Deck 10: Recording and Evaluating Revenue Process Activities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/92

العب

ملء الشاشة (f)

Deck 10: Recording and Evaluating Revenue Process Activities

1

For the collection process,which of the following sequences of events is correct?

A)Remittance advice received,deposit slip prepared,cash recorded in journal

B)Remittance advice received,cash recorded in journal,deposit slip prepared

C)Deposit slip prepared,remittance advice received,cash recorded in journal

D)Cash recorded in journal,deposit slip prepared,remittance advice received.

A)Remittance advice received,deposit slip prepared,cash recorded in journal

B)Remittance advice received,cash recorded in journal,deposit slip prepared

C)Deposit slip prepared,remittance advice received,cash recorded in journal

D)Cash recorded in journal,deposit slip prepared,remittance advice received.

Remittance advice received,deposit slip prepared,cash recorded in journal

2

The account which is reported at its net realizable value is:

A)sales returns and allowances

B)accounts receivable

C)notes payable

D)equipment

A)sales returns and allowances

B)accounts receivable

C)notes payable

D)equipment

accounts receivable

3

In the following journal entry,revenue is being recognized: Cash XXX

Customer Deposit XXX

A)after the cash is collected

B)before the cash is collected

C)no revenue is being recognized

D)at the same time cash is collected

Customer Deposit XXX

A)after the cash is collected

B)before the cash is collected

C)no revenue is being recognized

D)at the same time cash is collected

no revenue is being recognized

4

The journal entry to remove a specific customer's account,once it is identified as uncollectible,would include a:

A)credit to allowance for doubtful accounts

B)debit to uncollectible accounts expense

C)credit to accounts receivable

D)debit to sales revenue

A)credit to allowance for doubtful accounts

B)debit to uncollectible accounts expense

C)credit to accounts receivable

D)debit to sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

5

In the following journal entry,revenue is being recognized:

A)at the same time cash is collected

B)before the cash is collected

C)after the cash is collected

D)on an installment basis

A)at the same time cash is collected

B)before the cash is collected

C)after the cash is collected

D)on an installment basis

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

6

The journal entry to record a customer's payment within the discount period would include a:

A)credit to cash

B)debit to sales discounts

C)debit to accounts payable

D)credit to sales

A)credit to cash

B)debit to sales discounts

C)debit to accounts payable

D)credit to sales

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

7

In the following journal entry,revenue is being recognized: Cash XXX

Unearned Revenue XXX

A)after the cash is collected

B)before the cash is collected

C)no revenue is being recognized

D)at the same time cash is collected

Unearned Revenue XXX

A)after the cash is collected

B)before the cash is collected

C)no revenue is being recognized

D)at the same time cash is collected

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which of the following does not indicate that a revenue has been realized?

A)Cash has been received.

B)A valid promise to pay has been received.

C)The revenue has been earned.

D)The net assets (assets - liabilities)has been increased

A)Cash has been received.

B)A valid promise to pay has been received.

C)The revenue has been earned.

D)The net assets (assets - liabilities)has been increased

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

9

For the revenue process which of the following document sequences is correct?

A)Customer order,bill or lading,sales order,packing slip

B)Sales order,packing slip,customer order,bill of lading

C)Customer order,packing slip,sales order,bill of lading

D)Customer order,sales order,packing slip,bill of lading

A)Customer order,bill or lading,sales order,packing slip

B)Sales order,packing slip,customer order,bill of lading

C)Customer order,packing slip,sales order,bill of lading

D)Customer order,sales order,packing slip,bill of lading

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

10

The journal entry to record a customer's payment within the discount period would include all but one of the following.

A)Debit to cash

B)Debit to sales discount

C)Credit to sales

D)Credit to accounts receivable

A)Debit to cash

B)Debit to sales discount

C)Credit to sales

D)Credit to accounts receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following would be part of the entry to record a sales return?

A)Credit to sales returns and allowances

B)Debit to accounts receivable

C)Debit to sales returns and allowances

D)Debit to cash

A)Credit to sales returns and allowances

B)Debit to accounts receivable

C)Debit to sales returns and allowances

D)Debit to cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which of the following revenue process events is a business but not accounting event?

A)Receive payment from customer

B)Determine marketing and distribution channels

C)Deliver goods and services

D)Provide customer support

A)Receive payment from customer

B)Determine marketing and distribution channels

C)Deliver goods and services

D)Provide customer support

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

13

The journal entry to record a sales discount taken by a customer would include:

A)A debit to Accounts Receivable and Sales Discount

B)A debit to Cash and Sales Discount

C)A debit to Sales and a credit to Accounts Receivable

D)A debit to Cash and a credit to Sales Discount

A)A debit to Accounts Receivable and Sales Discount

B)A debit to Cash and Sales Discount

C)A debit to Sales and a credit to Accounts Receivable

D)A debit to Cash and a credit to Sales Discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

14

Revenues are recognized when they are:

A)Earned and have received cash

B)Received cash

C)Earned and realized

D)Realized

A)Earned and have received cash

B)Received cash

C)Earned and realized

D)Realized

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

15

One example of a contra-revenue account is:

A)allowance for doubtful accounts

B)sales returns and allowances

C)accumulated depreciation

D)sales revenue

A)allowance for doubtful accounts

B)sales returns and allowances

C)accumulated depreciation

D)sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

16

One example of a contra-asset is:

A)Sales Discount

B)Sales Returns and Allowances

C)Uncollectible Accounts Expense

D)None of the above are contra assets.

A)Sales Discount

B)Sales Returns and Allowances

C)Uncollectible Accounts Expense

D)None of the above are contra assets.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

17

The journal entry to record a sales return made by a customer would include:

A)A debit to Accounts Receivable and a credit to Sales Returns

B)A debit to Cash and Sales Returns

C)A debit to Sales Returns and a credit to Accounts Receivable

D)A debit to Accounts Receivable and a credit to Cash

A)A debit to Accounts Receivable and a credit to Sales Returns

B)A debit to Cash and Sales Returns

C)A debit to Sales Returns and a credit to Accounts Receivable

D)A debit to Accounts Receivable and a credit to Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

18

The journal entry to record the return of merchandise from a credit customer would include a:

A)credit to sales returns and allowances

B)credit to accounts receivable

C)debit to sales revenue

D)debit to cash

A)credit to sales returns and allowances

B)credit to accounts receivable

C)debit to sales revenue

D)debit to cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

19

The credit terms for an $10,000 sale are 1/10,n/60.The amount of discount allowed on this sale is:

A)$1,000

B)$100

C)$60

D)$600

A)$1,000

B)$100

C)$60

D)$600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

20

The account "Advances from Customers" is a(n):

A)asset account

B)liability account

C)revenue account

D)contra-revenue account

A)asset account

B)liability account

C)revenue account

D)contra-revenue account

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

21

On December 31,2010,Aurora Enterprises failed to make the necessary adjusting entry for estimated uncollectible accounts.This error would cause an:

A)understatement of net income and an understatement of liabilities

B)overstatement of net income and an understatement of liabilities

C)overstatement of net income and an overstatement of assets

D)understatement of assets and stockholders' equity

A)understatement of net income and an understatement of liabilities

B)overstatement of net income and an understatement of liabilities

C)overstatement of net income and an overstatement of assets

D)understatement of assets and stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

22

A data storage device listing each customer,along with all the credit sales made to,as well as payments received on account from that customer is called a(n):

A)aging schedule

B)marketing survey

C)sales returns and allowances report

D)subsidiary accounts receivable ledger

A)aging schedule

B)marketing survey

C)sales returns and allowances report

D)subsidiary accounts receivable ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

23

The Accounts Receivable account is reported on the balance sheet as a:

A)contra asset

B)current asset

C)long-term asset

D)current liability

A)contra asset

B)current asset

C)long-term asset

D)current liability

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

24

A transaction involving the receipt of a $10,000 retainer by an attorney's prior to any works being performed on behalf of the client would:

A)decrease assets

B)increase liabilities

C)increase net income

D)decrease stockholders' equity

A)decrease assets

B)increase liabilities

C)increase net income

D)decrease stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

25

The journal entry to remove a specific customer's account,once it is identified as uncollectible,would include a:

A)debit to allowance for doubtful accounts

B)debit to uncollectible accounts expense

C)debit to accounts receivable

D)debit to sales revenue

A)debit to allowance for doubtful accounts

B)debit to uncollectible accounts expense

C)debit to accounts receivable

D)debit to sales revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

26

Voyager Products,Inc.reported sales revenue of $295,000,beginning and ending accounts receivable of $24,600 and $31,800,respectively,and beginning and ending customer deposits of $18,600 and $14,500,respectively.Cash collections from customers during the year were:

A)$306,300

B)$295,000

C)$283,700

D)$277,700

A)$306,300

B)$295,000

C)$283,700

D)$277,700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

27

Allowance for Doubtful Accounts had a beginning and ending balance of $3,500 and $4,600,respectively.If uncollectible accounts expense was $9,500 for the period,the total dollar amount of accounts written off during the period was:

A)$13,000

B)$8,400

C)$10,600

D)$ 9,500

A)$13,000

B)$8,400

C)$10,600

D)$ 9,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

28

The journal entry to remove a specific customer's account,once it identified as uncollectible,would ______ net accounts receivable.

A)increase

B)decrease

C)not affect

D)eliminate

A)increase

B)decrease

C)not affect

D)eliminate

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

29

Uncollectible Accounts Expense and Allowance for Doubtful Accounts are shown on the:

A)balance sheet

B)income statement

C)balance sheet and income statement,respectively

D)income statement and balance sheet,respectively

A)balance sheet

B)income statement

C)balance sheet and income statement,respectively

D)income statement and balance sheet,respectively

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

30

A transaction involving the receipt of a $10,000 by a CPA prior to any works being performed on behalf of the client would:

A)decrease assets and increase liabilities

B)increase liabilities and increase assets

C)increase net income and increase assets

D)increase stockholders' equity and increase assets

A)decrease assets and increase liabilities

B)increase liabilities and increase assets

C)increase net income and increase assets

D)increase stockholders' equity and increase assets

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

31

Accounts receivable written off during the year totaled $61,500 while the beginning and ending balance of Allowance for Doubtful Accounts were $51,300 and $55,700,respectively.The amount of uncollectible accounts expense for the period was:

A)$57,100

B)$65,900

C)$61,500

D)cannot be determined from the information given

A)$57,100

B)$65,900

C)$61,500

D)cannot be determined from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

32

Candle Corporation's adjusted trial balance includes Allowance for Doubtful Accounts at $37,500,Uncollectible Accounts Expense at $18,700,Notes Receivable at $25,000,and Accounts Receivable at $136,800.Net accounts receivable amounts to:

A)$ 99,300

B)$118,000

C)$124,300

D)$143,000

A)$ 99,300

B)$118,000

C)$124,300

D)$143,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

33

On December 1,2010,Commonwealth Industries received a $10,000 deposit from a customer for a special order of merchandise to be manufactured and shipped in February,2011.Commonwealth made the following journal entry on December 1,2010:  The financial statements dated December 31,2010,would be:

The financial statements dated December 31,2010,would be:

A)correctly stated

B)in error,understating liabilities and overstating assets

C)in error,overstating net income and understating liabilities

D)in error,understating net income and understating stockholders' equity

The financial statements dated December 31,2010,would be:

The financial statements dated December 31,2010,would be:A)correctly stated

B)in error,understating liabilities and overstating assets

C)in error,overstating net income and understating liabilities

D)in error,understating net income and understating stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

34

The Customer Deposits account is reported on the balance sheet as a:

A)contra asset

B)current asset

C)current liability

D)long-term asset

A)contra asset

B)current asset

C)current liability

D)long-term asset

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

35

Kozicek Corporation reported credit sales of $200,000,accounts receivable of $110,000 at the beginning of the year,and accounts receivable of $150,000 at the end of the year.During the year Kozicek wrote off $10,00 as bad debt.Cash collections from customers during the year were:

A)$160,000

B)$200,000

C)$300,000

D)$150,000

A)$160,000

B)$200,000

C)$300,000

D)$150,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

36

Coast Starlight Company reported cash received from customers of $1,358,500 for the year ended June 30,2010.Comparative balance sheets for June 30,2009 and 2010,reported net accounts receivable balances of $85,600 and $79,300,respectively.Net sales reported on the income statement for the year ended June 30,2010 were:

A)$1,279,200

B)$1,352,200

C)$1,364,800

D)$1,437,800

A)$1,279,200

B)$1,352,200

C)$1,364,800

D)$1,437,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

37

Crete Carrier Corporation reported sales revenue of $1,724,000,accounts receivable of $179,000 at the beginning of the year,and accounts receivable of $201,000 at the end of the year.Cash collections from customers during the year were:

A)$1,702,000

B)$1,724,000

C)$1,746,000

D)$1,423,000

A)$1,702,000

B)$1,724,000

C)$1,746,000

D)$1,423,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

38

Sedlacek Corporation reported sales revenue of $785,000,accounts receivable of $42,600 at the beginning of the year,and accounts receivable of $66,200 at the end of the year.Cash collections from customers during the year were:

A)$808,600

B)$785,000

C)$761,400

D)$827,600

A)$808,600

B)$785,000

C)$761,400

D)$827,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

39

Worldwide Resources,Inc.reported sales revenue of $525,000,beginning and ending accounts receivable of $43,200 and $37,600,respectively,and beginning and ending customer deposits of $20,000 and $28,500,respectively.Cash collections from customers during the year were:

A)$510,900

B)$515,900

C)$525,000

D)$539,100

A)$510,900

B)$515,900

C)$525,000

D)$539,100

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

40

A cash sale would impact the:

A)income statement only

B)balance sheet and income statement only

C)balance sheet and statement of cash flows only

D)balance sheet,income statement,and statement of cash flows

A)income statement only

B)balance sheet and income statement only

C)balance sheet and statement of cash flows only

D)balance sheet,income statement,and statement of cash flows

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

41

The IRS requires that any firm using ______ for tax purposes must use ______ for financial statement reporting purposes.

A)FIFO,LIFO

B)LIFO,LIFO

C)FIFO,FIFO

D)LIFO,FIFO

A)FIFO,LIFO

B)LIFO,LIFO

C)FIFO,FIFO

D)LIFO,FIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

42

Use the following to answer questions

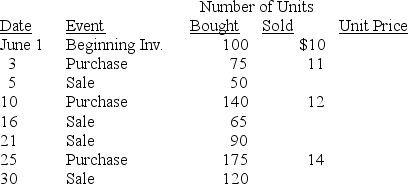

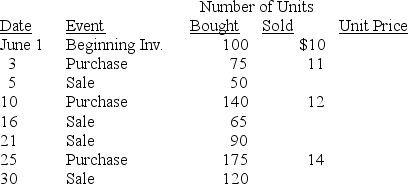

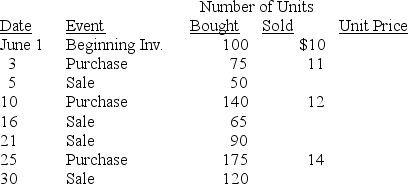

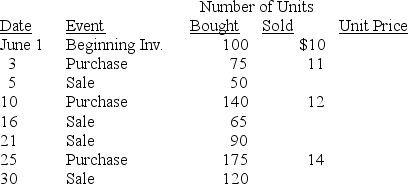

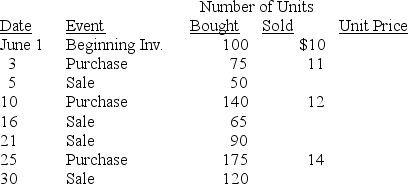

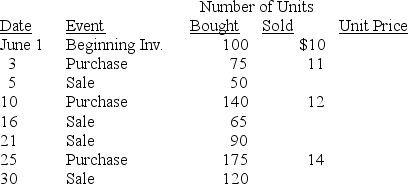

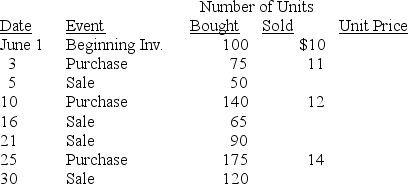

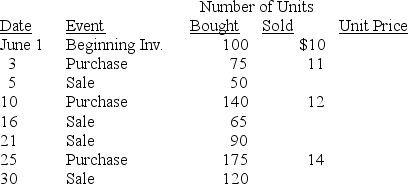

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The cost of goods sold for the June 5th sale is:

A)$500

B)$550

C)$600

D)$700

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The cost of goods sold for the June 5th sale is:

A)$500

B)$550

C)$600

D)$700

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

43

Use the following to answer questions

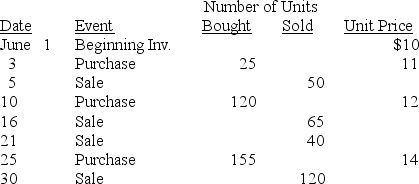

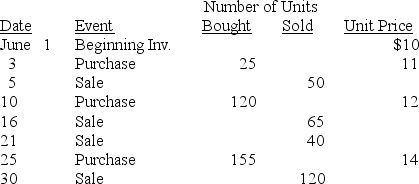

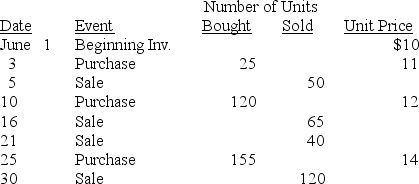

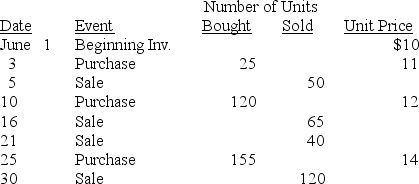

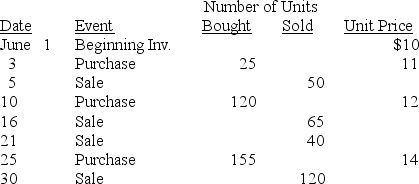

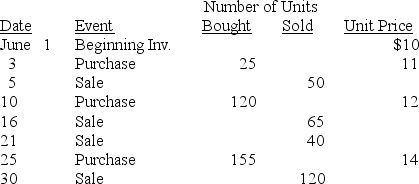

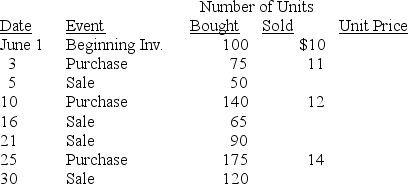

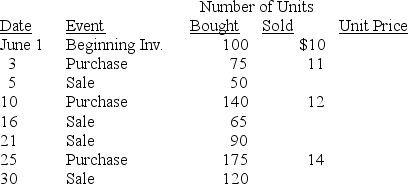

Ashland Company has a perpetual inventory system and uses the FIFO method of inventory costing. Ashland had a beginning inventory of 50 units and reported the following events during the month of June:

The cost of goods sold for the June 21 sale is:

A)$480

B)$400

C)$440

D)$560

Ashland Company has a perpetual inventory system and uses the FIFO method of inventory costing. Ashland had a beginning inventory of 50 units and reported the following events during the month of June:

The cost of goods sold for the June 21 sale is:

A)$480

B)$400

C)$440

D)$560

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

44

The beginning balance in the allowance for uncollectible accounts of Pankhurst Corporation was $26,000.During the period,$17,000 of accounts receivable were written off.At the end of the period,Pankhurst estimates that $30,000 of its accounts receivable will be uncollectible.What amount of uncollectible accounts expense should the firm report?

A)$9,000

B)$17,000

C)$21,000

D)$30,000

A)$9,000

B)$17,000

C)$21,000

D)$30,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

45

In times of rising prices,______ generally result(s)in the ______ cost of goods sold.

A)LIFO and FIFO,same

B)FIFO,higher

C)LIFO,lower

D)FIFO,lower

A)LIFO and FIFO,same

B)FIFO,higher

C)LIFO,lower

D)FIFO,lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

46

In times of rising prices,______ generally result(s)in the ______ ending inventory.

A)LIFO and FIFO,same

B)LIFO,higher

C)FIFO,lower

D)LIFO,lower

A)LIFO and FIFO,same

B)LIFO,higher

C)FIFO,lower

D)LIFO,lower

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

47

The sale of merchandise on account to a customer would:

A)increase assets

B)increase liabilities

C)decrease revenues

D)decrease stockholders' equity

A)increase assets

B)increase liabilities

C)decrease revenues

D)decrease stockholders' equity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

48

Use the following to answer questions

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The cost of goods sold for the June 30th sale is:

A)$1,320

B)$1,440

C)$1,460

D)$1,680

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The cost of goods sold for the June 30th sale is:

A)$1,320

B)$1,440

C)$1,460

D)$1,680

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is not an advantage of LIFO over FIFO?

A)lower income taxes

B)better inventory figure on balance sheet

C)better matching of revenues and costs on the income statement

D)cost of goods sold better approximates current replacement cost

A)lower income taxes

B)better inventory figure on balance sheet

C)better matching of revenues and costs on the income statement

D)cost of goods sold better approximates current replacement cost

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

50

Anthony Company sold merchandise on account to a customer at a price of $5,000.The merchandise cost Anthony $4,200.The terms of the sale were 3/10,n/30.If the customer paid within the discount period,by how much did this transaction increase Anthony's net income?

A)$5,000

B)$ 800

C)$ 650

D)$ 300

A)$5,000

B)$ 800

C)$ 650

D)$ 300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

51

The inventory costing system that charges inventory to cost of goods sold in chronological order of its purchase is referred to as:

A)FIFO

B)LIFO

C)specific identification

D)periodic identification

A)FIFO

B)LIFO

C)specific identification

D)periodic identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

52

Constanza Company had a beginning and ending allowance for doubtful accounts balance of $23,000 and $27,000,respectively.If $12,000 of accounts were written off during the period,what was the uncollectible accounts expense?

A)$27,000

B)$16,000

C)$12,000

D)$ 4,000

A)$27,000

B)$16,000

C)$12,000

D)$ 4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

53

In times of declining prices,______ generally result(s)in the ______ net income.

A)LIFO,lower

B)FIFO,higher

C)LIFO,higher

D)LIFO and FIFO,same

A)LIFO,lower

B)FIFO,higher

C)LIFO,higher

D)LIFO and FIFO,same

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

54

Carpenter Company had a beginning and ending allowance for doubtful accounts balance of $13,000 and $15,000,respectively.Its beginning and ending accounts receivable balances were $75,000 and $83,000,respectively.If $16,000 of accounts were written off during the period,what was net accounts receivable at the end of the period?

A)$67,000

B)$68,000

C)$71,000

D)$83,000

A)$67,000

B)$68,000

C)$71,000

D)$83,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

55

Use the following to answer questions

Ashland Company has a perpetual inventory system and uses the FIFO method of inventory costing. Ashland had a beginning inventory of 50 units and reported the following events during the month of June:

The cost of goods sold for the June 5 sale is:

A)$525

B)$600

C)$500

D)$550

Ashland Company has a perpetual inventory system and uses the FIFO method of inventory costing. Ashland had a beginning inventory of 50 units and reported the following events during the month of June:

The cost of goods sold for the June 5 sale is:

A)$525

B)$600

C)$500

D)$550

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

56

Cady,Inc.,had beginning and ending accounts receivable balances of $35,000 and 32,000,respectively.During the period,$100,000 was collected from credit customers.What was the amount of credit sales during the period?

A)$135,000

B)$132,000

C)$100,000

D)$97,000

A)$135,000

B)$132,000

C)$100,000

D)$97,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

57

Use the following to answer questions

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The cost of goods sold for the June 16th sale is:

A)$650

B)$665

C)$715

D)$780

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The cost of goods sold for the June 16th sale is:

A)$650

B)$665

C)$715

D)$780

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

58

A firm has accounts receivable of $100,000 and allowance for doubtful accounts of $15,000.How will this be reported on the financial statements?

A)$85,000 asset

B)$85,000 revenue

C)$100,000 asset and $15,000 liability

D)revenue of $100,000 and expense of $15,000

A)$85,000 asset

B)$85,000 revenue

C)$100,000 asset and $15,000 liability

D)revenue of $100,000 and expense of $15,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

59

Use the following to answer questions

Ashland Company has a perpetual inventory system and uses the FIFO method of inventory costing. Ashland had a beginning inventory of 50 units and reported the following events during the month of June:

The cost of goods sold for the June 16 sale is:

A)$780

B)$755

C)$715

D)$650

Ashland Company has a perpetual inventory system and uses the FIFO method of inventory costing. Ashland had a beginning inventory of 50 units and reported the following events during the month of June:

The cost of goods sold for the June 16 sale is:

A)$780

B)$755

C)$715

D)$650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

60

Use the following to answer questions

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The cost of goods sold for the June 21st sale is:

A)$1,260

B)$1,080

C)$1,065

D)$ 990

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The cost of goods sold for the June 21st sale is:

A)$1,260

B)$1,080

C)$1,065

D)$ 990

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

61

If a firm uses LIFO for income tax purposes,what method must be used for financial accounting purposes?

A)Any method may be used

B)Either FIFO or LIFO

C)FIFO

D)LIFO

A)Any method may be used

B)Either FIFO or LIFO

C)FIFO

D)LIFO

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

62

If beginning inventory is too big which of the following statements is true?

A)Cost of Good Sold is too big and income is too big.

B)Cost of Good Sold is too small and income is too big

C)Cost of Good Sold is too small and income is too small

D)Cost of Good Sold is too big and income is too small

A)Cost of Good Sold is too big and income is too big.

B)Cost of Good Sold is too small and income is too big

C)Cost of Good Sold is too small and income is too small

D)Cost of Good Sold is too big and income is too small

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

63

An unfavorable sale quantity variance reflects

A)Fewer units sold than budgeted.

B)A lower actual selling price than budgeted

C)An increase in the cost of products causing a decrease in income for the period

D)An increase in the number of units sold

A)Fewer units sold than budgeted.

B)A lower actual selling price than budgeted

C)An increase in the cost of products causing a decrease in income for the period

D)An increase in the number of units sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

64

Under which costing method is cost of good sold not systematically determined?

A)LIFO

B)FIFO

C)Average

D)Specific identification

A)LIFO

B)FIFO

C)Average

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

65

During the current year,cost of goods sold was higher under the LIFO method than under the FIFO method.Which of the following statements about price changes is true?

A)Prices were unchanged.

B)Prices were decreasing.

C)Prices were increasing.

D)Unable to determine from the information given

A)Prices were unchanged.

B)Prices were decreasing.

C)Prices were increasing.

D)Unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

66

Under which method are the most recent costs included in ending inventory?

A)LIFO

B)FIFO

C)Average

D)Specific identification

A)LIFO

B)FIFO

C)Average

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

67

If ending inventory is too big which of the following statements is true?

A)Cost of Good Sold is too big and income is too big

B)Cost of Good Sold is too small and income is too big

C)Cost of Good Sold is too small and income is too small

D)Cost of Good Sold is too big and income is too small

A)Cost of Good Sold is too big and income is too big

B)Cost of Good Sold is too small and income is too big

C)Cost of Good Sold is too small and income is too small

D)Cost of Good Sold is too big and income is too small

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

68

Under which method are the most recent costs included in cost of goods sold

A)LIFO

B)FIFO

C)Average

D)Specific identification

A)LIFO

B)FIFO

C)Average

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

69

Briefly describe the makeup of ending inventory under the FIFO and LIFO methods.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

70

A favorable sales price variance means

A)The cost of products have decreased increasing the profit from the product.

B)The actual selling price is greater than what was budgeted.

C)The company has sold more products than was anticipated.

D)The company sales price decreased causing more product to be sold

A)The cost of products have decreased increasing the profit from the product.

B)The actual selling price is greater than what was budgeted.

C)The company has sold more products than was anticipated.

D)The company sales price decreased causing more product to be sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

71

The inventory method that results in the highest net income during periods of declining prices is

A)LIFO

B)FIFO

C)Average

D)Specific identification

A)LIFO

B)FIFO

C)Average

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

72

The inventory method that results in the highest net income during periods of rising prices is

A)LIFO

B)FIFO

C)Average

D)Specific identification

A)LIFO

B)FIFO

C)Average

D)Specific identification

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

73

Explain how the write off of an accounts receivable will not affect the amount of net accounts receivable.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

74

Libretto,Inc.,uses the FIFO method and had ending inventory for 2010 of $35,000.If Libretto had used the LIFO method,its ending inventory would have been $32,000.Assume equal beginning inventories for the two methods.If Libretto had used the LIFO method instead of the FIFO method in 2010,how would its income before income tax have changed?

A)Decrease of $35,000

B)Increase of $35,000

C)Decrease of $3,000

D)Increase of $3,000

A)Decrease of $35,000

B)Increase of $35,000

C)Decrease of $3,000

D)Increase of $3,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

75

Use the following to answer questions

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The ending inventory on June 30 is:

A)$2,310

B)$1,880

C)$1,715

D)$1,650

Convisor Company has a perpetual inventory system and uses the LIFO method of inventory costing. Convisor reported the following events during the month of June:

The ending inventory on June 30 is:

A)$2,310

B)$1,880

C)$1,715

D)$1,650

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

76

In periods of rising prices LIFO result in lower income tax expense than FIFO? Explain why this occurs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

77

What is a revenue and what determines when revenues should be recorded? Give an example of a revenue.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following statements about LIFO is false?

A)It results in a higher cost of goods sold during periods of rising prices.

B)If inventory declines,it will result in a matching of current revenues and old costs

C)The cost of ending inventory will probably be very different from current replacement cost.

D)Firms that use LIFO run the risk of inventory obsolescence because they are keeping old goods on hand.

A)It results in a higher cost of goods sold during periods of rising prices.

B)If inventory declines,it will result in a matching of current revenues and old costs

C)The cost of ending inventory will probably be very different from current replacement cost.

D)Firms that use LIFO run the risk of inventory obsolescence because they are keeping old goods on hand.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

79

One of the basic principles of accounting is objectivity.Why,then,do businesses estimate their uncollectible accounts expense instead of waiting to see which accounts receivable will not be collected.That would be objective,wouldn't it?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck

80

During the current year,ending inventory was higher under the LIFO method than under the FIFO method.Which of the following statements about price changes is true?

A)Prices were unchanged.

B)Prices were decreasing.

C)Prices were increasing.

D)Unable to determine from the information given

A)Prices were unchanged.

B)Prices were decreasing.

C)Prices were increasing.

D)Unable to determine from the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 92 في هذه المجموعة.

فتح الحزمة

k this deck