Deck 3: Mortgage Loan Foundations: The Time Value of Money

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

سؤال

فتح الحزمة

قم بالتسجيل لفتح البطاقات في هذه المجموعة!

Unlock Deck

Unlock Deck

1/20

العب

ملء الشاشة (f)

Deck 3: Mortgage Loan Foundations: The Time Value of Money

1

The future value of $1,000 compounded annually for 8 years at 12% may be calculated with the following formula: FV = $1,000 * (1 + 12%)8

If the same $1,000 was compounded quarterly,what formula would you use to calculate the FV?

A) FV = $1,000 * (1 + 3%)8

B) FV = $1,000 * (1 + 12%)32

C) FV = $1,000 * (1 + 3%)32

D) FV = $1,000 * (1 + 12%)2

If the same $1,000 was compounded quarterly,what formula would you use to calculate the FV?

A) FV = $1,000 * (1 + 3%)8

B) FV = $1,000 * (1 + 12%)32

C) FV = $1,000 * (1 + 3%)32

D) FV = $1,000 * (1 + 12%)2

FV = $1,000 * (1 + 3%)32

2

The future value compound factor given for period (n)at 15%:

A) would be less than the factor for period (n+1)at 15%.

B) would be greater than the factor given for period (n+1)at 15%.

C) would be the same as the factor given for period (n+1)at 15%.

D) bears no relationship to the factor for period (n+1)at 15%.

A) would be less than the factor for period (n+1)at 15%.

B) would be greater than the factor given for period (n+1)at 15%.

C) would be the same as the factor given for period (n+1)at 15%.

D) bears no relationship to the factor for period (n+1)at 15%.

would be less than the factor for period (n+1)at 15%.

3

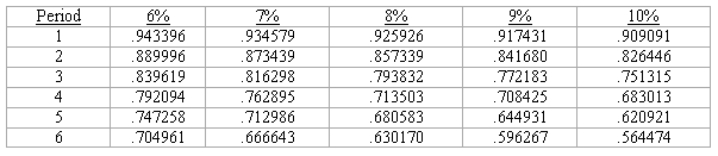

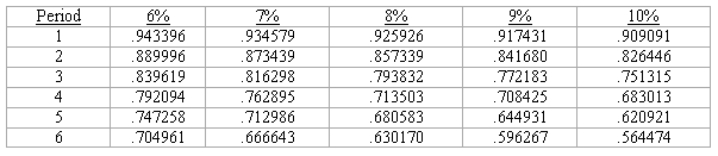

Using only the information above,what would the IRR be for an investment that cost $500 in period 0 and was sold for $750 in period 5?

A) Between 6% and 7%

B) Between 7% and 8%

C) Between 8% and 9%

D) Between 9% and 10%

Between 8% and 9%

4

Which of the following is not a basic component of any compounding problem?

A) An initial deposit

B) An interest rate

C) A period of time

D) A net present value

A) An initial deposit

B) An interest rate

C) A period of time

D) A net present value

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

5

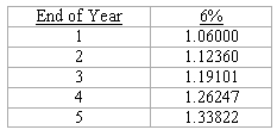

If you saw a table containing the following factors,what kind of interest factor would you be looking at?

A) Present value of a single amount

B) Future value of a single amount

C) Present value of an annuity

D) Future value of an annuity

A) Present value of a single amount

B) Future value of a single amount

C) Present value of an annuity

D) Future value of an annuity

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

6

In order to solve a compounding problem,you must know all four of its basic parts.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

7

You always see an ordinary annuity used in business and never see an annuity due used in business.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

8

At 6%,the present value of a $1 payment in 12 months is .941905.At 7%,the present value of a $1 payment in 12 months is .950342.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

9

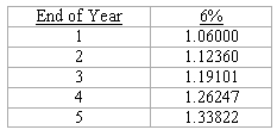

Using only the information above,approximately how much would you pay today for an investment that pays $0 annual interest,but earns 8% interest over the next four years and has a face value at maturity of $13,500?

A) $8,000

B) $9,000

C) $10,000

D) $11,000

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

10

The future value of a $1 annuity compounded at 5% annually is greater than the future value of a $1 annuity compounded at 5% semi-annually.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

11

One way to calculate the present value of a single payment is with the following formula:

PV = FV * (1+i)n.

PV = FV * (1+i)n.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

12

The internal rate of return is the good feeling you get inside when you earn a return on your investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

13

Begin with a single sum of money at period 0.First,calculate a future value of that sum at 12.01%.Then discount that future value back to period 0 at 11.99%.In relation to the initial single sum,the discounted future value:

A) is greater than the original amount.

B) is less than the original amount.

C) is the same as the original amount.

D) cannot be determined with the information given.

A) is greater than the original amount.

B) is less than the original amount.

C) is the same as the original amount.

D) cannot be determined with the information given.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

14

An investment may have more than one internal rate of return.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

15

The internal rate of return:

A) is also known as the investment of investor's yield.

B) represents a return on investment expressed as a compound rate of interest.

C) is calculated by setting the price of an investment equal to the stream of cash flows it generates and solve for the interest rate.

D) can be defined by all of the above.

A) is also known as the investment of investor's yield.

B) represents a return on investment expressed as a compound rate of interest.

C) is calculated by setting the price of an investment equal to the stream of cash flows it generates and solve for the interest rate.

D) can be defined by all of the above.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

16

Assume that an investment,with an single initial cost of $1,000 and a yield of $50 monthly for 10 years,had a 7% IRR in the 60th month and a 7.2% IRR five months later.The IRR can be 6.8% in the 62nd month.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

17

The future value of $800 deposited today would be greater if that deposit earned 8% rather than 7.75%.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

18

The future value of a single deposit of $1,000 will be greater when this amount is compounded:

A) annually

B) semi-annually

C) quarterly

D) monthly

A) annually

B) semi-annually

C) quarterly

D) monthly

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

19

If an investment earns 12% annually,

A) an equivalent monthly investment would have to earn a higher equivalent nominal rate to yield the same return.

B) an equivalent monthly investment would have to earn a lower equivalent nominal rate to yield the same return.

C) an equivalent monthly investment would have to earn the same equivalent nominal rate to yield the same return.

D) a relation cannot be determined between a monthly and annual investment.

A) an equivalent monthly investment would have to earn a higher equivalent nominal rate to yield the same return.

B) an equivalent monthly investment would have to earn a lower equivalent nominal rate to yield the same return.

C) an equivalent monthly investment would have to earn the same equivalent nominal rate to yield the same return.

D) a relation cannot be determined between a monthly and annual investment.

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck

20

You are able to calculate the present value of an annuity by understanding the following relationship: FV = PV (1+I)

فتح الحزمة

افتح القفل للوصول البطاقات البالغ عددها 20 في هذه المجموعة.

فتح الحزمة

k this deck