Deck 8: Purchasinghuman Resourcespayment Process: Recording and Evaluating Expenditure Process Activities

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

Match between columns

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/62

العب

ملء الشاشة (f)

Deck 8: Purchasinghuman Resourcespayment Process: Recording and Evaluating Expenditure Process Activities

1

Which of the following is not part of the expenditure process?

A)Determine the need for goods/services

B)Receive cash from sales during the period

C)Receive goods and services

D)Pay suppliers of goods and services

A)Determine the need for goods/services

B)Receive cash from sales during the period

C)Receive goods and services

D)Pay suppliers of goods and services

Receive cash from sales during the period

2

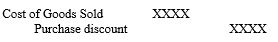

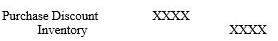

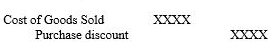

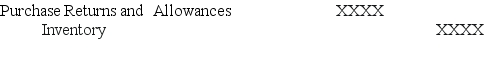

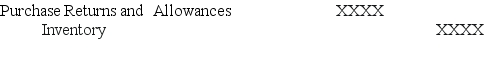

Which of the following entries reflects the use of a periodic inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

3

Which of the following could not be net pay?

A)Gross pay less FICA,union dues,income tax withheld

B)Gross pay less FICA,health insurance,income tax withheld

C)Gross pay less FICA,income tax withheld

D)Gross pay less FICA,income tax withheld,federal unemployment taxes

A)Gross pay less FICA,union dues,income tax withheld

B)Gross pay less FICA,health insurance,income tax withheld

C)Gross pay less FICA,income tax withheld

D)Gross pay less FICA,income tax withheld,federal unemployment taxes

Gross pay less FICA,income tax withheld,federal unemployment taxes

4

Which of the following is not a special journal?

A)Depreciation journal

B)Sales journal

C)Cash receipts journal

D)Purchases journal

A)Depreciation journal

B)Sales journal

C)Cash receipts journal

D)Purchases journal

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

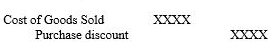

5

Which of the following is the entry used to determine cost of goods sold when the periodic inventory system is used?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

6

If a company uses the perpetual inventory method and it purchases inventory on account worth $2,000 with terms 2/10 n/30 what will be the cost of the inventory when the inventory is purchased if it is using the net method?

A)$2,000

B)$1,800

C)$1,960

D)$2,200

A)$2,000

B)$1,800

C)$1,960

D)$2,200

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

7

The purpose of the account payable subsidiary ledgers is:

A)Keep track of the various products being manufactured

B)Monitor the balance in the various cash accounts at banks

C)Identify individuals and companies who the company owes money

D)Identify the cash inflow expected from people who owe money to the company

A)Keep track of the various products being manufactured

B)Monitor the balance in the various cash accounts at banks

C)Identify individuals and companies who the company owes money

D)Identify the cash inflow expected from people who owe money to the company

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

8

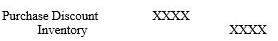

Which of the following entries reflects the use of a perpetual inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

9

Net pay is equal to:

A)Gross pay plus FICA

B)Gross pay plus all deductions

C)Gross pay minus all deductions

D)Gross pay less all deductions plus employer payroll taxes

A)Gross pay plus FICA

B)Gross pay plus all deductions

C)Gross pay minus all deductions

D)Gross pay less all deductions plus employer payroll taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

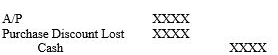

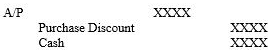

10

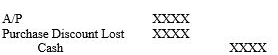

Which of the following entries is made when a discount is taken and the periodic system uses the gross method?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

11

Which of the following entries is made when a discount is not taken and the perpetual system uses the net method?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

12

The net method records

A)The purchase discounts lost

B)The purchased discounts taken

C)Both purchase discounts lost and taken

D)Only returns taken at a discount

A)The purchase discounts lost

B)The purchased discounts taken

C)Both purchase discounts lost and taken

D)Only returns taken at a discount

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

13

In a purchases journal only one amount is recorded but that amount is posted by

A)Debiting Accounts Payable and crediting Inventory

B)Debiting Inventory and crediting cash

C)Debiting cash and crediting accounts payable

D)Debiting inventory and crediting accounts payable

A)Debiting Accounts Payable and crediting Inventory

B)Debiting Inventory and crediting cash

C)Debiting cash and crediting accounts payable

D)Debiting inventory and crediting accounts payable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

14

The total of the accounts payable subsidiary ledger is equal to:

A)The balance in the general ledger purchases account

B)The balance in the general ledger accounts receivable account

C)The total amount the company owes to those provided inventory to the company

D)The total amount of the liabilities in the general ledger

A)The balance in the general ledger purchases account

B)The balance in the general ledger accounts receivable account

C)The total amount the company owes to those provided inventory to the company

D)The total amount of the liabilities in the general ledger

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

15

A company,using the net method,purchased inventory for $3,000 and term 2/10 net 30 but did not pay the bill in time to take advantage of the discount.The cost recorded in the inventory account after this event would be?

A)$3,000

B)$2,940

C)$3,060

D)Not enough data to determine

A)$3,000

B)$2,940

C)$3,060

D)Not enough data to determine

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

16

The purchase discount lost accounts is used when with -

A)The gross method is used with periodic system and the terms of the discount are not met.

B)The net method is used with the perpetual system and the terms of the discount are met.

C)The gross method is used with the periodic system the terms of the discount are not met.

D)The net method applied to either the periodic or perpetual systems and the terms of the discount are not met.

A)The gross method is used with periodic system and the terms of the discount are not met.

B)The net method is used with the perpetual system and the terms of the discount are met.

C)The gross method is used with the periodic system the terms of the discount are not met.

D)The net method applied to either the periodic or perpetual systems and the terms of the discount are not met.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

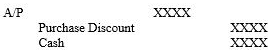

17

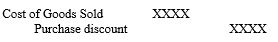

Which of the following entries is made when a discount is taken and the perpetual system uses the gross method?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

18

The gross method records the purchase discount.

A)When it is taken

B)When the inventory is purchased

C)When the inventory is sold

D)When the inventory is returned

A)When it is taken

B)When the inventory is purchased

C)When the inventory is sold

D)When the inventory is returned

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

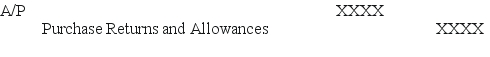

19

Which of the following entries reflects the use of a periodic inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

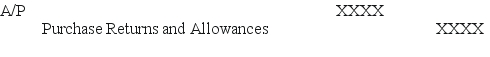

20

Which of the following entries reflects the use of a perpetual inventory system?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

21

Bonita Industries purchased $5,000 of merchandise on account for resale purposes.Bonita plans to sell the merchandise for $7,500.If Bonita returned $1,000 of merchandise for credit,the journal entry to record the return would include a:

A)debit to Accounts Payable for $1,000

B)credit to Inventory for $1,500

C)debit to Sales for $1,500

D)credit to Cash for $1,000

A)debit to Accounts Payable for $1,000

B)credit to Inventory for $1,500

C)debit to Sales for $1,500

D)credit to Cash for $1,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

22

In a perpetual inventory system,if the terms of sale are FOB shipping point the journal entry to record the payment of freight charges on purchased merchandise includes a:

A)debit to Inventory

B)credit to Freight Out

C)credit to Accounts Payable

D)debit to Cost of Goods Sold

A)debit to Inventory

B)credit to Freight Out

C)credit to Accounts Payable

D)debit to Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

23

In a perpetual inventory system that uses the gross method which of the following is true?

A)When a discount is taken the Purchase Discount account is credited.

B)The Accounts Payable account is debited for the cash paid.

C)The Inventory account is reduced when the discount is taken.

D)The Purchase Discount Lost account is debited when the discount is not taken.

A)When a discount is taken the Purchase Discount account is credited.

B)The Accounts Payable account is debited for the cash paid.

C)The Inventory account is reduced when the discount is taken.

D)The Purchase Discount Lost account is debited when the discount is not taken.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

24

All of the following payroll taxes are expenses incurred by an employer except:

A)social security taxes

B)federal income taxes

C)federal unemployment taxes

D)state unemployment taxes

A)social security taxes

B)federal income taxes

C)federal unemployment taxes

D)state unemployment taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

25

In a perpetual inventory system,the journal entry to record the sale of merchandise on account would include a:

A)debit to Cost of Goods Sold

B)credit to Accounts Payable

C)debit to Inventory

D)credit to Cash

A)debit to Cost of Goods Sold

B)credit to Accounts Payable

C)debit to Inventory

D)credit to Cash

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

26

The payroll tax which is paid by both the employee and the employer is:

A)FICA

B)FUTA

C)SUTA

D)Federal Income Taxes

A)FICA

B)FUTA

C)SUTA

D)Federal Income Taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

27

In a periodic inventory system,the journal entry to record the sale of merchandise on account would include a:

A)debit to Cost of Goods Sold

B)credit to Accounts Payable

C)debit to Inventory

D)no entry involving Inventory or Cost of Goods Sold

A)debit to Cost of Goods Sold

B)credit to Accounts Payable

C)debit to Inventory

D)no entry involving Inventory or Cost of Goods Sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

28

Purchase Discounts Lost should be:

A)added to the Merchandise Inventory account to determine the cost of inventory on hand

B)considered a loss account to be reported on the income statement

C)included on the income statement as a financing expense for the period

D)part of the cost of goods sold

A)added to the Merchandise Inventory account to determine the cost of inventory on hand

B)considered a loss account to be reported on the income statement

C)included on the income statement as a financing expense for the period

D)part of the cost of goods sold

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

29

BLP Corporation reported wages expense of $224,000,wages payable of $89,400 at the beginning of the year,and wages payable of $71,300 at the end of the year.Cash payments for wages during the year were:

A)$205,900

B)$224,000

C)$242,100

D)$295,300

A)$205,900

B)$224,000

C)$242,100

D)$295,300

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

30

Hurricane Enterprises purchased $4,000 of merchandise on account,terms 2/10,n/30.Assuming Hurricane uses the gross price method to account for purchase discounts,and it pays for the merchandise on the 9th day after the invoice date,which of the following would not be used in either the acquisition of the merchandise or the payment of the invoice :

A)credit to Cash for $3,920

B)credit to purchase discount for $80

C)debit to Accounts Payable for $3,920

D)debit to Purchase $4,000

A)credit to Cash for $3,920

B)credit to purchase discount for $80

C)debit to Accounts Payable for $3,920

D)debit to Purchase $4,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

31

Payroll deductions are a(n)______ to the employer at the time they are withheld.

A)expense

B)loss

C)liability

D)revenue

A)expense

B)loss

C)liability

D)revenue

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

32

Which of the following payroll items is an expense to the employer?

A)Federal income taxes

B)Union dues

C)State unemployment taxes

D)United way contributions by employee

A)Federal income taxes

B)Union dues

C)State unemployment taxes

D)United way contributions by employee

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

33

In a perpetual inventory system,the journal entry to record the purchase of merchandise on account includes a:

A)credit to Cash

B)debit to Purchases

C)debit to Inventory

D)credit to Accounts Receivable

A)credit to Cash

B)debit to Purchases

C)debit to Inventory

D)credit to Accounts Receivable

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

34

Omni Manufacturing reported cost of goods sold of $547,000,beginning and ending inventory of $76,400 and $68,600,respectively,and beginning and ending accounts payable of $39,700 and $27,500,respectively.Cash payments for merchandise inventory during the year were:

A)$527,000

B)$542,600

C)$551,400

D)$567,000

A)$527,000

B)$542,600

C)$551,400

D)$567,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

35

Purchase Discounts does all of the following except:

A)Decrease cost of goods sold

B)Decrease net purchase purchases

C)Increases net income

D)Decreases ending inventory

A)Decrease cost of goods sold

B)Decrease net purchase purchases

C)Increases net income

D)Decreases ending inventory

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

36

Orleans Enterprises purchased $37,500 of merchandise on account,terms 2/10,n/30.Assuming Orleans uses the net price method to account for purchase discounts,and it pays for the merchandise on the 30th day after the invoice date,the journal entry to record the payment would include a:

A)credit to Cash for $36,750

B)credit to Inventory for $37,500

C)debit to Accounts Payable for $37,500

D)debit to Purchase Discounts Lost for $750

A)credit to Cash for $36,750

B)credit to Inventory for $37,500

C)debit to Accounts Payable for $37,500

D)debit to Purchase Discounts Lost for $750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

37

Orleans Enterprises purchased $37,500 of merchandise on account,terms 2/10,n/30. Assuming Orleans uses the net price method to account for purchase discounts,the

Journal entry to record the purchase would include a:

A)debit to Inventory for $37,500

B)credit to Accounts Payable for $36,750

C)credit to Cash for $36,750

D)debit to Purchase Discounts Lost for $750

Journal entry to record the purchase would include a:

A)debit to Inventory for $37,500

B)credit to Accounts Payable for $36,750

C)credit to Cash for $36,750

D)debit to Purchase Discounts Lost for $750

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

38

JAFCO,Inc.reported insurance expense of $137,000,prepaid insurance of $8,300 at the beginning of the year,and prepaid insurance of $5,600 at the end of the year.Cash payments for insurance during the year were:

A)$134,300

B)$137,000

C)$139,700

D)$142,600

A)$134,300

B)$137,000

C)$139,700

D)$142,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

39

Corinthian Industries reported cost of goods sold of $765,000,beginning and ending inventory of $85,200 and $98,600,respectively,and beginning and ending accounts payable of $54,300 and $62,500,respectively.Cash payments for merchandise inventory during the year were:

A)$743,400

B)$759,800

C)$770,200

D)$786,600

A)$743,400

B)$759,800

C)$770,200

D)$786,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

40

Which of the following payroll items is not used to determine net pay?

A)Federal income taxes

B)Union dues

C)Social security taxes

D)State unemployment taxes

A)Federal income taxes

B)Union dues

C)Social security taxes

D)State unemployment taxes

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

41

Explain the difference between a periodic inventory system and a perpetual one.If a firm uses a perpetual inventory system,it still has to physically count the inventory on hand at least once a year.Why?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

42

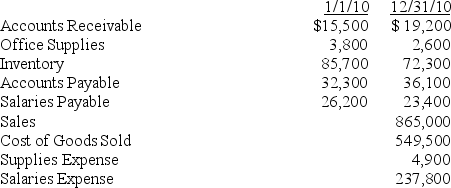

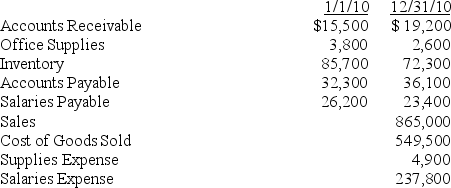

Carolina Corporation reported the following account balances at the beginning and end of 2010:

Determine the amount of cash paid for (

Determine the amount of cash paid for (

A)supplies,(b)salaries,and (c)inventory during 2010.

Determine the amount of cash paid for (

Determine the amount of cash paid for (A)supplies,(b)salaries,and (c)inventory during 2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

43

Which of the following payroll-related items is paid only by the employee?

A)FICA tax

B)Union dues

C)State unemployment tax

D)Federal unemployment tax

A)FICA tax

B)Union dues

C)State unemployment tax

D)Federal unemployment tax

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

44

Kinsey Company had beginning inventory of $50,000,ending inventory of $54,000,and cost of goods sold of $240,000.What was the cost of goods purchased?

A)$294,000

B)$290,000

C)$244,000

D)$236,000

A)$294,000

B)$290,000

C)$244,000

D)$236,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

45

Ogallah Corporation purchased $100,000 inventory on account with terms of 1/10 net 30 on November 1,2010.

Required:

Assume periodic inventory system and gross method

(A.)Make the entries to record the purchase of the inventory and subsequent payment of amount due on Nov 9,2010

Assume perpetual inventory system and net method

(B.)Make the entries to record the purchase of the inventory and subsequent payment of the amount due on Nov 30,2010.

Required:

Assume periodic inventory system and gross method

(A.)Make the entries to record the purchase of the inventory and subsequent payment of amount due on Nov 9,2010

Assume perpetual inventory system and net method

(B.)Make the entries to record the purchase of the inventory and subsequent payment of the amount due on Nov 30,2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

46

Why are subsidiary ledgers used?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

47

Wildcat Supply had a beginning balance of $600 in Utilities Payable account at the start of the year and an ending balance of $1,000.During the year Wildcat paid $4,000 cash to the utilities company.How much utilities expense was incurred during this year?

A)$4,000

B)$4,400

C)$4,600

D)Can't be determined with the information given

A)$4,000

B)$4,400

C)$4,600

D)Can't be determined with the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

48

If a firm overstates its ending inventory,how are its income statement and balance sheet affected for the current and next year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

49

Acme Paint company had a beginning balance in its prepaid advertising account of $1,000 and an ending balance of $750.During the year it spent $600 cash on advertising.How much advertising expense did Acme incur this year?

A)$850

B)$600

C)$1,600

D)$1,350

A)$850

B)$600

C)$1,600

D)$1,350

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

50

Park Corp had a beginning balance in its prepaid rent account of $10,000 and an ending balance of $7,500.Rent expense for the year was $12,000.How much cash did Park pay for rent during the year?

A)$14,500

B)$9,500

C)$12,000

D)$7,500

A)$14,500

B)$9,500

C)$12,000

D)$7,500

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

51

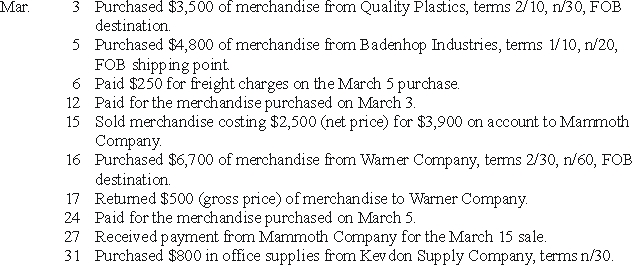

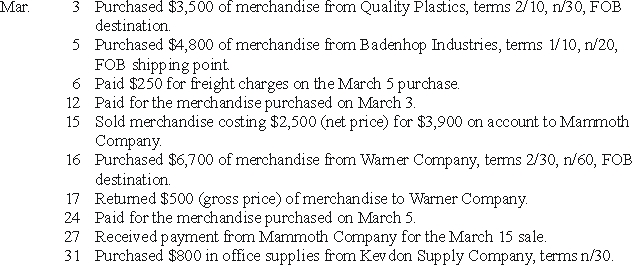

Thermalite Corporation uses the perpetual inventory system and the net price method.Prepare Thermalite's journal entries to record the following transactions:

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

52

The following information was taken from the accounting records of Swanson Farms in 2010.For each of the following determine the amount of expense Swanson Farms should report on its income statement related to data presented below and give the entry made to record the expense.

A.Beginning balance Prepaid Insurance $1,000

Ending balance Prepaid Insurance $1,400

Cash Paid for Insurance $2,000

B.Beginning Balance Salaries Payable $20,000

Ending Balance Salaries Payable $15,000

Cash Paid for Salaries in 2010 $150,000

C.Beginning Balance Supplies $-0-

Ending Balance Supplies $1,000

Cash paid for supplies $1,600

A.Beginning balance Prepaid Insurance $1,000

Ending balance Prepaid Insurance $1,400

Cash Paid for Insurance $2,000

B.Beginning Balance Salaries Payable $20,000

Ending Balance Salaries Payable $15,000

Cash Paid for Salaries in 2010 $150,000

C.Beginning Balance Supplies $-0-

Ending Balance Supplies $1,000

Cash paid for supplies $1,600

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

53

If wages payable increases between the beginning and end of a month,this indicates that

A)Wages paid were more than wages expense for the month.

B)Wages expense was more than wages paid for the month.

C)All wages expense for the month were paid as incurred.

D)No wages were paid during the period

A)Wages paid were more than wages expense for the month.

B)Wages expense was more than wages paid for the month.

C)All wages expense for the month were paid as incurred.

D)No wages were paid during the period

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

54

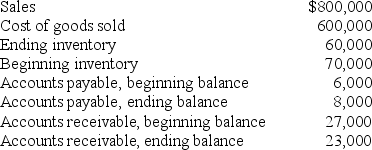

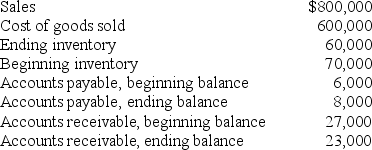

Information from the 2010 financial statements of Bravura Corporation is shown below.Calculate the cash paid for merchandise inventory.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

55

An increase in prepaid insurance indicates that

A)insurance expense and insurance paid were equal

B)no insurance expense was recorded during the period

C)insurance expense for the period exceeded insurance paid

D)insurance paid during the period exceeded insurance expense

A)insurance expense and insurance paid were equal

B)no insurance expense was recorded during the period

C)insurance expense for the period exceeded insurance paid

D)insurance paid during the period exceeded insurance expense

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

56

Lacross Corporation purchased $50,000 inventory on account with terms of 1/10 net 30 on September 1,2010.

Required:

Assume periodic inventory system and net method

(A.)Make the entries to record the purchase of the inventory and subsequent payment of amount due on Sept 30,2010

Assume perpetual inventory system and gross method

(B.)Make the entries to record the purchase of the inventory and subsequent payment of the amount due on Sept 9,2010.

Required:

Assume periodic inventory system and net method

(A.)Make the entries to record the purchase of the inventory and subsequent payment of amount due on Sept 30,2010

Assume perpetual inventory system and gross method

(B.)Make the entries to record the purchase of the inventory and subsequent payment of the amount due on Sept 9,2010.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

57

The following information was taken from the accounting records of Trego Farms in 2010.For each of the following determine the amount of cash Trego Farms paid for the item given the data presented below.

A.Beginning balance Prepaid Insurance $1,000

Ending balance Prepaid Insurance $1,400

Insurance Expense for 2010 $2,000

B.Beginning Balance Salaries Payable $20,000

Ending Balance Salaries Payable $15,000

Salaries Expense for 2010 $150,000

C.Beginning Balance Supplies $4,000

Ending Balance Supplies $5,000

Supplies Expense for 2010 $2,800

A.Beginning balance Prepaid Insurance $1,000

Ending balance Prepaid Insurance $1,400

Insurance Expense for 2010 $2,000

B.Beginning Balance Salaries Payable $20,000

Ending Balance Salaries Payable $15,000

Salaries Expense for 2010 $150,000

C.Beginning Balance Supplies $4,000

Ending Balance Supplies $5,000

Supplies Expense for 2010 $2,800

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

58

Iowa Corporation had a beginning balance of $8,600 in Utilities Payable account at the start of the year and an ending balance of $4,000.During the year Iowa recorded $10,000 of utilities expense.How much cash did Iowa pay the utility company during the year?

A)$14,600

B)$5,400

C)$10,00

D)Can't be determined with the information given

A)$14,600

B)$5,400

C)$10,00

D)Can't be determined with the information given

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

59

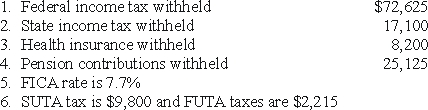

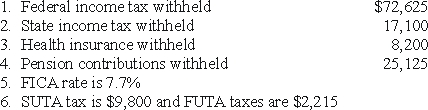

Gross pay for the employees of Mr.Scott Corporation for February 28,2010 is as follows:

Information on withholding and payroll taxes are shown below:

Information on withholding and payroll taxes are shown below:

Required:

Required:

(A.)Make the journal entry to record the February payroll.

(B.)Record the journal entry for the employer's payroll taxes.

(C.)Make the journal entry to record the employer's monthly payment of payroll tax liabilities.

Information on withholding and payroll taxes are shown below:

Information on withholding and payroll taxes are shown below: Required:

Required:(A.)Make the journal entry to record the February payroll.

(B.)Record the journal entry for the employer's payroll taxes.

(C.)Make the journal entry to record the employer's monthly payment of payroll tax liabilities.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

60

Why would the amount of supplies expense differ from the amount of cash paid for supplies in a year?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

61

Match between columns

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck

62

The following information was taken from the accounting records of Russell Oil Corp in 2010.For each of the following make the entries associated with the changes in the account given the data available.

A.Beginning balance Prepaid Insurance $3,000

Ending balance Prepaid Insurance $3,900

Cash paid for insurance for 2010 $3,500

B.Beginning Balance Salaries Payable $15,000

Ending Balance Salaries Payable $ 7,000

Salaries Expense for 2010 $350,000

C.Beginning Balance Supplies $14,000

Ending Balance Supplies $11,000

Supplies Expense for 2010 $32,000

A.Beginning balance Prepaid Insurance $3,000

Ending balance Prepaid Insurance $3,900

Cash paid for insurance for 2010 $3,500

B.Beginning Balance Salaries Payable $15,000

Ending Balance Salaries Payable $ 7,000

Salaries Expense for 2010 $350,000

C.Beginning Balance Supplies $14,000

Ending Balance Supplies $11,000

Supplies Expense for 2010 $32,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 62 في هذه المجموعة.

فتح الحزمة

k this deck