Deck 2: The CPA Profession

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/101

العب

ملء الشاشة (f)

Deck 2: The CPA Profession

1

In addition to attestation and assurance services, CPA firms provide other services to their clients. List three of these services.

Other services performed by a CPA firm include:

• accounting and bookkeeping services

• tax services

• management consulting and risk advisory services.

• accounting and bookkeeping services

• tax services

• management consulting and risk advisory services.

2

In a CPA firm, the audit senior or the in-charge auditor performs most of the detailed audit work.

False

3

________ is one of the Big Four international CPA firms.

A) Deloitte

B) KPMG

C) Ernst & Young

D) All of the above are classified as Big Four international CPA firms.

A) Deloitte

B) KPMG

C) Ernst & Young

D) All of the above are classified as Big Four international CPA firms.

D

4

Limited liability companies are structured and taxed like a general partnership, but their owners have limited personal liability similar to that of a general corporation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

5

Which of the following does not describe a size category for a CPA firm?

A) Big Four national firms

B) Big Four international firms

C) local firms

D) national and regional firms

A) Big Four national firms

B) Big Four international firms

C) local firms

D) national and regional firms

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

6

________ is not one of the National/Regional CPA Firms.

A) PwC

B) BDO USA

C) Grant Thornton

D) RSM US.

A) PwC

B) BDO USA

C) Grant Thornton

D) RSM US.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

7

The legal right to perform audits is granted to a CPA firm by regulation of

A) each state.

B) the Financial Accounting Standards Board (FASB).

C) the American Institute of Certified Public Accountants (AICPA).

D) the Auditing Standards Board.

A) each state.

B) the Financial Accounting Standards Board (FASB).

C) the American Institute of Certified Public Accountants (AICPA).

D) the Auditing Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

8

Which staff level in a CPA firm performs most of the detailed audit work?

A) partner

B) staff assistant

C) senior auditor

D) senior manager

A) partner

B) staff assistant

C) senior auditor

D) senior manager

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

9

Which staff level in a CPA firm manages the overall relationship with the client and manages the audit, in general?

A) the audit partner

B) the audit staff assistant

C) the senior or in-charge auditor with 2-5 years' experience

D) the audit manager

A) the audit partner

B) the audit staff assistant

C) the senior or in-charge auditor with 2-5 years' experience

D) the audit manager

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

10

Which of the following is not an accurate definition or description of a local CPA firm?

A) Some local CPA firms have several offices.

B) Local CPA firms do not compete for clients with the Big Four CPA firms.

C) Some local CPA firms are affiliated with other CPA firms to share resources.

D) Many local CPA firms provide primarily accounting and tax services to their clients only.

A) Some local CPA firms have several offices.

B) Local CPA firms do not compete for clients with the Big Four CPA firms.

C) Some local CPA firms are affiliated with other CPA firms to share resources.

D) Many local CPA firms provide primarily accounting and tax services to their clients only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

11

Sarbanes-Oxley and the Securities and Exchange Commission restrict auditors from providing many consulting services to their publicly traded audit clients. Which of the following is true for auditors of publicly traded companies?

I) They are restricted from providing consulting services to privately held companies.

II) There is no restriction on providing consulting services to non-audit clients.

A) I only

B) II only

C) I and II

D) Neither I nor II

I) They are restricted from providing consulting services to privately held companies.

II) There is no restriction on providing consulting services to non-audit clients.

A) I only

B) II only

C) I and II

D) Neither I nor II

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

12

Many small, local accounting firms perform audits as their primary service to their clients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

13

In which type of service does the CPA assemble the financial statements but provide no assurance to third parties?

A) audit

B) compilation

C) review

D) bookkeeping

A) audit

B) compilation

C) review

D) bookkeeping

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

14

In a CPA firm, the audit partner coordinates the performance of audit procedures.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

15

Sarbanes-Oxley and the Securities and Exchange Commission restrict auditors from providing many consulting services to their publicly traded audit clients.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following is not a characteristic of a small local CPA firm?

A) Most small firms have fewer than 25 professionals.

B) Small firms perform audits on small and not-for-profit businesses.

C) Tax services are more important than auditing services to the small firm.

D) Small firms are prohibited by the SEC from auditing publicly traded companies.

A) Most small firms have fewer than 25 professionals.

B) Small firms perform audits on small and not-for-profit businesses.

C) Tax services are more important than auditing services to the small firm.

D) Small firms are prohibited by the SEC from auditing publicly traded companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

17

All of the Big Four accounting firms and many of the smaller CPA firms now operate as limited liability partnerships.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

18

List and describe the three factors that influence the organizational structure of all CPA firms. What are the most common forms of CPA firm organization?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

19

Small local CPA Firms are allowed under Sarbanes-Oxley and the Securities and Exchange Commission a special exemption to perform audits of publicly-listed firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

20

Which of the following statements is true as it relates to limited liability partnerships?

A) Only senior partners are liable for the partnership's debts.

B) Partners have no liability in a limited liability partnership arrangement.

C) Partners are personally liable for the acts of those under their supervision.

D) All partners must be AICPA members.

A) Only senior partners are liable for the partnership's debts.

B) Partners have no liability in a limited liability partnership arrangement.

C) Partners are personally liable for the acts of those under their supervision.

D) All partners must be AICPA members.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

21

The Public Company Accounting Oversight Board (PCAOB) provides oversight to auditors of publicly traded and private companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

22

The Public Company Accounting Oversight Board

A) performs inspections of the quality controls of firms that audit public companies.

B) establishes auditing standards that must be followed by CPAs on all audits.

C) oversees auditors of private companies.

D) performs all of the above functions.

A) performs inspections of the quality controls of firms that audit public companies.

B) establishes auditing standards that must be followed by CPAs on all audits.

C) oversees auditors of private companies.

D) performs all of the above functions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

23

The PCAOB requires annual inspections of accounting firms that audit more than ten public companies.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

24

The organization that is responsible for providing oversight for auditors of public companies is called the

A) Auditing Standards Board.

B) American Institute of Certified Public Accountants.

C) Public Oversight Board.

D) Public Company Accounting Oversight Board.

A) Auditing Standards Board.

B) American Institute of Certified Public Accountants.

C) Public Oversight Board.

D) Public Company Accounting Oversight Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

25

Discuss the purpose of the Securities and Exchange Commission and its influence on setting generally accepted accounting principles.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

26

The overall purpose of the Securities and Exchange Commission is to assist in providing investors with reliable information upon which to make investment decisions.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

27

The difference between the Securities Act of 1933 and the Securities Act of 1934 is that only the 1934 Act requires audited financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

28

Which of the following is not a publication issued by the Securities and Exchange Commission?

A) Accounting and Auditing Enforcement Actions

B) Accounting Series Releases

C) Regulation S-X

D) State Board of Accountancy Enforcement Actions

A) Accounting and Auditing Enforcement Actions

B) Accounting Series Releases

C) Regulation S-X

D) State Board of Accountancy Enforcement Actions

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

29

Form 10-K must be filed with the SEC whenever a public company experiences a significant event.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

30

Has audit quality improved since the passage of Sarbanes-Oxley Act (SOX)? Which of the following statements is true with regards to audit quality since the passage of SOX?

A) The frequency of financial statement restatements has increased since SOX.

B) PCAOB audit engagement findings continue to document a high level of audit deficiencies.

C) Finally, the auditing professions agrees on the definition of audit quality.

D) No progress has been made on the definition of what are called "Audit Quality Indicators" since SOX.

A) The frequency of financial statement restatements has increased since SOX.

B) PCAOB audit engagement findings continue to document a high level of audit deficiencies.

C) Finally, the auditing professions agrees on the definition of audit quality.

D) No progress has been made on the definition of what are called "Audit Quality Indicators" since SOX.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

31

With respect to the SEC,

A) the attitude of the SEC is generally considered in any major change proposed by the FASB.

B) the SEC is the sole agency responsible for setting generally accepted accounting principles.

C) the SEC requirements of greatest interest to CPAs are set forth in their enforcement regulations.

D) the SEC has the power to establish rules for all CPAs.

A) the attitude of the SEC is generally considered in any major change proposed by the FASB.

B) the SEC is the sole agency responsible for setting generally accepted accounting principles.

C) the SEC requirements of greatest interest to CPAs are set forth in their enforcement regulations.

D) the SEC has the power to establish rules for all CPAs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

32

Members of the Public Company Accounting Oversight Board are appointed and overseen by the

A) U.S. Congress.

B) American Institute of Certified Public Accountants.

C) Auditing Standards Board.

D) Securities and Exchange Commission.

A) U.S. Congress.

B) American Institute of Certified Public Accountants.

C) Auditing Standards Board.

D) Securities and Exchange Commission.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

33

The form that must be filed with the Securities and Exchange Commission whenever a company plans to issue new securities to the public is the

A) Form S-1.

B) Form 8-K.

C) Form 10-K.

D) Form 10-Q.

A) Form S-1.

B) Form 8-K.

C) Form 10-K.

D) Form 10-Q.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

34

The form that must be completed and filed with the Securities and Exchange Commission whenever a company experiences a significant event that is of interest to public investors is the

A) Form S-1.

B) Form 8-K.

C) Form 10-K.

D) Form 10-Q.

A) Form S-1.

B) Form 8-K.

C) Form 10-K.

D) Form 10-Q.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

35

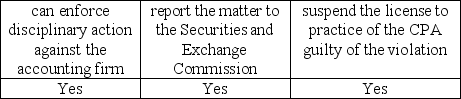

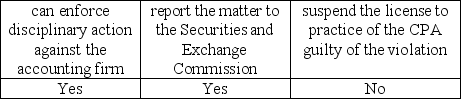

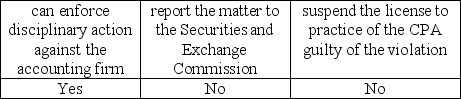

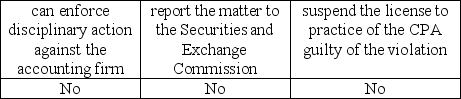

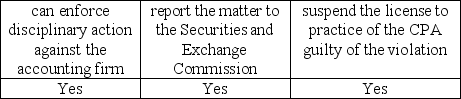

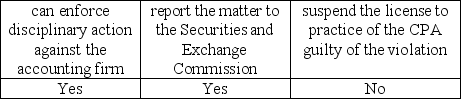

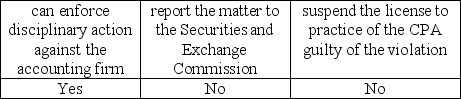

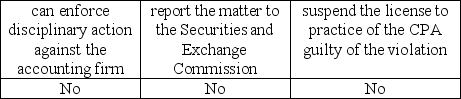

Assume the Public Company Accounting Oversight Board (PCAOB) identifies a violation during its inspection of a registered accounting firm. The PCAOB

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

36

The PCAOB requires annual inspections of other registered accounting firms that audit less than 100 publicly listed companies at least once every 3 years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

37

The Sarbanes-Oxley Act established the Public Company Accounting Oversight Board (PCAOB). What are the PCAOB's primary functions?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

38

List and describe the six organizational structures available to CPA firms.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

39

Which of the following is a correct statement regarding the SEC?

A) The Securities Act of 1934 requires most companies planning to issue new securities to the public to submit a registration statement to the SEC for approval.

B) All public companies must file monthly statements with the SEC.

C) The Form 10-K must be filed within 30 days after the close of the fiscal year.

D) The SEC has the power to establish rules for any CPA associated with audited financial statements submitted to the commission.

A) The Securities Act of 1934 requires most companies planning to issue new securities to the public to submit a registration statement to the SEC for approval.

B) All public companies must file monthly statements with the SEC.

C) The Form 10-K must be filed within 30 days after the close of the fiscal year.

D) The SEC has the power to establish rules for any CPA associated with audited financial statements submitted to the commission.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

40

Form 10-Q must be filed monthly with the Securities and Exchange Commission by every publicly held company.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

41

International Standards on Auditing are issued by the International Auditing and Assurance Standards Board (IAASB).

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

42

The Auditing Standards Board (ASB) of the AICPA is responsible for issuing pronouncements on auditing matters in the U.S. for the audits of every type of entity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

43

The PCAOB considers International Standards on Auditing (ISA) when developing its standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

44

The ASB has revised its audit standards to converge with international standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

45

What are the major functions of the AICPA?

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

46

Which of the following is not one of the main sets of auditing standards around the world today?

A) AICPA Auditing Standards

B) International Standards on Auditing

C) PCAOB Auditing Standards

D) Securities and Exchange Commission Auditing Standards

A) AICPA Auditing Standards

B) International Standards on Auditing

C) PCAOB Auditing Standards

D) Securities and Exchange Commission Auditing Standards

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

47

Who is responsible for establishing auditing standards for privately held companies?

A) Securities and Exchange Commission

B) Public Company Accounting Oversight Board

C) Auditing Standards Board

D) National Association of Accounting

A) Securities and Exchange Commission

B) Public Company Accounting Oversight Board

C) Auditing Standards Board

D) National Association of Accounting

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

48

The International Standards on Auditing (ISA)

A) are issued by the AICPA.

B) override a country's regulations governing the audit of a company.

C) has many of the same standards as the Auditing Standards Board (ASB).

D) must be followed by companies whose stock is traded in the U.S.

A) are issued by the AICPA.

B) override a country's regulations governing the audit of a company.

C) has many of the same standards as the Auditing Standards Board (ASB).

D) must be followed by companies whose stock is traded in the U.S.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

49

Which of the following is true with regards to the various auditing standards?

A) Statements on Auditing Standards (SASs) are issued by the PCAOB.

B) The ASB Clarity Project was intended to make the U.S. auditing standards easier to read, understand, and apply.

C) The ASB redrafted existing AICPA auditing standards to align them with respective International Standards on Auditing (ISA's).

D) Both B and C are correct.

A) Statements on Auditing Standards (SASs) are issued by the PCAOB.

B) The ASB Clarity Project was intended to make the U.S. auditing standards easier to read, understand, and apply.

C) The ASB redrafted existing AICPA auditing standards to align them with respective International Standards on Auditing (ISA's).

D) Both B and C are correct.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

50

Statements on Standards for Accounting and Review Services (SSARS) are issued by the

A) Accounting and Review Services Committee.

B) Professional Ethics Executive Committee.

C) Securities and Exchange Commission.

D) Financial Accounting Standards Board.

A) Accounting and Review Services Committee.

B) Professional Ethics Executive Committee.

C) Securities and Exchange Commission.

D) Financial Accounting Standards Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

51

The American Institute of Certified Public Accountants (AICPA)

A) is responsible for issuing licenses to new CPAs.

B) restricts its membership to CPAs who are independent auditors.

C) sets auditing standards for both public and private companies.

D) sets rules of conduct that CPAs are required to meet.

A) is responsible for issuing licenses to new CPAs.

B) restricts its membership to CPAs who are independent auditors.

C) sets auditing standards for both public and private companies.

D) sets rules of conduct that CPAs are required to meet.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

52

Membership in the AICPA is restricted to CPAs who are currently practicing as independent auditors.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

53

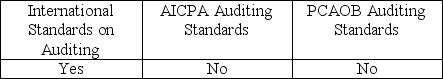

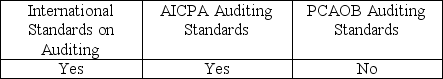

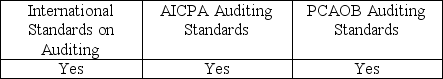

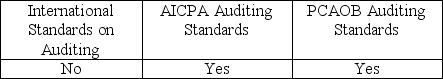

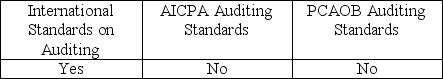

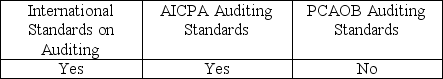

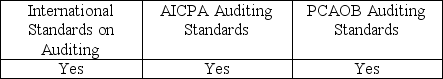

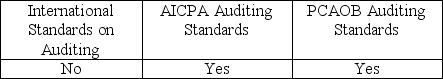

Which of the following are audit standards used in professional practice by audit firms?

A)

B)

C)

D)

A)

B)

C)

D)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

54

Standards issued by the Public Company Accounting Oversight Board must be followed by CPAs who audit

A) both private and public companies.

B) public companies only.

C) private companies, public companies, and nonprofit entities.

D) private companies only.

A) both private and public companies.

B) public companies only.

C) private companies, public companies, and nonprofit entities.

D) private companies only.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

55

A CPA must meet continuing education requirements to maintain their license to practice.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

56

Which of the following is a true statement regarding auditing standards?

A) Prior to the passage of Sarbanes-Oxley, the FASB established auditing principles for U.S. public companies.

B) PCAOB auditing standards are applicable to entities outside the U.S.

C) There are no similarities between PCAOB standards and International Standards on Auditing.

D) The Auditing Standards Board has revised most of its standards to converge with the international standards.

A) Prior to the passage of Sarbanes-Oxley, the FASB established auditing principles for U.S. public companies.

B) PCAOB auditing standards are applicable to entities outside the U.S.

C) There are no similarities between PCAOB standards and International Standards on Auditing.

D) The Auditing Standards Board has revised most of its standards to converge with the international standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

57

International Standards on Auditing (ISAs) override a country's regulations governing the audit of financial or other information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

58

Membership in the AICPA is mandatory for all licensed practicing CPAs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

59

In 2017, the American Institute of CPAs joined with which of the following to form the Association of International Certified Public Accountants?

A) the Chartered Institute of Management Accountants

B) the Securities and Exchange Commission

C) the Public Accounting Oversight Board

D) the Japanese Institute of Certified Public Accountants

A) the Chartered Institute of Management Accountants

B) the Securities and Exchange Commission

C) the Public Accounting Oversight Board

D) the Japanese Institute of Certified Public Accountants

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

60

________ are referred to as U.S. generally accepted auditing standards (GAAS).

A) AICPA auditing standards

B) SEC auditing standards

C) PCAOB auditing standards

D) Sarbanes-Oxley standards

A) AICPA auditing standards

B) SEC auditing standards

C) PCAOB auditing standards

D) Sarbanes-Oxley standards

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

61

When assessing the risk of material misstatements in the financial statements,

A) inadequate internal control procedures will mitigate client business risk.

B) GAAS specifies in detail how much and what types of evidence the auditor needs to obtain.

C) company management is responsible for determining materiality levels.

D) the auditor must understand the client's business and industry.

A) inadequate internal control procedures will mitigate client business risk.

B) GAAS specifies in detail how much and what types of evidence the auditor needs to obtain.

C) company management is responsible for determining materiality levels.

D) the auditor must understand the client's business and industry.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

62

To obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, the auditor must fulfill several performance responsibilities, including

A) verifying that all audit work is performed by a CPA with a minimum of three years' experience.

B) obtaining sufficient, appropriate audit evidence.

C) exercising professional judgment.

D) providing an opinion on the financial statements.

A) verifying that all audit work is performed by a CPA with a minimum of three years' experience.

B) obtaining sufficient, appropriate audit evidence.

C) exercising professional judgment.

D) providing an opinion on the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

63

Which of the following is an accurate statement regarding principles and auditing standards?

A) The principles underlying an audit give specific guidance to an auditor when a problem arises in an audit.

B) The principles underlying an audit state that the only objective of an audit is to provide financial statement users with an opinion.

C) All auditing standards issued by the PCAOB are given two classification numbers.

D) The Statement on Auditing Standard (SAS) number identifies the order in which it was issued in relation to other SASs.

A) The principles underlying an audit give specific guidance to an auditor when a problem arises in an audit.

B) The principles underlying an audit state that the only objective of an audit is to provide financial statement users with an opinion.

C) All auditing standards issued by the PCAOB are given two classification numbers.

D) The Statement on Auditing Standard (SAS) number identifies the order in which it was issued in relation to other SASs.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

64

The AICPA principles and the auditing standards should be viewed by practitioners as

A) ideals to work towards, but which are not achievable.

B) maximum standards that denote excellent work.

C) minimum standards of performance that must be achieved on each audit engagement.

D) benchmarks to be used on all audits, reviews, and compilations.

A) ideals to work towards, but which are not achievable.

B) maximum standards that denote excellent work.

C) minimum standards of performance that must be achieved on each audit engagement.

D) benchmarks to be used on all audits, reviews, and compilations.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

65

An auditor need not abide by a particular auditing standard if the auditor believes that

A) the issue in question is immaterial in amount.

B) more expertise is needed to fulfill the requirement.

C) the requirement of the standard has not been addressed by the PCAOB.

D) fraud is involved.

A) the issue in question is immaterial in amount.

B) more expertise is needed to fulfill the requirement.

C) the requirement of the standard has not been addressed by the PCAOB.

D) fraud is involved.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

66

In situations in which the CPA or the CPA's assistants are not qualified to perform the audit work, which of the following is not an option the CPA or the CPA firm has?

A) The CPA and the CPA's assistants have a professional obligation to acquire the required knowledge and skills.

B) The CPA and the CPA's assistants should simply rely more upon the client's representations when performing the audit.

C) The CPA should suggest someone else or another CPA firm which is qualified to perform the work.

D) The CPA should decline the audit engagement.

A) The CPA and the CPA's assistants have a professional obligation to acquire the required knowledge and skills.

B) The CPA and the CPA's assistants should simply rely more upon the client's representations when performing the audit.

C) The CPA should suggest someone else or another CPA firm which is qualified to perform the work.

D) The CPA should decline the audit engagement.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

67

In order to properly plan and perform an audit, an important fact for both the auditor and the client to understand is that

A) the internal control policies and procedures are developed by the auditors.

B) the purpose of an audit is to prevent fraud.

C) management is responsible for the preparation of the financial statements.

D) management can restrict the auditor's access to important information relevant to the financial statements.

A) the internal control policies and procedures are developed by the auditors.

B) the purpose of an audit is to prevent fraud.

C) management is responsible for the preparation of the financial statements.

D) management can restrict the auditor's access to important information relevant to the financial statements.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

68

Professional skepticism must be maintained only if the auditor suspects fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

69

Historically, auditing standards have been organized into three categories, including

A) standards of field work.

B) purpose of an audit.

C) responsibilities of the auditor.

D) proper planning and supervision.

A) standards of field work.

B) purpose of an audit.

C) responsibilities of the auditor.

D) proper planning and supervision.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

70

Which of the following statements about Generally Accepted Audit Standards are true?

I) They serve as broad guidelines to auditors for conducting an audit engagement.

II) They are sufficiently specific to provide a meaningful guide to practitioners.

III) They represent a framework upon which the AICPA can provide interpretations.

A) I and II

B) I and III

C) II and III

D) I, II and III

I) They serve as broad guidelines to auditors for conducting an audit engagement.

II) They are sufficiently specific to provide a meaningful guide to practitioners.

III) They represent a framework upon which the AICPA can provide interpretations.

A) I and II

B) I and III

C) II and III

D) I, II and III

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

71

The Statements on Auditing Standards issued by the Auditing Standards Board

A) are regarded as authoritative literature.

B) mandate the amount of evidence that must be obtained.

C) must be followed in all situations.

D) are optional guidelines which an auditor may choose to follow or not follow when conducting an audit.

A) are regarded as authoritative literature.

B) mandate the amount of evidence that must be obtained.

C) must be followed in all situations.

D) are optional guidelines which an auditor may choose to follow or not follow when conducting an audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

72

Statements on Auditing Standards (SASs) are issued by the Public Company Accounting Oversight Board.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

73

To obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, the auditor fulfills several performance responsibilities, including

A) complying with the AICPA Code of Professional Conduct.

B) issuing a written report on the financial statements.

C) determining and applying materiality levels.

D) having the appropriate competence to perform the audit.

A) complying with the AICPA Code of Professional Conduct.

B) issuing a written report on the financial statements.

C) determining and applying materiality levels.

D) having the appropriate competence to perform the audit.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

74

________ is an attitude that includes a questioning mind, being alert to conditions that might indicate possible misstatements due to fraud or error, and a critical assessment of audit evidence.

A) Reasonableness

B) Diligence

C) Professional skepticism

D) Competence

A) Reasonableness

B) Diligence

C) Professional skepticism

D) Competence

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

75

Which of the following is not true regarding the purpose of an audit performed on a set of financial statements in accordance with generally accepted auditing standards?

A) to provide users of the financial statements with an opinion on the financial statements

B) to provide users of the financial statements with absolute assurance that the financial statements contain no errors in them

C) to provide financial statement users with an opinion on whether the financial statements are presented fairly or not

D) to provide financial statement users with an opinion in accordance with the applicable financial reporting framework

A) to provide users of the financial statements with an opinion on the financial statements

B) to provide users of the financial statements with absolute assurance that the financial statements contain no errors in them

C) to provide financial statement users with an opinion on whether the financial statements are presented fairly or not

D) to provide financial statement users with an opinion in accordance with the applicable financial reporting framework

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

76

The AU-C number identifies the order in which it was issued in relation to all other codified auditing standards.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

77

The AICPA principles underlying an audit are organized around four principles. Which of the following is not one of those principles?

A) fairness

B) responsibilities

C) reporting

D) performance

A) fairness

B) responsibilities

C) reporting

D) performance

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

78

Which of the following is not one of the responsibilities of an auditor under the principles underlying an audit of financial statements?

A) possess appropriate competence and capabilities

B) comply with relevant ethical requirements

C) plan work and supervise assistants

D) maintain professional skepticism and exercise professional judgment

A) possess appropriate competence and capabilities

B) comply with relevant ethical requirements

C) plan work and supervise assistants

D) maintain professional skepticism and exercise professional judgment

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

79

The "Principles Underlying an Audit in Accordance with Generally Accepted Auditing Principles" provide a framework to help auditors

A) understand the ten GAAS standards.

B) obtain complete assurance that the financial statements are free from any error.

C) report on the financial statements.

D) prevent fraud.

A) understand the ten GAAS standards.

B) obtain complete assurance that the financial statements are free from any error.

C) report on the financial statements.

D) prevent fraud.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck

80

The principles underlying an audit

A) contain the procedures that must be followed during an audit.

B) carry the same authority as AICPA auditing standards.

C) only apply to the audits of public companies.

D) provide structure for the clarified Codification.

A) contain the procedures that must be followed during an audit.

B) carry the same authority as AICPA auditing standards.

C) only apply to the audits of public companies.

D) provide structure for the clarified Codification.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 101 في هذه المجموعة.

فتح الحزمة

k this deck