.8%

D)33.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

29

Use the following to answer questions

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The dividend yield was:

A)4.4%

B)4.7%

C)7.0%

D)7.5%

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The dividend yield was:

A)4.4%

B)4.7%

C)7.0%

D)7.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

30

A measure of a corporation's profitability that is required to be reported as part of the income statement is the:

A)earnings per share

B)cash flow per share

C)times interest earned

D)gross margin percentage

A)earnings per share

B)cash flow per share

C)times interest earned

D)gross margin percentage

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

31

Use the following to answer questions

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The price earnings ratio at the end of 2010 was:

A)14.2

B)18.1

C)22.7

D)24.3

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The price earnings ratio at the end of 2010 was:

A)14.2

B)18.1

C)22.7

D)24.3

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

32

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The gross margin percentage for 2010 was:

A)32.0%

B)45.1%

C)45.2%

D)84.3%

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The gross margin percentage for 2010 was:

A)32.0%

B)45.1%

C)45.2%

D)84.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

33

The dividend payout ratio relates the amount of dividends paid to the:

A)period's earnings

B)period's gross margin

C)net sales for the period

D)average assets for the period

A)period's earnings

B)period's gross margin

C)net sales for the period

D)average assets for the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

34

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The current ratio at the end of 2010 was:

A)1.23

B)1.18

C)0.97

D)0.81

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The current ratio at the end of 2010 was:

A)1.23

B)1.18

C)0.97

D)0.81

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

35

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on owners' equity for 2010 was:

A)30.0%

B)30.8%

C)53.6%

D)84.3%

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on owners' equity for 2010 was:

A)30.0%

B)30.8%

C)53.6%

D)84.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

36

The return on assets ratio is used to assess a firm's:

A)liquidity

B)efficiency

C)profitability

D)creditworthiness

A)liquidity

B)efficiency

C)profitability

D)creditworthiness

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

37

The numerator in the return on assets ratio is:

A)net sales

B)net income

C)gross margin

D)average total assets

A)net sales

B)net income

C)gross margin

D)average total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

38

Use the following to answer questions

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The times interest earned ratio was:

A)13.3

B)12.3

C)10.7

D)8.5

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The times interest earned ratio was:

A)13.3

B)12.3

C)10.7

D)8.5

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

39

Use the following to answer questions

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on sales for 2010 was:

A)10.8%

B)14.5%

C)32.0%

D)45.2%

Pioneer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on sales for 2010 was:

A)10.8%

B)14.5%

C)32.0%

D)45.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

40

Use the following to answer questions

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The cash flow per share was:

A)$.30

B)$.70

C)$.75

D)$.94

The Ventura Company reported total stockholders' equity of $500,000 at December 31, 2010. In addition, there were 80,000 shares of common stock and zero shares of preferred stock outstanding for the entire year. During 2010, Ventura earned net income equal to $75,000, which included deductions of $7,000 for interest and $11,000 for income taxes. Total dividends paid to common stockholders during the year were $60,000. The company's statement of cash flows showed $56,000 in net cash inflows from operating activities, and its stock was selling for $17 per share on December 31, 2010.

The cash flow per share was:

A)$.30

B)$.70

C)$.75

D)$.94

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

41

Which of the following ratios would be computed automatically in performing vertical analysis of an income statement?

A)dividend payout ratio

B)earnings per share

C)return on sales

D)current ratio

A)dividend payout ratio

B)earnings per share

C)return on sales

D)current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

42

Which of the following statements about the current ratio is false?

A)A firm with a higher current ratio is better off than one with a lower current ratio

B)It is determined by dividing current assets by current liabilities

C)It is affected by the accounting methods firms use

D)It is larger than the quick ratio

A)A firm with a higher current ratio is better off than one with a lower current ratio

B)It is determined by dividing current assets by current liabilities

C)It is affected by the accounting methods firms use

D)It is larger than the quick ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

43

In a common-sized balance sheet,each item is shown as a percentage of

A)common stockholders' equity

B)stockholders' equity

C)total liabilities

D)total assets

A)common stockholders' equity

B)stockholders' equity

C)total liabilities

D)total assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following would be most useful to you in deciding whether or not to make a short-term loan to a firm?

A)return on assets

B)return on sales

C)current ratio

D)EPS

A)return on assets

B)return on sales

C)current ratio

D)EPS

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

45

Which combination of ratios describes the length of the operating cycle?

A)Days in the Selling Period + Days in the Collection Period

B)Days in the Collection Period + Days in the Payment Period

C)Days in the Collection Period + Days in the Selling Period + Days in the Payment Period

D)Days in the Payment Period + Days in the Selling Period

A)Days in the Selling Period + Days in the Collection Period

B)Days in the Collection Period + Days in the Payment Period

C)Days in the Collection Period + Days in the Selling Period + Days in the Payment Period

D)Days in the Payment Period + Days in the Selling Period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

46

Use the following to answer questions

If a vertical analysis were performed relative to the year ended December 31,2010,the figure that would appear in the percent column for Net income would be:

A)56.3%

B)33.6%

C)22.2%

D)21.1%

If a vertical analysis were performed relative to the year ended December 31,2010,the figure that would appear in the percent column for Net income would be:

A)56.3%

B)33.6%

C)22.2%

D)21.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following helps analysts understand the relationships among the items in a financial statement?

A)common-sized financial statements

B)performance analysis

C)ratio analysis

D)trend analysis

A)common-sized financial statements

B)performance analysis

C)ratio analysis

D)trend analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the following to answer questions

Using horizontal analysis,the figure that would appear in the percent column for Gross margin is:

A)5.3%

B)8.5%

C)9.3%

D)23.8%

Using horizontal analysis,the figure that would appear in the percent column for Gross margin is:

A)5.3%

B)8.5%

C)9.3%

D)23.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

49

Use the following to answer questions

Using horizontal analysis,the figure that would appear in the percent column for Operating income is:

A)19.0%

B)17.0%

C)14.5%

D)4.2%

Using horizontal analysis,the figure that would appear in the percent column for Operating income is:

A)19.0%

B)17.0%

C)14.5%

D)4.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

50

Use the following to answer questions

Using horizontal analysis,the figure that would appear in the percent column for Net income is:

A)14.3%

B)16.7%

C)21.1%

D)22.2%

Using horizontal analysis,the figure that would appear in the percent column for Net income is:

A)14.3%

B)16.7%

C)21.1%

D)22.2%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

51

Which of the following statements about the current ratio is false?

A)it includes inventories

B)it is a measure of profitability

C)it is equal to current assets divided by current liabilities

D)it is affected by the accounting methods used by a company

A)it includes inventories

B)it is a measure of profitability

C)it is equal to current assets divided by current liabilities

D)it is affected by the accounting methods used by a company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following statements about sources of external standards for evaluating firm's performance is false?

A)Much of the information provided by investor services comes from firms' annual reports

B)Investor services often provide comparative ratios as well as other financial information

C)Investor services must follow SEC guidelines for reporting form and terminology used

D)All the information available to internal users is not provided by external sources

A)Much of the information provided by investor services comes from firms' annual reports

B)Investor services often provide comparative ratios as well as other financial information

C)Investor services must follow SEC guidelines for reporting form and terminology used

D)All the information available to internal users is not provided by external sources

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

53

What are the two elements of return on assets?

A)return on equity and return on sales

B)return on equity and asset turnover

C)return on sales and asset turnover

D)return on sales and profit margin

A)return on equity and return on sales

B)return on equity and asset turnover

C)return on sales and asset turnover

D)return on sales and profit margin

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

54

Use the following to answer questions

Using horizontal analysis,the figure that would appear in the percent column for Net sales is:

A)9.5%

B)10.5%

C)15.4%

D)16.8%

Using horizontal analysis,the figure that would appear in the percent column for Net sales is:

A)9.5%

B)10.5%

C)15.4%

D)16.8%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

55

In a common-sized income statement,each item is shown as a percentage of

A)income from continuing operations

B)comprehensive income

C)net income

D)net sales

A)income from continuing operations

B)comprehensive income

C)net income

D)net sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

56

When decision-makers want to know how well a firm manages the amounts owed to them by customers as compared to other firm's,they should use

A)current ratio

B)asset turnover

C)cash flow per share

D)average collection period

A)current ratio

B)asset turnover

C)cash flow per share

D)average collection period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following to answer questions

If a vertical analysis were performed relative to the year ended December 31,2010,the figure that would appear in the percent column for Cost of goods sold would be:

A)37.4%

B)38.1%

C)58.3%

D)61.5%

If a vertical analysis were performed relative to the year ended December 31,2010,the figure that would appear in the percent column for Cost of goods sold would be:

A)37.4%

B)38.1%

C)58.3%

D)61.5%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

58

Use the following to answer questions

If a vertical analysis were performed relative to the year ended December 31,2010,the figure that would appear in the percent column for Income tax expense would be:

A)6.4%

B)6.9%

C)11.1%

D)23.6%

If a vertical analysis were performed relative to the year ended December 31,2010,the figure that would appear in the percent column for Income tax expense would be:

A)6.4%

B)6.9%

C)11.1%

D)23.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

59

Which of the following helps analysts understand the relationship between two financial statement items?

A)common-sized financial statements

B)performance analysis

C)ratio analysis

D)trend analysis

A)common-sized financial statements

B)performance analysis

C)ratio analysis

D)trend analysis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

60

The total asset turnover ratio measures

A)how well a firm uses its assets to produce sales

B)the rate of return on a firm's investment in assets

C)the portion of assets that has been financed by investors

D)the portion of assets that has been financed by creditors

A)how well a firm uses its assets to produce sales

B)the rate of return on a firm's investment in assets

C)the portion of assets that has been financed by investors

D)the portion of assets that has been financed by creditors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

61

Use the following to answer questions

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on owners' equity for 2010 was:

A)35.0%

B)37.8%

C)45.0%

D)57.3%

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on owners' equity for 2010 was:

A)35.0%

B)37.8%

C)45.0%

D)57.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

62

Use the following to answer questions

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on assets for 2010 was:

A)10.5%

B)11.6%

C)18.8%

D)20.7%

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on assets for 2010 was:

A)10.5%

B)11.6%

C)18.8%

D)20.7%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

63

Use the following to answer questions

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The asset turnover ratio for 2010 was:

A)45.8

B)57.1

C)63.3

D)75.6

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The asset turnover ratio for 2010 was:

A)45.8

B)57.1

C)63.3

D)75.6

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

64

Use the following to answer questions

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The asset turnover ratio for 2010 was:

A)79.3

B)81.3

C)85.6

D)90.1

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The asset turnover ratio for 2010 was:

A)79.3

B)81.3

C)85.6

D)90.1

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

65

What is the role of auditors in capital markets? How is this role affected by the fact that auditors are paid by the firms they audit?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

66

Use the following to answer questions

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The current ratio at the end of 2010 was:

A)1.76

B)1.56

C)1.45

D)1.03

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The current ratio at the end of 2010 was:

A)1.76

B)1.56

C)1.45

D)1.03

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

67

Write out the dividend payout ratio ( Show your work here).

Explain how is the dividend payout ratio is used.

Explain how is the dividend payout ratio is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

68

Which of the following would be most useful in deciding whether or not to purchase a firm's common stock?

A)return on equity

B)return on assets

C)asset turnover

D)current ratio

A)return on equity

B)return on assets

C)asset turnover

D)current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

69

Write out the dividend yield ratio ( Show your work here).

Explain how the dividend yield ratio is used.

Explain how the dividend yield ratio is used.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

70

Use the following to answer questions

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The current ratio at the end of 2010 was:

A)1.76

B)1.56

C)1.45

D)1.36

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The current ratio at the end of 2010 was:

A)1.76

B)1.56

C)1.45

D)1.36

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

71

You know that a firm has a current ratio of 2.2 to 1.What other information do you need in order to determine whether that's good or bad?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

72

Is a firm that has a high dividend payout ratio better to invest in than one that has a low dividend payout ratio? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

73

Use the following to answer questions

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on owners' equity for 2010 was:

A)35.0%

B)58.8%

C)60.7%

D)65.3%

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on owners' equity for 2010 was:

A)35.0%

B)58.8%

C)60.7%

D)65.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

74

Explain the computation of cash flow per share.Do you believe cash flow per share should replace earnings per share? Why or why not?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the following to answer questions

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on assets for 2010 was:

A)10.5%

B)11.6%

C)13.8%

D)15.1%

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The return on assets for 2010 was:

A)10.5%

B)11.6%

C)13.8%

D)15.1%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

76

Use the following to answer questions

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The gross margin percentage for 2010 was:

A)35.0%

B)45.1%

C)49.7%

D)52.3%

Little Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The gross margin percentage for 2010 was:

A)35.0%

B)45.1%

C)49.7%

D)52.3%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

77

Use the following to answer questions

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The gross margin percentage for 2010 was:

A)33.0%

B)40.1%

C)42.2%

D)45.6%

Big Deer Industries gathered the following year-end data (in thousands) for 2010 and 2009:

-The gross margin percentage for 2010 was:

A)33.0%

B)40.1%

C)42.2%

D)45.6%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

78

Financial statements which report two or more years of information side by side are referred to as

A)consolidated

B)comparative

C)combined

D)trended

A)consolidated

B)comparative

C)combined

D)trended

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

79

If a firm's return on assets decreases and its asset turnover increases,how has the return on sales changed? Was this change more or less than the change in asset turnover? Explain.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck

80

Which of the following would be least useful in assessing a firm's long-term debt-paying ability?

A)long-term debt to equity

B)times interest earned

C)debt to equity

D)current ratio

A)long-term debt to equity

B)times interest earned

C)debt to equity

D)current ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 94 في هذه المجموعة.

فتح الحزمة

k this deck