Deck 4: Fixed Interest Rate Mortgage Loans

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/28

العب

ملء الشاشة (f)

Deck 4: Fixed Interest Rate Mortgage Loans

1

Risk is an important component of interest rates.Which of the following risks is not a determinant of interest rates?

A) Default Risks

B) Interest Rate Risks

C) Institutional Risks

D) Marketability Risks

A) Default Risks

B) Interest Rate Risks

C) Institutional Risks

D) Marketability Risks

Institutional Risks

2

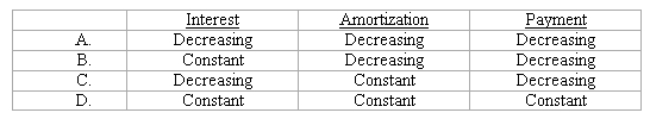

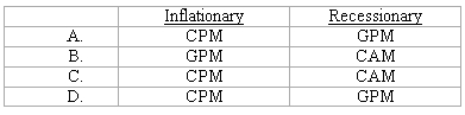

One of the first amortizing mortgages was the constant amortization mortgage.Which of the following characterized the components of the CAM payment over the life of the loan?

A) A Above.

B) B Above.

C) C Above.

D) D Above.

A) A Above.

B) B Above.

C) C Above.

D) D Above.

C Above.

3

Determining a loan balance on a CPM is a simple future value of an annuity problem.

False

4

Assuming all APRs equal,the effective interest rate on a loan is highest when:

A) The loan has no points and a 30 year maturity and is prepaid in five years

B) The loan has no points and is prepaid at maturity

C) Points are charged and the loan is paid off at maturity in 30 years

D) Points are charged and the loan has a 30 year maturity but prepaid in five years

A) The loan has no points and a 30 year maturity and is prepaid in five years

B) The loan has no points and is prepaid at maturity

C) Points are charged and the loan is paid off at maturity in 30 years

D) Points are charged and the loan has a 30 year maturity but prepaid in five years

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

5

At the end of five years,calculating the loan balance of a constant payment mortgage is simply the:

A) present value of a single amount.

B) future value of a single amount.

C) present value of an ordinary annuity.

D) future value of an ordinary annuity.

A) present value of a single amount.

B) future value of a single amount.

C) present value of an ordinary annuity.

D) future value of an ordinary annuity.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

6

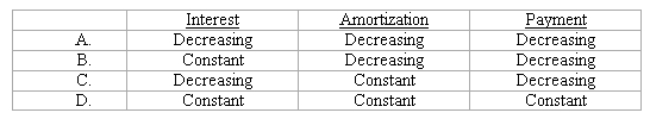

One of the most popular amortizing mortgages today is the constant payment mortgage.Which of the following characterizes the components of the CPM payment over the life of the loan?

A) A Above.

B) B Above.

C) C Above.

D) D Above.

A) A Above.

B) B Above.

C) C Above.

D) D Above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

7

Which of the following is not a determinant of interest rates for single family residential mortgages?

A) The demand and supply of mortgage funds

B) Inflation expectations

C) Liquidity

D) The demand and supply of apartments

A) The demand and supply of mortgage funds

B) Inflation expectations

C) Liquidity

D) The demand and supply of apartments

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

8

With every CPM,the effective costs of borrowing are higher than the stated rate of the loan.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

9

In comparison to the first month's payment of a CAM,the first month's payment of a CPM:

A) ishigher.

B) islower.

C) thesame.

D) cannot be determined with this information.

A) ishigher.

B) islower.

C) thesame.

D) cannot be determined with this information.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

10

Points are also known as:

A) Third party charges

B) Reduction in payment amount

C) Loan discount fees

D) Reduction of mortgage yield

A) Third party charges

B) Reduction in payment amount

C) Loan discount fees

D) Reduction of mortgage yield

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

11

Lenders and investors worry about default,interest rate,marketability,and liquidity risks.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

12

Which one of the following is TRUE about Prepayment penalties:

A) They are never used with residential mortgages

B) They lower the effective cost if the loan is repaid before maturity

C) They are equivalent to charging additional points for the loan

D) They are not included in the APR calculation

A) They are never used with residential mortgages

B) They lower the effective cost if the loan is repaid before maturity

C) They are equivalent to charging additional points for the loan

D) They are not included in the APR calculation

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

13

Because its payment stream looks like a staircase,which loan is sometimes referred to as "stepped-up" financing due to prearranged payment increases?

A) CAM

B) CPM

C) GPM

D) ARM

A) CAM

B) CPM

C) GPM

D) ARM

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

14

Over the life of the loan,which of the following loans would continually have a lower principal balance given each loan had the same term,principal amount,and average interest rate?

A) CAM

B) CPM

C) GPM

D) Cannot be determined with this information

A) CAM

B) CPM

C) GPM

D) Cannot be determined with this information

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

15

Demand for a mortgage loan is considered:

A) Stable Demand

B) Derived Demand

C) Interest Rate Demand

D) Nominal Demand

A) Stable Demand

B) Derived Demand

C) Interest Rate Demand

D) Nominal Demand

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

16

Which of the following closing costs do not increase the lender's effective loan yield?

A) Discount points

B) Prepayment penalties

C) Title insurance charges

D) Origination fees

A) Discount points

B) Prepayment penalties

C) Title insurance charges

D) Origination fees

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

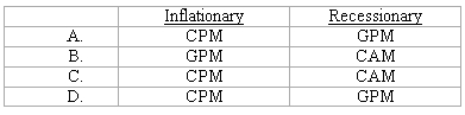

17

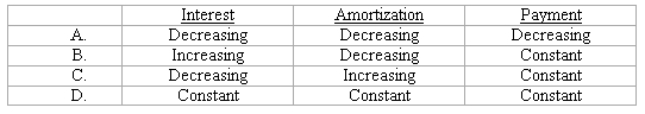

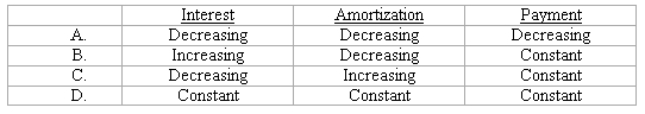

Which mortgage would a borrower prefer to have during inflationary and recessionary periods?

A) A Above.

B) B Above.

C) C Above.

D) D Above.

A) A Above.

B) B Above.

C) C Above.

D) D Above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

18

APR stands for which of the following:

A) Annual Percentage Rate

B) Amortized Percentage Regulator

C) Accrued Percentage Rate

D) Annual Percentage Regulator

A) Annual Percentage Rate

B) Amortized Percentage Regulator

C) Accrued Percentage Rate

D) Annual Percentage Regulator

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

19

One difference between the constant amortizing mortgage (CAM)and the constant payment mortgage (CPM)is the interest paid and loan amortization relationship.With a CAM,the loan amortization and interest paid are directly related and with the CPM the loan amortization and the interest paid are inversely related.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

20

Inflation makes very little difference to lenders of and investors needing money.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

21

Graduated payment mortgage are loans available to people who have graduated from college.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

22

Origination fees are tax deductible as an interest expense.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

23

Truth-in-lending requires the borrower to tell the truth on the loan application.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

24

The annual percentage rate,disclosed at the loan closing,closely approximates the borrower's true cost of funds.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

25

The APR for a loan assumes it is prepaid after ten years.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

26

Prepayment penalties increase the lender's mortgage yield and discount points decrease it.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

27

Borrowers with fixed rate mortgages generally benefit if actual inflation is higher than expected inflation.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck

28

With a reverse annuity mortgage the borrower receives payments from the bank.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 28 في هذه المجموعة.

فتح الحزمة

k this deck