Deck 13: Planning Equity Financing

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/98

العب

ملء الشاشة (f)

Deck 13: Planning Equity Financing

1

Which of the following ownership structures requires only the negligent owner to have unlimited liability?

A)Limited partnership

B)Limited liability partnership

C)Subchapter S corporation

D)Limited liability company

A)Limited partnership

B)Limited liability partnership

C)Subchapter S corporation

D)Limited liability company

Limited liability partnership

2

Which of the following ownership structures has double taxation - once on the income generated by the business entity and again on the distributions to the owners?

A)Subchapter S corporation

B)Limited liability company

C)Limited liability partnership

D)All of the above do not have double taxation

A)Subchapter S corporation

B)Limited liability company

C)Limited liability partnership

D)All of the above do not have double taxation

All of the above do not have double taxation

3

In which of the following ownership structures do none of the owners have unlimited liability?

A)Limited partnership

B)Limited liability partnership

C)Limited liability company

D)General partnership

A)Limited partnership

B)Limited liability partnership

C)Limited liability company

D)General partnership

Limited liability company

4

In which of the following scenarios would financial leverage be maximized?

A)High times interest earned ratio and low debt to equity ratio

B)Low times interest earned ratio and low debt to equity ratio

C)Low times interest earned ratio and high debt to equity ratio

D)High times interest earned ratio and a high debt to equity ratio

A)High times interest earned ratio and low debt to equity ratio

B)Low times interest earned ratio and low debt to equity ratio

C)Low times interest earned ratio and high debt to equity ratio

D)High times interest earned ratio and a high debt to equity ratio

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

5

When a company borrows more money how are the debt to equity and return on equity affected assuming income before interest and taxes remain the same? Debt to Equity Return on Equity

A)Increases Increases

B)Decreases Decreases

C)Decreases Increases

D)Increases Decreases

A)Increases Increases

B)Decreases Decreases

C)Decreases Increases

D)Increases Decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

6

Which of the following measures both the amount of a firm's debt financing and its equity financing?

A)Times interest earned ratio

B)Debt to equity ratio

C)Return on owners' equity

D)Return on common stockholders' equity

A)Times interest earned ratio

B)Debt to equity ratio

C)Return on owners' equity

D)Return on common stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

7

From the selections below identify the advantage of sole-proprietorships and partnerships.

A)Unlimited liability

B)Ease of capital formation

C)Income is not taxed twice

D)Mutual agency

A)Unlimited liability

B)Ease of capital formation

C)Income is not taxed twice

D)Mutual agency

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

8

If a firm has only one class of stock,the stock is called:

A)callable stock

B)common stock

C)preferred stock

D)convertible stock

A)callable stock

B)common stock

C)preferred stock

D)convertible stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

9

Ketek,Inc.has $400,000 in assets and one liability in the form of a $150,000 note payable with a 12% annual interest rate.Assuming Ketek's tax rate is 30% and the firm generates a 15% return on its assets,Ketek's rate of return on owners' equity is:

A)7.20%

B)11.76%

C)15.00%

D)16.80%

A)7.20%

B)11.76%

C)15.00%

D)16.80%

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is not a source of financing for a firm?

A)Selling asset of the firm.

B)Issuing stock for cash

C)Issuing a note to borrow cash

D)Net income

A)Selling asset of the firm.

B)Issuing stock for cash

C)Issuing a note to borrow cash

D)Net income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

11

The preemptive right possessed by common stockholders gives them the right to:

A)dispose of the shares of stock by sale or gift

B)receive dividends whenever they are declared

C)share proportionately in the residual assets upon liquidation of the corporation

D)maintain their percentage interest in the corporation when new shares of common stock are issued

A)dispose of the shares of stock by sale or gift

B)receive dividends whenever they are declared

C)share proportionately in the residual assets upon liquidation of the corporation

D)maintain their percentage interest in the corporation when new shares of common stock are issued

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

12

All of the following statements regarding preferred stock are false except:

A)there is no specified amount of dividends on preferred stock

B)preferred stockholders receive dividends after common stockholders

C)in the event of liquidation,preferred stockholders are paid before common stockholders

D)preferred stockholders are similar to common stockholders in that they are allowed one vote per share of stock owned

A)there is no specified amount of dividends on preferred stock

B)preferred stockholders receive dividends after common stockholders

C)in the event of liquidation,preferred stockholders are paid before common stockholders

D)preferred stockholders are similar to common stockholders in that they are allowed one vote per share of stock owned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

13

Financial risk is the risk associated with:

A)debt financing

B)equity financing

C)financing activities

D)ownership in a corporation

A)debt financing

B)equity financing

C)financing activities

D)ownership in a corporation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

14

All of the following features are common to preferred stock except:

A)Right to vote

B)Right to dividends

C)Cumulative

D)Convertible

A)Right to vote

B)Right to dividends

C)Cumulative

D)Convertible

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

15

Reinvestment of a firm's earnings in the firm is a type of:

A)leveraged financing

B)equity financing

C)bond financing

D)debt financing

A)leveraged financing

B)equity financing

C)bond financing

D)debt financing

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following measures a firm's ability to service its debt?

A)Times interest earned

B)Debt to equity ratio

C)Return on owners' equity

D)Return on common stockholders' equity

A)Times interest earned

B)Debt to equity ratio

C)Return on owners' equity

D)Return on common stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

17

Which of the following is a disadvantage of partnerships?

A)Ease of formation

B)Income is not taxed twice

C)Mutual agency

D)Owners manage the firm

A)Ease of formation

B)Income is not taxed twice

C)Mutual agency

D)Owners manage the firm

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

18

Which of the following is not an advantage of partnerships.

A)Ease of formation

B)Income is taxes only once

C)Owners' manage the firm

D)Limited Liability

A)Ease of formation

B)Income is taxes only once

C)Owners' manage the firm

D)Limited Liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

19

When a company borrows more money how are the debt to equity and times interest earned ratios affected? Debt to Equity Times Interest Earned

A)Increases Increases

B)Decreases Decreases

C)Decreases Increases

D)Increases Decreases

A)Increases Increases

B)Decreases Decreases

C)Decreases Increases

D)Increases Decreases

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

20

When employing a strategy of financial leverage:

A)the cost of using borrowed funds should be less than the return generated by the borrowed funds

B)the interest rate on borrowed funds should be more than the rate of return on

Owners' equity

C)the goal of the corporation is to have zero liabilities

D)the main goal is the highest possible total income

A)the cost of using borrowed funds should be less than the return generated by the borrowed funds

B)the interest rate on borrowed funds should be more than the rate of return on

Owners' equity

C)the goal of the corporation is to have zero liabilities

D)the main goal is the highest possible total income

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

21

A corporation's repurchased stock intended for reissuance at a later date is called:

A)callable stock

B)treasury stock

C)convertible stock

D)redeemable stock

A)callable stock

B)treasury stock

C)convertible stock

D)redeemable stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

22

Mutt and Jeff could not agree on how to share the profits and losses of their partnership.In this case,the law would require that partnership profits and losses be divided:

A)based upon a reasonable percentage return on their investment

B)according to the amount of work performed by each partner

C)according to each partner's relative capital contribution

D)equally

A)based upon a reasonable percentage return on their investment

B)according to the amount of work performed by each partner

C)according to each partner's relative capital contribution

D)equally

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

23

The number of shares of stock a corporation has sold to its stockholders is referred to as the number of shares:

A)issued

B)callable

C)authorized

D)outstanding

A)issued

B)callable

C)authorized

D)outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

24

The date which determines eligibility to receive a corporate dividend is the:

A)date of record

B)declaration date

C)date of payment

D)ex-dividend date

A)date of record

B)declaration date

C)date of payment

D)ex-dividend date

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

25

The obligation to pay a cash dividend becomes a legal liability on the:

A)date of record

B)declaration date

C)ex-dividend date

D)date of payment

A)date of record

B)declaration date

C)ex-dividend date

D)date of payment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

26

An arbitrary value assigned to shares of capital stock and approved by the state when the business is incorporated is referred to as:

A)par value

B)book value

C)stated value

D)market value

A)par value

B)book value

C)stated value

D)market value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

27

Preferred stock with a $50 par value and a stated dividend of 10% that was sold for $100 would entitle the owner of one share to an annual dividend of:

A)$50.00

B)$10.00

C)$ 5.00

D)$ .10

A)$50.00

B)$10.00

C)$ 5.00

D)$ .10

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

28

Gibraltar Corporation has 200,000 shares of 9%,$50 par value cumulative preferred stock authorized,80,000 shares issued,and 75,000 outstanding,as well as 300,000 shares of $10 par value common stock issued and outstanding.Dividends relative to the preferred stock are two years in arrears.If Gibraltar declares a $2,137,500 dividend during the current period,the amount of the dividend applicable to the preferred and common stockholders is:

A)$675,000 and $1,462,500,respectively

B)$1,012,500 and $1,125,000,respectively

C)$1,350,000 and $787,500,respectively

D)$2,025,000 and $112,500,respectively

A)$675,000 and $1,462,500,respectively

B)$1,012,500 and $1,125,000,respectively

C)$1,350,000 and $787,500,respectively

D)$2,025,000 and $112,500,respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

29

Treasury stock:

A)is an asset

B)is a liability

C)reduces stockholders' equity

D)none of the above

A)is an asset

B)is a liability

C)reduces stockholders' equity

D)none of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

30

An individual stockholder's interest in a corporation does not change when the company declares a:

A)stock split

B)stock dividend

C)both a and b

D)neither a nor b

A)stock split

B)stock dividend

C)both a and b

D)neither a nor b

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

31

If a board of directors decides to pay a dividend,the date on which they make their decision is known as the:

A)date of record

B)date of payment

C)ex-dividend date

D)date of declaration

A)date of record

B)date of payment

C)ex-dividend date

D)date of declaration

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

32

In a 2 for 1 stock split,the number of shares held by a stockholder will:

A)triple

B)double

C)not change

D)be cut in half

A)triple

B)double

C)not change

D)be cut in half

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

33

When stipulated cumulative preferred stock dividends have not been paid for a given period of time,they are referred to as:

A)participating dividends

B)dividends in arrears

C)dividends payable

D)stock dividends

A)participating dividends

B)dividends in arrears

C)dividends payable

D)stock dividends

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

34

The total number of shares of stock that a state has approved for issuance to shareholders is referred to as the number of shares:

A)issued

B)callable

C)authorized

D)outstanding

A)issued

B)callable

C)authorized

D)outstanding

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

35

The redeemable feature of preferred stock allows the preferred stockholder:

A)To buy more shares of preferred stock at a set price.

B)To redeem preferred stock for common stock with the right to vote.

C)To sell the preferred stock for a set price at certain times in the future.

D)To buy shares of common stock for cash and the preferred stock

A)To buy more shares of preferred stock at a set price.

B)To redeem preferred stock for common stock with the right to vote.

C)To sell the preferred stock for a set price at certain times in the future.

D)To buy shares of common stock for cash and the preferred stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

36

Which of the following computations will determine the number of shares of treasury stock?

A)Shares Authorized - Shares Issued

B)Shares Outstanding - Shares Issued

C)Shares Issued - Shares Outstanding

D)Shares Issued - Shares Authorized

A)Shares Authorized - Shares Issued

B)Shares Outstanding - Shares Issued

C)Shares Issued - Shares Outstanding

D)Shares Issued - Shares Authorized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

37

The number of shares of stock outstanding is equal to:

A)the number of shares authorized less the number of shares issued

B)the number of shares issued plus the number of shares authorized

C)the number of shares issued less the number of shares of treasury stock

D)the number of shares authorized less the number of shares of treasury stock

A)the number of shares authorized less the number of shares issued

B)the number of shares issued plus the number of shares authorized

C)the number of shares issued less the number of shares of treasury stock

D)the number of shares authorized less the number of shares of treasury stock

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

38

All of the following are features frequently applicable to preferred stock except:

A)cumulative

B)recumulative

C)redeemable

D)participating

A)cumulative

B)recumulative

C)redeemable

D)participating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

39

A stock dividend does all of the following except.

A)Increase the number of shares issued

B)Increase the number of shares outstanding

C)Decrease the assets of the corporation

D)Does all of the above

A)Increase the number of shares issued

B)Increase the number of shares outstanding

C)Decrease the assets of the corporation

D)Does all of the above

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

40

Nutritech Corporation has 500,000 shares of 7.5%,$100 par value cumulative preferred stock issued with 45,000 shares issued and 40,000 outstanding,as well as 275,000 shares of $1 par value common stock issued and 250,000 shares outstanding.Dividends relative to the preferred stock are three years in arrears.If Nutritech declares a $2,887,500 dividend during the current period,the per share dividend applicable to the preferred and common stockholders is:

A)$7.50 and $1.00,respectively

B)$22.50 and $7.95,respectively

C)$30.00 and $6.75,respectively

D)$40.00 and $1.00,respectively

A)$7.50 and $1.00,respectively

B)$22.50 and $7.95,respectively

C)$30.00 and $6.75,respectively

D)$40.00 and $1.00,respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

41

John,Doe and Smitty are partners in the NoName Company.Their profit and loss sharing relationship is 7:5:3.Doe's share of a $75,000 partnership loss would be:

A)$(37,500)

B)$(25,000)

C)$(20,000)

D)$(15,000)

A)$(37,500)

B)$(25,000)

C)$(20,000)

D)$(15,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

42

When a partner receives a salary allowance as part of his/her partnership agreement this mean.

A)The partner donates part of his salary to the partnership in exchange for an ownership interest.

B)The partner will be allocates a portion of the income or loss based on this salary figure.

C)The partner will receive a check for this salary if the company has a profit.

D)The partner will be paid that salary for the year regardless of whether the partnership generates income or loss.

A)The partner donates part of his salary to the partnership in exchange for an ownership interest.

B)The partner will be allocates a portion of the income or loss based on this salary figure.

C)The partner will receive a check for this salary if the company has a profit.

D)The partner will be paid that salary for the year regardless of whether the partnership generates income or loss.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

43

During the current year,Chris,Casey,and Steve,who are partners in the CCS Company,had average capital balances of $39,000,$43,000,and $55,000,respectively.The partners share profits and losses by allowing a 12% return on average capital,with any remaining income or loss divided in a ratio of 7:5:3.If the company's income was $8,940,Casey's capital account would:

A)increase by $2,980

B)decrease by $2,806

C)increase by $2,660

D)decrease by $2,500

A)increase by $2,980

B)decrease by $2,806

C)increase by $2,660

D)decrease by $2,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

44

Which of the following statements is true about distribution of partners earning?

A)The interest on capital reduces net income on the income statement

B)The salary component is reported as salary expense on the income statement.

C)The interest and salary allocations have no effect on cash flows

D)Owners' equity is reduced by the salary allocation.

A)The interest on capital reduces net income on the income statement

B)The salary component is reported as salary expense on the income statement.

C)The interest and salary allocations have no effect on cash flows

D)Owners' equity is reduced by the salary allocation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

45

Moe,Larry and Curly are partners in the 3S Company.Their profit and loss sharing relationship is 6:4:2.Larry's share of $48,000 in partnership income would be:

A)$16,000

B)$19,200

C)$24,000

D)$32,600

A)$16,000

B)$19,200

C)$24,000

D)$32,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

46

During the current year,Lisa,Tony,and Brian,who are partners in the Corsetti Company,had average capital balances of $41,000,$53,000,and $48,000,respectively.The partners share profits and losses by allowing a $16,000 salary to Lisa and a $14,000 salary to Brian,and a 12% return on average capital balances to all the partners.Any remaining income or loss is divided equally.If the company's income was $101,040,Brian's capital account would increase by:

A)$13,920

B)$33,680

C)$37,760

D)$53,440

A)$13,920

B)$33,680

C)$37,760

D)$53,440

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

47

Which of the following is not one of the advantages of sole proprietorships and partnerships,as compared to corporations?

A)limited liability

B)ease of formation

C)income is only taxed once

D)owners are more likely to be managers

A)limited liability

B)ease of formation

C)income is only taxed once

D)owners are more likely to be managers

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

48

Russ,Adam,and Brent,who are partners in the Bowinkles Company,had ending capital balances for the current year equal to $95,000,$43,000,and $62,000,respectively.If the partners share income and losses based on the ratio of these ending capital balances,Brent's share of $95,000 in partnership income would be:

A)$58,900

B)$29,450

C)$23,900

D)$0

A)$58,900

B)$29,450

C)$23,900

D)$0

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

49

If you own convertible preferred stock,what right does the convertibility feature give you?

A)You can convert the stock into cash whenever you want

B)You can convert the stock into the firm's common shares

C)You can convert the stock into cash but only at pre-specified times

D)You have the right to receive dividends in arrears before common stock gets a dividend

A)You can convert the stock into cash whenever you want

B)You can convert the stock into the firm's common shares

C)You can convert the stock into cash but only at pre-specified times

D)You have the right to receive dividends in arrears before common stock gets a dividend

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

50

Which of the following is not one of the advantages of the corporation as compared to sole proprietorships and partnerships?

A)ability to raise large sums of money

B)ease of formation

C)limited liability

D)unlimited life

A)ability to raise large sums of money

B)ease of formation

C)limited liability

D)unlimited life

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

51

If preferred stock has the right to receive dividends in excess of its stated dividend rate it is referred to as

A)callable

B)convertible

C)redeemable

D)participating

A)callable

B)convertible

C)redeemable

D)participating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

52

Which of the following statements about a limited liability partnership (LLP)is true?

A)an LLP has one or more general partners and one or more limited partners

B)partners in an LLP are liable only for their investments in the partnership

C)partners in an LLP are not liable for the misdeeds of another partner

D)only the general partners in an LLP can participate in management

A)an LLP has one or more general partners and one or more limited partners

B)partners in an LLP are liable only for their investments in the partnership

C)partners in an LLP are not liable for the misdeeds of another partner

D)only the general partners in an LLP can participate in management

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

53

Tom,Dick and Harry are partners in the Wipeout Company.Their partnership income sharing agreement calls for Tom and Dick to receive salary allowances of $24,000 and $18,500,respectively.Any remaining income or loss is to be divided equally.If the company's income was $96,500,Dick's share would be:

A)$18,000

B)$18,500

C)$36,500

D)$37,000

A)$18,000

B)$18,500

C)$36,500

D)$37,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

54

If preferred stockholders have the right to sell their stock for cash to the corporation it is referred to as

A)callable

B)convertible

C)redeemable

D)participating

A)callable

B)convertible

C)redeemable

D)participating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

55

Nap,Olie,and Eon,who are partners in the Josephine Company,had beginning capital balances of $35,000,$62,000,and $28,000,respectively.If the partners share income and losses based on the ratio of their beginning capital balances,Olie's share of a $250,000 partnership loss would be:

A)$(155,000)

B)$(124,000)

C)$ (62,000)

D)$ (31,000)

A)$(155,000)

B)$(124,000)

C)$ (62,000)

D)$ (31,000)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

56

During the current year,Julia,Vanessa,and Connie,who are partners in the MacIntosh Company,had average capital balances of $62,000,$56,000,and $74,000,respectively.The partners share profits and losses by allowing a $15,000 salary to Julia and a $19,000 salary to Vanessa,and a 12% return on average capital balances to all the partners.Any remaining income or loss is divided equally.If the company had a loss of $2,960,Julia's capital account would:

A)decrease by $987

B)increase by $2,440

C)increase by $14,013

D)decrease by $20,000

A)decrease by $987

B)increase by $2,440

C)increase by $14,013

D)decrease by $20,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

57

Michael,Zoe and Perry are partners in the Andover Company.Their partnership income sharing agreement provides that Michael and Zoe are to receive salary allowances of $15,000 and $18,000,respectively,and that any remaining income or loss is to be divided equally among all partners.If the company had a loss of $30,000,Zoe's capital account would:

A)increase by $18,000

B)increase by $8,000

C)decrease by $10,000

D)decrease by $3,000

A)increase by $18,000

B)increase by $8,000

C)decrease by $10,000

D)decrease by $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

58

During the current year,Jacob,Alicia,and Shawn,who are partners in the JAS Company,had average capital balances of $57,000,$49,000,and $64,000,respectively.The partners share profits and losses by allowing a 12% return on average capital,with any remaining income or loss divided in a ratio of 5:3:2.If the company's income for the current year was $73,800,Shawn's capital account would increase by:

A)$14,760

B)$18,360

C)$22,440

D)$27,784

A)$14,760

B)$18,360

C)$22,440

D)$27,784

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

59

Sage,Rosemary and Thyme are partners in the Music Company.Their partnership income sharing agreement provides that Sage and Thyme are to receive salary allowances of $29,700 and $16,800,respectively,and that any remaining income or loss is to be divided equally among all partners.If the company's income was $39,000,Thyme's share would be:

A)$14,300

B)$16,800

C)$19,300

D)$29,800

A)$14,300

B)$16,800

C)$19,300

D)$29,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

60

Preferred stock for which unpaid dividends must be paid before dividends can be paid to common stockholders is referred to as

A)callable

B)convertible

C)cumulative

D)participating

A)callable

B)convertible

C)cumulative

D)participating

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

61

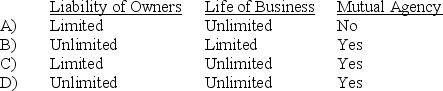

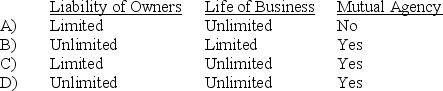

Which of the following is true about the characteristics of a corporation?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

62

Babylon Corporation has 1,000,000,$1 par shares of common stock authorized.A total of 400,000 shares have been sold to stockholders and 10,000 shares have been repurchased by the firm for later resale.How many shares are issued and outstanding? Issued Outstanding

A)1,000,000 400,000

B)390,000 390,000

C)400,000 390,000

D)400,000 400,000

A)1,000,000 400,000

B)390,000 390,000

C)400,000 390,000

D)400,000 400,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

63

Callisto began 2000 with 100,000 shares of $3 par common stock.The firm declared a 3-for-1 stock split on March 1,2010.How will the stock split affect Callisto's stockholders' equity?

A)increase

B)decrease

C)no effect

D)unable to determine from the information given

A)increase

B)decrease

C)no effect

D)unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

64

Zathras Corporation has 2,000,000,$1 par shares of common stock authorized.A total of 800,000 shares have been sold to stockholders and 40,000 shares have been repurchased by the firm and retired.How many issued and outstanding shares does Zathras have? Issued Outstanding

A)2,000,000 800,000

B)800,000 800,000

C)800,000 760,000

D)760,000 760,000

A)2,000,000 800,000

B)800,000 800,000

C)800,000 760,000

D)760,000 760,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

65

Which of the following is not a right of common stockholders?

A)Preemptive right

B)Right to vote

C)Right to dividend when declared

D)All of the above are rights of common stockholders.

A)Preemptive right

B)Right to vote

C)Right to dividend when declared

D)All of the above are rights of common stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

66

Aslo Corporation has 10,000,000,$1 par shares of common stock authorized.A total of 6,000,000 shares have been sold to stockholders in 2001 and in 2008 Aslo purchased 50,000 of its own stock.Then in 2010 5,000 shares of the treasury shares were sold.As of the end of 2010 how many shares are issued and outstanding? Issued Outstanding

A)6,000,000 5,955,000

B)10,000,000 9,955,000

C)6,000,000 6,045,000

D)6,050,000 6,045,000

A)6,000,000 5,955,000

B)10,000,000 9,955,000

C)6,000,000 6,045,000

D)6,050,000 6,045,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

67

Which of the following balance sheet accounts describes the stockholders' claims on the assets of a firm that have been created by the company's operating profits?

A)Retained Earnings

B)Net Income

C)Contributed Capital

D)Paid-in-Capital in Excess of Par

A)Retained Earnings

B)Net Income

C)Contributed Capital

D)Paid-in-Capital in Excess of Par

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

68

On which of the following dates is no accounting entry made?

A)Date of payment

B)Date of record

C)Date of declaration

D)Entries are made on all three dates

A)Date of payment

B)Date of record

C)Date of declaration

D)Entries are made on all three dates

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

69

Which of the following statements is true about the debt to equity ratio?

A)The greater the debt to equity ratio the smaller the opportunity to increase the return on equity of a firm through financial leverage.

B)The greater the debt to equity ratio the greater the chance the firm will not meet its debt obligations.

C)The size of a of a company's debt to equity ratio is directly related to amount of a firm's sales.

D)The lower the debt to equity ratio the higher the risk that financial leverage will have a negative impact on a firm's return on equity.

A)The greater the debt to equity ratio the smaller the opportunity to increase the return on equity of a firm through financial leverage.

B)The greater the debt to equity ratio the greater the chance the firm will not meet its debt obligations.

C)The size of a of a company's debt to equity ratio is directly related to amount of a firm's sales.

D)The lower the debt to equity ratio the higher the risk that financial leverage will have a negative impact on a firm's return on equity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following is true about financial leverage?

A)Financial leverage boosts the rate of return for the creditors of the firm.

B)Financial leverage can increase the rate of return on owners' equity when the rate of return on invested assets is greater than the interest rate paid to creditors.

C)Financial leverage is created when there is no debt and the rate of return is increased with an increase in sales.

D)Financial leverage increases sales by increasing the amount invested in plant and equipment rather than financial assets such as bonds and stock.

A)Financial leverage boosts the rate of return for the creditors of the firm.

B)Financial leverage can increase the rate of return on owners' equity when the rate of return on invested assets is greater than the interest rate paid to creditors.

C)Financial leverage is created when there is no debt and the rate of return is increased with an increase in sales.

D)Financial leverage increases sales by increasing the amount invested in plant and equipment rather than financial assets such as bonds and stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

71

Creditors are interested in a corporation's stockholders' equity because

A)stockholders' equity will be used to pay the creditors' claims

B)they get to vote in corporate elections when their claims are past due

C)they are entitled to dividends before any are paid to common stockholders

D)stockholders' equity represents a margin of safety for meeting their claims on assets

A)stockholders' equity will be used to pay the creditors' claims

B)they get to vote in corporate elections when their claims are past due

C)they are entitled to dividends before any are paid to common stockholders

D)stockholders' equity represents a margin of safety for meeting their claims on assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

72

Starfury Corporation has 1,000,000,$1 par shares of common stock authorized.A total of 400,000 shares have been sold to stockholders and 10,000 shares have been repurchased by the firm.How many shares are outstanding?

A)1,000,000

B)600,000

C)400,000

D)390,000

A)1,000,000

B)600,000

C)400,000

D)390,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

73

Which of the following is not a right of common stockholders?

A)Preemptive right

B)Right to vote

C)Right to dividend when declared

D)The redemptive right

E)All of the above are rights of common stockholders.

A)Preemptive right

B)Right to vote

C)Right to dividend when declared

D)The redemptive right

E)All of the above are rights of common stockholders.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

74

Which of the following is NOT a potential feature of preferred stock?

A)Cumulative preferred stock

B)Participating preferred stock

C)Redeemable preferred stock

D)Convertible preferred stock

E)All of the above could be a feature of preferred stock.

A)Cumulative preferred stock

B)Participating preferred stock

C)Redeemable preferred stock

D)Convertible preferred stock

E)All of the above could be a feature of preferred stock.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is NOT one of the four basic rights of a corporation's common stockholders?

A)Stock appreciation rights.

B)The right to vote.

C)The right to dividends when declared by the board of directors.

D)The preemptive right.

A)Stock appreciation rights.

B)The right to vote.

C)The right to dividends when declared by the board of directors.

D)The preemptive right.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

76

If a corporation goes out of business,whose claims would be satisfied last,if at all?

A)preferred shareholders

B)common shareholders

C)employees

D)creditors

A)preferred shareholders

B)common shareholders

C)employees

D)creditors

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

77

On which of the following are accounting entries made on both dates?

A)Date of record and date of payment

B)Date of payment and ex-dividend date

C)Date of declaration and date of payment

D)Date of record and date of declaration

A)Date of record and date of payment

B)Date of payment and ex-dividend date

C)Date of declaration and date of payment

D)Date of record and date of declaration

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

78

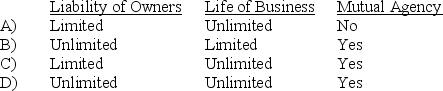

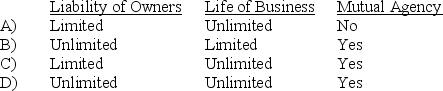

Which of the following is true about the characteristics of a partnership?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

79

When a corporation issues additional stock,current shareholders will be able to purchase new shares in proportion to their current ownership because of the

A)liquidation right

B)preemptive right

C)redemption privilege

D)cumulative privilege

A)liquidation right

B)preemptive right

C)redemption privilege

D)cumulative privilege

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck

80

Double taxation is a disadvantage of the corporate ownership structure.What does double taxation mean?

A)Corporate tax rates are double the tax rates of sole proprietorships and partnerships

B)Corporations are subject to both a tax on profits and on retained earnings

C)Corporate profits are taxed at both the corporate and individual level

D)Corporate profits are subject to both federal and state income taxes

A)Corporate tax rates are double the tax rates of sole proprietorships and partnerships

B)Corporations are subject to both a tax on profits and on retained earnings

C)Corporate profits are taxed at both the corporate and individual level

D)Corporate profits are subject to both federal and state income taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 98 في هذه المجموعة.

فتح الحزمة

k this deck